Foran Announces Strategic Investments by Fairfax Financial, Agnico Eagle and other Cornerstone Investors, Formal Construction Decision for Phase 1 at McIlvenna Bay and Advances Planning for Phase 2

Strategic Investment by Cornerstone Investors supports McIlvenna Bay’s Development and Future Upside Opportunities

Project Finance Credit Facility to be Expanded to US$250 Million

Board of Directors Formally Approves Construction, led by G Mining Services, with Commercial Production Expected in H1 2026

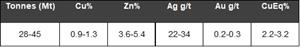

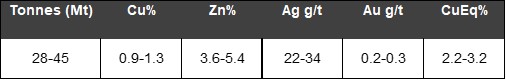

Initial Tesla Exploration Target of 28-45Mt at 2.2-3.2% CuEq Highlights Future Exploration Potential

All amounts are in Canadian dollars unless stated otherwise

VANCOUVER, British Columbia, July 15, 2024 (GLOBE NEWSWIRE) -- Foran Mining Corporation (TSX: FOM) (OTCQX: FMCXF) (“Foran” or the “Company”) is pleased to announce a series of brokered and non-brokered strategic investments for up to $315 Million, consisting of a brokered equity private placement for which the Company has received indications of interest from several of its existing shareholders, including Fairfax Financial Holdings Limited (“Fairfax”), and an equity private placement by Agnico Eagle Mines Limited (“Agnico Eagle”). The Company is also announcing that a term sheet has been signed with a fund managed by Sprott Resource Lending Corp. (“Sprott”) to upsize its existing US$150 million senior secured project credit facility to US$250 million, which will be used to advance construction at the McIlvenna Bay Project.

The strategic investments underscore the strength of the Company’s 100%-owned McIlvenna Bay Project in Saskatchewan (the “McIlvenna Bay Project” or the “Project”), and demonstrate robust, long-term shareholder backing. Support from the cornerstone investors emphasizes the quality and exploration potential at the Project.

In conjunction with the comprehensive financing package announced today, the Company’s Board of Directors has made the formal decision to proceed with the construction of the McIlvenna Bay Project. In addition, the Company is providing an updated initial capital cost estimate for the Phase 1 plan, a project development update, and an initial target for further exploration at Tesla (“Exploration Target”).

Key Highlights:

- $222 million brokered private placement, with participation indications received from various existing long-term shareholders, including Fairfax, underscoring continued strategic support and confidence in the McIlvenna Bay Project's development, highlighting the Project's potential and the Company’s commitment to driving long-term shareholder value

- Concurrent strategic investment from Agnico Eagle will bring another cornerstone shareholder to the Company, with an expected 9.9% pro forma equity ownership on a basic voting basis

- Upsized credit facility to US$250 million from US$150 million with Sprott, will provide greater financial flexibility as the Company proceeds to full development of the McIlvenna Bay Project.

- Phase 1 capital budget expected to be eligible for Federal Investment Tax Credits, potentially leading to refundable investment tax credits of approximately $130-150 million

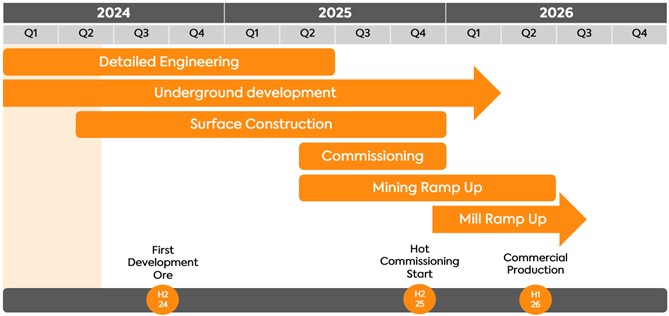

- Board of Directors made the formal construction decision, with initial production expected in Q4 2025 and commercial production expected in H1 2026

- Phase 1 Capital Cost estimated at US$604 million to commercial production, optimized and focused on initial phase production, while laying the groundwork for potential future Phase 2 expansion opportunities

- Phase 2 Expansion Planning - Foran is evaluating a phased expansion approach, leveraging recent exploration discoveries at the Tesla and Bridge Zones. The Company has initiated modeling and expedited the necessary fieldwork to assess the estimated growth potential identified in the Tesla Exploration Target

- Initial Exploration Target for further exploration at the Tesla Zone of 28-45 Mt at 0.9-1.3% Cu, 3.6-5.4% Zn, 22-34 g/t Ag and 0.2-0.3 g/t Au (2.2-3.2% CuEq). The Tesla Zone remains open in all directions, with ongoing summer drilling aimed at extending known mineralization. Concurrently, high-priority regional exploration targets are being tested, highlighting the growth potential of the Project

Dan Myerson, Foran’s Executive Chairman & CEO, commented: “Foran is at an exciting inflection point in our journey towards critical mineral production, with the Board of Directors making the formal decision to proceed with the construction of the McIlvenna Bay Project. Continued support from our largest shareholder, Fairfax, highlights the unique nature of our generational project and the growing demand for new sources of copper, zinc, gold, and silver. Agnico Eagle is a partner of choice within the mining industry, recognized globally for its leading practices, and we are proud to have Agnico Eagle as a strategic investor. Partnering with G Mining Services as our integrated project management team represents the ultimate opportunity to ensure a successful build, leveraging their unparalleled expertise and proven track record in delivering projects on time and on budget, most recently at Lundin Gold’s Fruta Del Norte project, Equinox’s Greenstone project, and G Mining Ventures’ Tocantinzinho project. Our collective work is focused on building for the future by scaling this world-class asset through evaluating our ongoing exploration success for upside project opportunities and leveraging the current commodity price environment all while focused on maximizing risk-adjusted value per share. In an era where permitted copper assets located in safe geopolitical jurisdictions are both rare and vital, Foran is strategically positioned to support global growth in green energy, infrastructure, and artificial intelligence, moving us towards a decarbonized future.”

Brokered Private Placement

The Company is pleased to announce that it has entered into an agreement with Eight Capital, BMO Capital Markets, and National Bank Financial as co-lead agents and joint bookrunners, on behalf of a syndicate of agents (together the “Agents”), pursuant to which the Company has launched a proposed private placement for aggregate gross proceeds up to $222,000,008 (the “Brokered Offering”).

The Brokered Offering will consist of (i) up to 47,407,408 common shares of the Company (“Common Shares” at an issue price of $4.05 per Common Share, for gross proceeds of up to $192,000,002; and (ii) up to 4,501,874 Common Shares with each such Common Share to be issued as a “flow-through share” within the meaning of the Income Tax Act (Canada) (the “FT Shares”) at an average issue price of $6.66 per FT Share, for gross proceeds up to $30,000,006. The Company has received several indications from existing shareholders, including Fairfax, to participate in the Brokered Offering. Pricing of the Common Shares and FT Shares is subject to approval of the Toronto Stock Exchange (the “TSX”).

The net proceeds of the Brokered Offering will be used for exploration and development of the Company’s mineral projects in Saskatchewan, and for working capital and general corporate purposes. The Company will use an amount equal to the gross proceeds from the sale of the FT Shares, pursuant to the provisions of the Income Tax Act (Canada), to incur eligible "Canadian exploration expenses" that qualify as "flow-through critical mineral mining expenditures" as both terms are defined in the Income Tax Act (Canada) (the "Qualifying Expenditures") related to the Company’s mineral projects located in Saskatchewan, on or before December 31, 2025, and will renounce all of the Qualifying Expenditures in favour of the subscribers of the FT Shares with an effective date not later than December 31, 2024.

The Brokered Offering is scheduled to close on or about August 8, 2024, or such other date as the Company and the Agents may agree, and is subject to certain conditions including, but not limited to, the execution of an agency agreement and the receipt of all necessary regulatory and other approvals, including that of the TSX.

The securities issued pursuant to the Brokered Offering shall be subject to a four-month plus one day hold period commencing on the day of the closing of the Brokered Offering under applicable Canadian securities laws. The securities being offered have not, nor will they be registered under the United States Securities Act of 1933, as amended, and may not be offered or sold within the United States or to, or for the account or benefit of, U.S. persons in the absence of U.S. registration or an applicable exemption from the U.S. registration requirements. This release does not constitute an offer for sale of securities in the United States.

Agnico Eagle Investment

The Company is pleased to announce that it has entered into a subscription agreement pursuant to which Agnico Eagle has agreed to acquire up to 22,962,963 Common Shares at an issue price of $4.05 per Common Share for gross proceeds of up to $93,000,000. The net proceeds will be used for development of the McIlvenna Bay Project, working capital and general corporate purposes.

Upon closing of Agnico Eagle’s investment and the Offering, Agnico Eagle is expected to have a 9.9% equity interest in the Company on a basic voting basis.

Closing of the Agnico Eagle investment is subject to a number of conditions, including closing of the Offering and receipt of all necessary regulatory and other approvals (including approval of the TSX). It is anticipated that the Agnico Eagle investment will close concurrently with the Offering. The securities issued to Agnico Eagle will be subject to a four-month plus one day hold period commencing on the day of the closing under applicable Canadian securities laws.

In connection with Agnico Eagle’s investment, Foran and Agnico Eagle will enter into an investor rights agreement, pursuant to which Agnico Eagle is entitled to certain rights, provided Agnico Eagle maintains certain ownership thresholds in Foran, including but not limited to: participation rights, top-up rights, the right to appoint one member to Foran’s Board of Directors and the ability to participate in a technical committee to provide recommendations and advice to the Company on technical matters.

Credit Facility Upsizing

On December 21, 2022, Foran announced the closing of a US$150 million senior secured project credit facility (the “Credit Facility”) with a fund managed by Sprott. The Company is pleased to announce that it has signed a term sheet for an upsize of the Credit Facility to US$250 million, subject to completion of all due diligence, definitive credit documentation and approval by Sprott’s investment committee. The interest rate on the proposed upsized Credit Facility remains unchanged and the Company will provide further details upon completion of definitive documentation and closing of the upsizing, which is expected to occur in Q3 2024.

Investment Tax Credits

Foran and its tax advisors have reviewed the initial capital budget for the Phase 1 plan at the McIlvenna Bay Project, in conjunction with draft legislative proposals relating to the Clean Technology Manufacturing Investment Tax Credit and legislation for the Clean Technology Investment Tax Credit, first introduced in the 2023 Canadian Federal Budget. As contemplated, each tax credit would provide for up to 30 per cent of the cost of investment in eligible property used for eligible activities through a refundable investment tax credit mechanism.

Based on a review of the draft legislative proposals and subsequent updates provided in the 2024 Canadian Federal Budget, Foran and its tax advisors estimate that up to $440-$510 million of expected costs associated with the Phase 1 capital budget may be deemed eligible under the aforementioned tax credits, leading to a potential refundable investment tax credit range of approximately $130-150 million. Additional upside to the investment tax credits may be realized in future periods as sustaining capital is incurred and growth capital is allocated to a potential Phase 2 expansion. It is expected Foran would claim the qualifying costs annually, as incurred, and credits would be received after filing of the Company’s annual income tax return.

Government Funding Initiatives

The Canadian federal government has introduced several funding programs aimed at supporting critical mineral infrastructure across the supply chain. Foran has applied for funding through two of these programs: the Strategic Innovation Fund via the Ministry of Innovation, Science, and Economic Development), and the Critical Mineral Infrastructure Fund through Natural Resources Canada. The Company is progressing through the application process and will provide updates on the potential funding outcomes as information becomes available.

McIlvenna Bay Project Overview and Initial Capital

The McIlvenna Bay Project is located in east-central Saskatchewan approximately 375km northeast of Saskatoon, and 85km West of Flin Flon Manitoba, and is accessible year-round via a 18km all-weather road connected to Saskatchewan Provincial Highway 106.

The Project is designed to be a decline/shaft underground mining operation using typical long-hole mining methods for ore extraction with cemented paste fill replacement. Ore is expected to be processed via a conventional single stage crushing circuit with a semi-autogenous grinding (“SAG”) mill and ball mill design. Grinding is planned to be followed by a flotation circuit to produce both a copper and zinc concentrate for transportation from site to the Flin Flon area for shipment by rail for further refinement. Additionally, a pyrite concentrate will be produced and introduced within the cemented paste fill recipe for storage underground.

Foran has been conducting various trade-off studies to optimize the Project, focusing on maximizing Phase 1 production while laying the groundwork for future growth opportunities. Through these optimization studies, several initiatives have been incorporated into Phase 1 construction, facilitating future transitions for future expansion opportunities. These efforts ensure that planning towards potential Phase 2 expansion opportunities is well-aligned with the Company's long-term strategic goals.

These initiatives include:

- Increased Phase 1 nameplate throughput capacity to 4,900 tpd. The Company has enhanced throughput capacity to maximize efficiency, increase margins, accelerate cash flows, and provide the scope and scale for future potential expansion opportunities, while accelerating investment to take advantage of the favorable tax environment associated with the aforementioned investment tax credits.

- Construction of the hydropower transmission line with sufficient capacity for future potential load increases. While Foran is utilising the existing distribution line with approximately 1.2 MW in available capacity, the Company, through work managed by SaskPower, will construct a new 77km-long dedicated 138 kV transmission line, sourced from the Island Falls Hydro Generating Station, targeted to be completed and commissioned earlier than envisioned in the Technical Report on the Feasibility Study for the McIlvenna Bay Project (the “2022 Feasibility Study”), dated April 14, 2022 with an effective date of February 28, 2022. This transmission line will have additional load capacity available, enhancing economies of scale in future expansion phases

- G Mining Services Integrated Project Management Team Strategy. Updated costs associated with the selection of G Mining Services Inc. (“GMS”) as our integrated project management team partner have been included. GMS has a proven track record of delivering projects successfully on time and on budget, including Lundin Gold Inc.'s Fruta del Norte Project in Ecuador, Newmont Corporation’s Merian Mine in Suriname, Equinox Gold Corp.’s Greenstone Project in Ontario, and most recently the Tocantinzinho project in Brazil.

- Purchasing mobile underground equipment. The Company has elected to purchase and finance its battery electric vehicle fleet, including batteries and chargers, rather than opting to lease as envisioned in the 2022 Feasibility Study. The Company believes this to be a prudent capital allocation decision in light of the favourable environment for federal government tax incentives, including the Clean Technology Investment Tax Credit.

- Purchase of permanent camp. The Company has purchased a permanent 288-person camp, leveraging favorable purchasing opportunities, instead of leasing as anticipated in the 2022 Feasibility Study.

- Increased underground development. The Company intends on increasing lateral development during the construction phase, opening more working fronts for production. This is expected to benefit mine sequencing and production ramp-up during commissioning.

- Additional Redundancies. To mitigate ramp-up risks and ensure a smooth production start, the Company has included provisions for early onboarding of team members, integrated additional capacities within the grinding, filtration and paste circuits and increased the size of the mobile underground fleet.

The initial capital cost estimate outlined in the 2022 Feasibility Study was revised to incorporate detailed engineering efforts, including expansionary capacity and additional processing redundancies. The initial capital budget is based on capital expenditures from June 1, 2024 through to commercial production.

Phase 1 project capital costs have been estimated to completion, net of costs incurred up to and including May 31, 2024, with a resulting US$604 million capital cost set out in Table 1 below.

Table 1 – Initial Capital Cost Summary

| Items | Phase 1 Capital Budget (in US$M)1 | |

| Process Plant | $126 | |

| Underground Development, Equipment & Infrastructure | $114 | |

| Project Indirects | $112 | |

| Infrastructure | $105 | |

| Owner's Costs | $82 | |

| Facilities & Surface Equipment | $22 | |

| Contingency | $56 | |

| Net Pre-Commercial Production Credits | -$14 | |

| Total | $604 | |

| ¹ USD/CAD 1.37. | ||

| ² Values may not add up due to rounding. | ||

Development Timelines and Phase 1 Production

In accordance with the Phase 1 capital budget, early works have already commenced, with completion of preliminary earthworks and concrete activities within the process plant and ancillary buildings underway. After reaching the first two mining levels underground earlier this year, first development ore from underground is expected to be extracted in H2 2024. Mechanical completion of the grinding and processing circuit is expected in H2 2025, with hot commissioning expected to commence in H2 2025. The Company is targeting an ore stockpile of approximately 275,000 tonnes to support commissioning, and the anticipated ramp-up to commercial production expected to occur in H1 2026. A timeline towards commercial production is set out in Table 2 below.

Table 2 – Commercial Production Timelines

McIlvenna Bay Project Update

| Description | Progress to Date (as at May 31, 2024 unless otherwise stated) |

| Health & Safety |

|

| Underground Development |

|

| Engineering |

|

| Procurement |

|

| Construction Progress |

|

| Permitting |

|

| Human Resources |

|

Note: LNG = liquid natural gas.

Potential Phase 2 Expansion Opportunities

The Company is committed to evaluating expansion opportunities following the recent discoveries of the Tesla and Bridge Zones, immediately adjacent to the McIlvenna Bay deposit, and the Company’s growing geologic understanding of its properties. Leveraging the growing geologic understanding of these properties, the Company has initiated modeling and are expediting the necessary fieldwork to assess the growth potential identified in the Tesla Exploration Target tonnage and grade work below. This proactive approach represents an important step towards exploring future opportunities to scale and maximize value from McIlvenna Bay.

Tesla Zone Exploration Target Tonnage and Grade

Foran is pleased to announce an initial Exploration Target tonnage and grade range for the Tesla Zone (“Tesla Zone” or “Tesla”), which lies adjacent to and approximately 300 metres north of the McIlvenna Bay Deposit and linked by the recently discovered Bridge Zone outlining the potential scale of the current drill-defined zone. Although Tesla has not yet been drilled to a sufficient density to support a mineral resource estimate, the close proximity of Tesla to the McIlvenna Bay deposit, coupled with the tenor of the results and the size of the footprint of mineralization defined by drilling to date, indicate that Tesla is quickly evolving into an important discovery with upside potential for McIlvenna Bay. The estimated tonnage and grade range for the Tesla Exploration Target is set out in Table 3 below.

Table 3 - 2024 Tesla Exploration Target**

**The potential quantity and grade of this Exploration Target is conceptual in nature. There has been insufficient exploration to define a mineral resource in this area and it is uncertain if further exploration will result in the target being delineated as a mineral resource.

Notes:

- Canadian Institute of Mining, Metallurgy and Petroleum (“CIM”) definitions for mineral resources were followed; Cu = copper, Zn = zinc, Ag = silver; Au = gold, CuEq = copper equivalent

- Exploration Target is based on the results from 32 drill holes using a Cu cut-off grade of 0.3% Cu for the copper-dominated lenses and a Zn cut-off grade of 1.0% Zn for the zinc-dominated lenses to define the wire frames for the mineralized zones; Assays within these lenses were composited into 1m composites, with Zn capped at 20% and Cu capped at 7%

- CuEq grades were derived using provisions for metallurgical recovery based on life of mine (LOM) metallurgical recovery rates derived from test work on blended ores for the McIlvenna Bay Deposit completed as part of the 2022 Feasibility Study: 91.1% Cu, 79.8% Zn, 88.6% Au and 62.3% Ag. Metal prices used are US$4.00/lb. Cu, US$1.50/lb. Zn, US$1,800/oz. Au, and US$20.00/oz.

- A specific gravity of 3.59 g/cm3 was applied to massive sulphide lenses, and 3.00 g/cm3 was applied to stockwork lenses in the Exploration Target volume based on the results of 85 density measurements of mineralized drill core

The tonnage and grade range estimates for the Tesla Exploration Target incorporate over 42,969 metres of drilling in 32 drill holes and wedges completed since the discovery of Tesla in 2022. The Exploration Target volume is supported by three-dimensional wire frames constructed to connect the mineralized lenses between the drill holes. The wire frames define a mineralized footprint for Tesla extending 1,200 m along strike and 500-700 m in the down dip direction. Current drilling has defined the Tesla footprint over a 1,050 m strike length where it remains open for expansion. Based on the thick intersections obtained at the current periphery of the drilling, it is clear that the mineralization extends beyond the drilling and therefore the strike of the wireframe was extended to 1,200 m, based on support from borehole electromagnetic (“EM”) data collected and interpreted from the winter 2023 and 2024 drill programs that define robust plate models indicating that the Tesla Zone extends for at least that distance. Multiple lenses of mineralization were modelled based on mineralization style, copper and zinc ratios, and the location of the mineralization within the stratigraphy. The thickness of the modelled lenses varies from 2m to 20m, with an average combined thickness of 10m.

Wireframes were created in Leapfrog Geo using a threshold of 0.3% Cu for copper-dominated lenses, and 1% Zn for massive sulphide lenses. Assays within these lenses were composited into 1 m composites, with zinc capped at 20% and copper capped at 7%. The capped composites were used to estimate the Exploration Target using an inverse distance weighting to the second power (ID2) methodology with a nearest neighbour estimation as a check.

Grade ranges were developed by applying a copper-equivalent cut-off similar to those used at McIlvenna Bay. Copper equivalent values were calculated using metal prices of US$4.00/lb Cu, US$1.50/lb Zn, US$20.00/oz Ag and US$1,800/oz Au and life-of-mine metallurgical recovery rates derived from test work on blended ores for the McIlvenna Bay Deposit completed as part of the 2022 Feasibility Study: 91.1% Cu, 79.8% Zn, 88.6% Au and 62.3% Ag. A specific gravity of 3.59 g/cm3 was applied to massive sulphide lenses, and 3.00 g/cm3 was applied to stockwork lenses in the Exploration Target volume based on the results of 85 density measurements of mineralized drill core.

The continuity of the geology and the interpreted volumes of mineralization across the Tesla Zone is well established through multiple datasets, and additional drilling continues to demonstrate the expansion potential of Tesla through the intersection of multiple lenses of mineralization along the periphery of the current footprint. The stratigraphy through the Tesla area is consistent across all the drill holes, based on both drill core logging and over 30,000 m of TruScan data that verify a geochemical link between the geological units. The TruScan data also confirms the stratigraphic and likely genetic link between the large McIlvenna Bay Deposit and Tesla by confirming that mineralization in both areas sits directly below a common marker horizon that can be traced geochemically between the two areas. The continuity of mineralization between drill holes at Tesla is also supported by the orientation of drill core angles and structural data that indicate the mineralized horizons form consistent tabular bodies between drill holes with consistent styles of mineralization within individual lenses (i.e. massive to semi-massive sulphides versus stringer styles, etc). Bore hole EM surveys were completed on several individual drill holes during the drill programs. These consistently identify EM conductors associated with the mineralization, aligning between drill holes to define trends parallel to the mineralization. The data also indicates that the mineralization likely extends beyond the current drilling edges, supporting the interpretation that the Tesla Zone remains open for potential expansion with further drilling.

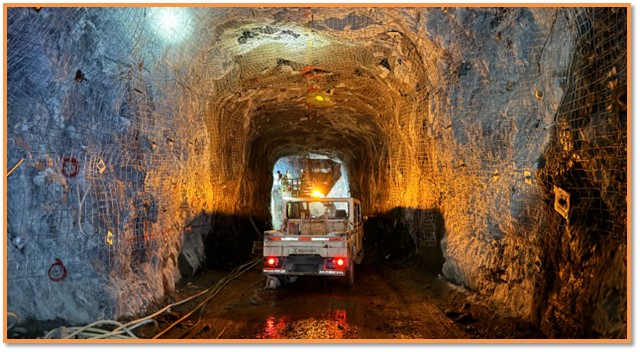

McIlvenna Bay Project Development Photos

Site Layout

First Concrete Pour for SAG & Ball Mills

Sandvik BEV Jumbo at 60 Level

Rebar Dowel Installation at Ball Mill

Haul truck being loaded underground

Installing ground support in 60-90L Decline

Loading explosives for development round in 60L Access

Mine Geologist Conducting Geological Mapping

New Kitchen & Commissary

New Gym

New Indigenous Cultural Room

Members of our Foran-PBCN joint environment committee meeting after site tour

Veracio TruScan in Operation On Site

Foran Fire & Rescue Training

Qualified Persons and Quality Assurance and Quality Control

Mr. Samuele Renelli, P. Eng., Vice President, Technical Services for Foran, is the Qualified Person for all technical information in this news release regarding McIlvenna Bay Phase 1 operations disclosures and has reviewed, verified and approved the technical information in this news release.

Mr. Roger March, P. Geo., Principal Geoscientist for Foran, is the Qualified Person for all technical information herein regarding the Tesla Zone Exploration Target, including the validity of all assay and geological information incorporated herein, and has reviewed, verified and approved the technical information in this news release.

Tesla drilling was completed using NQ size diamond drill core and core was logged by employees of the Company. During the logging process, mineralized intersections were marked for sampling and given unique sample numbers. Sampled intervals were sawn in half using a diamond blade saw. One half of the sawn core was placed in a plastic bag with the sample tag and sealed, while the second half was returned to the core box for storage on site. Sample assays are performed by the Saskatchewan Research Council (“SRC”) Geoanalytical Laboratory in Saskatoon, Saskatchewan. SRC is a Canadian accredited laboratory (ISO/IEC 17025:2017) and independent of Foran. Analysis for Ag, Cu, Pb and Zn is performed using ICP-OES after total multi-acid digestion. Au analysis is completed by fire assay with ICP-OES finish and any samples which return results greater than 1.0 g/t Au are re-run using gravimetric finish. A complete suite of QA/QC reference materials (standards, blanks, and duplicates) are included in each batch of samples processed by the laboratory. The results of the assaying of the QA/QC material included in each batch are tracked to ensure the integrity of the assay data. No data quality problems were indicated by the QAQC program, and the qualified person has reviewed and approved all information included in the Exploration Target estimates.

FOR ADDITIONAL INFORMATION & MEDIA ENQUIRIES:

Foran:

Jonathan French, CFA

VP, Capital Markets & External Affairs

409 Granville Street, Suite 904

Vancouver, BC, Canada, V6C 1T2

ir@foranmining.com

+1 (604) 488-0008

About Foran Mining

Foran Mining is a copper-zinc-gold-silver exploration and development company, committed to supporting a greener future, empowering communities and creating circular economies which create value for all our stakeholders, while also safeguarding the environment. The McIlvenna Bay Project is located entirely within the documented traditional territory of the Peter Ballantyne Cree Nation, comprises the infrastructure and works related to pre-development and advanced exploration activities of the Company, and hosts the McIlvenna Bay Deposit and Tesla Zone. The Company also owns the Bigstone Deposit, a resource-development stage deposit located 25 km southwest of the McIlvenna Bay Property.

The McIlvenna Bay Deposit is a copper-zinc-gold-silver rich VHMS deposit intended to be the centre of a new mining camp in a prolific district that has already been producing for 100 years. The McIlvenna Bay Property sits just 65 km West of Flin Flon, Manitoba, and is part of the world class Flin Flon Greenstone Belt that extends from Snow Lake, Manitoba, through Flin Flon to Foran’s ground in eastern Saskatchewan, a distance of over 225 km.

The McIlvenna Bay Deposit is the largest undeveloped VHMS deposit in the region. The Company announced the results from its NI 43-101 compliant Technical Report on the 2022 Feasibility Study for the McIlvenna Bay Deposit on February 28, 2022, outlining that current Mineral Reserves would potentially support an 18-year mine life producing an average of 65 million pounds of copper equivalent annually. The Company filed the Technical Report on April 14, 2022, with an effective date of February 28, 2022. The Company also filed a NI 43-101 Technical Report for the Bigstone Deposit resource estimate on January 21, 2021, as amended on February 1, 2022. Investors are encouraged to consult the full text of these technical reports which may be found on the Company’s profile on www.sedarplus.ca.

The Company’s head office is located at 409 Granville Street, Suite 904, Vancouver, BC, Canada, V6C 1T2. Common Shares of the Company are listed for trading on the TSX under the symbol “FOM” and on the OTCQX under the symbol “FMCXF”.

CAUTIONARY NOTE REGARDING FORWARD LOOKING STATEMENTS

This news release contains certain forward-looking information and forward-looking statements, as defined under applicable securities laws (collectively referred to herein as “forward-looking statements”). These statements relate to future events or to the future performance of Foran Mining Corporation and reflect management’s expectations and assumptions as of the date hereof or as of the date of such forward looking statement. All statements other than statements of historical fact are forward-looking statements. Often, but not always, forward-looking statements can be identified by the use of words such as “plans”, “expects”, “is expected”, “budget”, “scheduled”, “estimates”, “continues”, “forecasts”, “projects”, “predicts”, “potentially”, “intends”, “likely”, “anticipates” or “believes”, or variations of, or the negatives of, such words and phrases, or state that certain actions, events or results “may”, “could”, “would”, “should”, “might” or “will” be taken, occur or be achieved. Such forward-looking statements include, but are not limited to, statements relating to the terms, including pricing and size, conditions and anticipated timing of definitive documentation and completion of the Agnico Eagle investment, the Brokered Offering and the Credit Facility Upsizing, including the use of proceeds therefrom; statements regarding our objectives and our strategies to achieve such objectives; our beliefs, plans, estimates, projections and intentions, and similar statements concerning anticipated future events; as well as specific statements in respect of the Agnico Eagle private placement and expected 9.9% proforma equity ownership on a basic voting basis that Agnico Eagle will have in the Company; the entering into an investor rights agreement between the Company and Agnico Eagle; expectations regarding the technical committee our intention to scale the McIlvenna Bay Project through evaluating exploration results, leverage the current commodity price environment and focus on maximizing risk-adjusted value per share; the expectation that Fairfax and other existing shareholders will participate in the Brokered Offering; our views regarding the strength of the Project and of long-term shareholder support and confidence in same; upside opportunities in respect of the Project; our view that Agnico Eagle’s support emphasizes the quality and exploration potential of the Project; our intention and ability to proceed with construction of the Project; the Company’s commitment to driving long-term shareholder value; our execution of an agency agreement in connection with the Brokered Offering; expected approvals and conditions by the TSX, including in respect of the Agnico Eagle Investment and the Brokered Offering; expectations regarding the upsizing of the Credit Facility from US$150 million to US$250 million, including Sprott’s completion of due diligence and approval by Sprott’s investment committee; the expectation that upsizing of the Credit Facility will provide greater financial flexibility to the Company as it proceeds to full development of the Project; eligibility of Phase 1 capital costs at the Project for investment tax credits, and our expectation that such credits could potentially apply to $440-510 million of expected costs associated with the Phase 1 capital budget and lead to refundable investment tax credits of approximately $130-150 million; the expectation that additional upside to the investment tax credits may be realized as sustaining capital is incurred in future periods and growth capital is allocated to a potential Phase 2 project expansion; our expectation that qualifying costs in respect of tax credits will be claimed annually and received after filing of the Company’s annual income tax return; the development and Phase 1 commissioning and production timelines and associated capital cost estimates at the McIlvenna Bay Project, including our capital cost estimate of US$604 million to commercial production and its components; the initiation of initial production in Q4 2025 and of commercial production in H1 2026; our commitment in respect of plans for the potential future Phase 2 expansion opportunities at the McIlvenna Bay Project, and our ability to lay the groundwork in respect of same in our Phase 1 plans, including by modeling and expediting field work to assess the estimated growth potential identified in the Tesla Exploration Target tonnage and grade; our plans, designs, optimizations, goals, and expectations in respect of the Project, including in respect of Phase 1 construction, including in respect of processing, grinding, final products, and our ability to optimize the Project and maximize production; our ability to ensure that planning for a potential Phase 2 expansion is aligned with the Company’s long-term strategic goals; our plans to increase Phase 1 throughput capacity to 4,900 tpd, and related objectives and expected benefits thereof; the expectation that construction of the hydropower transmission line will proceed according to plan, will have sufficient capacity for future potential load increases to enhance economies of scale in potential future expansion phases, and will be completed and commissions earlier than envisioned in the 2022 Feasibility Study; GMS’ track record in respect of delivering major projects successfully on time and on budget; the Company’s views regarding its capital allocation decisions; our intention to increase lateral development during the construction phase to open more work fronts for production, and the expectation that this will benefit mine sequencing and production ramp-up during commissioning; our goal of mitigating ramp-up risks and optimize production start by conducting early onboarding of team members, integrating additional capacities within the grinding, filtration and paste circuits, and increasing the size of the mobile underground fleet; our development timelines and commercial production schedule; mechanical completion of the grinding and processing circuit being completed in H2 2025 and hot commissioning commencement in H2 2025; our target of stockpiling ore of approximately 275,000 tonnes to support commissioning; our ability to explore future opportunities to scale and maximize value from McIlvenna Bay; our views, calculations and expectations in respect of the Tesla Exploration Target, including in respect of our estimates regarding its tonnage and grade range, and its potential scale and upside for McIlvenna Bay; expansion potential of the Tesla Zone, including potential expansion directions, and its importance for potential future growth initiatives; expectations regarding mineralization in the Tesla Zone and Bridge Zone; our exploration plan’s current focus and objectives, including in respect of the Company conducting additional drilling at Tesla and expected results; and our commitment to a greener future, empowering communities and creating circular economies which create value for all stakeholders while safeguarding the environment. The forward-looking statements in this news release speak only as of the date of this news release or as of the date specified in such statement.

Inherent in forward-looking statements are known and unknown risks, estimates, assumptions, uncertainties and other factors that may cause the actual results, performance or achievements of the Company to be materially different from any future results, performance or achievements expressed or implied by the forward-looking statements contained in this news release. These factors include, but are not limited to, management's belief or expectations relating to the following and, in certain cases, management's response with regard to the following: the Company’s reliance on the McIlvenna Bay Property; the certainty of funding, including that the Agnico Eagle investment, the Brokered Offering and the Credit Facility Upsizing will be completed on the terms and conditions and in line with anticipated timing disclosed herein, that all requisite regulatory approvals will be obtained and that the proceeds from the financings will be applied as anticipated; the Company’s statements about the expected productive capacity and other technical estimates on its projects, and the Company’s reliance on technical experts with respect thereto; government, securities, and stock exchange regulation and policy, including with respect to receiving TSX approval for the Project financing including with respect to pricing of the Agnico Eagle investment and Brokered Offering; the Company has a history of losses and may not be able to generate sufficient revenue to be profitable or to generate positive cash flow on a sustained basis; the Company is exposed to risks related to mineral resources exploration and development; failure to comply with covenants under the Senior Credit Facility or the Equipment Finance Facility may have a material adverse impact on the Company’s operations and financial condition; the Company may require additional financing and future share issuances may adversely impact share prices; the Company has no history of mineral production; the Company is subject to government regulation and failure to comply could have an adverse effect on the Company’s operations; the Company may be involved in legal proceedings which may have a material adverse impact on the Company’s operations and financial condition; interest rates risk; market and liquidity risk; the Company’s operations are subject to extensive environmental, health and safety regulations; mining operations involve hazards and risks; the Company may not be able to acquire or maintain satisfactory mining title rights to its property interests; indigenous peoples’ title claims may adversely affect the Company’s ability to pursue exploration, development and mining on the Company’s mineral properties; the Company may be unable to obtain adequate insurance to cover risks; the Company’s business may be impacted by international conflict; the Company’s operations require the acquisition and maintenance of permits and licenses, and strict regulatory requirements must be adhered to; mineral resource and mineral reserve estimates are based on interpretations and assumptions that may not be accurate; uncertainties and risks relating to the 2022 Feasibility Study; the current global financial conditions are volatile and may impact the Company in various manners; metals prices are subject to wide fluctuations; the Company may be involved in disputes related to its contractual interests in certain properties; the mining industry is highly competitive; the Company’s success is largely dependent on management; the Company has a limited history of operations; loss of key personnel could materially affect the Company’s operations and financial condition; price volatility of publicly traded securities may affect the market price of the Common Shares; the Company’s operations may be adversely impacted by the effects of climate change and climate change regulation; risks related to wildfires and other extreme weather events; security breaches of the Company’s information systems could adversely affect the Company; inadequate infrastructure may affect the Company’s operations; risks related to surface rights; the Company may be subject to production risks; the Company has incurred substantial losses and may never be profitable; the Company has no history of paying dividends; and the additional risks identified in our filings with Canadian securities regulators on SEDAR+ in Canada (available at www.sedarplus.ca). Although the Company has attempted to identify important factors that could cause actual results to differ materially, there may be other factors that cause results not to be as anticipated, estimated, described or intended.

The forward-looking statements contained in this press release reflect the Company’s current views with respect to future events and are based upon a number of assumptions that, while considered reasonable by the Company, are inherently subject to significant operational, business, economic and regulatory uncertainties and contingencies. These assumptions include: the accuracy of mineral reserve and resource estimates and the assumptions upon which they are based, including geotechnical and metallurgical characteristics of rocks confirming to sampled results and metallurgical performance; tonnage of ore to be mined and processed; ore grades and recoveries; assumptions and discount rates being appropriately applied to the technical studies; success of the Company’s projects, including the McIlvenna Bay Project; prices for zinc, copper, gold and silver remaining as estimated; currency exchange rates remaining as estimated; availability of funds for the Company’s projects; capital decommissioning and reclamation estimates; prices for energy inputs, labour, materials, supplies and services (including transportation); availability of equipment; sustained labour stability with no labour-related disruptions; that infrastructure anticipated to be developed, operated or made available by third parties will be developed, operated or made available as currently anticipated; no unplanned delays or interruptions in scheduled construction and production; all necessary permits, licenses and regulatory approvals are received in a timely manner; and the ability to comply with environmental, health and safety laws. The foregoing list of assumptions is not exhaustive.

Readers are cautioned not to place undue reliance on forward-looking statements and should note that the assumptions and risk factors discussed in this press release are not exhaustive. Actual results and developments are likely to differ, and may differ materially, from those expressed or implied by the forward-looking statements contained in this press release. All forward-looking statements herein are qualified by this cautionary statement. The Company disclaims any intention or obligation to update or revise any forward-looking statements, whether as a result of new information, future events or otherwise, except as may be required by law. If the Company does update one or more forward-looking statements, no inference should be drawn that it will make additional updates with respect to those or other forward-looking statements, unless required by law. Additional information about these assumptions, risks and uncertainties is contained in our filings with securities regulators.

Table 2 is available at https://www.globenewswire.com/NewsRoom/AttachmentNg/ae736014-279a-4c2b-9d97-117e2ddd184a

Table 3 is available at https://www.globenewswire.com/NewsRoom/AttachmentNg/f429860a-2061-442e-8174-8b26f39b219e

Photos accompanying this announcement are available at:

https://www.globenewswire.com/NewsRoom/AttachmentNg/4ee8b4fe-c1a8-4318-88cc-b1c761205233

https://www.globenewswire.com/NewsRoom/AttachmentNg/6157e678-768e-4d41-bf04-b74758d2ca64

https://www.globenewswire.com/NewsRoom/AttachmentNg/047c1ee4-a8e5-4e59-9a50-8510e0b50b2a

https://www.globenewswire.com/NewsRoom/AttachmentNg/097a1a18-f880-4cdd-9922-d8a37715ba7b

https://www.globenewswire.com/NewsRoom/AttachmentNg/b2a0d3ff-161e-4fff-a0a8-bc709e1e0dc1

https://www.globenewswire.com/NewsRoom/AttachmentNg/c433dd80-b6e4-4409-bcc4-9b439d9a4f11

https://www.globenewswire.com/NewsRoom/AttachmentNg/18e4934d-d430-4e8d-9edc-502e3ee8e1f8

https://www.globenewswire.com/NewsRoom/AttachmentNg/b29e4ce8-14f2-4292-937f-64ab9fb5a4fa

https://www.globenewswire.com/NewsRoom/AttachmentNg/a7efd2bf-04de-4443-b933-22f0de3bea5a

https://www.globenewswire.com/NewsRoom/AttachmentNg/9d697eaf-76ca-481e-9273-85d1299b42ce

https://www.globenewswire.com/NewsRoom/AttachmentNg/ae919029-792f-480b-ba9f-11c2ea3da573

https://www.globenewswire.com/NewsRoom/AttachmentNg/375159e2-bbd2-4f85-83b8-3ef8ca5f1099

https://www.globenewswire.com/NewsRoom/AttachmentNg/58a27e4b-a902-428f-8761-88516d149eb1

https://www.globenewswire.com/NewsRoom/AttachmentNg/8339257d-95de-46a7-876a-72c0c9474d4e