Hudbay Highlights Proven Track Record, Successful Execution and Strong Corporate Governance

TORONTO, Jan. 17, 2019 (GLOBE NEWSWIRE) -- Hudbay Minerals Inc. (“Hudbay” or the “company”) (TSX, NYSE:HBM) highlights its proven track record, successful execution and strong corporate governance following Waterton Global Resource Management’s (“Waterton”) news release naming its nominees for election to the company’s Board of Directors at its next annual shareholders’ meeting.

|

|||||

Proven Growth Strategy and World-Class Asset Base

Hudbay’s Board and management remain committed to the company’s disciplined approach to driving long-term and sustainable value creation. Over the last several years, Hudbay has grown beyond its Manitoba base through acquisition and exploration into a leading mid-tier copper producer with low-cost, long-life assets in Canada, Peru, Arizona, and most recently in Nevada with the acquisition of the Ann Mason project.

History of Successful Execution

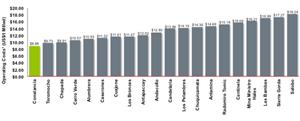

Hudbay’s management team has a proven track record of successful new mine development and expertise in both open pit and underground mining. In 2015, Hudbay completed the best in-class development and ramp-up of the Constancia mine in Peru, which is now the lowest cost open-pit copper mine in South America1. Constancia was a greenfield project in a new jurisdiction for Hudbay and the strong community relationships the company has built provides it with the social license to continue to grow its Peruvian business.

During this time, Hudbay also completed the construction of its Lalor underground mine in Manitoba, a deposit that was discovered by Hudbay’s exploration team in 2007 and achieved commercial production only seven years after its discovery. In the first quarter of 2019, Hudbay expects to release a new reserve and resource estimate at Lalor incorporating the gold-rich zones, along with detailed plans relating to the refurbishment of the New Britannia gold mill, which has significant upside potential from nearby satellite deposits. This is one of the many near-term catalysts that could materially increase the value of the company.

Strong Governance Track Record

Hudbay has an independent, diverse and highly-qualified Board that has been consistently recognized for its strong corporate governance practices:

- Hudbay is ranked in the top 20% for overall governance quality by proxy advisor Institutional Shareholders Service (ISS)2;

- ISS has recommended for all directors over the last ten annual meetings (2009 – 2018); and

- The company was ranked in the top 50 by The Globe and Mail’s 2018 Board Games Corporate Governance Ranking, the only base metal miner to be ranked in the top 1003.

Hudbay’s strong corporate governance is complemented by its ongoing commitment to board renewal as evidenced by an average Board tenure of five years and the fact that 60% of Hudbay’s current directors have joined the Board in the last six years.

The company remains open to constructive engagement with all shareholders. To that end, Hudbay previously met with Waterton and invited it to privately share the names and biographies of individuals it thought could potentially add value to the Board. Rather than engaging with the Board through our normal course process, Waterton has repeatedly changed its demands and now has nominated directors to replace the vast majority (80%) of the Board. Waterton, a relatively recent shareholder, is a mining private equity firm that competes with Hudbay for mining assets and may not have interests aligned with other shareholders.

Hudbay will set a date for its annual meeting and file a proxy circular, including a fulsome response to Waterton and voting recommendation for shareholders, in due course.

Forward-Looking Information

This news release contains “forward-looking statements” and “forward-looking information” (collectively, “forward-looking information”) within the meaning of applicable Canadian and United States securities legislation. Forward-looking information includes information that relates to, among other things, statements with respect to Hudbay’s strategy and strategic priorities and the Board’s intentions in advance of its annual shareholders’ meeting. Forward-looking information is not, and cannot be, a guarantee of future results or events.

Forward-looking information is based on, among other things, opinions, assumptions, estimates and analyses that, while considered reasonable by us at the date the forward-looking information is provided, inherently are subject to significant risks, uncertainties, contingencies and other factors that may cause actual results and events to be materially different from those expressed or implied by the forward-looking information. The risks, uncertainties, contingencies and other factors that may cause actual results to differ materially from those expressed or implied by the forward-looking information may include, but are not limited to, risks generally associated with the mining industry, such as economic factors (including future commodity prices, currency fluctuations, energy prices and general cost escalation), as well as the risks discussed under the heading “Risk Factors” in Hudbay’s most recent Annual Information Form.

Should one or more risk, uncertainty, contingency or other factor materialize or should any factor or assumption prove incorrect, actual results could vary materially from those expressed or implied in the forward-looking information. Hudbay does not assume any obligation to update or revise any forward looking information after the date of this news release or to explain any material difference between subsequent actual events and any forward-looking information, except as required by applicable law.

About Hudbay

Hudbay (TSX, NYSE: HBM) is an integrated mining company producing copper concentrate (containing copper, gold and silver), molybdenum concentrate and zinc metal. With assets in North and South America, the company is focused on the discovery, production and marketing of base and precious metals. Through its subsidiaries, Hudbay owns three polymetallic mines, four ore concentrators and a zinc production facility in northern Manitoba and Saskatchewan (Canada) and Cusco (Peru), and a copper project in Arizona (United States). The company is governed by the Canada Business Corporations Act and its shares are listed under the symbol "HBM" on the Toronto Stock Exchange, New York Stock Exchange and Bolsa de Valores de Lima. Further information about Hudbay can be found on www.hudbay.com.

For further information, please contact:

Candace Brûlé

Director, Investor Relations

(416) 814-4387

candace.brule@hudbay.com

For media inquiries, please contact:

Scott Brubacher

Director, Corporate Communications

(416) 814-4373

scott.brubacher@hudbay.com

1 Sourced from Wood Mackenzie Q4 2018 dataset. Based on 2018 forecasted operating costs, including mining, processing and general and administrative expenditures on a per tonne basis, for primary copper, open pit sulphide mines in South America. Wood Mackenzie’s costing methodology may be different than the methodology reported by Hudbay or its peers in their public disclosure. For details regarding Hudbay’s costs, refer to Hudbay’s management discussion and analysis for the three and nine months ended September 30, 2018.

2 Score as of January 2019. ISS scores indicate decile rank relative to index or region. A decile score of 1 indicates lower governance risk (top 10%), while a 10 indicates higher governance risk (bottom 10%).

3 The Globe and Mail’s 2018 Board Game Hudbay Minerals Score, ranking is out of 242 companies total and information as of November 27, 2018.

A photo accompanying this announcement is available at http://www.globenewswire.com/NewsRoom/AttachmentNg/ae178da6-227d-433e-97a9-2b794f995b36