Global Energy Metals Signs Earn-In and JV Agreement with Metal Bank Limited to Advance Its Millennium Cobalt-Copper-Gold Project In Queensland, Australia

(TheNewswire)

Vancouver, BC - TheNewswire - December 13, 2021 - Global Energy Metals Corporation (TSXV:GEMC) | (OTC:GBLEF) | (FSE:5GE1) (“Global Energy Metals”, the “Company” and/or “GEMC”), a company involved in investment exposure to the battery metals supply chain, is pleased to announce that it has entered into a formal earn-in and joint venture agreement (“JV Agreement”) with MBK Millennium Pty Ltd. (“MBKM”), a wholly owned subsidiary of Metal Bank Limited (“Metal Bank” and/or “MBK”) in favour of MBKM to earn-in up to an 80% interest in the Millennium Copper, Cobalt and Gold Project in Mount Isa, Queensland (“Millennium Project”) owned by GEMC’s wholly owned subsidiary, Element Minerals Australia Pty Ltd (“EMA”).

The Millennium Project is an advanced exploration and development project located in the Mount Isa region, 19km from the Rocklands copper-cobalt project which is host to 55.4Mt of Resources grading 0.64%Cu, 0.15 g/t Au, 290ppm Co (0.90% CuEq)1. The Millennium Project holds an inferred 2012 JORC resource of 5.89Mt @ 1.08% CuEq2 across 5 granted Mining Leases with significant potential for expansion.

1CDU:ASX Announcement dated 31 October 2017

2 HMX ASX Announcement dated 6 December 2016 “Millennium Mineral Resource Estimate”. Copper equivalent (CuEq) calculation was based solely on commodity prices using prices as follows: Cu: US$4,600/t; Co: US$27,000/t; Au: US$1,330/oz; and Ag: US$20/oz

The Stage 1 earn-in phase has commenced. During this stage, MBK will sole fund exploration expenditures of $1M over the next year to earn a 51% interest in the Project.

As part of its Stage 1 earn-in obligations, MBK will issue 31,250,000 shares to GEMC based on an issue price of $0.008, being the 30 day VWAP as at close of business on Friday 10 December 2021.

The terms of the JV Agreement are summarised in this announcement.

-

MBK has exercised its option to earn in stages up to an 80% interest in the Millennium Project;

-

Earn-in and joint venture agreement signed;

-

GEMC to receive 31,250,000 shares in MBK as initial consideration for the option in Millennium;

-

In conjunction with significant increases in copper and cobalt prices since maiden Resource reporting, results from exploration success supports an initial Exploration Target for the Project of 8-10Mt @ 1.0-1.1% CuEq*;

-

MBK has developed a $1 million three-phase work program including up to 5,500 metres of drilling for 2022 to test key outcomes to confirm the exploration target and Resource expansion and development program; and

-

With recent successful capital raising by MBK, GEMC will benefit from having a well funded partner to pursue exploration and development work at Millennium aimed at increasing the project’s Resources

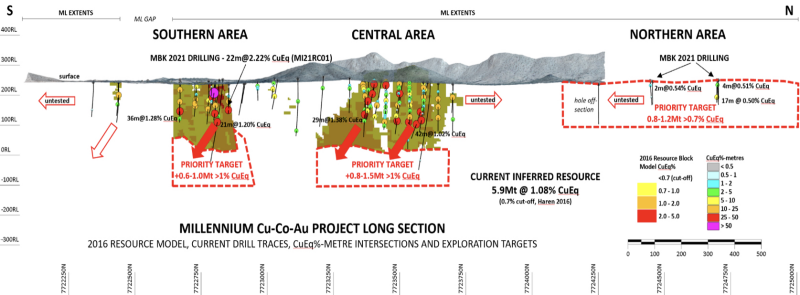

Figure 1: Millennium copper-cobalt long section showing current (2016) Inferred Resource model, resource drilling traces and CuEq%-metre intersections, interpreted mineralisation shoots, and priority targets for Phase 1 work program to define and confirm the Exploration Target and project scale prior to resource and peripheral exploration drilling. Refer to Appendix 1 and 2 drill hole CuEq% and location details.

NB: Intervals shown calculated at a 0.5% CuEq minimum reportable value, 1 metre minimum width and 3m internal dilution <0.2% CuEq (not as per individual elements). Lost sample intervals (if present) form breaks. CuEq% calculated as per Inferred Resource (Haren, 2016) using the following metal values: Cu: US$4,600/t; Co: US$27,000/t; Au: US$1,330/oz; and Ag: US$20/oz with the respective formula of CuEq = Cu% + (Co% x 5.9) + (Au g/t x 0.9) + (Ag g/t x 0.01).

Mitchell Smith, President & CEO commented:

“We are pleased to have entered into a partnership with a group that shares our position that Millennium is a project with great potential for the discovery of a globally significant battery metals resource at a time when ramping up and sourcing supply is so critical to the electrification movement. I am very pleased to say that we have achieved this with Metal Bank, an organization with the financial and technical capability to grow this project to its full potential. We are extremely excited to be working with them and executing on our strategy in advancing our projects through peer collaboration and building exposure to the critical metals powering an electrified future.”

Commenting on the signing of the JV Agreement, Metal Bank’s Chair, Inés Scotland said:

“We are very excited to be moving forward with the Millennium project. Our exploration success at the Millennium Project has enabled a significant Exploration Target to be estimated for the project and our earn-in work program is aimed at converting that target into JORC Resources, as well as following up on the significant cobalt results from our drilling earlier this year. We welcome GEMC as a MBK shareholder and look forward to continuing to work with them to advance the Millennium Project.”

Following completion of its recent drill program, MBK commenced a review of the existing current Inferred Resource in the Southern and Central Areas of the Project, MBK’s recent drill results and other previous drilling.

In conjunction with significant increases in copper and cobalt prices since maiden Resource reporting, results from this review provided support for an initial Exploration Target for the Project of 8-10Mt @ 1.0-1.1% CuEq.* This Exploration Target is based on extensions both along strike and down dip in both the Southern and Central copper-cobalt-gold resource areas and also in the Northern Area, where shallow copper intervals at broad spacing have been returned some 800-1000m north of the closest resource.

*It should be noted that the Exploration Target is conceptual in nature. There has been insufficient drilling at depth of the existing Resource and in the Northern Area of the project and insufficient information relating to the Reasonable Prospects of Eventual Economic Extraction (RPEEE) of the Millennium project to estimate a Mineral Resource over the Exploration Target area, and it is uncertain if further study will result in the estimation of a Mineral Resource over this area. It is acknowledged that the currently available data is insufficient spatially in terms of the density of drill holes, and in quality, in terms of MBK’s final audit procedures for down hole data, data acquisition and processing, for the results of this analysis to be classified as a Mineral Resource in accordance with the JORC Code and/or NI 43-101 reporting requirements.

In addition to the Exploration Target areas, there are a number of adjacent and/or peripheral drill ready targets including the Corella and Federal Trends plus key conceptual targets down dip of the Northern, Central and Southern Areas towards and/or adjacent the Fountain Range/Quamby Fault system. Scree and alluvial cover also obscure surface geology and geochemical signatures in areas, adding to previous exploration complexity.

MBK has developed a three-phase work program for 2022 seeking to test key outcomes to confirm the Exploration Target and future resource expansion and development potential.

The work program comprises:

• Phase 1 – 1800-2000m RC/DD Exploration Target confirmation of scale drilling program. The aim of this program will be to test open Southern and Central Area shoots at depth, the shallow Northern Area extension and infill, and the adjacent Pilgrim/Fountain Range/Quamby Fault Zone resource potential;

• Phase 2 – 2000m RC drilling extension program to Infill resource gaps, extend near surface existing resources, first pass testing of peripheral targets and Phase 1 follow-up; and

-

Phase 3 – 1500m RC Resource infill, economic assessment and follow-up work from Phase 1 and 2.

MBK is currently assessing drilling tenders for commencement of Phase 1 after the end of the wet season in March 2022.

Summary of the Earn-In and JV Agreement

The JV Agreement is between MBK and EMA and includes MBK and GEMC as parties to guarantee their respective subsidiaries’ obligations until the Joint Venture (JV) is formed. The JV area includes all of the Millennium mining leases and a 30km2 area around them. MBKM will manage the project during the Stage 1 Earn-in and has the right to appoint the manager of the joint venture so long as it holds a majority joint venture interest.

The JV Agreement provides for three stages as follows:

-

Stage 1 Earn-in, during which MBKM will sole fund exploration expenditure to earn a 51% Joint Venture interest and the right to either:

-

form the JV and move to Stage 2, at which time MBK must issue shares to GEMC (or its nominee) equivalent in value to $350,000, based on the 30 day VWAP of MBK shares at the date of MBKM giving notice to move to Stage 2; or

-

give notice to buy-out 29% of EMA’s remaining interest, with MBKM taking an 80% interest in the project in consideration of the payment by MBKM of $1M in cash and the issue of MBK shares to GEMC (or its nominee) equivalent in value to $250,000, based on the 30 day VWAP of MBK shares at the date of MBKM giving the buy-out notice. In the event such notice is given and the consideration is paid, the Stage 3 Joint Venture will be formed on an 80% MBK, 20% EMA basis.

-

-

Stage 2 Joint Venture, with MBKM holding a 51% JV interest. During this Stage MBKM will sole fund exploration expenditure of $2M to earn an additional 29% interest in the JV, taking MBKM’s JV interest to 80%.

-

Stage 3 Joint Venture, where MBKM holds an 80% JV interest and EMA holds a 20% JV interest and each party contributes its percentage share of expenditure.

In addition to the above, upon MBKM completing its Stage 2 expenditure commitment and moving to an 80% JV interest, EMA may elect to require MBK to buy out EMA’s remaining 20% interest for shares in MBK at a value to be agreed, or failing agreement to be determined by an expert. If EMA does not exercise this right, the Stage 3 Joint Venture will proceed with both parties jointly funding exploration, feasibility and development expenditure in their proportionate shares.

The JV agreement provides for:

-

formation of a management committee, comprising representatives of each party, to oversee the management of the JV;

-

decisions of the management committee by majority vote, excluding specific significant decisions requiring a unanimous vote, including disposal of the mining tenements;

-

provision of cross securities by each joint venturer in favour of the other;

-

restrictions on dealing with JV interests, including rights of pre-emption;

-

dilution of joint venture interests in accordance with a standard industry formula upon a monetary default, including a party failing to contribute its share of budgeted expenditure;

-

a non-defaulting joint venturer having the right to buy out the interest of a defaulting joint venturer; and

-

other terms and conditions usual in agreements of this nature.

The Millennium Project

The Millennium Project is a significant advanced copper-cobalt-gold project with a large defined zone of copper-cobalt mineralisation that remains open for expansion at depth and along strike. Copper-cobalt mineralisation is associated with shear zones hosted within a sequence of volcanic and sedimentary units.

The Millennium Project is strategically located on granted mining leases, less than 20 km from the Rocklands mine site and processing facility and within the economic and infrastructure hub of Mount Isa, Queensland. The Mt. Isa Mineral Province is recognized as a world-class mining region, with more than a quarter of the world’s lead and zinc reserves, 5% of the world’s silver resources and 1.5% of the world’s copper resources.

In 2017 and 2018, GEMC conducted a 10-hole, 1,141 metre drilling campaign on the Millennium Project to test the up-dip continuity at the Millennium North deposit and confirm historical estimates of cobalt mineralization reported in 2016 by Hammer Metals. The program was successful in both duplicating historical results, demonstrating the continuity of mineralisation within the mineralised zone and in determining mineralisation continues to depth, including 28 metres of @0.35% Cu and 0.2% Co (MIRC026). Significantly, cobalt and copper mineralisation was encountered along the entire targeted 1,500 metre strike length with the zones remaining open in all directions.

Mapping, soil geochemistry and rock sampling conducted by GEMC identified an additional 1.5 km of anomalous cobalt-copper mineralisation in geological analogues that occur along a potential strike extension in the northern half of the tenement package (“Northern Extension”). This area has no previous drilling to date and provides an excellent opportunity to increase the overall resource potential of the Millennium Project. The Millennium mining leases also include the Corella and Federal prospects, along a parallel zone of significant surface Cu-Co-Au anomalism and historical workings, that are untested by drilling and provide yet further potential to grow the resource base.

Rock chip sampling was also conducted by GEMC to test for additional zones of cobalt and copper mineralisation along the Millennium trend and in particular the Northern Extension where similar host rock units and strong soil geochemical anomalies are located. This zone is located approximately 1 km north of the current Millennium Resource as defined. The continuation of elevated soil arsenic and copper geochemistry and presence of anomalous cobalt and copper in rock chip samples and analogous geology between the Millennium Resource area and the Northern Extension indicate that this area is a priority target for further investigation.

GEMC also conducted initial metallurgical test work on the Millennium Project in 2018, reporting cobalt and copper recoveries exceeding 95%.

For more information on the Millennium Project please refer to the Company’s website: https://www.globalenergymetals.com/projects/millennium-cobalt-project/

Metal Bank Limited

Metal Bank Limited is an ASX-listed minerals exploration company (ASX:MBK).

Metal Bank’s core focus is creating value through a combination of exploration success and quality project acquisition. The company’s key projects are the 8 Mile and Eidsvold gold projects situated in the northern New England Fold Belt of central Queensland, which also hosts the Cracow (3 Moz Au), Mt Rawdon (2 Moz Au), Mt Morgan (8 Moz Au, 0.4Mt Cu) and Gympie (5 Moz Au) gold deposits. The projects are both associated with historical goldfields and represent intrusion related gold systems (IRGS) with multi-million-ounce upside.

The Company has an experienced Board and management team which brings regional knowledge, expertise in early stage exploration and project development, relevant experience in the mid cap ASX-listed resource sector and a focus on sound corporate governance.

The Company is committed to a strategy of diversification and growth through identification of new exploration opportunities which complement its existing portfolio and pursuit of other opportunities to diversify the Company’s assets through acquisition of advanced projects or cash-flow generating assets to assist with funding of the exploration portfolio.

In pursuit of this strategy, MBK holds a significant portfolio of advanced gold and copper exploration projects, with substantial growth upside, including:

-

a 75% interest in the Livingstone Gold Project in Western Australia;

-

the right to earn up to 80% of the Millennium Copper Cobalt project which holds an inferred 2012 JORC resource of 5.9Mt @ 1.08% CuEq1 across 5 granted Mining Leases with significant potential for expansion; and

-

the 8 Mile, Wild Irishman and Eidsvold Gold projects in South East Queensland where considerable work by MBK to date has drill-proven both high grade vein-style and bulk tonnage intrusion-related Au mineralisation.

Qualified Person

Mr. Paul Sarjeant, P. Geo., is the qualified person for this release as defined by National Instrument 43-101 - Standards of Disclosure for Mineral Projects.

Global Energy Metals Corporation

(TSXV:GEMC | OTC:GBLEF | FSE:5GE1)

Global Energy Metals Corp. offers investment exposure to the growing rechargeable battery and electric vehicle market by building a diversified global portfolio of exploration and growth-stage battery mineral assets.

Global Energy Metals recognizes that the proliferation and growth of the electrified economy in the coming decades is underpinned by the availability of battery metals, including cobalt, nickel, copper, lithium and other raw materials. To be part of the solution and respond to this electrification movement, Global Energy Metals has taken a ‘consolidate, partner and invest’ approach and in doing so have assembled and are advancing a portfolio of strategically significant investments in battery metal resources.

As demonstrated with the Company’s current copper, nickel and cobalt projects in Canada, Australia, Norway and the United States, GEMC is investing-in, exploring and developing prospective, scaleable assets in established mining and processing jurisdictions in close proximity to end-use markets. Global Energy Metals is targeting projects with low logistics and processing risks, so that they can be fast tracked to enter the supply chain in this cycle. The Company is also collaborating with industry peers to strengthen its exposure to these critical commodities and the associated technologies required for a cleaner future.

Securing exposure to these critical minerals powering the eMobility revolution is a generational investment opportunity. Global Energy Metals believe the the time to be part of this electrification movement.

For Further Information:

Global Energy Metals Corporation

#1501-128 West Pender Street

Vancouver, BC, V6B 1R8

Email: info@globalenergymetals.com

t. + 1 (604) 688-4219

www.globalenergymetals.com

Twitter: @EnergyMetals | @USBatteryMetals | @ElementMinerals

Cautionary Statement on Forward-Looking Information:

Certain information in this release may constitute forward-looking statements under applicable securities laws and necessarily involve risks associated with regulatory approvals and timelines. Although Global Energy Metals believes the expectations expressed in such forward-looking statements are based on reasonable assumptions, such statements are not guarantees of future performance and actual results or developments may differ materially from those in the forward-looking statements. Except as required by law, the Company undertakes no obligation to update these forward-looking statements in the event that management’s beliefs, estimates or opinions, or other factors, should change.

GEMC’s operations could be significantly adversely affected by the effects of a widespread global outbreak of a contagious disease, including the recent outbreak of illness caused by COVID-19. It is not possible to accurately predict the impact COVID-19 will have on operations and the ability of others to meet their obligations, including uncertainties relating to the ultimate geographic spread of the virus, the severity of the disease, the duration of the outbreak, and the length of travel and quarantine restrictions imposed by governments of affected countries. In addition, a significant outbreak of contagious diseases in the human population could result in a widespread health crisis that could adversely affect the economies and financial markets of many countries, resulting in an economic downturn that could further affect operations and the ability to finance its operations.

For more information on Global Energy and the risks and challenges of their businesses, investors should review the filings that are available at www.sedar.com.

Neither TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

We seek safe harbour.

Copyright (c) 2021 TheNewswire - All rights reserved.