Hudbay Announces Increased Lalor Mineral Reserves and Resources and Updated Mine Plan that Confirms Substantial Increase in Gold Production

TORONTO, Feb. 19, 2019 (GLOBE NEWSWIRE) -- Hudbay Minerals Inc. (“Hudbay” or the “company”) (TSX, NYSE:HBM) is pleased to announce increased mineral reserves and resources for its Lalor mine and nearby satellite deposits, and a new mine plan that includes the processing of gold and copper-gold ore at the company’s New Britannia mill. An updated National Instrument (“NI”) 43-101 Technical Report for Lalor will be filed on SEDAR by the end of the first quarter of 2019. All amounts are in U.S. dollars, unless otherwise noted.

|

|||||

Summary

- Lalor annual gold production set to more than double from current levels once the New Britannia mill is refurbished with average annual production of approximately 140,000 ounces during the first five years at a sustaining cash cost, net of by-product credits, of $450 per ounce1, positioning Lalor as one of the lowest-cost gold mines in Canada

- Gold recoveries are estimated to increase to 93% at the New Britannia mill compared to 53% at the Stall mill

- Lalor’s reserve update increased in-situ contained gold by 65%, copper by 23%, zinc by 11% and silver by 15%2

- Drilling defined higher quality gold zone reserve estimates with increased gold grades

- The capital cost required to refurbish the New Britannia mill is estimated at $95 million – a low capital-intensity, low-risk brownfield expansion

- Lalor’s life-of-mine production increased gold by 91%, copper by 16%, zinc by 13% and silver by 21%3

- Current reserve life of 10 years could be extended with successful conversion of additional mineral resources at Lalor and additional resources at Hudbay’s satellite deposits in the Snow Lake region within trucking distance of Stall and New Britannia

- Hudbay’s extensive land package in the Chisel Basin and around Snow Lake provides significant additional upside for further gold and base metals exploration

“We are pleased to demonstrate the significant value we have unlocked so far by leveraging our exploration expertise, our existing processing infrastructure and several inexpensive acquisitions to develop a compelling strategy to maximize the value of our gold mineralization at Lalor and nearby deposits,” said Alan Hair, Hudbay’s president and chief executive officer. “With our extensive experience operating responsibly in Manitoba, we look forward to delivering on this strategy over the next several years by refurbishing the New Britannia mill, substantially increasing our gold production at low cash costs and realizing additional value through continued exploration success.”

Overview

Lalor was discovered in 2007 on 100% owned land using Hudbay’s innovative exploration techniques and it is the largest VMS deposit found in the Snow Lake region to-date. In 2009, the company commenced construction of Lalor with initial ramp access from the Chisel North mine. Construction of the main production shaft was approved in 2010 and was completed on time and on budget, achieving commercial production in 2014, a mere seven years from initial discovery. Hudbay acquired the New Britannia gold mill in 2015 for approximately $10 million as a potential long-term processing option for the Lalor gold and copper-gold zones. Since acquiring New Britannia, Hudbay has conducted significant technical work to assess the grade, tonnage, mineability and metallurgy of the gold and copper-gold zones at Lalor to support and de-risk the investment required to refurbish New Britannia and maximize the net present value of Lalor.

Most recently, Hudbay has focused on drilling and test mining in the gold-rich Lens 25, and has confirmed the existence of a continuous high grade core of mineralization within the wider lower grade mineral resource estimates reported in the NI 43-101 technical report for Lalor dated March 31, 2017 (the “2017 Technical Report”) and most recently updated in Hudbay’s annual information form dated March 29, 2018 (the “2018 AIF”). In parallel, Hudbay has revised its geological model of the copper-gold rich Lens 27, which better reflects the steeper orientation of the mineralization observed during core logging. This re-interpretation indicates there is a simpler and more consistent mineralized envelope and, together with additional drilling conducted in 2018, has resulted in an increase in tonnage of this high grade mineralization.

Refurbishing New Britannia is expected to significantly increase gold production from Lalor and enable new gold and copper-gold exploration opportunities in the Snow Lake region by having an operating processing facility with substantially higher gold and copper recoveries. New Britannia was placed on care and maintenance in 2005 by its previous owner after producing 1.6 million ounces of gold and it demonstrates the opportunity to create additional value through owning multiple processing facilities in the Flin Flon and Snow Lake regions as Hudbay pursues low-risk brownfield development opportunities.

Based on the detailed work completed in the last 12 months, Hudbay believes that the refurbishment of the New Britannia mill, including the addition of a copper flotation circuit, is the optimal processing solution for Lalor, as it capitalizes on existing infrastructure, significantly grows gold production from a deposit that is unencumbered by any royalties or streams and offers further upside potential from nearby satellite deposits.

The New Britannia development plan contemplates completion of detailed engineering by February 2020, environmental permitting completion in April 2020 and construction activities occurring between June 2020 and August 2021, with plant commissioning and ramp-up occurring during the fourth quarter of 2021. The estimated capital expenditures and the schedules for completion and plant ramp-up are deemed to be low risk since this project involves industry standard equipment and proven processing technology in a brownfield environment. Permitting activities started in 2018 and are proceeding in line with the development plan.

The revised mine plan for Lalor supports a 10 year mine life, based solely on proven and probable reserves, and utilizes the existing mining capacity of 4,500 tonnes per day at Lalor for the first six years of the mine plan. The technical work completed supports 4,500 tonnes per day as the optimal mining rate to maximize net present value, although the Lalor production shaft has the potential to hoist at higher throughput rates. The production plan has the copper-gold rich ore feeding a refurbished New Britannia mill starting in 2022 at an average feed rate of 1,100 tonnes per day at 6.7 g/t gold and 1.2% copper for seven years based on the current reserve estimate. The New Britannia mill is expected to achieve gold recoveries of approximately 93% compared to current gold recoveries of approximately 53% at the Stall mill. An estimated investment of $95 million (C$124 million) will be required between 2019 and 2021 for the refurbishment of the New Britannia mill, including the addition of a copper flotation and dewatering circuit and a pipeline to direct the tailings to the existing Anderson facility. Of this, approximately $10 million is expected to be incurred in 2019 as part of Hudbay’s growth capital expenditure plans.

Between 2019 and 2021, the Stall mill is expected to process approximately 3,500 tonnes per day and approximately 1,000 tonnes per day of Lalor base metal ore is expected to be transported to the Flin Flon mill for processing. Based on the current reserves, starting in 2022, Stall mill throughput will gradually decrease from approximately 3,200 tonnes per day to approximately 1,800 tonnes per day.

The updated resource model at Lalor includes 5.9 million tonnes of inferred mineral resources, which has the potential to extend the mine life beyond 10 years while feeding both the Stall and New Britannia mills (see Lalor Mineral Resource Estimates table below). In addition, the mineral resources at Hudbay’s satellite deposits in the Snow Lake region, including the copper-gold WIM deposit acquired last year for C$0.5 million from Alexandria Minerals Corporation, the former gold producing New Britannia mine and the zinc-rich Pen II deposit could provide feed for the Stall and New Britannia processing facilities and further extend the mine life (see “Regional Exploration Potential” section below).

Lalor Mineral Reserve and Resource Estimate

The updated estimate of mineral reserves at Lalor has increased in-situ contained gold by 65%, copper by 23%, zinc by 11% and silver by 15%, relative to the previous estimate of mineral reserves in Hudbay’s 2018 AIF, adjusted for 2018 production depletion.

| Lalor Mineral Reserve Estimates | Tonnes | Zn Grade (%) | Au Grade (g/t) | Cu Grade (%) | Ag Grade (g/t) | |

| Base Metal Zone | ||||||

| Proven | 5,137,000 | 7.13 | 2.37 | 0.76 | 26.31 | |

| Probable | 5,552,000 | 4.19 | 3.52 | 0.44 | 27.39 | |

| Gold Zone | ||||||

| Proven | 58,000 | 2.65 | 5.46 | 0.80 | 39.09 | |

| Probable | 2,928,000 | 0.31 | 6.74 | 1.09 | 23.08 | |

| Total proven and probable | 13,675,000 | 4.46 | 3.78 | 0.70 | 26.11 | |

Note:

- Totals may not add up correctly due to rounding.

- Mineral reserves are estimated as of January 1, 2019.

- Mineral reserves are estimated at a minimum NSR cut-off of C$96.19 per tonne for waste filled mining areas and a minimum of C$104.58 per tonne for paste filled mining areas.

- Estimates are based on the following metals price and foreign exchange rate assumptions: zinc price of $1.17 per pound (includes premium), copper price of $3.10 per pound, gold price of $1,260 per ounce and silver price of $18.00 per ounce, and an exchange rate of 1.25 C$/US$.

- For further information regarding data verification, quality assurance / quality control and risks associated with the estimate of the mineral reserves at the Lalor mine, please refer to the 2018 AIF.

Hudbay is implementing a more stringent approach to resource reporting for underground deposits. With this approach, the potential for economic extraction of the mineral resource estimates at Lalor are reported within the constraint of a ‘stope optimization envelope’ process similar in concept to a Lerchs-Grossman pit shell for an open pit deposit. This excludes from the resource estimate small individual resource blocks that may meet an economic cut-off criteria on an individual basis but could not be aggregated into mineable shapes.

There are no measured or indicated resources reported for Lalor in 2019. The measured and indicated resources reported in the 2018 AIF have all been converted to mineral reserve estimates or deemed uneconomic.

The updated estimate of inferred mineral resources at Lalor has increased the in-situ contained gold by 21%, copper by 51%, and silver by 21% while zinc has decreased by 17%, relative to the 2018 AIF.

| Lalor Mineral Resource Estimates (Exclusive of Mineral Reserves) | Tonnes | Zn Grade (%) | Au Grade (g/t) | Cu Grade (%) | Ag Grade (g/t) | |

| Base Metal Zone | ||||||

| Inferred | 1,385,000 | 2.30 | 4.49 | 0.70 | 43.58 | |

| Gold Zone | ||||||

| Inferred | 4,516,000 | 0.35 | 4.38 | 1.08 | 20.42 | |

| Total inferred | 5,901,000 | 0.81 | 4.41 | 0.99 | 25.85 | |

Note:

- Totals may not add up correctly due to rounding.

- Mineral resources are estimated as of January 1, 2019.

- Mineral resources are estimated at a minimum NSR cut-off of C$96.19 per tonne.

- Estimates are based on the following metals price and foreign exchange rate assumptions: zinc price of $1.17 per pound (includes premium), copper price of $3.10 per pound, gold price of $1,260 per ounce and silver price of $18.00 per ounce, and an exchange rate of 1.25 C$/US$.

- Mineral resources do not include mining dilution or recovery factors.

- Mineral resources that are not mineral reserves do not have demonstrated economic viability.

- For further information regarding data verification, quality assurance / quality control and risks associated with the estimate of the mineral resources at the Lalor mine, please refer to the 2018 AIF.

Mine Plan

The revised mine plan for Lalor mineral reserves optimizes net present value by preserving gold-rich ore for processing at the New Britannia mill and zinc-rich ore for the Stall mill, which is expected to result in significantly higher gold and copper recoveries. Life-of-mine production of gold, copper, zinc, and silver has increased by 91%, 16%, 13% and 21%, respectively, compared to the 2017 Technical Report for the period starting January 1, 2019.

| 2019 | 2020 | 2021 | 2022 | 2023 | 2024 | 2025 | 2026 | 2027 | 2028 | LOM | ||

| Base Metal Ore | ||||||||||||

| Ore Mined | tonnes (000s) | 1,589 | 1,481 | 1,559 | 1,135 | 1,251 | 1,144 | 894 | 612 | 667 | 512 | 10,844 |

| Ore Mined | tpd | 4,353 | 4,057 | 4,271 | 3,110 | 3,428 | 3,134 | 2,449 | 1,677 | 1,827 | 1,403 | - |

| Cu Grade | % Cu | 0.63% | 0.62% | 0.64% | 0.58% | 0.51% | 0.46% | 0.51% | 0.53% | 0.56% | 0.72% | 0.58% |

| Zn Grade | % Zn | 5.43% | 6.37% | 6.18% | 5.92% | 5.94% | 5.93% | 3.98% | 3.40% | 4.28% | 4.82% | 5.49% |

| Au Grade | g/t Au | 2.41 | 2.12 | 2.75 | 2.35 | 2.78 | 2.50 | 4.7 | 4.69 | 4.52 | 4.66 | 3.02 |

| Ag Grade | g/t Ag | 22.96 | 28.57 | 28.23 | 26.04 | 24.48 | 24.66 | 28.35 | 26.15 | 28.15 | 37.57 | 26.80 |

| Gold Ore | ||||||||||||

| Ore Mined | tonnes (000s) | - | - | - | 473 | 380 | 500 | 547 | 330 | 285 | 319 | 2,832 |

| Ore Mined | tpd | - | - | - | 1,295 | 1,041 | 1,370 | 1,499 | 904 | 781 | 874 | - |

| Cu Grade | % Cu | - | - | - | 0.94% | 1.43% | 2.21% | 1.29% | 0.31% | 0.39% | 0.92% | 1.17% |

| Zn Grade | % Zn | - | - | - | 0.35% | 0.41% | 0.33% | 0.20% | 0.30% | 0.30% | 1.86% | 0.48% |

| Au Grade | g/t Au | - | - | - | 6.99 | 6.64 | 5.97 | 6.22 | 6.74 | 8.10 | 7.14 | 6.72 |

| Ag Grade | g/t Ag | - | - | - | 25.04 | 22.40 | 22.81 | 19.23 | 19.90 | 29.86 | 28.82 | 23.48 |

| Total Ore | ||||||||||||

| Ore Mined | tonnes (000s) | 1,589 | 1,481 | 1,559 | 1,607 | 1,631 | 1,644 | 1,441 | 941 | 952 | 830 | 13,676 |

| Ore Mined | tpd | 4,353 | 4,057 | 4,271 | 4,403 | 4,468 | 4,504 | 3,948 | 2,579 | 2,608 | 2,274 | - |

| Cu Grade | % Cu | 0.63% | 0.62% | 0.64% | 0.68% | 0.72% | 0.99% | 0.81% | 0.45% | 0.51% | 0.79% | 0.70% |

| Zn Grade | % Zn | 5.43% | 6.37% | 6.18% | 4.28% | 4.65% | 4.23% | 2.54% | 2.31% | 3.09% | 3.69% | 4.46% |

| Au Grade | g/t Au | 2.41 | 2.12 | 2.75 | 3.71 | 3.68 | 3.56 | 5.28 | 5.41 | 5.59 | 5.61 | 3.78 |

| Ag Grade | g/t Ag | 22.96 | 28.57 | 28.23 | 25.75 | 24.00 | 24.10 | 24.89 | 23.96 | 28.66 | 34.21 | 26.11 |

Note: Tonnes per day (“tpd”) assumes 365 operating days a year.

Metallurgical Recoveries

| LOM Average | |

| Base Metal Ore Through Stall | |

| Recovery to Copper Concentrate | |

| Cu | 83.6% |

| Au | 52.9% |

| Ag | 53.3% |

| Recovery to Zinc Concentrate | |

| Zn | 93.2% |

| Base Metal Ore Through Flin Flon | |

| Recovery to Copper Concentrate | |

| Cu | 84.4% |

| Au | 63.2% |

| Ag | 53.7% |

| Recovery to Zinc Concentrate | |

| Zn | 87.0% |

| Gold Ore Through New Britannia | |

| Recovery to Copper Concentrate | |

| Cu | 93.9% |

| Au | 63.1% |

| Ag | 55.1% |

| Recovery to Doré | |

| Au | 30.2% |

| Ag | 22.8% |

| Overall Precious Metals Recovery | |

| Au | 93.3% |

| Ag | 77.8% |

Production Profile

Compared with the 2017 Technical Report life-of-mine plan, with the inclusion of the New Britannia mill, net revenue at Lalor has shifted from primarily zinc to primarily gold in the updated production profile, positioning Lalor as a primary gold mine with significant zinc, copper and silver by-products. The life-of-mine net revenue from Lalor is approximately 50% precious metals, 33% zinc and 17% copper4. Once the New Britannia mill is operational in 2022, revenue from precious metals through the remaining life-of-mine is expected to be approximately 60% of total revenue. Significant zinc and copper revenue provides diversified commodity exposure.

| Contained Metal | 2019 | 2020 | 2021 | 2022 | 2023 | 2024 | 2025 | 2026 | 2027 | 2028 | LOM | |

| Cu | tonnes (000s) | 8 | 8 | 9 | 10 | 10 | 15 | 11 | 4 | 4 | 6 | 83 |

| Zn | tonnes (000s) | 79 | 88 | 89 | 63 | 70 | 64 | 32 | 18 | 26 | 23 | 552 |

| Au | ounces (000s) | 69 | 58 | 75 | 143 | 137 | 138 | 172 | 114 | 119 | 108 | 1,134 |

| Ag | ounces (000s) | 651 | 692 | 725 | 781 | 742 | 764 | 749 | 478 | 547 | 513 | 6,644 |

Note: Production includes metal contained in concentrate and doré.

Unit Operating Costs and Cash Costs

| Unit Operating Costs | LOM Average | |

| Mining | C$/tonne | $92.04 |

| Milling – Stall | C$/tonne | $25.72 |

| Milling – New Britannia | C$/tonne | $41.63 |

Note:

- Unit operating costs exclude general and administrative costs related to shared services incurred in Flin Flon and allocated between 777 and Lalor mines.

- Mining costs include costs to truck approximately 1,000 tonnes per day from Lalor to Flin Flon until New Britannia is operating in 2022.

Lalor’s significant by-product credits reduce its cash operating costs and sustaining cash costs on both a zinc and gold basis. During the first five years of operation with New Britannia (2022 to 2026), Lalor is estimated to produce approximately 140,000 ounces of gold annually at a sustaining cash cost, net of by-product credits, of $450/oz. This positions Lalor to be one of the lowest cost gold mines in Canada.

| Cash Costs | 2019 | 2020 | 2021 | 2022 | 2023 | 2024 | 2025 | 2026 | 2027 | 2028 | LOM | |

| Zinc Basis | ||||||||||||

| Contained zinc | tonnes (000s) | 79 | 88 | 89 | 63 | 70 | 64 | 32 | 18 | 26 | 23 | 552 |

| Cash costs | US$/lb | $0.61 | $0.73 | $0.55 | ($0.05) | $0.03 | ($0.18) | ($1.21) | ($0.87) | ($0.68) | ($1.08) | $0.09 |

| Sustaining cash costs | US$/lb | $1.04 | $1.14 | $0.78 | $0.26 | $0.22 | ($0.04) | ($0.95) | ($0.77) | ($0.67) | ($1.07) | $0.35 |

| Gold Basis | ||||||||||||

| Contained gold | ounces (000s) | 69 | 58 | 75 | 143 | 137 | 138 | 172 | 114 | 119 | 108 | 1,134 |

| Cash costs | US$/oz | ($672) | ($308) | $35 | $268 | $211 | $85 | $333 | $581 | $448 | $278 | $198 |

| Sustaining cash costs | US$/oz | $400 | $1,051 | $616 | $571 | $416 | $229 | $442 | $618 | $456 | $279 | $473 |

Note:

- ”LOM” refers to life-of-mine.

- Cash costs include all onsite (mining, milling and general and administrative) and offsite costs associated with Lalor and are reported net of by-product credits. By-product credits calculated using the following assumptions: zinc price of $1.28 per pound in 2019, $1.27 per pound in 2020, $1.17 per pound 2021 and long-term (includes premium); gold price of $1,250 per ounce in 2019, $1,300 per ounce in 2020 and 2021, $1,250 per ounce in 2022 and long-term; copper price of $3.00 per pound in 2019, $3.10 per pound in 2020, $3.20 per pound in 2021 and 2022, and $3.10 per pound long-term; silver price of $16.50 per ounce in 2019, $18.00 per ounce in 2020 and long-term; C$/US$ exchange rate of 1.30 in 2019 and 1.25 in 2020 and long-term.

- Sustaining cash costs incorporate all costs included in cash costs calculation plus sustaining capital expenditures.

Capital Expenditures

The growth capital estimate at New Britannia was engineered to a pre-feasibility level by Aecom and includes a 20% contingency. The scope of the project includes the addition of a new flotation building, new crushers, screen deck, flotation circuit, thickener for the copper concentrate, filter press, acid wash vessel, reagent packages, lime silo, instrumentation systems, transformers and an emergency generator. In addition, two new pipelines will flow thickened tailings from New Britannia to Stall while reclaim water and copper concentrate will flow from Stall to New Britannia. This arrangement will facilitate environmental monitoring, make use of the paste plant efficiently and reduce the moisture content of the copper concentrate produced at Hudbay’s Snow Lake operations.

The development plan contemplates detailed engineering being completed by February 2020 and environmental permitting being completed in April 2020 with construction activities occurring between June 2020 and August 2021 and plant commissioning and ramp-up occurring during the fourth quarter of 2021.

The estimated capital expenditures and the schedules for completion and plant ramp-up are deemed to be low risk since this project involves industry standard equipment and proven processing technology in a brownfield environment. Permitting activities started in 2018 and are proceeding in line with the development plan.

Of the $95 million growth capital estimate, approximately $10 million is expected to be incurred in 2019 as part of Hudbay’s growth capital expenditures budget.

The total sustaining capital and growth capital expenditures are shown below.

| Capital Expenditures | 2019 | 2020 | 2021 | 2022 | 2023 | 2024 | 2025 | 2026 | 2027 | 2028 | LOM | |

| Sustaining Capital | ||||||||||||

| Capitalized development | C$ millions | $64 | $57 | $44 | $33 | $20 | $12 | $9 | $5 | $1 | - | $246 |

| Mine equipment and buildings | C$ millions | $9 | $35 | $10 | $11 | $14 | $8 | $14 | - | - | - | $102 |

| Stall equipment and buildings | C$ millions | $4 | $3 | $1 | $1 | $1 | $1 | - | - | - | - | $11 |

| Shared general plant | C$ millions | $11 | $3 | - | - | - | - | - | - | - | - | $14 |

| Environmental | C$ millions | $8 | - | - | $8 | - | $4 | - | - | - | - | $21 |

| Total sustaining capital | C$ millions | $97 | $98 | $55 | $54 | $35 | $25 | $23 | $5 | $1 | - | $394 |

| Total sustaining capital | US$ millions | $74 | $76 | $42 | $42 | $27 | $19 | $18 | $4 | $1 | - | $303 |

| Growth Capital | ||||||||||||

| New Britannia capital | C$ millions | $13 | $69 | $42 | - | - | - | - | - | - | - | $124 |

| New Britannia capital | US$ millions | $10 | $53 | $32 | - | - | - | - | - | - | - | $95 |

Note: Totals may not add up correctly due to rounding. ”LOM” refers to life-of-mine. Canadian dollar capital expenditures converted to U.S. dollar capital expenditures at an exchange rate of 1.30 C$/US$.

Regional Exploration Potential

Hudbay has identified several satellite deposits in the Snow Lake region that could provide additional feed for both New Britannia and Stall.

| Regional Deposits Mineral Resource Estimates | Tonnes (million) | Zn Grade (%) | Au Grade (g/t) | Cu Grade (%) | Ag Grade (g/t) | |

| Indicated Resources (Exclusive of Mineral Reserves) | ||||||

| WIM | 3.9 | 0.26 | 1.57 | 1.71 | 6.68 | |

| Pen II | 0.5 | 8.89 | 0.35 | 0.49 | 6.81 | |

| Total indicated | 4.4 | 1.19 | 1.44 | 1.58 | 6.69 | |

| Inferred Resources | ||||||

| Lalor base metal zone | 1.4 | 2.30 | 4.49 | 0.70 | 43.58 | |

| Lalor copper-gold zone | 4.5 | 0.35 | 4.38 | 1.08 | 20.42 | |

| WIM | 0.7 | 0.37 | 1.76 | 1.03 | 4.65 | |

| Pen II | 0.1 | 9.81 | 0.30 | 0.37 | 6.85 | |

| Birch & 3 Zone | 1.7 | - | 5.34 | - | - | |

| New Britannia | 2.8 | - | 4.51 | - | - | |

| Total New Britannia zones | 4.4 | - | 4.82 | - | - | |

| Total inferred | 11.2 | 0.57 | 4.35 | 0.59 | 14.01 | |

Note:

- Totals may not add up correctly due to rounding.

- Mineral resources that are not mineral reserves do not have demonstrated economic viability.

- Mineral resources in the above tables do not include mining dilution or recovery factors.

- For further information regarding the mineral resource estimate for the Lalor mine, please refer to the Lalor Mineral Resource Estimates table above.

- WIM mineral resources reported based on a 1.3 CuEq% cut-off for the underground portion, and a 0.5% cut-off for the open pit portion, assuming processing recoveries of 90% for copper and zinc and 70% for gold and silver, and using long-term prices of $3.00 per pound copper, $1,200 per ounce gold, $1.00 per pound zinc and $15.00 per ounce silver. A 20m crown pillar below the open pit bottom is excluded from resources.

- Pen II mineral resources are estimated at a minimum NSR cut-off of C$65 per tonne and assume that the Pen II mineral resources would be amenable to processing at the Stall mill.

- New Britannia mineral resource estimates have been reported at a minimum true width of 1.5 metres and with a cut-off grade varying from 2 grams per tonne (at 3 Zone and the lower part of New Britannia) to 3.3 grams per tonne (at Birch and for the upper part of New Britannia).

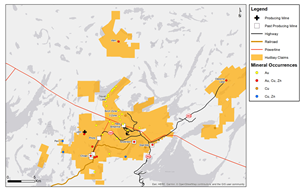

A map accompanying this announcement is available at http://www.globenewswire.com/NewsRoom/AttachmentNg/3e65eb60-7b34-462b-8c69-94ad35c802a7

The WIM deposit was acquired by Hudbay in the third quarter of 2018 for approximately C$0.5 million. WIM is a copper-gold deposit that starts from surface and is located approximately 15 kilometres by road from New Britannia. Golder Associates was engaged by Hudbay following the acquisition to independently validate the previous mineral resource estimates. Golder has confirmed that WIM hosts an indicated resource of 3.9 million tonnes grading 1.7% copper, 1.6 g/t gold, 6.7 g/t silver and 0.26% Zn plus an inferred resource of 0.7 million tonnes grading 1.0% copper, 1.8 g/t gold, 4.7 g/t silver and 0.37% zinc. Hudbay is developing a mine plan and conducting metallurgical testing on the WIM deposit with the objective to upgrade the measured and indicated resource to a mineral reserve. WIM has the potential to be developed via an underground ramp and could feed the New Britannia mill after the richest portions of the Lalor reserves and resources have been depleted.

New Britannia is a former producing gold mine that produced approximately 600,000 ounces between 1949 and 1958 and an additional 800,000 ounces between 1995 and 2005. Significant mineral resources remain accessible at New Britannia as well as in the nearby Birch and 3 Zone with some investment in the existing mining infrastructure. WSP was engaged in 2018 to audit and restate the historical resource estimates previously reported for these deposits. Based on this recent work, WSP has re-estimated a combined inferred resource of 4.4 million tonnes grading 4.8 g/t gold. Hudbay plans to initiate technical studies in the second half of 2019 to determine the technical and economic viability of the existing mineral resources and the potential to process this material at the New Britannia mill.

Pen II is a low tonnage and high-grade zinc deposit that starts from surface and is located approximately six kilometres by road from the Stall mill. Based on recent infill drilling, Hudbay has updated the resource model in 2018 to reflect of 0.5 million tonnes of indicated resources at 8.9% Zn, 0.5% Cu, 0.4g/t Au and 6.8 g/t Ag and of 0.1 million tonnes of inferred resources at 9.8% Zn, 0.4% Cu, 0.3 g/t Au and 6.9 g/t Ag. Pen II could constitute a supplemental source of feed for the Stall mill. In 2019, Hudbay will continue metallurgical testing, infill drilling on the inferred resource estimates and technical studies in an attempt to confirm the technical and economic viability of the mineral resource estimates.

Next Steps

In 2018, Hudbay spent C$14 million on major airborne and ground geophysical surveys as well as on surface exploration drilling in the Flin Flon and Snow Lake areas. This work was instrumental in identifying several base metal and gold targets that are to be tested in 2019 with a comparable exploration budget. In parallel, the company plans to spend approximately C$4 million on in-mine exploration at Lalor with the intent to convert inferred resources to indicated mineral resources and add additional inferred mineral resources in base metal and gold-rich mineralization. Hudbay will continue to advance engineering studies on Lalor and its satellite deposits in an attempt to continue to increase the tonnage of the mineral reserve estimates and the estimated operating life of the Snow Lake processing facilities at or near full capacity.

Qualified Person

The technical and scientific information contained in this news release that is related to the estimate of mineral reserves and resources at Lalor and the Lalor life of mine plan has been approved by Olivier Tavchandjian, P. Geo, Hudbay’s Vice President, Exploration and Geology. Mr. Tavchandjian is a qualified person pursuant to NI 43-101.

A detailed description of the key assumptions, parameters and methods used to estimate the mineral reserves and resources disclosed in this news release, as well as data verification procedures and a general discussion of the extent to which the estimates of scientific and technical information may be affected by any known environmental, permitting, legal title, taxation, sociopolitical, marketing or other relevant factors, will be provided by the end of the first quarter of 2019 in a NI 43-101 technical report to be filed by Hudbay on SEDAR at www.sedar.com.

The inferred mineral resources referenced in this news release are considered too speculative geologically to have the economic considerations applied to them to enable them to be categorized as mineral reserves and are therefore not included in the mine plan. It cannot be assumed that the inferred mineral resources will be successfully converted to mineral reserves through further drilling.

Forward-Looking Information

This news release contains forward-looking information within the meaning of applicable Canadian and United States securities legislation. All information contained in this news release, other than statements of current and historical fact, is forward-looking information. Often, but not always, forward-looking information can be identified by the use of words such as “plans”, “expects”, “budget”, “guidance”, “scheduled”, “estimates”, “forecasts”, “strategy”, “target”, “intends”, “objective”, “goal”, “understands”, “anticipates” and “believes” (and variations of these or similar words) and statements that certain actions, events or results “may”, “could”, “would”, “should”, “might” “occur” or “be achieved” or “will be taken” (and variations of these or similar expressions). All of the forward-looking information in this news release is qualified by this cautionary note.

Forward-looking information includes, but is not limited to, the anticipated Lalor mine plan, including assumptions as to the recoveries, production profile, costs and expansion potential, the expected benefits of refurbishing the New Britannia mill, the expected capital investment required to refurbish the New Britannia mill and implement the Lalor mine plan, expectations regarding Hudbay’s ability to covert inferred mineral resources at Lalor and the nearby satellite deposits into higher confidence categories and bring them into the mine plan, expectations regarding the schedule for processing ore at the New Britannia mill, anticipated exploration and development plans for the Snow Lake region, including the strategy for further technical and economic studies on the satellite deposits, the possibility of developing a sustainable, low-cost gold business in Manitoba, anticipated metals prices and the anticipated sensitivity of the company’s financial performance to metals prices, estimation of mineral reserves and resources, mine life projections and sustaining capital and reclamation costs. Forward-looking information is not, and cannot be, a guarantee of future results or events. Forward-looking information is based on, among other things, opinions, assumptions, estimates and analyses that, while considered reasonable by the company at the date the forward-looking information is provided, inherently are subject to significant risks, uncertainties, contingencies and other factors that may cause actual results and events to be materially different from those expressed or implied by the forward-looking information.

The material factors or assumptions that Hudbay identified and were applied by the company in drawing conclusions or making forecasts or projections set out in the forward-looking information include, but are not limited to:

- the schedule for the refurbishment of the New Britannia mill and the success of the company’s Lalor gold strategy;

- the success of mining, processing, exploration and development activities at Lalor;

- the scheduled maintenance and availability of the Stall and New Britannia processing facilities;

- the accuracy of geological, mining and metallurgical estimates;

- anticipated metals prices and the costs of production;

- the supply and demand for metals the company produces;

- the supply and availability of all forms of energy and fuels at reasonable prices;

- no significant unanticipated operational or technical difficulties;

- the execution of Hudbay’s business and growth strategies, including the success of its strategic investments and initiatives;

- the availability of additional financing, if needed;

- the ability to complete project targets on time and on budget and other events that may affect the company’s ability to implement the Lalor life-of-mine plan;

- the timing and receipt of various regulatory and governmental approvals;

- the availability of skilled personnel for Lalor’s ongoing operations and the gold development project;

- ongoing employee and union relations;

- maintaining good relations with the communities in which the company operates, including the First Nations communities surrounding the Lalor mine;

- no significant unanticipated challenges with stakeholders at the company’s Manitoba business unit;

- no significant unanticipated events or changes relating to regulatory, environmental, health and safety matters;

- no contests over title to the company’s properties, including as a result of rights or claimed rights of aboriginal peoples;

- no significant unanticipated litigation; and

- no significant and continuing adverse changes in general economic conditions or conditions in the financial markets (including commodity prices and foreign exchange rates).

The risks, uncertainties, contingencies and other factors that may cause actual results to differ materially from those expressed or implied by the forward-looking information may include, but are not limited to, risks generally associated with the mining industry, such as economic factors (including future commodity prices, currency fluctuations, energy prices and general cost escalation), uncertainties related to the development and operation of the Lalor mine, risks related to the new Lalor mine plan, including the schedule for the refurbishment of the New Britannia mill and the ability to convert inferred mineral resource estimates to higher confidence categories, dependence on key personnel and employee and union relations, risks in respect of aboriginal and community relations, rights and title claims, operational risks and hazards, including unanticipated environmental, industrial and geological events and developments and the inability to insure against all risks, failure of plant, equipment, processes, transportation and other infrastructure to operate as anticipated, compliance with government and environmental regulations, including permitting requirements and anti-bribery legislation, depletion of the company’s reserves, volatile financial markets that may affect the company’s ability to obtain additional financing on acceptable terms, the failure to obtain required approvals or clearances from government authorities on a timely basis, uncertainties related to the geology, continuity, grade and estimates of mineral reserves and resources, and the potential for variations in grade and recovery rates, uncertain costs of reclamation activities, the company’s ability to abide by the covenants in its debt instruments and other material contracts, tax refunds, hedging transactions, as well as the risks discussed under the heading “Risk Factors” in Hudbay’s most recent Annual Information Form.

Should one or more risk, uncertainty, contingency or other factor materialize or should any factor or assumption prove incorrect, actual results could vary materially from those expressed or implied in the forward-looking information. Accordingly, you should not place undue reliance on forward-looking information. Hudbay does not assume any obligation to update or revise any forward-looking information after the date of this news release or to explain any material difference between subsequent actual events and any forward-looking information, except as required by applicable law.

Note to United States Investors

This news release has been prepared in accordance with the requirements of the securities laws in effect in Canada, which may differ materially from the requirements of United States securities laws applicable to U.S. issuers.

About Hudbay

Hudbay (TSX, NYSE: HBM) is an integrated mining company primarily producing copper concentrate (containing copper, gold and silver), molybdenum concentrate and zinc metal. With assets in North and South America, the company is focused on the discovery, production and marketing of base and precious metals. Directly and through its subsidiaries, Hudbay owns three polymetallic mines, four ore concentrators and a zinc production facility in northern Manitoba and Saskatchewan (Canada) and Cusco (Peru), and copper projects in Arizona and Nevada (United States). The company’s growth strategy is focused on the exploration and development of properties it already controls, as well as other mineral assets it may acquire that fit its strategic criteria. Hudbay’s vision is to be a responsible, top-tier operator of long-life, low-cost mines in the Americas. Hudbay’s mission is to create sustainable value through the acquisition, development and operation of high-quality, long-life deposits with exploration potential in jurisdictions that support responsible mining, and to see the regions and communities in which the company operates benefit from its presence. The company is governed by the Canada Business Corporations Act and its shares are listed under the symbol "HBM" on the Toronto Stock Exchange, New York Stock Exchange and Bolsa de Valores de Lima. Further information about Hudbay can be found on www.hudbay.com.

For further information, please contact:

Candace Brûlé

Director, Investor Relations

(416) 814-4387

candace.brule@hudbay.com

________________________

1 Sustaining cash cost per ounce of gold produced, net of by-product credits, is a non-IFRS financial performance measure with no standardized definition under IFRS. All-in sustaining cash cost includes all operating and sustaining capital costs, including mining, milling and G&A, associated with Lalor gold production and is reported net of by-product credits. By-product credits are based on the following assumptions: zinc price of $1.28 per pound in 2019, $1.27 per pound in 2020, $1.17 per pound 2021 and long-term (includes premium); copper price of $3.00 per pound in 2019, $3.10 per pound in 2020, $3.20 per pound in 2021 and 2022, and $3.10 per pound long-term; silver price of $16.50 per ounce in 2019, $18.00 per ounce in 2020 and long-term; C$/US$ exchange rate of 1.30 in 2019 and 1.25 in 2020 and long-term.

2 Increase in in-situ contained metal in estimated reserves compared to the previous estimate of mineral reserves in Hudbay’s annual information form dated March 28, 2018, adjusted for 2018 production depletion.

3 Increase in life-of-mine contained metal in concentrate and gold doré produced compared to the 2017 Technical Report for the period starting January 1, 2019.

4 Net revenue calculated net of zinc refining and using the following assumptions: zinc price of $1.28 per pound in 2019, $1.27 per pound in 2020, $1.17 per pound 2021 and long-term (includes premium); gold price of $1,250 per ounce in 2019, $1,300 per ounce in 2020 and 2021, $1,250 per ounce in 2022 and long-term; copper price of $3.00 per pound in 2019, $3.10 per pound in 2020, $3.20 per pound in 2021 and 2022, and $3.10 per pound long-term; silver price of $16.50 per ounce in 2019, $18.00 per ounce in 2020 and long-term; C$/US$ exchange rate of 1.30 in 2019 and 1.25 in 2020 and long-term.