Fortuna reports on Yaramoko's updated reserves and resources evaluation work and its Brownfields exploration program

VANCOUVER, British Columbia, Jan. 27, 2023 (GLOBE NEWSWIRE) -- Fortuna Silver Mines Inc. (NYSE: FSM) (TSX: FVI) provides an update on the evaluation work of the Mineral Reserves and Mineral Resources and the brownfields exploration program at the Yaramoko Mine complex in Burkina Faso.

Following the completion of Fortuna’s acquisition of Roxgold Inc. on July 2, 2021, the Company updated the technical report previously filed by Roxgold in 2017 and filed a new technical report on March 30, 2022 (the “2022 Technical Report”) to describe the proposed open pit mining operation at the 55 Zone as disclosed by Roxgold on November 10, 2020. During the first half of 2022, the Company carried out additional exploration drilling and a re-evaluation of the modeling and estimation techniques to improve the definition of the mineralization. A summary of the drilling and evaluation programs completed at Yaramoko during 2022 are summarized below, together with the highlights of its brownfields exploration program.

2022 Drilling Programs and Studies

55 Zone underground drilling

Underground drilling of the 55 Zone concentrated on grade control drilling within the Mineral Resource and Mineral Reserve boundaries to provide increased confidence in the mine plans. Step-out drilling associated with the 2022 grade control drilling program returned encouraging results, incrementally extending the western limit of the drill defined mineralization a further 20 to 50 meters, where it remains open. Additional step-out drilling is planned for the first half of 2023.

In addition, four holes totaling 1,490 meters were drilled to test the area between the 4900 and 5100 meters above Relative Level (mRL) on the eastern side of the 55 Zone, which confirmed an up-dip extension of a high-grade shoot previously intersected in the development drives between the 4800 and 4900 mRL.

109 Zone open pit exploration drilling and first-time estimate of Mineral Reserves

A total of 60 reverse circulation and diamond core drill holes totaling 4,922 meters were completed at the 109 Zone during 2022, including 13 holes drilled for geotechnical purposes. Drilling was designed to infill and upgrade the geological confidence to support the estimation of Mineral Resources and Mineral Reserves.

55 Zone open pit drilling

Reverse circulation drilling to test projections of near surface structural splays identified from mapping of the underground openings was completed during 2022, with 25 holes completed for a total of 1,500 meters. Historic resource drilling had intersected several isolated high-grade intervals related to sub-parallel mineralized veins associated with the main 55 Zone and which coincided with structures identified from detailed mapping of the near surface 55 Zone underground workings.

The drilling was successful in identifying the mineralized structures and veins although continuity of economic intervals and strike lengths resulted in downgrading of the potential.

55 Zone open pit re-evaluation

Roxgold´s proposal to build an open pit at the 55 Zone was based on extracting high-grade near surface material that formed the crown pillar by mining both remnant mineralization identified as being adjacent to existing mine workings and additional sub-parallel structures related to the main 55 Zone structure. Based on recommendations in the 2022 Technical Report, Fortuna completed an evaluation of the mineralization that was identified as potentially recoverable from surface, which was to include an underground transition study and the preparation of a void management plan.

During this evaluation process, the Company identified a spatial discrepancy attributed to a surveying error which occurred prior to August 2020. This resulted in horizontal differences averaging from 2 to 3 meters between the drill holes used to define the 55 Zone main mineralized structure and the underground face channel samples collected during underground development. The updated estimate, having corrected for this inconsistency, results in a reduction of 120,000 ounces of gold previously identified as modelled remnant mineralized material. Subsequently, an economic evaluation of the open pit resulted in a reduction of a further 46,000 ounces of mineralized material which the Company determined cannot be economically extracted from surface or underground due to its isolated location and low-grade nature.

The updated estimate of the 55 Zone crown pillar decreases the life of mine from 5 years to 3 years and results in a reduction in pit size that reduces risk associated with the plan by lowering the strip ratio from 55:1 to 19:1; optimising throughput during the last three years; no longer requiring the relocation of infrastructure; removing the need for significant pre-stripping; and eliminating the requirement to expand the tailings storage facility as a result of processing fewer tonnes.

Bagassi South QV Prime Underground re-evaluation

An evaluation was conducted to assess the optimal mining method proposed for the QV Prime structure at Bagassi South. Changing the method from the originally proposed long hole stoping to shrinkage stoping resulted in lower dilution levels and an increase in estimated gold content in the updated Mineral Reserve.

Yaramoko Mineral Reserves and Mineral Resources as of June 30, 2022

| Mineral Reserves – Proven and Probable as of June 30, 2022 | ||||

| Property | Classification | Tonnes (000) | Au (g/t) | Contained Au (koz) |

| 55 Zone underground | Proven | 29 | 4.83 | 4 |

| Probable | 743 | 7.42 | 177 | |

| Proven + Probable | 772 | 7.32 | 182 | |

| 55 Zone open pit | Proven | 72 | 5.79 | 13 |

| Probable | 73 | 4.69 | 11 | |

| Proven + Probable | 145 | 5.23 | 24 | |

| 109 Zone open pit | Proven | |||

| Probable | 160 | 1.77 | 9 | |

| Proven + Probable | 160 | 1.77 | 9 | |

| Bagassi South QV Prime underground | Proven | |||

| Probable | 142 | 6.75 | 31 | |

| Proven + Probable | 142 | 6.75 | 31 | |

| Bagassi South underground | Proven | |||

| Probable | 10 | 4.44 | 1.4 | |

| Proven + Probable | 10 | 4.44 | 1.4 | |

| Stockpiles | Proven | 180 | 2.59 | 15 |

| Probable | ||||

| Proven + Probable | 180 | 2.59 | 15 | |

| TOTAL | Proven | 281 | 3.64 | 33 |

| Probable | 1,128 | 6.33 | 230 | |

| Proven + Probable | 1,409 | 5.80 | 263 | |

| Mineral Resources– Measured and Indicated (exclusive of Reserves) as of June 30, 2022 | ||||||

| Property | Classification | Tonnes (000) | Au (g/t) | Contained Au (koz) | ||

| 55 Zone underground | Measured | 81 | 6.35 | 17 | ||

| Indicated | 199 | 6.42 | 41 | |||

| Measured + Indicated | 280 | 6.40 | 58 | |||

| 55 Zone open pit | Measured | |||||

| Indicated | 46 | 4.18 | 6 | |||

| Measured + Indicated | 46 | 4.18 | 6 | |||

| 109 Zone open pit | Measured | |||||

| Indicated | 32 | 1.63 | 2 | |||

| Measured + Indicated | 32 | 1.63 | 2 | |||

| Bagassi South QV Prime underground | Measured | |||||

| Indicated | 74 | 7.27 | 17 | |||

| Measured + Indicated | 74 | 7.27 | 17 | |||

| Bagassi South underground | Measured | |||||

| Indicated | 54 | 7.07 | 12 | |||

| Measured + Indicated | 54 | 7.07 | 12 | |||

| TOTAL | Measured | 81 | 6.35 | 17 | ||

| Indicated | 404 | 6.02 | 78 | |||

| Measured + Indicated | 485 | 6.08 | 95 | |||

Mineral Resources– Inferred (exclusive of Reserves) as of June 30, 2022 | ||||||

| Property | Classification | Tonnes (000) | Au (g/t) | Contained Au (koz) | ||

| 55 Zone underground | Inferred | 26 | 6.74 | 6 | ||

| 55 Zone open pit | Inferred | 41 | 3.62 | 5 | ||

| 109 Zone open pit | Inferred | 3 | 1.35 | 0 | ||

| Bagassi South QV Prime underground | Inferred | 22 | 6.12 | 4 | ||

| Bagassi South underground | Inferred | 49 | 6.07 | 10 | ||

| TOTAL | Inferred | 141 | 5.39 | 25 | ||

Notes:

- Mineral Reserves and Mineral Resources are as defined by the 2014 CIM Definition Standards for Mineral Resources and Mineral Reserves

- Mineral Resources are exclusive of Mineral Reserves

- Mineral Resources that are not Mineral Reserves do not have demonstrated economic viability

- Factors that could materially affect the reported Mineral Resources or Mineral Reserves include: changes in metal price and exchange rate assumptions; changes in local interpretations of mineralization; changes to assumed metallurgical recoveries, mining dilution and recovery; and assumptions as to the continued ability to access the site, retain mineral and surface rights titles, maintain environmental and other regulatory permits, and maintain the social license to operate

- Mineral Resources and Reserves for the Yaramoko Mine are estimated and reported as of June 30, 2022

- Mineral Reserves for Yaramoko are reported at a cut-off grade of 1.26 g/t Au for the 55 Zone open pit, 0.73 g/t Au for the 109 Zone open pit, 4.1 g/t Au for 55 Zone and Bagassi South underground (SLS), 3.1 g/t Au for Bagassi South QV Prime (shrinkage) based on an assumed gold price of US$1,600/oz, metallurgical recovery rates of 98.0%, underground mining costs of US$135/t, processing cost of US$31/t and G&A costs of US$28/t, surface mining costs of US$3.44/t, processing cost of US$27/t and G&A costs of US$25/t. Underground average mining recovery is estimated at 86% (SLS) and 90% (shrinkage) for Bagassi South, 92% (SLS) for 55 Zone stopes and 100% for sill drifts. A mining dilution factor of 10% has been applied for sill drifts, 0.6 meter and 0.4 meter dilution skin has been applied for SLS and shrinkage mining respectively. Surface mining recovery is estimated to average 100% and mining dilution 0% having been accounted for during block regularization to 5 meters x 5 meters x 5 meters size within an optimized pit shell and only Proven and Probable categories reported within the final pit designs. Yaramoko Mineral Resources are reported in situ at a gold grade cut-off grade of 0.9 g/t Au for the 55 Zone open pit, 0.5 g/t Au for the 109 Zone open pit, and 2.9 g/t Au for underground (Zone 55 and Bagassi South), based on an assumed gold price of US$1,700/oz and the same costs, metallurgical recovery and constrained within an optimised pit shell. The Yaramoko Mine is subject to a 10% carried interest held by the government of Burkina Faso.

- Matthew Cobb, (MAIG #5486) is the Qualified Person responsible for Mineral Resources being an employee of Roxgold Inc. (a wholly-owned subsidiary of Fortuna), Raul Espinoza (FAUSIMM (CP) #309581) is the Qualified Person responsible for Mineral Reserves, being an employee of Fortuna

- Totals may not add due to rounding procedures

Changes to the Yaramoko Mine Mineral Reserves and Mineral Resources since December 31, 2021

Proven and Probable Reserves decreased from 2.1 million tonnes averaging 6.78 g/t Au containing 464,000 ounces of gold to 1.4 million tonnes averaging 5.80 g/t Au containing 263,000 ounces of gold in the first six months of 2022 representing a 34 percent decrease in tonnes and 43 percent decrease in gold ounces. Reasons for the changes include:

- 55 Zone underground and Bagassi South underground: decrease of 12 percent or 53,000 ounces due to production related depletion and sterilization

- 55 Zone open pit: decrease of 26 percent or 120,000 ounces due to a reduction of remnant mineralized material related to a survey discrepancy identified in the historical model that was corrected in the updated resource model evaluation

- 55 Zone open pit: decrease of 10 percent or 46,000 ounces due to changes in pit size as material at depth cannot be economically extracted from surface due to increased strip ratios as a result of the depletion of the aforementioned remnant material

- 55 Zone underground and Bagassi South underground: increase of 1 percent or 5,000 ounces due to updated geological interpretation as a result of brownfields drilling counteracting marginal increases in cut-off grades

- 109 Zone open pit: gain of 2 percent or 9,000 ounces due to infill drilling and first time estimation of resources and reserves

- Bagassi South QV Prime: gain of 2 percent or 8,000 ounces in the Bagassi South underground mine due to a change in the proposed mining method to shrinkage stoping and subsequent re-evaluation of the Mineral Reserves

Measured and Indicated Resources excluding reserves remain relatively unchanged at 0.5 million tonnes averaging 6.10 g/t Au containing 95,000 ounces of gold.

Inferred Resources decreased slightly from 0.25 million tonnes averaging 4.41 g/t Au containing 35,000 ounces of gold to 0.14 million tonnes averaging 5.39 g/t Au containing 25,000 ounces of gold in the first 6 months of 2022. Reasons for the changes are related to geological reinterpretation and upgrading based on the exploration and infill drilling.

The aforementioned updated Mineral Resources and Mineral Reserves for the Yaramoko Mine will be included in the Company’s consolidated Mineral Resource and Mineral Reserve update to be released prior to the end of the first quarter of 2023, subject to the completion of depletion for the period from June 30, 2022 to December 31, 2022. The Company will also prepare an updated technical report for the Yaramoko Mine to be filed together with its annual continuous disclosure filings prior to the end of the first quarter. The aforementioned changes in the Mineral Resources and Mineral Reserves are not material to the Company´s consolidated Mineral Resources and Mineral Reserves.

Brownfields Exploration Highlights

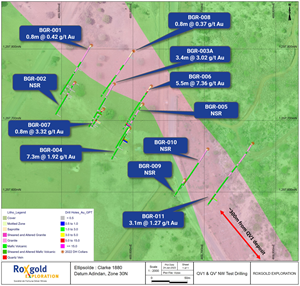

A program of 11 reverse circulation holes totaling 1,182 meters was completed in 2022 as part of a scout drilling program to test the projected northwest extension of the QV and QV Prime veins approximately 300 to 400 meters along strike from Bagassi South.

Hosted in similar variably sheared granite and mafic volcanic lithologies to the Bagassi South mineralization (refer to Figure 1), drilling intersected quartz vein hosted mineralization interpreted as a continuation of the Bagassi South vein system. At Bagassi South this system comprises several veins including the QV, QV Prime, QV1 to QV3 veins and is characterized by anastomosing and steeply plunging high-grade shoots within the vein system. Refer to Appendix 1 for full results.

Highlight intervals include:

- YRM-22-RC-BGR-006: 7.36 g/t Au over an estimated true width of 5.5 meters from 119 meters downhole, including 17.43 g/t Au over an estimated true width of 2.2 meters from 123 meters

- YRM-22-RC-BGR-004: 1.92 g/t Au over an estimated true width of 7.3 meters from 22 meters

Figure 1. Plan view of scout drilling testing strike projections of the QV and QV Prime veins at Bagassi South.

Quality Assurance & Quality Control (QA-QC)

All drilling data completed by the Company utilized the following procedures and methodologies. All drilling was carried out under the supervision of the Company’s personnel.

All RC drilling used a 5.25-inch face sampling pneumatic hammer with samples collected into 60-liter plastic bags. Samples were kept dry by maintaining enough air pressure to exclude groundwater inflow. If water ingress exceeded the air pressure, RC drilling was stopped, and drilling converted to diamond core tails. Once collected, RC samples were riffle split through a three-tier splitter to yield a 12.5% representative sample for submission to the analytical laboratory. The residual 87.5% sample were stored at the drill site until assay results were received and validated. Coarse reject samples for all mineralized samples corresponding to significant intervals are retained and stored on-site at the company-controlled core yard.

All DD drill holes at Yaramoko were drilled with HQ sized diamond drill bits. The core was logged, marked up for sampling using standard lengths of one meter or to a geological boundary. Samples were then cut into equal halves using a diamond saw. One half of the core was left in the original core box and stored in a secure location at the company core yard at the project site. The other half was sampled, catalogued, and placed into sealed bags and securely stored at the site until shipment.

All Yaramoko RC and DD core samples were transported to ALS Laboratories in Ouagadougou for preparation. Routine gold analysis using a 50-gram charge and fire assay with an atomic absorption finish was completed for all samples. Quality control procedures included the systematic insertion of blanks, duplicates and sample standards into the sample stream. In addition, the ALS laboratory inserted its own quality control samples.

Qualified Persons

Eric Chapman, Senior Vice President of Technical Services at Fortuna, is a Professional Geoscientist of the Association of Professional Engineers and Geoscientists of the Province of British Columbia (Registration Number 36328) and a Qualified Person as defined by National Instrument 43-101- Standards of Disclosure for Mineral Projects (“NI 43-101”). Mr. Chapman has reviewed and approved the scientific and technical information contained in this news release related to the Mineral Resources and Mineral Reserves at the Yaramoko Mine and has verified the underlying data.

Paul Weedon, Senior Vice President of Exploration at Fortuna, is a member of the Australian Institute of Geoscientists (Membership #6001) and a Qualified Person as defined by NI 43-101. Mr. Weedon has reviewed and approved the scientific and technical information contained in this news release related to the exploration programs at the Yaramoko Mine. Mr. Weedon has verified the data disclosed, and the sampling, analytical and test data underlying the information or opinions contained herein by reviewing geochemical and geological databases and reviewing diamond drill core. There were no limitations to the verification process.

About Fortuna Silver Mines Inc.

Fortuna Silver Mines Inc. is a Canadian precious metals mining company with four operating mines in Argentina, Burkina Faso, Mexico and Peru, and a fifth mine under construction in Côte d'Ivoire. Sustainability is integral to all our operations and relationships. We produce gold and silver and generate shared value over the long-term for our stakeholders through efficient production, environmental protection, and social responsibility. For more information, please visit our website.

ON BEHALF OF THE BOARD

Jorge A. Ganoza

President, CEO, and Director

Fortuna Silver Mines Inc.

Investor Relations:

Carlos Baca | info@fortunasilver.com | Twitter: @Fortuna_Silver | LinkedIn: fortunasilvermines | YouTube: Fortuna Silver Mines

Forward looking Statements

This news release contains forward-looking statements which constitute “forward-looking information” within the meaning of applicable Canadian securities legislation and “forward-looking statements” within the meaning of the “safe harbor” provisions of the Private Securities Litigation Reform Act of 1995 (collectively, “Forward-looking Statements”). All statements included herein, other than statements of historical fact, are Forward-looking Statements and are subject to a variety of known and unknown risks and uncertainties which could cause actual events or results to differ materially from those reflected in the Forward-looking Statements. The Forward-looking Statements in this news release may include, without limitation, statements about the Company’s plans for its mines and mineral properties; the Company’s business strategy, plans and outlook; the merit of the Company’s mines and mineral properties; the Yaramoko Mine Mineral Resource and Mineral Reserve estimates; expected metallurgical recoveries; the Company’s ability to convert Inferred Mineral Resources to Indicated Mineral Resources and to convert Mineral Resources to Mineral Reserves; timelines; production at the Yaramoko Mine; the future financial or operating performance of the Company; the effects of laws, regulations and government policies affecting our operations or potential future operations; future successful development of the Yaramoko Mine; the estimates of expected or anticipated economic returns from the Company’s mining operations including future sales of metals, doré and concentrate or other products produced by the Company and the Company’s ability to achieve its production and cost guidance; capital expenditures at the Company’s operations; estimated brownfields and greenfields expenditures in 2023; the success of the Company’s exploration activities, including infill drill programs at its mines and development projects; the duration and impacts of COVID-19 on the Company’s production, workforce, business, operations and financial condition; metal price estimates, estimated metal grades in 2023; approvals and other matters. Often, but not always, these Forward-looking Statements can be identified by the use of words such as “estimated”, “potential”, “open”, “future”, “assumed”, “projected”, “used”, “detailed”, “has been”, “gain”, “planned”, “reflecting”, “will”, “anticipated”, “estimated” “containing”, “remaining”, “to be”, or statements that events, “could” or “should” occur or be achieved and similar expressions, including negative variations.

Forward-looking Statements involve known and unknown risks, uncertainties and other factors which may cause the actual results, performance or achievements of the Company to be materially different from any results, performance or achievements expressed or implied by the Forward-looking Statements. Such uncertainties and factors include, among others, operational risks associated with mining and mineral processing; uncertainty relating to Mineral Resource and Mineral Reserve estimates; uncertainty relating to capital and operating costs, production schedules and economic returns; risks relating to the Company’s ability to replace its Mineral Reserves; risks associated with mineral exploration and project development; uncertainty relating to the repatriation of funds as a result of currency controls; environmental matters including obtaining or renewing environmental permits and potential liability claims; uncertainty relating to nature and climate conditions; risks associated with political instability and changes to the regulations governing the Company’s business operations; changes in national and local government legislation, taxation, controls, regulations and political or economic developments in countries in which the Company does or may carry on business; risks associated with war, hostilities or other conflicts, such as the Ukrainian – Russian conflict, and the impact it may have on global economic activity; risks relating to the termination of the Company’s mining concessions in certain circumstances; developing and maintaining relationships with local communities and stakeholders; risks associated with losing control of public perception as a result of social media and other web-based applications; potential opposition to the Company’s exploration, development and operational activities; risks related to the Company’s ability to obtain adequate financing for planned exploration and development activities; property title matters; risks relating to the integration of businesses and assets acquired by the Company; impairments; risks associated with climate change legislation; reliance on key personnel; adequacy of insurance coverage; operational safety and security risks; legal proceedings and potential legal proceedings; the ability of the Company to successfully contest and revoke the resolution issued by SEMARNAT which annuls the extension of the environmental impact authorization for the San Jose mine; uncertainties relating to general economic conditions; risks relating to a global pandemic, including COVID-19, which could impact the Company’s business, operations, financial condition and share price; competition; fluctuations in metal prices; risks associated with entering into commodity forward and option contracts for base metals production; fluctuations in currency exchange rates and interest rates; tax audits and reassessments; risks related to hedging; uncertainty relating to concentrate treatment charges and transportation costs; sufficiency of monies allotted by the Company for land reclamation; risks associated with dependence upon information technology systems, which are subject to disruption, damage, failure and risks with implementation and integration; risks associated with climate change legislation; labor relations issues; as well as those factors discussed under “Risk Factors” in the Company's Annual Information Form. Although the Company has attempted to identify important factors that could cause actual actions, events or results to differ materially from those described in Forward-looking Statements, there may be other factors that cause actions, events or results to differ from those anticipated, estimated or intended.

Forward-looking Statements contained herein are based on the assumptions, beliefs, expectations and opinions of management, including but not limited to the accuracy of the Company’s current mineral resource and reserve estimates; that the Company’s activities will be conducted in accordance with the Company’s public statements and stated goals; that there will be no material adverse change affecting the Company, its properties or its production estimates (which assume accuracy of projected ore grade, mining rates, recovery timing, and recovery rate estimates and may be impacted by unscheduled maintenance, labour and contractor availability and other operating or technical difficulties); the duration and effect of global and local inflation; the duration and impacts of COVID-19 and geo-political uncertainties on the Company’s production, workforce, business, operations and financial condition; the expected trends in mineral prices, inflation and currency exchange rates; that the Company will be successful in challenging the annulment of the extension to the San Jose environmental impact authorization; that all required approvals and permits will be obtained for the Company’s business and operations on acceptable terms; that there will be no significant disruptions affecting the Company's operations and such other assumptions as set out herein. Forward-looking Statements are made as of the date hereof and the Company disclaims any obligation to update any Forward-looking Statements, whether as a result of new information, future events or results or otherwise, except as required by law. There can be no assurance that these Forward-looking Statements will prove to be accurate, as actual results and future events could differ materially from those anticipated in such statements. Accordingly, investors should not place undue reliance on Forward-looking Statements.

Cautionary Note to United States Investors Concerning Estimates of Reserves and Resources

Reserve and resource estimates included in this news release have been prepared in accordance with National Instrument 43-101 Standards of Disclosure for Mineral Projects ("NI 43-101") and the Canadian Institute of Mining, Metallurgy, and Petroleum Definition Standards on Mineral Resources and Mineral Reserves. NI 43-101 is a rule developed by the Canadian Securities Administrators that establishes standards for public disclosure by a Canadian company of scientific and technical information concerning mineral projects. Unless otherwise indicated, all mineral reserve and mineral resource estimates contained in the technical disclosure have been prepared in accordance with NI 43-101 and the Canadian Institute of Mining, Metallurgy and Petroleum Definition Standards on Mineral Resources and Reserves.

Canadian standards, including NI 43-101, differ significantly from the requirements of the Securities and Exchange Commission, and mineral reserve and resource information included in this news release may not be comparable to similar information disclosed by U.S. companies.

APPENDIX 1. Yaramoko Mine, Burkina Faso: Bagassi South QV and QV Prime drill results

| HoleID | Easting (ADINDAN_30N) | Northing (ADINDAN_30N) | Elevation (m) | EOH Depth (m) | UTM Azimuth | Dip | Depth From (m) | Depth To (m) | Width (m) | EST1 (m) | Au (ppm) | Hole Type2 |

| YRM-22-RC-BGR-001 | 469543 | 1297805 | 309 | 121 | 210 | 48 | 99 | 100 | 1 | 0.84 | 0.42 | RC |

| YRM-22-RC-BGR-002 | 469520 | 1297754 | 310 | 80 | 210 | 50 | NSR3 | RC | ||||

| YRM-22-RC-BGR-003A | 469575 | 1297752 | 311 | 110 | 210 | 50 | 71 | 75 | 4 | 3.36 | 3.02 | RC |

| YRM-22-RC-BGR-004 | 469596 | 1297689 | 316 | 80 | 210 | 50 | 22 | 31 | 9 | 7.3 | 1.92 | RC |

| YRM-22-RC-BGR-005 | 469615 | 1297723 | 312 | 115 | 210 | 50 | NSR3 | RC | ||||

| YRM-22-RC-BGR-006 | 469626 | 1297748 | 313 | 144 | 212 | 56 | 119 | 129 | 10 | 5.5 | 7.36 | RC |

| incl | 123 | 127 | 4 | 2.2 | 17.43 | RC | ||||||

| YRM-22-RC-BGR-007 | 469559 | 1297716 | 311 | 46 | 210 | 50 | 30 | 31 | 1 | 0.84 | 3.22 | RC |

| YRM-22-RC-BGR-008 | 469601 | 1297797 | 318 | 170 | 210 | 50 | 158 | 159 | 1 | 0.84 | 0.37 | RC |

| YRM-22-RC-BGR-009 | 469673 | 1297617 | 319 | 44 | 210 | 50 | NSR3 | RC | ||||

| YRM-22-RC-BGR-010 | 469705 | 1297660 | 321 | 105 | 210 | 50 | NSR3 | RC | ||||

| YRM-22-RC-BGR-011 | 469768 | 1297668 | 323 | 167 | 210 | 50 | 146 | 150 | 4 | 3.1 | 1.27 | RC |

| YRM-22-RC-BGR-001 | 469543 | 1297805 | 309 | 121 | 210 | 48 | 99 | 100 | 1 | 0.84 | 0.42 | RC |

| YRM-22-RC-BGR-002 | 469520 | 1297754 | 310 | 80 | 210 | 50 | NSR3 | RC | ||||

| YRM-22-RC-BGR-003A | 469575 | 1297752 | 311 | 110 | 210 | 50 | 71 | 75 | 4 | 3.36 | 3.02 | RC |

Notes:

- EST: Estimated true width

- RC: Reverse circulation

- NSR: No significant result

A photo accompanying this announcement is available at https://www.globenewswire.com/NewsRoom/AttachmentNg/213adcb0-a016-4411-bc6e-3c005affdf76