GT Gold's Expands High-Grade Saddle North Cu-Au Porphyry to Depth and Along Trend

VANCOUVER, British Columbia, Oct. 16, 2019 (GLOBE NEWSWIRE) -- GT Gold (TSX-V:GTT) (the “Company” or “GT Gold”) is pleased to announce results from five drill holes from its 15,000-metre Phase 2 exploration program at its 100% owned Saddle North Cu-Au porphyry system in northwest B.C.

The results from three of the five drill holes, TTD128, TTD129 and TTD130, have extended the known higher-grade core of mineralization previously intersected in drill holes TTD093, TTD112 and TTD109, down-dip by approximately 150 to 200 metres, to a vertical depth below surface of 1,550 metres. Drill hole TTD132 confirms continuity of the higher-grade core in the central part of the deposit, while TTD131 extends near surface mineralization to the northwest. Mineralization at Saddle North remains open in most directions, particularly at depth.

Highlights:

- Drill hole TTD128 intersected 635.00 metres @ 0.40 g/t Au, 0.31% Cu, 0.93 g/t Ag (0.61 % CuEq; 0.83 g/t AuEq) from 696 to 1,331 metres, including 225.39 metres @ 0.74 g/t Au, 0.46 % Cu, 1.57 g/t Ag (1.01% CuEq; 1.39 g/t AuEq) from 1,083.81 to 1,309.20 metres, and 137.63 metres @ 0.52 g/t Au, 0.36% Cu, 1.38 g/t Ag (0.75 % CuEq; 1.03 g/t AuEq) from 1,353 to 1,490.63 metres, including 61.00 metres @ 0.73 g/t Au, 0.43% Cu, 1.87 g/t Ag (0.99% CuEq; 1.35 g/t AuEq) from 1,358 to 1,419 metres (Table 1)

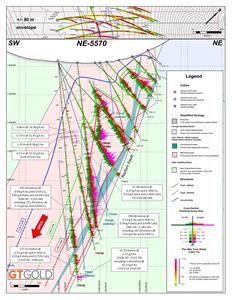

- The two broad high-grade intervals are separated by a narrow, 10-metre-wide, lower grade interval hosted by a late inter-mineral diorite porphyry intrusion. Along with drill hole TTD128, drill hole TTD129 shows that the deepest and highest-grade mineralization intersected to date remains open to depth (Figures 1 and 2).

- Drill hole TTD129 intersected 793 metres @ 0.46 g/t Au, 0.38% Cu, 1.00 g/t Ag (0.72% CuEq; 0.99 g/t AuEq) from 488 to 1,281 metres, including 355 metres @ 0.61 g/t Au, 0.45% Cu, 1.25 g/t Ag (0.91% CuEq; 1.25 g/t AuEq) from 642 to 997 metres, and 230 metres 0.42 g/t Au, 0.29% Cu, 1.25 g/t Ag (0.60 % CuEq; 0.82 g/t AuEq) from 1,291 to 1,521 metres, including 93.67 metres @ 0.55 g/t Au, 0.39% Cu, 1.42 g/t Ag (0.81% CuEq; 1.11 g/t AuEq) from 1,308.33 to 1,402 metres

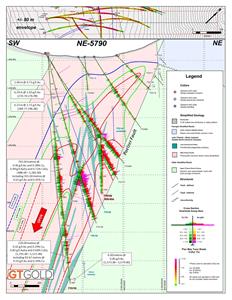

- The two broad higher-grade intervals are separated by a narrow, 10-metre-wide, lower grade interval hosted by a late inter-mineral diorite porphyry intrusion. Along with drill hole TTD128, this drill hole shows that the deep higher-grade mineralization remains open at depth (Figure 3).

- Drill hole TTD130 intersected 599 metres @ 0.52 g/t Au, 0.30% Cu, 0.90 g/t Ag (0.69% CuEq; 0.94g/t AuEq) from 682 metres to 1,281 metres, including 343 metres @ 0.63 g/t Au, 0.34 % Cu, 1.02 g/t Ag (0.81% CuEq; 1.11 g/t AuEq) from 890 to 1,233 metres

- This interval extends the higher-grade core zone to depth by linking deeper mineralized intercepts in drill holes TTD128 and TTD129 with that of the higher-grade mineralization encountered previously in drill holes TTD109 and TTD093 (Figure 2).

- Drill hole TTD131 intersected 250 metres @ 0.35 g/t Au, 0.20% Cu, 0.71 g/t Ag (0.46% CuEq; 0.63 g/t AuEq) from 70 to 320 metres

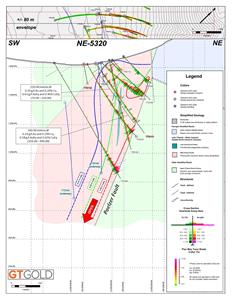

- Extends broad, near-surface zone of Cu-Au mineralization at Saddle North to the northwest and confirms presence and continuity of higher-grade mineralization in the immediate hangingwall of the Poelzer fault on this section between previous drill holes TTD102, TTD122 and TTD120 (Figure. 4).

- Drill hole TTD132 intersected 137.78 metres @ 1.71 g/t Au, 0.77% Cu, 2.36 g/t Ag (2.04% CuEq; 2.79 g/t AuEq) from 476.00 metres to 613.78 metres within 378.71 metres @ 1.00 g/t Au, 0.52% Cu, 1.42 g/t Ag (1.26% CuEq; 1.72 g/t AuEq) from 270.00 to 648.71 metres

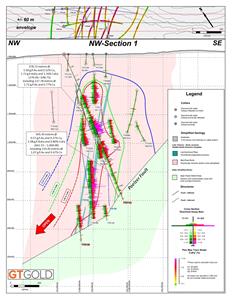

- This southeasterly inclined “cross-hole” successfully links the higher-grade mineralization of previously released drill holes TTD112, TTD121, TTD126, TTD093 and TTD109 (Figure 5).

The results from the recent drilling have outlined a well-mineralized, northerly-trending and west-southwesterly dipping envelope of mineralization that has down-plunge, strike and width dimensions of 1,400 - 1,600 metres, 700 metres and 200 - 560 metres respectively. Within this broader zone of mineralization is a south-southwesterly-plunging, northerly-elongate core of higher-grade mineralization with a down-plunge, strike and width dimensions of 1,200 - 1,600 metres, 200 - 400 metres and 40 - 450 metres, respectively. Drilling has confirmed excellent continuity of mineralization with Cu-Au grades generally increasing with depth.

The system remains open at depth, and highly prospective targets remain untested along strike to the west and south east.

High-grade Gold Intercepts

In addition to the porphyry style of mineralization, high-grade precious metal veins have been intersected peripheral to the main body of porphyry mineralization, both in the hangingwall and footwall, and they offer further exploration upside in the large Saddle North mineralizing system (Table 1; Figures 2 to 4). Drill hole TTD128 returned a number of significant gold intersections, including 4.11 metres @ 25.42 g/t Au from 529.20 metres and 15.70 metres @ 6.21 g/t Au from 1,506.00 metres and 5.00 metres @ 16.13 g/t Au from 1,515.61 metres (Figure 2). The footwall intersections are a largely new and exciting development, showing that the variable and commonly intense quartz-sericite-pyrite alteration of footwall volcanic (and local intrusive) rocks also have realizable exploration potential. Like the footwall intersections, the significant hangingwall gold values (Figure 3) are associated with pyrite-rich cm- to dm-scale veins that bear similarities to the high-grade gold (silver) veins at Saddle South. While the full nature, geometry, and relationships to the porphyry system of the high-grade gold veins at Saddle North remain to be established, similar hangingwall veins appear to be widespread, as they were also intersected previously in drill holes TTD126 (see news release dated Sept 4, 2019), TTD121 (2 metres @ 6.43 g/t Au from 389 to 391 metres), and in drill hole TTD130 in the present release, where a pair of 2 metre samples at 574 metres and 578 metres yielded 2.56 and 1.53 g/t Au, respectively.

CEO Paul Harbidge commented, “It is great to see a set of strong drill results which is providing further delineation to this large-scale gold rich porphyry Cu system. It is very encouraging to see the continuity of the high-grade core drill hole to drill hole and section to section, especially with the results of TTD132 and the fact that the system remains open to depth and targets remain untested along trend.”

Harbidge went on to say, “The grade, size, and geometry of the Saddle North porphyry system makes this amenable to a bulk mining operation, both open pit as well as underground. With its proximity to infrastructure and location within the Tier 1 mining jurisdiction of British Columbia, Canada, this makes for a very compelling project.”

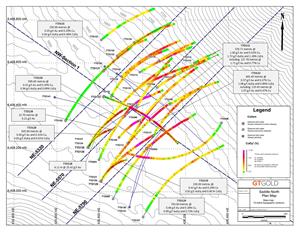

Figure 1 – Saddle North Drill Plan View

Figure 1 is available at https://www.globenewswire.com/NewsRoom/AttachmentNg/235ccf2e-3471-4ef1-93e6-92597a01af49

Figure 2 – Saddle North Drilling Cross-Section NE-5570

Figure 2 is available at https://www.globenewswire.com/NewsRoom/AttachmentNg/b12cfbe8-54d7-4e5b-af85-21b79532f178

Figure 3 – Saddle North Drilling Cross-Section NE-5790

Figure 3 is available at https://www.globenewswire.com/NewsRoom/AttachmentNg/0fa423b8-2b0d-4f54-8bfc-bb83584c8351

Figure 4 – Saddle North Drilling Cross-Section NE-5320

Figure 4 is available at https://www.globenewswire.com/NewsRoom/AttachmentNg/d5984a00-740c-40cd-81b8-8e6bcce450ee

Figure 5 – Saddle North Drilling Cross-Section NW-Section 1

Figure 5 is available at https://www.globenewswire.com/NewsRoom/AttachmentNg/4e2f2e31-c335-4ea1-9b09-58ee33fd1451

2019 Exploration Summary

Phase 2 of the planned 25,000 metre drill program (combined phase 1 and 2) is nearing completion, with 23,837 metres now drilled, and 14,847 metres reported. Assays are pending for nearly 9,000 metres in 11 drill holes beyond what has been reported, and drilling will be completed prior to the end of October. Final assays will likely be received before year-end, with further results to be reported following receipt, compilation and interpretation of the assays.

GT Gold has initiated consultation with engineering firms and others to develop a scope, schedule and budget for study work that will progress Saddle North through resource estimation and economic evaluation, with an initial goal of completion of a robust geologic model by the end of the first quarter of 2020.

Table 1 – Saddle North Assay Results for Drill Holes TTD128 to TTD132

| TTD128 | From (m) | To (m) | Interval* (m) | Au (g/t) | Ag (g/t) | Cu (%) | CuEq**(%) | AuEq** (g/t) | Mineralization Style |

| Interval | 483.66 | 484.46 | 0.80 | 76.90 | 38.60 | 0.74 | 57.16 | 78.39 | Precious Metal Veins |

| Interval | 495.00 | 495.75 | 0.75 | 11.95 | 4.12 | 0.36 | 9.12 | 12.50 | Precious Metal Veins |

| Interval | 503.67 | 505.00 | 1.33 | 8.38 | 9.98 | 0.84 | 7.04 | 9.66 | Precious Metal Veins |

| Interval | 525.00 | 526.19 | 1.19 | 5.87 | 1.93 | 0.18 | 4.48 | 6.15 | Precious Metal Veins |

| Interval | 529.20 | 533.31 | 4.11 | 25.42 | 17.65 | 0.56 | 19.25 | 26.40 | Precious Metal Veins |

| Interval | 696.00 | 1,331.00 | 635.00 | 0.40 | 0.93 | 0.31 | 0.61 | 0.83 | Porphyry |

| Including | 1,083.81 | 1,309.20 | 225.39 | 0.74 | 1.57 | 0.46 | 1.01 | 1.39 | Porphyry |

| Interval | 1,353.00 | 1,490.63 | 137.63 | 0.52 | 1.38 | 0.36 | 0.75 | 1.03 | Porphyry |

| Including | 1,358.00 | 1,419.00 | 61.00 | 0.73 | 1.87 | 0.43 | 0.99 | 1.35 | Porphyry |

| Interval | 1,496.33 | 1,497.49 | 1.16 | 9.51 | 11.00 | 0.02 | 7.05 | 9.67 | Precious Metal Veins |

| Interval | 1,506.00 | 1,521.70 | 15.70 | 6.21 | 6.37 | 0.10 | 4.68 | 6.42 | Precious Metal Veins |

| Including | 1,515.61 | 1,520.61 | 5.00 | 16.13 | 11.94 | 0.17 | 12.05 | 16.52 | Precious Metal Veins |

| Including | 1,515.61 | 1,516.75 | 1.14 | 48.30 | 14.40 | 0.04 | 35.39 | 48.54 | Precious Metal Veins |

| TTD129 | From (m) | To (m) | Interval* (m) | Au (g/t) | Ag (g/t) | Cu (%) | CuEq** (%) | AuEq** (g/t) | Mineralization Style |

| Interval | 265.00 | 266.00 | 1.00 | 4.71 | 2.70 | 0.33 | 3.79 | 5.20 | Precious Metal Veins |

| Interval | 270.70 | 276.99 | 6.29 | 2.65 | 1.37 | 0.21 | 2.15 | 2.95 | Precious Metal Veins |

| Including | 275.5 | 276.99 | 1.49 | 9.23 | 3.97 | 0.28 | 7.05 | 9.67 | Precious Metal Veins |

| Interval | 289.77 | 296.00 | 6.23 | 2.21 | 3.26 | 0.12 | 1.76 | 2.42 | Precious Metal Veins |

| Including | 294.50 | 296.00 | 1.50 | 6.33 | 10.35 | 0.19 | 4.90 | 6.72 | Precious Metal Veins |

| Interval | 488.00 | 1,281.00 | 793.00 | 0.46 | 1.00 | 0.38 | 0.72 | 0.99 | Porphyry |

| Including | 582.00 | 1,154.15 | 572.15 | 0.49 | 1.10 | 0.41 | 0.77 | 1.06 | Porphyry |

| Including | 642.00 | 997.00 | 355.00 | 0.61 | 1.25 | 0.45 | 0.91 | 1.25 | Porphyry |

| Interval | 1,291.00 | 1,521.00 | 230.00 | 0.42 | 1.25 | 0.29 | 0.60 | 0.82 | Porphyry |

| Including | 1,308.33 | 1,402.00 | 93.67 | 0.55 | 1.42 | 0.39 | 0.81 | 1.11 | Porphyry |

| Interval | 1,573.00 | 1,579.00 | 6.00 | 0.85 | 0.44 | 0.03 | 0.66 | 0.90 | Precious Metal Veins |

| TTD130 | From (m) | To (m) | Interval* (m) | Au (g/t) | Ag (g/t) | Cu (%) | CuEq** (%) | AuEq** (g/t) | Mineralization Style |

| Interval | 325.00 | 408.00 | 83.00 | 0.25 | 0.55 | 0.16 | 0.35 | 0.48 | Porphyry |

| Interval | 531.00 | 582.00 | 51.00 | 0.37 | 0.78 | 0.18 | 0.46 | 0.63 | Porphyry |

| Interval | 610.00 | 670.00 | 60.00 | 0.17 | 0.40 | 0.17 | 0.30 | 0.42 | Porphyry |

| Interval | 682.00 | 1,281.00 | 599.00 | 0.52 | 0.90 | 0.30 | 0.69 | 0.94 | Porphyry |

| Including | 732.00 | 1,250.07 | 518.07 | 0.57 | 0.96 | 0.32 | 0.74 | 1.02 | Porphyry |

| Including | 890.00 | 1,233.00 | 343.00 | 0.63 | 1.02 | 0.34 | 0.81 | 1.11 | Porphyry |

| Including | 981.00 | 1,218.00 | 237.00 | 0.62 | 1.04 | 0.35 | 0.82 | 1.13 | Porphyry |

| TTD131 | From (m) | To (m) | Interval* (m) | Au (g/t) | Ag (g/t) | Cu (%) | CuEq** (%) | AuEq** (g/t) | Mineralization Style |

| Interval | 70.00 | 320.00 | 250.00 | 0.35 | 0.71 | 0.20 | 0.46 | 0.63 | Porphyry |

| Including | 102.00 | 163.00 | 61.00 | 0.43 | 0.60 | 0.22 | 0.54 | 0.74 | Porphyry |

| Interval | 334.00 | 494.00 | 160.00 | 0.24 | 0.52 | 0.24 | 0.42 | 0.58 | Porphyry |

| Including | 454.00 | 494.00 | 40.00 | 0.37 | 0.64 | 0.31 | 0.58 | 0.80 | Porphyry |

| TTD132 | From (m) | To (m) | Interval* (m) | Au (g/t) | Ag (g/t) | Cu (%) | CuEq** (%) | AuEq** (g/t) | Mineralization Style |

| Interval | 270.00 | 648.71 | 378.71 | 1.00 | 1.42 | 0.52 | 1.26 | 1.72 | Porphyry |

| Including | 311.00 | 613.78 | 302.78 | 1.18 | 1.63 | 0.61 | 1.49 | 2.04 | Porphyry |

| Including | 476.00 | 613.78 | 137.78 | 1.71 | 2.36 | 0.77 | 2.04 | 2.79 | Porphyry |

| Interval | 662.55 | 1,068.00 | 405.45 | 0.57 | 0.94 | 0.37 | 0.80 | 1.08 | Porphyry |

| Including | 662.55 | 915.00 | 252.45 | 0.74 | 1.00 | 0.41 | 0.95 | 1.31 | Porphyry |

| Including | 662.55 | 782.00 | 119.45 | 1.07 | 1.26 | 0.47 | 1.26 | 1.73 | Porphyry |

*Intervals are calculated using a 0.4 g/t AuEq, a maximum of ten metres of internal dilution for porphyry-style mineralization and no top cut is applied. All intervals are reported as drill widths and are expected between 50% and 85% of true width,

**Prices used to calculate CuEq and AuEq are, Au: $1,300.00/oz, Ag: $16.00/oz, Cu: $2.60/lb. All values are reported in USD and do not consider metal recoveries.

Table 2 – Saddle North Drill Hole Collar Information:

| Drill Hole (#) | Azimuth* (0) | Inclination* (0) | Length (m) | Elevation (masl) | UTM E (m) | UTM N (m) |

| TTD128 | 037 | -85 | 1,550.50 | 1,633 | 435746 | 6408207 |

| TTD129 | 030 | -85 | 1,605.00 | 1,637 | 435806 | 6408049 |

| TTD130 | 031 | -79 | 1,345.60 | 1,633 | 435746 | 6408207 |

| TTD131 | 048 | -55 | 594.18 | 1,629 | 435823 | 6408567 |

| TTD132 | 111 | -65 | 1,098.00 | 1,622 | 435819 | 6408444 |

Tatogga Property

GT Gold’s Tatogga Project lies in the northern part of northwest B.C.’s prolific Golden Triangle. The property features district scale exploration potential, with two recent discoveries, Saddle North and Saddle South, along with a third target, Quash-Pass. which is close to being drill-ready. All are proximal to Highway 37 and to grid power that leads to the nearby Red Chris copper-gold mine, approximately 20 km to the southeast. GT Gold is well funded, with a cash position of approximately C$17.8 million at June 30, 2019.

Saddle North

Initial drilling at Saddle North followed indications from early rock and soil geochemical sampling, geology, and geophysical work which outlined a kilometre-scale geochemical, magnetic and Induced Polarization chargeability anomaly coincident with local exposure of quartz-sericite-pyrite altered rocks. Reconnaissance holes TTD062 and 064, completed late in the 2017 drilling season, indicated the presence of a copper-gold porphyry system that bore some similarities to the nearby Red Chris copper-gold mine. The results from the 2018 program demonstrated the potential for a significant copper-gold porphyry system at Saddle North, with grades exceeding 1.0% CuEq1 and 1.5 g/t AuEq1 in a higher-grade core zone (see news January 9, 2019). It also showed that this core zone reached from near surface (hole TTD108) to greater than 1,300 metres down-dip, where it remains open. True thickness of the core zone is approximately 100 metres in hole TTD108, at a depth of 200m. Copper equivalent grade increase with depth, and mineralized intervals increase to greater than 300 metres in drill holes TTD093 and TTD109. The 2018 results also demonstrated that the high-grade core zone extends along strike at least 500 metres (to hole TTD102) and that it lies within a much broader, strongly mineralized envelope with a drilled strike length in excess of 650 metres, a true thickness of approximately 700 metres, and a down-dip extent of more than 1,300 metres. The 2019 drilling suggests that the high-grade core zone also extends to surface to the northwest along trend of TTD108. This large, high-grade copper-gold mineralized zone appears to trend northwest to north-northwest and to dip steeply to the west-southwest to southwest, while the central higher-grade core zone has a plunge of similar orientation to the dip.

QA/QC Procedures

GT Gold has implemented a rigorous quality assurance / quality control (QA/QC) program to ensure best practices in sampling and analysis of diamond drill core, the details of which can be viewed on the Company's website at http://www.gtgoldcorp.ca/projects/tatogga/. All assays are performed by ALS Canada Ltd., with sample preparation carried out at the ALS facility in Terrace, BC, and assays at the North Vancouver laboratory. Assay values are uncut. For gold, fire assays are performed as per ALS method Au-AA26 (0.01- 100.00 g/t Au) using 50 grams of sample measured by atomic absorption (AA). Assays equal to or greater than 100 g/t Au are reanalyzed gravimetrically by method Au-GRA22. Silver and copper are analyzed by ALS method ME-MS61 with a 4-acid digestion followed by ICP-MS analysis. Assays greater than 100ppm silver or 1% copper are reanalyzed by ICP-AES by method OG-62.

Qualified Person

Charles J. Greig, M.Sc., P.Geo., Vice President, Exploration for GT Gold Corp. and a Qualified Person as defined by NI 43-101, has reviewed and approved the technical information in this press release.

About GT Gold

GT Gold Corp. is focused on exploring for base and precious metals in the geologically fertile terrain of British Columbia’s renowned Golden Triangle. The Company’s flagship asset is the wholly-owned, 46,827 hectare Tatogga property, located near Iskut, BC, upon which it achieved two significant discoveries in 2017 and 2018 at its Saddle prospect: a near surface bulk-tonnage and potential deep high-grade underground-style epithermal gold-silver vein system at Saddle South and, close by at Saddle North, a large-scale, richly mineralized porphyry gold-copper-silver intrusion.

For further information, please contact:

| GT Gold Corp. | GT Gold Corp. |

| Paul Harbidge | Charles J. Greig, P.Geo |

| President and Chief Executive Officer | Vice President, Exploration |

| Tel: (647) 256-6754 | Tel: (250) 492-2331 |

| Website: www.gtgoldcorp.ca |

Cautionary Statement Regarding Forward Looking Statements

This news release contains forward-looking statements and forward-looking information (together, "forward-looking statements") within the meaning of applicable securities laws. All statements, other than statements of historical facts, are forward-looking statements. Generally, forward-looking statements can be identified by the use of terminology such as "plans", "expects", "estimates", "intends", "anticipates", "believes" or variations of such words, or statements that certain actions, events or results "may", "could", "would", "might", "will be taken", "occur" or "be achieved". Forward looking statements involve risks, uncertainties and other factors disclosed under the heading “Risk Factors” and elsewhere in the Company’s filings with Canadian securities regulators, that could cause actual results, performance, prospects and opportunities to differ materially from those expressed or implied by such forward-looking statements. Although the Company believes that the assumptions and factors used in preparing these forward-looking statements are reasonable based upon the information currently available to management as of the date hereof, actual results and developments may differ materially from those contemplated by these statements. Readers are therefore cautioned not to place undue reliance on these statements, which only apply as of the date of this news release, and no assurance can be given that such events will occur in the disclosed times frames or at all. Except where required by applicable law, the Company disclaims any intention or obligation to update or revise any forward-looking statement, whether as a result of new information, future events or otherwise. Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.