FPX Nickel Reports Potential to Achieve Production with Lowest Carbon Footprint in Global Nickel Industry

VANCOUVER, BC, Jan. 12, 2021 /CNW/ - FPX Nickel Corp. (TSXV: FPX) ("FPX" or the "Company") is pleased to highlight the potential for the Company's Baptiste Project ("Baptiste" or the "Project") in central British Columbia to produce refined nickel with a significantly lower carbon footprint than other sources of production in the global nickel industry. These findings are based on the Project's recent Preliminary Economic Assessment ("PEA"), which outlined the development of a conventional processing facility powered by low-carbon hydro-electric power for the production of a refined, high-grade (63% nickel) product capable of bypassing smelting and being sold directly to end users.

Highlights

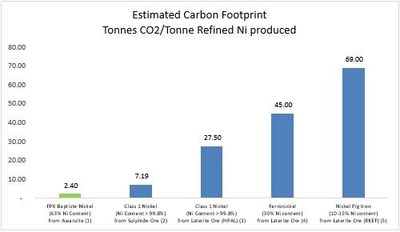

- The carbon intensity of Baptiste operations is expected to average 2.40 tonnes of carbon dioxide ("CO2") per tonne of refined nickel production ("t CO2/t refined Ni")

- Baptiste carbon intensity compares very favourably to published literature estimating the carbon intensity of existing nickel production from various mineral deposit types:

- 7.19 t CO2/t refined Ni for Class 1 nickel production from sulphide ore

- 27.50 t CO2/t refined Ni for Class 1 nickel production from laterite ore

- 45.00 t CO2/t refined Ni for ferronickel production from laterite ore

- 69.00 t CO2/t refined Ni for nickel pig iron production from laterite ore

- Results summarized herein assume no sequestration of carbon dioxide in Baptiste tailings

"These results, taken in combination with the recent PEA, position Baptiste as a truly disruptive project in the global nickel industry, with the potential to become a significant nickel producer at both low-cost and low-carbon intensity for the electric vehicle battery and stainless steel markets," commented Martin Turenne, FPX's President and CEO. "Importantly, these estimates of Baptiste's carbon footprint do not account for the potential sequestration of CO2 in the Project's tailings, which our ongoing research collaboration with the University of British Columbia suggests could act as a sizeable carbon storage facility and further lower the Project's net carbon emissions below 2.40 t CO2/t refined Ni. Given the regulatory push by governments in Europe and elsewhere to impose maximum carbon footprint thresholds for electric vehicle batteries, we see the favorable positioning of Baptiste on the global nickel 'carbon curve' as a key differentiator for the Project going forward."

Based on the diesel and electricity consumption for mining and processing activities outlined in the PEA, the carbon intensity of Baptiste operations is expected to average 2.40 tonnes of CO2 per tonne of refined nickel production over the Project's 35-year mine life. Figure 1 provides a comparison of the estimated carbon footprint of Baptiste nickel production versus industry-wide emissions averages for other major forms of nickel production, as documented in published independent studies.

Figure 1 – Estimated Carbon Footprint for Selected Global Nickel Production

Sources: 1 FPX analysis based on September 2020 PEA; 2 "Life Cycle Assessment of Nickel Products" (Mistry et al., 2016); 3 "Assessing the Energy and Greenhouse Gas Footprints of Nickel Laterite Processing" (Norgate et al., 2010); 4 "Ferronickel Life Cycle Data" (Nickel Institute, 2020), 5 "Energy Consumption and Greenhouse Gas Emissions of Nickel Products" (Wei et al., 2020)

The low carbon intensity of Baptiste nickel production is a function of several features specific to the Project, including:

- Low Stripping Ratio: Baptiste has a life-of-mine stripping ratio of 0.40:1, and thus requires lower consumption of diesel for the mining fleet compared to other similar-scale operations with higher overburden and waste content and higher stripping ratios

- Hydroelectric Power: The Project's processing facility will be powered by low-carbon hydro-electric power, while a significant proportion of global nickel operations (e.g. ferronickel and nickel pig iron) are powered by carbon-intensive coal-fired plants

- Refined Nickel Product with No Smelting: Given their high metal content (63% nickel and 30% iron) and low level of deleterious elements, Baptiste's ferronickel briquettes are expected to bypass the traditional nickel smelting process and be sold as a refined nickel product directly to stainless steel producers, thereby avoiding the carbon emissions associated with the smelting and refining of typical nickel sulphide concentrates.

Comparison to Sulphide Nickel Production

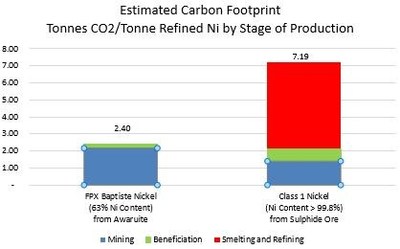

Figure 2 provides a breakdown of the estimated carbon footprint of Baptiste nickel production by mining and processing stage versus the production of Class 1 nickel from sulphide ores. While the carbon intensity of mining and concentrate production (benefication) are similar for both types of operations, the smelting and refining requirements to produce Class 1 refined nickel from sulphide concentrates (with typical nickel content of 15%) entails a significant additional carbon burden on sulphide-derived production as compared to the planned Baptiste operation.

Figure 2 – Estimated Carbon Footprint by Stage of Production

Sources: FPX analysis, "Life Cycle Assessment of Nickel Products" (Mistry et al., 2016)

The Baptiste PEA (which was filed September 29, 2020 under the Company's SEDAR profile) demonstrates the potential for establishing a greenfield open-pit mine and an on-site magnetic separation and flotation processing plant, using conventional technology and equipment. At a throughput rate of 120,000 tonnes per day (or 43.8 million tonnes per year), annual production is projected to average 99 million pounds (44,932 tonnes) nickel contained in ferronickel briquettes grading 63% nickel at C1 operating costs of US$2.74 per pound (US$6,038 per tonne) of nickel.

Cautionary Statement: The PEA is preliminary in nature and includes inferred mineral resources that are considered too speculative geologically to have the economic considerations applied to them that would enable them to be categorized as mineral reserves. Mineral resources are not mineral reserves and do not have demonstrated economic viability. There is no certainty that the conclusions or results as reported in the PEA will be realized.

Investor Relations Engagement

The Company has retained the services of Renmark Financial Communications Inc. ("Renmark") to assist with its investor relations activities. In consideration of the services to be provided, the monthly fees incurred by the Company will be a cash consideration of up to $8,000 CAD, starting January 1st, 2021 for a period ending on June 30th, 2021 and monthly thereafter. Renmark does not have any interest, directly or indirectly, in the Company or its securities, or any right or intent to acquire such an interest.

Dr. Peter Bradshaw, P. Eng., FPX's Qualified Person under NI 43-101, has reviewed and approved the technical content of this news release.

About the Decar Nickel District

The Company's Decar Nickel District claims cover 245 square kilometres of the Mount Sidney Williams ultramafic/ophiolite complex, 90 km northwest of Fort St. James in central British Columbia. The District is a two-hour drive from Fort St. James on a high-speed logging road.

Decar hosts a greenfield discovery of nickel mineralization in the form of a naturally occurring nickel-iron alloy called awaruite, which is amenable to bulk-tonnage, open-pit mining. Awaruite mineralization has been identified in four target areas within this ophiolite complex, being the Baptiste Deposit, the B target, the Sid target and Van target, as confirmed by drilling in the first three plus petrographic examination, electron probe analyses and outcrop sampling on all four. Since 2010, approximately US $24 million has been spent on the exploration and development of Decar.

Of the four targets in the Decar Nickel District, the Baptiste Deposit, which was initially the most accessible and had the biggest known surface footprint, has been the main focus of diamond drilling since 2010, with a total of 82 holes and over 31,000 metres of drilling completed. The Sid target was tested with two holes in 2010 and the B target had a single hole drilled into it in 2011; all three holes intersected nickel-iron alloy mineralization over wide intervals with DTR nickel grades comparable to the Baptiste Deposit. The Van target was not drill-tested at that time as rock exposure was very poor prior to logging activity by forestry companies.

As reported in the current NI 43-101 resource estimate, having an effective date of September 9, 2020, the Baptiste Deposit contains 1.996 billion tonnes of indicated resources at an average grade of 0.122% DTR nickel, containing to 2.4 million tonnes of nickel, plus 593 million tonnes of inferred resources with an average grade of 0.114% DTR nickel, containing 0.7 million tonnes of nickel, both reported at a cut-off grade of 0.06% DTR nickel. Mineral resources are not mineral reserves and do not have demonstrated economic viability.

About FPX Nickel Corp.

FPX Nickel Corp. is focused on the exploration and development of the Decar Nickel District, located in central British Columbia, and other occurrences of the same unique style of naturally occurring nickel-iron alloy mineralization known as awaruite. For more information, please view the Company's website at www.fpxnickel.com or contact Martin Turenne, President and CEO, at (604) 681-8600 or ceo@fpxnickel.com.

On behalf of FPX Nickel Corp.

"Martin Turenne"

Martin Turenne, President, CEO and Director

Forward-Looking Statements

Certain of the statements made and information contained herein is considered "forward-looking information" within the meaning of applicable Canadian securities laws. These statements address future events and conditions and so involve inherent risks and uncertainties, as disclosed in the Company's periodic filings with Canadian securities regulators. Actual results could differ from those currently projected. The Company does not assume the obligation to update any forward-looking statement.

Neither the TSX Venture Exchange nor its Regulation Services Provider accepts responsibility for the adequacy or accuracy of this release.

SOURCE FPX Nickel Corp.

![]() View original content to download multimedia: http://www.newswire.ca/en/releases/archive/January2021/12/c2168.html

View original content to download multimedia: http://www.newswire.ca/en/releases/archive/January2021/12/c2168.html