Further Wide Zones of Mineralization Intersected - Lone Star Copper-Gold Project

(TheNewswire)

Vancouver, B.C. Canada – TheNewswire - February 14, 2022 - Belmont Resources Inc. (“Belmont”), (or the “Company”), (TSXV:BEA) (FSE:L3L2) reports results from an ongoing drilling program on the Belmont-Marquee Resources. (ASX: MQR) (“Marquee”) Lone Star Joint Venture (JV) in North Eastern Washington State.

Highlights:

-

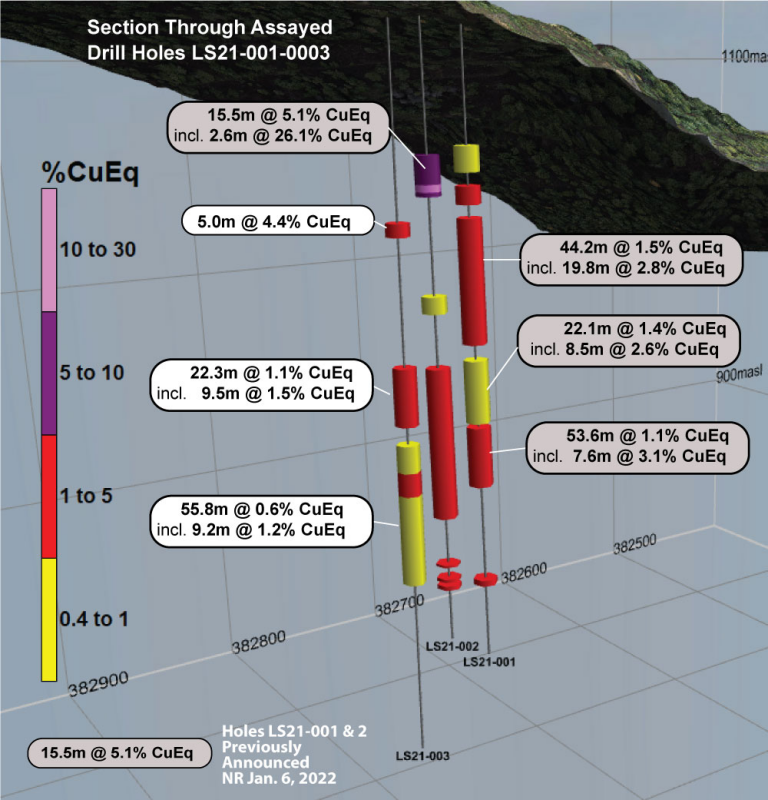

LS21-003: 5.0m @ 4.4% CuEq from 72.4m

-

LS21-003: 22.3m @ 1.1% CuEq from 125.6m(including 9.5m @ 1.5% CuEq)

-

LS21-003: 55.8m @ 0.6% CuEq from 155.2m (including 9.15m @ 1.2% CuEq

-

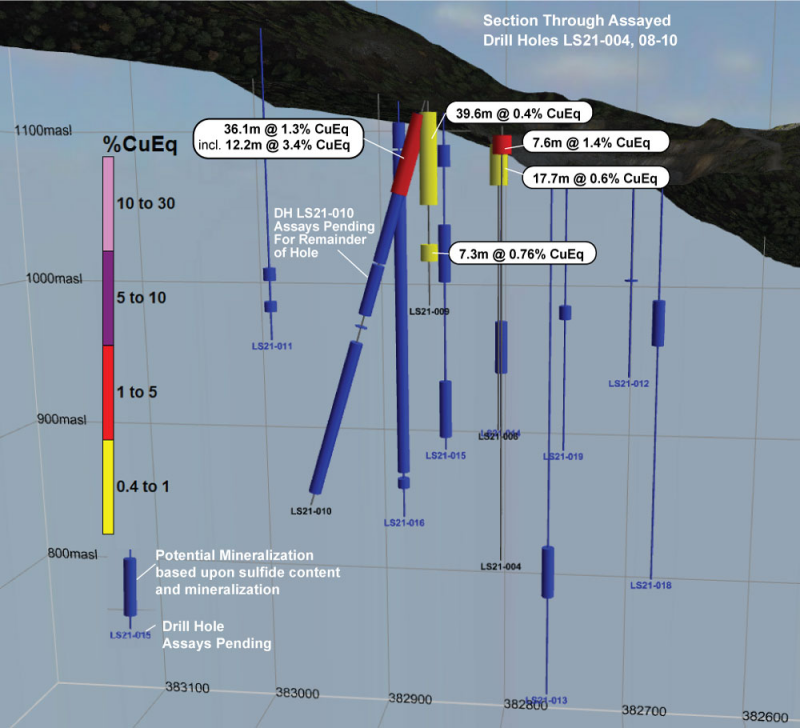

LS21-004: 7.6m @ 1.4% CuEq from 7m

-

LS21-008: 17.7m @ 0.8% CuEq from 5.5m

-

LS21-009: 39.6m @ 0.4% CuEq from 6.4m

-

LS21-010: 36.1m @ 1.3% CuEq from 25.5m(including 12.2m @ 3.4% CuEq)

(note: only 28 of 131 assays received from drill hole 10 thus far)

Highlights Released January 6, 2022

-

LS21-001:44.2m @ 1.5% CuEq from 65.8m (including 19.8m @ 2.8% CuEq

-

LS21-001:22.1m @ 1.4% CuEq from 140.4m (including 8.5m @ 2.6% CuEq

-

LS21-002:15.5m @ 5.1% CuEq from 46.9m (including. 2.6m @ 26.1% CuEq

-

LS21-002: 53.6m @ 1.1% CuEq from 120.7m (including 7.6m @ 3.1% CuEq

The objective of the drill program is to:

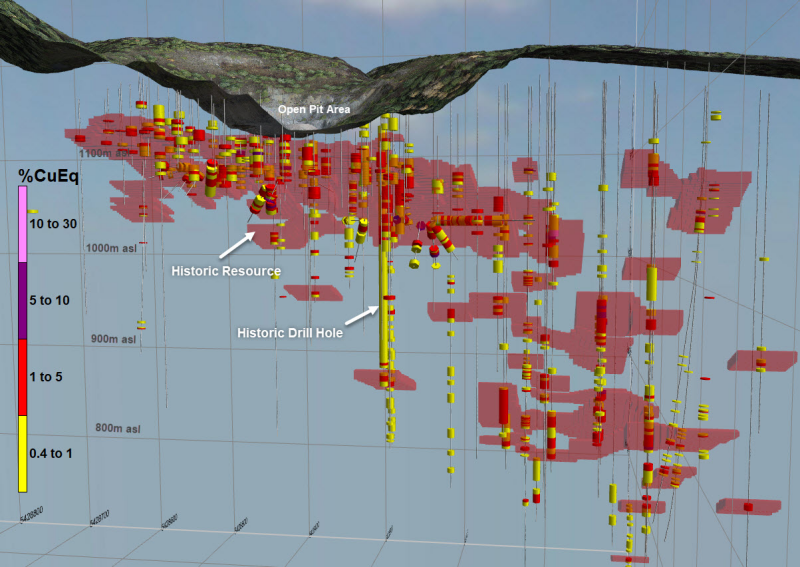

1) Validate the historical 252 drill hole database and resource model;

2) Achieve an infill drill hole spacing that is appropriate for advancing the 2007 historic inferred mineral resource to a current measured and indicated resource category;

3) Test for extensions of the historical resource both laterally and at depth;

4) Deliver a 43-101/JORC compliant mineral resource

estimate and scoping study.

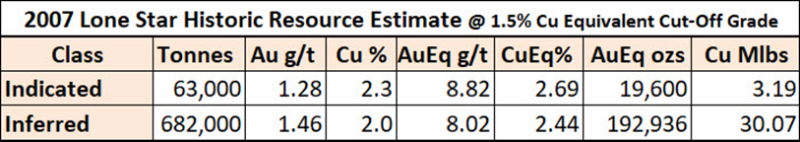

Lone Star 2007 Historical Resource

Calculated utilizing a gold price of US$593/oz and copper price of US$2.84/lb.

(1) Mineral resources which are not mineral reserves do not have demonstrated economic viability.

(2) Gold equivalent (AuEq) grade was calculated utilizing a gold price of US$593/oz and copper price of US$2.84/lb., based on the 24 month (at July 31, 2007) trailing average of gold and copper prices, to obtain a conversion factor of % copper x 3.284 + gold g/t = Au Eq g/t. Metallurgical recoveries and smelting/refining costs were not factored into the gold equivalent calculation.

(3) The Cu equivalent (CuEq) cut-off value of 1.5% was calculated and rounded utilizing the following: Cu price US$2.84/lb, $US exchange rate $0.88, process recovery $95%, smelter payable 95%, smelting and refining charges C$7/tonne mined, mining cost C$62/tonne mined, process cost $C28/tonne processed, G&A cost $7.50/tonne processed.

(4) A qualified person has not done sufficient work to classify the historic estimate as current mineral resources or mineral reserves. As such the issuer, Belmont Resources, is not treating this historical estimate as current mineral resources or mineral reserves.

Lone Star Diamond Drilling Program Update

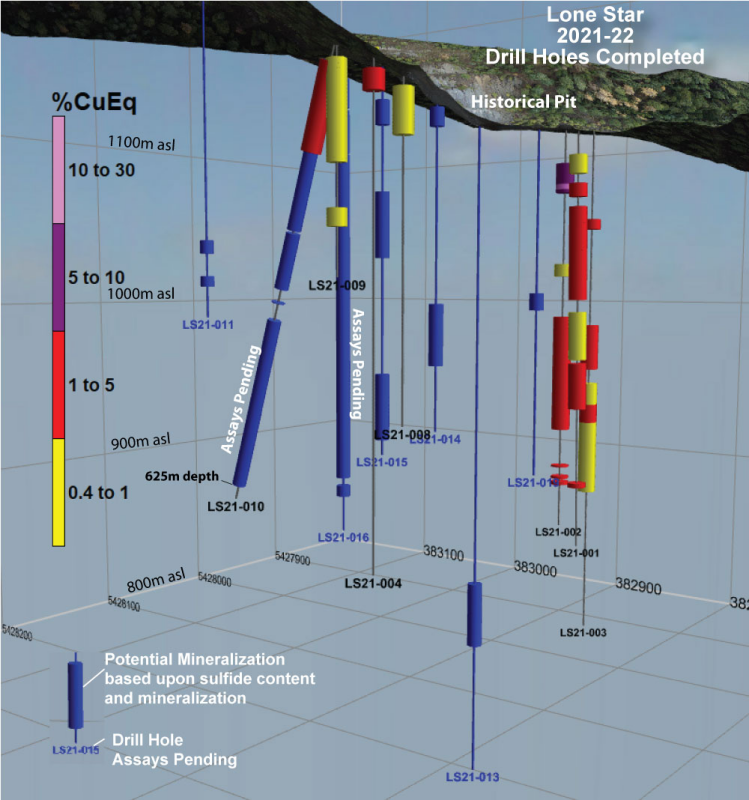

To date a total of 16 diamond drill holes for 2,815m have been completed at Lone Star Error: Reference source not foundwith full assay results from the first six drill holes received (LS21-001-004, 008-009), and partial results for 28 of 131 results from LS21-010 received.

The third batch of core is at the laboratory for assay, with the fourth batch currently being transported to the laborartory. Drilling continues 24 hours a day as part of the forty-two hole, ~6,000m of diamond drilling program. Drilling is expected to be completed at the Lone Star Copper-Gold Project in Q1-2022.

Drill hole LS21-003 was drilled approximately 30m south of LS21-002. 91.15m of variably mineralised core was observed with massive quartz-sulphide veins intersected in the dacite hosted Upper Zone. Disseminated to locally abundant sulphides were intersected in the serpentinite hosted Lower Zone. Significant intersections from LS21-003 included 55.8m @ 0.6% CuEq from 155.2m (including 9.15m @ 1.2% CuEq), 22.3m @ 1.1% CuEq from 125.6m (including 9.5m @ 1.5% CuEq) & 5m @ 4.4% CuEq).

Drill hole LS21-004 was focused to the northwest pit area to begin the systematic resource drilling program and intersected rhyolite-hosted, Upper Zone sulphide mineralisation, with results including 7.6m @ 1.4% CuEq from 7m.

Drill hole LS21-008 intersected sulphide mineralisation associated with quartz-carbonate veining and fractures within the rhyolite hosted Upper Zone. Significant results from LS21-008 included 17.7m @ 0.8% CuEq from 5.5m .

Drill hole LS21-009 was drilled vertically and intersected rhyolite hosted Upper Zone sulphide mineralisation associated with brecciation, quartz-carbonate veining and alteration. Significant results included 39.6m @ 0.4% CuEq from 6.4m).

Drill hole LS21-010 was drilled at a dip of 70o to the east on the same drill pad that LS21-009 was collared from. Early results (28 of 131 results received) from LS21-010 highlight the near surface potential of the project with multiple zones of disseminated and vein hosted, massive sulphide observed in both the Upper Zone and Lower Zones. Significant assay results received thus far from LS21-010 include 36.1m @ 1.3% CuEq from 25.5m (including. 12.2m @ 3.4% CuEq). Note: only 28 of 131 assays received from drill hole 10 have been received.

Drilling continues 24 hours a day with batches of samples being delivered fortnightly to MSA Laboratories in Langley, British Columbia, Canada. Despite the winter conditions, production rates remain high and drill holes are being extended well beyond historical drill hole depths. Additionally, Mining Plus Pty Ltd have been engaged to begin resource modelling studies as the Company pushes towards delivering a 2012 JORC-compliant resource in 1H-2022.

Table 1: Table of significant intercepts

|

Hole_ID |

From |

To |

Int. |

Cu |

Au |

Ag |

CuEq2 |

|

(m) |

(m) |

(m) |

(%) |

(g/t) |

(g/t) |

(%) |

|

|

LS21-003 |

72.40 |

77.40 |

5.00 |

3.50 |

1.10 |

17.50 |

4.35 |

|

LS21-003 |

125.60 |

147.90 |

22.30 |

0.80 |

0.40 |

NSR |

1.06 |

|

incl. |

133.80 |

143.30 |

9.50 |

1.10 |

0.50 |

5.60 |

1.47 |

|

LS21-003 |

155.20 |

211.00 |

55.80 |

0.60 |

NSR |

NSR |

0.60 |

|

incl. |

165.90 |

175.10 |

9.20 |

1.00 |

0.30 |

NSR |

1.20 |

|

LS21-004 |

7.00 |

14.60 |

7.60 |

1.20 |

0.30 |

NSR |

1.40 |

|

LS21-008 |

5.50 |

23.20 |

17.70 |

0.60 |

0.30 |

NSR |

0.80 |

|

LS21-009 |

6.40 |

46.00 |

39.60 |

0.40 |

NSR |

NSR |

0.40 |

|

LS21-009 |

63.40 |

70.70 |

7.30 |

0.50 |

0.40 |

NSR |

0.76 |

|

LS21-010 |

7.80 |

43.90 |

36.10 |

1.00 |

0.40 |

4.50 |

1.30 |

|

incl. |

21.00 |

33.20 |

12.20 |

2.60 |

1.10 |

9.00 |

3.39 |

|

Note: 80% of assays for LS21-010 still outstanding |

|||||||

-

True widths of the reported mineralized intervals have not been determined.

-

Assumptions used in USD for the copper equivalent calculation were metal prices of $4.00/lb. Copper, $1,800/oz Gold, $20/oz Silver, and recovery is assumed to be 100% given the level of metallurgical test data available. The following equation was used to calculate copper equivalence: CuEq = Copper (%) + (Gold (g/t) x 0.656) + (Silver (g/t) x 0.00729).

George Sookochoff, President & CEO commented, “Drilling continues to support the new geological model to be that of a submarine rhyolite dome with associated VMS. At least three stratigraphically separate rhyolite layers, each of which is prospective for undiscovered mineralization, have been identified thus far.

We now are very excited to see over 150 meters of well mineralized rhyolite in each of drill holes LS21-010 and LS21-016. Assays are pending for LS21-016 and the lower 150 meters of LS21-010, however, the top portion of LS21-010 assayed over 36 meters of 1.3% CuEq including 12.20 meters of 3.39% CuEq.

Our geologist James Ebisch, M.Sc., P.Geo. is tentatively interpreting these two holes as intercepting a sub-vertical feeder for one or more of the three stratigraphically separate rhyolite layers closer to surface. The discovery of a feeder system may add an additional resource target and significant upside potential to the Lone Star project.”

About the Lone Star

The Lone Star is a past producing open pit and underground mine situated on the north end of the prolific Republic Graben of Washington State. The project has 252 historic drill holes. In 2006 former owner Merrit Mining drilled an additional six holes and completed a 2007 resource as reported in a “Technical Report and Resource Estimate on the Lone Star Deposit, Ferry County Washington (September 23, 2007)” for Merit Mining Corp. and authored by P&E Mining Consultants Inc.

The company went into receivership shortly after the publishing of the resource estimate due to the 2008 economic crisis. Belmont acquired the Lone Star property in July 2021 and is the first company to continue where Merit Mining left off, in advancing the Lone Star to production.

Belmont-Marquee Joint Venture

Marquee Resources (ASX:MQR) is earning the right to acquire an 80% interest in the Lone Star property (NR Nov. 4, 2021 – Belmont Signs Option/JV Agreements With Marquee Resources On Lone Star Property) by committing to the following:

• $504,000 cash payments

• $2,550,000 Work Program

• 3,000,000 MQR Shares

• Produce a 43-101 & JORC Resource and Scoping Study on the project

• Within a 24 month term.

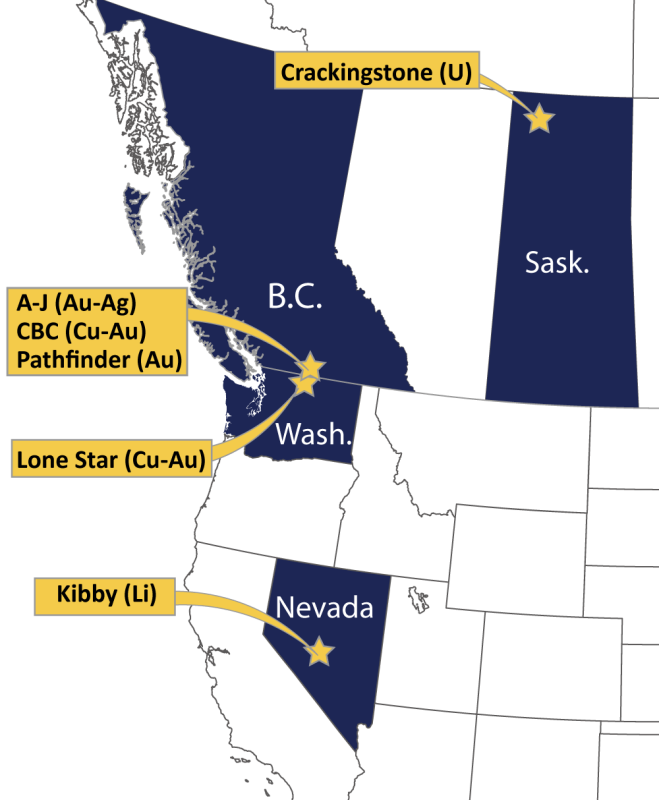

About Belmont Resources

Belmont Resources is engaged in the business of acquiring and re-developing past producing copper-gold-silver mines in southern British Columbia and Northern Washington State. This region is considered to have the highest concentration of mineralization and past producing mines in western North America.

By utilizing new exploration technology, geological modelling and specialized 3D data analysis, the company is successfully identifying new areas of mineralization beneath and/or in the near vicinity of the past producing mines.

-

Athelstan-Jackpot, B.C. – * Gold-Silver mines

-

Come By Chance, B.C. – * Copper-Gold mine

-

Lone Star, Washington – * Copper-Gold mine

-

Pathfinder, B.C. – * Gold–Silver mines

-

Black Bear, B.C. – Gold

-

Pride of the West, B.C.- Gold

-

Kibby Basin, Nevada – Lithium

-

Crackingstone, Sask. – Uranium

* past producing mine

NI 43-101 Disclosure:

Technical disclosure in this news release has been approved by James Ebisch P.Geo, a Qualified Person as defined by National Instrument 43-101.

ON BEHALF OF THE BOARD OF DIRECTORS

“George Sookochoff”

George Sookochoff, CEO/President

Ph: 604-505-4061

Email: george@belmontresources.com

Website: www.BelmontResources.com

We seek safe harbor. Neither TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release. The TSX Venture Exchange has not approved nor disapproved of the information contained herein.

Copyright (c) 2022 TheNewswire - All rights reserved.