Horizonte Minerals Plc: Vermelho Pre-Feasibility Study Returns NPV of US$1.7 Billion and Confirms Low Cost, Long Life Nickel Sulphate Project

LONDON, Oct. 17, 2019 (GLOBE NEWSWIRE) -- Horizonte Minerals Plc, (AIM/TSX: HZM) ('Horizonte' or 'the Company') the nickel development company focused in Brazil, is pleased to publish the results of the Pre-Feasibility Study ('PFS' or the ‘Study’) for the 100% owned Vermelho Nickel-Cobalt Project (‘Vermelho, or ‘the Project’) in Brazil’s Pará State.

Highlights:

- The Study confirms Vermelho as a large, high-grade resource, with a long mine life and low-cost source of nickel sulphate for the battery industry;

- The compelling economic and technical results from the study support further development of the project towards a full Feasibility Study;

- A 38-year mine life estimated to generate total cash flows after taxation of US$7.3billion1;

- An estimated Base Case post-tax Net Present Value1 (‘NPV’) of US$1.7 billion2 and Internal Rate of Return (‘IRR’) of 26%;

- At full production capacity the Project is expected to produce an average of 25,000 tonnes of nickel and 1,250 tonnes of cobalt per annum utilising the High-Pressure Acid Leach process;

- The base case PFS economics assume a flat nickel price of US$16,400 per tonne (‘/t’) for the 38-year mine life;

- C1 (Brook Hunt) cash cost of US$8,020/t Ni (US$3.64/lb Ni), defines Vermelho as a low-cost producer;

- Initial Capital Cost estimate is US$652 million (AACE class 4), including US$97.7 million of contingencies (equating to approximately 18% of capital); and

- Vermelho is set to deliver significant socio-economic benefits for communities in the Pará state, including over 1,800 direct jobs in the construction phase, and over 600 jobs during operation, as well as additional economic and social development programs.

1USD/BRL 1/3.8 exchange rate applied for life-of-mine

2 NPV calculated using 8% discount rate

Horizonte CEO, Jeremy Martin, commented;

“I am delighted to deliver the Pre-Feasibility Study for the Vermelho nickel-cobalt project which represents another significant milestone delivered by the Company this year. The Study now positions Horizonte as a multi-asset nickel developer with a combined NPV in excess of US$2.5 billion at current nickel prices across the Araguaia and Vermelho projects.

The PFS demonstrates that Vermelho can be a significant low-cost supplier of nickel in the form of battery grade nickel-sulphate. Over the 38-year mine life using the Base Case nickel price of $16,400, the operation is expected to generate cash flows after taxation of US$7.3 billion, an IRR of over 26%, and sits on the lower half of the global cost curve. If we apply the long-term Wood Mackenzie nickel price of US$19,800, the project IRR increases to 31% and the NPV to approximately $2.3 billion.

Importantly, the Vermelho project will also produce battery grade cobalt sulphate, another key component for the electric vehicle (‘EV’) battery industry with 60% of global supply currently sourced from a single country. The consumer driven EV market is trending towards both sustainability and ethically sourced materials, including nickel and cobalt, and we see both of the Company’s projects in Brazil as being attractive to end users who are focused on traceable, ethically sourced materials.

With the PFS now successfully completed, the priority now is to identify partners, secure funding and advance the project by undertaking a full feasibility study on Vermelho. We will look to the replicate the success achieved by the Coral Bay Nickel Corporation where the company is currently producing around 20,000 tonnes per year of nickel utilising a twin line HPAL plant. This was a low capex plant which has been operating successfully for the last 15 years.

With a combined contained nickel inventory of over 4 million tonnes and the obvious synergies that come with having two world-class projects within 85 kilometres of each other in a stable and mining friendly jurisdiction, we have further cemented the Company as having one of the largest undeveloped nickel portfolios in the world. With financing discussions underway to commence the construction of Araguaia and Vermelho demonstrating significant economic potential, Horizonte is well positioned, owning two high-quality projects at an advanced stage.

The nickel market fundamentals continue to be positive for the short to long term, driven by robust demand from stainless steel growth and anticipated increase in EV penetration rates. Physical LME metal inventories continue to be drawn down to levels not seen in the last five years. This, combined with a lack of new major projects scheduled to come online in the short term, means that this is an opportune time to develop Vermelho.”

Analyst conference call and presentation

Horizonte will host an analyst conference call and presentation today, 17 October 2019, at 11:00 BST. Participants can access the call by dialling one of the following numbers below approximately 10 minutes prior to the start of the call.

UK Toll-Free Number: 0800 358 9473

PIN: 91815157#

UK Toll Number: +44 3333 000 804

PIN: 91815157#

The presentation will be available for download from the Company’s website www.horizonteminerals.com or by clicking on the link below:

https://www.anywhereconference.com?Conference=301302216&PIN=91815157&UserAudioMode=DATA

A recording of the conference call will subsequently be available on the Company’s website.

Vermelho Pre-Feasibility Study Detailed Information

Project Summary

The Project is located in the north-western Brazilian state of Pará in the Carajás Mining District, approximately 85 kilometres (‘km’) north-west of the Company’s 100% owned Araguaia North Project.

The Project comprises a planned 38 year operation with an open pit nickel laterite mining operation that mines a 141.3 million tonne (Mt) Probable Mineral Reserve (at a cut-off of 0.7% Ni) to produce 924,000 tonnes of nickel contained in nickel sulphate, 36,000 tonnes of cobalt contained in cobalt sulphate and a saleable by-product, kieserite (a form of fertiliser) of which 4.48 Mt are produced. The project will utilise a hydro-metallurgical process comprised of a beneficiation plant where ore is upgraded prior to being fed to a High-Pressure Acid Leach (HPAL) and refining Plant which produces the sulphates. The plant will be constructed in two phases, with an initial capacity of 1 Mt per annum (Mt/a) autoclave feed (Stage 1), then after three years of production, a second process train (Stage 2 Expansion) will be constructed effectively doubling the autoclave feed rate to 2 Mt/a. The Stage 1 plant and project infrastructure will be constructed over a 31-month period. The nickel and cobalt sulphate products will be transported by road to the port of Vila do Conde (the same facility planned for Araguaia) for sale to overseas customers. The kieserite will be transported to consumers within Pará state.

The engineering has been developed for the process plant, mining, infrastructure and utilities to support capital (‘capex’) and operating expenditure (‘opex’) estimates to an Association for the Advancement of Cost Engineering (AACE) class 4 standard. This means that capex and opex estimates have a combined accuracy of between -25% and +20% at a confidence level of 50%. The capex and opex are dated Q2 2019 and are exclusive of future escalation.

The results of the PFS demonstrate that Vermelho shows positive economics (Table 1, below).

Table 1: Key Feasibility Study Project Economic Indicators (post taxation)

| Item | Unit | Nickel price basis (US$/t Ni)** | |||

| Base Case 16,400 | Long Term 19,800 | ||||

| Net cash flow | US$ M | 7,304 | 9,546 | ||

| NPV8 | US$ M | 1,722 | 2,373 | ||

| IRR | % | 26.3 | % | 31.5 | % |

| Breakeven (NPV8) nickel price | US$/t | 7,483 | 7,483 | ||

| C1 cost (Brook Hunt) | US$/t Ni | 8,029 | 8,029 | ||

| C1 cost (Brook Hunt) years 1–10 | US$/t Ni | 7,286 | 7,286 | ||

| Production year payback | years | 4.2 | 3.6 | ||

| LOM nickel recovered | kt | 924.0 | 924.0 | ||

| LOM cobalt recovered | kt | 46.61 | 46.61 | ||

| LOM kieserite produced | kt | 4,482 | 4,482 | ||

| LOM Total revenue | US$ M | 19,034 | 22,175 | ||

| LOM Total costs | US$ M | 11,729 | 12,629 | ||

| Operating cash flow | US$ M | 8,451 | 10,693 | ||

| Capital intensity – initial capex/t Ni | US$/t Ni | 635 | 635 | ||

Note: ** US$2,000/t premium for battery sulphate production has been added to Nickel revenue, US$34,000/t for the cobalt produced as cobalt sulphate, and a net revenue of US$100/t of the by-product, kieserite.

The economic model assumes 100% equity, providing the opportunity for increased returns leveraging commercial or other debt. The base case was developed using a flat nickel price of US$16,400/t Ni. An alternate case using the Wood Mackenzie long term Nickel price of US$19,800/t Ni was also developed.

As shown in Table 1 (above), for the base case the project has a 4.2-year payback period with cumulative gross revenues of US$19,034 million. The economic analysis indicates a post-tax NPV8 of US$1,722 million and an IRR of 26.3% using the base case forecast of US$16,400/t Ni, this increases to US$2,373 million and 31.5% when using the Wood Mackenzie long term price of US$19,800/t Ni.

Resources / Reserves and Mining

The Vermelho nickel deposits consist of two hills named V1 and V2 (after Vermelho 1 and Vermelho 2), aligned on a northeast-southwest trend, overlying ultramafic bodies. A third ultramafic body, named V3, also located in the same trend lies on flat terrain, southwest of V2. The ultramafic bodies have had an extensive history of tropical weathering, which has produced a thick profile of nickel-enriched lateritic saprolite at V1 and V2.

The Vermelho area was explored in various stages by Companhia Vale do Rio Doce (‘Vale’) from 1974 to 2004 involving approximately 152,000 m of combined drilling and pitting. The drilling density was substantially enhanced in 2002 to 2004, with the majority of the resource upgraded to the Measured category as defined in JORC (2004) and CIM Definition Standards (2014). Pilot plant metallurgical studies were conducted in Australia focused on the HPAL processing method. A PFS was prepared in 2003, and a Feasibility Study (‘FS’) was completed in August 2004 by GRD-Minproc (2005). This study confirmed the positive economics supporting the outcomes obtained in previous studies and showed production capacity of 46,000 tonnes per annum (t/a) of metallic nickel, and 2,500 t/a of metallic cobalt. The project was given construction approval in 2005 however later that year Vale elected to place the Project on hold after Vale acquired Canadian nickel producer Inco.

Mineral Resources

Snowden Mining and Industry Consultants (‘Snowden’) were commissioned by Horizonte to produce the Geology and Mineral Resources sections of the PFS for the Project.

Within the mining licence, at a cut-off grade of 0.7% Ni, a total of 140.8 Mt at a grade of 1.05% Ni and 0.05% Co is defined as a Measured Mineral Resource and a total of 5.0 Mt at a grade of 0.99% Ni and 0.06% Co is defined as an Indicated Mineral Resource. This gives a combined tonnage of 145.7 Mt at a grade of 1.05% Ni and 0.05% Co for Measured and Indicated Mineral Resources. A further 3.1 Mt at a grade of 0.96% Ni and 0.04% Co is defined as an Inferred Mineral Resource at a cut-off grade of 0.7% Ni.

The Mineral Resource is summarised in Table 2.

Table 2 V1 + V2 – combined classified Mineral Resource report for Vermelho above 0.7% Ni cut-off within the mining licence

| Classification | Tonnage (Mt) | Ni % | Ni metal (kt) | Co % | Co metal (kt) | Fe2O3 % | MgO2 % | SiO2 % |

| Measured | 140.8 | 1.05 | 1,477 | 0.05 | 74.6 | 31.1 | 11.3 | 41.0 |

| Indicated | 5.0 | 0.99 | 49 | 0.06 | 2.8 | 26.3 | 8.6 | 49.0 |

| Measured + Indicated | 145.7 | 1.05 | 1,526 | 0.05 | 77.3 | 30.9 | 11.2 | 41.3 |

| Inferred | 3.1 | 0.96 | 29 | 0.04 | 1.4 | 24.0 | 15.5 | 42.2 |

Notes

- Mineral Resources are not Mineral Reserves and do not have demonstrated economic viability. All figures are rounded to reflect the relative accuracy of the estimate and have been used to derive subtotals, totals and weighted averages. Such calculations inherently involve a degree of rounding and consequently introduce a margin of error. Where these occur, Snowden does not consider them to be material.

- Mineral Resources are reported inclusive of Mineral Reserves.

- The reporting standard adopted for the reporting of the Mineral Resource estimate uses the terminology, definitions and guidelines given in the CIM Standards on Mineral Resources and Mineral Reserves (May 2014) as required by NI 43-101.

- Mineral Resources are reported on 100% basis for all Project areas.

- Snowden completed a site inspection of the deposit by Mr Andy Ross FAusIMM, an appropriate "independent qualified person" as such term is defined in NI 43-101.

- kt = thousand tonnes (metric).

Mineral Reserves

Mineral Reserves were prepared for the Project as part of the PFS, using the CIM Definition Standards (2014).

In accordance with the CIM Definition Standards on Mineral Resources and Mineral Reserves (as adopted and amended), Mineral Reserves are classified as either “Probable” or “Proven” Mineral Reserves and are based on Indicated and Measured Mineral Resources only in conjunction “estimation of Mineral Resource and Mineral Reserve best practice guidelines” as provided by the CIM. No Mineral Reserves have been estimated using Inferred Mineral Resources.

All economic Measured and Indicated Resources within the pit designs were classified as Probable Reserves. A summary of the Mineral Reserves is provided in Table 3.

Table 3 Open pit Mineral Reserves reported as of October 2018

| Value | Probable |

| Ore (Mt) | 141.3 |

| Ni (%) | 0.91 |

| Co (%) | 0.052 |

| Fe (%) | 23.1 |

| Mg (%) | 3.81 |

| Al (%) | 0.79 |

Notes

- Cut-off varies by resource model block depending on individual block geochemistry, however, as a guide the cut-off is approximately 0.5% Ni.

- A site inspection on was completed four occasions between March 2017 and September 2019 by Mr Anthony Finch P. Eng. MAusIMM (CP Min.), an appropriate “independent qualified person” as such term is defined in NI 43-101.

Mining

Snowden were commissioned by Horizonte to produce the mining plans of the PFS.

Mining at Vermelho is planned to be undertaken with conventional open pit truck and excavator mining methods. Blasting will be necessary for the upper parts of the deposit. Waste overburden will be stripped on 4 m benches, and ore on 2 m benches for additional selectivity.

Reverse circulation (‘RC’) grade control drilling will be completed at 12.5 m x 12.5 m spacing to define the waste/ore/ore type boundary ahead of mining.

Waste will be stored in dumps adjacent to the pits. Ore will be transported to the run of mine (‘ROM’) stockpile near the processing plant or the low-grade stockpiles for later processing.

Due to the wet season, mining (including stockpile rehandling) will be reduced between October and March (as is standard practice in the region). It was assumed that a fleet of Scania G500 8x4 22 m3 heavy tippers will be used as part of the fleet and coarse beneficiation rejects will be used as sheeting, to mitigate trafficability issues.

The mine production schedule targeted a processing rate of 1 Mt/a HPAL feed for the first three years and a doubling in capacity thereafter to 2 Mt/a. To facilitate this, ROM feed of approximately 2.25 Mt/a to 4.5 Mt/a is required as well as an acid production capacity of 350 kt/a to 700 kt/a.

The annual mining rate starts at 8 Mt/a and peaks at 12 Mt/a between production years 5 and 11. Strip ratios for the deposit are extremely low (0.14 Waste:Ore) consequently waste dumps are relatively small.

The mine supplies higher grade ore in the early mine life to the HPAL circuit, reaching up to 2% Ni and 0.1% Co in the first four production years. The HPAL feed grade (after beneficiation) is above 1.5% Ni and 0.08% Co for the majority of the first 17 years of production and decreases over the remaining LOM as feed is sourced from large lower grade stockpiles that are to be developed in the early years and are processed in the later years.

Processing

The process plant design, along with capital and operating cost estimates were completed by Simulus (Engineers) Pty Ltd, Perth Australia (‘Simulus’). Simulus is a specialist in nickel and cobalt laterite project metallurgical testwork, piloting and process design.

The process selected for the Project is the production of a nickel and cobalt sulphate product via HPAL, mixed sulphide precipitation (‘MSP’), pressure oxidation leaching (‘POX’), cobalt solvent extraction (‘CoSX’) and crystallization. Prior to the HPAL process, barren free silica is removed from the ore via a beneficiation process which involves crushing, scrubbing, washing and separation by screening and hydrocyclones. To avoid accumulation of magnesium sulphate in the recycled process water, a portion is sent to the Kieserite (magnesium sulphate monohydrate, MgSO4•H2O) crystallization area where Kieserite is recovered and crystallised for potential sale as fertiliser.

The process plant has been designed to process 4.34 Mt/a of ROM ore at 1.07% Ni. Of this total feed, 2.34 Mt/a is rejected as coarse, low grade siliceous waste from the beneficiation plant. The 2 Mt/a beneficiated product at 1.85% Ni grade is then fed to the HPAL processing plant as upgraded feed (1 Mt/a per train). A common refining circuit treats the MSP produced from each train via POX, CoSX and crystallization.

The proposed process plant has been designed to recover 94.4% and 94.9% of the nickel and cobalt from the HPAL feed at an acid consumption of 347 kg/t. The nickel and cobalt sulphate products are of high purity suitable for sale directly into the battery market. The Kieserite by-product is of appropriate quality to be sold to the local fertiliser market.

Extensive metallurgical testwork and process design was undertaken on the Project by the former owner, Vale, at scoping, prefeasibility and feasibility stages, included drilling and pitting programs totalling 152,000 m, variability batch testwork, full-scale pilot testwork and detailed engineering studies. A five-year, exhaustive, metallurgical testwork and pilot plant program demonstrated that a high degree of mined ore upgradeable using a simple beneficiation processes was possible. The resultant feed delivered 96% average leach extraction for nickel and cobalt via HPAL technology.

Additional testwork has been completed by the current Project owner, HZM, during 2018 and 2019. This testwork on selected samples from Vermelho validated the potential to produce high-grade sulphate products using the HPAL process.

The 6,000 plus samples totalling over 160t used for PFS and Final Feasibility Study (FFS) piloting were large diameter drill core and were representative (geographically, of depth, ore type and by lithology). Additionally, 10% of the samples (1 m from every 10 m) was used for variability testing so piloting and variability were related.

The processing plant consists of the following main process unit operations:

- Beneficiation

- HPAL

- Slurry neutralization and residue filtration

- MSP

- POX

- Impurity removal

- CoSX

- Nickel sulphate crystallization

- Cobalt sulphate crystallization

- Acid liquor neutralization

- Kieserite crystallization

- Sulphuric acid plant

- Reagents and utilities.

Financial Evaluation

Capital Cost

The estimate is based on the AACE class 4 standard, with an estimated accuracy range between -25% and +20% of the final project cost (excluding contingency).

The largest capital item is the HPAL plant. In order to manage initial capital, this is constructed in two phases. The first phase (Stage 1) has a capacity of 1 Mt/a autoclave feed. Stage 2 is brought online in year 3 of production and effectively doubles the HPAL feed rate to 2 Mt/a.

The capex estimate includes all the direct and indirect costs, local taxes and duties and appropriate contingencies for the facilities required to bring the Project into production, including the process plant, power line, water pipelines and associated infrastructure as defined by the PFS. The estimate is based on an Engineering Procurement and Construction Management (‘EPCM’) implementation approach and the is the contracting strategy expected to be utilised for the Project.

The total estimated initial (pre-production) capex for the project is US$652.2 million (after tax, including contingency, excluding growth and escalation). A summary of the capex is shown in Table 4.

Table 4: Summary of capex

| Capital cost component | Initial (US$ M) | Train 2 (year 3) (US$ M) | Remainder (US$ M) | LOM (US$ M) |

| Process plant | 575.06 | 446.68 | 1,022 | |

| Mining pre-production | 10.78 | - | 10.78 | |

| Tailings and sediment | 24.12 | - | 24.12 | |

| Pumping | 2.34 | - | 2.34 | |

| Powerline | 14.16 | - | 14.16 | |

| Road | 2.59 | - | 2.59 | |

| Permitting and land acquisition | 23.19 | - | 23.19 | |

| Mining sustaining | - | - | 21.58 | 21.58 |

| Other sustaining (including land permitting and land) | - | - | 1.33 | 1.33 |

| Closure | - | - | 29.37 | 29.37 |

| TOTAL | 652.24 | 446.68 | 52.28 | 1,151 |

The costs in Table 4 include all direct and indirect costs including owner costs, supply, shipping and site installation. The total contingency carried in the capex is US$97.7 million, this represents 18% of the initial capex (excluding contingency) and 25% of the plant direct costs.

Operational costs

The operating costs shown in Table 5 (below) represent the average over the LOM; actual costs for these vary from year-to-year depending on the fixed and variable costs as well as sustaining capital requirement for the given year. The operating costs cover the mine, process plant, ore preparation, social and environmental, royalties and general and administrative costs. The main contributors of the overall operating costs are power, sulphur, (for acid and power production) labour and mining costs, with additional consumables and other indirect costs, including G&A.

Table 5: Summary of opex

| Area | LOM total (US$ M) | US$/t nickel** | US$/t ore | Average annual (US$ M) |

| Mining | 981 | 1,062 | 6.94 | 25.81 |

| Rejects and tails handling | 414 | 448 | 2.93 | 10.89 |

| Processing costs | 5,785 | 6,261 | 40.93 | 152.23 |

| Royalties (CFEM) | 23 | 25 | 0.16 | 0.60 |

| Royalty (Vale) | 66 | 72 | 0.47 | 1.74 |

| G&A and other costs | 215 | 233 | 1.52 | 5.67 |

| SHE | 24 | 26 | 0.17 | 0.63 |

| TOTAL | 7,508 | 8,126 | 53.13 | 197.57 |

Note: ** US$2,000/t premium for battery sulphate production has been added to Nickel revenue, US$34,000/t for the cobalt produced as cobalt sulphate, and a net revenue of US$100/t of the by-product, kieserite.

Summary Economics

The financial model based on 100% equity. The Base Case was developed using a flat nickel price of US$16,400/t Ni for LOM. The second case was prepared; using the Wood Mackenzie long term price of US$19,800/t Ni.

The revenue breakdown by product is shown in Table 1.

Table 1 LOM Revenue by product

| Revenue by product | LOM Revenue (US $M)** | % of total | |

| Ni Sulphate | 17,001 | 89 | % |

| Co Sulphate | 1,585 | 8 | % |

| Kieserite | 448 | 2 | % |

| 19,034 | 100 | % | |

Note: ** A US$2,000/t Ni premium for battery sulphate production has been added to Nickel revenue, US$34,000/t for the cobalt produced as cobalt sulphate, and a net revenue of US$100/t of the by-product, kieserite

As shown in Table 1, the post taxation model for the Base Case has a 4.6-year payback period with cumulative gross revenues of US$19,034 million. The economic analysis indicates a post-tax NPV of US$1,722million and an IRR of 26.3% using the Base Case of US$16,400/t Ni. These figures increase to US$2,373 million and 31.5% when using the Wood Mackenzie long term price of US$19,800/t Ni. Table 7 shows the pre-taxation results.

Table 7: Project economic performance (pre-taxation)

| Item | Unit | Nickel price basis (US$/t Ni)** | |||

| Base Case (consensus) 16,400 | WM Long Term 19,800 | ||||

| Net cash flow | US$ million | 10,379 | 13,509 | ||

| NPV8 | US$ million | 2,342 | 3,185 | ||

| IRR | % | 28.8 | % | 34.5 | % |

| Breakeven (NPV8) Ni price | US$/t | 6,946 | 6,946 | ||

| C1 Cost (Brooke Hunt) | US$/t | 8,029 | 8,029 | ||

| Production year payback | Years | 4.0 | 3.5 | ||

| Cash costs | US$ million | 7,508 | 7,520 | ||

| Operating cash flow | US$ million | 11,526 | 14,655 | ||

Note: ** US$2,000/t premium for battery sulphate production has been added to Nickel revenue, US$34,000/t for the cobalt produced as cobalt sulphate, and a net revenue of US$100/t of the by-product, kieserite.

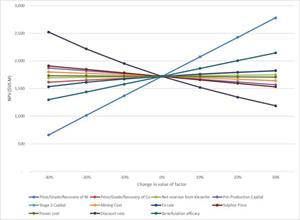

Sensitivity Analysis

The sensitivity analysis demonstrates how the NPV8 is affected by changes to one variable while holding the other variables constant. The results of the sensitivity analysis are presented in Table 8 and Figure 1.

Table 8: Sensitivity table for the Base Case (US$16,400/t) NPV8, after taxation

| Sensitivity parameter | -30 | % | -20 | % | -10 | % | 0 | % | 10 | % | 20 | % | 30 | % |

| Price/Grade/Recovery of Ni | 661 | 1,016 | 1,369 | 1,722 | 2,074 | 2,427 | 2,779 | |||||||

| Price/Grade/Recovery of Co | 1,617 | 1,652 | 1,687 | 1,722 | 1,757 | 1,792 | 1,827 | |||||||

| Net revenue from Kieserite | 1,693 | 1,703 | 1,712 | 1,722 | 1,731 | 1,741 | 1,751 | |||||||

| Pre-Production Capital | 1,873 | 1,823 | 1,772 | 1,722 | 1,671 | 1,621 | 1,570 | |||||||

| Stage 2 Capital | 1,802 | 1,775 | 1,749 | 1,722 | 1,695 | 1,668 | 1,642 | |||||||

| Mining Cost | 1,799 | 1,773 | 1,748 | 1,722 | 1,696 | 1,670 | 1,645 | |||||||

| Fx rate | 1,535 | 1,613 | 1,674 | 1,722 | 1,761 | 1,794 | 1,821 | |||||||

| Sulphur Price | 1,911 | 1,848 | 1,785 | 1,722 | 1,659 | 1,596 | 1,532 | |||||||

| Power cost | 1,735 | 1,730 | 1,726 | 1,722 | 1,718 | 1,713 | 1,709 | |||||||

| Discount rate | 2,523 | 2,217 | 1,952 | 1,722 | 1,521 | 1,345 | 1,189 | |||||||

| Beneficiation efficacy | 1,298 | 1,439 | 1,581 | 1,722 | 1,863 | 2,004 | 2,146 |

A photo accompanying this announcement is available at https://www.globenewswire.com/NewsRoom/AttachmentNg/f43a4e14-2ddf-4fce-bf92-99c07be12258

The sensitivity analysis shows that the Project is more sensitive to nickel price, nickel recovery and grade than it is to either opex or capex.

Section 5 – Market Review and Nickel Pricing

In June 2019, HZM commissioned Wood Mackenzie to develop a report on the market for nickel sulphate. As consequence of that report the following assumptions with respect to commodity pricing were used in the PFS.

- The consensus nickel price of US$16,400/t (US$7.44/lb) was used in the Base Case for the PFS along with a US$2,000/t (US$0.91/lb) nickel sulphate product premium. The nickel sulphate premium is driven by the battery market (where nickel sulphate is valued higher than class 1 nickel) and is supported by very strong growth in the EV car market. The US$2,000/t (US$0.91/lb) sulphate premium is the average value realised in the market over the last 12 months. The Wood Mackenzie long-term price currently stands at approximately US$19,800/t (US$8.98/lb); this was used as an alternative case for the PFS. A fixed price for nickel was applied over the LOM. The Qualified Person has reviewed the above and consider that the results support the assumptions in this Technical Report.

- The cobalt price assumption of US$34,000/t (US$15.43/lb) used in this study is significantly below the long-term consensus bank/broker forecasts which stand at US$55,000/t (US$25/lb).

Kieserite

In July 2019, HZM commissioned a report on the market for kieserite in Brazil from Dr Fabio Vale (Director Técnico/Technical Manager) of Adubai Consultoria Agronômica (Adubai).

The study concludes that:

The fertilizer market in Brazil is large. In 2018, 35.6 Mt of fertilizer was sold, of this 77.5% was imported and 22.5% was manufactured locally. The most likely consumers of the kieserite produced at the Project are the palm oil growers in Pará state, as palm oil trees have a very high demand for both magnesium and sulphur, although it has been demonstrated that coffee and cotton would also benefit from kieserite. The location of the Vermelho plant in the centre of the Pará state gives its distribution a competitive advantage over the imported product. The Project will produce approximately 150,000 t of kieserite a year, which is 10 times the current market for imported kieserite. This means there would be oversupply which would be expected to dictate a lower realised price then the current market, and substitution of other agro-products would be required for all Project kieserite to be consumed in the local market. This suggest that it would be unlikely for current prices (approximately US$380/t FOB Barcarena) to be realised. For the study, HZM has assumed a kieserite price of US$180/t (delivered) – about half of the current price in Barcarena. The study assumes a cost of US$80/t for delivery and marketing of Keiserite.

Community, Environment and Permitting

The Project is located 3km from the town of Canaã dos Carajás, founded in 1994, which forms the southern limit of the Carajás Mining District (CMD) Pará state, north of Brazil. The CMD is host to a number of tier 1 iron, nickel and copper mines operated by Vale.

Mining and related industries in the CMD play a vital role in the socio-economic fabric of the region, with the municipality presenting considerable per capita income, the second highest of the Pará state.

In 2004, Vale started to operate the Sossego Copper Mine after several infrastructure municipality improvements, and most recently (2017) ramped-up the S11D project, one of the largest standalone iron operations in the world. As a result of the advances of mining in the region, there has been a significant influx of people and investment, which has in turn promoted changes and improvements in the areas of economic growth, cultural diversity and a more developed economy than nearby towns, heavily centered around mining related activities.

Key environmental studies for the advancement of project licensing stages were completed by Vale. HZM will utilize the studies and baseline data collected by previous owners to inform and expedite new EIA RIMA studies.

The following mining and environmental permits were granted to Vale by the end of 2016:

- EIA/RIMA studies (Environmental Impact Study (‘EIS’) and Environmental Impact Report (‘EIR’)) issued

- Award of Preliminary Licence (‘LP’)

- Environmental Controls Plan issued

- Application for Installation Licence (‘LI’)

- Final Exploration Report approved

- Mine Plan (Plano de Aproveitamento Economico – PAE) approved

Whilst a new permit pathway is proposed, the previously awarded permits for Vermelho provide a solid basis from which to progress the project permitting.

HZM will utilize the Vale studies and baseline data collected to inform and expedite new EIA RIMA studies. As HZM will recommence the licensing for Vermelho, the Company will both update studies and undertake new studies to accurately characterize the current physical environment, biological environment and social settings.

Next Steps

The PFS demonstrates that the Project is technically, economically viable, and is expected to obtain all the regulatory and permitting requirements. Consequently, the Project should progress to a Feasibility Stage.

Report Filing

A technical report on this PFS, prepared in accordance with the NI 43-101 reporting requirements, will be filed on SEDAR at www.sedar.com and at www.horizonteminerals.com within forty-five (45) days of the date of this news release.

Qualified Persons

Mr Anthony Finch, P Eng. (APEGBC), B.Eng, B Econ, MAusIMM (CP Mining), Independent Consultant;

Mr Andrew Ross, BSc (Hons), MSc, FAusIMM, Principal Consultant, Snowden Mining Industry Consultants Pty Ltd;

Simon Walsh, BSc (Extractive Metallurgy and Chemistry), MBA, MAusIMM (CP), GAICD, Principal Metallurgist, Simulus (Engineers & Laboratories) Pty ltd;

are the Qualified Persons under NI 43-101, and have reviewed, approved and verified the technical content of this press release, related to their area of expertise.

For further information visit www.horizonteminerals.com or contact:

| Horizonte Minerals plc | |

| Jeremy Martin (CEO) | +44 (0) 203 356 2901 |

| Numis Securities Ltd (NOMAD & Joint Broker) | |

| John Prior Paul Gillam | +44 (0) 207 260 1000 |

| Shard Capital (Joint Broker) | |

| Damon Heath Erik Woolgar | +44 (0) 20 186 9952 |

| Tavistock (Financial PR) | |

| Gareth Tredway Annabel de Morgan | +44 (0) 207 920 3150 |

About Horizonte Minerals:

Horizonte Minerals plc is an AIM and TSX-listed nickel development company focused in Brazil. The Company is developing the Araguaia project, as the next major ferronickel mine in Brazil, and the Vermelho nickel-cobalt project, with the aim of being able to supply nickel and cobalt to the EV battery market. Both projects are 100% owned.

Horizonte shareholders include: Teck Resources Limited, Canaccord Genuity Group, JP Morgan, Lombard Odier Asset Management (Europe) Limited, City Financial, Richard Griffiths and Glencore.

Glossary of technical terms

| AACE | Association for the Advancement of Cost Engineering |

| AACE Class 4 | +-20% +25% accuracy |

| C1 | C1 cash cost as defined by Brook Hunt |

| Capex | Capital cost |

| Co | Cobalt |

| Cut-off grade | Lowest grade of mineralisation material considered economic, used in the calculation of ore resources |

| Dilution | Waste or low-grade material accidentally mined with the ore |

| EPC | Engineering Procurement and Construction |

| EPCM | Engineering Procurement and Construction Management |

| EV | Electric Vehicles |

| Fe | Iron |

| FeNi30 | Ferronickel with 30% Nickel and 70% Iron |

| Ferronickel or FeNi | An alloy that contains approximately 30% nickel and 70% iron and is the produced by the project as an ingot |

| HZM, Horizonte or the Company | Horizonte Minerals plc |

| IFC | International Finance Corporation |

| IRR | Internal Rate of Return |

| Kt | Thousand Tonnes (metric) |

| LME | London Metal Exchange |

| LOM | Life of mine |

| Loss | Ore that is unintentionally left behind or mined as waste |

| MgO | Magnesium Oxide |

| MT | Million Tonnes (metric) |

| Ni | Nickel |

| NPV8 | Net present value at an 8% discount rate |

| Opex | Operating cost |

| Ore | A naturally occurring solid material from which a metal or valuable mineral can be extracted profitably |

| PEA | Preliminary Economic Assessment |

| Reverse Circulation Drilling | A rock drilling system that circulates drill cuttings through the centre of the drill rod so that they can be collected and assayed without contamination |

| RKEF | Rotating Kiln Electric Furnace is the process by which nickel laterite ore is reduced and then melted in so that metal is separated from the slag to produce ferronickel |

| ROM | Run of mine stockpile |

| Shotted | Formation of small pellets from molten material |

| SiO2 | Silicon Dioxide |

| Tpa | Tonnes (metric) per annum |

| US$ | United States Dollar |

| WM | Wood Mackenzie |

| Mineral Reserves | Mineral Reserves are sub-divided into 2 categories. The highest level of Reserves or the level with the most confidence is the `Proven' category and the lower level of confidence of the Reserves is the `Probable' category. Reserves are distinguished from resources as all of the technical and economic parameters have been applied and the estimated grade and tonnage of the resources should closely approximate the actual results of mining. The guidelines state "Mineral Reserves are inclusive of the diluting material that will be mined in conjunction with the Mineral Reserve and delivered to the treatment plant or equivalent facility." The guidelines also state that, "The term `Mineral Reserve' need not necessarily signify that extraction facilities are in place or operative or that all government approvals have been received. It does signify that there are reasonable expectations of such approvals. |

| Proven Mineral Reserves | A `Proven Mineral Reserve' is the economically mineable part of a Measured Mineral Resource demonstrated by at least a Preliminary Feasibility Study. This study must include adequate information on mining, processing, metallurgical, economic, and other relevant factors that demonstrate, at the time of reporting, that economic extraction is justified. |

| Probable Mineral Reserves | A `Probable Mineral Reserve' is the economically mineable part of an Indicated and in some circumstances a Measured Mineral Resource demonstrated by a least a Preliminary Feasibility Study. This study must include adequate information on mining, processing, metallurgical, economic, and other relevant factors that demonstrate, at the time of reporting, that economic extraction can be justified. |

| Mineral Resources | Mineral Resources are sub-divided into 3 categories depending on the geological confidence. The highest level with the most confidence is the `Measured' category. The next level of confidence is the `Indicated' category and the lowest level, or the resource with the least confidence, is the `Inferred' category. |

| Indicated Mineral Resource | An `Indicated Mineral Resource' is that part of a Mineral Resource for which quantity, grade or quality, densities, shape and physical characteristics, can be estimated with a level of confidence sufficient to allow the appropriate application of technical and economic parameters, to support mine planning and evaluation of the economic viability of the deposit. The estimate is based on detailed and reliable exploration and testing information gathered through appropriate techniques from locations such as outcrops, trenches, pits, workings and drill holes that are spaced closely enough for geological and grade continuity to be reasonably assumed. |

| Measured Mineral Resource | A `Measured Mineral Resource' is that part of a Mineral resource for which quantity, grade or quality, densities, shape and physical characteristics are so well established that they can be estimated with confidence sufficient to allow the appropriate application of technical and economic parameters, to support production planning and evaluation of the economic viability of the deposit. The estimate is based on detailed and reliable exploration, sampling and testing information gathered through appropriate techniques from locations such as outcrops, trenches, pits, workings and drill holes that are spaced closely enough to confirm both geological and grade continuity. |

| Inferred Mineral Resource | An `Inferred Mineral Resource' is that part of a Mineral Resource for which quantity and grade or quality can be estimated on the basis of geological evidence and limited sampling and reasonably assumed, but not verified, geological and grade continuity. The estimate is based on limited information and sampling, gathered through appropriate techniques from locations such as outcrops, trenches, pits, workings and drill holes. |

CAUTIONARY STATEMENT REGARDING FORWARD LOOKING INFORMATION

Except for statements of historical fact relating to the Company, certain information contained in this press release constitutes "forward-looking information" under Canadian securities legislation. Forward-looking information includes, but is not limited to, statements with respect to the potential of the Company's current or future property mineral projects; the success of exploration and mining activities; cost and timing of future exploration, production and development; the estimation of mineral resources and reserves and the ability of the Company to achieve its goals in respect of growing its mineral resources; the ability of the Company to obtain the required capital to construct and operated the Company’s projects and the realization of mineral resource and reserve estimates. Generally, forward-looking information can be identified by the use of forward-looking terminology such as "plans", "expects" or "does not expect", "is expected", "budget", "scheduled", "estimates", "forecasts", "intends", "anticipates" or "does not anticipate", or "believes", or variations of such words and phrases or statements that certain actions, events or results "may", "could", "would", "might" or "will be taken", "occur" or "be achieved". Forward-looking information is based on the reasonable assumptions, estimates, analysis and opinions of management made in light of its experience and its perception of trends, current conditions and expected developments, as well as other factors that management believes to be relevant and reasonable in the circumstances at the date that such statements are made, and are inherently subject to known and unknown risks, uncertainties and other factors that may cause the actual results, level of activity, performance or achievements of the Company to be materially different from those expressed or implied by such forward-looking information, including but not limited to risks related to: exploration and mining risks, competition from competitors with greater capital; the Company's lack of experience with respect to development-stage mining operations; fluctuations in metal prices; uninsured risks; environmental and other regulatory requirements; exploration, mining and other licences; the Company's future payment obligations; potential disputes with respect to the Company's title to, and the area of, its mining concessions; the Company's dependence on its ability to obtain sufficient financing in the future; the Company's dependence on its relationships with third parties; the Company's joint ventures; the potential of currency fluctuations and political or economic instability in countries in which the Company operates; currency exchange fluctuations; the Company's ability to manage its growth effectively; the trading market for the ordinary shares of the Company; uncertainty with respect to the Company's plans to continue to develop its operations and new projects; the Company's dependence on key personnel; possible conflicts of interest of directors and officers of the Company and various risks associated with the legal and regulatory framework within which the Company operates. Although management of the Company has attempted to identify important factors that could cause actual results to differ materially from those contained in forward-looking information, there may be other factors that cause results not to be as anticipated, estimated or intended. There can be no assurance that such statements will prove to be accurate, as actual results and future events could differ materially from those anticipated in such statements.