Harte Gold Reports Year End 2018 Results

TORONTO, April 02, 2019 (GLOBE NEWSWIRE) -- HARTE GOLD CORP. (“Harte Gold” or the “Company”) (TSX: HRT / OTC: HRTFF / Frankfurt: H4O) is pleased to announce results for the year ended December 31, 2018.

Highlights

Sugar Zone Mine Construction

- In 2018, Harte Gold successfully permitted, constructed and commissioned the Sugar Zone Mine.

- Earthworks and preparation for the mill concrete pour started in September 2017.

- Erection of the mill building started in December 2017, cladding of the mill was completed by March 2018.

- Updated Mineral Resource estimate was announced in February 2018, tripling the combined Indicated and Inferred Mineral Resources.

- Installation of the ball mill began in April 2018.

- Impact Benefits Agreement was signed with Pic Mobert First Nation announced in May.

- Mill commissioning started in August.

- Announced first gold pour mid-October.

- Shipment of first concentrate to the Horne smelter in early December.

- Declared commercial production effective January 1, 2019.

- As at December 31, 2018, during commissioning and prior to declaration of commercial production, the Company generated approximately $1.6 million from gold production and an additional $2.9 million was held as gold inventory at year end.

Resource Development

- A 90,000 metre drill program was completed over 2018 with the following objectives:

- Expand near mine mineralization along strike and down dip.

- Demonstrate resource grade continuity. - On February 20, 2019 an updated Mineral Resource Estimate was announced highlighting

- 55% increase to Indicated Mineral Resources to 1.1 million ounces grading 8.12 g/t.

- Inferred Mineral Resources updated to 558,000 ounces Au grading 5.88 g/t.

- A significant portion of the lower grade Inferred Mineral Resource upgraded to higher grade Indicated Resource.

- Mineralization was extended along strike to include the Wolf Zone both near surface and down dip.

- Inferred mineralization extended down dip – the Sugar and Middle Zones are now converging.

Financing

- In January 2018, the final tranche of a December 2017 equity raise was closed for proceeds of $7.7 million ($24.8 million closed in December).

- May 11, 2018, a US$20 million subordinated debt financing package with ANR Investments B.V. (“Appian”) was closed and drawn in its entirety.

- June 1, 2018, a US$50 million senior secured debt financing (“Sprott Facility”) was closed with Sprott Private Resource Lending (Collector), L.P. (“Sprott”) was closed, with an initial draw of US$20 million.

- October 11, 2018, the Company drew a further US$15 million under the Sprott Facility.

- February 11, 2019, the Company drew a further US$5 million under the Sprott Facility.

- Advanced discussions are underway with existing and potential new financing sources regarding the refinancing of its current debt facilities with debt and/or equity.

- These discussions include the Company's major shareholder, Appian, regarding an interim liquidity solution.

Corporate

- A net smelter royalty (“NSR”) on the property was reduced by 1.5%, to 2.0%, in 2018 upon payments of $1.0 million and the intention to pay a further $0.5 million.

Sugar Zone Mine Construction Timeline

Surface Earthworks and Mill Foundations – September 2017 to March 2018

- Earthworks started in late August / early September.

- Concrete batch plant was mobilized to site at that time.

- First concrete forms for mill footings were poured in October.

- Ball mill foundation pouring continued in November.

- Crushing spread pads were completed and stockpile area started in December.

- Erection of the steel building began mid-December.

- First install of the cladding and mill interior took place in February.

- Cladding of the mill exterior was completed in March.

Populating the Mill – April to September 2018

- Installation of the ball mill began in April.

- Installation of power to site was also started around that time.

- Crusher feed conveyor was installed in June.

- Cold commissioning started in August.

- Power line construction was completed shortly thereafter.

- A 13.8 kV transformer was installed to support underground mining.

- Grid power was completed in September and the site was successfully energized.

- Commercial production permits were received on September 20.

- Tailings dam construction also resumed.

Commissioning and Ramp-Up – October to December 2018

- Hot commissioning started in October and gold was being recovered through the gravity circuit.

- Flotation concentrate started shipping to the Horne smelter for processing in early December.

- With receipt of commercial production permits, mining of sills and stopes resumed.

- As at December, five levels of development had been completed supporting approximately six months of ore production.

- For the month of December, the mill processed 16,400 tonnes over a 29 day period.

- Mill feed was a combination of stockpiled material, development material and stope production.

- Commercial production was declared effective January 1st, 2019.

Exploration and Evaluation Expenditures

In 2018, Harte Gold incurred $13.8 million in exploration expenditures in the following areas:

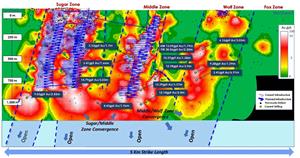

Near Mine Resource Drilling Highlights

- Sugar Zone drilling continued to demonstrate continuity of mineralization down dip.

- Hole SZ-18-247 returned 14.79 g/t over 3.03 m, including 25.29 g/t over 1.16 m.

- Hole SZ-17-230 returned 9.03 g/t over 2.43 m. - Middle Zone drilling defined an entirely new zone of mineralization, the “Footwall Zone”.

- The Footwall Zone is situated east of the Middle Zone and contains 23 metres of anomalous mineralization supported by a high-grade core.

- Hole WZ-18-146 returned 38.06 g/t over 2.20 m.

- Hole WZ-18-129 returned 5.41 g/t over 7.66 m and 14.80 g/t over 2.12 m.

- Hole WZ-18-126 returned 5.53 g/t over 1.70 m. - Wolf Zone drilling significantly expanded known mineralization near surface and at depth.

- Hole WZ-18-157 returned 6.16 g/t over 3.03 m, including 14.74 g/t over 1.15 m.

- Hole WZ-18-158W2 returned 9.28 g/t over 1.59 m.

- Hole WZ-18-170 returned 5.41 g/t over 6.91 m and 11.88 g/t over 2.66 m. - Drilling in areas between the Sugar, Middle and Wolf Zones returned entirely new areas of mineralization that reconfirm management’s belief that all zones are part of a larger system at depth.

- Hole SZ-18-241 returned 4.43 g/t over 1.96 m.

- Hole WZ-18-197W2 returned 12.14 g/t over 2.00 m.

- Hole WZ-19-197W3 returned 13.39 g/t over 3.57 m.

- Hole WZ-18-221W2 returned 10.27 g/t over 1.58 m.

- Hole WZ-18-222W4 returned 12.98 g/t over 3.90 m.

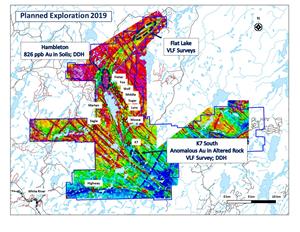

Property Wide Exploration

- Near-surface drilling was completed at both the Eagle and Highway Zones in 2018. No significant mineralization has been returned to-date from these areas.

- An exploration plan is now focused on following three highly prospective areas based on exploration completed over the summer and fall of 2018.

- The Hambleton Lake area, an on-strike extension to known mineralization north of the Wolf Zone, returned high gold in soil samples up to 826 ppb and significantly higher than geochemical analysis that first led to identification of the Sugar Zone deposit.

- The K7 South area is a southern extension of mineralization where prospecting samples returned anomalous gold and base metals values.

- The Flat Lake area to the northeast has returned significant electromagnetic anomalies as well as up to 1% zinc in surface sampling. - VLF geophysical surveying as well as diamond drilling will be completed at these areas over the course of 2019.

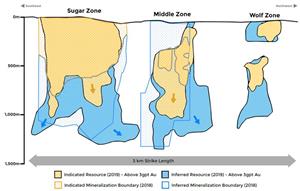

Mineral Resource Update

- An updated NI 43-101 Mineral Resource Estimate was announced February 20, 2019.

- Indicated Mineral Resources increased 55% to 1.1 million ounces Au grading 8.12 g/t.

- Inferred Mineral Resources were 558,000 ounces Au grading 5.88 g/t.

- Grade continuity was confirmed – a portion of the lower grade Inferred Mineral Resource was upgraded to higher grade Indicated Mineral Resource.

- Mineralization was extended to the Wolf Zone both near surface and down dip – the Sugar and Middle Zones appear to be converging.

- In-fill drilling of the Middle Zone successfully converted inferred resources to indicated resources at an increased grade.

| 2018 – 2019 Mineral Resource Estimate Comparison | ||||||

| Description | Indicated | Inferred | ||||

| Tonnes | Grade (g/t) | Ounces Au | Tonnes | Grade (g/t) | Ounces Au | |

| Sugar, Middle, Wolf Zones (2019) | 4,243,000 | 8.12 | 1,108,000 | 2,954,000 | 5.88 | 558,000 |

| Sugar and Middle Zones (2018) | 2,607,000 | 8.52 | 714,200 | 3,590,000 | 6.59 | 760,800 |

(1) Mineral Resources which are not Mineral Reserves do not have demonstrated economic viability.

(2) The estimate of Mineral Resources may be materially affected by environmental, permitting, legal, title, taxation, socio-political, marketing, or other relevant issues.

(3) The Inferred Mineral Resource in this estimate has a lower level of confidence than that applied to an Indicated Mineral Resource and must not be converted to a Mineral Reserve. It is reasonably expected that the majority of the Inferred Mineral Resource could be upgraded to an Indicated Mineral Resource with continued exploration.

(4) The Mineral Resources in this report were estimated using the Canadian Institute of Mining, Metallurgy and Petroleum (CIM), CIM Standards on Mineral Resources and Reserves, Definitions and Guidelines prepared by the CIM Standing Committee on Reserve Definitions and adopted by the CIM Council.

(5) Advanced Exploration Bulk Sample mined out area removed from the model.

Financial Condition, Liquidity and Capital Resources

At December 31, 2018, the Company has current liabilities of $101.5 million. Of which, $23.6 million relate to accounts payable and accrued liabilities generally payable within 30 to 90 days. The Company had current assets of $12.7 million. The Company had historically financed its activities by accessing equity markets from time to time.

Appian provided the Company a US$20 million bridge loan facility which is due on May 9, 2019 and is included in current liabilities.

In May 2018, the Company also entered into a long-term debt agreement and related production payment liability with Sprott. The total availability under this facility was US$50 million, of which US$35 million had been drawn at December 31, 2018. In February 2019, the Company drew down a further US$5 million under the Sprott Facility. A further US$10 million remains available under this facility.

The Company is in advanced discussions with existing and potential new financial parties regarding the refinancing of its current debt facilities with debt and/or equity. These discussions include the Company’s major shareholder, Appian, on an interim liquidity solution.

Outlook

- Completion of Feasibility Study in early April.

- Mine planning for 2019 and life-of-mine guidance and declaration of Mineral Reserves will be completed in combination with the Feasibility Study.

- Commercial production permitting to expand throughput to 800 tonnes per day in Q2 2019.

- Deep drilling at the Sugar, Middle and Wolf Zone Convergence Zone.

- Exploration drilling to test targets on-strike of the Sugar Zone Mine and regionally on Harte Gold's extensive land package.

QA/QC Statement

The Company has implemented a quality assurance and control (“QA/QC”) program to ensure sampling and analysis of mine and exploration work is conducted in accordance with industry standards. Drill core is sawn in half with one half of the core shipped to Actlabs Laboratories located in Thunder Bay, ON, while the other half is retained at the Company’s core facilities in White River, ON, for future verification. Certified reference standards and blanks are inserted into the sample stream on a regular interval basis and monitored as part of the QA/QC program. Gold analysis is performed by fire assay using atomic absorption, gravimetric or pulp metallic finish. The Mineral Resource Estimate was prepared in compliance with NI 43-101 guidelines. Robert Kusins, P. Geo., Harte Gold’s Senior Mineral Resource geologist, is the Company’s Qualified Person and has prepared, supervised the preparation, or approved the scientific and technical disclosure in this news release.

About Harte Gold Corp.

Harte Gold is Ontario’s newest gold producer through its wholly owned Sugar Zone Mine in White River Ontario. Using a 3 g/t gold cut-off, the NI 43-101 compliant Mineral Resource Estimate dated February 19, 2019 contains an Indicated Mineral Resource of 4,243,000 tonnes grading 8.12 g/t for 1,108,000 ounces contained gold and an Inferred Mineral Resource of 2,954,000 tonnes, grading 5.88 g/t for 558,000 ounces contained gold. Exploration continues on the Sugar Zone property, which encompasses 83,850 hectares covering a significant greenstone belt.

| For further information, please contact: | ||||

| Stephen G. Roman | Shawn Howarth | |||

| President and CEO | Vice President, Corporate Development | |||

| Tel: 416-368-0999 | Tel: 416-368-0999 | |||

| Email: sgr@hartegold.com | E-mail: sh@hartegold.com | |||

The Toronto Stock Exchange has not reviewed and does not accept responsibility for the adequacy or accuracy of this release.

Photos accompanying this announcement are available at

http://www.globenewswire.com/NewsRoom/AttachmentNg/9c1374d5-ac12-4963-9ec8-61060c7e94aa

http://www.globenewswire.com/NewsRoom/AttachmentNg/3b20c3c8-8a15-4bc4-aee5-19669eaf26ff

http://www.globenewswire.com/NewsRoom/AttachmentNg/f59fc647-b3c5-4be0-944e-1e8b7b7baab6

http://www.globenewswire.com/NewsRoom/AttachmentNg/d12a258e-5919-4b45-a09b-4e4fc288024e

http://www.globenewswire.com/NewsRoom/AttachmentNg/cbc1b7f8-6196-420b-86e5-c5f6a642cec3

http://www.globenewswire.com/NewsRoom/AttachmentNg/a3cb27a3-4589-49c6-b262-bab6f13b2ce9

http://www.globenewswire.com/NewsRoom/AttachmentNg/80a4c3ba-6abc-4c7a-b08d-1472a1d20c23

http://www.globenewswire.com/NewsRoom/AttachmentNg/26c8f148-871f-41ba-a963-0de24f8c5c44

http://www.globenewswire.com/NewsRoom/AttachmentNg/ac4f74c9-4ed5-42a8-86c6-7e3c8a295ec6

http://www.globenewswire.com/NewsRoom/AttachmentNg/f5f6ad83-f424-4798-a29f-d966b86cf54c

http://www.globenewswire.com/NewsRoom/AttachmentNg/8a9e0883-d23f-440f-be0d-0173f88a6b33

http://www.globenewswire.com/NewsRoom/AttachmentNg/ea412c3c-dcac-4b0e-b336-b5cd2493d504

http://www.globenewswire.com/NewsRoom/AttachmentNg/19bfa80a-1959-456a-b556-99759c6e2c95

http://www.globenewswire.com/NewsRoom/AttachmentNg/e116a3e1-7b0f-48bf-a6bb-d4a2c41f5eaf

http://www.globenewswire.com/NewsRoom/AttachmentNg/316a0098-7e0e-401d-90f6-19dd9e8009d4