Global Atomic Announces Q2 2022 Results

TORONTO, Aug. 11, 2022 /CNW/ - Global Atomic Corporation ("Global Atomic" or the "Company"), (TSX: GLO) (OTCQX: GLATF) (FRANKFURT: G12) announced today its operating and financial results for the three and six months ended June 30, 2022.

HIGHLIGHTS

Dasa Uranium Project

- In Q4 2021, the Company began a 15,000-meter drill program at the Dasa Project with three objectives:

- Conduct infill drilling to upgrade Inferred Resources to Indicated Resources so that they may be included in a revised mine plan.

- Connect Mining Zones 2, 2a and 2b to Zone 3 to form one continuous expanded zone instead of four separate zones.

- Expand the total resources in the area of Phase 1.

- On April 19, 2022, the Company provided a second update on the drill program that included the probe results of 10 additional holes which indicated that mining zones 2, 2a, 2b and 3 now represent a contiguous ore body approximately three times larger than initially defined in the Phase 1 Feasibility Study mine plan.

- On April 19, 2022, the Company also announced that it had received a Letter of Interest from Export Development Canada ("EDC") confirming their interest in working with the Company in regard to the financing of the Dasa Uranium Project.

- On June 15, 2022, the Company announced that it had entered into a Letter of Intent with a major North American utility to supply 2.1 million pounds U3O8 over a six-year period commencing 2025; the revenue potential of this sale exceeds US$110 million in real terms and represents about 7% of Phase 1 production.

- On June 20, 2022, the Company announced that it had received Letters of Intent from a banking syndicate to finance the processing plant at Dasa and that the syndicate is comprised of North American financial institutions, including EDC.

- On July 21, 2022, the Company announced it had engaged Enernet Global Inc. ("Enernet") to design an optimal hybrid power solution for the Dasa Project, which would be built, owned, operated and maintained by Enernet.

- The Box-Cut excavation for the mine continued and was completed with ground support installed subsequent to the end of the quarter.

- Site work in preparation for portal and ramp development includes construction of employee housing, warehouse and maintenance facilities, surface buildings for mining activities, power and water servicing of the site.

- A convoy of 37 trucks carrying camp infrastructure including accommodations, generators and office buildings has arrived on site in anticipation of the arrival of the mining team.

- The Company's Niger mining subsidiary, Société Minière de DASA S.A. ("SOMIDA") was incorporated on August 11, 2022.

- The Niger Government elected to increase its interest in total to 20% of SOMIDA, including the 10% free carried interest and an additional 10% interest to be funded.

Turkish Zinc Joint Venture

- The Turkish Zinc Joint Venture ("BST" or the "Turkish JV") plant processed 45,611 tonnes EAFD for first six months of 2022 (36,642 in 2021).

- The Company's share of the Turkish JV EBITDA was $2.5 million in Q2 2022 ($1.6 million in Q2 2021).

- Year-to-date 2022, the Company's share of EBITDA was $6.0 million ($5.8 million in 2021).

- For the first six months of 2021 and 2022, the zinc contained in concentrate shipments was 20.0 million pounds.

- In the first six months of 2022 the average zinc price was US$1.74/lb (US$1.28/lb in 2021).

- The non-recourse Befesa 2019 plant expansion loan was fully paid at the end of Q2 2022, a reduction of US$4.65 million from the year end.

- The revolving credit facility of the Turkish JV has been paid down to US$6.8 million at the end of Q2 2022 (Global Atomic share – US$3.3 million).

- The cash balance of the Turkish JV was US$2.8 million as at June 30, 2022.

Corporate

- At the Company's Annual and Special Meeting of Shareholders on June 23, 2022, George Flach, Vice Chairman and VP Exploration resigned from the Board and Management but continues as a consultant to the Company.

- Fergus P. Kerr, P.Eng, former General Manager of Denison's Elliot Lake uranium operation joined the Board of Directors.

- Global Atomic continues to receive management fees and sales commissions monthly from the Turkish JV ($398,000 in Q2 2022 compared to $167,000 in Q2 2021).

- Cash balance at June 30, 2022, was $15 million.

President & CEO of Global Atomic, Stephen Roman, stated, "Global Atomic had an excellent second quarter of 2022. We advanced several key initiatives for the Dasa Project and our Turkish JV Zinc operation had a strong operating performance and made its final payment on the 2019 expansion loan."

"Earlier today, the Company finalized the formation of SOMIDA as its Niger subsidiary enabling the Company to accelerate activities in Niger. With all permits in place and project financing scheduled for completion by the end of the year, Dasa remains on track for yellowcake production by the beginning of 2025."

"We believe the Dasa Project is well timed with the renaissance in demand for nuclear power. Global Atomic is expected to be in the lowest cost quartile of uranium producers."

OUTLOOK

Dasa Uranium Project

- The banking syndicate that intends to finance the processing plant at Dasa has begun its due diligence process and expects to close its project financing in Q4 of this year.

- The Company is continuing discussions with Orano Mining relating to the direct shipment of development ore to the Somaïr processing facility located 105 kilometers north of the Dasa Project.

- Discussions with international Electric Utilities continue with the expectation that additional long-term contracts will be concluded during 2022.

- Surface infrastructure construction to support mine and mill development activities continues.

- Mining equipment and supplies have arrived on site and at the Port of Cotonou in Benin to support the start of mine development.

- Additional mining equipment and supplies will arrive throughout Q3 2022.

- CMAC-Thyssen ("CMAC"), the Company's contract miner, will begin training programs in Q3 2022 and start mine development in Q4 2022.

- The Company's EPCM strategy (Engineering, Procurement, and Construction Management) is expected to be finalized in Q3, with detailed engineering and procurement activities beginning shortly thereafter.

- On completion of the Dasa drill program anticipated in early September, and subsequent receipt of assays, the Company will update the current Mineral Resource Estimate ("MRE").

- Following the MRE update, a revised Mine Plan will be developed, and the reserve statement updated. It is expected that this will result in an increase in Phase 1 ore reserves and lower operating costs.

- Permeability and porosity test results to determine in-situ leaching potential for the Isakanan Project on the Adrar Emoles 4 permit are expected in Q3 2022.

Turkish Zinc Joint Venture

- The Turkish zinc plant continues to operate at target operating efficiencies.

- The zinc price has weakened but remains well above the 2020 low price of US$0.80/lb, at which the Turkish JV was still profitable.

- The business outlook continues to be positive amid inflationary pressures and lower prices.

- Now that the Befesa loan has been repaid, Turkish JV dividend payments will resume.

COMPARATIVE RESULTS

The following table summarizes comparative results of operations of the Company:

Three months ended June 30, | Six months ended June 30, | |||||||

(all amounts in C$) | 2022 | 2021 | 2022 | 2021 | ||||

Revenues | $ 397,862 | $ 166,627 | $ 829,978 | $ 609,790 | ||||

General and administration | 1,856,994 | 1,704,173 | 5,033,228 | 3,715,706 | ||||

Share of equity loss (earnings) | (1,095,964) | (308,491) | (2,529,301) | (1,809,581) | ||||

Other (income) expense | (15,076) | (32,000) | 591,635 | (67,000) | ||||

Finance (income) expense | (13,321) | 6,262 | (43,138) | 10,601 | ||||

Foreign exchange (gain) loss | (113,508) | 82,755 | 67,413 | 53,373 | ||||

Net income (loss) | $ (221,263) | $ (1,286,072) | $ (2,289,859) | $ (1,293,309) | ||||

Other comprehensive income (loss) | $ (2,287,301) | $ (792,754) | $ (4,535,985) | $ (3,886,893) | ||||

Comprehensive income (loss) | $ (2,508,564) | $ (2,078,826) | $ (6,825,844) | $ (5,180,202) | ||||

Basic and diluted net loss per share | ($0.001) | ($0.008) | ($0.013) | ($0.008) | ||||

Basic and diluted weighted-average | 177,036,594 | 162,119,449 | 175,963,295 | 158,934,765 | ||||

June 30, | December 31, | ||

2022 | 2021 | ||

Cash | $ 14,964,775 | $ 34,179,449 | |

Property, plant and equipment | 60,981,836 | 46,175,097 | |

Exploration & evaluation assets | 914,132 | 681,989 | |

Investment in joint venture | 9,572,848 | 8,981,986 | |

Other assets | 2,717,982 | 3,581,512 | |

Total assets | $ 89,151,573 | $ 93,600,033 | |

Total liabilities | $ 1,444,009 | $ 2,895,756 | |

Shareholders' equity | $ 87,707,564 | $ 90,704,277 |

The consolidated financial statements reflect the equity method of accounting for Global Atomic's interest in the Turkish JV.

Revenues include management fees and sales commissions received from the joint venture. These are based on joint venture revenues generated and zinc concentrate tonnes sold.

General and administration costs at the corporate level include general office and management expenses, stock option awards, depreciation, costs related to maintaining a public listing, professional fees, audit, legal, accounting, tax and consultants' costs, insurance, travel and other miscellaneous office expenses. The variance between the years is largely due to higher stock option grants in Q1 2022 and increased staffing that took place in Q2 and Q3 2021.

Share of net earnings from joint venture represents Global Atomic's equity share of net earnings from the Turkish JV. In view of higher zinc prices in 2022, operating margins more than offset the non-cash expenses, resulting in a positive equity income of $1.1 million in Q2 2022 ($308,500 in Q2 2021) and $2.5 million in H1 2022 ($1.8 million in H1 2021).

Other Comprehensive Income (loss) represents unrealized exchange gains (losses) that arise from the translation of the balance sheets from functional currencies (West African CFA Franc and Turkish Lira) to the Canadian dollar presentation currency. For example, the Turkish plant had a cost to construct that is reported in Turkish Lira, translated at the time the investment was made. Since then, the Turkish Lira has depreciated relative to the Canadian dollar, so an unrealized loss occurs on translation of the same asset at the current date, even though there has been no change in its economic value. This unrealized loss on translation of non-monetary balance sheet assets and liabilities is recorded as comprehensive income (loss).

Uranium Business

Following completion of the Preliminary Economic Assessment of the Dasa Project in May 2020, the Company initiated various trade-off studies which were followed up by a Feasibility Study for the first 12 years ("Phase 1"). The Phase 1 Feasibility Study was reported with an effective date of November 15, 2021 and the full Feasibility Study was filed on SEDAR on December 30, 2021.

Laboratory test work was undertaken in three independent pilot plant campaigns with results from each campaign guiding and directing the subsequent campaign. Variations in quantity and type of process recovery consumables were used to determine the optimum recovery of uranium for the most practical equipment selection with the lowest reasonable consumable cost. The final selection of the process followed the principles established in uranium operations in the region which have proven to be successful over the past 50 years.

Mineral Reserves for the Dasa Project were estimated based on the geology and Mineral Reserve Estimate ("MRE") previously reported by CSA Global. An engineering design and costing exercise was undertaken to a feasibility study level of accuracy which supports the MRE.

Detailed engineering designs were undertaken for the underground mine workings, mining surface infrastructure, process plant, tailing storage facility, and support services infrastructure. These designs enabled detailed pricing enquiries to be issued to the market in the development of a comprehensive capital cost and sustaining cost estimate. Labour and consumable material requirements were developed and costed in the open markets to establish an expected operating cost over Phase 1. Sourcing of electrical power and water was determined to meet the mine requirements, and these too, contributed to the operational cost estimate. The capital cost estimate, sustaining cost estimate and operational cost estimates for the various elements of the mine and process plant were combined into an economic analysis of the project to determine a financial model for the mine.

The Feasibility Study was completed at a detailed level of design and engineering to enable an appropriate level of confidence to be applied to the economic viability and outcomes of the project. As a result of the Feasibility Study, the following Mineral Reserves were estimated.

Mineral Reserve Category | RoM (tonnes) | U308 (ppm) | U308 (t) | U308 (Million lbs) |

Proven Mineral Reserve | - | - | - | |

Probable Mineral Reserve | 4,066,390 | 5,267 | 21,417 | 47.217 |

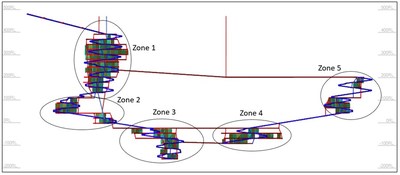

The Phase 1 Feasibility Study identified five zones of mineral reserves as shown in the following schematic.

The mining inventory included in the Feasibility Study included a minor amount of Inferred Resources shown as follows:

RoM tonnes | U3O8 ppm | U3O8 (t) | U3O8 (Million lbs) | |

Measured | - | - | - | |

Indicated | 4,066,390 | 5,267 | 21,417 | 47.217 |

Inferred | 187,236 | 3,375 | 632 | 1.393 |

Total Mining inventory | 4,253,626 | 5,184 | 22,050 | 48.611 |

The Zones vary in grades, with Zone 1 (Flank Zone) contributing the largest portion of the U3O8 tonnes:

Zone | In-situ Tonnes | U3O8 PPM | RoM Tonnes | RoM U3O8 PPM | RoM U3O8 Tonnes |

1 | 2,464,615 | 6,980 | 2,316,047 | 6,887 | 15,950 |

2 | 264,339 | 3,621 | 256,078 | 3,574 | 915 |

3 | 656,114 | 3,093 | 633,541 | 3,056 | 1,936 |

4 | 604,673 | 3,003 | 584,616 | 2,966 | 1,734 |

5 | 478,916 | 3,312 | 463,345 | 3,269 | 1,515 |

Total | 4,468,657 | 5,279 | 4,253,626 | 5,184 | 22,050 |

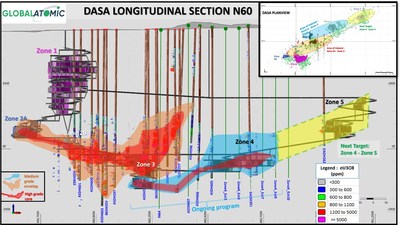

Reserve Expansion

As noted on the overall resource schematic, there are significant Inferred Resources located above Zone 3 and between Zones 2 and 3. In Q4 2021, the Company began an infill drilling program to convert the Inferred Resources to Indicated Resources. To date, this drilling program has been very successful and has identified additional resources in these areas as well. The drilling campaign will likely be completed at the end of Q3 2022. Once the assays have been received, the MRE will be updated to reflect both the additional resources and changes in resource categorization.

These drill results indicate that Zones 2, 2a and 2b now represent a contiguous zone with Zone 3 which is estimated to be approximately three times larger than initially defined (see the longitudinal depiction on the following page). Recent drilling has also targeted the extension of Zone 4.

As the next step to compiling these drill results into a new Mineral Resource Estimate ("MRE") for Dasa, the Company has engaged Dmitry Pertel of AMC Consultants of Perth, Australia. Mr. Pertel completed all the previous work on the Dasa Project while with CSA Global. The updated MRE results will then be used to develop an updated Mine Plan and resultant Reserves update. With increased Indicated Resources between Zones 2 and 3, such resources are expected to extend the number of years of mining in Zones 2 and 3, which will defer the development required to access Zones 4 and 5. This should improve overall production costs of the Dasa Project.

Mining Permits and Niger Mining Company

In September 2020, GAFC applied for the Mining Permit on the Dasa deposit and the Mining Permit was subsequently awarded on December 23, 2020. The Company also completed its Environmental Impact Statement and on January 28, 2021 received its Environmental Certificate of Compliance. GAFC now holds all permits required to construct and mine the Dasa deposit.

Under Niger's Mining Code, upon the issuance of a mining permit, the resource must be transferred to a newly incorporated Niger mining corporation, which the Company and the Niger Mines Minister have agreed to name Société Minière de Dasa S.A. ("SOMIDA"). SOMIDA was incorporated on August 11, 2022. The Republic of Niger is granted 10% of the common shares of SOMIDA at no cost on a carried interest basis and GAFC is entitled to be repaid 100% of the historic exploration costs incurred. The Republic of Niger has also elected to increase its interest in the common shares of SOMIDA by 10% by committing to fund its proportional share of future debt and equity requirements. Subsequent to the incorporation of SOMIDA, the Republic of Niger has no rights to further increase its interest. The Government interest in SOMIDA is solely in the common shares of that entity and entitles it to payments of dividends on such equity shares.

Dasa Mine Development and Construction

The Company has entered into an agreement with CMAC-Thyssen International Inc. ("CMAC"), a contract miner based in Val d'Or, Quebec to provide contract mining services in the development of the Dasa underground mine over the first 24 months of mining. Following the March 2020 closure of the Cominak underground uranium mine in Arlit, there is a pool of skilled miners available to the Company in Niger. CMAC will be providing training, development and oversight of the Niger workforce with the new equipment that will be used at site. Initial mining will comprise only ramp development during the first 12 months, followed by access and level development. Equipment and mining consumables are being procured and shipped to site. In view of worldwide supply chain disruptions, moving materials to site is taking longer than expected.

The Box-Cut has been completed and is prepared for development of the portal once CMAC site work begins. CMAC is presently scheduled to begin development work on November 1, 2022. Surface infrastructure is under construction and will continue to be installed over the period prior to start of CMAC development work. All equipment and supplies should arrive at site by the end of Q3.

The EPCM strategy is being finalized with contract award expected shortly, at which time detailed engineering and procurement activities will proceed. Surface groundwork preparation will begin later this year followed by civil works and construction. The Company's plan is to commission the processing plant in Q4 2024 so that yellowcake can be produced at the beginning of 2025.

Project Financing

Global Atomic has received a Letter of Interest ("LOI") from Export Development Canada ("EDC") confirming their interest in working with the Company on a project financing of the Dasa Project. EDC expects to partner with other export credit agencies, commercial banks and/or financial institutions as co-lenders and to have a lead role in the structuring of the debt facility. EDC has indicated a potential participation, at typical bank rates for a greenfield mining project finance, of up to US$75 million to form the cornerstone of what is expected to be a syndicate of banks. On June 15, 2022, Global Atomic also received additional Letters of Intent such that a complete syndicate has been formed to finance the Dasa Project. The syndicate is comprised of North American financial institutions, including EDC.

The names of all members of the syndicate will be named following further due diligence and board approvals by the financial institutions. The Company expects to complete the Dasa Project financing arrangements in Q4 2022.

Turkish Zinc JV EAFD Operations

The Company's Turkish EAFD business operates through a joint venture with Befesa Zinc S.A.U. ("Befesa"), an industry leading Spanish company that operates several Waelz kilns throughout Europe, North America and Asia. On October 27, 2010, Global Atomic and Befesa established a joint venture, known as Befesa Silvermet Turkey, S.L. ("BST" or the "Turkish JV") to operate an existing plant and develop the EAFD recycling business in Turkey. BST is held 51% by Befesa and 49% by Global Atomic. A Shareholders Agreement governs the relationship between the parties. Under the terms of the Shareholders Agreement, management fees and sales commissions are distributed pro rata to Befesa and Global Atomic. Net income earned each year in Turkey, less funds needed to fund operations, must be distributed to the partners annually, following the BST annual meeting, which is usually held in the second quarter of the following year.

BST owns and operates an EAFD processing plant in Iskenderun, Turkey. The plant processes EAFD containing 20% to 30% zinc that is obtained from electric arc steel mills, and produces a zinc concentrate grading 65% to 70% zinc that is then sold to zinc smelters.

Global Atomic holds a 49% interest in the Turkish JV and, as such, the investment is accounted for using the equity basis of accounting. Under this basis of accounting, the Company's share of BST's earnings is shown as a single line in its Consolidated Statements of Income (Loss).

The following table summarizes comparative operational metrics of the Iskenderun facility.

Three months ended June 30, | Six months ended June 30, | ||||||

2022 | 2021 | 2022 | 2021 | ||||

100 % | 100 % | 100 % | 100 % | ||||

Exchange rate (C$/TL, average) | 12.33 | 6.84 | 11.65 | 6.34 | |||

Exchange rate (US$/C$, average) | 1.28 | 1.23 | 1.27 | 1.25 | |||

Exchange rate (C$/TL, period-end) | 12.95 | 7.02 | 12.95 | 7.02 | |||

Exchange rate (US$/C$, period-end) | 1.29 | 1.24 | 1.29 | 1.24 | |||

Average zinc price (US$/lb) | 1.78 | 1.32 | 1.74 | 1.28 | |||

EAFD processed (DMT) | 25,826 | 12,235 | 45,611 | 36,642 | |||

Production (DMT) | 8,159 | 4,262 | 13,854 | 13,017 | |||

Shipments (DMT) | 8,172 | 3,742 | 13,761 | 13,197 | |||

Shipments (zinc content '000 lbs) | 11,780 | 5,632 | 19,963 | 20,056 | |||

For the six months ended June 30, 2022, world steel production decreased by 5.5% over the comparable 2021 period. The impact by region was mixed. In H1 2022 compared to H1 2021: Chinese production decreased 6.5%; European Union production decreased 6.2%; North American production decreased 2.3%, and Turkish production decreased by 4.6%.

In April 2022, the World Steel Association published its short-term outlook for demand, which projected 0.4% overall global demand growth in 2022 and a further growth of 2.2% in 2023. The impact of the Ukrainian conflict on global steel markets is uncertain, however as exports from Russia and Ukraine have historically accounted for 10% of global steel exports, it is likely a material percentage of this supply will be replaced by increased production in other countries.

The Ukrainian conflict, post-COVID demand increases, raw material shortages and global logistics challenges have in combination resulted in substantial inflationary pressures on all costs. Although strong zinc prices have largely offset the impact of inflation on dollar margins, the EBITDA margin percentage has declined in the current year.

The Turkish economy became hyperinflationary after the International Monetary Fund World Economic Outlook ("IMF WEO") that was published in April 2022 reported a 3-year cumulative rate of inflation of 74% and an annual rate of inflation of 36% as of December 2021. For 2022, the IMF WEO forecasts an annual rate of inflation of 52% (2023: 30%) and a 3-year cumulative rate of inflation of 138% (2023: 169%). The Turkish Statistical Institute ("TURKSTAT") reported a 3-year and 12-month cumulative rate of inflation of 136% and 79%, respectively, as of June 30, 2022. Therefore, in the first half of 2022, the Turkish economy became hyperinflationary, requiring the first-time application of IAS 29, Financial Reporting in Hyperinflationary Economies. The company is currently in the process of calculating the impact and application of the standard and expecting to apply IAS 29, Financial Reporting in Hyperinflationary Economies in the Condensed Interim Consolidated Statements for the three and nine months ended September 30, 2022 and 2021.

The following table summarizes comparative results for the three and six months ended June 30, 2022 and 2021 of the Turkish JV at 100%.

Three months ended June 30, | Six months ended June 30, | ||||||

2022 | 2021 | 2022 | 2021 | ||||

100 % | 100 % | 100 % | 100 % | ||||

Net sales revenues | $ 18,128,699 | $ 6,408,617 | $ 32,477,422 | $ 22,207,251 | |||

Cost of sales | 13,872,538 | 3,279,251 | 21,289,519 | 11,266,770 | |||

Foreign exchange gain | 940,773 | 88,850 | 986,008 | 817,225 | |||

EBITDA(1) | $ 5,196,934 | $ 3,218,216 | $ 12,173,911 | $ 11,757,706 | |||

Management fees & sales commissions | 667,781 | 320,933 | 1,689,945 | 1,226,675 | |||

Depreciation | 349,364 | 614,511 | 743,572 | 1,343,868 | |||

Interest expense | 232,696 | 190,139 | 536,753 | 470,957 | |||

Foreign exchange loss on debt and cash | 1,119,211 | 611,939 | 2,560,470 | 3,234,932 | |||

Tax expense | 591,221 | 851,121 | 1,481,332 | 1,788,251 | |||

Net income | $ 2,236,661 | $ 629,573 | $ 5,161,839 | $ 3,693,023 | |||

Global Atomic's equity share | $ 1,095,964 | $ 308,491 | $ 2,529,301 | $ 1,809,581 | |||

Global Atomic's share of EBITDA | $ 2,546,498 | $ 1,576,926 | $ 5,965,216 | $ 5,761,276 | |||

(1) EBITDA is a non-IFRS measure, does not have a standardized meaning prescribed by IFRS and may not be comparable to similar terms and measures presented by other issuers. EBITDA comprises earnings before income taxes, interest expense (income), foreign exchange loss (gain) on debt and bank, depreciation, management fees, sales commissions, losses (gains) on sale of property, plant and equipment. |

Zinc concentrates are sold to smelters in US dollars. Because the Turkish Lira is the functional currency of the Turkish operations, sales are converted to Turkish Lira at the date of the sale when funds are subsequently received. When the Turkish Lira depreciated in both Q2 2021 and Q2 2022, exchange gains were recognized on those sales. In calculating EBITDA, these exchange changes related to the functional and reporting currencies are treated as operations related (i.e., above the EBITDA subtotal). Sales are recorded upon receipt at the smelter, which means that recorded sales in any given month generally represent the concentrate from EAFD processed in the prior month. Sales for the six months ended June 30, 2022 were produced in December 2021 through May 2022.

The cash balance of the Turkish JV was US$2.8 million at June 30, 2022.

Total debt was reduced to US$6.8 million in Q2 2022 from US$12.45 million at the end of 2021. The local Turkish revolving credit facility balance was US$6.8 million at June 30, 2022 (December 31, 2021 - US$7.8 million) and bears interest at 9%. The Turkish revolving credit facility can be rolled forward. At June 30, 2022, the Befesa loan related to the 2019 plant expansion, was fully paid (December 31, 2021 – US$4.65 million). Now that the Befesa loan has been repaid, Turkish JV dividend payments will resume.

QP Statement

The scientific and technical disclosures in this news release have been reviewed and approved by Ronald S. Halas, P.Eng. who is a "qualified person" under National Instrument 43- 101 – Standards of Disclosure for Mineral Properties.

About Global Atomic

Global Atomic Corporation (www.globalatomiccorp.com) is a publicly listed company that provides a unique combination of high-grade uranium mine development and cash-flowing zinc concentrate production.

The Company's Uranium Division includes four deposits with the flagship project being the large, high-grade Dasa Project, discovered in 2010 by Global Atomic geologists through grassroots field exploration. With the issuance of the Dasa Mining Permit and an Environmental Compliance Certificate by the Republic of Niger, the Dasa Project is fully permitted for commercial production. The Phase 1 Dasa Feasibility Study filed December 2021 represents approximately 20% of the current resource and estimates 45.4 million pounds U3O8 production over a 12-year period to commence by the end of 2024. Mine excavation began in Q1 2022.

Global Atomics' Base Metals Division holds a 49% interest in the Befesa Silvermet Turkey, S.L. ("BST") Joint Venture, which operates a modern zinc production plant, located in Iskenderun, Turkey. The plant recovers zinc from Electric Arc Furnace Dust ("EAFD") to produce a high-grade zinc oxide concentrate which is sold to zinc smelters around the world. The Company's joint venture partner, Befesa Zinc S.A.U. ("Befesa") listed on the Frankfurt exchange under 'BFSA', holds a 51% interest in and is the operator of the BST Joint Venture. Befesa is a market leader in EAFD recycling, with approximately 50% of the European EAFD market and facilities located throughout Europe, Asia and the United States of America.

The information in this release may contain forward-looking information under applicable securities laws. Forward-looking information includes, but is not limited to, statements with respect to completion of any financings; Global Atomics' development potential and timetable of its operations, development and exploration assets; Global Atomics' ability to raise additional funds necessary; the future price of uranium; the estimation of mineral reserves and resources; conclusions of economic evaluation; the realization of mineral reserve estimates; the timing and amount of estimated future production, development and exploration; cost of future activities; capital and operating expenditures; success of exploration activities; mining or processing issues; currency exchange rates; government regulation of mining operations; and environmental and permitting risks. Generally, forward-looking statements can be identified by the use of forward-looking terminology such as "plans", "is expected", "estimates", variations of such words and phrases or statements that certain actions, events or results "could", "would", "might", "will be taken", "will begin", "will include", "are expected", "occur" or "be achieved". All information contained in this news release, other than statements of current or historical fact, is forward-looking information. Statements of forward-looking information are subject to known and unknown risks, uncertainties and other factors that may cause the actual results, level of activity, performance or achievements of Global Atomic to be materially different from those expressed or implied by such forward-looking statements, including but not limited to those risks described in the annual information form of Global Atomic and in its public documents filed on SEDAR from time to time.

Forward-looking statements are based on the opinions and estimates of management at the date such statements are made. Although management of Global Atomic has attempted to identify important factors that could cause actual results to be materially different from those forward-looking statements, there may be other factors that cause results not to be as anticipated, estimated or intended. There can be no assurance that such statements will prove to be accurate, as actual results and future events could differ materially from those anticipated in such statements. Accordingly, readers should not place undue reliance upon forward-looking statements. Global Atomic does not undertake to update any forward-looking statements, except in accordance with applicable securities law. Readers should also review the risks and uncertainties sections of Global Atomics' annual and interim MD&As.

The Toronto Stock Exchange has not reviewed and does not accept responsibility for the adequacy and accuracy of this news release.

SOURCE Global Atomic Corporation

![]() View original content to download multimedia: http://www.newswire.ca/en/releases/archive/August2022/11/c1742.html

View original content to download multimedia: http://www.newswire.ca/en/releases/archive/August2022/11/c1742.html