Iceland's Gold

(TheNewswire)

Reykjavik – TheNewswire - July 2, 2020 – St-Georges Eco-Mining Corp. (CSE:SX) (CNSX:SX.CN) (OTC:SXOOF) (FSE: 85G1) is pleased to disclose gold results from surface exploration in Iceland and the signing of a binding letter of intent pursuant to which it will acquire all of the shares of Melmi EHF. Melmi is an Icelandic entity that owns a 100% interest in the Thor Gold Project in Iceland in which St-Georges had, until now, a 41% farm-in option.

Highlights

- Acquisition of Icelandic licenses holder Melmi EHF for considerations up to CA $775,000 ;

- Commissioning of a drilling contractor who will contribute up to CA$400,000 toward the costs of drilling on the Thor Gold Project;

- Surface sampling returning gold values ranging between 0.3 to 4.18 g/t;

- Sediment stream sampling returning a gold value of 2.33 g/t in a new area;

Gold results from the Vididalur and Vatnsdalur projects.

Set in a Miocene age basic to felsic volcanic flows and tuffs context, the region has been previously explored by Teck and others that have identified several areas of mineralization occurring within fault zones. Until recently, no important exploration campaign had been deployed in the area. This region was previously mapped in the 1990’s by Teck. Limited surface sampling yielded anomalous gold results ranging from <0.005 to 34 g/t of gold with some association with silver.

Recent and previously undisclosed work from St-Georges’ geological contractor in Iceland yielded surface gold values ranging between <0.3 to 4.18 g/t. These results were obtained from float and outcrops. Trace elements associated with the results from this exploration effort are significantly elevated in arsenic, antimony, and mercury typical of epithermal mineralization. A single stream sample yielded a value of 2.33 g/t gold.

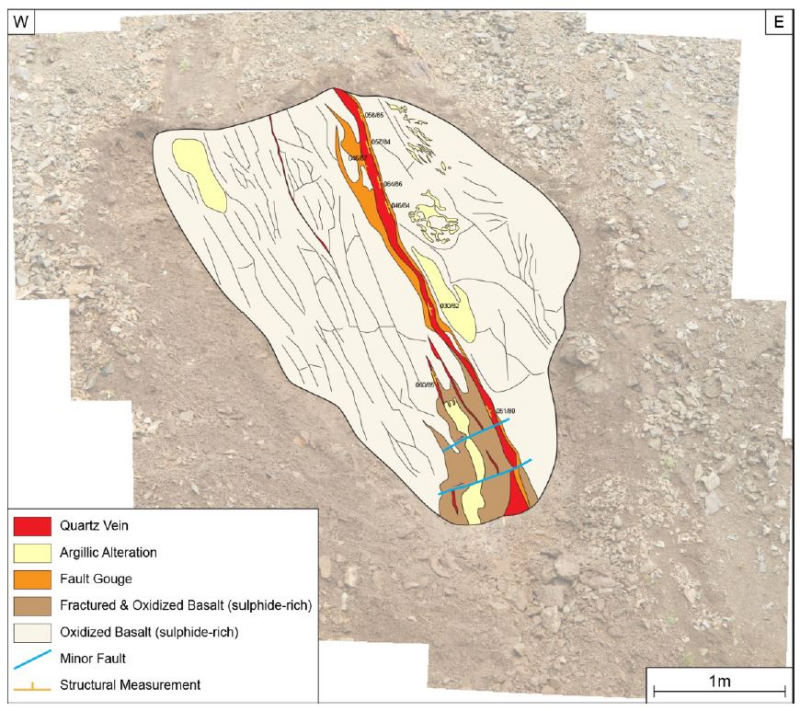

Figure 1. Picture of one of the areas with anomalous gold on the Vatnsdalur & Vididalur Projects

Figure 2. The Mountains of Vididalur area.

Acquisition of 100% of Melmi EHF

Following this spring exploration work program in Iceland, St-Georges’ management approached the principals at Melmi to discuss the possibility of accelerating the Thor Gold Project farm-in option. The favorable context surrounding the discussions allowed St-Georges to initiate discussions to acquire outright all of Melmi’s assets. When concluded, this acquisition will replace the Thor Farm-in Option Agreement and give St-Georges direct control on all active mineral licenses and applications in Iceland. It will also streamline the decisional and licensing process by eliminating the obligation to negotiate a long time in advance and have a third-party interest influencing the conduct of the Company's geological affairs and also allow the company to have direct communication with local municipalities in regards of operational licenses.

Under the terms of the LOI, the Corporation will pay up to CA$775,000 in consideration of the Melmi Shares, as follows:

-

(i) pay $65,000 upon the execution of the definitive share purchase agreement (the “Definitive Agreement”)

-

(ii) pay an additional $60,000 on the earlier of: (a) 90 days of execution of the Definitive Agreement; and (b) the start of drilling on the Thor Property;

-

(iii) issue $400,000 of non-transferable debentures of the Corporation bearing a 6% annual interest, maturing 3 years from issuance (the “Maturity Date”), of $100,000 will be convertible into common shares in the capital of SX (the “SX Shares”) at a deemed price of $0.10 per SX Shares, $150,000 at a deemed price of $0.15 per SX Shares, and $150,000 at a deemed price of $0.20 per SX Shares; and

-

(iv) as additional consideration, subject to and upon all the Licences Application having been granted, issue $250,000 non-transferable debentures of SX bearing a 6% annual interest, maturing 3 years from issuance, and convertible into SX Shares at a deemed price of $0.20 per SX Shares.

The Iceland Acquisition remains subject to due diligence, the entering into the Definitive Agreement on or before September 29, 2020, and the approval of the Canadian Securities Exchange. All securities issued under the Definitive Agreement will be subject to a hold period expiring four months and one day from their date of issuance.

Nomination of Dr. Helen Salmon

The Company is pleased to report that it has retained the services of Dr. Helen Salmon to lead the Icelandic exploration team. Dr. Salmon has Ph.D. in Geology from London University. She’s been a senior geologist with several exploration companies, and she is an experienced field geologist. She has managed many drilling programs and has extensive knowledge of Iceland geology.

Update on Thor Gold

The Thor Gold Project is now ready to be drilled. The Company has entered into an agreement with a local geological contractor and driller. The contractor has agreed to contribute up to CA$400,000 of the first phase total budget of CA$750,00 to be subscribed in shares of St-Georges at a later date or in cash at the discretion of SX management. The balance of the budget will come from available cash and receivables. The first drilling campaign to be initiated will be a mix of exploration, delineation, and confirmation (twinning) drill holes. The Company’s objective is to use the results from this first phase to establish a maiden NI 43-101 gold resources later in the year.

The agreement to acquire Melmi EHF gives 100% ownership of the Thor Gold Project to St-Georges with a section of the project subject to a 1% mining royalty (NSR).

The Thormodsdalur Gold Project is located about 20km east of the city center of Reykjavík and south-east of the Lake Hafravatn. The project was discovered in 1908. The property produced a gold concentrate from 1911 to 1925, which was then shipped to Germany for processing. Over 300 meters of tunnels explored and mined one or more quartz veins and wall rock below open cuts at the surface.

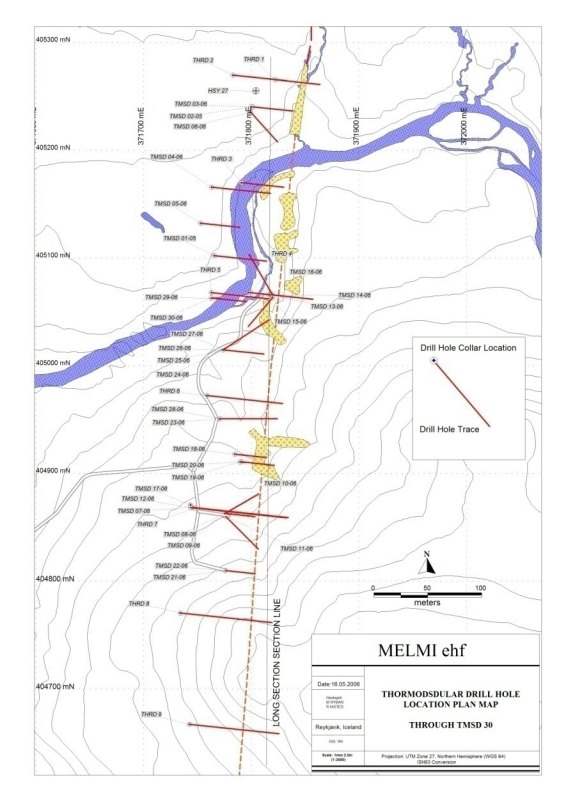

Studies between 1996 and 2013 identified a low sulfidation system hosted by basic to intermediate flows of Pliocene to Miocene age. The host contains banded chalcedony and ginguro within a fault zone up to 5 meters in width where drills intercepts identified a gold trend with a strike length of 700 meters. To date, the identified gold trend has a known strike length of 700 meters determined by drill intercepts. Petrographic analysis of the vein material identified gold occurring in its free form and as part of an assemblage with pyrite and chalcopyrite. Petrographic and XRD studies show an evolution of the vein system from the zeolite assemblage to quartz-adularia and lastly, to minor calcite.

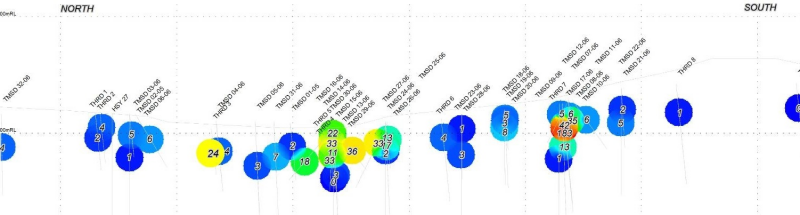

To date, thirty-two holes have been drilled on the project, for a total of 2439 meters. Gold grades returned up of 415 g/t over 0.2 meters. (These values were obtained from selected random intervals and cannot be construed to be representative of any particular thickness or overall length.) The best intercepts from the diamond drilling are 33.5m of 8.0 g/t Au (true thickness) and 5.2m of 35.4 g/t Au (true thickness).

Note: All information pertaining to mineral resources, grades or operational results related to the Thor Project are historical in nature, and, while relevant, the information was obtained from sources that cannot be independently verified and are hence non-compliant with National Instrument 43-101.

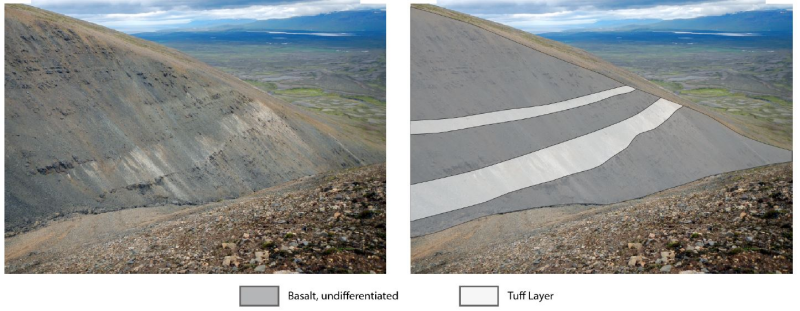

Figure 3. Tuff layers intercalated with undifferentiated basaltic flows north of Elbow Creek on Vididalur Project.

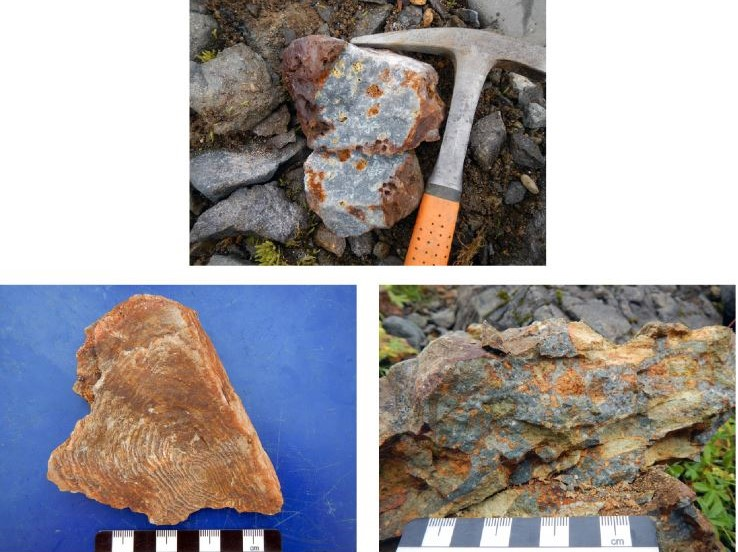

Figure 4. Outcrops of volcanic flow breccia E of Axlaröxl (left) and SE of Elbow Creek (right)

Figure 5. Obsidian flow on top of Hrafnaklettur (left) & obsidian lens within basalt in gorge E of Axlaröxl (right)

Figure 6. Chosen samples of the preliminary rock unit of “silica-flushed basalt”. Top: grey quartz boulder with weathered vesicles; Bottom left: concretion-like texture in a quartz-rich hand specimen; Bottom right: Boulder showing remnant pyroclastic texture.

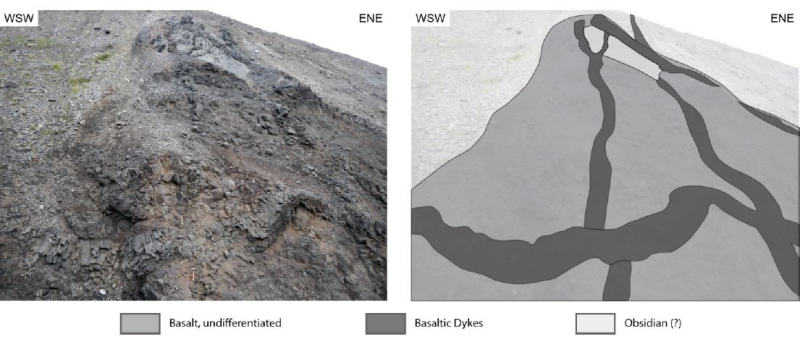

Figure 7. Graphic showing the outcrop of a dyke swarm in the gully E of Axlaröxl with a small lens of obsidian.

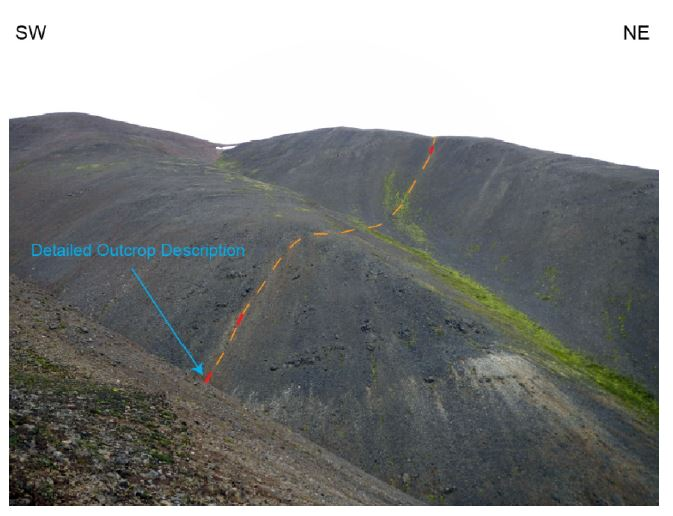

Figure 8. Photo showing the inferred vein trace in scree (dotted orange) and outcropping vein (solid red) in

Elbow Creek. The outcrop at the creek bed was cleaned out and studied in detail.

Figure 9 & 10 (below): Detailed graphic of the vein outcrop in Elbow Creek.

Figure 11. Historical drill holes location on the Thor Gold Project

Figure 12. Two high-grade plunging ore shoots. Warmer colours show higher grades.

Vilhjalmur Thor Vilhjalmsson, St-Georges' President and CEO, stated: "(…)I’m delighted that we have been able to secure a 100% hold on the assets. It is a major milestone for the Company and secures all tenures in Iceland, both issued and pending. This will enable us to plan all work and execution in-house and further enable us to work on the Icelandic projects all year round. The next step will be finalizing Thor's sampling program that was put on hold during these negotiations and preparing the team for the drilling program to follow. With the purchase of Melmi and its assets, the Company gains an enormous amount of historical data that covers the last three decades of mineral exploration in Iceland. We will now set up a dedicated full-time team to work on enhancing the assets. This will also enable us to partner out some of the projects, and discussions are already taking place with interesting parties. I would also like to welcome Dr. Helen Salmon back to the team; she has extensive knowledge of the Icelandic geology and the assets.(…)"

The technical information in this release has been reviewed and approved by Mr. Herb Duerr, P. Geo. St-Georges’ director, a qualified person as defined by National Instrument 43-101 Standards of Disclosure for Mineral Projects.

ON BEHALF OF THE BOARD OF DIRECTORS

“Vilhjalmur Thor Vilhjalmsson”

Vilhjalmur Thor Vilhjalmsson

President and CEO

About St-Georges

St-Georges is developing new technologies to solve some of the most common environmental problems in the mining industry.

The Company controls directly or indirectly, through rights of first refusal, all of the active mineral tenures in Iceland. It also explores for nickel on the Julie Nickel Project & for industrial minerals on Quebec’s North Shore and for lithium and rare metals in Northern Quebec and in the Abitibi region. Headquartered in Montreal, St-Georges’ stock is listed on the CSE under the symbol SX, on the US OTC under the Symbol SXOOF and on the Frankfurt Stock Exchange under the symbol 85G1

The Canadian Securities Exchange (CSE) has not reviewed and does not accept responsibility for the adequacy or the accuracy of the contents of this release.

Copyright (c) 2020 TheNewswire - All rights reserved.