Foran Announces Positive Pre-Feasibility Study Results for McIlvenna Bay

- Pre-tax $219 million NPV7.5% and 23.4% IRR

- After-tax $$147 million NPV7.5% and 19.2% IRR

- Based on 3 year trailing average metal prices

- Capital expenditures: $261 million pre-production (including $30 million contingency)

- Probable Mineral Reserve: 11.34 million tonnes @ US$100/t NSR (see Table 4)

- Contained within Indicated Resources of 22.95 million tonnes @US$60/t NSR (see Table 6)

- Zinc and Copper Production

- Average Annual: 89.2 million lbs zinc, 27.9 million lbs copper

- Cash Cost (net of by product credits) – US$0.41/lb zinc OR US$0.44/lb copper

- Next Steps

- Advance to feasibility

- Discussions with potential partners for development

- “When we first invested in Foran, we envisioned McIlvenna Bay as being the centre of operations for a new mining camp. A number of mining executives and friends shared our vision and invested with us in financings as we advanced the project. Today, we take a massive step towards realizing our dream with the release of this Pre-Feasibility Study.” Patrick Soares, President & CEO

VANCOUVER, British Columbia, March 12, 2020 (GLOBE NEWSWIRE) -- Foran Mining Corporation (TSX.V: FOM) (“Foran” or the “Company”) is pleased to announce the results of a positive Pre-Feasibility Study (“PFS” or the “Study”) for Foran’s 100% owned McIlvenna Bay zinc-copper volcanogenic massive sulphide (“VMS”) deposit (“McIlvenna Bay” or the “Project”) in east-central Saskatchewan.

Patrick Soares, President & CEO commented, “We assembled a project team that has deep experience with projects similar to McIlvenna Bay to prepare this pre-feasibility study. We are proposing a modern underground mine supported by surface infrastructure designed to take into account feedback we have received from local communities. We are committed to taking the project through feasibility and into production in a safe, responsible manner that will provide economic benefits to the region for years to come. We are now in a position to advance discussions with potential investors with experience developing similar mines as we explore the best way to credibly and safely build and operate McIlvenna Bay. Our goal, as always, is to maximize value per share.”

McIlvenna Bay is currently the largest undeveloped deposit in the Flin Flon Greenstone Belt and the second largest deposit discovered in the region. The Project is located in a top mining jurisdiction within a producing district, with known geology and a limited physical footprint. All results in this release are reported in Canadian dollars, unless otherwise indicated.

McIlvenna Bay PFS Highlights:

Economics

- $219 million (“M”) pre-tax net present value (“NPV”) using a 7.5% discount rate ($147M after-tax) and an internal rate of return (“IRR”) of 23.4% (19.2% after-tax) using 3 year trailing average metal prices of US$1.26 per pound (“lb”) zinc (“Zn”), US$2.82/lb copper (“Cu”), US$1,312/ounce (“oz”) gold (“Au”) and US$16.30/oz silver (“Ag”), foreign exchange rate CAD:USD $1.30 / USD:CAD $0.77 (see Table 1).

- Cash cost of US$0.41/lb Zn or US$0.44/lb Cu (net of by-product credits).

- Cash cost includes mine cash operating costs (including sustaining capital), smelting and refining charges, royalties and transportation costs.

- Pre-production capital cost of $261.3M and Life of Mine (“LOM”) sustaining capital cost of $338.6M.

- After-tax free cash flow of over $626M ($365M net of pre-production capital).

- Overall average operating cost of $69.48 per tonne:

- In addition, LOM sustaining capital of $29.86 per tonne (calculated from total LOM sustaining capital of $338.6M)

Reserves & Resources

- A Probable Mineral Reserve of 11.34 million tonnes (“Mt”) at 4.01% Zn, 1.14% Cu, 0.54 grams per tonne (“g/t”) Au and 20.97 g/t Ag, derived using a USD$100/t net smelter return (“NSR”) cut-off (see Table 4).

- Probable Reserves are contained within Indicated Resources outlined in the 2019 Mineral Resource Estimate (using a US$60/t NSR cut-off) (see Table 6):

- Indicated resources of 22.95Mt

- Grading 1.17% Cu, 3.05% Zn, 0.44 g/t Au and 16.68 g/t Ag

- Inferred resources of 11.15Mt

- Grading 1.38% Cu, 1.83% Zn, 0.10 % lead, 0.47 g/t Au and 14.81 g/t Ag

- Resources and reserves are open for expansion.

- Indicated resources of 22.95Mt

Mining & Processing

- Life of mine concentrate production containing over 800 M lbs Zn, over 250 M lbs Cu, over 155,000 oz. Au and approximately 4.4 M oz. Ag.

- Average annual production of 89.2 M lbs Zn, 27.9 M lbs Cu, 17,312 oz Au and 492,667 oz Ag

- Underground mine with 9-year life, employing a combination of longitudinal longhole retreat (“Avoca”) and sub-level transverse stoping methods to mine at a nominal rate of 3,600 tonnes per day (“tpd”).

- Metallurgical testwork yielded robust metallurgical performance, with recoveries of 80% Zn, 88.2% Cu, 79.1% Au and 58.0% Ag into separate high-grade zinc and copper flotation concentrates.

- Low carbon footprint mining project:

- Powered by existing hydroelectric power

- Haulage of ore to surface using Battery Electric Vehicles (“BEVs”)

- Efficient ore haulage from deeper levels using vertical ore conveying technology

Surface Infrastructure

- Modern on-site processing facilities, including conventional crushing, grinding, flotation and dewatering units.

- Cemented paste backfill plant

- On-site 5.6Mt capacity filter tailing (“dry stack”) storage impoundment.

Project Description

McIlvenna Bay is a large polymetallic VMS deposit containing zinc, copper, lead, gold and silver which has been defined by 239 diamond drill holes and over 115,000 metres (“m”) of diamond drilling. The bulk of the resource is contained in two contiguous lenses consisting of a large zinc +/- copper-rich massive sulphide lens and the underlying Copper Stockwork Zone (“CSZ”) which represents a copper-rich feeder zone to the massive sulphide. These two lenses form a coherent mineralized body that averages 17.6m in thickness and plunges over 2,000 m from surface, where it remains open for further expansion. Production will initially focus on mining the high value massive sulphide material with incremental production coming from the CSZ as metal prices allow.

Project economics are summarized in Table 1 below.

Table 1: Summary of McIlvenna Bay PFS Economic Metrics(1-4)

| Pre-Tax NPV (7.5%) & IRR (3) | NPV: $218.6M IRR: 23.4% |

| After-Tax NPV (7.5%) & IRR (1)(3) | NPV: $147.1M IRR: 19.2% |

| Undiscounted After-Tax Free Cash Flow (Life of Mine – “LOM”) (Before pre-production capital deductions) | $626 M |

| Undiscounted After-Tax Free Cash Flow (LOM) (Net of pre-production capital) | $365.4 M |

| Payback Period from start of processing (undiscounted, after-tax cash flow) (3) | 3.8 years |

| Metal Prices (2) (3 Year Trailing Average, CAD and USD) | $1.67/lb Zn (US$1.26/lb) $3.66/lb Cu (US$2.82/lb) $1,704/oz Au (US$1,312/oz) $21.17/oz Ag (US$16.30/oz) |

| Foreign Exchange Rate | CAD:USD - $1.30 USD:CAD - $0.77 |

| Pre-Production Capital Expenditures (rounded) | $261.3 M |

| LOM Sustaining Capital Expenditures (including closure) (3) | $338.6 M |

| LOM Cash Cost (for either Zn or Cu): (per lb Zinc) (net of by-products) (3)(4) or (per lb Copper) (net of by-products) (3)(4) | US$0.41 US$0.44 |

| Nominal Throughput (tonnes per day) | 3,600 |

| Mine Life | 9 years |

| Average Annual Metal Production (Y1-9) | 89.17 M lb Zn 27.88 M lb Cu 17,312 oz Au 492,667 oz Ag |

| LOM Average Metallurgical Recoveries (Massive sulphide & CSZ blended) | 80.0% Zn 88.2% Cu 79.1% Au 58.0% Ag |

(1) All figures reported in 2020 Canadian dollars, and where applicable, using the 3-year trailing average foreign exchange rate of $0.77 USD:CAD ($1.30 CAD:USD).

(2) 3 year trailing average metal prices to January 20, 2020.

(3) Please see “Non-IFRS Financial Measures” at the end of this news release for a discussion of these measures.

(4) McIlvenna Bay gross revenues are derived from the production of zinc (48%), copper (38%), gold (11%) and silver (4%).

A decision was made to deliver a PFS to provide an early economic review of the Project, after the Company determined that on-site processing offered a better economic outcome than off-site milling and toll processing. Foran believes that this PFS, and the economics presented herein, could allow McIlvenna Bay to be fast tracked to feasibility and an eventual production decision. An on-site study to feasibility standards would have required additional engineering that would further delay reporting Project economics.

Several opportunities to improve project margins include:

- Refinement of the mine cut-off value to extend mine life with incremental economic material

- Further refinement of the metallurgical program

- Extend the use of BEVs to load-haul-dump (“LHD”) fleet

- Cost savings from use of mine waste as backfill in secondary transverse stopes (currently all paste fill)

- Large inferred resource remains which may be converted into additional reserves with further drilling to extend mine life

- Additional feed source development: further expansion of the resource at McIlvenna Bay, and continuation of exploration of identified and new satellite deposits.

The Project, as envisaged by the PFS, is a conventional ramp-access underground mine producing zinc/copper ore at a nominal rate of 3,600 tpd. The mine will utilize modern technology (BEV haul trucks and a vertical conveyor) to bring ore to surface as feed for an on-site processing plant of equivalent capacity. Process plant tailings will be de-sulphurized, filtered and either used for cemented backfill or deposited on a small (5-6 Mt) dry stack tailings facility. Concentrate from the process plant would be shipped offsite via Flin Flon to copper and zinc smelters.

The underground mine design focuses on rapid development and access to high grade stopes utilizing a combination of Avoca and sub-level transverse stoping methods to extract the ore. The operation will utilize a fleet of 50-t BEV haul trucks to bring ore to the surface along the ramp for the first three years of production, followed by the installation of vertical conveyor technology to move ore to the surface from the deeper parts of the mine. Mineable reserves were calculated using a US$100/t NSR cut-off which focuses initial mining on the higher value massive sulphide blocks within the resource. Current probable reserves for the deposit sit at 11.34Mt (inclusive of mining dilution) grading 4.01% Zn, 1.14% Cu, 0.54 g/t Au and 20.97 g/t Ag. Based on the 2019 resource estimate, the current mine plan captures most of the material available in the deposit above the US$100/t NSR cut-off value.

The McIlvenna Bay processing plant utilizes a conventional mineral processing circuit with crushing, ball milling and sequential selective sulphide flotation to produce clean copper and zinc concentrates which will be readily saleable to smelters worldwide. Metallurgical testwork and modelling was advanced in 2019 and this highlighted the ability of massive sulphide and CSZ mineralization to be co-processed as a blended feed to the mill. A program of variability testwork helped to develop head grade vs. recovery relationships for the PFS, and these have been applied to the mine production schedule to define robust concentrate production profiles. Since metallurgical testing commenced in 2012, samples have displayed solid metallurgical characteristics and life of mine average zinc and copper recoveries of 80.0% and 88.2% respectively have been determined for the PFS. Separate zinc and copper flotation concentrates with grades of 54.7% Zn and 26.8% Cu respectively are indicated, and the copper concentrate also carries by-product credits for gold and silver (with recoveries of 79.1% and 58.0% respectively).

On-site infrastructure will include offices, workshops, mine dry, water treatment facilities, fuel storage areas and a paste plant. An overhead powerline will supply hydropower to the project from Pelican Narrows, some 65 kilometres (“km”) north of the project site.

In order to advance the Project to a definitive feasibility study level, further detailed engineering and cost optimization must be undertaken for the on-site processing facilities and the dry stack tailings impoundment. This work is planned to start in earnest along with further optimization of the mine plan and cut-off calculations which is expected to provide additional upside for the Project.

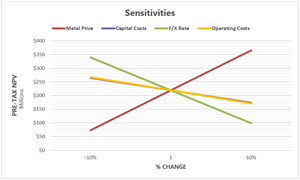

Economic Sensitivity to Metal Prices

A discounted cash flow (“DCF”) calculation was tabulated for the Project, based on the various PFS cost and revenue inputs. The DCF was developed using 3-year trailing average prices (in USD) for Zn ($1.26/lb), Cu ($2.82/lb), Au ($1,312/oz) and Ag ($16.30/oz). Figure 1 below illustrates the sensitivity of the estimated pre-tax NPV for the cash flow generated at McIlvenna Bay related to changes in metals prices and cost inputs at the 7.5% discount rate.

Figure 1: Sensitivities (Pre-tax)

Sensitivity to +/- 10 % change in metal prices, capital costs, operating costs and foreign exchange is modeled below:

A photo accompanying this announcement is available at https://www.globenewswire.com/NewsRoom/AttachmentNg/31ca2e13-5087-41dd-803b-4bbc4e650236

Capital and Operating Cost Estimates

Capital costs were prepared using information from a variety of sources, including derivation from first principles, equipment quotes, and factoring from other costs within the PFS. Capital costs are split into pre-production costs and sustaining costs and estimated to an accuracy of +/- 25%.

Table 2: Capital Cost Summary

| Estimated Capital Cost | CAPEX, CAD millions | ||

| Pre-Production | Sustaining | Total | |

| Mine | 72.7 | 273.9 | 346.6 |

| Mill | 100.6 | 7.2 | 107.8 |

| Infrastructure | 50.8 | 0.0 | 50.8 |

| G&A | 0.7 | 0.0 | 0.7 |

| Tailings | 5.9 | 11.8 | 17.6 |

| Closure | 0.0 | 6.4 | 6.4 |

| Sub-total | 230.7 | 299.3 | 530.0 |

| Contingency | 30.6 | 39.3 | 70.0 |

| Total | 261.3 | 338.6 | 600.0 |

* All figures are rounded to reflect the relative accuracy of the estimate. Totals may not sum due to rounding as required by reporting guidelines

Table 3: Operating Cost Summary

| Operating Costs | (CAD/t processed) | |

| Mining | $ | 41.19 |

| Milling | $ | 19.55 |

| Infrastructure | $ | 2.82 |

| G&A | $ | 4.13 |

| Tailings | $ | 1.78 |

| Subtotal | $ | 69.48 |

| Sustaining Costs (Capitalized)* | $ | 29.86 |

| Total | $ | 99.34 |

*Sustaining capital costs per tonne calculated from total sustaining costs outlined in Table 2.

Mineral Reserve Statement

The Mineral Reserve Statement for McIlvenna Bay is based on the Mineral Resource Estimate with an effective date of May 7, 2019 (see news release titled “Foran Announces Significant Increase in Resources for McIlvenna Bay Deposit” dated May 28, 2019 and available under the Company’s profile on SEDAR and on the Company website). The Mineral Resources are inclusive of Mineral Reserves.

Table 4: Mineral Reserve Statement (@ US$100/t NSR cut-off)

| Probable Tonnes | Grade | ||||

| Zn (%) | Cu (%) | Au (g/t) | Ag (g/t) | ||

| Massive Sulphide | 7,773,176 | 5.71 | 0.88 | 0.51 | 25.24 |

| Copper Stockwork Zone | 3,566,067 | 0.31 | 1.70 | 0.60 | 11.65 |

| Total | 11,339,243 | 4.01 | 1.14 | 0.54 | 20.97 |

Notes:

- Mineral Reserves have an effective date of February 17, 2020. The Qualified Person for the estimate is Denis Flood, P.Eng.

- The Mineral Reserves were estimated in accordance with the CIM Definition Standards for Mineral Resources and Reserves

- The Mineral Reserves are supported by a mine plan, based on a preliminary cut off NSR value calculation. Inputs to that process are:

- Metal prices of Zn $1.25/lb, Cu $3.30/lb, Au $1310/oz and Ag $16.20/oz

- Average operating cost of C$100/t

- Recoveries of 81.1% Zn; 88.8% Cu:69.7% Au; and 56.8% Ag

- The Mineral Reserve Estimate incorporates a mining recovery of 95% and dilution of 10% globally.

- All figures are rounded to reflect the relative accuracy of the estimate. Totals may not sum due to rounding as required by reporting guidelines.

Mining & Processing

McIlvenna Bay will be mined using a combination of sub-level transverse stoping and Avoca producing 78% and 19% of the total ore respectively (with the balance to be produced from development). Sub-level intervals of 30m were used in the PFS design with panel widths of 20m. Ore will be drilled and blasted using conventional tophammer production drills and and mucked with diesel LHD. In years 1-3, ore would be hauled to surface using 50t capacity BEVs, and tipped into the surface crushing plant feed bin. As underground ramp development passes the 0m level (about 400m below surface), an underground crushing station together with a vertical conveyor system (similar to that installed in 2017 at the Fresnillo Mine, Zacatecas, Mexico) will be commissioned to supplement the truck haulage. Production stopes will be backfilled using a combination of paste fill and development waste. Production is calculated at a nominal rate of 3,600 tpd over the 9-year minelife.

The material handling strategy represents a significant reduction in capital and operating costs over conventional diesel trucks due to the reduced ventilation requirements, which results in a reduction in the excavation of ventilation raises, reduced energy consumption and reduced fan sizes.

Regardless of primary crushing location, all coarse crushed ore would be stockpiled ahead of secondary surface crushing equipment and fine ore storage facilities. The fine ore would be fed into a two-stage ball milling circuit to reduce the particle size to 80% -75 microns prior to a sequential selective flotation process. Regrinding of zinc and copper rougher concentrates would be completed using high intensity grinding mills prior to multi-stage clear flotation. Separate zinc and copper concentrates would be dewatered using thickening and pressure filtration to form final saleable products.

Zinc flotation tailing slurry would be directed through a simple sulphur reduction flotation process designed to reduce the grade of sulphur in material destined for the dry stack tailings impoundment. The small volume of sulphur concentrate would be directed to the paste plant for incorporation into cemented paste fill material used underground.

Approximately half of tailings generated by the process plant would be used as paste backfill, with the remainder trucked to a dry stack tailings storage area – located on ground previously used as a sand quarry.

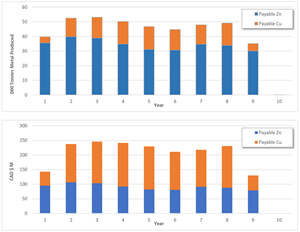

Figure 2: Production Schedule

The proposed PFS payable metal production & net revenue profiles are shown in the figures below:

A photo accompanying this announcement is available at https://www.globenewswire.com/NewsRoom/AttachmentNg/5efee326-3bf3-448b-b10b-89e952be86e7

Note: there is a small amount of production in year 10. For the purposes of this news release, all annual production numbers have been calculated based on production for years 1 – 9.

Metallurgy

Metallurgical testing of McIlvenna Bay samples began in 2012, and several subsequent programs have incrementally advanced the quality of metallurgical predictions. The most recent metallurgical testwork program, carried out at Base Metallurgical Laboratories Ltd in Kamloops, tested three master composite samples, fifteen variability composites, and four blend composites. Samples were submitted for mineralogy, comminution tests, open and locked cycle flotation test, dewatering tests and environmental characterisation tests.

The sample selection procedures carried out in support of the 2019 program used larger masses of sample, including significant use of core drilled during the 2018 summer exploration program. The samples are considered to be representative of projected mine production in terms of grade and spatial coverage within the current resource.

Flowsheet development continued using the three master composites (zinc-rich massive sulphide, copper-rich massive sulphide and copper stockwork) in a program of open circuit and locked cycle lab tests. Various reagent recipes, flowsheet configurations and grinding targets (primary ore and rougher concentrates) were also tested to advance the understanding of metallurgical response. A variability program tested fifteen composites with a wide range of grades and metal ratios. The results from this program, together with historical lab test results and 2019 master composite results were used to support the development of various grade vs. recovery relationships suitable for PFS level NSR modelling.

Importantly, the 2019 work showed that the processing of several different blends of massive sulphide and CSZ material through the baseline flowsheet had no significant detrimental effects on metallurgical performance. The work shows that the conventional mill/flotation flowsheet proposed for McIlvenna Bay will be able to accept blended feed from the mine, allowing significant simplification of the mining operation.

The McIlvenna Bay deposit contains relatively low levels of lead on average, so current process designs make no attempt to separate lead from the copper concentrate. However, the 2019 metallurgical program did highlight the importance of the copper/lead ratio in the plant feed stream, with ratios below 1.5 noted to be quite detrimental to metallurgical performance. Modern online grade monitoring equipment has been included in the process flowsheet so that operators may measure and control this parameter prior to entering the plant. This refinement in metallurgical understanding helps engineers to fine-tune the process thereby mitigating process risk.

Average metallurgical performance for the PFS flotation process is summarized in Table 5 below:

Table 5: Metallurgical Performance Summary

| Metallurgical Recovery (LOM Average) | Copper | Zinc | Gold | Silver | |

| Massive Sulphide Recovery | % | 80.9 | 81.8 | 68.8 | 53.7 |

| CSZ Recovery | % | 96.2 | 10.0 | 97.5 | 78.5 |

| Blended Recovery | % | 88.2 | 80.0 | 79.1 | 58.0 |

| Concentrate Grades (LOM Average) | Copper (%) | Zinc (%) | Gold (g/t) | Silver (g/t) | |

| Copper Concentrate | 26.8 | 11.5 | 326 | ||

| Zinc Concentrate | 54.7 |

Infrastructure

In late 2018, Foran set out to complete a feasibility study to provide advanced definition of the Project. The original project scope included off-site toll processing using existing facilities at Hudbay Minerals Inc.’s (“Hudbay”) 777 complex in Flin Flon. As the feasibility study work advanced during 2019, it became clear that the cost of toll milling in Flin Flon and the related costs of tailings storage would create disproportionate commercial and environmental risks while decreasing the economic viability of the Project.

On-site processing requires additional pre-production capital but lowers operating costs, provides independence to the operations and enhanced developmental flexibility to construct a long-lived mine at McIlvenna Bay. In addition, mining efficiencies are improved by utilizing tailings for paste fill rock support, and potential environmental impacts are significantly reduced. In addition, in this economic environment, fixed price construction contracts are available, allowing greater control over capital expenditures.

Site infrastructure considers the following:

- Water Supply: The majority of water that will need to be managed at the site will arise from the dewatering of underground workings, followed by surface run off around site during major precipitation events. Water collected around site will be treated through an effluent treatment plant and recycled where possible to processing facilities and to underground equipment. Potable water will be supplied from an on-site well.

- Power Supply: Discussions with SaskPower are ongoing regarding the supply of hydropower to McIlvenna Bay. The project site is already served by a 1.2MVA overhead line from Pelican Narrows (currently disconnected), and the PFS includes a plan to twin this line with a new parallel 10MVA line. An average power unit cost of $75.00 per MWh has been used for the PFS.

- Access Road: the existing access road is already in good condition and would require minor upgrades.

- Concentrate Transportation: Approximately 732,000 wet tonnes of zinc concentrate and 460,000 wet tonnes of copper concentrate will be produced over the life of mine. Concentrates would be shipped via Flin Flon to domestic smelters, and a total transportation budget of $142 million is budgeted over the life of mine.

Tailings

Approximately 50% of the tailings produced will be utilized as paste backfill for the underground mining operations. The remaining 50% of tailings (approximately 5.6Mt) will be stored on site, utilizing best available practices into a dry stack tailings facility. Tailings will be de-sulphurized to reduce the potential for acid generation, and then filter pressed to optimum moisture content prior to hauling and placement into the tailings facility. The facility will be located within the footprint of a previously operated frac sand quarry located within approximately 1 km of the mill which will minimize overall project impact on undisturbed areas.

A PFS level design of the dry stack tailings facility has been completed by Knight Piésold Ltd. The facility will be comprised of a tailings storage pad, a perimeter runoff and seepage collection ditch, and water management pond, all of which will be lined with a conventional polyethylene geomembrane to prevent seepage reporting to the environment. The tailings stack will be compacted during placement which will increase stability and minimize infiltration of precipitation. The outer slopes of the facility will be constructed at a shallow angle of 4H:1V up to an approximate height of 16 m above original ground in order to minimize effort required at closure.

Social & Environmental

The Project lies in the Boreal Plain Ecozone on the boundary of Namew Lake Upland landscape area of the Mid-Boreal Lowland Ecoregion, and the Flin Flon Plain landscape area of the Churchill River Upland Ecoregion. The boundary between these two ecoregions passes through McIlvenna Bay on Hanson Lake, such that the northern part of the baseline study area lies in the Churchill River upland, and the southern part lies in the Mid-Boreal Lowland. Extensive mining and exploration activities associated with other metal and silica sand mining projects have occurred in the Project area; therefore, the area does not represent undisturbed baseline conditions.

Comprehensive environmental baseline studies for McIlvenna Bay were completed by Canada North Environmental Services in 2012. The baseline program was designed to prepare the Project for future licensing and regulatory requirements, and included collection of a full suite of environmental data including:

| • climate and meteorology | • noise |

| • surface water hydrology | • water and sediment quality |

| • plankton, benthic invertebrate, and fish communities | • fish habitat |

| • fish spawning | • fish chemistry |

| • ecosite classification | • vegetation communities |

| • species at risk | • wildlife communities |

| • heritage resources |

Follow-up hydrological studies were completed between 2013 and 2014 and in 2018 and 2019 to extend the hydrological data set and to characterize the hydrologic regime of the local area.

The Project lies within the area traditionally occupied by the Peter Ballantyne Cree Nation (“PBCN”) and is located approximately 40km southeast of the settlement of Deschambault Lake and approximately 50km west of the community of Denare Beach. Approximately 1,500 PBCN members reside in these communities. The Project is also located within the Métis Nation of Saskatchewan Eastern Region 1. Foran has been meeting with members of the communities of Deschambault Lake and Denare Beach to update them about the Project since 2012. Foran also initiated a Traditional Land Use/Knowledge Inventory Study which was completed by ASKI Resource Management and Environmental Services (a corporation of the PBCN) in 2012. More recently, Foran has entered into discussion with the PBCN with the objective of negotiating a Memorandum of Understanding that outlines the terms and details of an understanding focused on areas of community engagement, environmental stewardship, training and employment opportunities, and business development.

Mineral Resource

The McIlvenna Bay resource estimate remains unchanged from the Mineral Resource Estimate reported by the Company on May 28, 2019 and is based on 239 diamond drill holes and over 115,000 m of drilling. The Mineral Resource Estimate is presented in Table 6 below.

Table 6: McIlvenna Bay Resource Estimate (US$60/t NSR cut-off) 1-4

| Zone | Tonnage (Mt) | Cu (%) | Zn (%) | Pb (%) | Au (g/t) | Ag (g/t) |

| Indicated | ||||||

| Main Lens – Massive Sulphide | 9.25 | 0.90 | 6.43 | 0.40 | 0.52 | 25.97 |

| Lens 3 | 1.99 | 0.85 | 3.29 | 0.14 | 0.27 | 14.71 |

| Stringer Zone | 0.70 | 1.38 | 0.62 | 0.04 | 0.35 | 13.34 |

| Copper Stockwork Zone | 10.30 | 1.43 | 0.28 | 0.02 | 0.40 | 9.30 |

| Copper Stockwork Footwall Zone | 0.71 | 1.60 | 1.04 | 0.04 | 0.54 | 11.47 |

| Total Indicated | 22.95 | 1.17 | 3.05 | 0.19 | 0.44 | 16.68 |

| Inferred | ||||||

| Main Lens – Massive Sulphide | 2.97 | 1.29 | 4.79 | 0.29 | 0.47 | 23.58 |

| Copper Stockwork Zone | 8.18 | 1.42 | 0.76 | 0.03 | 0.47 | 11.63 |

| Total Inferred | 11.15 | 1.38 | 1.83 | 0.10 | 0.47 | 14.81 |

Notes:

- Effective date May 7, 2019; CIM definitions were followed for Mineral Resources; NSR = Net Smelter Return.

- The base case mineral resource is estimated based on 239 diamond drill holes and a NSR cut-off grade of US$60/t. NSR grades were calculated and high-grade caps were applied as per the discussion in Estimation Methodology and Parameters below and include provisions for metallurgical recovery and estimates of current shipping terms and smelter rates for similar concentrates. Metal prices used are US$3.30/lb. Cu, US$1.25/lb. Zn, US$1.00/lb. Pb, US$1,310/oz. Au, and US$16.20/oz. Ag. Specific gravity was interpolated for each block based on measurements taken from core specimens.

- Mr. William Lewis, P.Geo., of Micon, has reviewed and verified this mineral resource estimate. Mr. Lewis is independent of Foran and is a “Qualified Person” within the meaning of NI 43-101.

- Mineral resources which are not mineral reserves do not have demonstrated economic viability. The estimate of mineral resources may be materially affected by environmental, permitting, legal, marketing or other issues.

Qualified Persons

The following Qualified Persons (“QPs”) will co-author the technical report based on the PFS. These QPs have approved the information in this news release that pertains to the sections of the PFS for which they take responsibility:

| Geology: | Roger March, P.Geo. (Foran) (non-independent) | |

| Metallurgy: | Andy Holloway, P.Eng. (AGP) | |

| Mineral Resource: | William Lewis, P.Geo. (Micon) | |

| Mining & Mineral Reserve: | Denis Flood, P.Eng. (AGP) | |

| Processing: | Andy Holloway, P.Eng. (AGP) | |

| Infrastructure: | Manoj Patel, P.Eng. (Halyard) | |

| Economic Evaluation: | Stephen Cole, P.Eng. | |

| Tailings: | Alex McIntyre, P.Eng. (Knight Piésold) | |

| Environmental & Social: | Jocelyn Howery, P.Ag. (CanNorth) | |

Each of the above-named individuals are independent QPs (except for Roger March) for the purposes of NI 43-101. All scientific and technical information in this news release regarding the McIlvenna Bay project or the PFS upon which the information is based was prepared by or under the supervision of these individuals.

A National Instrument 43-101 (“NI 43-101”) Technical Report summarizing the results of the PFS and incorporating the initial reserve statement for the Project will be filed within 45 days on SEDAR and the Company’s website.

About Foran Mining

Foran Mining is a zinc-copper exploration and development company with projects located along the Flin Flon Greenstone Belt. The McIlvenna Bay Project, Foran’s flagship asset located within the Hanson Lake District, sits just 65km from Flin Flon, Manitoba and is part of the world class Flin Flon Greenstone Belt that extends from Snow Lake, Manitoba, through Flin Flon to Foran’s ground in eastern Saskatchewan, a distance of over 225km.

McIlvenna Bay is the largest undeveloped VMS deposit in the region. This prolific Metallogenic Belt is host to 29 past and present producing mines, including Hudbay Minerals Inc.’s 777 and Lalor operations. The Company is preparing a NI-43-101 Technical Report for the Pre-Feasibility Study on the McIlvenna Bay Deposit.

Foran trades on the TSX.V under the symbol “FOM”.

Data Verification

The “qualified persons”, as such term is defined in NI 43-101, responsible for the preparation of the PFS have verified the data disclosed in this news release, including sampling, analytical, and test data underlying the information contained in this news release. Geological, mine engineering and metallurgical reviews included, among other things, reviewing mapping, core logs, and re-logging existing drill holes, review of geotechnical and hydrological studies, environmental and community factors, the development of the life of mine plan, capital and operating costs, transportation, taxation and royalties, and review of existing metallurgical test work. In the opinion of the qualified persons responsible for the preparation of the PFS, the data, assumptions, and parameters used to estimate mineral resources and mineral reserves, the metallurgical model, the economic analysis, and the preliminary feasibility study are sufficiently reliable for those purposes. The PFS, when filed, will contain more detailed information concerning individual responsibilities, associated quality assurance and quality control, and other data verification matters, and the key assumptions, parameters and methods used by the Company.

Non-IFRS Measures

This news release refers to certain financial measures, such as pre-production capital costs, sustaining capital expenditure, closure costs, cash costs, payback period, undiscounted after tax cash flow, and net present value, and other financial metrics which are not measures recognized under IFRS and do not have a standardized meaning prescribed by IFRS. In the mining industry, these are common performance measures but may not be comparable to similar measures presented by other issuers. The Company believes that, in addition to conventional measures prepared in accordance with IFRS, certain investors use this information to evaluate the Company’s potential performance and ability to generate cash flow. Accordingly, it is intended to provide additional information and should not be considered in isolation or as a substitute for measures of performance prepared in accordance with IFRS.

Estimates of Mineral Reserves and Mineral Resources

Information regarding reserve and resource estimates has been prepared in accordance with Canadian standards under applicable Canadian securities laws. The terms “Probable Mineral Reserve”, “Mineral Resource,” “Indicated Mineral Resource” and “Inferred Mineral Resource” used in this news release are Canadian mining terms as defined in accordance with NI 43-101 standards under guidelines set out in the Canadian Institute of Mining, Metallurgy and Petroleum (“CIM”) Standards on Mineral Resources and Mineral Reserves adopted by the CIM Council on May 10, 2014.

For Additional Information Please Contact Foran Mining Corporation:

| Patrick Soares | |

| President & CEO | |

| 409 Granville Street, Suite 904 | |

| Vancouver, BC, Canada, V6C 1T2 ir@foranmining.com |

Neither the TSX-V nor its Regulation Services Provider (as that term is defined in the policies of the TSX-V) accepts responsibility for the adequacy of this release. No stock exchange, securities commission or other regulatory authority has approved or disapproved the information contained herein.

CAUTIONARY NOTE REGARDING FORWARD LOOKING STATEMENTS

This news release contains "forward-looking information" (also referred to as "forward looking statements"), which relate to future events or future performance and reflect management’s current expectations and assumptions. Often, but not always, forward-looking statements can be identified by the use of words such as "plans", "hopes", "expects", "is expected", "budget", "scheduled", "estimates", "forecasts", "intends", "anticipates", or "believes" or variations (including negative variations) of such words and phrases, or state that certain actions, events or results "may", "could", "would", "might" or "will" be taken, occur or be achieved. Such forward-looking statements reflect management’s current beliefs and are based on assumptions made by and information currently available to the Company. All statements, other than statements of historical fact, are forward-looking statements or information. Forward-looking statements or information in this news release relate to, among other things: the Pre-Feasibility Study and the anticipated capital and operating costs, sustaining costs, net present value, internal rate of return, payback period, process capacity, average annual metal production, average process recoveries, anticipated mining and processing methods, proposed PFS production schedule and metal production profile, anticipated construction period, anticipated mine life, expected recoveries and grades, anticipated production rates, infrastructure, social and environmental impact studies, future financial or operating performance of the Company, subsidiaries and its projects, estimation of mineral resources, exploration results, opportunities for exploration, development and expansion of the McIlvenna Bay Project, its potential mineralization, the future price of metals, the realization of mineral reserve estimates, costs and timing of future exploration, the timing of the development of new deposits, requirements for additional capital, foreign exchange risk, government regulation of mining and exploration operations, environmental risks, reclamation expenses, title disputes or claims, insurance coverage and regulatory matters. In addition, these statements involve assumptions made with regard to the Company’s ability to develop the McIlvenna Bay Project and to achieve the results outlined in the PFS, and the ability to raise capital to fund construction and development of the McIlvenna Bay Project.

These forward-looking statements and information reflect the Company’s current views with respect to future events and are necessarily based upon a number of assumptions that, while considered reasonable by the Company, are inherently subject to significant operational, business, economic and regulatory uncertainties and contingencies. These assumptions include: our mineral reserve and resource estimates and the assumptions upon which they are based, including geotechnical and metallurgical characteristics of rock confirming to sampled results and metallurgical performance; tonnage of ore to be mined and processed; ore grades and recoveries; assumptions and discount rates being appropriately applied to the PFS; success of the Company’s projects, including the McIlvenna Bay Project; prices for zinc, copper, gold and silver remaining as estimated; currency exchange rates remaining as estimated; availability of funds for the Company’s projects; capital decommissioning and reclamation estimates; mineral reserve and resource estimates and the assumptions upon which they are based; prices for energy inputs, labour, materials, supplies and services (including transportation); no labour-related disruptions; no unplanned delays or interruptions in scheduled construction and production; all necessary permits, licenses and regulatory approvals are received in a timely manner; and the ability to comply with environmental, health and safety laws. The foregoing list of assumptions is not exhaustive.

The Company cautions the reader that forward-looking statements and information include known and unknown risks, uncertainties and other factors that may cause actual results and developments to differ materially from those expressed or implied by such forward-looking statements or information contained in this news release and the Company has made assumptions and estimates based on or related to many of these factors. Such factors include, without limitation: fluctuations in zinc, copper, gold and silver prices; fluctuations in prices for energy inputs, labour, materials, supplies and services (including transportation); fluctuations in currency markets (such as the Canadian dollar versus the U.S. dollar); operational risks and hazards inherent with the business of mining (including environmental accidents and hazards, industrial accidents, equipment breakdown, unusual or unexpected geological or structure formations, cave-ins, flooding and severe weather); inadequate insurance, or the inability to obtain insurance, to cover these risks and hazards; our ability to obtain all necessary permits, licenses and regulatory approvals in a timely manner; changes in laws, regulations and government practices in Canada, including environmental, export and import laws and regulations; legal restrictions relating to mining; risks relating to expropriation; increased competition in the mining industry for equipment and qualified personnel; the availability of additional capital; title matters and the additional risks identified in our filings with Canadian securities regulators on SEDAR in Canada (available at www.sedar.com). Although the Company has attempted to identify important factors that could cause actual results to differ materially, there may be other factors that cause results not to be as anticipated, estimated, described or intended. Investors are cautioned against undue reliance on forward-looking statements or information.

These forward-looking statements are made as of the date hereof and, except as required by applicable securities regulations, the Company does not intend, and does not assume any obligation, to update the forward-looking information.

CAUTIONARY NOTE FOR U.S. INVESTORS REGARDING RESERVE AND RESOURCE ESTIMATES

Canadian public disclosure standards, including NI 43-101, differ significantly from the requirements of the SEC set forth in Industry Guide 7 (“Industry Guide 7”), and information concerning mineralization deposits, mineral reserve and resource information contained or referred to herein may not be comparable to similar information disclosed by U.S. companies in accordance with Industry Guide 7. In particular, without limiting the generality of the foregoing, this news release uses terms “probable mineral reserves,” “indicated mineral resources” and “inferred mineral resources”. U.S. investors are advised that, while such terms are recognized and required by Canadian securities laws, Industry Guide 7 does not recognize them. The requirements of NI 43-101 for identification of “reserves” are not the same as those of Industry Guide 7, and reserves reported by the Company in compliance with NI 43-101 may not qualify as “reserves” under Industry Guide 7. Under Industry Guide 7, mineralization may not be classified as a “reserve” unless the determination has been made that the mineralization could be economically and legally produced or extracted at the time the reserve determination is made. U.S. investors are cautioned not to assume that any part of a “indicated mineral resource” will ever be converted into a “reserve”. U.S. investors should also understand that “inferred mineral resources” have a great amount of uncertainty as to their existence and great uncertainty as to their economic and legal feasibility. It cannot be assumed that all or any part of “inferred mineral resources” exist, are economically or legally mineable or will ever be upgraded to a higher category. Under Canadian securities laws, estimated “inferred mineral resources” may not form the basis of feasibility or pre-feasibility studies except in rare cases. Disclosure of “contained ounces” in a mineral resource is permitted disclosure under Canadian securities laws. However, Industry Guide 7 normally only permits issuers to report mineralization that does not constitute “reserves” by Industry Guide 7 standards as in place tonnage and grade, without reference to unit measures. In addition, the definition of “Probable Mineral Reserves” under CIM standards differ in certain respects from the standards of the United States Securities and Exchange Commission. “Mineral Resources” that are not “Mineral Reserves” do not have demonstrated economic viability. Accordingly, information concerning mineral deposits set forth herein may not be comparable with information made by public companies that report in accordance with Industry Guide 7.