Harte Gold Announces Positive Feasibility Study For The Sugar Zone Mine

TORONTO, April 08, 2019 (GLOBE NEWSWIRE) -- HARTE GOLD CORP. (“Harte Gold” or the “Company”) (TSX: HRT / OTC: HRTFF / Frankfurt: H4O) is pleased to announce the results of a Feasibility Study (“FS”) for the Company’s 100% owned Sugar Zone Mine (“Sugar Zone”), located in White River Ontario, Canada.

Feasibility Study Highlights

- Declaration of Probable Mineral Reserves: 3.9 million tonnes at 7.1 g/t Au, net of mining dilution of 38%, containing 890,000 ounces of gold

- “Base Case” scenario: 800 tpd operation producing 61,000 gold ounces annually over a 14 year mine life

o Generates approximately $30 million annually in net free cash flow at US$1,300/oz gold

o The mine and process plant are operational with no additional construction capital expenditures required

o Costs well defined based on contracted rates and operating experience: cash operating cost US$643/oz and all in sustaining cost (“AISC”) of US$845/oz - Expansion opportunity: Feasibility Study confirms the mine is capable of 1,200 tpd based on current Mineral Reserves

o Could increase production to 95,000 gold ounces annually and potentially reduce cash costs through benefits of scale - Other significant value opportunities identified:

o Conversion of near mine exploration targets could extend mine life and reduce mining development cost per tonne of ore processed

o Installation of a leach circuit to process flotation concentrate on-site could reduce costs and increase payable gold ounces

Stephen G. Roman, President and CEO of Harte Gold, commented “The Feasibility Study announced today validates the Company’s “Base Case” operating scenario and supports the Company’s longer-term strategy to generate cash flow for continued exploration and Mineral Resource growth on the Sugar Zone property.”

Mr. Roman added “The opportunities to expand production and cash flow identified in the Feasibility Study are solid. Since taking over the project in 2009, management has increased the property wide mineralization tenfold. The “Base Case” scenario is an interim step to stabilize production, develop and train the workforce and generate positive returns for shareholders. As the Mineral Resource grows, we contemplate the continuation of our expansion plans as we envisioned in our PEA”.

Feasibility Study Details

The Feasibility Study defines an 800 tpd underground mining operation. The Operation benefits from having all capital expenditures completed, including the process plant, related surface infrastructure and initial mine development. No further development capital is required to operate at 800 tpd.

The Feasibility Study was prepared by P&E Mining Consultants Inc. and is summarized as follows:

Feasibility Study Base Case Parameters

| Unit | Value | |||

| Commodity Price and FX | ||||

| Gold Price | US$/oz | 1,300 | ||

| CAD:USD | CDN:US | 0.77 | ||

| Mine Plan Summary | ||||

| Mine Life | Years | 14 | ||

| Resource Mined | kt | 3,879 | ||

| Diluted Grade | g/t Au | 7.1 | ||

| Processing Rate | tpd | 800 | ||

| Recovery | ||||

| Gravity Recovery (Doré) | % | 61.0% | ||

| Flotation Recovery (Concentrate) | % | 34.5% | ||

| Overall Recovery | % | 95.5% | ||

| Gold Recovered (Life of Mine) | koz | 849 | ||

| Annual Production | koz/yr | 61 | ||

| LOM Operating Cost | ||||

| Mining (Including Sustaining Development) | C$/tonne | 153 | ||

| Processing | C$/tonne | 34 | ||

| G&A | C$/tonne | 33 | ||

| Cash Operating Cost | US$/oz | 643 | ||

| AISC Cost | US$/oz | 845 | ||

| Taxes / Royalties | ||||

| Property NSR | 2% | |||

| Corporate / Ontario Mining Tax | 25% / 10% | |||

| First Nations NPI | 4% | |||

| Net Free Cash Flow | ||||

| Annual | C$ million | $30.9 | ||

| LOM Cumulative | C$ million | $374.8 | ||

| NPV Results | ||||

| Pre-Tax NPV5% | C$ million | $313.9 | ||

| Post-Tax NPV5% | C$ million | $266.9 | ||

The Feasibility Study Incorporates the Following Improvements Over Previous Studies

1. Increased Mineral Resources, Improved Head Grade

Mineralization at the Sugar Zone Mine has expanded significantly over the past eight years. Drilling completed in 2018 increased overall Indicated Mineral Resource and now incorporates the Sugar, Middle and Wolf Zones.

The Mineral Reserve Estimate defined for the Feasibility Study represents an improvement to the overall tonnage and gold ounces, compared to the Indicated Mineral Resources prepared for the Preliminary Economic Assessment (“PEA”) completed in 2018.

Indicated Mineral Resource Comparison – Feasibility Study vs. 2018 PEA

| Sugar Zone | Middle – Wolf Zones | ||||||||

| 2018 PEA | 2019 FS | Improvement | 2018 PEA | 2019 FS | Improvement | ||||

| Tonnage | 2,148,000 | 2,545,000 | 18 | % | 460,000 | 1,698,000 | 269 | % | |

| Au (g/t) | 8.6 | 8.6 | 0 | % | 8.1 | 7.3 | -10 | % | |

| Au (oz) | 595,000 | 707,000 | 19 | % | 120,000 | 401,000 | 234 | % | |

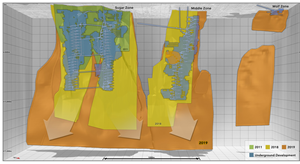

The figure below illustrates the Mineral Resource growth over the past eight years. The current mine plan represents a small portion of overall Mineral Resource potential.

Mineral Resource Potential and Feasibility Study Mine Plan is available at http://www.globenewswire.com/NewsRoom/AttachmentNg/695edd93-3546-411c-8a65-400a9a8d8d51

2. Greater Cost Certainty and Mining Dilution Control

Of total operating costs, 70% is attributable to mining activities. The Feasibility Study uses contracted rates for mining and real operating data for the process plant. Management is confident in the basis of these estimates and its ability to effectively manage operating costs going forward.

Underground development costs have been further minimized by generating a mine plan that takes a “top-down” development approach, particularly in the early years, that re-invests cash flow into mine development.

To minimize mining dilution, sublevel spacing in the mine plan has been designed in a conservative manner. The mine plan will continue to be optimized based on real time operating results.

Opportunities Identified To Further Enhance Value

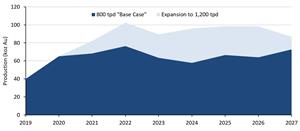

i. Expansion to 1,200 tonnes per day

The mine plan can support a higher throughput mining scenario of 1,200 tonnes per day in 2022 after sufficient development to mine the Sugar Zone North, Sugar Zone South and the Middle Zone concurrently.

- At 1,200 tpd throughput, annual production would average 95,000 gold ounces from 2022 onwards

- An economic assessment of this expansion is outside the scope of the Feasibility Study; however, 40% of current mining costs are fixed, which presents the opportunity to reduce cash costs per ounce

Production Comparison – Base Case vs. 1,200 tpd is available at http://www.globenewswire.com/NewsRoom/AttachmentNg/612f692c-302d-4e57-8dc8-7842a78168b5

ii. Increase process plant recovery and lower cash costs by implementing leach circuit

The process plant was initially designed to produce a rougher flotation concentrate that is transported to the Horne Smelter in Rouyn, QC for further processing. A trade-off study on the addition of a cyanide circuit to leach flotation concentrate concluded the concentrate leaches well, which could increase production and negate the requirement to process the concentrate off site.

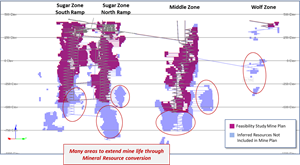

iii. Mine life extension through Mineral Resource conversion and expansion

Through additional infill drilling and sill development, there is potential to convert a portion of the Inferred Mineral Resources to the Indicated Mineral Resources category. Mineral Resource conversion will have a significant impact on areas near the current mine plan, by extending zones at depth, on strike and parallel to existing mineralization.

While there is no certainty that Inferred Mineral Resources will be converted to Mineral Reserves, the Sugar Zone Mine has many such areas to be explored. Historically, infill drilling has successfully converted lower grade Inferred Mineral Resources to higher grade Indicated Mineral Resources.

Potential Mine Life Extension Through Mineral Resource Conversion is available at http://www.globenewswire.com/NewsRoom/AttachmentNg/190d6620-d3ce-4a01-b269-3a85e273cd1f

Mineral Resource Estimate

The Mineral Resource Estimate completed February 20, 2019 forms the basis of the Feasibility Study. A database of 683 drill holes totaling 258,605 metres forms the basis of the Mineral Resource Estimate. The Mineral Resource Estimate incorporates mineralization from the Sugar, Middle and Wolf Zones.

Mineral Resource Estimate at 3 g/t Au cut-off

| Classification | Zone | Tonnes | Au (g/t) | Au (oz) |

| Indicated | Sugar, Middle, Wolf | 4,243,000 | 8.1 | 1,108,000 |

| Inferred | Sugar, Middle, Wolf | 2,954,000 | 5.9 | 558,000 |

(1) Mineral Resources which are not Mineral Reserves do not have demonstrated economic viability.

(2) The estimate of Mineral Resources may be materially affected by environmental, permitting, legal, title, taxation, socio-political, marketing, or other relevant issues.

(3) The Inferred Mineral Resource in this estimate has a lower level of confidence than that applied to an Indicated Mineral Resource and must not be converted to a Mineral Reserve. It is reasonably expected that the majority of the Inferred Mineral Resource could be upgraded to an Indicated Mineral Resource with continued exploration.

(4) The Mineral Resources in this report were estimated using the Canadian Institute of Mining, Metallurgy and Petroleum (CIM), CIM Standards on Mineral Resources and Reserves, Definitions and Guidelines prepared by the CIM Standing Committee on Reserve Definitions and adopted by the CIM Council.

(5) Advanced exploration bulk sample and commercial production mined-out areas were depleted from the Mineral Resource model.

Mining and Mineral Reserves

The mine plan is based on a Probable Mineral Reserve of 890,000 ounces grading 7.1 g/t Au. The cut-off grade of 4.4 g/t Au was determined for a mining rate of 800 tpd at estimated costs of $98/t mining, $40/t processed, $34.5/t G&A and $2/t sustaining services, plus $46/t capital development costs, and a foreign exchange rate of US$0.77 = CAD$1.00.

Mineral Reserve Estimate at 4.4 g/t Au cut-off

| Classification | Zone | Tonnes | Au (g/t) | Au (oz) |

| Probable | Sugar | 2,437,000 | 7.4 | 583,000 |

| Probable | Middle and Wolf | 1,442,000 | 6.6 | 307,000 |

| Total | 3,879,000 | 7.1 | 890,000 |

1) The Mineral Reserve Estimate is based on a gold price of US$1,300/oz, with 94.4% processing recovery, and a cut-off grade of 4.4 g/t Au.

2) The Mineral Reserves in this Technical Report were estimated using the Canadian Institute of Mining, Metallurgy and Petroleum (CIM), CIM Standards on Mineral Resources and Reserves, Definitions and Guidelines prepared by the CIM Standing Committee on Reserve Definitions and adopted by the CIM Council.

3) Bulk sample and commercial production mined-out areas were depleted from the Mineral Reserve.

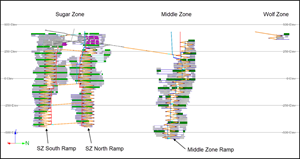

The Sugar Zone North and South ramp area stopes are targeted first, to maximize near-term production and minimize pre-production development costs. A level-by-level, bottom up stope sequencing was applied to the stopes within each mining block. Sugar Zone stope designs are based on 15 m levels, 40 m lengths and assume 45% mining dilution. Middle Zone stope design is based on 20 m levels, 25 m lengths and factoring in 28% dilution. The average mining dilution for all mining areas combined is estimated at 38%.

Longitudinal longhole retreat stoping was selected as an appropriate mining method based on the favourable geometry, current geotechnical knowledge and the success of the 70,000 tonne Bulk Sample and 30,000 tonne Phase I production mining. Both the mineralized material and the host rock are sufficiently competent to facilitate the void sizes required for effective longitudinal longhole retreat stoping. Paste backfill will be the primary stope fill type.

Typically, four to five levels will be combined to form a mining block. Subdivision of the mine into mining blocks increases the number of mining faces available, thereby increasing reliability and flexibility of production. Within each mining block a bottom-up stoping sequence will be used with mining commencing on the lowest level and progressing upwards.

Mine Design (Longitudinal Projection North-South) is available at http://www.globenewswire.com/NewsRoom/AttachmentNg/5ee6af4b-58c8-4cba-b26d-411e4ecd6a21

The mine design is based on ramp development from surface to access the mine workings and production levels. Ramp development will extend down from both the existing Sugar Zone North Ramp and the Sugar Zone South Ramp. The Sugar Zone requires two ramps for access due to the large strike extent (up to 650 m), while single ramp access is sufficient for mining the Middle Zone.

Ore Tonnes and Development Metres

| Ore Tonnes (kt) | # Mining Levels | Tonnes/vertical metre | |

| Sugar Zone | 2,437 | 58 | 1,418 |

| Middle and Wolf Zones | 1,442 | 49 | 1,511 |

Mining equipment consists of one-boom and two-boom drill jumbos, longhole drills, 40 t diesel trucks, 1.8, 2.5 and 4.5 m3 LHDs, rockbolter, scissorlifts, grader and ancillary equipment.

Process Plant

Construction of the process plant was completed in 2018. The plant produces both a gold doré bar and a gold concentrate through gravity concentration and flotation circuits respectively. The process plant was commissioned at 575 tpd and has a nameplate capacity of 800 tpd.

The major process steps in the existing process plant are as follows:

- Primary jaw crusher and secondary cone crusher

- Fine feed storage (12 hour live covered stockpile)

- Grinding (800 kW ball mill)

- Gravity concentration (Falcon SB1350 gravity concentrators)

- Flotation (TC10 Outotec flotation cells)

- Concentrate thickening and filtration

- Tailings thickening

- Reagent mixing

- Process water, clean water, and fire water

- Paste Backfill

The paste backfill plant has been constructed to meet underground mining backfill requirements and to provide tailings dewatering and distribution for the tailings management facility. Each paste backfill batch is loaded into a ready-mix truck and delivered to the paste portal. The paste backfill is subsequently fed to the underground mine via a gravity pipeline.

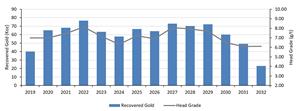

Forecast Mine Production and Au Grade

Over the life of mine, a total of 849,000 ounces will be recovered at an average head grade of 7.1 g/t Au.

LOM Production And Grade is available at http://www.globenewswire.com/NewsRoom/AttachmentNg/c648886e-02a8-40d3-83d0-df1bb937285f

Operating Cost and Capital Cost Summary

Operating Costs

Operating costs for the Feasibility Study are based on the following methodologies and assumptions:

- Recent contract mining rates for ore production and waste development over LOM

- Transport and treatment costs to custom process concentrate based on contracted terms

- Harte Gold employed work force for operation of the process plant and for site G&A

- Contract rates for bunkhouse and camp services located in White River

- Hydro, diesel and other consumables based on current market rates

- 2% net smelter royalty payable to royalty holders on the Property

- 4% First Nations net profits interest (“NPI”), calculated based on the World Gold Council definition of AISC

Capital Costs

Effective March 31, 2019, all capital expenditures for process plant construction and related site infrastructure have been spent. The largest sustaining capital item is future underground development costs. Other sustaining capital items include mine ventilation infrastructure, tailings expansion (years 2021 and 2029) and other sustaining costs for process plant infrastructure and maintenance.

LOM Operating and Capital Cost Summary

The following table summarizes operating capital costs over LOM:

LOM Cost Summary

| C$/t processed | US$/oz1 | LOM C$ M | ||||

| Operating Costs | ||||||

| Mining - Stope Production | $100 | $350 | $386.6 | |||

| Royalties/Transport/Treatment | $17 | $60 | $65.9 | |||

| Processing | $34 | $118 | $130.3 | |||

| G&A | $33 | $115 | $127.1 | |||

| Operating Cash Cost | $183 | $643 | $709.8 | |||

| Sustaining Capital Costs | ||||||

| Mining - Development | $53 | $186 | $204.8 | |||

| Other Sustaining Cost | $5 | $16 | $17.9 | |||

| AISC | $240 | $845 | $1,255.6 | |||

1) Based on CAD$:US$ exchange rate 0.77

LOM Financial Model Economic Analysis

An economic model based on mine plan and operation assumptions was developed to estimate future cash flows. Other economic factors include the following:

- Gold price: US$1,300/oz

- CAD$:US$ exchange rate: 0.77

- Discount rate: 5%

- Nominal 2019 dollars

- Cash flows discounted to January 1, 2019

Cash Flow – First 5 Years and LOM

| 2019 | 2020 | 2021 | 2022 | 2023 | LOM Total | ||||||||

| Production | |||||||||||||

| Average Daily Throughput | tpd | 574 | 800 | 800 | 800 | 800 | 783 | ||||||

| Ore Tonnage | Tonnes | 206,547 | 303,614 | 298,201 | 306,068 | 288,254 | 3,879,083 | ||||||

| Diluted Head Grad | Au (g/t) | 6.37 | 6.98 | 7.45 | 8.14 | 7.17 | 7.14 | ||||||

| Mill Recovery | % | 94.6% | 95.5% | 95.5% | 95.5% | 95.5% | 95.4% | ||||||

| Ounces Recovered | Au (oz) | 40,031 | 65,078 | 68,205 | 76,541 | 63,426 | 849,432 | ||||||

| Cash Flow | |||||||||||||

| Net Revenue | C$ M | 62.8 | 102.5 | 107.4 | 120.6 | 99.9 | 1,337.9 | ||||||

| Operating Income | C$ M | 22.1 | 54.2 | 57.7 | 70.0 | 52.3 | 655.7 | ||||||

| Net Free Cash Flow After Tax | C$ M | -4.0 | 29.0 | 35.3 | 53.7 | 34.1 | 374.8 | ||||||

| Costs | |||||||||||||

| Operating Cash Cost1 | US$/oz | 833 | 615 | 604 | 545 | 619 | 643 | ||||||

| AISC1 | US$/oz | 1,335 | 913 | 856 | 709 | 840 | 845 | ||||||

1) Based on CAD$:US$ exchange rate 0.77

The cash flows and net present value at various gold prices are summarized in the following table:

Financial Valuation At Various Gold Prices

| Gold Price (US$/oz) | $1,200 | $1,300 | $1,400 | |||

| Operating Income (C$ M) | ||||||

| Annual (LOM) | $40.3 | $46.8 | $53.4 | |||

| Annual (2020+) | $42.1 | $48.7 | $55.4 | |||

| LOM Cumulative | $564.0 | $655.7 | $747.3 | |||

| Net Free Cash Flow After Tax (C$ M) | ||||||

| Annual (LOM) | $23.2 | $28.2 | $33.3 | |||

| Annual (2020+) | $25.9 | $30.9 | $35.9 | |||

| LOM Cumulative | $306.6 | $374.8 | $442.2 | |||

| NPV Results (C$ M) | ||||||

| Pre-Tax NPV5% | $241.0 | $313.9 | $386.9 | |||

| Post-Tax NPV5% | $216.1 | $266.9 | $316.2 | |||

QA/QC Statement

The Company has implemented a quality assurance and control (“QA/QC”) program to ensure sampling and analysis of mine and exploration work is conducted in accordance with industry standards. Drill core is sawn in half with one half of the core shipped to Actlabs Laboratories located in Thunder Bay, ON, while the other half is retained at the Company’s core facilities in White River, ON, for future verification. Certified reference standards and blanks are inserted into the sample stream on a regular interval basis and monitored as part of the QA/QC program. Gold analysis is performed by fire assay using atomic absorption, gravimetric or pulp metallic finish. The Mineral Resource Estimate was prepared in compliance with NI 43-101 guidelines.

Qualified Persons and NI 43-101 Disclosure

Independent Qualified Person, Eugene Puritch, P.Eng., FEC, CET of P&E Mining Consultants Inc. has reviewed and approved the technical contents of this news release.

Robert Kusins, P. Geo., Harte Gold’s Senior Mineral Resource geologist, is the Company’s Qualified Person and has prepared, supervised the preparation, or approved the scientific and technical disclosure in this news release.

About Harte Gold Corp.

Harte Gold is Ontario’s newest gold producer through its wholly owned Sugar Zone Mine in White River Ontario. Using a 3 g/t gold cut-off, the NI 43-101 compliant Mineral Resource Estimate dated February 19, 2019 contains an Indicated Mineral Resource of 4,243,000 tonnes grading 8.12 g/t Au with 1,108,000 ounces contained gold and an Inferred Mineral Resource of 2,954,000 tonnes, grading 5.88 g/t Au with 558,000 ounces contained gold. Exploration continues on the Sugar Zone Property, which encompasses 79,335 hectares covering a significant greenstone belt.

For further information, please contact:

Stephen G. Roman

President and CEO

Tel: 416-368-0999

Email: sgr@hartegold.com

Shawn Howarth

Vice President, Corporate Development

Tel: 416-368-0999

E-mail: sh@hartegold.com

The Toronto Stock Exchange has not reviewed and does not accept responsibility for the adequacy or accuracy of this release.