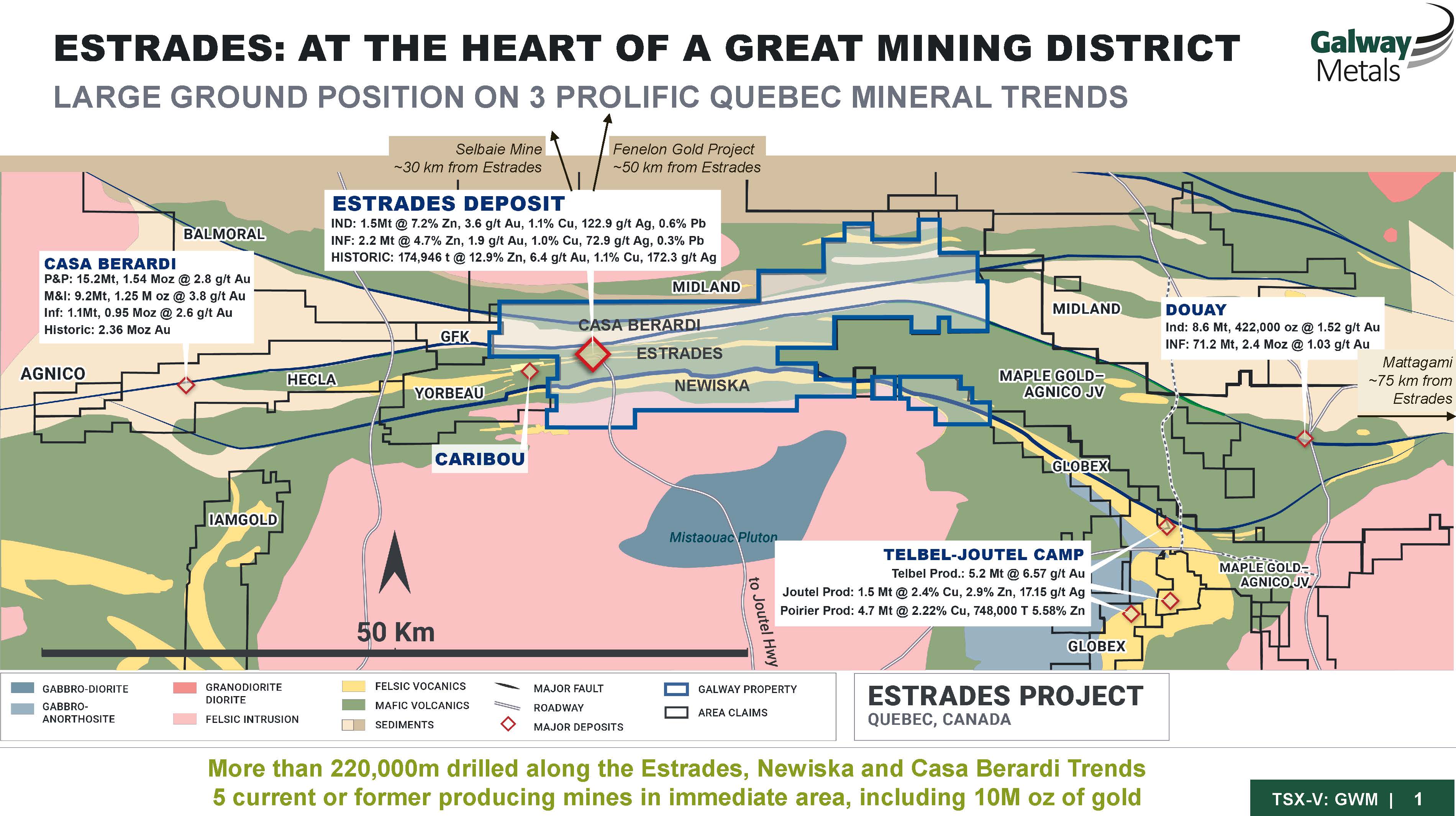

Galway Metals: Extensive 2022 Programs Being Undertaken at the Former Producing High-Grade Estrades Project in the Abitibi of Western Quebec

TORONTO, ON / ACCESSWIRE / February 9, 2022 / Galway Metals Inc. (TSXV:GWM)(OTCQB:GAYMF) (the "Company" or "Galway") is pleased to announce new drill results and an update on its 100%-owned, approximately 20,000-hectare Estrades zinc-gold property in the Abitibi of western Quebec. Breakwater Resources Ltd. spent CDN$20 million in 1990 developing Estrades, including the installation of a 200-metre deep by 150-metre along strike decline, a ventilation raise and associated infrastructure. Production in 1990-91 totalled 174,946 tonnes grading 12.9% Zn, 6.4 g/t Au, 1.1% Cu and 172.3 g/t Ag. Breakwater closed the mine amid sharp declines in metal prices.

Robert Hinchcliffe, President and CEO of Galway Metals, said, "Estrades has many high priority copper source vent and other VMS targets that have excellent potential to create significant value for shareholders. As such, the company has raised its rig count to three from one in order to conduct the current 25,000-meter drill program. The potential high-grade copper source vent targets are below and on the east and west sides of the Estrades resource. Other strong VMS targets exist along the Newiska horizon. Galway has begun drilling several of these targets along both the Estrades and Newiska horizons. The company also plans to continue its environmental and engineering studies, including metallurgical and ore sorting tests. As Estrades currently stands, there aren't many zinc-gold deposits with such high precious metals grades in the world - and even fewer that are as close to being shovel ready."

Drilling Highlights - Metallurgical and Ore Sorting Holes

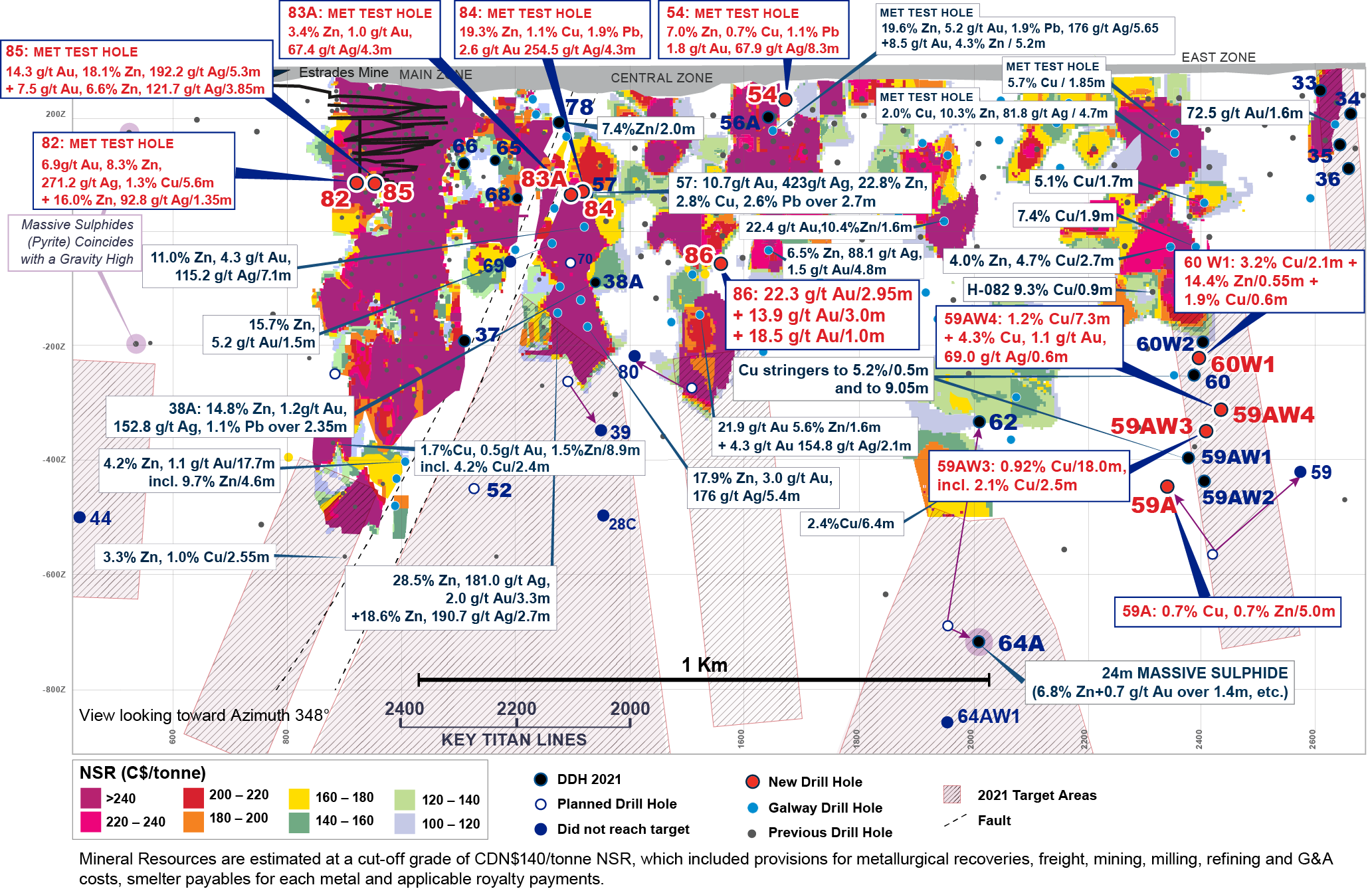

The wide, PQ-sized holes drilled for ore sorting/metallurgical testing purposes highlight near-surface results received in various zones from the middle to the western edge of the resource. Galway has previously released results from this program from the middle to the eastern edge, with highlights returning 19.8 g/t AuEq or 36.4% ZnEq over 5.65m, plus 11.6 g/t AuEq over 5.2m in hole 56, 1.6 g/t Au, 130.8 g/t Ag, 4.6% Zn, and 5.7% Cu over 1.85m in hole 49, and 22.2% ZnEq over 4.7m in hole 50. Refer to Figure 1 for details.

- GWM-21E-85: 28.0 g/t AuEq or 51.5% ZnEq over 5.3m (14.3 g/t Au, 192.2 g/t Ag, 18.1% Zn, 0.2% Cu, and 1.6% Pb), plus 14.0 g/t AuEq or 25.7% ZnEq over 3.85m (7.5 g/t Au, 121.7 g/t Ag, 6.6% Zn, 0.2% Cu, and 1.7% Pb), at vertical depths of 194m, and 186m below surface; both are Massive Sulphide zones, with a mine opening between

- GWM-21E-82: 17.9 g/t AuEq or 32.9% ZnEq over 5.6m (6.9 g/t Au, 271.2 g/t Ag, 8.3% Zn, 1.3% Cu, and 0.9% Pb, plus 15.6 g/t AuEq or 28.7% ZnEq over 0.7m (4.3 g/t Au, 240.8 g/t Ag, 11.1% Zn, 0.7% Cu, and 1.3% Pb), plus 21.6% ZnEq over 1.35m (0.7 g/t Au, 92.8 g/t Ag, 16.0% Zn, and 0.6% Cu) 200m, 192m, and 228m below surface; all are Massive Sulphide zones

- GWM-21E-84: 35.9% ZnEq over 4.3m (2.6 g/t Au, 254.5 g/t Ag, 19.3% Zn, 1.1% Cu, and 1.9% Pb) at a vertical depth of 217m below surface; this is a Massive Sulphide zone

- GWM-21E-83A: 8.3% ZnEq over 4.3m (1.0 g/t Au, 67.4 g/t Ag, 3.4% Zn, 0.3% Cu, and 0.4% Pb), including 3.9 g/t Au, 146.9 g/t Ag, 15.4% Zn, 0.3% Cu, and 1.5% Pb over 0.7m) at a vertical depth of 217m below surface; this is a Massive Sulphide zone

- GWM-21E-54: 15.2% ZnEq over 8.3m (1.8 g/t Au, 67.9 g/t Ag, 7.0% Zn, 0.7% Cu, and 1.1% Pb) at a vertical depth of 36m below surface; this is a Massive Sulphide zone

Drilling Highlights - Exploration Holes

The first bullet below is a follow-up, 80m above a gold-rich zone identified in 2018 in hole 31, which returned 26.6 g/t AuEq over 1.6m, plus 7.0 g/t AuEq over 2.1m located near the middle of the resource. The remaining exploration holes highlight new results from holes and wedges located 146m to 343m below the east side of the resource where Galway believes this copper-rich zone might lead to the discovery of a wider, high-grade source vent at depth. This area, as well as several others along both the Estrades and Newiska horizons, coincide with a strong TITAN IP/MT geophysical target.

- GWM-21E-86: **24.0 g/t AuEq over 2.95m (22.3 grams per tonne (g/t) Au, 46.2 g/t Ag, 1.3% Zn, and 0.2% Cu), plus **16.1 g/t AuEq over 3.0m (13.9 g/t Au, 50.7 g/t Ag, 1.1% Zn, and 0.5% Cu), plus 20.8 g/t AuEq over 1.0m (18.5 g/t Au, 70.7 g/t Ag, 1.4% Zn and 0.3% Cu), at vertical depths of 377m, 401m, and 423m below surface; all 3 are Massive Sulphide zones

- GWM-21E-60W1: 3.2% Cu, 0.8 g/t Au, 46.5 g/t Ag, and 0.7% Zn over 2.1m, plus 14.4% Zn over 0.55m, plus 1.9% Cu over 0.6m, plus 0.4% Cu, 0.2 g/t Au, 6.6 g/t Ag, and 0.4% Zn over 4.0m of massive sulphides, at vertical depths of 514m, 520m, 559m, and 530m below surface, respectively. The 3.2% Cu copper zone is 146m below the closest hole that's in the resource

- GWM-21E-59AW4: 1.2% Cu, 0.5 g/t Au, and 6.3 g/t Ag over 7.3m, including 4.8% Cu over 0.5m and 2.7% Cu over 0.5m, and 5.3 g/t Au over 0.5m, plus 4.3% Cu, 1.1 g/t Au, and 69.0 g/t Ag over 0.6m, plus 1.4 g/t Au, 1.7% Zn, and 6.6 g/t Ag over 2.0m, at vertical depths of 625m, 579m, and 584m below surface, respectively. The 1.2% copper zone is 240m below the closest hole that's in the resource

- GWM-21E-59AW3: 0.92% Cu, and 5.3 g/t Ag over 18.0m, including 2.1% Cu over 2.5m, at a vertical depth of 637m below surface. This copper zone is 252m below the closest hole that's in the resource

- GWM-21E-59A: 0.7% Cu, 0.3 g/t Au, 21.5 g/t Ag, and 0.7% Zn, over 5.0m, at a vertical depth of 727m below surface. This copper zone is 343m below the closest hole that's in the resource

** previously released. For equivalence calculations, refer to the notes under Table 1. Equivalents are provided when the underlying Au and/or Zn metal content is above 25% of the intersect value.

Engineering of Estrades is Progressing, Along With the Company's ESG Efforts

Galway has contracted the services of Peter Gula, P. Eng. to oversee all engineering and processing test work for the Estrades Project. Peter brings 30+ years of mining experience to the Galway team in both operations and management.

- Galway is evaluating alternative variations of long hole mining methods that could be applied to potentially reduce development and operating costs, materially improving project economics. Estrades has good continuity vertically and horizontally (sheet of mineralization). It is vertical, and at near 90 degrees dip is ideal for long-hole mining methods.

- Galway is dedicated to reducing the mine's environmental footprint; custom milling options are being explored. This would eliminate the need to construct a mill and tailings facility, reduce site power requirements, streamline the permitting process and lead times to restart production.

- Galway has commenced initial test work for the application of Ore Sorting Technology to reject waste rock dilution. If successful, this process will reduce transportation and mill costs as well as decrease the volume of tailings being created, thus reducing the overall environmental footprint.

- In addition to ore sorting, Galway has completed the drilling of large PQ-size core across the different metal zones for metallurgical test work to be conducted later this year. Estrades was an operating mine with concentrates produced via toll milling at Matagami, located 128 km by road to the east. Recovery rates using conventional methods of crushing, grinding, gravity, flotation and cyanidization were 93% Zn, 90% Cu, 86% Pb, 78% Au and 63% Ag. After milling was completed, Breakwater transported the concentrates 290 km south to Rouyn-Noranda for smelting. Galway will attempt to improve on these results during this year's metallurgical testing program.

- Galway will conduct geochemistry testing on waste rock after the drilling campaign.

- Galway will conduct line cutting and subsequent geophysics this winter for expanded target generation as follow-up to anomalies defined in a previous FALCON gravity survey by CGG Canada Services Ltd., and as follow-up to a TITAN24 survey by Quantec Geoscience - primarily along the current Estrades resource, along extensions east and west of the resource, and along the Newiska horizon to find VMS vent areas.

Galway has contracted an environmental consultant to oversee and further flora/fauna studies, water sampling, and native consultations; Gail Amyot, Eng. has extensive experience regarding environmental affairs and community relations with the mining industry in Quebec and elsewhere in the world.

- Galway has initiated the baseline data collection with surface water sampling

- Galway has installed foundations of a relationship with the Pikogan community by giving work mandates to a local enterprise.

Drill Results Summary

Holes were drilled for ore sorting and metallurgical test work into 4 areas of the 1.6 km long deposit. Holes 82 and 85 are located directly below the workings (where the ramp was intersected in hole 85). 28.0 g/t AuEq or 51.5% ZnEq over 5.3m, and 14.0 g/t AuEq or 25.7% ZnEq over 3.85m were intersected on both sides of the mine opening, and 17.9 g/t AuEq or 32.9% ZnEq over 5.6m was intersected just east of that. Holes 83A and 84 are located in the vicinity of previously-reported hole 57 that returned 35.1 g/t AuEq or 64.5% ZnEq over 2.7m (10.7 g/t Au, 423 g/t Ag, 22.8% Zn, 2.8% Cu, and 2.6% Pb). Holes 83A and 84 returned 4.3m of 8.3% ZnEq and 35.9% ZnEq, respectively. Previously-reported metallurgical/ore sorting results in two other zones - located in the central and eastern areas of the deposit - include 19.8 g/t AuEq or 36.4% ZnEq over 5.65m (5.2 g/t Au, 176.2 g/t Ag, 19.6% Zn, 1.9% Pb, and 0.3% Cu), plus 11.6 g/t AuEq over 5.2m (8.5 g/t Au, 57 g/t Ag, and 4.2% Zn) in hole 56, 1.6 g/t Au, 130.8 g/t Ag, 4.6% Zn, and 5.7% Cu over 1.85m in hole 49, and 22.2% ZnEq over 4.7m (1.8 g/t Au, 81.8 g/t Ag, 10.3% Zn, 2.0% Cu, and 0.4% Pb) in hole 50. A new metallurgical/ore sorting result from hole 54 returned 15.2% ZnEq over 8.3m.

Exploration drill hole 86 was drilled to follow-up a strong intersect drilled in 2018 - hole 31, which was the deepest intersect in the middle of the deposit and returned 26.6 g/t AuEq over 1.6m (21.9 g/t Au + 113.1 g/t Ag + 5.6% Zn), plus 7.0 g/t AuEq over 2.1m (4.3 g/t Au Au + 154.8 g/t Ag + 0.9% Zn). Hole 86 was drilled in a gap located 80m above hole 31, and intersected 3 massive sulphide horizons, returning 24.0 g/t AuEq over 2.95m, plus 16.1 g/t AuEq over 3.0m, plus 20.8 g/t AuEq over 1.0m.

Drill holes and wedges 59A, 59AW3, 59AW4, and 60W1 host intersections of copper over good widths located in the copper-rich eastern portion of the deposit. Previous Galway drilling returned grades up to 7.4% Cu over 1.9m at -309m vertical in hole 5, and the deepest hole at -392m returned 9.3% Cu over 0.9m. The new holes/wedges returned wide zones of up to 18.0m (0.9% Cu), and grades to 4.8% Cu over 0.5m. Previous results returned copper stringer zones to 9.0m wide and with grades up to 5.2% Cu over 0.5m, within 1.9% Cu over 3.75m in wedge hole 59AW1, and 4.1 g/t AuEq over 9.05m (1.2 g/t Au, 11.9 g/t Ag, 1.0% Zn, and 1.3% Cu) from hole 60A. All these are located 146m to 343m below the deepest resource hole that returned 9.3% Cu over 0.9m as noted above.

Galway's 2022 Drill Program at Estrades Has Many VMS and Copper Source Targets

- 24m of massive sulphides with zinc grades as high as 11.4% (hole 64A - 16.1m true width; see photos; on the copper-rich eastern portion of the Estrades resource area. At 1km vertical, hole 64A represents the deepest intersection drilled on the property in its history. At 16.1m true width, this intersection is far wider than the typical 1-7 metre width of the resource. This hole targeted a strong TITAN anomaly (IP/MT), which may indicate the presence of a nearby source vent. Massive sulphides tend to widen in proximity to source vents. Drilling will target where it is open below, west, and east.

- New hole 86 intersected 3 massive sulphide horizons, with two previously-reported returning 24.0 g/t AuEq over 2.95m (22.3 g/t Au, 46.2 g/t Ag, 1.3% Zn, and 0.2% Cu), plus 16.1 g/t AuEq over 3.0m (13.9 g/t Au, 50.7 g/t Ag, 1.1% Zn, and 0.5% Cu), plus the third just received returning 20.8 g/t AuEq over 1.0m (18.5 g/t Au, 70.7 g/t Ag, 1.4% Zn, and 0.3% Cu). Drilling will target where it is open below.

- Previous Galway discovery in a zinc-rich area east of the cross fault will target extensions to strong massive sulphides intersected in holes 27, 57 and 48. Hole 27 returned 39.1% ZnEq over 3.3m (28.5% Zn, 2.2 g/t Au, 181.0 g/t Ag, 0.3% Cu, and 0.9% Pb) (2.1m TW), plus 26.2% ZnEq over 2.6m (18.6% Zn, 0.3 g/t Au, 190.7 g/t Ag, 0.5% Cu, and 0.5% Pb) (1.7m TW) that is open below; The intersections in holes 57 and 48 are the upper-most holes and open to surface. Hole 57 returned 35.1 g/t AuEq or 64.5% ZnEq over 2.7m (10.7 g/t Au, 473 g/t Ag, 22.8% Zn, 2.8% Cu, and 2.6% Pb) and hole 48 intersected 7.1m grading 14.3 g/t AuEq or 26.3% ZnEq (4.3 g/t Au, 155.2 g/t Ag, 11.0% Zn, 0.8% Cu, and 0.9% Pb). Drilling will target areas where it is open below and above.

- A copper-rich area, located approximately 400m east of and above the 24m of massive sulphides encountered in hole 64A in search of vent sources: Galway will target extensions to 5.1% Cu and 62.0 g/t Ag over 1.65m (1.2m TW), including 12.9% Cu and 159.0 g/t Ag over 0.55m (0.4m TW), and7.4% Cu over 1.9m. These intersections overlie recently-reported copper stringer zones in hole 59AW1 that are up to 9.0m wide and with grades up to 5.2% Cu over 0.5m; drilling will target where it is open below.

- A copper-rich area in search of vent sources: Galway will target extensions to 1.7% Cu over 8.9m in the far west side of the resource, below the bottom of the resource and mine ramp.

- A zinc-rich deep target (TITAN targets identified by geophysics):10.8% ZnEq over 17.7m (4.2% Zn, 1.1 g/t Au, 95.2 g/t Ag, 0.6% Cu, and 0.3% Pb), including 22.3% ZnEq over 4.5m (9.7% Zn, 1.7 g/t Au, 190.9 g/t Ag, 1.3% Cu, and 0.5% Pb), and 15.2% ZnEq over 2.0m (8.3% Zn, 1.0 g/t Au, 147.6 g/t Ag, 0.2% Cu, and 0.6% Pb) (unknown TW); drilling will target where it is open below.

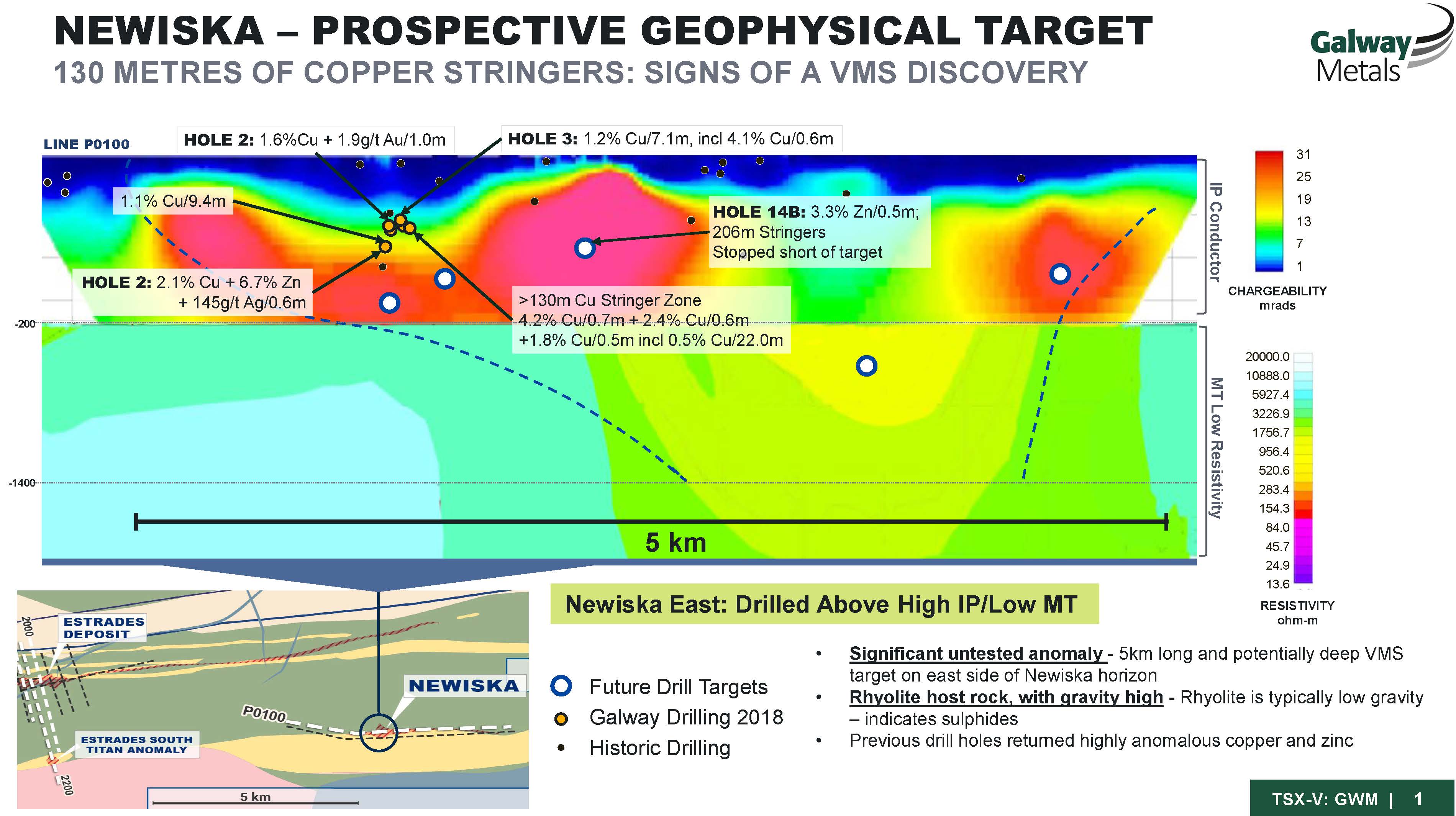

- The Newiska VMS horizon to the south (Au-Ag-Zn-Cu-Pb), home to the former producing Telbel gold mine (1.1 million ounces at 6.6 g/t Au in 5.2 million tonnes), and the former producing Joutel and Poirier VMS mines, all located approximately 20 km to the east (Figure 2): Galway will target extensive copper stringer zones over 132m (Figure 3). This area also hosts 1.1% Cu over 9.4m including 2.0% Cu over 1.5m, 1.2% Cu over 7.1m including 4.1% Cu over 0.6m, 2.1% Cu, 6.7% Zn, and 145 g/t Ag over 0.6m, 0.5% Cu over 22.0m including 4.2% Cu over 0.7m, and 1.6% Cu and 1.9 g/t Au over 1.0m. These intersections are located above, east, and west of strong conductors delineated from TITAN geophysics with co-incident gravity high anomalies in the host rhyolite. Rhyolites typically have a gravity low signature; the gravity high indicates the presence of massive sulphides.

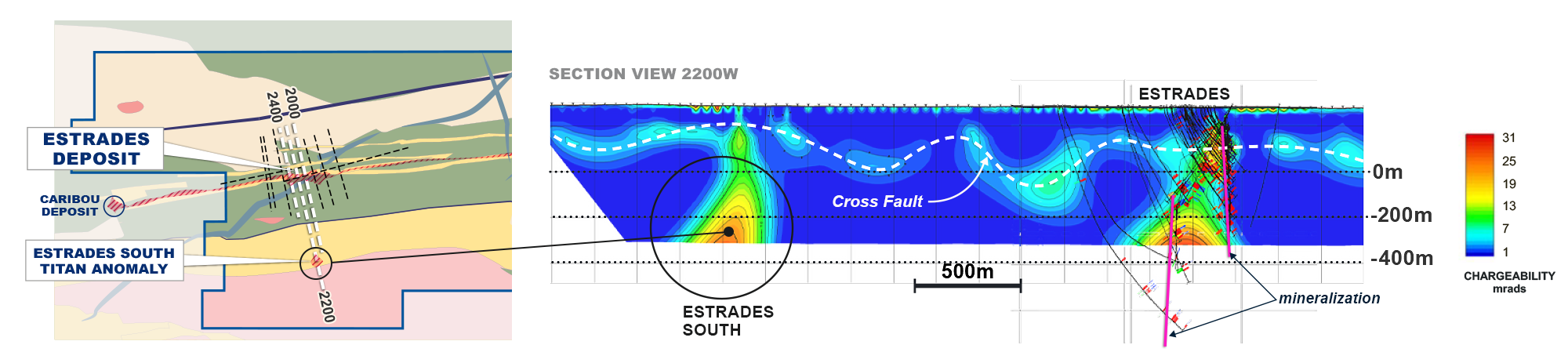

- The Newiska VMS horizon, south of the Estrades mine along the Newiska horizon will be targeted to follow up on a TITAN conductor (Figure 4). Previous Galway drilling intersected 3.1m of massive sulphide (all pyrite) within rhyolite (host of VMS deposits at Estrades and elsewhere in the area). Massive pyrite is present above some VMS deposits; Galway plans to drill deeper, below the pyrite. Also in this western area of the Newiska horizon, Galway plans on following up on 5 historic drill holes that returned up to 4.7% Cu over 0.6m (these 5 holes returned individual narrow intervals of 1.7% Cu, 1.8% Cu, 2.0% Cu, 3.0% Cu, and 4.7% Cu).

Estrades Resources

An NI 43-101 Technical Report on the "Mineral Resource Estimate for the Estrades Project, Northwestern Quebec, Canada" dated November 5, 2018, with an amended date of March 15, 2019, was prepared by Roscoe Postle Associates (RPA). Full details are available on the Company's website at www.galwaymetalsinc.com or SEDAR profile at www.sedar.com. From gold and zinc equivalent perspectives, the Estrades mine contains:

Zinc Equivalent

- Indicated Resources of 1.5 mm tonnes, hosting 685 million ZnEq lb grading 20.8%, plus

- Inferred Resources of 2.2 mm tonnes, hosting 656 million ZnEq lb grading 13.5%

Gold Equivalent

- Indicated Resources of 1.5 mm tonnes, hosting 543,051 AuEq oz at 11.3 g/t AuEq, plus

- Inferred Resources of 2.2 mm tonnes, hosting 520,430 AuEq oz at 7.4 g/t AuEq

Notes:

- CIM definitions were followed for Mineral Resources.

- No Mineral Reserves are present.

- All metal prices, the US$/CDN$ exchange rate and cut-off grade were provided by RPA.

- Mineral Resources are estimated at long-term metal prices (USD) as follows: Zn $1.15/lb, Cu $3.50/lb, Pb $1.00/lb, Au $1,450/oz, and

Ag $21.00/oz. - Mineral Resources are estimated using an average long-term foreign exchange rate of US$0.80 per CDN$1.00.

- Mineral Resources are estimated at a cut-off grade of CDN$140/tonne NSR, which included provisions for metallurgical recoveries, freight, mining, milling, refining and G&A costs, smelter payables for each metal and applicable royalty payments.

- A minimum mining width of approximately 1.5 m was used.

- Mineral Resources that are not Mineral Reserves do not have demonstrated economic viability.

- Numbers may not add due to rounding.

Table 1: Drill Result Highlights

Hole ID | From (m) | To (m) | Intercept (m) | TW (m) | Au Eq* (g/t) | Zn Eq* (%) | Au (g/t) | Ag (g/t) | Zn (%) | Cu (%) | Pb (%) | Type** |

| GWM-21E-86 | 311.70 | 314.30 | 2.60 | 1.20 | 0.2 | 18.6 | 1.2 | DSS | ||||

343.00 | 343.75 | 0.75 | 0.30 | 0.2 | 1.5 | DSS | ||||||

392.80 | 395.80 | 3.00 | 1.30 | 16.1 | 13.9 | 50.7 | 1.1 | 0.5 | MSS | |||

| incl. | 393.30 | 393.80 | 0.50 | 0.20 | 45.5 | 43.1 | 87.5 | 0.55 | MSS | |||

395.80 | 397.30 | 1.50 | 0.70 | 0.7 | 16.7 | 0.2 | 0.3 | DSS | ||||

408.50 | 419.40 | 10.90 | 4.90 | 1.3 | 6.1 | 0.8 | DSS | |||||

419.40 | 422.35 | 2.95 | 1.30 | 24.0 | 22.3 | 46.2 | 1.3 | 0.2 | MSS | |||

443.40 | 444.40 | 1.00 | 0.50 | 20.8 | 18.5 | 70.7 | 1.4 | 0.3 | MSS | |||

| GWM-21E-60W1 | 541.60 | 544.80 | 3.20 | 1.70 | 0.7 | 35.9 | 0.7 | 2.4 | DSS | |||

| incl. | 542.70 | 544.80 | 2.10 | 1.10 | 0.8 | 46.5 | 0.8 | 3.2 | DSS | |||

548.30 | 548.80 | 0.50 | 0.30 | 0.1 | 4.8 | 1.9 | 0.5 | DSS | ||||

549.25 | 549.80 | 0.55 | 0.30 | 15.5 | 0.4 | 4.1 | 14.4 | 0.1 | DSS | |||

560.10 | 564.10 | 4.00 | 2.30 | 0.2 | 6.6 | 0.4 | 0.4 | MSS | ||||

590.65 | 591.25 | 0.60 | 0.30 | 0.1 | 4.0 | 1.9 | DSS | |||||

| GWM-21E-59AW4 | 597.20 | 597.80 | 0.60 | 0.40 | 1.1 | 69 | 0.6 | 4.3 | DSS | |||

599.70 | 600.70 | 0.60 | 0.40 | 1.35 | 9.4 | 2.6 | 0.3 | 0.3 | DSS | |||

603.00 | 605.00 | 2.00 | 1.20 | 1.44 | 6.6 | 1.7 | DSS | |||||

| incl. | 603.00 | 604.00 | 1.00 | 0.60 | 1.33 | 6.6 | 2.6 | 0.2 | DSS | |||

620.00 | 635.00 | 15.00 | 8.80 | 0.5 | 8.2 | 1.1 | DSS | |||||

| incl. | 634.00 | 635.00 | 1.00 | 0.60 | 5.2 | DSS | ||||||

635.00 | 636.00 | 1.00 | 0.60 | 0.9 | DSS | |||||||

638.00 | 639.00 | 1.00 | 0.60 | 0.5 | DSS | |||||||

640.70 | 641.40 | 0.70 | 0.40 | 1.2 | DSS | |||||||

642.90 | 643.70 | 0.80 | 0.50 | 1.7 | DSS | |||||||

645.20 | 652.50 | 7.30 | 4.60 | 0.5 | 6.3 | 1.2 | DSS | |||||

| incl. | 645.70 | 646.20 | 0.50 | 0.30 | 5.3 | 2.3 | ||||||

| incl. | 649.20 | 649.70 | 0.50 | 0.30 | 0.5 | 20.9 | 2.7 | DSS | ||||

| incl. | 652.00 | 652.50 | 0.50 | 0.30 | 0.2 | 16.6 | 4.8 | DSS | ||||

| GWM-21E-59A | 750.00 | 755.00 | 5.00 | 2.50 | 0.3 | 21.5 | 0.7 | 0.7 | DSS | |||

755.00 | 763.00 | 8.00 | 4.00 | 0.2 | 13.2 | 0.44 | DSS | |||||

| GWM-21E-85 | 192.10 | 195.95 | 3.85 | 1.80 | 14.0 | 25.7 | 7.5 | 121.7 | 6.6 | 0.2 | 1.7 | MSS |

200.00 | 205.30 | 5.30 | 2.50 | 28.0 | 51.5 | 14.3 | 192.2 | 18.1 | 0.2 | 1.6 | MSS | |

| GWM-21E-82 | 199.50 | 200.20 | 0.70 | 0.30 | 15.6 | 28.7 | 4.3 | 240.8 | 11.1 | 0.74 | 1.3 | DSS |

208.00 | 213.55 | 5.55 | 2.60 | 17.9 | 32.9 | 6.9 | 271.2 | 8.3 | 1.3 | 0.9 | MSS | |

237.90 | 239.25 | 1.35 | 0.60 | 21.6 | 0.7 | 92.8 | 16.0 | 0.6 | DSS | |||

| GWM-21E-84 | 310.50 | 314.80 | 4.30 | 3.60 | 35.9 | 2.6 | 254.5 | 19.3 | 1.1 | 1.9 | MSS | |

| GWM-21E-83A | 268.40 | 272.70 | 4.30 | 3.10 | 8.3 | 1 | 67.4 | 3.4 | 0.3 | 0.4 | MSS | |

| incl | 269.50 | 270.20 | 0.70 | 0.50 | 15.6 | 28.8 | 3.93 | 146.9 | 15.4 | 0.3 | 1.5 | MSS |

| GWM-20E-56 | 89.00 | 93.50 | 4.50 | 2.80 | 0.61 | 12.5 | 1.9 | 0.4 | DSS | |||

| GWM-21E-54 | 51.00 | 59.30 | 8.30 | 6.10 | 15.2 | 1.8 | 67.9 | 7.0 | 0.7 | 1.1 | MSS | |

60.70 | 61.20 | 0.50 | 0.40 | 21.3 | 11.6 | 65.7 | 0.2 | 5.2 | 0.1 | MSS | ||

61.70 | 62.30 | 0.50 | 0.40 | 1.7 | 18.0 | 1.6 | MSS | |||||

71.00 | 73.00 | 2.00 | 1.50 | 23.0 | 3.8 | 0.3 | DSS | |||||

| GWM-21E-59AW3 | 657.00 | 675.00 | 18.00 | 11.30 | 0.9 | DSS | ||||||

| incl | 664.50 | 667.00 | 2.50 | 1.60 | 2.1 | DSS |

Notes:

* Au (Eq g/t) and Zn (Eq %) represent the in-situ metal content expressed as Au and Zn equivalents.

** previously-released

Equivalents are not provided when the underlying Au and/or Zn metal content is below 25% of the intersect value.

Preliminary analysis indicates that no metal is dominant; however, Au and Zn are the largest contributors to the Estrades resource.

Equivalencies are calculated using the following metal prices (US$) and exchange rate (US$/C$) provided by RPA:

Au $1,450/oz, Ag $21.00/oz, Zn $1.15/lb, Cu $3.50/lb, Pb $1.00/lb, US$0.80/C$1.00.

MSS = massive sulphide, SMS = semi-massive sulphide DSS = disseminated and stringer sulphides.

Holes were not drilled in sequential numerical order.

If true width (TW) is not specified, the orientation of the zone is unknown at this time.

Estrades, Newiska, and Casa Berardi Geology and Mineralization

Information on Geology and Mineralization can be found on the Estrades project page of our website at www.galwaymetalsinc.com along with a complete Table of Drill Results released to date.

Review by Qualified Person, Quality Control and Reports

In compliance with National Instrument 43-101, Mr. Kamil Khobzi, P.Eng., is the Qualified Person responsible for the accuracy of this news release. Mr Reno Pressacco, P. Geo., is the Qualified Person responsible for preparation and disclosure of the Estrades Mineral Resource estimate, and is independent of Galway. The drill core is sawn in half with one half of the core sample shipped to Swastika Laboratories situated in Swastika, ON, which has accreditation of ISO/IEC 17025. The other half of the core is retained for future assay verification. Other QA/QC measures includes the insertion of certified reference standards (gold and polymetallics) and blanks into the sample stream, and the regular re-assaying of pulps and rejects at alternate certified labs. Gold analysis is conducted by fire assay using atomic absorption or gravimetric finish for samples greater than 10 g/t gold. Other Metals (Ag, Cu, Pb, Zn, Co, As) have full acid digestion and analyzed by AAS; with over limits (5000 ppm) analyzed by AAS using method dilutions, and the Silver (Ag) over limits (200 ppm) analyzed by fire assay (FA) & gravimetric finish. The laboratory re-assays at least 10% of all samples and additional checks may be run on anomalous values.

Table 2: Drill Hole Coordinates

Hole ID | Azimuth | Dip | Northing | Easting | Hole Length (m) |

| GWM-21E-86 | 170 | -73 | 5494903 | 654770 | 499.2 |

| GWM21E-60W1 | 286 | -75 | 5494893 | 655773 | 339.0 |

| GWM21E-59AW4 | 280 | -80 | 5494894.9 | 655762.5 | 381 |

| GWM21E -59A | 280 | -80 | 5494894.9 | 655762.5 | 882 |

| GWM21E -85 | 171 | -75 | 5494931 | 654127 | 207 |

| GWM21E -82 | 171 | -75 | 5494931 | 654127 | 261 |

| GWM21E -84 | 179 | -55 | 5495041 | 654559.9 | 225 |

| GWM21E -83A | 179 | -54 | 5495041 | 654559.9 | 300 |

| GWM20E -56 | 186 | -62 | 5494904 | 654882.5 | 219 |

| GWM20E -54 | 150 | -54 | 5494899 | 654882.5 | 100.5 |

| GWM21E -59AW3 | 280 | -80 | 5494894.9 | 655762.5 | 384 |

Figure 1 - Estrades Long Section

Figure 3 - Newiska Titan Anomaly

Figure 4 - Estrades South Titan Anomaly (on Newiska Horizon)

About the Company

Galway Metals is well capitalized with two projects in Canada: Clarence Stream, an emerging gold district in New Brunswick, and Estrades, the former producing, high-grade VMS mine in Quebec. The Company began trading on January 4, 2013, after its successful spinout to existing shareholders from Galway Resources following the completion of the US$340 million sale of that company. With substantially the same management team and Board of Directors, Galway Metals is keenly intent on creating similar value as it had with Galway Resources.

Should you have any questions and for further information, please contact (toll free):

Galway Metals Inc.

Robert Hinchcliffe

President & Chief Executive Officer

1-800-771-0680

Website: www.galwaymetalsinc.com

Email: info@galwaymetalsinc.com

Look us up on Facebook, Twitter or LinkedIn

CAUTIONARY STATEMENT: Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy of this news release. No stock exchange, securities commission or other regulatory authority has approved or disapproved the information contained herein.

This news release contains forward-looking information, which is not comprised of historical facts. Forward-looking information involves risks, uncertainties and other factors that could cause actual events, results, performance, prospects and opportunities to differ materially from those expressed or implied by such forward-looking information. Forward-looking information in this news release includes statements made herein with respect to, among other things, the Company's objectives, goals or future plans, potential corporate and/or property acquisitions, exploration results, potential mineralization, exploration and mine development plans, timing of the commencement of operations, and estimates of market conditions. Factors that could cause actual results to differ materially from such forward-looking information include, but are not limited to, exploration results being less favourable than anticipated, capital and operating costs varying significantly from estimates, delays in obtaining or failures to obtain required governmental, environmental or other project approvals, political risks, uncertainties relating to the availability and costs of financing needed in the future, changes in equity markets, inflation, changes in exchange rates, fluctuations in commodity prices, delays in the development of projects, risks associated with the defence of legal proceedings and other risks involved in the mineral exploration and development industry, as well as those risks set out in the Company's public disclosure documents filed on SEDAR. Although the Company believes that management's assumptions used to develop the forward-looking information in this news release are reasonable, including that, among other things, the Company will be able to identify and execute on opportunities to acquire mineral properties, exploration results will be consistent with management's expectations, financing will be available to the Company on favourable terms when required, commodity prices and foreign exchange rates will remain relatively stable, and the Company will be successful in the outcome of legal proceedings, undue reliance should not be placed on such information, which only applies as of the date of this news release, and no assurance can be given that such events will occur in the disclosed time frames or at all. The Company disclaims any intention or obligation to update or revise any forward-looking information contained herein, whether as a result of new information, future events or otherwise, except as required by applicable securities laws.

SOURCE: Galway Metals Inc.

View source version on accesswire.com:

https://www.accesswire.com/687911/Galway-Metals-Extensive-2022-Programs-Being-Undertaken-at-the-Former-Producing-High-Grade-Estrades-Project-in-the-Abitibi-of-Western-Quebec