Harte Gold Reports Q2 Production Increase Of 42% Over Q1 Ramp Up Continues To 800 TPD

TORONTO, Aug. 14, 2019 (GLOBE NEWSWIRE) -- HARTE GOLD CORP. (“Harte Gold” or the “Company”) (TSX: HRT / OTC: HRTFF / Frankfurt: H4O) is pleased to provide the following results for second quarter (“Q2 2019”) ended June 30, 2019.

Operations

- Gold production increased 42% quarter over quarter to 7,754 ounces

- 42,601 tonnes of ore were mined for the quarter, a 33% increase over Q1 2019.

- Average head grade for mined ore was 6.01 g/t

- 42,601 tonnes of ore were mined for the quarter, a 33% increase over Q1 2019.

- The mill processed 53,216 tonnes of ore (591 tpd average), a 39% increase quarter over quarter

- Average head grade processed was 4.89 g/t resulting from the blended grade of mine production and the lower grade surface stockpiles

- Mill feed was supplied by 80% run of mine (“ROM”) ore and 20% surface stockpiles

- Surface stockpiles are fully drawn at the end of July and 100% of mill feed will be ROM ore going forward

- Average head grade processed was 4.89 g/t resulting from the blended grade of mine production and the lower grade surface stockpiles

- Net revenue was $11.8 million a 50% increase quarter over quarter

- Attributable to increased gold production and higher gold prices

- Average realized gold price for the quarter was US $1,305 per payable ounce

- Attributable to increased gold production and higher gold prices

- Mine EBITDA1 for Q2 2019 was $2.7 million, compared to a loss of ($2.5) million in Q1

- Operating costs were stabilized in Q2, cost containment measures are taking effect

- Cash costs2 were reduced 26% quarter over quarter, to US$1,070/oz

- Operating costs were stabilized in Q2, cost containment measures are taking effect

- All in sustaining costs2 (“AISC”) reduced 33% to US$1,734/oz

- Mine development costs, $4.3 million were consistent with Q1 and reflect the capital required for underground infrastructure necessary to support continued ramp-up of the mine

- AISC will decline in H2 2019 as costs stabilize and ounces produced increase

- Mine development costs, $4.3 million were consistent with Q1 and reflect the capital required for underground infrastructure necessary to support continued ramp-up of the mine

- Quarterly results compared to the Feasibility Study plan

- Production tracked approximately 80% of the Feasibility Study plan for Q2 2019

- Delays with completion of mine ventilation and start-up of the paste fill plant impacted stope availability for the quarter. Mine ventilation has since been resolved and the paste fill plant should be fully operational by the end of September.

- The Company is currently operating from both the Sugar Zone north and south areas, which will provide sufficient underground material to achieve the 800 tonne per day production target by the end of Q4 2019

- Production tracked approximately 80% of the Feasibility Study plan for Q2 2019

Operational Summary and Quarter-Over-Quarter Comparison

| Three months ended June 30, 2019 | Three months ended March 31, 2019 | Q2 vs. Q1 Increase / (Decrease) | |||||

| Operating Data | |||||||

| Ore mined (tonnes) | 42,601 | 32,044 | 33 | % | |||

| Ore processed (tonnes) | 53,216 | 38,278 | 39 | % | |||

| Average daily throughput (tpd) | 591 | 425 | 39 | % | |||

| Head grade (g/t) | 4.89 | 4.86 | 1 | % | |||

| Recovery (%) | 93 | % | 92 | % | 1 | % | |

| Gold ounces produced | 7,754 | 5,476 | 42 | % | |||

| Mine Financial Data (000 $) | |||||||

| Revenues | 11,821 | 7,859 | 50 | % | |||

| Mining cost | (5,122 | ) | (4,459 | ) | 15 | % | |

| Processing cost | (2,583 | ) | (2,686 | ) | (4 | %) | |

| Site G&A | (3,354 | ) | (3,473 | ) | (3 | %) | |

| Inventory changes | 1,968 | 277 | 610 | % | |||

| Mine EBITDA1 | 2,730 | (2,482 | ) | ||||

| Mine Development Costs | (4,285 | ) | (4,517 | ) | (5 | %) | |

| Other Development Capital | 0 | (942 | ) | (100 | %) | ||

| Exploration Costs | (1,699 | ) | (2,048 | ) | (17 | %) | |

| Corporate Costs | (886 | ) | (905 | ) | (2 | %) | |

| Net Cash Flow | (4,141 | ) | (10,893 | ) | |||

| Unit Input Costs (in dollars) | |||||||

| Mining cost (per tonne ROM) | 120 | 139 | (14 | %) | |||

| Processing cost (per tonne) | 49 | 70 | (31 | %) | |||

| Site G&A (per tonne) | 63 | 91 | (31 | %) | |||

| Cash Cost (US$ per oz)2 | 1,070 | 1,454 | (26 | %) | |||

| AISC (US$ per oz)2 | 1,734 | 2,606 | (33 | %) | |||

| 1) | Mine EBITDA is a non-IFRS measure, refer to the Company’s “Non-IFRS Measures” and “Results of Operations” in the Company’s MD&A for a description and reconciliation to Net Income (Loss) |

| 2) | Refer to the Company’s MD&A under “Non-IFRS Measures” for description of these measures |

Corporate

- Closed US$82.5 million financing package on June 14, 2019 and comprised of

- US$52.5 million 6-year non-revolving term credit facility provided by BNP Paribas (“BNP”)

- US$20.0 million 3-year revolving term credit facility provided by BNP

- US$52.5 million 6-year non-revolving term credit facility provided by BNP Paribas (“BNP”)

- Entered into a hedge program in connection with the BNP financing, comprising approximately 79,000 ounces over the years 2020 through 2024, representing 24% of payable gold projected to be produced over this period, with a high of 32% in any year

- Unrealized hedge gains (losses) are recognized in each accounting period and reversed when the hedge contracts mature in future periods

- Repaid the US$20 million loan from ANR Investments B.V. (“Appian”) and the US$40 million loan from Sprott Private Resource Lending (Collector) LP plus accrued interest, prepayment penalties, production payment liability and other costs, totalling approximately US$70.7 million

- Closed US$10 million equity subscription with Appian Natural Resources Fund (“Appian”)

Operational Outlook

- Management expects mine performance to continue improving in the second half of 2019, supported by the following:

- Ventilation constraints are resolved

- Sufficient underground development is now completed to access both the Sugar Zone north and south areas

- The number of available stopes was recently increased to three, with additional stope development ongoing

- Operational team additions at the mine site include a mine superintendent, a health & safety coordinator and a senior environmental consultant

- Ventilation constraints are resolved

- At a stable 800 tpd run-rate, cash costs are expected to reduce to US$551 per ounce (AISC of US$957 per ounce) for 2020 and US$580 per ounce (AISC of $891 per ounce) over life of mine

Financial Outlook

By Q4 2019 the Company expects to return to net positive free cash flow. The following table summarizes projected cash flows for Q4 2019, 12 months ended July 31, 2020 and 12 months ended December 31, 2020.

- Quantities and dollars are based on the Feasibility Study, which used a gold price of US$1,300 per ounce and a Canadian dollar exchange rate of 0.77

- The table illustrates the impact on cash flows using a gold price of US$1,400 per ounce and a Canadian dollar exchange rate of 0.75

- Corporate overhead costs are based on 2019 budgeted amounts with an increase in 2020

- Principal payments are based on the debt repayment schedules and interest calculated at a LIBOR base rate of 2.75% plus 2.875% to 3.875% premium

| Financial Outlook Q4 2019 and 2020 | ||||||||||||||

| Q4 2019 | Aug 1, 2019 to Jul 31, 2020 | CY 2020 | ||||||||||||

| Prior Gold $ | Current Gold $ | Prior Gold $ | Current Gold $ | Prior Gold $ | Current Gold $ | |||||||||

| Gold price | $ | 1,300 | $ | 1,400 | $ | 1,300 | $ | 1,400 | $ | 1,300 | $ | 1,400 | ||

| Payable ounces | 13,156 | 13,156 | 54,482 | 54,482 | 63,902 | 63,902 | ||||||||

| Exchange rate | 0.77 | 0.75 | 0.77 | 0.75 | 0.77 | 0.75 | ||||||||

| Net revenues | $ | 21.1 | $ | 23.4 | $ | 87.4 | $ | 96.9 | $ | 102.5 | $ | 113.7 | ||

| Operating expenses | 11.4 | 11.4 | 45.9 | 45.9 | 48.1 | 48.6 | ||||||||

| Operating income | 9.8 | 12.1 | 41.5 | 51.0 | 54.4 | 65.1 | ||||||||

| Development / CAPEX | 6.2 | 6.2 | 27.6 | 27.6 | 25.2 | 25.2 | ||||||||

| Feasibility cash flow | 3.5 | 5.8 | 13.9 | 23.4 | 29.2 | 39.9 | ||||||||

| Corporate overhead | 0.7 | 0.7 | 3.6 | 3.6 | 4.3 | 4.3 | ||||||||

| Interest expense | 1.6 | 1.6 | 6.2 | 6.3 | 5.8 | 5.9 | ||||||||

| Principal payments | 0.0 | 0.0 | 4.1 | 4.2 | 8.2 | 8.5 | ||||||||

| Net Cash Flow | $ | 1.3 | $ | 3.5 | $ | 0.0 | $ | 9.3 | $ | 10.9 | $ | 21.3 | ||

As noted in the discussion on financial instruments, 20,316 ounces of the 2020 production are hedged at a maximum price of US$1,391

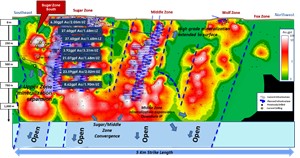

Near Mine Exploration Continues To Grow Sugar Zone South Area

Exploration along strike and to the south continues to intersect high grade mineralization. The Company has been successful in extending mineralization by 300 meters along strike and 200 meters down dip to the south of the Sugar Zone Mine. Drilling will continue in the area with the intention to expand the mineralized boundary.

Near Mine Drilling – Sugar Zone South Extension

| Hole # | From | To | Grade (g/t Au) | Width (m) |

| SZ-19-265 | 638.85 | 640.75 | 8.62 | 1.90 |

| SZ-19-266 | 491.32 | 493.00 | 21.07 | 1.68 |

| SZ-19-267 | 405.23 | 408.54 | 3.92 | 3.31 |

| SZ-19-269 | 463.41 | 465.00 | 7.00 | 1.59 |

| SZ-19-271 | 394.4 | 396.08 | 27.60 | 1.68 |

| SZ-19-273 Including | 412.00 412.81 | 413.41 413.00 | 6.06 27.80 | 1.41 0.30 |

| SZ-19-274 Including | 358.70 350.45 | 360.75 360.75 | 6.30 42.00 | 2.05 0.30 |

| SZ-19-276 Including | 487.09 488.00 | 489.11 489.11 | 23.59 42.32 | 2.02 1.11 |

(core intersection lengths approximate 80% true width, assay results are uncut, fire assay with metallic screen on samples >10 g/t)

Financial Instruments - Hedging

In connection with the BNP debt financing, the Company executed a gold hedge program for approximately 79,000 ounces, covering a period from January 2020 through June 2024. The hedge position was established using zero cost put/call collars on June 14, 2019 concurrent with the closing of the BNP loan facility. On that date, the gold price was US$1,351 and in the context of the market, put options were purchased to result in a floor price of US $1,300 on the hedged ounces. Such purchase price was funded by the sale of call options at prices varying between US $1,391 and $1,399 over the years.

In view of the gold price movement from US $1,351 on June 14th to US $1,409 on June 30th, the fair value of the hedge position resulted in a non-cash loss of $10.6 million as detailed in the financial statements. As each hedge position matures, any unrealized gains or losses will be realized and be offset by the opposite effect on the physical gold sales in each period.

The Company recognizes the mark-to-market adjustments in its statements of operations and comprehensive income or loss, however this is not a cash flow item and does not affect the day to day operations of the Sugar Zone Mine.

Liquidity and Capital Resources

Excluding debt, the Company had a working capital deficit of $7.5 million at June 30, 2019 compared to a deficit of $10.9 million at December 31, 2018. Although the current liquidity position and operations have improved, the Company expects to seek financing in addition to cash generated from operations in the future, either by way of equity, debt or drawn down under the standby commitment facility with Appian for up to an additional US$7.5 million in non-equity financing, available at the Company’s option and subject to conditions for drawdown. While the Company has been successful in raising funds to date, there can be no assurance that such funds will be available to the Company on terms that it finds acceptable.

On July 22, 2019, the Company entered into an underwriting agreement on a bought deal basis with Echelon Wealth Partners Inc. (“Echelon”) for 20,000,000 flow-through common shares at a price of $0.30 per common share for gross proceeds of $6,000,000. Echelon will receive a cash fee of 5% plus warrants to purchase up to 5% of the common shares sold, with each warrant exercisable at a price of $0.30 per common share for 18 months. The Company also granted Echelon an over-allotment option of up to 15% of the underwritten common shares, or up to 3,000,000 additional flow-through common shares.

Qualified Persons and NI 43-101 Disclosure

The company has implemented a quality assurance and control (“QA/QC”) program to ensure sampling and analysis of mine and exploration work is conducted in accordance with industry standards. Drill core is sawn in half with one half of the core shipped to Activation Laboratories located in Thunder Bay, ON, while the other half is retained at the Company’s core facilities in White River, ON, for future verification. Channel and Chip samples were sent to Wesdome Mines lab in Wawa, ON. Certified reference standards and blanks are inserted into the sample stream on a regular interval basis and monitored as part of the QA/QC program. Gold analysis is performed by fire assay using atomic absorption, gravimetric or pulp metallic finish.

Robert Kusins, P. Geo., Harte Gold’s Senior Mineral Resource geologist, is the Company’s Qualified Person and has prepared, supervised the preparation, or approved the scientific and technical disclosure in this news release.

About Harte Gold Corp.

Harte Gold is Ontario’s newest gold producer through its wholly owned Sugar Zone Mine in White River Ontario. Using a 3 g/t gold cut-off, the NI 43-101 compliant Mineral Resource Estimate dated February 19, 2019 contains an Indicated Mineral Resource of 4,243,000 tonnes grading 8.12 g/t Au with 1,108,000 ounces contained gold and an Inferred Mineral Resource of 2,954,000 tonnes, grading 5.88 g/t Au with 558,000 ounces contained gold.

A NI 43-101 compliant Feasibility Study was completed on the Sugar Zone Mine effective February 15, 2019 calculating total Reserves of 3,879,000 tonnes grading 7.1 g/t Au with 890,000 ounces of gold. Exploration continues on the Sugar Zone Property, which encompasses 79,335 hectares covering a significant greenstone belt.

| For further information, please contact: | |

| Stephen G. Roman President and CEO Tel: 416-368-0999 Email: sgr@hartegold.com | Shawn Howarth Vice President, Corporate Development Tel: 416-368-0999 E-mail: sh@hartegold.com |

This news release includes "forward-looking statements", within the meaning of applicable securities legislation, which are based on the opinions and estimates of Management and are subject to a variety of risks and uncertainties and other factors that could cause actual events or results to differ materially from those projected in the forward-looking statements. Forward-looking statements are often, but not always, identified by the use of words such as "seek", "anticipate", "budget", "plan", "continue", "estimate", "expect", "forecast", "may", "will", "project", "predict", "potential", "targeting", "intend", "could", "might", "should", "believe" and similar words suggesting future outcomes or statements regarding an outlook. Such risks and uncertainties include, but are not limited to, risks associated with the mining industry, including operational risks in exploration, development and production; delays or changes in plans with respect to exploration or development projects or capital expenditures; the uncertainty of reserve estimates; the uncertainty of estimates and projections in relation to production, costs and expenses; the uncertainty surrounding the ability of the Company to obtain all permits, consents or authorizations required for its operations and activities; and health, safety and environmental risks, the risk of commodity price and foreign exchange rate fluctuations, the ability of Harte Gold to fund the capital and operating expenses necessary to achieve the business objectives of Harte Gold, the uncertainty associated with commercial negotiations and negotiating with foreign governments and risks associated with international business activities, as well as those risks described in public disclosure documents filed by the Company. Due to the risks, uncertainties and assumptions inherent in forward-looking statements, prospective investors in securities of the Company should not place undue reliance on these forward-looking statements. Statements in relation to "reserves" or “resources” are deemed to be forward-looking statements, as they involve the implied assessment, based on certain estimates and assumptions, that the reserves or resources described may be profitably produced in the future.

Readers are cautioned that the foregoing list of risks, uncertainties and other factors are not exhaustive. The forward-looking statements contained in this document are made as of the date hereof and the Company undertakes no obligation to update publicly or revise any forward-looking statements or in any other documents filed with Canadian securities regulatory authorities, whether as a result of new information, future events or otherwise, except in accordance with applicable securities laws. The forward-looking statements are expressly qualified by this cautionary statement.

The Toronto Stock Exchange has not reviewed and does not accept responsibility for the adequacy or accuracy of this release.

1 Mine EBITDA is a non-IFRS measure, refer to the Company’s “Non-IFRS Measures” and “Results of Operations” in the Company’s MD&A for a description and reconciliation to Net Income (Loss)

2 Refer to the Company’s MD&A under “Non-IFRS Measures” for description of these measures

A photo accompanying this announcement is available at https://www.globenewswire.com/NewsRoom/AttachmentNg/815a218c-cf35-46af-97ef-5c29439138e0