Group Ten Reports 4.3 Meters of 2.94 g/t Platinum, Palladium and Gold, Plus 0.24% Nickel and Copper, at the Crescent and Cathedral Target Areas of the Stillwater West Project in Montana, USA

VANCOUVER, British Columbia, May 29, 2019 (GLOBE NEWSWIRE) -- Group Ten Metals Inc. (TSX.V: PGE; US OTC: PGEZF; FSE: 5D32) (the “Company” or “Group Ten”) announces results from the Crescent and Cathedral target areas on the east side of the Stillwater West PGE-Ni-Cu Project, adjacent to Sibanye-Stillwater’s high-grade Platinum Group Element (“PGE”) mines in Montana, USA. This is the fifth news release to report results of 2018 exploration programs and on-going data synthesis and modeling work at the Company’s flagship project. Highlights include:

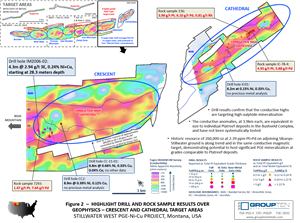

- Past shallow drilling at the Crescent target area includes 4.3 meters of 2.94 g/t platinum, palladium and gold, plus 0.24% combined nickel and copper in drill hole IM2006-02, starting at 28.3 meters depth. Mineralization in this interval is comparable to the observed grades on Platreef deposits in the Bushveld Complex of South Africa at Anglo American’s Mogalakwena Mine and Ivanhoe’s Platreef Mine, in a similar geological setting;

- Deeper historic drilling approximately 700 meters east of IM2006-02 includes hole CC2 which intercepted 8.9 meters of 0.39% nickel and 0.12% copper, with no precious metals analysis;

- A total of ten past drill holes returned additional long mineralized intercepts, with a total of 15 intervals reporting greater than 25 gram-meter (g-m) grade thickness, ranging from 25.6 to 194.7 meters in length at base metal grades that are comparable to, or exceed, those of the Platreef;

- Historic drilling at the Cathedral target area includes drill hole IC01 which intercepted 6.2 meters of 0.15% nickel and 0.33% copper, with no precious metals analysis;

- 2018 and historic rock samples returned high-grade results with 12 samples over 2 g/t Total Platinum Equivalent (“TotPtEq”) in the Crescent target area, and 22 at Cathedral. A total of 9 samples returned over 5 g/t platinum, palladium and gold, with base metals ranging up to 0.39% nickel and 0.12% cobalt;

- Sibanye-Stillwater controls a small block of claims in the Crescent area that host a historic resource of approximately 260,000 ounces grading 2.39 ppm Pt+Pd1 along trend in the same conductive magmatic target, demonstrating the potential for that target area to host significant PGE mineralization at grades comparable to Platreef deposits;

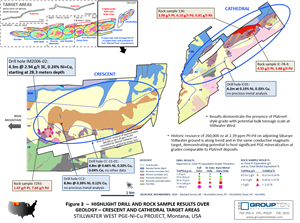

- Results confirm that the airborne geophysical conductive highs are targeting high-sulphide mineralization at both the Crescent and Cathedral target areas. Further, the scale of the conductive anomalies, at 3.9 kilometers each, is equivalent to the scale of individual Platreef deposits in the Bushveld Complex.

Michael Rowley, President and CEO, commented, "Even in the less-explored Crescent and Cathedral target areas we continue to see correlating geophysical and geological data that confirms the potential for large-scale PGE-Ni-Cu-Co mineralization within the Ultramafic and Banded Series along the 25 kilometer strike of the project. Work to date demonstrates the presence of Platreef-style grade in these two target areas within conductive high anomalies that, at nearly four kilometers each in size, show the potential for bulk tonnage scale. Like our other target areas at Stillwater West, the strongest conductive anomalies have only seen limited drilling to date, and the identified mineralization is open for expansion in all directions. We look forward to further announcements including our exploration plans for 2019 in the very near future.”

Crescent and Cathedral are the two easternmost target areas of eight bulk tonnage targets identified in the synthesis and modeling work by Group Ten Metals (see Figure 1), centering on geophysical conductive high anomalies with mineralization confirmed by drill and rock sample results.

Figure 1 – Fourteen Target Areas Across the 25-Kilometer Length of the Stillwater West Project

Figure 1 is available at https://www.globenewswire.com/NewsRoom/AttachmentNg/6dfaf860-a91d-4693-b090-5a125575dce7

Crescent Target Area

As shown in Table 1 and Figures 2 and 3, ten shallow drill holes define an area approximately 250 meters by 500 meters on the western portion of the target area in which all holes returned significant mineralized intercepts and mineralization remains open in all directions. Nine of those holes returned grade-thickness values of more than 25 gram-meter (g-m) TotPtEq, and five over 100 g-m grade thickness. Grade-thickness values, determined as grade x thickness, of 25 gram-meter or more are considered economically significant, and values of 100 to 300 gram-meter are considered exceptional. Grade-thickness values at the adjacent J-M Reef mines average approximately 34 gram-meter palladium and platinum1.

Hole IM2006-02 returned 166 g-m grade-thickness TotPtEq including 4.3 meters of 2.94 g/t 3E (Pt + Pd + Au) plus 0.24% Ni+Cu starting at just 28.3 meters depth, demonstrating grade that is directly comparable to that of the Platreef over potentially minable widths. Hole IM2006-02 also returned a number of other mineralized intercepts including 1.0 meter at 11 g/t 3E and 4.7 meters of 0.68 g/t 3E plus 0.63% Ni+Cu.

Located approximately 700 meters to the east of IM2006-02, hole CC2 confirms mineralization laterally along the layered magmatic system, while also providing a deeper test to the Basal Series. Drilled by Anaconda in 1990, CC2 reached 569 meters deep and returned multiple mineralized intervals including 1.2 meters grading 0.13% Ni and 4.08% Cu, and 8.9 meters grading 0.39% Ni and 0.12% Cu, starting at 532 meters down hole. Precious metals were not analyzed in this historic drill hole but would be expected to occur with these base metal sulphides.

Reconnaissance rock sampling and geological mapping results from 2018 and previous campaigns confirm the grade potential of the Crescent target area with 12 rock samples reporting greater than 2 g/t TotPtEq, ranging up to 10.54 g/t TotPtEq. In addition, high-grade palladium results in rock samples include up to 5.74 g/t and 7.64 g/t Pd with strong base metal results of up to 0.377% and 0.391% Ni, and 0.12% Co.

As shown in Figures 2 and 3, historic drilling on a small block of adjacent claims held by Sibanye-Stillwater led to the development of a historic resource of approximately 260,000 ounces grading 2.39 g/t platinum and palladium, along trend of the same conductive magmatic target. While not on Group Ten’s claim block, these results demonstrate the potential in that target area to host significant PGE mineralization at grades comparable to Platreef deposits and confirm that the observed electro-magnetic conductive anomalies are targeting nickel-copper sulphide mineralization.

Figure 2 is available at https://www.globenewswire.com/NewsRoom/AttachmentNg/f05739f4-45ad-463c-916a-4d574d65f67f

Figure 3 is available at https://www.globenewswire.com/NewsRoom/AttachmentNg/ea7b867a-ca2c-4aae-b04b-b7c70f43842f

Cathedral Target Area

Cathedral is one of the least explored target areas at Stillwater West, however existing data reports high-grade PGE results in geological mapping which correlates with the conductive geophysical high noted above. Results from the only drill hole with surviving data report significant base metal grade and width with 6.2 meters of 0.15% Ni plus 0.33% Cu in IC-01, confirming that the conductive highs are targeting significant nickel and copper sulphide mineralization. Precious metals were not analyzed in this historic drill hole but would be expected to occur with these base metal sulphides.

Reconnaissance surface sampling to date, presented in Table 3, returned 22 samples with over 2 g/t TotPtEq with seven results over 5 g/t platinum, palladium and gold. Strong rhodium values are also noted, with five samples returning more than 0.56 g/t Rh. Rhodium values have not been included in the calculation of metal equivalents in the tables above and below.

Table 1 – Drill Results – Crescent Target Area

| INTERVAL | PRECIOUS METALS | BASE METALS | TOTAL METAL EQUIVALENTS | GRADE THICKNESS | ||||||||||

| HOLE ID | From | To | Width | Pt | Pd | Au | 3E | Ni | Cu | Co | NiEq | TotPtEq | TotNiEq | Grade x Width |

| (m) | (m) | (m) | (g/t) | (g/t) | (g/t) | (g/t) | (%) | (%) | (%) | (%) | (Pt g/t) | (Ni %) | (gram-meters) | |

| IM2006-01 | 33.1 | 176.9 | 143.9 | 0.05 | 0.08 | 0.02 | 0.14 | 0.14 | 0.02 | n/a | 0.16 | 0.79 | 0.19 | 113.3 |

| including | 155.8 | 175.9 | 20.1 | 0.16 | 0.23 | 0.07 | 0.46 | 0.17 | 0.07 | n/a | 0.21 | 1.34 | 0.32 | 26.9 |

| and | 199.8 | 235.0 | 35.2 | 0.13 | 0.08 | 0.08 | 0.30 | 0.29 | 0.12 | n/a | 0.34 | 1.73 | 0.42 | 61.0 |

| including | 208.6 | 228.0 | 19.4 | 0.21 | 0.12 | 0.12 | 0.46 | 0.44 | 0.18 | n/a | 0.53 | 2.67 | 0.65 | 51.7 |

| IM2006-02 | 8.3 | 203.0 | 194.7 | 0.05 | 0.11 | 0.02 | 0.18 | 0.15 | 0.03 | n/a | 0.16 | 0.85 | 0.21 | 166.4 |

| including | 28.3 | 32.6 | 4.3 | 0.59 | 2.26 | 0.09 | 2.94 | 0.20 | 0.04 | n/a | 0.22 | 3.89 | 0.94 | 16.8 |

| including | 28.6 | 29.6 | 1.0 | 2.28 | 8.45 | 0.28 | 11.00 | 0.24 | 0.05 | n/a | 0.26 | 12.16 | 2.95 | 12.3 |

| including | 152.5 | 184.7 | 32.2 | 0.07 | 0.12 | 0.05 | 0.24 | 0.19 | 0.09 | n/a | 0.23 | 1.22 | 0.30 | 39.3 |

| and | 212.8 | 251.8 | 39.0 | 0.05 | 0.10 | 0.07 | 0.22 | 0.17 | 0.09 | n/a | 0.22 | 1.15 | 0.28 | 44.8 |

| including | 229.5 | 234.2 | 4.7 | 0.06 | 0.35 | 0.27 | 0.68 | 0.41 | 0.22 | n/a | 0.52 | 2.89 | 0.70 | 13.5 |

| including | 249.3 | 251.8 | 2.4 | 0.03 | 0.14 | 0.08 | 0.26 | 0.21 | 0.05 | n/a | 0.24 | 1.26 | 0.31 | 3.1 |

| IM2006-03 | 12.2 | 66.5 | 54.3 | 0.04 | 0.05 | 0.02 | 0.12 | 0.12 | 0.02 | n/a | 0.13 | 0.64 | 0.16 | 34.6 |

| and | 72.5 | 197.8 | 125.3 | 0.08 | 0.09 | 0.05 | 0.22 | 0.15 | 0.05 | n/a | 0.18 | 0.95 | 0.23 | 119.0 |

| IM2006-04 | 11.0 | 46.4 | 35.5 | 0.09 | 0.11 | 0.01 | 0.21 | 0.14 | 0.01 | n/a | 0.14 | 0.80 | 0.19 | 28.2 |

| and | 79.5 | 243.8 | 164.3 | 0.06 | 0.11 | 0.05 | 0.22 | 0.17 | 0.04 | n/a | 0.19 | 1.02 | 0.25 | 168.4 |

| including | 168.7 | 240.2 | 71.5 | 0.11 | 0.17 | 0.10 | 0.37 | 0.22 | 0.07 | n/a | 0.26 | 1.46 | 0.35 | 104.0 |

| IM2006-05 | 0.0 | 76.8 | 76.8 | 0.05 | 0.05 | 0.01 | 0.11 | 0.20 | 0.04 | n/a | 0.22 | 1.00 | 0.24 | 76.5 |

| and | 213.7 | 308.5 | 94.8 | 0.04 | 0.07 | 0.04 | 0.15 | 0.19 | 0.04 | n/a | 0.20 | 1.00 | 0.24 | 95.0 |

| IM2006-06 | 1.2 | 58.5 | 57.3 | 0.03 | 0.02 | 0.01 | 0.05 | 0.18 | 0.02 | n/a | 0.19 | 0.83 | 0.20 | 47.6 |

| and | 171.3 | 315.2 | 143.9 | 0.04 | 0.08 | 0.01 | 0.13 | 0.14 | 0.02 | n/a | 0.14 | 0.72 | 0.18 | 103.7 |

| IM2006-07 | 17.7 | 43.3 | 25.6 | 0.01 | 0.01 | 0.00 | 0.03 | 0.23 | 0.06 | n/a | 0.26 | 1.09 | 0.27 | 28.0 |

| including | 42.1 | 43.3 | 1.2 | 0.01 | 0.01 | 0.01 | 0.03 | 2.33 | 1.26 | n/a | 2.96 | 12.21 | 2.97 | 14.9 |

| IMC04-1 | 0.0 | 96.9 | 96.9 | 0.04 | 0.10 | 0.01 | 0.15 | 0.12 | 0.01 | 0.011 | 0.16 | 0.83 | 0.20 | 80.2 |

| including | 19.5 | 27.5 | 8.0 | 0.23 | 0.72 | 0.04 | 0.99 | 0.20 | 0.06 | 0.014 | 0.27 | 2.12 | 0.52 | 17.0 |

| including | 23.4 | 26.5 | 3.1 | 0.49 | 1.42 | 0.07 | 1.98 | 0.19 | 0.05 | 0.013 | 0.26 | 3.06 | 0.74 | 9.5 |

| IMC04-2 | 0.0 | 67.7 | 67.7 | 0.02 | 0.03 | 0.00 | 0.05 | 0.13 | 0.01 | 0.010 | 0.16 | 0.73 | 0.18 | 49.2 |

| CC2 | 129.8 | 143.0 | 13.1 | n/a | n/a | n/a | n/a | 0.16 | 0.10 | n/a | 0.21 | 0.86 | 0.21 | 11.3 |

| and | 223.0 | 240.2 | 17.2 | n/a | n/a | n/a | n/a | 0.18 | 0.06 | n/a | 0.21 | 0.87 | 0.21 | 14.9 |

| including | 223.0 | 232.3 | 9.3 | n/a | n/a | n/a | n/a | 0.24 | 0.07 | n/a | 0.28 | 1.16 | 0.28 | 10.8 |

| and | 346.9 | 348.1 | 1.2 | n/a | n/a | n/a | n/a | 0.13 | 4.08 | n/a | 2.17 | 8.92 | 2.17 | 10.9 |

| and | 531.6 | 540.5 | 8.9 | n/a | n/a | n/a | n/a | 0.39 | 0.12 | n/a | 0.45 | 1.85 | 0.45 | 16.5 |

Intercepts with grade-thickness values over 25 gram-meter TotPtEq, plus select lesser intervals, are presented above. Total Platinum Equivalent (TotPtEq g/t) and Total Nickel Equivalent calculations reflect total gross metal content using metals prices as follows (all USD): $6.00/lb nickel (Ni), $3.00/lb copper (Cu), $20.00/lb cobalt (Co), $1,000/oz platinum (Pt), $1,000/oz palladium (Pd), and $1,250/oz gold (Au). Values have not been adjusted to reflect metallurgical recoveries. Total metal equivalent values include both base and precious metals, where available. Results labelled ‘n/a’ were not assayed for that metal. Total platinum equivalent grade-thickness was determined by multiplying the thickness (in meters) by the Total Platinum Equivalent grade (in grams/tonne) to provide gram-meter values (g-m) as shown. Total nickel equivalent grade-thickness was determined by multiplying the thickness (in meters) by the Total Nickel Equivalent grade (in percent) to provide percent-meter values as shown. IM series drill holes were conducted by Group Ten’s QP and are not considered historic. CC series drill are considered historic and have not been independently verified by Group Ten.

Table 2 – Rock Sample Results – Crescent Target Area

| PRECIOUS METALS | BASE METALS | TOTAL METAL EQUIVALENTS | OTHER METALS* | |||||||||

| SAMPLE ID | Pt | Pd | Au | 3E | Ni | Cu | Co | NiEq | TotPtEq | TotNiEq | Rh | |

| (g/t) | (g/t) | (g/t) | (g/t) | (%) | (%) | (%) | (%) | (Pt g/t) | (Ni %) | (g/t) | ||

| 7293 | 1.47 | 7.64 | 0.11 | 9.22 | 0.207 | 0.071 | 0.022 | 0.316 | 10.54 | 2.56 | n/a | |

| 1090 | 0.62 | 5.74 | n/a | 6.35 | 0.000 | 0.000 | 0.120 | 0.399 | 7.99 | 1.94 | 0.26 | |

| 7296 | 0.69 | 3.44 | 0.11 | 4.24 | 0.177 | 0.067 | 0.022 | 0.284 | 5.43 | 1.32 | n/a | |

| 7301 | 1.76 | 2.67 | 0.03 | 4.46 | 0.092 | 0.000 | n/a | 0.092 | 4.85 | 1.18 | n/a | |

| 5838 | 0.73 | 0.93 | 0.12 | 1.79 | 0.391 | 0.156 | 0.021 | 0.539 | 4.03 | 0.98 | n/a | |

| 5840 | 0.86 | 1.29 | 0.16 | 2.31 | 0.192 | 0.027 | 0.019 | 0.269 | 3.45 | 0.84 | n/a | |

| 7294 | 0.90 | 1.17 | 0.06 | 2.13 | 0.158 | 0.034 | 0.021 | 0.245 | 3.15 | 0.77 | n/a | |

| 3190253 | 0.31 | 0.53 | 0.11 | 0.95 | 0.377 | 0.039 | 0.026 | 0.483 | 2.96 | 0.72 | n/a | |

| 7295 | 0.57 | 1.01 | 0.06 | 1.64 | 0.144 | 0.036 | 0.022 | 0.235 | 2.63 | 0.64 | n/a | |

| 1088 | 0.45 | 0.71 | 0.13 | 1.30 | 0.003 | 0.000 | 0.076 | 0.257 | 2.39 | 0.58 | 0.30 | |

| 867 | 0.21 | 0.26 | 0.06 | 0.53 | 0.352 | 0.032 | 0.017 | 0.423 | 2.29 | 0.56 | n/a | |

| 873 | 0.08 | 0.18 | 0.19 | 0.45 | 0.289 | 0.142 | 0.013 | 0.402 | 2.15 | 0.52 | n/a | |

Results over 2 g/t TotPtEq are presented above. Total Platinum Equivalent (TotPtEq g/t) and Total Nickel Equivalent were determined as per Table 1.

Table 3 – Rock Sample Results – Cathedral Target Area

| PRECIOUS METALS | BASE METALS | TOTAL METAL EQUIVALENTS | OTHER METALS* | |||||||||

| SAMPLE ID | Pt | Pd | Au | 3E | Ni | Cu | Co | NiEq | TotPtEq | TotNiEq | Rh | |

| (g/t) | (g/t) | (g/t) | (g/t) | (%) | (%) | (%) | (%) | (Pt g/t) | (Ni %) | (g/t) | ||

| 136 | 3.99 | 6.10 | 0.13 | 10.22 | 0.053 | 0.010 | 0.003 | 0.067 | 10.53 | 2.56 | 0.81 | |

| IC-78-4 | 4.55 | 5.88 | n/a | 10.43 | n/a | n/a | n/a | n/a | 10.43 | 2.53 | n/a | |

| IC-78-1 | 5.08 | 1.95 | n/a | 7.03 | n/a | n/a | n/a | n/a | 7.03 | 1.71 | n/a | |

| 145 | 2.97 | 2.33 | 0.25 | 5.55 | 0.213 | 0.063 | 0.010 | 0.279 | 6.76 | 1.64 | 0.44 | |

| CW061100-1 | 1.14 | 4.85 | 0.12 | 6.11 | 0.108 | 0.069 | 0.003 | 0.151 | 6.76 | 1.64 | 0.37 | |

| CM061100-2 | 1.17 | 3.94 | 0.11 | 5.22 | 0.140 | 0.103 | 0.003 | 0.201 | 6.07 | 1.48 | n/a | |

| CW061100-12 | 2.16 | 3.06 | 0.07 | 5.29 | 0.079 | 0.029 | 0.006 | 0.114 | 5.78 | 1.40 | 0.56 | |

| 84 | 1.38 | 3.24 | 0.10 | 4.72 | 0.085 | 0.012 | 0.004 | 0.103 | 5.17 | 1.26 | 0.56 | |

| IC-78-5 | 0.91 | 3.98 | n/a | 4.88 | n/a | n/a | n/a | n/a | 4.88 | 1.19 | n/a | |

| IC-78-8 | 1.93 | 2.78 | n/a | 4.70 | n/a | n/a | n/a | n/a | 4.70 | 1.14 | n/a | |

| 85 | 1.93 | 2.04 | 0.03 | 4.00 | 0.108 | 0.006 | 0.007 | 0.133 | 4.56 | 1.11 | 0.75 | |

| CM061100-4 | 1.17 | 2.50 | 0.11 | 3.78 | 0.083 | 0.035 | 0.002 | 0.109 | 4.25 | 1.03 | 0.37 | |

| CW061100-7 | 0.51 | 2.26 | 0.05 | 2.82 | 0.064 | 0.022 | 0.002 | 0.081 | 3.16 | 0.77 | 0.19 | |

| CM061100-8 | 1.35 | 1.24 | 0.02 | 2.61 | 0.066 | 0.009 | 0.009 | 0.100 | 3.02 | 0.74 | 0.56 | |

| 81 | 0.53 | 1.77 | 0.06 | 2.36 | 0.123 | 0.048 | 0.003 | 0.158 | 3.02 | 0.73 | 0.19 | |

| CW061100-14 | 0.45 | 1.72 | 0.08 | 2.25 | 0.136 | 0.037 | 0.007 | 0.176 | 3.00 | 0.73 | 0.19 | |

| 78 | 1.03 | 1.01 | 0.07 | 2.10 | 0.115 | 0.039 | 0.004 | 0.149 | 2.73 | 0.66 | 0.19 | |

| 140 | 0.54 | 1.53 | 0.10 | 2.16 | 0.083 | 0.037 | 0.003 | 0.110 | 2.64 | 0.64 | 0.25 | |

| 139 | 0.42 | 1.06 | 0.13 | 1.61 | 0.153 | 0.034 | 0.011 | 0.208 | 2.49 | 0.61 | 0.09 | |

| 79 | 0.63 | 1.12 | 0.05 | 1.80 | 0.111 | 0.023 | 0.007 | 0.144 | 2.40 | 0.58 | 0.19 | |

| 146 | 0.45 | 0.83 | 0.07 | 1.35 | 0.173 | 0.017 | 0.012 | 0.221 | 2.28 | 0.55 | 0.25 | |

| 83 | 0.87 | 0.50 | 0.02 | 1.39 | 0.122 | 0.010 | 0.009 | 0.156 | 2.04 | 0.50 | 0.19 | |

Results over 2 g/t TotPtEq are presented above. Total Platinum Equivalent (TotPtEq g/t) and Total Nickel Equivalent were determined as per Table 1.

Next Steps

Follow up target definition work is planned for both the Crescent and Cathedral target areas to develop and allow prioritization of future targets for testing. Planning is currently underway for the next phase of drill testing at the advanced target areas at Stillwater West project including Iron Mountain and Chrome Mountain with the objective of offsetting higher-grade mineralized intercepts that show the potential to be rapidly advanced to a resource delineation stage. Additional synthesis and modelling work is underway on less advanced areas at Stillwater West to develop and refine targets for drill testing. News flow will be on-going to report on this effort in addition to announcing exploration plans.

About Stillwater West

The Stillwater West PGE-Ni-Cu Project positions Group Ten as the second largest landholder in the Stillwater Complex, adjoining and adjacent to Sibanye-Stillwater’s world-leading Stillwater, East Boulder, and Blitz platinum group elements (PGE) mines in south central Montana, USA. With more than 41 million ounces of past production and current M&I resources, plus another 49 million ounces of Inferred resources2,3, the Stillwater Complex is recognized as one of the top regions in the world for PGE-Ni-Cu mineralization, alongside the Bushveld Complex and Great Dyke in southern Africa, which are similar layered intrusions. The J-M Reef, and other PGE-enriched sulphide horizons in the Stillwater Complex, share many similarities with the highly prolific Merensky and UG2 Reefs in the Bushveld Complex, while the lower part of the Stillwater Complex also shows the potential for much larger scale disseminated and high-sulphide PGE-nickel-copper type deposits, possibly similar to Platreef in the Bushveld Complex4. Group Ten’s Stillwater West property covers the lower part of the Stillwater Complex along with the Picket Pin PGE Reef-type deposit in the upper portion, and includes extensive historic data, including soil and rock geochemistry, geophysical surveys, geologic mapping, and historic drilling.

| Note 1: | Hammarstrom, J.M., Zientek, M.L., Elliott, J.E., USGS Open-File Report 93-207, 1993. |

| Note 2: | Report on Montana Platinum Group Metal Mineral Assets of Sibanye-Stillwater, November 2017, Measured and Indicated Resources of 57.2 million tonnes grading 17.0 g/t Pt+Pd containing 31.3 million ounces and 92.5 million tonnes grading 16.6 g/t containing 49.4 million ounces. Grade thickness was determined by applying the reported minimum mining width of 2.0 meters to the M&I grade of 17 g/t Pt+Pd for an average grade-thickness of approximately 34 gram-meter (g-m). |

| Note 3: | Public production records from Stillwater Mining Company from 1992 to present. |

| Note 4: | Magmatic Ore Deposits in Layered Intrusions—Descriptive Model for Reef-Type PGE and Contact-Type Cu-Ni-PGE Deposits, Michael Zientek, USGS Open-File Report 2012–1010. |

About Group Ten Metals Inc.

Group Ten Metals Inc. is a TSX-V-listed Canadian mineral exploration company focused on the development of high-quality platinum, palladium, nickel, copper, cobalt, and gold exploration assets in top North American mining jurisdictions. The Company’s core asset is the Stillwater West PGE-Ni-Cu project adjacent to Sibanye-Stillwater’s high-grade PGE mines in Montana, USA. Group Ten also holds the high-grade Black Lake-Drayton Gold project in the Rainy River District of northwest Ontario and the highly prospective Kluane PGE-Ni-Cu Project on trend with Nickel Creek Platinum’s Wellgreen deposit in Canada‘s Yukon Territory.

About the Metallic Group of Companies

The Metallic Group is a collaboration of leading precious and base metals exploration companies, with a portfolio of large, brownfields assets in established mining districts adjacent to some of the industry’s highest-grade producers of platinum and palladium, silver, and copper. Member companies include Group Ten Metals (TSX-V: PGE) in the Stillwater PGM-Ni-Cu district of Montana, Metallic Minerals (TSX-V: MMG) in the Yukon’s Keno Hill Silver District, and Granite Creek Copper (TSX-V: GCX) in the Yukon’s Carmacks Copper District. The founders and team members of the Metallic Group include highly successful explorationists formerly with some of the industry’s leading explorer/developers and major producers and are undertaking a systematic approach to exploration using new models and technologies to facilitate discoveries in these proven historic mining districts. The Metallic Group is headquartered in Vancouver, BC, Canada and its member companies are listed on the Toronto Venture, US OTC, and Frankfurt stock exchanges.

FOR FURTHER INFORMATION, PLEASE CONTACT:

| Michael Rowley, President, CEO & Director | |

| Email: info@grouptenmetals.com | Phone: (604) 357 4790 |

| Web: http://grouptenmetals.com | Toll Free: (888) 432 0075 |

Quality Control and Quality Assurance

2018 rock chip samples were analyzed by Bureau Veritas Mineral Laboratories in Vancouver, B.C. Samples were crushed and split, and a 250 g split pulverized with 85% passing 200 mesh. Gold, platinum, and palladium were analyzed by fire assay (FA350) with ICP finish. Selected major and trace elements were analyzed by peroxide fusion with ICP-EB finish to insure complete dissolution of resistate minerals. Following industry QA/QC standards, blanks, duplicate samples, and certified standards were also assayed.

2006 drilling was conducted by Group Ten’s QP while working for Beartooth Platinum. Pre-2001 drill results are considered historic and have not been independently verified by Group Ten. Mr. Mike Ostenson, P.Geo., is the qualified person for the purposes of National Instrument 43-101, and he has reviewed and approved the technical disclosure contained in this news release.

Forward-Looking Statements

Forward Looking Statements: This news release includes certain statements that may be deemed "forward-looking statements". All statements in this release, other than statements of historical facts including, without limitation, statements regarding potential mineralization, historic production, estimation of mineral resources, the realization of mineral resource estimates, interpretation of prior exploration and potential exploration results, the timing and success of exploration activities generally, the timing and results of future resource estimates, permitting time lines, metal prices and currency exchange rates, availability of capital, government regulation of exploration operations, environmental risks, reclamation, title, and future plans and objectives of the company are forward-looking statements that involve various risks and uncertainties. Although Group Ten believes the expectations expressed in such forward-looking statements are based on reasonable assumptions, such statements are not guarantees of future performance and actual results or developments may differ materially from those in the forward-looking statements. Forward-looking statements are based on a number of material factors and assumptions. Factors that could cause actual results to differ materially from those in forward-looking statements include failure to obtain necessary approvals, unsuccessful exploration results, changes in project parameters as plans continue to be refined, results of future resource estimates, future metal prices, availability of capital and financing on acceptable terms, general economic, market or business conditions, risks associated with regulatory changes, defects in title, availability of personnel, materials and equipment on a timely basis, accidents or equipment breakdowns, uninsured risks, delays in receiving government approvals, unanticipated environmental impacts on operations and costs to remedy same, and other exploration or other risks detailed herein and from time to time in the filings made by the companies with securities regulators. Readers are cautioned that mineral resources that are not mineral reserves do not have demonstrated economic viability. Mineral exploration and development of mines is an inherently risky business. Accordingly, the actual events may differ materially from those projected in the forward-looking statements. For more information on Group Ten and the risks and challenges of their businesses, investors should review their annual filings that are available at www.sedar.com.

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release