Further Extensions to High Grade Zones at Stockwork Hill

TORONTO, Dec. 01, 2021 (GLOBE NEWSWIRE) -- Xanadu Mines Ltd (ASX: XAM, TSX: XAM) (Xanadu or the Company) is pleased to update the market on its on-going exploration program for porphyry copper and gold deposits at the Kharmagtai District in the South Gobi region of Mongolia.

Highlights

- Strong step-out drilling results pave the way for further growth of both the gold-rich bornite and high-grade tourmaline breccia zones at Stockwork Hill, with copper and gold grades materially exceeding the 2018 Mineral Resource Estimate1.

- High-grade intercept from drill hole KHDDH584 at Stockwork Hill extends the gold-rich bornite zone by 80 metres up-dip and 30 metres down-dip returning:

- 229.5m @ 0.57% CuEq from 747.5m

- including 88m @ 0.96% CuEq

- including 28m @ 1.35% CuEq

- High-grade partial intercepts from drill hole KHDDH585 at Stockwork Hill expands the Tourmaline Breccia Zone by 25 metres north and 25 metres south returning:

- 309m @ 0.80% CuEq from 250m

- including 225m @ 1.04% CuEq

- including 124m @ 1.55% CuEq

- Including 50m @ 2.18% CuEq

- Drilling between White Hill and Zaraa intercepts a broad zone of mineralisation indicating another porphyry system is nearby and mineralisation likely extends between the two deposits.

- Xanadu is on track for an updated Mineral Resource Estimate for Kharmagtai in December 2021.

Xanadu’s Chief Executive Officer, Dr Andrew Stewart, said “We are very pleased with new results from ongoing step-out drilling at Stockwork Hill. This includes outstanding results from drill hole KHDDH584 that has significantly expanded the higher-grade copper and gold core, supporting our view that this is a big system with huge untested potential. Upside exists not only for increased tonnage, but more importantly for increasing gold to copper ratio, as we drill deeper into the core of the system.

These latest results continue to exceed the grades that were estimated in the 2018 Kharmagtai Mineral Resource, and our geology team has been working hard on an interim Mineral Resource Estimate (MRE) update, to incorporate significant drilling since 2018. We are pleased to confirm that we remain on schedule to release the updated interim MRE this month.”

Full intercepts and drill hole details can be found in Appendix 1, Tables 1 and 2.

Drill Hole KHDDH584

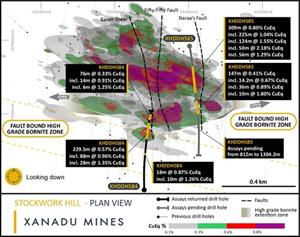

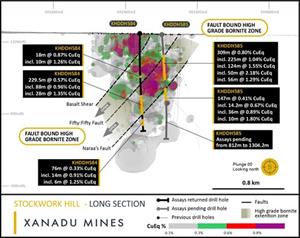

Drill hole KHDDH584 (see Figure 1, 2 & 3) was designed to target down-dip extensions to the higher-grade bornite zone at the Stockwork Hill deposit. It intercepted wide zones of mineralisation, grading up to 0.71% copper (Cu) and 1.26g/t gold (Au) within a broader intercept of 229.5m grading 0.57% copper equivalent (CuEq) from 747.5m.

| Hole ID | Interval | Cu | Au | CuEq | From |

| KHDDH584 | 12m | 1.10% | 0.14g/t | 1.17% | 520m |

| and | 229.5m | 0.34% | 0.45g/t | 0.57% | 747.5m |

| including | 124m | 0.48% | 0.61g/t | 0.79% | 779m |

| including | 88m | 0.57% | 0.77g/t | 0.96% | 813m |

| including | 12m | 0.64% | 0.86g/t | 1.07% | 819m |

| including | 28m | 0.71% | 1.26g/t | 1.35% | 853m |

| and | 14m | 0.88% | 0.07g/t | 0.91% | 1031m |

| including | 6m | 1.20% | 0.09g/t | 1.25% | 1033m |

Note that true widths will generally be narrower than those reported. See disclosure in JORC explanatory statement attached.

Drill hole KHDDH584 extended the higher-grade bornite zone by 80 metres up-dip and 30 metres down-dip at Stockwork Hill, which represents an increase to the interpreted tonnage of higher-grade material at Stockwork Hill.

Significantly, two zones of copper-rich, mineralisation were encountered above and below the main bornite zone. At 520m, a breccia body containing 12m @ 1.1% Cu was returned and at 1,033m, a second breccia was drilled returning 6m @ 1.2% Cu. These breccias occur well outside the stockwork Hill deposit and may represent a vector to a new target.

Drill Hole KHDDH585

Drill hole KHDDH585 (see Figure 1, 2 & 3) was designed to target northern and southern extensions to the high-grade tourmaline breccia zone at the Stockwork Hill deposit. Assays have been returned to 812m, intercepting wide zones of mineralisation, grading up to 1.87% Cu and 0.61g/t Au within a broader intercept of 309m grading 0.80% CuEq from 250m. Furthermore, gold grade was of very high tenor at 784m, returning 10m @ 2.65g/t Au. We look forward to receipt of remaining assays for the end of hole, to better understand the potential for high gold mineralisation at depth.

| Hole ID | Interval | Cu | Au | CuEq | From |

| KHDDH585 | 309m | 0.65% | 0.30g/t | 0.80% | 250m |

| including | 225m | 0.84% | 0.38g/t | 1.04% | 284m |

| including | 124m | 1.28% | 0.52g/t | 1.55% | 322m |

| including | 50m | 1.87% | 0.61g/t | 2.18% | 330m |

| including | 56m | 1.00% | 0.58g/t | 1.29% | 390m |

| including | 14m | 0.40% | 0.60g/t | 0.71% | 479m |

| and | 147m | 0.19% | 0.42g/t | 0.41% | 665m |

| including | 4m | 0.92% | 1.28g/t | 1.57% | 752m |

| including | 36m | 0.30% | 1.14g/t | 0.89% | 774m |

| including | 10m | 0.45% | 2.65g/t | 1.80% | 784m |

Note that true widths will generally be narrower than those reported. See disclosure in JORC explanatory statement attached.

Assays are returned to 812m; the remaining results are expected in the coming weeks and are not expected to materially impact the findings in this Announcement.

Figure 1. Stockwork Hill plan view, drill holes KHDDH584 and KHDDH585 and interpreted grade shells is available at https://www.globenewswire.com/NewsRoom/AttachmentNg/3320ecc0-9d63-4ec4-a355-2161ed659de1

Figure 2. Stockwork Hill long section, drill hole KHDDH584 and KHDDH585 and interpreted grade shells is available at https://www.globenewswire.com/NewsRoom/AttachmentNg/79443c97-80b4-444e-a935-6b308c7a21b3

Figure 3. Stockwork Hill cross section, drill hole KHDDH584 and KHDDH585 and interpreted grade shells https://www.globenewswire.com/NewsRoom/AttachmentNg/1c86f87c-f19f-4a32-a384-e8751884280b

Other Drilling

Pending assays that were discussed in the September 2021 Quarterly Report2 have now been returned for drill holes KHDDH581, KHDDH582 and KHDDH583.

- KHDDH581 returned patchy tourmaline breccia mineralisation throughout the drill hole, without delivering any significant intercepts. Details can be found in Tables 1 and 2.

- KHDDH582 was drilled as a discovery hole between White Hill and Zaraa deposits. This hole encountered a broad zone of porphyry mineralisation, as defined by a 700m wide zone of porphyry veining, including 177m @ 0.14% CuEq. Results indicate the potential for another porphyry system in close proximity. Mineralisation has potential to extend between the White Hill and Zaraa deposits with future drill testing. Details can be found in Tables 1 and 2.

- KHDDH583 was drilled targeting the upper fault block of the high-grade bornite zone. This hole returned a broad zone of moderate grade mineralisation with several narrow zones of high-grade including 27m @ 0.57% CuEq. Drill hole details and intercepts can be found in Tables 1 and 2.

About Xanadu Mines

Xanadu is an ASX and TSX listed Exploration company operating in Mongolia. We give investors exposure to globally significant, large-scale copper-gold discoveries and low-cost inventory growth. Xanadu maintains a portfolio of exploration projects and remains one of the few junior explorers on the ASX or TSX who control a globally significant copper-gold deposit in our flagship Kharmagtai project. For information on Xanadu visit: www.xanadumines.com.

Andrew Stewart

CEO

Xanadu Mines Ltd

Andrew.stewart@xanadumines.com

+61 409 819 922

This Announcement was authorised for release by Xanadu’s Board of Directors.

Appendix 1: Drilling Results

Table 1: Drill hole collar

| Hole ID | Prospect | East | North | RL | Azimuth (°) | Inc (°) | Depth (m) |

| KHDDH581 | Stockwork Hill | 592982 | 4877864 | 1281 | 180 | -67 | 870.4 |

| KHDDH582 | Zaraa | 593586 | 4876318 | 1293 | 0 | -60 | 1,437.0 |

| KHDDH583 | Stockwork Hill | 592376 | 4877485 | 1293 | 0 | -70 | 935.5 |

| KHDDH584 | Stockwork Hill | 592560 | 4877182 | 1298 | 0 | -70 | 1,171.0 |

| KHDDH585 | Stockwork Hill | 592806 | 4877968 | 1282 | 170 | -65 | 1,304.2 |

Table 2: Significant drill results

| Hole ID | Prospect | From (m) | To (m) | Interval (m) | Au (g/t) | Cu (%) | CuEq (%) | AuEq (g/t) |

| KHDDH581 | Stockwork Hill | 180 | 228 | 48 | 0.10 | 0.14 | 0.19 | 0.37 |

| including | 200 | 204 | 4 | 0.26 | 0.23 | 0.37 | 0.71 | |

| and | 238 | 246 | 8 | 0.04 | 0.14 | 0.16 | 0.32 | |

| and | 284 | 302 | 18 | 0.06 | 0.09 | 0.12 | 0.23 | |

| and | 320 | 330 | 10 | 0.15 | 0.09 | 0.17 | 0.32 | |

| and | 374 | 416 | 42 | 0.05 | 0.08 | 0.10 | 0.20 | |

| and | 436 | 456 | 20 | 0.03 | 0.18 | 0.19 | 0.38 | |

| and | 474 | 498 | 24 | 0.04 | 0.12 | 0.14 | 0.27 | |

| and | 508 | 512 | 4 | 0.10 | 0.06 | 0.11 | 0.22 | |

| and | 522 | 580 | 58 | 0.04 | 0.06 | 0.09 | 0.17 | |

| and | 596 | 600 | 4 | 0.28 | 0.14 | 0.28 | 0.55 | |

| and | 616.1 | 622 | 5.9 | 0.08 | 0.09 | 0.13 | 0.25 | |

| and | 632 | 660 | 28 | 0.05 | 0.12 | 0.15 | 0.29 | |

| and | 698 | 714 | 16 | 0.07 | 0.13 | 0.17 | 0.33 | |

| and | 740 | 762 | 22 | 0.03 | 0.14 | 0.16 | 0.31 | |

| and | 808 | 814 | 6 | 0.02 | 0.09 | 0.10 | 0.20 | |

| and | 838 | 850 | 12 | 0.03 | 0.10 | 0.12 | 0.24 | |

| KHDDH582 | Zaraa | 521 | 525 | 4 | 0.07 | 0.10 | 0.13 | 0.26 |

| and | 539 | 554 | 15 | 0.03 | 0.09 | 0.11 | 0.22 | |

| and | 566 | 580 | 14 | 0.04 | 0.10 | 0.12 | 0.23 | |

| and | 592 | 604 | 12 | 0.03 | 0.09 | 0.11 | 0.21 | |

| and | 628 | 646 | 18 | 0.05 | 0.14 | 0.16 | 0.32 | |

| and | 656 | 833 | 177 | 0.05 | 0.12 | 0.14 | 0.28 | |

| and | 1040 | 1044 | 4 | 0.07 | 0.15 | 0.19 | 0.37 | |

| and | 1053.5 | 1062 | 8.5 | 0.05 | 0.10 | 0.12 | 0.24 | |

| KHDDH583 | Stockwork Hill | 5 | 35 | 30 | 0.05 | 0.09 | 0.12 | 0.24 |

| and | 73 | 77 | 4 | 0.05 | 0.11 | 0.14 | 0.27 | |

| and | 158 | 164 | 6 | 0.06 | 0.14 | 0.17 | 0.33 | |

| and | 174 | 194 | 20 | 0.04 | 0.12 | 0.14 | 0.28 | |

| and | 246 | 250 | 4 | 0.05 | 0.08 | 0.10 | 0.20 | |

| and | 312 | 322 | 10 | 0.07 | 0.07 | 0.11 | 0.21 | |

| and | 342 | 365 | 23 | 0.06 | 0.07 | 0.10 | 0.20 | |

| and | 375 | 411 | 36 | 0.05 | 0.07 | 0.10 | 0.20 | |

| and | 459 | 480 | 21 | 0.11 | 0.06 | 0.12 | 0.23 | |

| and | 490 | 614 | 124 | 0.12 | 0.17 | 0.23 | 0.45 | |

| including | 583 | 610 | 27 | 0.25 | 0.44 | 0.57 | 1.12 | |

| including | 585 | 591 | 6 | 0.16 | 0.73 | 0.81 | 1.59 | |

| including | 603 | 608.3 | 5.3 | 0.47 | 0.47 | 0.71 | 1.39 | |

| and | 691 | 703 | 12 | 0.10 | 0.08 | 0.13 | 0.26 | |

| and | 716 | 747 | 31 | 0.10 | 0.07 | 0.12 | 0.24 | |

| including | 737 | 743 | 6 | 0.20 | 0.29 | 0.39 | 0.76 | |

| and | 759 | 806 | 47 | 0.09 | 0.15 | 0.20 | 0.39 | |

| including | 773 | 781 | 8 | 0.19 | 0.25 | 0.35 | 0.68 | |

| and | 800 | 804 | 4 | 0.27 | 0.49 | 0.63 | 1.23 | |

| and | 868 | 924 | 56 | 0.07 | 0.07 | 0.11 | 0.21 | |

| KHDDH584 | Stockwork Hill | 123 | 135 | 12 | 0.11 | 0.09 | 0.14 | 0.28 |

| and | 375 | 387 | 12 | 0.06 | 0.13 | 0.16 | 0.31 | |

| and | 516 | 534 | 18 | 0.11 | 0.82 | 0.87 | 1.71 | |

| including | 516 | 532 | 16 | 0.12 | 0.90 | 0.96 | 1.88 | |

| including | 520 | 532 | 12 | 0.14 | 1.10 | 1.17 | 2.29 | |

| including | 522 | 532 | 10 | 0.15 | 1.18 | 1.26 | 2.46 | |

| and | 747.5 | 977 | 229.5 | 0.45 | 0.34 | 0.57 | 1.11 | |

| including | 754.8 | 767 | 12.2 | 0.31 | 0.20 | 0.35 | 0.69 | |

| including | 779 | 903 | 124 | 0.61 | 0.48 | 0.79 | 1.55 | |

| including | 813 | 901 | 88 | 0.77 | 0.57 | 0.96 | 1.87 | |

| including | 819 | 831 | 12 | 0.86 | 0.64 | 1.07 | 2.10 | |

| including | 853 | 881 | 28 | 1.26 | 0.71 | 1.35 | 2.65 | |

| including | 916 | 930 | 14 | 0.36 | 0.23 | 0.41 | 0.80 | |

| including | 950 | 977 | 27 | 0.45 | 0.20 | 0.43 | 0.85 | |

| including | 950 | 956 | 6 | 0.90 | 0.32 | 0.78 | 1.53 | |

| and | 991 | 1001 | 10 | 0.11 | 0.07 | 0.12 | 0.24 | |

| and | 1029 | 1105 | 76 | 0.03 | 0.31 | 0.33 | 0.65 | |

| including | 1029 | 1073 | 44 | 0.05 | 0.45 | 0.47 | 0.93 | |

| including | 1031 | 1045 | 14 | 0.07 | 0.88 | 0.91 | 1.78 | |

| including | 1033 | 1039 | 6 | 0.09 | 1.20 | 1.25 | 2.45 | |

| and | 1137 | 1157 | 20 | 0.23 | 0.02 | 0.14 | 0.28 | |

| including | 1145.4 | 1157 | 11.6 | 0.39 | 0.01 | 0.21 | 0.40 | |

| KHDDH585 | Stockwork Hill | 8 | 14 | 6 | 0.03 | 0.10 | 0.12 | 0.23 |

| and | 40 | 120 | 80 | 0.06 | 0.09 | 0.12 | 0.23 | |

| and | 204 | 222 | 18 | 0.11 | 0.07 | 0.13 | 0.25 | |

| and | 234 | 238 | 4 | 0.08 | 0.29 | 0.33 | 0.65 | |

| and | 250 | 559 | 309 | 0.30 | 0.65 | 0.80 | 1.57 | |

| including | 284 | 509 | 225 | 0.38 | 0.84 | 1.04 | 2.03 | |

| including | 322 | 446 | 124 | 0.52 | 1.28 | 1.55 | 3.02 | |

| including | 330 | 380 | 50 | 0.61 | 1.87 | 2.18 | 4.27 | |

| including | 390 | 446 | 56 | 0.58 | 1.00 | 1.29 | 2.52 | |

| including | 479 | 493 | 14 | 0.60 | 0.40 | 0.71 | 1.38 | |

| including | 481 | 493 | 12 | 0.60 | 0.41 | 0.72 | 1.41 | |

| including | 521 | 537 | 16 | 0.23 | 0.17 | 0.28 | 0.55 | |

| and | 569 | 591 | 22 | 0.09 | 0.07 | 0.11 | 0.22 | |

| and | 611 | 637 | 26 | 0.04 | 0.05 | 0.07 | 0.14 | |

| and | 665 | 812 | 147 | 0.42 | 0.19 | 0.41 | 0.80 | |

| including | 675 | 687 | 12 | 0.13 | 0.19 | 0.26 | 0.50 | |

| including | 721 | 725 | 4 | 0.96 | 0.31 | 0.80 | 1.56 | |

| including | 749.8 | 764 | 14.2 | 0.48 | 0.43 | 0.67 | 1.32 | |

| including | 752 | 756 | 4 | 1.28 | 0.92 | 1.57 | 3.07 | |

| including | 774 | 810 | 36 | 1.14 | 0.30 | 0.89 | 1.73 | |

| including | 780 | 810 | 30 | 1.27 | 0.32 | 0.97 | 1.91 | |

| including | 784 | 794 | 10 | 2.65 | 0.45 | 1.80 | 3.53 | |

| assays pending | ||||||||

Appendix 2: Statements and Disclaimers

Mineral Resources and Ore Reserves Reporting Requirements

The 2012 Edition of the Australasian Code for Reporting of Exploration Results, Mineral Resources and Ore Reserves (the JORC Code 2012) sets out minimum standards, recommendations and guidelines for Public Reporting in Australasia of Exploration Results, Mineral Resources and Ore Reserves. The Information contained in this Announcement has been presented in accordance with the JORC Code 2012.

The information in this Announcement relates to the exploration results previously reported in ASX Announcements which are available on the Xanadu website at:

http://www.xanadumines.com/irm/content/announcements.aspx.

The Company is not aware of any new, material information or data that is not included in those market announcements.

Competent Person Statement

The information in this announcement that relates to exploration results is based on information compiled by Dr Andrew Stewart, who is responsible for the exploration data, comments on exploration target sizes, QA/QC and geological interpretation and information. Dr Stewart, who is an employee of Xanadu and is a Member of the Australasian Institute of Geoscientists, has sufficient experience relevant to the style of mineralisation and type of deposit under consideration and to the activity he is undertaking to qualify as the “Competent Person” as defined in the 2012 Edition of the Australasian Code for Reporting Exploration Results, Mineral Resources and Ore Reserves and the National Instrument 43-101. Dr Stewart consents to the inclusion in the report of the matters based on this information in the form and context in which it appears.

Copper Equivalent Calculations

The copper equivalent (CuEq or eCu) calculation represents the total metal value for each metal, multiplied by the conversion factor, summed and expressed in equivalent copper percentage with a metallurgical recovery factor applied. The copper equivalent calculation used is based off the CuEq calculation defined by CSA Global Pty Ltd (CSA Global) in the 2018 Mineral Resource Upgrade (see ASX Announcement dated 31 October 2018).

Copper equivalent grade values were calculated using the formula CuEq = Cu + Au * 0.62097 * 0.8235.

Where Cu = copper grade (%); Au = gold grade (gold per tonne (g/t)); 0.62097 = conversion factor (gold to copper); and 0.8235 = relative recovery of gold to copper (82.35%).

These equivalent formulas were based on the following parameters (prices are in USD): Copper price = 3.1 $/lb (or 6,834 $ per tonne ($/t)); Gold price = 1,320 $ per ounce ($/oz); Copper recovery = 85%; Gold recovery = 70%; and Relative recovery of gold to copper = 70% / 85% = 82.35%.

Forward-Looking Statements

Certain statements contained in this Announcement, including information as to the future financial or operating performance of Xanadu and its projects may also include statements which are ‘forward‐looking statements’ that may include, amongst other things, statements regarding targets, estimates and assumptions in respect of mineral reserves and mineral resources and anticipated grades and recovery rates, production and prices, recovery costs and results, capital expenditures and are or may be based on assumptions and estimates related to future technical, economic, market, political, social and other conditions. These ‘forward-looking statements’ are necessarily based upon a number of estimates and assumptions that, while considered reasonable by Xanadu, are inherently subject to significant technical, business, economic, competitive, political and social uncertainties and contingencies and involve known and unknown risks and uncertainties that could cause actual events or results to differ materially from estimated or anticipated events or results reflected in such forward‐looking statements.

Xanadu disclaims any intent or obligation to update publicly or release any revisions to any forward‐looking statements, whether as a result of new information, future events, circumstances or results or otherwise after the date of this Announcement or to reflect the occurrence of unanticipated events, other than required by the Corporations Act 2001 (Cth) and the Listing Rules of the Australian Securities Exchange (ASX) and Toronto Stock Exchange (TSX). The words ‘believe’, ‘expect’, ‘anticipate’, ‘indicate’, ‘contemplate’, ‘target’, ‘plan’, ‘intends’, ‘continue’, ‘budget’, ‘estimate’, ‘may’, ‘will’, ‘schedule’ and similar expressions identify forward‐looking statements.

All ‘forward‐looking statements’ made in this Announcement are qualified by the foregoing cautionary statements. Investors are cautioned that ‘forward‐looking statements’ are not guarantee of future performance and accordingly investors are cautioned not to put undue reliance on ‘forward‐looking statements’ due to the inherent uncertainty therein.

For further information please visit the Xanadu Mines’ Website at www.xanadumines.com.

Appendix 3: Kharmagtai Table 1 (JORC 2012)

Set out below is Section 1 and Section 2 of Table 1 under the JORC Code, 2012 Edition for the Kharmagtai project. Data provided by Xanadu. This Table 1 updates the JORC Table 1 disclosure dated 16 August 2021.

JORC TABLE 1 - SECTION 1 - SAMPLING TECHNIQUES AND DATA

(Criteria in this section apply to all succeeding sections).

| Criteria | JORC Code explanation | Commentary |

| Sampling techniques |

|

|

| Drilling techniques |

|

|

| Drill sample recovery |

|

|

| Logging |

|

|

| Sub-sampling techniques and sample preparation |

|

|

| Quality of assay data and laboratory tests |

|

|

| Verification of sampling and assaying |

|

|

| Location of data points |

|

|

| Data spacing and distribution |

|

|

| Orientation of data in relation to geological structure |

|

|

| Sample security |

|

|

| Audits or reviews |

|

|

JORC TABLE 1 - SECTION 2 - REPORTING OF EXPLORATION RESULTS

(Criteria in this section apply to all succeeding sections).

| Criteria | Commentary |

| Mineral tenement and land tenure status |

|

| Exploration done by other parties |

|

| Geology |

|

| Drill hole Information |

|

| Data Aggregation methods |

Copper equivalent (CuEq or eCu) grade values were calculated using the following formula: eCu or CuEq = Cu + Au * 0.62097 * 0.8235, Gold Equivalent (eAu) grade values were calculated using the following formula: eAu = Au + Cu / 0.62097 * 0.8235. Where: Cu - copper grade (%) Au - gold grade (g/t) 0.62097 - conversion factor (gold to copper) 0.8235 - relative recovery of gold to copper (82.35%) The copper equivalent formula was based on the following parameters (prices are in USD):

|

| Relationship between mineralisation on widths and intercept lengths |

|

| Diagrams |

|

| Balanced reporting |

|

| Other substantive exploration data |

|

| Further Work |

|

JORC TABLE 1 - SECTION 3 - ESTIMATION AND REPORTING OF MINERAL RESOURCES

Mineral Resources are not reported so this is not applicable to this Announcement. Please refer to the Company’s ASX Announcement dated 31 October 2018 for Xanadu’s most recent reported Mineral Resource Estimate and applicable Table 1, Section 3.

JORC TABLE 1 - SECTION 4 - ESTIMATION AND REPORTING OF ORE RESERVES

Ore Reserves are not reported so this is not applicable to this Announcement.

_______________________________

1 ASX/TSX Announcement 31 October 2018 - Major increase in Kharmagtai Open Cut Resource to 1.9Mt Cu & 4.3Moz Au

2 ASX/TSX Announcement 28 October 2021 – Quarterly Activities Report and Appendix 5B – 30 September 2021