GFG Confirms Continuity - Drills 3.40 g/t Au Over 15.0 m at the Montclerg Gold Project, East of the Prolific Timmins Gold District

KEY HIGHLIGHTS:

- Demonstrated strong continuity at MC Central zone with multiple gold zones intersected:

- MTC-22-029: 4.98 grams of gold per tonne (“g/t Au”) over 7.1 metres (“m”).

- MTC-22-030: 3.40 g/t Au over 15.0 m.

- Achieved over 85% hit rate in drilling since acquiring the Montclerg Gold Project in October of 2021.

- Surface regional exploration program demonstrating high prospectivity across the Goldarm Property with approximately 300 rock samples and 63 till samples collected.

- 2022 Phase 2 drill program is expected to begin in October with approximately 4,000 – 6,000 m.

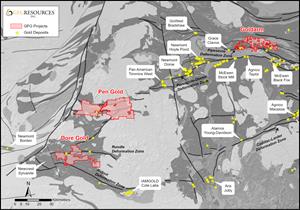

SASKATOON, Saskatchewan, Aug. 22, 2022 (GLOBE NEWSWIRE) -- GFG Resources Inc. (TSXV: GFG) (OTCQB: GFGSF) (“GFG” or the “Company”) reports the remaining five assay results from its 2022 Phase 1 drill program at the Montclerg Gold Project (the “Project” and/or “Montclerg”). The Project is located 48 kilometres (“km”) east of the prolific Timmins Gold District in Ontario, Canada (See Figure 1) which has produced over 70 million ounces of gold. The Project is surrounded by significant infrastructure, easily accessible and can be explored year-round.

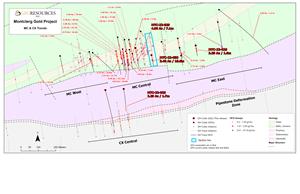

The Company’s 2022 Phase 1 program was completed in April and consisted of 4,200 m and 17 drill holes testing multiple targets along the Montclerg gold system. The 2022 Phase 1 drill program was designed to confirm continuity within the MC Central target, evaluate and expand the gold system via larger step-out holes focused over a strike length of 1 km and to complete an initial test of the CX target (See Tables 1-2 and Figures 1-3).

In the second half of 2022, GFG plans to drill an additional 4,000 - 6,000 m at Montclerg and has initiated a significant regional exploration program focused at its Montclerg and Goldarm properties that includes geophysics, till sampling, prospecting and mapping.

“With our first two drill programs completed and assays received, we are excited by the opportunity that exists at Montclerg,” stated Brian Skanderbeg, President and CEO of GFG. “The results to date have demonstrated a robust, near-surface, gold system with solid continuity in multiple lenses and it remains open in many directions. As we strengthen our geological model and understanding of the mineralizing system, we grow more confident in the potential to uncover the next Timmins gold deposit.”

“As we look ahead to the remainder of 2022 and into 2023, we are eager to resume drilling in the fourth quarter. Focus will be on in-fill drilling within the MC Central target, completing further step-out holes at depth and along the MC and CX trends and assessing the potential to make discoveries along this 10 km corridor. Lastly, we are making great strides with our summer field programs across the Goldarm property outlining high quality drill targets that demonstrate the prospectivity of this region of the Abitibi. We believe in the potential to grow Montclerg and that there are more like it to be discovered across the Goldarm property.”

Table 1: New Assay Results from 2022 Phase 1 Drilling at the Montclerg Gold Project*

| Hole ID | From (m) | To (m) | Length (m) | Au g/t | Zone |

| MTC-22-026 | 96.6 | 98.2 | 1.6 | 3.39 | Unknown |

| incl. | 97.2 | 98.2 | 1.0 | 4.27 | |

| MTC-22-027 | No Significant Intercepts | Canamax Zone | |||

| MTC-22-028 | 317.0 | 328.5 | 11.5 | 0.35 | Canamax Zone |

| and | 391.8 | 393.5 | 1.7 | 2.29 | |

| incl. | 391.8 | 392.3 | 0.5 | 7.22 | |

| MTC-22-029 | 22.7 | 25.0 | 2.3 | 0.76 | MC Central Upper Main |

| and | 33.0 | 36.6 | 3.6 | 0.60 | MC Central Upper Main |

| and | 104.4 | 111.5 | 7.1 | 4.98 | MC Central Upper Footwall |

| incl. | 104.4 | 107.6 | 3.2 | 7.02 | |

| incl. | 110.4 | 111.5 | 1.1 | 7.79 | |

| MTC-22-030 | 39.3 | 43.0 | 3.7 | 1.02 | MC Central Lower Main |

| and | 71.0 | 86.0 | 15.0 | 3.40 | MC Central Upper Footwall |

| incl. | 71.0 | 74.0 | 3.0 | 6.21 | |

| incl. | 80.9 | 82.9 | 2.0 | 10.36 | |

*Drill intercepts are presented using a 0.20 g/t Au cut-off and as drilled length. Composites include internal dilution of up to 3 m at grades less than 0.2 g/t Au. True width is estimated to be 50 to 90% of drilled length.

Table 2: Previously Released Assay Results from 2022 Phase 1 Drilling at the Montclerg Gold Project*

| Hole ID | From (m) | To (m) | Length (m) | Au g/t | Zone |

| MTC-22-014 | 153.0 | 162.0 | 9.0 | 1.47 | MC West |

| incl. | 154.0 | 156.2 | 2.2 | 3.40 | |

| MTC-22-015 | 24.0 | 57.5 | 33.5 | 1.32 | MC West |

| incl. | 24.0 | 28.7 | 4.7 | 5.15 | |

| MTC-22-016 | No Significant Intercepts | ||||

| MTC-22-017 | 153.5 | 157.0 | 3.5 | 1.13 | MC West |

| incl. | 154.0 | 155.0 | 1.0 | 1.60 | |

| and | 160.5 | 162.4 | 1.9 | 0.77 | |

| incl. | 178.7 | 180.8 | 2.1 | 1.05 | |

| MTC-22-018 | 52.0 | 57.9 | 5.9 | 3.51 | MC West |

| incl. | 53.9 | 56.0 | 2.1 | 7.93 | |

| and | 68.6 | 70.95 | 2.4 | 1.91 | |

| incl. | 69.2 | 70.95 | 1.8 | 2.45 | |

| and | 81.0 | 85.5 | 4.5 | 1.92 | |

| incl. | 82.6 | 84.6 | 2.0 | 3.39 | |

| MTC-22-019 | 20.4 | 22.4 | 2.0 | 0.94 | MC Central Upper Main |

| and | 27.2 | 38.8 | 11.6 | 0.60 | |

| incl. | 28.2 | 29.2 | 1.0 | 1.12 | |

| and | 112.6 | 118.1 | 5.5 | 4.38 | MC Main Upper Footwall |

| incl. | 112.6 | 116.0 | 3.4 | 6.37 | |

| MTC-22-020 | 22.4 | 34.1 | 11.7 | 1.07 | MC Central Upper Main |

| incl. | 24.6 | 25.6 | 1.0 | 2.01 | |

| incl. | 28.0 | 28.8 | 0.8 | 2.43 | |

| incl. | 32.0 | 33.0 | 1.0 | 2.16 | |

| and | 97.0 | 105.3 | 8.3 | 4.95 | MC Main Upper Footwall |

| incl. | 102.8 | 105.3 | 2.5 | 12.83 | |

| MTC-22-021 | 50.3 | 72.0 | 21.7 | 1.51 | MC Central Upper Main |

| incl. | 62.2 | 64.0 | 1.8 | 8.17 | |

| MTC-22-022 | 31.8 | 38.8 | 7.0 | 0.60 | MC Central Upper Main |

| and | 91.7 | 95.9 | 4.2 | 0.78 | MC Central Lower Main |

| MTC-22-023 | 17.6 | 88.0 | 70.4 | 1.60 | MC Central Upper Main |

| incl. | 35.2 | 42.0 | 6.8 | 2.43 | |

| incl. | 76.2 | 81.0 | 4.8 | 4.97 | |

| and | 124.5 | 133.2 | 8.7 | 2.46 | MC Central Upper Footwall |

| incl. | 131.4 | 133.2 | 1.8 | 7.75 | |

| MTC-22-024 | 368.8 | 376.5 | 7.7 | 0.74 | Unknown |

| incl. | 370.6 | 372.0 | 1.4 | 3.00 | |

| MTC-22-025 | 280.6 | 284.0 | 3.4 | 1.37 | Unknown |

*Drill intercepts are presented using a 0.20 g/t Au cut-off and as drilled length. Composites include internal dilution of up to 3 m at grades less than 0.2 g/t Au. True width is estimated to be 50 to 90% of drilled length.

Technical Commentary of Assay Results

The Company completed 17 holes in its Phase 1 2022 drill program at Montclerg (See Tables 1-2 and Figures 2-3). This 4,200 m drill program was designed to complete infill and step-out holes over a one km segment of the Montclerg gold system. Infill drilling focused on the MC Central panel testing for extensions of the Upper and Lower Main zones and the high-grade Upper and Lower Footwall zones. Step-out drilling tested the MC West, MC East and the CX targets. Detailed analyses of today’s assay results are outlined below.

MTC-22-026 is a 100 m step-out hole testing the lower mafic stratigraphy where hole MTC-21-012 intersected 8.26 g/t Au over 1.0 m in 2021. Hole MTC-22-026 successfully intersected the same stratigraphy in the lower mafic volcanics grading 3.39 g/t Au over 1.6 m. The mineralization formed in chloritized mafic volcanics with irregular quartz carbonate veinlets associated with pyrite and arsenopyrite up to 5% total sulphides. This area of the MC East target has only been tested sporadically and remains open at depth and along strike.

MTC-22-028 was drilled on the Canamax trend which is located on the Pipestone Deformation Zone. The hole was designed to test approximately 200 m below historical drilling. The mineralization forms at the contact between ultramafic stratigraphy and feldspar porphyry (Canamax Porphyry). This is a similar style of mineralization to the Clavos Gold Deposit located approximately 8 km west of Montclerg. The hole intersected a broad low-grade zone of 0.35 g/t Au over 11.9 m at the contact between the ultramafic and porphyry. The zone consisted of sheared, strongly sericite-altered, feldspar porphyry with stringers and blebs of pyrite up to 0.5%. The hole also intersected 2.29 g/t Au over 1.7 m in a second zone located at the contact of the Canamax Porphyry and the footwall Porcupine-aged sediments. The mineralization formed in a brecciated segment with trace disseminated pyrite and minor quartz carbonate veinlets. Further drilling is warranted along this trend and will be a target area in future drill campaigns.

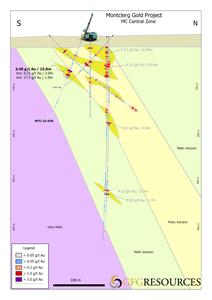

MTC-22-029 was drilled to test the Upper Footwall mafic volcanic and returned 4.98 g/t Au over 7.1 m. Hole MTC-22-029 was similar to hole MTC-21-005, situated 60 m to the west, which returned 4.82 g/t Au over 26.0 m (see news release dated February 10, 2022). The mineralization comprises several, higher-grade zones developed in strongly carbonate-altered, grey mafic volcanics with up to 10% fine grained pyrite and arsenopyrite. Irregular quartz veins up to 25% are also noted with arsenopyrite halos. The Upper Footwall zone is only sporadically tested, is open along strike and will be a focus for upcoming drill programs.

MTC-22-030 was drilled as an 80 m step-out hole east of hole MTC-22-029 to test the Upper Footwall mafic volcanics. A very well mineralized zone was intersected 70 m below surface yielding 3.40 g/t Au over 15.0 m. The mineralization comprises several, higher-grade zones formed in strongly carbonate-leucoxene-altered, grey mafic volcanic stratigraphy with up to 15% fine grained pyrite and arsenopyrite. There was limited veining in the zone and mineralization is associated with zones of strong brittle-ductile deformation. The Upper Footwall zone remains open along strike to the east and west and will see further testing.

Outlook

The Company is currently focused on its summer regional surface exploration programs which include airborne geophysics, sonic and conventional till sampling programs, prospecting, mapping and data compilation. Following the completion of the surface exploration programs, the Company will resume drilling in the fourth quarter with the objective to complete 4,000 – 6,000 m of drilling. The 2022 Phase 2 drill program will primarily focus on the Montclerg gold system that includes infill drilling at the MC Prospect, completing step-out holes along strike and greenfield targets across the Goldarm Property. To aid in the Company’s surface programs, GFG has also partnered with Metal Earth to drive a variety of regional initiatives designed to better understand the belt scale architecture and gold potential of the Pipestone Deformation Zone where the Company holds over 200 square km.

Following the successful initial metallurgical test work that exceeded recovery rate expectations at the Rattlesnake Hills Gold Project (“RSH Project”) (see news release dated March 15, 2022), the Company’s option partner, Group 11 Technologies Inc. (“Group 11”), will proceed to conduct further in-situ recovery analyses and data review. The technical review will further assess the amenability and recovery rates for extracting gold using an eco-friendly water-based solution. The next steps to advance the RSH Project during the remainder of 2022 will include additional laboratory tests, large diameter drill testing and related project permitting. A more detailed update on activities at Rattlesnake Hills will be provided as they become available.

Figure 1: Regional Map of GFG Gold Projects in the Timmins Gold District

https://www.globenewswire.com/NewsRoom/AttachmentNg/aaf72def-3319-47c0-afab-42fd3ab7d027

Figure 2: Montclerg Gold Project Plan View Map

https://www.globenewswire.com/NewsRoom/AttachmentNg/d3ded016-a613-4a2f-9c36-cb465fcbaf44

Figure 3: Cross Section Map of MC Central Zone

https://www.globenewswire.com/NewsRoom/AttachmentNg/f1f34793-f17e-43d0-b665-ae57c8f702aa

About the Montclerg Gold Project

The Montclerg Gold Project is part of the recently consolidated Goldarm Property which consists of more than 15,000 hectares and covers over 30 km of the prospective Pipestone and North Pipestone deformation zones which hosts multiple gold deposits and mines in one of the most prolific gold districts in the world. The Project is strategically located east of the prolific Timmins Gold Camp and is surrounded by significant infrastructure (See Figure 1). The Project consists of patented and unpatented mining claims that cover 10 km of the highly prospective Pipestone Deformation Zone.

About GFG Resources Inc.

GFG is a North American precious metals exploration company focused on district scale gold projects in tier one mining jurisdictions, Ontario and Wyoming. In Ontario, the Company operates three gold projects, each large and highly prospective gold properties within the prolific gold district of Timmins, Ontario, Canada. The projects have similar geological settings that host most of the gold deposits found in the Timmins Gold Camp which have produced over 70 million ounces of gold. The Company also owns 100% of the Rattlesnake Hills Gold Project, a district scale gold exploration project located approximately 100 km southwest of Casper, Wyoming, U.S. In Wyoming, the Company has partnered with Group 11 through an option and earn-in agreement to advance the Company’s Rattlesnake Hills Gold Project with a technology that could revolutionize the gold mining industry.

All scientific and technical information contained in this press release has been prepared under the supervision of Brian Skanderbeg, P.Geo. President, CEO and Director of GFG, a qualified person within the meaning of National Instrument 43-101.

Drill intercepts are presented using a 0.20 g/t Au cut-off and as drilled length. Composites include internal dilution of up to 3 m at grades less than 0.2 g/t Au. True width is estimated to be 50 to 90% of drilled length.

Sampling protocols, quality control and assurance measures and geochemical results related to historic drill core samples quoted in this news release have not been verified by the Qualified Person and therefore must be regarded as estimates.

For further information, please contact:

Brian Skanderbeg, President & CEO

Phone: (306) 931-0930

or

Marc Lepage, Vice President, Business Development

Phone: (306) 931-0930

Email: info@gfgresources.com

Website: www.gfgresources.com

Stay Connected with Us

Twitter: @GFGResources

LinkedIn: https://www.linkedin.com/company/gfgresources/

Facebook: https://www.facebook.com/GFGResourcesInc/

CAUTION REGARDING FORWARD-LOOKING INFORMATION

All statements, other than statements of historical fact, contained in this news release constitute “forward-looking information” within the meaning of applicable Canadian securities laws and “forward-looking statements” within the meaning of the United States Private Securities Litigation Reform Act of 1995 (referred to herein as “forward-looking statements”). Forward-looking statements include, but are not limited to, the Company’s future exploration plans with respect to its property interests and the timing thereof, the prospective nature of the projects, future price of gold, success of exploration activities and metallurgical test work, permitting time lines, currency exchange rate fluctuations, requirements for additional capital, government regulation of exploration work, environmental risks, unanticipated reclamation expenses, title disputes or claims and limitations on insurance coverage. Generally, these forward-looking statements can be identified by the use of forward-looking terminology such as “plans”, “expects” or “does not expect”, “is expected”, “budget”, “scheduled”, “estimates”, “forecasts”, “intends”, “anticipates” or “does not anticipate” or “believes”, or the negative connotation thereof or variations of such words and phrases or state that certain actions, events or results, “may”, “could”, “would”, “will”, “might” or “will be taken”, “occur” or “be achieved” or the negative connotation thereof.

All forward-looking statements are based on various assumptions, including, without limitation, the expectations and beliefs of management, the assumed long-term price of gold, that the Company will receive required permits and access to surface rights, that the Company can access financing, appropriate equipment and sufficient labour, and that the political environment within Canada and the United States will continue to support the development of mining projects in Canada and the United States. In addition, the similarity or proximity of other gold deposits to the Company’s projects is not necessary indicative of the geological setting, alteration and mineralization of the Rattlesnake Hills Gold Project, the Goldarm Property, the Pen Gold Project and the Dore Gold Project.

Forward-looking statements are subject to known and unknown risks, uncertainties and other factors that may cause the actual results, level of activity, performance or achievements of GFG to be materially different from those expressed or implied by such forward-looking statements, including but not limited to: actual results of current exploration activities; environmental risks; future prices of gold; operating risks; accidents, labour issues and other risks of the mining industry; availability of capital, delays in obtaining government approvals or financing; and other risks and uncertainties. These risks and uncertainties are not, and should not be construed as being, exhaustive.

Although GFG has attempted to identify important factors that could cause actual results to differ materially from those contained in forward-looking statements, there may be other factors that cause results not to be as anticipated, estimated or intended. There can be no assurance that such statements will prove to be accurate, as actual results and future events could differ materially from those anticipated in such statements. In addition, forward-looking statements are provided solely for the purpose of providing information about management’s current expectations and plans and allowing investors and others to get a better understanding of our operating environment. Accordingly, readers should not place undue reliance on forward-looking statements.

Forward-looking statements in this news release are made as of the date hereof and GFG assumes no obligation to update any forward-looking statements, except as required by applicable laws.