Golden Tag Drills 93 g/t Ag.Eq over 395 m Expanding Fernandez Zone 70 m to Northwest

TORONTO, May 05, 2022 (GLOBE NEWSWIRE) -- Golden Tag Resources Ltd. (“Golden Tag” or the "Company") (TSX.V: GOG) (OTCQB: GTAGF) is pleased to announce complete results from diamond drillholes 22-65A and 65B, part of an exploration program targeting bulk-tonnage mineralization on the Company’s 100% owned San Diego Project, located in Durango Mexico.

Key highlights from holes 22-65A & 65B include:

- High-grade intersections located close to surface, including 1,551 g/t Ag.Eq over 0.60 metres (“m”), and 1,194 g/t Ag.Eq over 0.65 m in the Rata Zone

- 174 g/t Ag.Eq over 16.48 m, including 690 g/t Ag.Eq over 2.50 m, within the Canta Zone

- 363 g/t Ag.Eq over 4.27 m within the CSplay Zone

- 93 g/t Ag.Eq over 395 m, including a higher-grade interval of 109 g/t Ag.Eq over 186 m, of Fernandez Zone mineralization beyond the western limit of the previously established resource envelope, approximately 70 m NW of historical hole 12-47

Greg McKenzie, President and CEO commented: "We are pleased to discover that the Fernandez Zone extends 70 metres to the northwest as measured from the previous most westerly hole. We can see that the continuity of mineralization on the western side is really remarkable as we have encountered 395 metres of mineralization with a maximum internal dilution of only 4.5 metres.

Combining the results from hole 65B with the results from the previously reported hole 21-58, we can now anticipate that the potential extension of the Fernandez Zone could measure approximately 140 m x 70 m in the horizontal plane and 530 m in the vertical plane. There are no drill holes to the west of hole 22-65B and thus the Fernandez Zone remains open to the west.”

Holes 22-65A & 65B

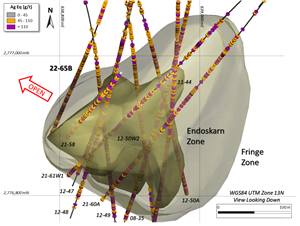

Holes 22-65A and 65B were drilled from the same setup to test the western extension of the Fernandez Zone (Figure 1). Hole 22-65A was abandoned at 252 m due to excessive deviation and hole 22-65B was successfully completed to target.

Holes 22-65A and 65B cut across the several quartz-sulphide veins from the east-west trending Rata Zone at the top of both holes intersecting 1,551 g/t Ag.Eq over 0.60 m (94.55 to 95.15 m) and 1,194 g/t Ag.Eq over 0.65 m (102.55 to 103.20 m) in hole 22-65A and 312 g/t Ag.Eq over 1.20 m (154.35 to 155.55 m) in hole 22-65B (Table 1). Both holes then progressed into the east-west trending quartz-sulphide veins of the Canta Zone where hole 22-65B intersected 690 g/t Ag.Eq over 2.50 m (242.70 to 245.20 m) within a broader interval of 174 g/t Ag.Eq over 16.48 m (236.80 to 253.28 m). Hole 22-65B continued into quartz-sulphide veins of the northeast trending CSplay Zone returning 363 g/t Ag.Eq over 4.27 m (350.20 to 354.47 m) and progressed through the Montanez Zone and Midzone.

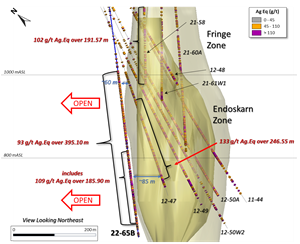

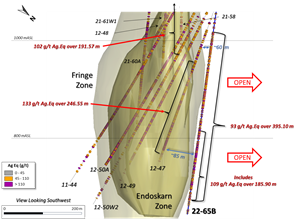

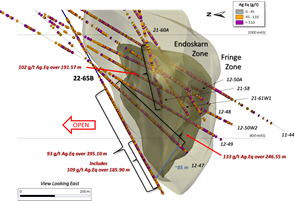

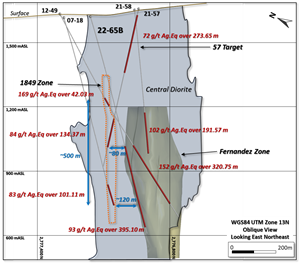

Hole 22-65B intersected bulk tonnage Fernandez Zone mineralization at approximately 630 m vertical depth from surface returning 93 g/t Ag.Eq over 395.10 m (632.60 to 1027.70 m), including a higher-grade interval of 109 g/t Ag.Eq over 185.90 m (840.60 to 1026.50 m) (Figures 2, 3, & 4). The mineralization was observed to be consistent throughout the interval, with a maximum dilution interval of 4.5 m. The Fernandez Zone interval includes several subintervals of higher-grade copper mineralization, most notably 0.41% Cu over 12.10 m (982.40 to 994.50 m), that are spatially associated with a feldspar porphyry monzodiorite, which is a distinct unit within the central diorite in this area.

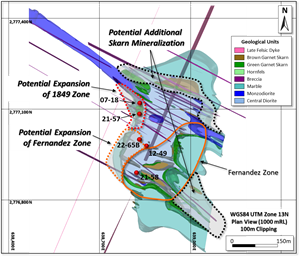

The Fernandez Zone intercept within hole 22-65B lies beyond the western limit of the resource envelope, established in the 43-101 Technical Report Mineral Resource Estimate prepared by SGS Canada effective April 2013. In the resource estimate, the Fernandez Zone resource envelope had been extended out approximately an average of 70 m to the west of the westernmost historical hole 12-47, into an area with no drill data. The results from holes 22-65B and 21-58 (102 g/t Ag.Eq over 191.57 m; see Table 2) confirm that this projected extension was accurate, and will also potentially extend the Fernandez Zone resource envelope a further minimum 70 m to the northwest, depending on the resource estimation assumptions employed. The potential extension of the Fernandez Zone, based on the results from holes 22-65B and 21-58, would measure approximately 140 m x 70 m in the horizontal plane and 530 m in the vertical plane (1174 mASL to 644 mASL elevation or 476 m to 1006 m vertical depth from surface:1650 mASL elevation). No drill holes exist to the west of hole 22-65B and thus the Fernandez Zone remains open to the west.

Furthermore, the Fernandez Zone in hole 22-65B lies an average of 100 m to the south of the 1849 Zone, described in a Company news release dated September 8, 2021, where hole 07-18 returned 83 g/t Ag.Eq over 101.11 m (813.99 to 915.10 m), hole 12-49 returned 169 g/t Ag.Eq over 42.03 m (440.88 to 482.91 m), and hole 21-57 returned 84 g/t Ag.Eq over 134.37 m (521.88 to 656.25 m)(Figure 5). As was previously reported, it was observed during the relogging of historic hole 07-18 that mineralization within the 1849 Zone is like that found in the Fernandez Zone, being comprised of quartz-sulfide vein, stringer and stockwork zones within green and brown exoskarn and red garnet endoskarn. It is possible that the two zones merge, which would extend the Fernandez Zone a further 100 m to the north of hole 22-65B (Figure 6).

The Fernandez Zone is steeply plunging cigar-shaped structure characterized by green and brown garnet exoskarn and red garnet endoskarn sulphide mineralization (pyrite-pyrrhotite-sphalerite-galena) contained within quartz-sulphide stockwork veins, breccias, and massive sulphide zones which are spatially associated with the contacts of diorite intrusive bodies. The Fernandez Zone was divided into 2 subunits in the 2013 SGS Canada resource estimate - Endoskarn and Fringe - which respectively correspond to a higher-grade core unit with stockwork mineralization within and proximal to the southern contact of the Central Diorite intrusive, surrounded by an outer section of lower-grade skarn mineralization hosted for the most part in altered limestones. See Table 2 below for select assay intervals of historic holes within the Fernandez Zone.

Table 1 – Select Assay Intervals from Holes 22-65A & 65B

| Zone | Hole | From | To | Length (m) | Ag.Eq(1) g/t | Au g/t | Ag g/t | Pb % | Zn % | Cu % |

| RATA | 22-65A | 94.55 | 95.15 | 0.60 | 1551 | 0.02 | 1350 | 1.37 | 2.99 | 0.35 |

| RATA | 22-65A | 102.55 | 103.20 | 0.65 | 1194 | 0.03 | 981 | 2.45 | 2.50 | 0.35 |

| 22-65A | 143.20 | 144.87 | 1.67 | 288 | 0.11 | 210 | 0.61 | 1.14 | 0.05 | |

| CANTA | 22-65A | 231.15 | 232.00 | 0.85 | 280 | 0.12 | 197 | 1.24 | 0.75 | 0.06 |

| RATA | 22-65B | 154.35 | 155.55 | 1.20 | 312 | 0.08 | 286 | 0.16 | 0.26 | 0.04 |

| 22-65B | 177.20 | 178.20 | 1.00 | 136 | 0.32 | 84 | 0.34 | 0.28 | 0.04 | |

| 22-65B | 204.70 | 206.25 | 1.55 | 180 | 0.62 | 73 | 0.51 | 0.92 | 0.04 | |

| CANTA | 22-65B | 236.80 | 253.28 | 16.48 | 174 | 0.27 | 103 | 0.60 | 0.64 | 0.05 |

| includes | 236.80 | 239.00 | 2.20 | 163 | 0.09 | 108 | 0.45 | 0.73 | 0.05 | |

| includes | 242.70 | 245.20 | 2.50 | 690 | 0.12 | 460 | 3.04 | 2.71 | 0.19 | |

| CANTA | 22-65B | 265.30 | 266.60 | 1.30 | 127 | 0.08 | 86 | 0.33 | 0.46 | 0.06 |

| CSPLAY | 22-65B | 350.20 | 354.47 | 4.27 | 363 | 0.11 | 135 | 2.90 | 3.06 | 0.09 |

| MONTANEZ | 22-65B | 413.40 | 414.57 | 1.17 | 472 | 1.71 | 160 | 2.65 | 1.79 | 0.22 |

| MONTANEZ | 22-65B | 426.50 | 427.50 | 1.00 | 308 | 0.04 | 126 | 3.45 | 1.71 | 0.07 |

| MONTANEZ | 22-65B | 430.00 | 431.00 | 1.00 | 142 | 0.04 | 67 | 1.65 | 0.39 | 0.07 |

| MONTANEZ | 22-65B | 449.58 | 450.60 | 1.02 | 263 | 0.05 | 145 | 3.18 | 0.25 | 0.08 |

| MONTANEZ | 22-65B | 457.17 | 458.67 | 1.50 | 180 | 0.21 | 73 | 1.03 | 1.05 | 0.15 |

| MIDZONE | 22-65B | 466.00 | 466.50 | 0.50 | 282 | 0.28 | 145 | 2.50 | 0.76 | 0.09 |

| 22-65B | 608.15 | 609.65 | 1.50 | 151 | 0.30 | 39 | 1.68 | 0.73 | 0.08 | |

| FERNANDEZ | 22-65B | 632.60 | 1027.70 | 395.10 | 93 | 0.05 | 35 | 0.36 | 0.78 | 0.11 |

| includes | 840.60 | 1026.50 | 185.90 | 109 | 0.03 | 37 | 0.28 | 1.13 | 0.14 |

Table 2 – Select Assay Intervals from Historic Holes within the 57 Target, 1849 & Fernandez Zones

| Zone | Hole | From | To | Length (m) | Ag.Eq(1) g/t | Au g/t | Ag g/t | Pb % | Zn % | Cu % |

| FERNANDEZ | 08-35 | 708.30 | 1062.95 | 354.65 | 90 | 0.04 | 33 | 0.43 | 0.92 | 0.05 |

| FERNANDEZ | 11-44 | 645.40 | 988.20 | 342.80 | 105 | 0.03 | 42 | 0.56 | 0.88 | 0.08 |

| FERNANDEZ | 12-47 | 757.80 | 1004.35 | 246.55 | 133 | 0.04 | 51 | 0.47 | 1.20 | 0.16 |

| FERNANDEZ | 12-48 | 617.00 | 814.00 | 197.00 | 70 | 0.05 | 27 | 0.45 | 0.48 | 0.06 |

| FERNANDEZ | 12-49 | 697.80 | 1018.55 | 320.75 | 152 | 0.06 | 55 | 0.68 | 1.34 | 0.17 |

| FERNANDEZ | 12-50A | 686.50 | 1049.10 | 362.60 | 161 | 0.10 | 58 | 0.67 | 1.43 | 0.16 |

| FERNANDEZ | 12-50W2 | 702.20 | 1076.80 | 374.60 | 97 | 0.04 | 36 | 0.40 | 0.84 | 0.11 |

| FERNANDEZ | 21-58 | 483.13 | 674.70 | 191.57 | 102 | 0.04 | 35 | 0.81 | 0.81 | 0.06 |

| FERNANDEZ | 21-60A | 598.30 | 921.20 | 322.90 | 100 | 0.03 | 40 | 0.62 | 0.77 | 0.08 |

| FERNANDEZ | 21-61W1 | 615.90 | 856.20 | 240.30 | 83 | 0.04 | 32 | 0.54 | 0.66 | 0.06 |

| 1849 | 07-18 | 813.99 | 915.10 | 101.11 | 83 | 0.05 | 30 | 0.57 | 0.65 | 0.05 |

| 1849 | 12-49 | 440.88 | 482.91 | 42.03 | 169 | 0.15 | 62 | 1.56 | 1.14 | 0.02 |

| 1849 | 21-57 | 521.88 | 656.25 | 134.37 | 84 | 0.13 | 21 | 0.60 | 0.74 | 0.05 |

| 57 TARGET | 21-57 | 29.55 | 303.20 | 273.65 | 72 | 0.10 | 43 | 0.19 | 0.33 | 0.02 |

(1) All results in this release are rounded. Assays are uncut and undiluted. Widths are core-lengths, not true widths as a full interpretation of actual orientation of mineralization is not complete. Intervals of skarn mineralization were chosen based on a 45 g/t Ag.Eq cutoff with no more than 4.5 m of dilution and intervals of vein mineralization were chosen based on a 110 g/t Ag.Eq cutoff with 0 m dilution. For the 57 Target, intervals of epithermal, skarn, massive sulfide or stockwork mineralization to a vertical depth of 300 m were chosen based on a 22 g/t Ag.Eq cutoff with no more than 14.5 m of dilution. Silver equivalent: Ag.Eq g/t was calculated using 3-year trailing average commodity prices of $20.60/oz Ag, $0.90/lb Pb, $1.20/lb Zn, $1650/oz Au, and $3.25/lb Cu. The calculations assume 100% metallurgical recovery and are indicative of gross in-situ metal value, the Company is planning to perform additional metallurgical studies later in 2022. The 57 Target, 1849 Zone and Fernandez Zone drill intercepts from historical holes 07-18, 08-35, 11-44, 12-47, 12-48, 12-49, 12-50A, 12-50W2, 21-57 and 58, which were released in 2021, and 21-60A and 61W1 which were released in 2022, were calculated using the current silver equivalent parameters outlined above.

Sample Analysis and QA/QC Program

Golden Tag Resources uses a quality assurance/quality control (QA/QC) program that monitors the chain of custody of samples and includes the insertion of blanks, duplicates, and reference standards in each batch of samples sent for analysis. Drill core is photographed, logged, and cut in half with one half retained in a secured location for verification purposes and one half shipped for analysis. Sample preparation (crushing and pulverizing) is performed at ALS Geochemistry, an independent ISO 9001:2001 certified laboratory, in Zacatecas, Mexico and pulps are sent to ALS Geochemistry in Vancouver, Canada and Lima, Peru for analyses. The entire sample is crushed to 70% passing -2 mm and a riffle split of 250 grams is taken and pulverized to better than 85% passing 75 microns. Samples are analyzed for gold using a standard fire assay with Atomic Absorption Spectrometry (AAS) (Au-AA23) from a 30-gram pulp. Gold assays greater than 10 g/t are re-analyzed on a 30-gram pulp by fire assay with a gravimetric finish (Au-GRA21). Samples are also analyzed using a 35 element inductively coupled plasma (ICP) method with atomic emission spectroscopy (AES) on a pulp digested by aqua regia (ME-ICP41). Overlimit sample values for silver (>100 g/t), lead (>1%), zinc (>1%), and copper (>1%) are re-assayed using a four-acid digestion overlimit method with ICP-AES (ME-OG62). For silver values greater than 1,500 g/t samples are re-assayed using a fire assay with gravimetric finish on a 30-gram pulp (Ag-GRA21). No QA/QC issues were noted with the results reported herein.

True widths of drill intercepts have not been determined. Assays are uncut except where indicated.

Review by Qualified Person and QA/QC

The scientific and technical information in this document has been reviewed and approved by Bruce Robbins, P.Geo., a Qualified Person as defined by National Instrument 43-101.

About Golden Tag Resources

Golden Tag Resources Ltd. is a Toronto based mineral resource exploration company. The Company holds a 100% interest, subject to a 2% NSR, in the San Diego Project, in Durango, Mexico. The San Diego property is among the largest undeveloped silver assets in Mexico and is located within the prolific Velardeña Mining District. Velardeña hosts several mines having produced silver, zinc, lead and gold for over 100 years. For more information regarding the San Diego property please visit our website at www.goldentag.ca.

For additional information, please contact:

Greg McKenzie, President & CEO

Ph: 416-504-2020

Email: info@goldentag.ca

www.goldentag.ca

Cautionary Statement:

Neither the TSXV nor its Regulation Services Provider (as that term is defined in the policies of the TSXV) accepts responsibility for the adequacy or accuracy of this news release. Certain statements in this news release are forward-looking and involve a number of risks and uncertainties. Such forward-looking statements are within the meaning of the phrase ‘forward-looking information’ in the Canadian Securities Administrators’ National Instrument 51-102 – Continuous Disclosure Obligations. Forward-looking statements are not comprised of historical facts. Forward-looking statements include estimates and statements that describe the Company’s future plans, objectives or goals, including words to the effect that the Company or management expects a stated condition or result to occur. Forward-looking statements may be identified by such terms as “believes”, “anticipates”, “expects”, “estimates”, “may”, “could”, “would”, “will”, or “plan”. Since forward-looking statements are based on assumptions and address future events and conditions, by their very nature they involve inherent risks and uncertainties. Although these statements are based on information currently available to the Company, the Company provides no assurance that actual results will meet management’s expectations. Risks, uncertainties and other factors involved with forward-looking information could cause actual events, results, performance, prospects and opportunities to differ materially from those expressed or implied by such forward-looking information. Forward-looking information in this news release includes, but is not limited to, statements regarding the effects of the Company’s exploration program, assay results from the ongoing drill program, the expansion or discovery of additional bulk tonnage mineralization or zones, potential expansion of resources. Factors that could cause actual results to differ materially from such forward-looking information include, but are not limited to: the ability to predict and counteract the effects of COVID-19 on the business of the Company, including but not limited to the effects of COVID-19 on the price of commodities, capital market conditions, restriction on labour and international travel and supply chains; failure to identify mineral resources; failure to convert estimated mineral resources to reserves; the inability to complete a feasibility study which recommends a production decision; the preliminary nature of metallurgical test results; delays in obtaining or failures to obtain required governmental, environmental or other project approvals; political risks; changes in equity markets; uncertainties relating to the availability and costs of financing needed in the future; the inability of the Company to budget and manage its liquidity in light of the failure to obtain additional financing; inflation; changes in exchange rates; fluctuations in commodity prices; delays in the development of projects; capital, operating and reclamation costs varying significantly from estimates and the other risks involved in the mineral exploration and development industry; and those risks set out in the Company’s public documents filed on SEDAR. Although the Company believes that the assumptions and factors used in preparing the forward-looking information in this news release are reasonable, undue reliance should not be placed on such information, which only applies as of the date of this news release, and no assurance can be given that such events will occur in the disclosed time frames or at all. The Company disclaims any intention or obligation to update or revise any forward-looking information, whether as a result of new information, future events or otherwise, other than as required by law. No stock exchange, securities commission or other regulatory authority has approved or disapproved the information contained herein.

Figure 1: Plan View of Holes 08-35, 11-44, 12-47, 48, 49, 50A, 50W2, 21-58, 60A, 61W1 & 22-65B and Fernandez Zone

https://www.globenewswire.com/NewsRoom/AttachmentNg/f9bc30d8-d917-433d-97b9-d4fda1ea74b8

Figure 2: View to Northeast of Key Results Holes 12-47, 21-58 & 22-65B and Fernandez Zone

https://www.globenewswire.com/NewsRoom/AttachmentNg/9e620e0d-1a73-4534-8df8-400d3f5ca35f

Figure 3: Oblique View to Southwest of Key Results Holes 12-47, 21-58 & 22-65B and Fernandez Zone

https://www.globenewswire.com/NewsRoom/AttachmentNg/ffca8b0f-895e-4ffd-ae43-bd44a0d91eee

Figure 4: Oblique View to the East of Key Results Holes 12-47, 21-58 & 22-65B and Fernandez Zone

https://www.globenewswire.com/NewsRoom/AttachmentNg/9c530f0f-339a-4119-895f-c5dfdc86c686

Figure 5: Oblique View to the East-Northeast of Key Results Holes 07-18, 12-49, 21-57 & 58, and 22-65B

showing Central Diorite, 57 Target, 1849 Zone and Fernandez Zone

https://www.globenewswire.com/NewsRoom/AttachmentNg/271002b4-4990-4c2d-9e4a-34b0e008dc5f

Figure 6: Plan View 1000 mASL of Holes 07-18, 12-49, 21-57 & 58, and 22-65B showing Fernandez Zone

with Potential Expansion of 1849 and Fernandez Zones and Areas of Potential Additional Skarn Mineralization

https://www.globenewswire.com/NewsRoom/AttachmentNg/9e50e065-774f-440d-bb42-f7e2ba821866