GALIANO GOLD ANNOUNCES AN IMPROVED LONG-TERM OUTLOOK AT THE ASANKO GOLD MINE

VANCOUVER, BC, Feb. 22, 2023 /CNW/ - Galiano Gold Inc. ("Galiano" or the "Company") (TSX: GAU) (NYSE American: GAU), as operator of the Asanko Gold Mine ("AGM") under the joint venture ("JV") with Gold Fields Ltd. ("Gold Fields") (JSE: GFI) (NYSE: GFI), is pleased to report the results of an independent Feasibility Study report ("Independent FS"), which includes the reinstatement of Mineral Reserves, along with Galiano's operating outlook at the AGM. The adoption and implementation of the revised life-of-mine ("LOM") plan and the operating outlook remain subject to approval pursuant to the JV agreement. The AGM located in Ghana, West Africa is a 50:50 JV with Gold Fields, which is managed and operated by Galiano. All figures are stated in US dollars unless otherwise stated.

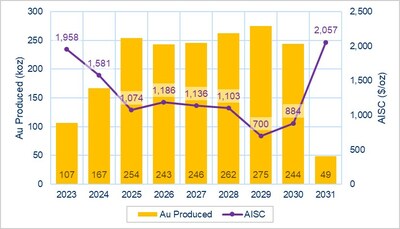

The reinstated Mineral Reserve and updated Mineral Resource estimates, underpinning the Independent FS, was led by SRK Consulting (Canada) Inc. ("SRK") and was reported in accordance with National Instrument 43-101 ("NI 43-101"). The Mineral Reserve estimate forms the basis of a revised LOM plan at the AGM, encompassing 4 main open-pit mining areas: Abore, Miradani North, Esaase and Nkran, and 2 satellite deposits: Dynamite Hill and Adubiaso. The Independent FS demonstrates an operating plan with a total LOM production of 1.85 million ounces ("Moz") of gold, at an all-in-sustaining cost ("AISC") of $1,1431 per oz. Production during the LOM averages 217,000 oz of gold per year. Using the base case of $1,700 per oz gold price, the AGM has an after-tax net present value discounted at 5% ("NPV5%") of $343 million.

AGM Updated Independent FS Highlights - 100% basis, using a base case of $1,700/oz gold

- Robust mine economics: $478 million pre-tax NPV5% and $343 million after-tax NPV5%.

- Highly leveraged to the gold price: after-tax NPV5% of $535 million, at $1,900 per oz gold.

- Low cash costs: $905/oz average total cash costs1 and $1,143/oz average AISC1.

- Increased production profile: annual average gold production of 254,000 oz from 2025 to 2030, inclusive.

- Mining to recommence in 2023: mining contractors expected to be in operation at Abore during the fourth quarter.

- Reinstated Proven and Probable Mineral Reserves (assuming a gold price of $1,500/oz): 2.068 Moz Au (48.9 Mt at 1.31 g/t Au).

- Increased Measured and Indicated Mineral Resources (assuming a gold price of $1,800/oz): 3.504 Moz Au (82.3 Mt at 1.32 g/t Au), inclusive of Mineral Reserves, representing an increase of +21% in total ounces, compared to the previous Mineral Resource estimate dated February 28, 2022.

- Increased Inferred Mineral Resources (assuming a gold price of $1,800/oz): 1.084 Moz Au (25.1 Mt at 1.34 g/t Au), representing an increase of +251% in total ounces, compared to the previous Mineral Resource estimate dated February 28, 2022.

________________________________ |

1 See "Non-IFRS performance measures" |

"On the back of significant exploration success, the new life of mine plan now includes four cornerstone deposits at the Asanko Gold Mine. The plan demonstrates a solid production profile averaging 217,000 ounces per year with an extended mine life through 2031," stated Matt Badylak, Galiano's President and Chief Executive Officer. "Restructuring our operating cost base in 2022 has in part enabled the life of mine plan to achieve all-in-sustaining costs of $1,143 per ounce4, which is expected to generate approximately $500 million in cumulative cash flow over the mine life. Significant opportunities also remain to further enhance the asset through both the continued optimization of operations, and exploration success on the highly prospective Asankrangwa gold belt.

It is also important to note that the Joint Venture held $91 million of cash at December 31, 20222 placing the AGM in a strong position to execute the life of mine plan, commencing with the restart of mining later this year."

AGM INDEPENDENT FEASIBILITY STUDY OVERVIEW

The Independent FS was prepared in accordance with NI 43-101 and led by SRK with an effective date of December 31, 2022. The Company will file a Technical Report on SEDAR at www.sedar.com in accordance with NI 43-101, and on its website within 45 days.

Table 1: LOM Highlights

General | Units | Value |

Gold price assumption (base case) | $/oz | 1,700 |

Average gold production | oz/year | 217,000 |

Peak average gold production (2025 to 2030, inclusive) | oz/year | 254,000 |

Total gold production | Moz | 1.8 |

Mine life | years | 8.5 |

Total ore mined | million tonnes | 41.7 |

Average mill head grade | g/t Au | 1.31 |

Average mill recovery rate | % | 89 % |

Proven and Probable Mineral Reserves | Moz Au | 2.1 |

Economics | ||

Net present value (NPV 5%) (pre-tax) | $ M | 477.8 |

LOM cumulative cash flow (pre-tax) | $ M | 673.7 |

Net present value (NPV 5%) (after-tax) | $ M | 343.3 |

LOM cumulative cash flow (after-tax) | $ M | 490.8 |

Operating Costs | ||

Mining cost3 | $/t mined | 3.66 |

Processing cost | $/t milled | 10.80 |

G&A cost4 | $/t milled | 6.00 |

Total cash costs1 | $/oz sold | 905 |

AISC1 | $/oz sold | 1,143 |

Capital Costs | ||

Development capital (excluding deferred stripping) | $ M | 58.4 |

Sustaining capital (excluding deferred stripping) | $ M | 95.2 |

Closure costs | $ M | 80.9 |

1 See "Non-IFRS Performance Measures" below. |

2 Unaudited as at December 31, 2022. |

3 Mining costs include deferred stripping of $428.4M LOM and ore transportation of $101.3M LOM. |

4 G&A costs include management fee payable to Galiano of approximately $7M per year. |

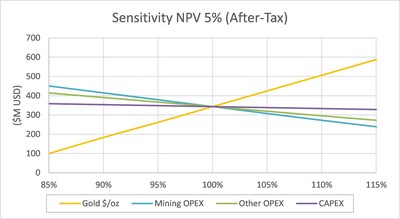

ECONOMIC SENSITIVITIES

Using the base case gold price of $1,700/oz and incorporating only Proven and Probable Mineral Reserves, the project has an after-tax NPV5% of $343 million. A sensitivity analysis was conducted on the base case after-tax NPV5% of the Independent FS, using the following variables: gold price, capital expenditure and operating costs, as illustrated in Table 2 and Figure 1.

Table 2: Sensitivity to Gold Price

Gold Price ($/oz) | $1,500 | $1,600 | $1,700 (Base Case) | $1,800 | $1,900 |

Pre-tax Free Cashflow ($M) | $324 | $499 | $674 | $849 | $1,024 |

Pre-tax NPV5% ($M) | $202 | $340 | $478 | $615 | $753 |

After-tax Free Cashflow ($M) | $256 | $371 | $491 | $612 | $733 |

After-tax NPV5% ($M) | $155 | $248 | $343 | $439 | $535 |

Note: Sensitivity for "Mining OPEX" is inclusive of deferred stripping costs |

AGM MINE PLAN

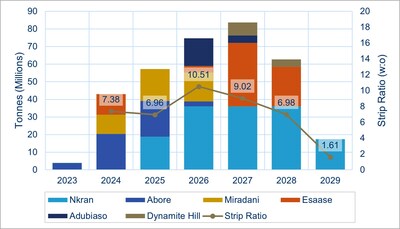

The revised mine plan is based on the following sequencing and timeline:

- Fourth quarter 2023: the Abore pit;

- First half of 2024: limited mining activities at the Esaase pit with a return to full production in late 2026;

- Mid-2024: the Miradani North pit;

- Mid-2025: the Nkran pit;

- Mid-2026: the Adubiaso pit;

- Mid-2027: the Dynamite Hill pit.

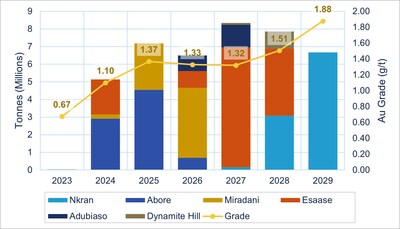

Figures 2 and 3 show the annual total tonnes mined and annual ore tonnes mined by deposit.

AGM PROCESSING

The processing facility will continue to operate at the rate of approximately 5.8M tonnes per annum ("Mtpa") throughout the remaining life of mine to mid-2031. The life of mine is expected to produce a total of 1.846 Moz Au from a reserve of 2.068 Moz with a weighted average recovery of 89% (see below, Tables 3 & 4, and Figure 4).

As of December 31, 2022, current stockpiled ore inventory totaled 7.2 Mt at 0.67 g/t gold. The stockpiles are of sufficient tonnage and grade to continue operations, both independently and as supplemental feed, until the Abore pit has exposed sufficient ore to produce the majority of mill feed, expected by the second quarter 2024.

Table 3: Annual Mill Feed Grade, Gold Production & AISC1 Profiles

Year | 2023 | 2024 | 2025 | 2026 | 2027 | 2028 | 2029 | 2030 | 2031 | Total |

Mill Feed Grade (g/t Au) | 0.68 | 0.99 | 1.45 | 1.39 | 1.58 | 1.60 | 1.57 | 1.51 | 0.76 | 1.31 |

Au Recovered (koz) | 107 | 167 | 254 | 243 | 246 | 262 | 275 | 244 | 49 | 1,846 |

Recovery % | 85 % | 91 % | 94 % | 94 % | 84 % | 88 % | 94 % | 87 % | 77 % | 89 % |

Note |

1 See "Non-IFRS Performance Measures" below. |

Table 4: Summary of Mining & Processing Inputs

Mining & Processing Inputs | Units | Value |

Mining | ||

Mining duration | years | 5.8 |

Total ore mined | million tonnes | 41.7 |

Average mined ore gold grade | g/t | 1.43 |

Total waste mined | million tonnes | 300.9 |

Total material mined | million tonnes | 342.6 |

Strip ratio | Waste (t) : Ore (t) | 7.21 |

Existing stockpiles tonnage | million tonnes | 7.2 |

Existing stockpiles gold grade | g/t | 0.67 |

Processing | ||

Life of mine | years | 8.5 |

Annual feed rate | Mtpa | 5.8 |

Total tonnes processed | million tonnes | 48.9 |

Average mill head gold grade | g/t | 1.31 |

Average gold recovery | % | 89 % |

TAILINGS MANAGEMENT

The AGM has a single existing paddock/valley tailings storage facility ("TSF"), which is fully lined and has incorporated a total of 6 stages. Stage 7 is currently under construction and involves the amalgamation of Stage 5 and Stage 6. The life of mine facility design includes a total of 8 stages, providing storage capacity for an additional 51 million dry tonnes placement of tailings, which exceeds LOM tailings requirements.

ADDITIONAL INFRASTRUCTURE

The AGM site is an established operation, with most of the infrastructure already in place to support the life of mine:

- A carbon-in-leach process plant with various structures, including offices, stores, workshops and reagent storage / mixing facilities;

- An administration block, exploration offices, core storage area, medical clinic and laboratory;

- Accommodation facilities;

- Multiple boreholes for water supply and a water treatment plant;

- A 161 kV incoming power line from the Asawinso substation; and

- Multiple site accesses via sealed public roads, and an airstrip located adjacent to the mill.

An existing 28 km haul road between Obotan and Esaase supports the haulage of Esaase ore to the mill. A new 11 km haul road to the Miradani North deposit is planned to be constructed throughout 2023 and 2024.

CAPITAL, AISC AND OPERATING COSTS

Operating costs have been compiled based on the following sources and assumptions:

- Mining unit costs have been estimated based on recent competitive tenders;

- Processing unit costs have been estimated from first principles and compared with historical actual process costs;

- General and Administration ("G&A") costs are based on ongoing and anticipated costs; and

- Capital expenditure has been estimated from first principals.

Table 5: AGM LOM Capital Expenditures

Total Capital Costs | ($M) |

Development Capital | |

Deferred Stripping (Nkran) | 258.5 |

Site Establishment | 58.4 |

Subtotal Development Capital | 316.9 |

Sustaining Capital | |

Deferred Stripping (other pits) | 169.8 |

Site Establishment | 23.0 |

Tailings Storage Facility and Water Treatment | 44.7 |

Plant and Infrastructure | 27.5 |

Subtotal Sustaining | 265.1 |

Closure and Reclamation | |

Mine Closure and Reclamation | 80.9 |

Total Capital Costs | 662.8 |

Note: Numbers may not sum due to rounding |

Table 6: Life of Mine All-in Sustaining Cost1 Components

Component | Amount | Unit Value ($/oz sold) |

Mining Costs | 723 | 392 |

Ore Transportation | 101 | 55 |

Processing Costs | 528 | 286 |

Stockpile movement | 17 | 9 |

G&A | 294 | 159 |

Royalties | 162 | 88 |

Refining costs | 8 | 4 |

Reclamation Accretion | 12 | 7 |

Sustaining Capital | 95 | 52 |

Sustaining Stripping Costs | 170 | 92 |

All-in Sustaining Costs1 | 2,110 | 1,143 |

Note |

1 See "Non-IFRS Performance Measures" below. |

OPPORTUNITIES

Mining methodologies can be further optimized for all deposits. Opportunity remains to upsize the planned mining equipment, which can reduce operating costs and increase mining advance rates, effectively reducing the duration of pre-stripping. The AGM will incorporate operating technology improvements as part of its Standard Operating Procedures prior to commencement of mining, aimed at improving productivity and safety performance.

The AGM also holds the largest land package on the highly prospective and underexplored Asankrangwa Gold Belt, totaling approximately 476 square kilometres of land tenements. Going forward, the AGM will evaluate the viability of expanding reserves and extending mine life further by testing for extensions of mineralization at depth and along strike at all the current orebodies.

Table 7: Summary of Life of Mine Operating Data & Cash Flows @ $1,700/oz Au (in US$000's)

Description | Units | LOM | 2023 | 2024 | 2025 | 2026 | 2027 | 2028 | 2029 | 2030 | 2031 | 2032-2035 | |||||||

Ore mined | kt | 41,718 | 20 | 5,138 | 7,185 | 6,495 | 8,349 | 7,855 | 6,678 | - | - | - | |||||||

Waste mined | kt | 300,908 | 3,809 | 37,926 | 50,003 | 68,245 | 75,335 | 54,838 | 10,752 | - | - | - | |||||||

Strip ratio | # | 7.2 | 194.0 | 7.4 | 7.0 | 10.5 | 9.0 | 7.0 | 1.6 | - | - | - | |||||||

Mined Grade | g/t | 1.43 | 0.67 | 1.10 | 1.37 | 1.33 | 1.32 | 1.51 | 1.88 | - | - | - | |||||||

Ore processed | kt | 48,920 | 5,787 | 5,792 | 5,794 | 5,794 | 5,794 | 5,794 | 5,794 | 5,794 | 2,579 | - | |||||||

Grade Milled | g/t | 1.31 | 0.68 | 0.99 | 1.45 | 1.39 | 1.58 | 1.60 | 1.57 | 1.51 | 0.76 | - | |||||||

Processing recovery | % | 89.3 % | 84.6 % | 90.5 % | 93.9 % | 93.9 % | 83.6 % | 88.2 % | 94.0 % | 86.6 % | 77.2 % | - | |||||||

Gold produced | kt | 1,846 | 107 | 167 | 254 | 243 | 246 | 262 | 275 | 244 | 49 | - | |||||||

Revenue | 3,138,047 | 181,366 | 283,951 | 431,347 | 412,583 | 418,210 | 445,475 | 467,313 | 415,323 | 82,479 | - | ||||||||

Mining Costs | 723,172 | 13,065 | 95,182 | 108,652 | 131,083 | 134,643 | 157,284 | 74,396 | 5,809 | 3,059 | - | ||||||||

Ore Transportation | 101,327 | 21,022 | 14,950 | 227 | 211 | 18,762 | 12,094 | 14 | 21,438 | 12,610 | - | ||||||||

Processing Costs | 528,273 | 60,683 | 59,663 | 62,809 | 63,544 | 63,282 | 63,668 | 64,285 | 62,735 | 27,606 | - | ||||||||

Stockpile movement (non-cash) | 16,634 | 14,602 | (11,861) | (20,023) | (18,679) | (34,994) | (28,228) | (1,644) | 77,898 | 39,562 | - | ||||||||

G&A | 293,534 | 38,070 | 38,367 | 38,070 | 38,189 | 38,784 | 37,832 | 28,761 | 23,642 | 11,821 | - | ||||||||

Royalties | 161,960 | 10,062 | 15,089 | 21,620 | 20,644 | 22,052 | 23,132 | 23,366 | 21,515 | 4,481 | - | ||||||||

Refining costs | 8,251 | 477 | 747 | 1,134 | 1,085 | 1,100 | 1,171 | 1,229 | 1,092 | 217 | - | ||||||||

Reclamation Accretion (non-cash) | 12,007 | 2,119 | 2,119 | 2,119 | 2,119 | 2,119 | 1,413 | - | - | - | - | ||||||||

Sustaining Capital | 95,249 | 38,488 | 3,500 | 19,680 | 22,207 | 4,447 | 2,625 | 2,115 | 1,750 | 438 | - | ||||||||

Sustaining Stripping Costs 1 | 169,846 | 10,322 | 46,392 | 38,339 | 27,389 | 29,361 | 18,042 | - | - | - | - | ||||||||

All-in sustaining costs | 2,110,253 | 208,908 | 264,149 | 272,626 | 287,792 | 279,556 | 289,033 | 192,521 | 215,878 | 99,792 | - | ||||||||

All-in sustaining costs | US$/oz | 1,143 | 1,958 | 1,581 | 1,074 | 1,186 | 1,136 | 1,103 | 700 | 884 | 2,057 | - | |||||||

Nkram prestrip | 258,532 | - | - | 40,754 | 92,696 | 96,035 | 29,048 | - | - | - | - | ||||||||

Development capex | 58,361 | 23,663 | 30,940 | 3,758 | - | - | - | - | - | - | - | ||||||||

Rehabilitation cash outflow | 80,857 | - | - | - | - | - | 11,792 | 20,214 | 20,214 | 19,449 | 9,187 | ||||||||

Working Capital inflows | (15,000) | - | - | - | - | - | - | - | - | (15,000) | - | ||||||||

Other non-cash items in AISC | (28,640) | (16,721) | 9,742 | 17,904 | 16,560 | 32,875 | 26,816 | 1,644 | (77,898) | (39,562) | - | ||||||||

Cash Taxes | 182,923 | - | - | 1,372 | 27,705 | 40,214 | 14,415 | 31,119 | 68,099 | - | - | ||||||||

Free cash flow after tax | 490,760 | (34,483) | (20,880) | 94,933 | (12,169) | (30,470) | 74,371 | 221,815 | 189,031 | 17,800 | (9,187) | ||||||||

NPV | 343,320 | ||||||||||||||||||

Operating cash flow after tax2 | 1,072,748 | 37,989 | 59,953 | 197,463 | 130,122 | 99,373 | 124,087 | 223,930 | 190,781 | 18,237 | (9,187) | ||||||||

1 Excludes the pre-strip at Nkran | |||||||||||||||||||

2 Cash flow after tax before capital expenditures and stripping costs | |||||||||||||||||||

2023 OUTLOOK

The Company is providing preliminary guidance for 2023 based on the Independent FS, which may be adjusted in the near term as the short-term stockpile processing plan and profile of capital spend is refined and the required joint venture approvals are obtained. The AGM is expected to produce between 100,000 - 120,000 oz at AISC1 between $1,900 and $1,975 per ounce. The AISC1 is anticipated to be elevated in 2023 primarily due to waste stripping necessary to restart mining at Abore, which will benefit future years production, as well as higher expenditures on the TSF.

It is expected that $38 million of sustaining capital expenditures will be spent on the TSF Stage 7 expansion, plant infrastructure and water management in 2023. Additionally, development capital of $24 million is expected to be spent on Abore and the Miradani North site establishment.

Despite the capital-intensive year, the AGM is estimated to break even in terms of cash flow, assuming production achieves the top end of guidance at prevailing metal prices. The investment in 2023 will provide a solid foundation for the next phase of the operation.

For 2023, the exploration budget at the AGM is estimated at $15 million, which includes approximately 40,000 metres of drilling, as well as ground geophysics, trenching, soil sampling and regional mapping. The 2023 exploration program is focused on targeting discoveries on underexplored greenfield areas of the AGM tenements, as well as increasing the Mineral Reserve and Mineral Resources at the known deposits.

Note |

1 See "Non-IFRS Performance Measures" below. |

AGM MINERAL RESOURCE AND MINERAL RESERVE ESTIMATES

Table 8: Mineral Resource Estimate as of December 31, 2022

Measured | Indicated | Measured + Indicated | Inferred | |||||||||

Tonnes | Grade | Au Cont. | Tonnes | Grade | Au Cont. | Tonnes | Grade | Au Cont. | Tonnes | Grade | Au Cont. | |

Deposit | (Mt) | (g/t) | (koz) | (Mt) | (g/t) | (koz) | (Mt) | (g/t) | (koz) | (Mt) | (g/t) | (koz) |

Nkran | - | - | - | 15.3 | 1.89 | 931 | 15.3 | 1.89 | 931 | 3.6 | 1.83 | 209 |

Esaase | - | - | - | 30.6 | 1.25 | 1,227 | 30.6 | 1.25 | 1,227 | 8.2 | 1.26 | 334 |

Abore | - | - | - | 12.8 | 1.16 | 477 | 12.8 | 1.16 | 477 | 3.6 | 1.14 | 131 |

Adubiaso | - | - | - | 3.1 | 1.47 | 148 | 3.1 | 1.47 | 148 | 0.1 | 1.05 | 3 |

Akwasiso | - | - | - | 1.4 | 1.16 | 52 | 1.4 | 1.16 | 52 | 0.2 | 1.28 | 9 |

Asuadai | - | - | - | 1.6 | 1.23 | 64 | 1.6 | 1.23 | 64 | 0.1 | 1.29 | 4 |

Dynamite Hill | - | - | - | 2.2 | 1.34 | 95 | 2.2 | 1.34 | 95 | 1.0 | 1.24 | 40 |

Midras South | - | - | - | - | - | - | - | - | - | 5.4 | 1.32 | 232 |

Miradani North | - | - | - | 7.9 | 1.39 | 352 | 7.9 | 1.39 | 352 | 2.9 | 1.30 | 122 |

Stockpiles | 7.4 | 0.67 | 158 | - | - | - | 7.4 | 0.67 | 158 | - | - | - |

Total | 7.4 | 0.67 | 158 | 75.0 | 1.39 | 3,346 | 82.3 | 1.32 | 3,504 | 25.1 | 1.34 | 1,084 |

Notes on Mineral Resource Estimates:

- Mr. Malcolm Titley of CSA Global UK is the Qualified Person responsible for the Nkran Mineral Resource statement. Dr. Oy Leuangthong, PEng and Mr. Glen Cole, PGeo of SRK Consulting (Canada) Inc. are Qualified Persons responsible Mineral Resource statements for Esaase, Abore, Miradani North, Adubiaso, Midras South, Akwasiso, Asuadai and Dynamite Hill.

- Mineral Resources are not Mineral Reserves and have not demonstrated economic viability. All figures have been rounded to reflect the relative accuracy of the estimates. Due to rounding, some columns or rows may not compute exactly as shown.

- Reported within an optimized pit shell assuming a price of USD1,800/oz gold and using various cut-off grades: 0.40 g/t gold for Nkran; 0.50 g/t in Oxides and 0.60 g/t gold in Transition and Fresh for Esaase; and 0.45 g/t gold for all other deposits. Metallurgical recovery of 94% for all deposits, except in Esaase, where gold recoveries vary based on lithology.

- All tonnages are reported as in situ dry tonnes.

- Mineral Resources are inclusive of Mineral Reserves.

- Galiano's share of the project on an equity basis is 45%. All quantities are reported on a 100% basis.

Table 9: Mineral Reserve Estimate as of December 31, 2022

Proven | Probable | Proven + Probable | |||||||

Tonnes | Grade | Au Contained | Tonnes | Grade | Au Contained | Tonnes | Grade | Au Contained | |

Deposit | (Mt) | (g/t) | (koz) | (Mt) | (g/t) | (koz) | (Mt) | (g/t) | (koz) |

Nkran | - | - | - | 9.9 | 1.82 | 582 | 9.9 | 1.82 | 582 |

Esaase | - | - | - | 13.6 | 1.22 | 533 | 13.6 | 1.22 | 533 |

Miradani North | - | - | - | 6.8 | 1.41 | 310 | 6.8 | 1.41 | 310 |

Abore | - | - | - | 8.2 | 1.27 | 334 | 8.2 | 1.27 | 334 |

Dynamite Hill | - | - | - | 1.1 | 1.31 | 45 | 1.1 | 1.31 | 45 |

Adubiaso | - | - | - | 2.2 | 1.58 | 110 | 2.2 | 1.58 | 110 |

Stockpiles | 7.2 | 0.67 | 155 | - | - | - | 7.2 | 0.67 | 155 |

Total | 7.2 | 0.67 | 155 | 41.7 | 1.43 | 1,913 | 48.9 | 1.31 | 2,068 |

Notes on Mineral Reserve Estimates:

- Mineral Reserves are reported assuming a gold price of US$1,500/oz Au.

- Mineral Reserves are defined within six different pit designs guided by pit shells derived from the optimization software, GEOVIA Whittle™ and Datamine Studio NPVS™.

- Cut-off grades vary based on the deposit. Nkran is close to the mill and contains only fresh ore. The Mineral Reserves are reported at 0.40 g/t Au cut-off for the fresh ore in Nkran. For Esaase, Mineral Reserves are reported at cut-offs of 0.55 g/t Au for the oxide ore and 0.70 g/t Au for the remaining ore types. For all other open pits, the Mineral Reserves are reported at 0.5 g/t Au cut-off for all ore types.

- Mining costs vary based on the pit, the rock type, and the depth of the pit. The base mining costs for Nkran, Esaase, Miradani North, Abore, Dynamite Hill and Adubiaso are $2.44/t, $1.98/t, $1.94/t, $2.00/t, $2.29/t, and $2.06/t, respectively. There are additional expenditures for fixed contractor monthly fees, grade control, community fees, Owner's Mining G&A, and other small costs that vary with each deposit and are in addition to the $/t stated.

- Processing cost is $8.81/t for oxide ore, $10.39/t for transition ore and $10.66/t for fresh ore.

- General and administration cost is $6.69/t for Esaase and $6.19/t for all other pits.

- Ore transportation cost varies for each pit based on the haul distance. It ranges between $0.61/t for Nkran and $6.15/t for Esaase.

- Processing recovery is 94.0% for all ore types in all pits except for Esaase. Processing recovery varies based on the ore type and head grade in Esaase, where the average recovery for oxide, Upper Sandstone, Cobra and Central Sandstone ore types are 90.1%, 73.8%, 71.3% and 76.4%, respectively.

- Mining dilution varies between pits. The average mining dilution is calculated to be 11.9%, 14.4%, 6.0%, 10.8%, 11.6% and 15.3%, for Nkran, Esaase, Miradani North, Abore, Dynamite Hill and Adubiaso, respectively.

- A 2% ore loss has been applied to the total reserve in each pit and for the stockpiles.

- Figures are rounded to the appropriate level of precision for the reporting of Mineral Reserves. Due to rounding, some columns or rows may not compute as shown.

- The overall strip ratio (the amount of waste mined for each tonne of ore) for AGM is 7.21 (W:O). The strip ratio for Nkran, Esaase, Miradani North, Abore, Dynamite Hill and Adubiaso is 13.5, 4.5, 5.6, 4.8, 9.8, and 8.2, respectively.

- The Mineral Reserve is stated as diluted dry metric tonnes.

- The Qualified Person, Dr. Anoush Ebrahimi, does not know of any legal, political, environmental, or other risks that could materially affect the potential development of the Mineral Reserves. Dr. Ebrahimi believes the risks regarding permitting and socio-economic factors to be low.

NON-IFRS PERFORMANCE MEASURES

The Company has included certain non-IFRS performance measures in this press release. These non-IFRS performance measures do not have any standardized meaning and therefore may not be comparable to similar measures presented by other issuers. Accordingly, these performance measures are intended to provide additional information and should not be considered in isolation or as a substitute for measures of performance prepared in accordance with IFRS. Refer to the Non-IFRS Measures section of Galiano's most recently filed Management's Discussion and Analysis for an explanation of these measures.

- Total Cash Costs per ounce

Management of the Company uses total cash costs per gold ounce sold to monitor the operating performance of the JV. Total cash costs include the cost of production, adjusted for share-based compensation expense, by-product revenue and production royalties of approximately 5% per ounce of gold sold. - All-in Sustaining Costs Per Gold Ounce

The Company has adopted the reporting of "all-in sustaining costs per gold ounce" ("AISC") as per the World Gold Council's guidance. AISC include total cash costs, corporate overhead expenses, sustaining capital expenditure, capitalized sustaining stripping costs where not defined as non-sustaining, reclamation cost accretion and lease payments and interest expense on the AGM's mining and service lease agreements per ounce of gold sold.

QUALIFIED PERSON

The Updated Feasibility Study report was prepared for Galiano Gold by the following Qualified Persons (QP's) under National Instrument 43-101:

- Mr. Bob McCarthy, P.Eng. (SRK Consulting) – Mine Infrastructure and Economics

- Dr. Anoush Ebrahimi, P.Eng. (SRK Consulting) – Mining and Mineral Reserves

- Dr. Oy Leuangthong, P.Eng. (SRK Consulting) – Mineral Resources (except Nkran)

- Dr. John Willis, MAusIMM(CP) (SRK Consulting) – Metallurgy and Mineral Processing

- Mr. Glen Cole, P.Geo. (SRK Consulting) – Geology and Mineral Resources (except Nkran)

- Mr. Desmond Mossop, Pr.Sci.Nat. (SRK Consulting) – Mine Geotechnical

- Mr. Ismail Mahomed, Pr.Sci.Nat. (SRK Consulting) – Hydrogeology

- Mr. Malcolm Titley, MAIG (CSA Global) – Geology and Mineral Resources (Nkran)

- Mr. Mitch Hanger, MAIG (Resource Engineering Consultants) – Tailings Storage Facility and Water

- Mr. Faan Coetzee, Pr.Sci.Nat. (ABS Africa) – Environmental

Richard Miller, P.Eng., Vice President Technical Services with Galiano Gold Inc., is a Qualified Person as defined by Canadian National Instrument 43-101, Standards of Disclosure for Mineral Projects, and has approved the scientific and technical information contained in this news release.

WEBCAST DETAILS

Management will host a webcast and conference call to discuss the results of the Updated Feasibility Study on February 22, 2023, at 11:00 am ET. Please refer to the details below to join the conference call or the webcast.

Conference Call Participant Details | |

Confirmation #: | 90830577 |

Local: | Toronto: 416-764-8688 |

North American Toll Free: | 888-390-0546 |

Webcast URL: | |

A replay of the conference call will be available at 1:30 pm on the Company's website and by calling (888) 390-0541 or (416) 764-8677. Please enter confirmation: 830577 #

About Galiano Gold Inc.

Galiano is focused on creating a sustainable business capable of value creation for all stakeholders through production, exploration and disciplined deployment of its financial resources. The Company operates and manages the Asanko Gold Mine, located in Ghana, West Africa, jointly owned with Gold Fields Ltd. Galiano is committed to the highest standards for environmental management, social responsibility, and the health and safety of its employees and neighbouring communities. For more information, please visit www.galianogold.com.

Cautionary Note Regarding Forward-Looking Statements

Certain statements and information contained in this news release constitute " forward-looking statements " within the meaning of applicable U.S. securities laws and " forward-looking information " within the meaning of applicable Canadian securities laws, which we refer to collectively as " forward-looking statements ". Forward-looking statements are statements and information regarding possible events, conditions or results of operations that are based upon assumptions about future conditions and courses of action. All statements and information other than statements of historical fact may be forward looking statements. In some cases, forward-looking statements can be identified by the use of words such as " seek ", " expect ", " anticipate ", " budget ", " plan ", " estimate ", " continue ", " forecast ", " intend ", " believe ", " predict ", " potential ", " target ", " may ", " could ", " would ", " might ", " will " and similar words or phrases (including negative variations) suggesting future outcomes or statements regarding an outlook.

Forward-looking statements in this news release include, but are not limited to: statements regarding the timing of release of full financial and operational results; the preparation and filing of a new technical report and release of updated mineral resources and mineral reserves at the AGM and the timing thereof; anticipated timing of release of the highlights of an improved operating plan along with 2023 guidance; information regarding the plans and expectations of the Company; including with respect to timing of mining recommencement, ore sufficiency, operation of the processing facility, construction of a haul road, testing for extensions of mineralization and incorporation or operating technology improvements; any additional work programs to be undertaken by the Company and potential exploration opportunities; expectation regarding AISC, capital expenditure, cash flow and the Company's exploration budget; expectations regarding the life of mine plan, including with respect to generation of free cash flow; and the usage and comparability of non-IFRS performance measures. Such forward-looking statements are based on a number of material factors and assumptions, including, but not limited to: the Company's new technical report and release of updated mineral resources and mineral reserves at the AGM proceeding as currently anticipated; mining proceeding as currently anticipated; the Company proceeding with further exploration programs as currently anticipated; that future exploration programs will provide the basis for future mineral resources and reserves; that the JV approves the Company's exploration budget; the ability of the AGM to continue to operate during the COVID-19 pandemic; that gold production and other activities will not be curtailed as a result of the COVID-19 pandemic; that the AGM will be able to continue to ship doré from the AGM site to be refined; that the doré produced by the AGM will continue to be able to be refined at similar rates and costs to the AGM, or at all; that the Company's and the AGM's responses to the COVID-19 pandemic will be effective in continuing its operations in the ordinary course; the accuracy of the estimates and assumptions underlying mineral resource and mineral reserve estimates and prior exploration results, including future gold prices, cut-off grades and production and processing estimates; the successful completion of development and exploration projects, planned expansions or other projects within the timelines anticipated and at anticipated production levels; that mineral resources can be developed as planned; that the Company's relationship with joint venture partners will continue to be positive and beneficial to the Company; that required financing and permits will be obtained; general economic conditions; that labour disputes or disruptions, flooding, ground instability, geotechnical failure, fire, failure of plant, equipment or processes to operate are as anticipated and other risks of the mining industry will not be encountered; that contracted parties provide goods or services in a timely manner; that there is no material adverse change in the price of gold or other metals; title to mineral properties; costs; the retention of the Company's key personnel; and changes in laws, rules and regulations applicable to Galiano.

Forward-looking statements involve known and unknown risks, uncertainties and other factors which may cause actual results, performance or achievements to differ materially from those anticipated in such forward-looking statements. The Company believes the expectations reflected in such forward-looking statements are reasonable, but no assurance can be given that these expectations will prove to be correct and you are cautioned not to place undue reliance on forward-looking statements contained herein. Some of the risks and other factors which could cause actual results to differ materially from those expressed in the forward-looking statements contained in this news release, include, but are not limited to that the preparation of a new technical report and definition of mineral reserves may not proceed or be completed as expected or at all; that the results of the Company's exploration programs will not conform with the Company's expectations, and will not be sufficient to support mineral resources or mineral reserves at the AGM or be sufficient to include in the Company's updated life of mine plan; that the Company may not undertake planned future mining or exploration, or that such future mining or exploration will not be sufficient to support mineral resources or mineral reserves at the AGM; that the JV will not approve the Company's proposed exploration and mining programs; the Company's and/or the AGM's operations may be curtailed or halted entirely as a result of the COVID-19 pandemic, whether as a result of governmental or regulatory law or pronouncement, or otherwise; that the doré produced at the AGM may not be able to be refined at expected levels, on expected terms or at all; that the Company and/or the AGM will experience increased operating costs as a result of the COVID-19 pandemic; that the AGM may not be able to source necessary inputs on commercially reasonable terms, or at all; the Company's and the AGM's responses to the COVID-19 pandemic may not be successful in continuing its operations in the ordinary course; AGM has a limited operating history and is subject to risks associated with establishing new mining operations; sustained increases in costs, or decreases in the availability, of commodities consumed or otherwise used by the Company may adversely affect the Company; actual production, costs, returns and other economic and financial performance may vary from the Company's estimates in response to a variety of factors, many of which are not within the Company's control; adverse geotechnical and geological conditions (including geotechnical failures) may result in operating delays and lower throughput or recovery, closures or damage to mine infrastructure; the ability of the Company to treat the number of tonnes planned, recover valuable materials, remove deleterious materials and process ore, concentrate and tailings as planned is dependent on a number of factors and assumptions which may not be present or occur as expected; the Company's operations may encounter delays in or losses of production due to equipment delays or the availability of equipment; the Company's operations are subject to continuously evolving legislation, compliance with which may be difficult, uneconomic or require significant expenditures; the Company may be unsuccessful in attracting and retaining key personnel; labour disruptions could adversely affect the Company's operations; the Company's business is subject to risks associated with operating in a foreign country; risks related to the Company's use of contractors; the hazards and risks normally encountered in the exploration, development and production of gold; the Company's operations are subject to environmental hazards and compliance with applicable environmental laws and regulations; the Company's operations and workforce are exposed to health and safety risks; unexpected costs and delays related to, or the failure of the Company to obtain, necessary permits could impede the Company's operations; the Company's title to exploration, development and mining interests can be uncertain and may be contested; the Company's properties may be subject to claims by various community stakeholders; risks related to limited access to infrastructure and water; the Company's exploration programs may not successfully expand its current mineral reserves or replace them with new reserves; the Company's revenues are dependent on the market prices for gold, which have experienced significant recent fluctuations; the Company may not be able to secure additional financing when needed or on acceptable terms; and the Company's primary asset is held through a joint venture, which exposes the Company to risks inherent to joint ventures, including disagreements with joint venture partners and similar risks.

Although the Company has attempted to identify important factors that could cause actual results or events to differ materially from those described in the forward-looking statements, you are cautioned that this list is not exhaustive and there may be other factors that the Company has not identified. Furthermore, the Company undertakes no obligation to update or revise any forward-looking statements included in, or incorporated by reference in, this news release if these beliefs, estimates and opinions or other circumstances should change, except as otherwise required by applicable law.

![]() View original content to download multimedia:https://www.prnewswire.com/news-releases/galiano-gold-announces-an-improved-long-term-outlook-at-the-asanko-gold-mine-301752702.html

View original content to download multimedia:https://www.prnewswire.com/news-releases/galiano-gold-announces-an-improved-long-term-outlook-at-the-asanko-gold-mine-301752702.html

SOURCE Galiano Gold Inc.

![]() View original content to download multimedia: http://www.newswire.ca/en/releases/archive/February2023/22/c0011.html

View original content to download multimedia: http://www.newswire.ca/en/releases/archive/February2023/22/c0011.html