Galway Metals Expands Clarence Stream's North Zone; New Drill Results Include 4.3 g/t Au over 9.0m, 6.1 g/t Au over 5.0m and 2.2 g/t Au over 6.0m

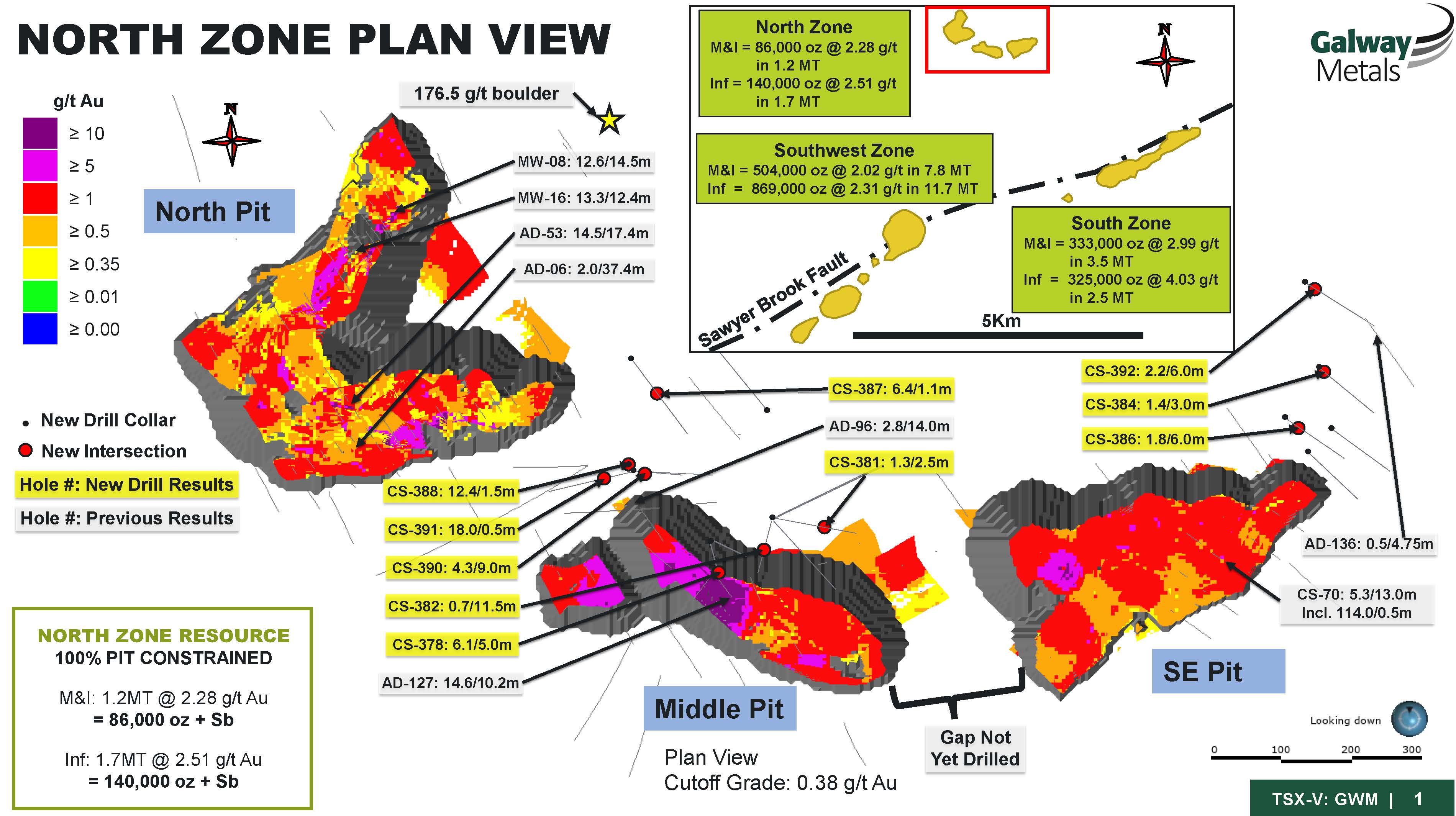

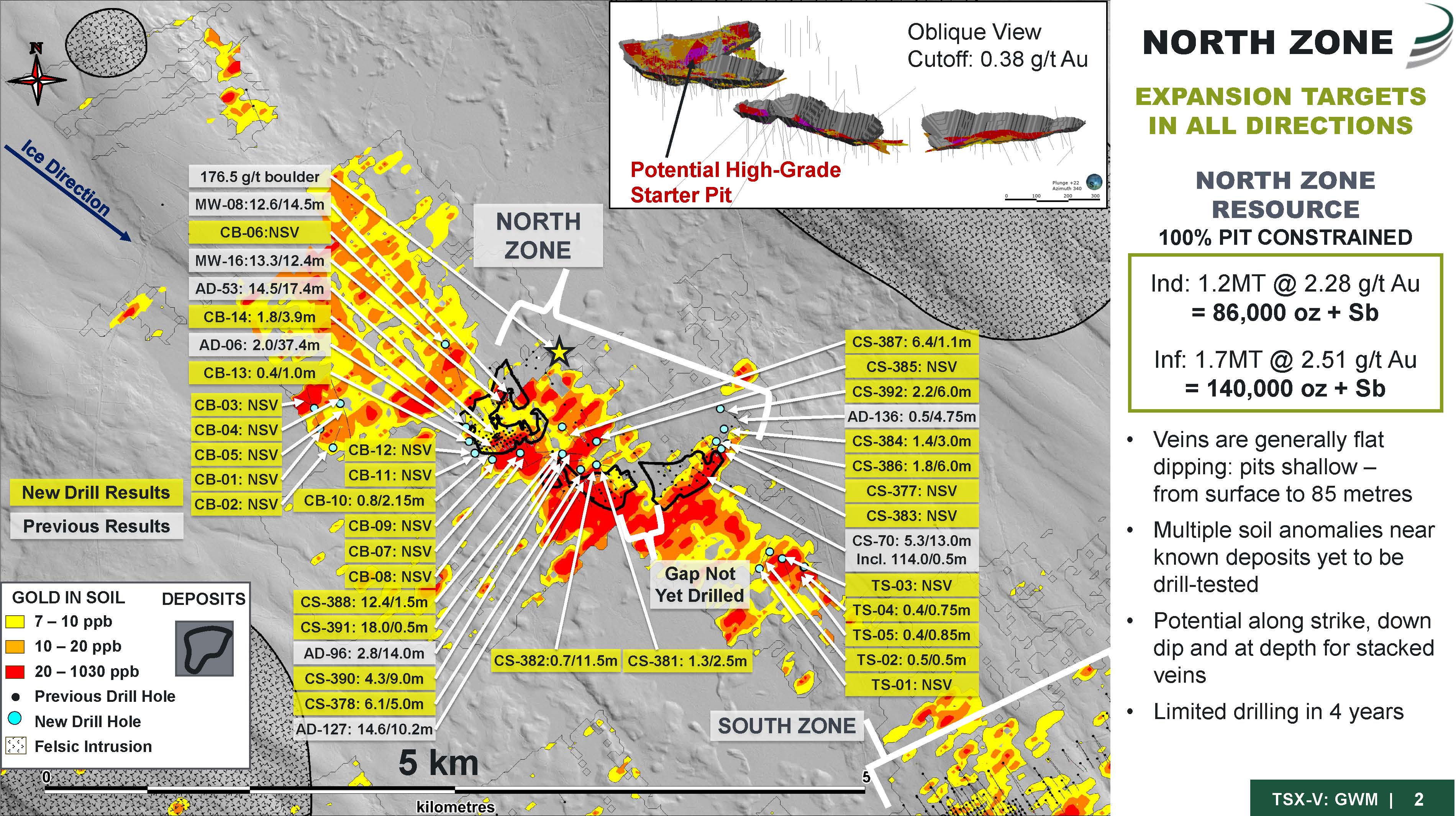

TORONTO, ON / ACCESSWIRE / February 28, 2023 / Galway Metals Inc. (TSXV:GWM); (OTCQB:GAYMF) (the "Company" or "Galway") is pleased to report new drill results from the North Zone of its high grade, multi-million-ounce Clarence Stream Gold Project in SW New Brunswick, Canada. The new results expand on known gold mineralization outside the North Zone's pit shell boundaries in two key areas. The pit shells were defined in the N.I. 43-101 Resource Update titled "Technical Report on the Clarence Stream Mineral Resource Project, New Brunswick, Canada" dated March 31, 2022, by SLR Consulting (Canada) Ltd. The new drill results intersected gold mineralization at shallow depths, ranging from just 16 metres to 112 metres below surface. The results show that gold mineralization is present outside the current resource model and pit limits of the three pits planned in the North Zone, which is currently the smallest of the three resource Zones at Clarence Stream. The new drill results are highlighted in Figure 1 and in Figure 2 below.

Robert Hinchcliffe, President and CEO of Galway Metals, states: "All zones at Clarence Stream remain open for significant expansion. In addition to the North Zone, obvious expansion opportunities exist at the much larger SW Zone, its adjacent Triangle Area, the South Zone and at Oak Bay and Lily Hill. Beyond these, there are many undrilled coincident geochemical and geophysical targets on our district-scale property where we expect to make new discoveries, just as we have throughout our history at Clarence Stream. The current respective Indicated and Inferred Clarence Stream Mineral Resource already contains 0.92Moz at 2.3 g/t Au (within 12.4MT) plus 1.33Moz at 2.6 g/t Au (within 16.0MT). In the fullness of time, we believe it will become increasingly clear that Clarence Stream is one of the most important new gold districts in Eastern Canada."

Summary of Drill Results:

Extensions Between the North and Middle Pits

- Hole GWM22CS-390: 4.3 g/t Au over 9.0m, including 57.3 g/t Au over 0.5m (Visible Gold - (VG)), starting at 35m from surface

- Hole GWM22CS-378: 6.1 g/t Au over 5.0m, including 16.6 g/t Au over 1.0m, starting at 54m from surface is just on the edge of the resource

- Hole GWM22CS-388: 12.4 g/t Au over 1.5m, including 32.4 g/t Au over 0.5m, starting at 43m from surface

- Hole GWM22CS-391: 18.0 g/t Au over 0.5m (VG), starting at 35m from surface

- Hole GWM22CS-387: 6.4 g/t Au over 1.1m (VG), starting at 74m from surface

- Hole GWM22CS-382: 0.7 g/t Au over 11.5m, including 2.6 g/t Au over 0.7m, plus 0.8 g/t Au over 4.0m, starting at 88m and 112m, respectively, from surface

Extensions to the East of the SE Pit

- Hole GWM22CS-392: 2.2 g/t Au over 6.0m, including 8.1 g/t Au over 0.6m, plus 1.1 g/t Au over 3.6m, starting at 25m and 36m, respectively, from surface

- Hole GWM22CS-386: 1.8 g/t Au over 6.0m, plus 1.7 g/t Au over 0.5m, starting at 25m and 58m, respectively, from surface

- Hole GWM22CS-384: 1.4 g/t Au over 3.0m, including 3.1 g/t Au over 0.9m, starting at 16m from surface

Figure 1: North Zone, Clarence Stream Gold Project Map and Drill Hole Locations

Detailed Discussion and Analysis:

Expansions Between the North Zone's North and Middle Pits

The North Zone resource is made up of 3 pits separated by gaps of 90 and 230m in width. The purpose of drilling between the North and Middle pits was to determine whether potential exists to combine them into one. The intercepts received are encouraging and additional drilling is now warranted in order to confirm if the pits could be combined.

North Zone gold mineralization is characterized by flat dipping veins, dipping generally at shallow angles to the east but can vary locally. The intersections of 4.3 g/t Au over 9.0m, 12.4 g/t Au over 1.5m, and 18.0 g/t Au over 0.5m in holes 390, 388 and 391, respectively, are located in the 230m gap between the North and Middle Pit resource areas.

The intersection of 4.3 g/t Au over 9.0m in hole 390 is located 159 metres south of the closest hole in the resource from the northern-most (bowl-shaped) pit. It is located 68 metres NE of a previously reported intercept that contained 2.8 g/t Au over 14.0 metres, including 56.2 g/t Au over 0.6 metres (March 28, 2017), that is also not in the resource. The closest intersection in the Middle Pit resource in that area is 54 metres away. The intersection of 0.7 g/t Au over 1.0m in hole 389 is 36m downdip of the intercept in hole 390.

The intersection of 6.1 g/t Au over 5.0m in hole 378 is located just on the edge of the resource, 40 metres NW of a previously-reported intersection of 14.6 g/t Au over 10.2m (hole AD 17-127). The intersections in holes 379, 382, 380, and 381 in Table 1 are located 55m, 91m, 127m, and 218m downdip, respectively, of the intercept in hole 378.

The intersection of 6.4 g/t Au over 1.1m in hole 387 is located 113 metres NE from the 4.3 g/t Au over 9.0m in hole 390, and both of these are outside the current resource area. Hole 385, which did not return significant values, is 115m downdip of the intercept in hole 387.

Expansions to the NE of the North Zone's Southeast Pit

The intersection of 2.2 g/t Au over 6.0m, including 8.1 g/t Au over 0.6m in hole 392, constitutes the furthest northeast intersection to date for the North Zone resource area. It is 271m NE of the closest hole in the resource, extending well beyond the SE-most pit. This intersection is also 108m down-dip to the NNW of an intersection of 0.5 g/t Au over 4.75m that is also not in the resource. The North Zone is interpreted to dip NW in this area. A second mineralized zone also exists in hole 392, returning 1.1 g/t Au over 3.6m.

The intersections of 1.8 g/t Au over 6.0m in hole 386 and 1.4 g/t Au over 3.0m in hole 384 are located 75m and 161m NE, respectively, of the resource envelope. Holes 383 and 377, which did not return significant values, were drilled 43m SW and 53m NE, respectively, from the 1.8 g/t Au over 6.0m and appear to be out of the plunge of the mineralization.

Six wildcat exploration holes were drilled NW (generally 700m from the north boundary of the resource) and 5 were drilled SE (~600m) of the North Zone, and 8 holes were drilled on the up-dip of the zone near where it comes to surface. Only low gold values less than 0.25 g/t were intersected to the NW; it is thought the holes are too far west or may have been drilled parallel to any possible mineralization due to folding. To the SE, 4 intersections of 0.4 and 0.5 g/t were returned. Follow-up drilling is warranted. The up-dip holes were mainly just past where the zone hits surface, but 2 holes had intersections - as high as 1.8 g/t Au over 3.9m.

Figure 2: North Zone, Clarence Stream Gold Project Map with Gold-in-Soil Anomalies

Table 1. Assay Results

| Hole ID | From (m) | To (m) | Intercept (m) | TW (m) | Au g/t |

|---|---|---|---|---|---|

| AD17-127 | 56.80 | 67.00 | 10.20 | 8.80 | **14.6 |

| incl. | 56.80 | 57.80 | 1.00 | 0.90 | **31.7 |

| incl. | 57.80 | 58.90 | 1.00 | 0.90 | **37.3 |

| incl. | 66.00 | 67.00 | 1.00 | 0.90 | **36.1 |

| AD17-136 | 24.00 | 28.75 | 4.75 | 0.5 | |

| incl. | 27.55 | 28.15 | 0.60 | 1.2 | |

| GWM22CS-378 | 78.00 | 83.00 | 5.00 | 6.1 | |

| incl. | 78.00 | 79.00 | 1.00 | 16.6 | |

| GWM22CS-379 | 85.50 | 86.00 | 0.50 | 1.2 | |

93.00 | 94.00 | 1.00 | 0.6 | ||

97.00 | 97.80 | 0.80 | 0.5 | ||

106.00 | 107.00 | 1.00 | 0.5 | ||

110.00 | 111.00 | 1.00 | 0.8 | ||

| GWM22CS-380 | 84.50 | 85.00 | 0.50 | 0.5 | |

91.00 | 92.00 | 1.00 | 0.4 | ||

| GWM22CS-381 | 114.50 | 115.00 | 0.50 | 1.3 | |

126.50 | 127.00 | 0.50 | 0.4 | ||

128.00 | 129.50 | 1.50 | 1.0 | ||

161.40 | 162.00 | 0.60 | 0.5 | ||

167.50 | 168.00 | 0.50 | 0.4 | ||

180.50 | 183.00 | 2.50 | 1.3 | ||

| GWM22CS-382 | 97.50 | 109.00 | 11.50 | 0.7 | |

| incl. | 103.00 | 103.50 | 0.50 | 1.5 | |

| incl. | 106.50 | 107.20 | 0.70 | 2.6 | |

124.50 | 128.50 | 4.00 | 0.8 | ||

| GWM22CS-384 | 19.00 | 20.00 | 1.00 | 0.8 | |

22.90 | 25.90 | 3.00 | 1.4 | ||

| incl. | 25.00 | 25.90 | 0.90 | 3.1 | |

| GWM22CS-386 | 36.00 | 42.00 | 6.00 | 1.8 | |

| incl. | 39.50 | 40.00 | 0.50 | 4.6 | |

82.50 | 83.00 | 0.50 | 1.7 | ||

| GWM22CS-387 | 103.50 | 104.60 | 1.10 | 6.4 V.G. | |

122.50 | 123.00 | 0.50 | 0.6 | ||

| GWM22CS-388 | 31.00 | 32.00 | 1.00 | 0.8 | |

42.00 | 43.50 | 1.50 | 12.4 | ||

| incl. | 42.50 | 43.00 | 0.50 | 32.4 | |

| GWM22CS-389 | 77.00 | 78.00 | 1.00 | 0.7 | |

| GWM22CS-390 | 39.50 | 54.00 | 9.00 | 4.3 V.G. | |

| incl. | 53.50 | 54.00 | 0.50 | 57.3 | |

| GWM22CS-391 | 48.80 | 49.30 | 0.50 | 18.0 V.G. | |

49.80 | 51.00 | 1.20 | 0.4 | ||

| GWM22CS-392 | 35.00 | 41.00 | 6.00 | 2.2 | |

| incl. | 38.65 | 39.25 | 0.60 | 8.1 | |

| incl. | 39.25 | 40.00 | 0.75 | 4.6 | |

50.40 | 54.00 | 3.60 | 1.1 | ||

| GWM21CB-10 | 7.85 | 10.00 | 2.15 | 0.8 | |

| GWM21CB-13 | 23.00 | 24.00 | 1.00 | 0.4 | |

| GWM21CB-14 | 31.10 | 35.00 | 3.90 | 1.8 | |

| incl. | 33.95 | 35.00 | 1.05 | 4.7 | |

| GWM19TS-02 | 143.80 | 144.30 | 0.50 | 0.5 | |

| GWM19TS-04 | 83.05 | 83.80 | 0.75 | 0.5 | |

| GWM19TS-05 | 61.10 | 61.95 | 0.85 | 0.4 | |

99.75 | 100.25 | 0.50 | 0.4 |

** previously reported; used 0.38 g/t Au for the bottom cut-off as per pit constrained for all new results; 0.42 g/t Au was used for previously-released pit constrained results. (TW=True Widths, which are calculated - sectional measuring may give slightly different numbers); True widths are unknown if not noted; VG=Visible Gold; Drill holes CS-377, 383, 385, and CB-01-09, 11-12, and TS-01, 03 did not produce significant assays.

Table 2: Drill Hole Coordinates

| Hole ID | Easting | Northing | Elevation (m) | Azimuth | Dip | Final Depth |

AD 17-127 | 655847 | 5025827 | 113 | 143 | -45 | 156 |

AD 17-136 | 656775 | 5026189 | 113 | 145 | -45 | 171 |

GWM22CS-377 | 656728 | 5026027 | 149 | 125 | -45 | 150 |

GWM22CS-378 | 655840 | 5025870 | 116.3 | 170 | -45 | 140 |

GWM22CS-379 | 655840 | 5025870 | 116.3 | 120 | -65 | 150 |

GWM22CS-380 | 655935 | 5025898 | 113 | 142 | -55 | 351 |

GWM22CS-381 | 655935 | 5025898 | 113 | 100 | -55 | 201 |

GWM22CS-382 | 655935 | 5025898 | 113 | 200 | -65 | 189 |

GWM22CS-383 | 656691 | 5025994 | 113 | 153 | -45 | 150 |

GWM22CS-384 | 656715 | 5026115 | 153 | 120 | -45 | 150 |

GWM22CS-385 | 655935 | 5026042 | 113 | 320 | -45 | 201 |

GWM22CS-386 | 656665 | 5026140 | 154 | 120 | -45 | 150 |

GWM22CS-387 | 655727 | 5026131 | 116 | 142 | -45 | 198 |

GWM22CS-388 | 655730 | 5025965 | 113 | n/a | -90 | 186 |

GWM22CS-389 | 655730 | 5025965 | 113 | 95 | -45 | 167 |

GWM22CS-390 | 655730 | 5025965 | 113 | 95 | -62 | 165 |

GWM22CS-391 | 655730 | 5025965 | 113 | 250 | -45 | 168 |

GWM22CS-392 | 656686 | 5026240 | 113 | 120 | -45 | 180 |

WILDCAT HOLES | ||||||

GWMCB-01 | 654258 | 5026117 | 137 | 340 | -45 | 387.0 |

GWMCB-02 | 654339 | 5026003 | 135 | 20 | -45 | 183.0 |

GWMCB-03 | 654225 | 5026244 | 137 | 300 | -45 | 359.0 |

GWMCB-04 | 654383 | 5026273 | 134 | 330 | -45 | 297.3 |

GWMCB-05 | 654383 | 5026273 | 134 | 150 | -45 | 401.0 |

GWMCB-06 | 655019 | 5026632 | 117 | 150 | -45 | 392.6 |

GWMCB-07 | 655473 | 5025972 | 109 | 360 | -90 | 123.0 |

GWMCB-08 | 655474 | 5025970 | 109 | 150 | -45 | 125.0 |

GWMCB-09 | 655305 | 5025931 | 115 | 150 | -45 | 107.0 |

GWMCB-10 | 655304 | 5025932 | 115 | 360 | -90 | 155.0 |

GWMCB-11 | 655198 | 5025971 | 118 | 360 | -90 | 77.0 |

GWMCB-12 | 655199 | 5025970 | 119 | 150 | -45 | 101.0 |

GWMCB-13 | 655163 | 5026042 | 116 | 360 | -90 | 83.0 |

GWMCB-14 | 655144 | 5026128 | 115 | 330 | -45 | 101.0 |

GWMTS-01 | 656923 | 5025268 | 123 | 25 | -45 | 243.0 |

GWMTS-02 | 656985 | 5025370 | 130 | 200 | -45 | 234.0 |

GWMTS-03 | 657062 | 5025329 | 132 | 160 | -45 | 213.0 |

GWMTS-04 | 657192 | 5025276 | 134 | 195 | -45 | 99.0 |

GWMTS-05 | 657197 | 5025279 | 134 | 195 | -45 | 279.0 |

New Brunswick Junior Mining Assistance Program

Galway would like to acknowledge financial support from the New Brunswick Junior Mining Assistance Program, which partially funded drilling of the SW Deposit.

Clarence Stream Geology and Mineralization

Clarence Stream deposits can be characterized as intrusion-related, quartz-vein hosted gold deposits. They contain elevated levels of bismuth and arsenopyrite in multiple quartz veins, with significant antimony in the South and North Zones and tungsten in the vicinity. The Zones contain multiple zones of quartz veining with sulfides and sericite alteration. In general, mineralization at Clarence Stream consists of 10-70% quartz stockworks and veins with 1-5% fine pyrite plus pyrrhotite plus arsenopyrite in sericite altered sediments. The South and North Zones also contain stibnite. Locally there is up to 10% sphalerite and semi-massive galena veinlets. The 3.1 km trend that hosts the SW Deposit is associated with a mineralized mafic intrusive locally - similar to the South Zone. A more complete description of Clarence Stream's geology and mineralization can be found at www.galwaymetalsinc.com.

Review by Qualified Person, Quality Control and Reports - Clarence Stream

The Mineral Resource estimates for the North and South Zones were prepared by Mr. Reno Pressacco, P.Geo, SLR Principal Geologist. The Mineral Resource estimate for the Southwest Deposit was prepared under the supervision of Ms. Valerie Wilson, M.Sc., P.Geo., SLR Managing Principal Geologist. Mr. Pressacco and Ms. Wilson are Independent Qualified Persons as defined by NI 43-101 and have read and approved the scientific and technical content of this news release as it relates to the updated Mineral Resource estimates. Michael Sutton, P.Geo., Director and VP of Exploration for Galway Metals, is the Qualified Person who supervised the preparation of the scientific and technical disclosure of the Clarence Stream portion of this news release on behalf of Galway Metals Inc. All core, chip/boulder samples, and soil samples are assayed by Activation Laboratories, located at 41 Bittern Street, Ancaster, Ontario, Canada, Agat Laboratories, located at 5623 McAdam Road, Mississauga Ontario, Canada L4Z 1N9 and 35 General Aviation Road, Timmins, ON P4P 7C3, and/or Swastika Laboratories situated in Swastika, ON. All four labs have ISO/IEC 17025 accreditation. All core is under watch from the drill site to the core processing facility. All samples are assayed for gold by Fire Assay, with gravimetric finish, and other elements assayed using ICP. The Company's QA/QC program includes the regular insertion of blanks and standards into the sample shipments, as well as instructions for duplication. Standards, blanks and duplicates are inserted at one per 20 samples. Approximately five percent (5%) of the pulps and rejects are sent for check assaying at a second lab with the results averaged and intersections updated when received. Core recovery in the mineralized zones has averaged 99%.

About the Company

Galway Metals is focused on creating significant per share value through the exploration and sustainable development of its two 100%-owned projects in Canada. Galway's flagship, Clarence Stream, is one of the most important gold districts in Atlantic Canada as it hosts a large, high-grade gold resource in SW New Brunswick. Also important is Estrades, the former-producing, high-grade, gold- and zinc-rich polymetallic VMS mine in the northern Abitibi of western Quebec as it hosts significant resources in the middle of a major 10-million-ounce gold camp, based on production, reserves and resources. Galway's activities will be conducted while respecting the environment and communities in which it operates. Galway is well capitalized. The Company began trading on January 4, 2013, after its successful spinout to existing shareholders from Galway Resources following the completion of the US$340 million sale of that company. With substantially the same management team and Board of Directors, Galway Metals is keenly intent on creating similar value as it had with Galway Resources.

Should you have any questions and for further information, please contact (toll free):

Galway Metals Inc.

Robert Hinchcliffe

President & Chief Executive Officer

1-800-771-0680

Website: www.galwaymetalsinc.com

Email: info@galwaymetalsinc.com

Look us up on Facebook, Twitter or LinkedIn

CAUTIONARY STATEMENT: Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy of this news release. No stock exchange, securities commission or other regulatory authority has approved or disapproved the information contained herein.

This news release contains forward-looking information, which is not comprised of historical facts. Forward-looking information involves risks, uncertainties and other factors that could cause actual events, results, performance, prospects and opportunities to differ materially from those expressed or implied by such forward-looking information. Forward-looking information in this news release includes statements made herein with respect to, among other things, the Company's objectives, goals or future plans, potential corporate and/or property acquisitions, exploration results, potential mineralization, exploration and mine development plans, timing of the commencement of operations, and estimates of market conditions. Factors that could cause actual results to differ materially from such forward-looking information include, but are not limited to, exploration results being less favourable than anticipated, capital and operating costs varying significantly from estimates, delays in obtaining or failures to obtain required governmental, environmental or other project approvals, political risks, uncertainties relating to the availability and costs of financing needed in the future, changes in equity markets, inflation, changes in exchange rates, fluctuations in commodity prices, delays in the development of projects, risks associated with the defence of legal proceedings and other risks involved in the mineral exploration and development industry, as well as those risks set out in the Company's public disclosure documents filed on SEDAR. Although the Company believes that management's assumptions used to develop the forward-looking information in this news release are reasonable, including that, among other things, the Company will be able to identify and execute on opportunities to acquire mineral properties, exploration results will be consistent with management's expectations, financing will be available to the Company on favourable terms when required, commodity prices and foreign exchange rates will remain relatively stable, and the Company will be successful in the outcome of legal proceedings, undue reliance should not be placed on such information, which only applies as of the date of this news release, and no assurance can be given that such events will occur in the disclosed time frames or at all. The Company disclaims any intention or obligation to update or revise any forward-looking information contained herein, whether as a result of new information, future events or otherwise, except as required by applicable securities laws.

SOURCE: Galway Metals Inc.

View source version on accesswire.com:

https://www.accesswire.com/741076/Galway-Metals-Expands-Clarence-Streams-North-Zone-New-Drill-Results-Include-43-gt-Au-over-90m-61-gt-Au-over-50m-and-22-gt-Au-over-60m