Infill Drilling Further Enhancing the Marathon Deposit, 1.41 g/t Au over 105.0 meters & 2.67 g/t Au over 42.0 meters, Valentine Lake Gold Camp, Newfoundland

Highlights:

|

||||||||||

Drilling

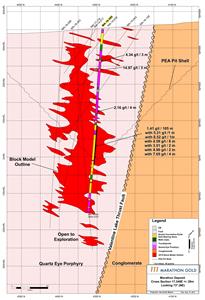

- MA-18-305 intersected 1.41 g/t Au over 105.0 meters including 4.59 g/t Au over 6.0 meters, 7.65 g/t Au over 4.0 meters, 4.90 g/t Au over 2.0 meters and 3.51 g/t Au over 2.0 meters as well as 14.97 g/t Au over 3.0 meters and 4.34 g/t Au over 3.0 meters. This infill hole, located in the NE end of the Marathon Deposit, was designed to penetrate down through a 200-meter vertical gap between existing drill holes on section and confirms the continuity of very good gold grades in this area along the footwall margin of the mineralized corridor (Figure 1).

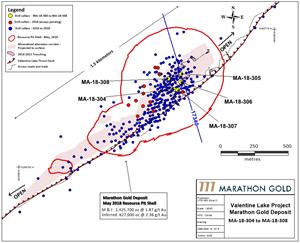

- MA-18-308 intersected 2.67 g/t Au over 42.0 meters including 12.84 g/t Au over 4.0 meters, 7.23 g/t Au over 2.0 meters and 7.22 g/t Au over 2.0 meters as well as 11.93 g/t Au over 5.0 meters with 28.34 g/t Au over 2.0 meters and 2.93 g/t Au over 7.0 meters with 11.32 g/t Au over 1.0 meter. This infill hole, located along the hanging wall margin of the main mineralized corridor (Figure 2) was designed prove up continuity of mineralization in an area with less previous drilling and led to re-classify inferred material into the measured and indicated category for the next resource update.

- MA-18- 304 intersected 9.53 g/t Au over 5.0 meters including 23.30 g/t Au over 2.0 meters and 5.65 g/t Au over 10.0 meters including 12.71 g/t Au over 4.0 meters. This infill hole tested the area between the mineralized corridor and the footwall fault, effectively increasing the width of the mineralized corridor and adding mineralization to the Marathon pit shell.

- MA-18-306 intersected 5.67 g/t Au over 7.0 meters including 12.26 g/t Au over 3.0 meters and 3.82 g/t Au over 12.0 meters including 9.90 g/t Au over 4.0 meters.

- MA-18-307 intersected 5.14 g/t Au over 7.0 meters including 15.54 g/t Au over 2 meters.

Program Update

- Step-out drilling with 2 drill rigs located towards the SW end of the Marathon Deposit are focused on discovering new mineralization in this area of limited previous drilling and adding more ounces of gold to the Marathon Deposit.

- Infill drilling with 1 drill rig in the SE area of the Victory Deposit area is aimed at re-classifying inferred material into the measured and indicated category for the next resource update. The widely spaced exploration holes to the southwest of Victory are complete and awaiting assay results.

TORONTO, Sept. 19, 2018 (GLOBE NEWSWIRE) -- Marathon Gold Corporation (“Marathon” or the “Company”) (TSX: MOZ) is pleased to announce continued drilling success with the intersection of new wide and continuous intervals of gold mineralization at open-pit depths in both the footwall and hanging wall margins of the main mineralized corridor of the Marathon Deposit (Figure 1 & 2). Drill holes MA-18-305 and MA-18-308 were both highly successful in penetrating wide intervals of high grade gold within en-echelon stacked QTP veining including 1.41 g/t Au over 105.0 meters with 4.59 g/t Au over 6.0 meters, 7.65 g/t Au over 4.0 meters, 4.90 g/t Au over 2.0 meters and 3.51 g/t Au over 2.0 meters in MA-18-305, and 2.67 g/t Au over 42.0 meters including 12.84 g/t Au over 4.0 meters, 7.23 g/t Au over 2.0 meters and 7.22 g/t Au over 2.0 meters in MA-18-308. These infill holes, as well as the other new drill holes, are to decrease the open pit strip ratio and move inferred material into the measured and indicated resource categories.

“These great gold intercepts are expected to add significantly to the upgrading of the next Marathon resource update.” said Phillip Walford, President and CEO of Marathon Gold. “The current program of infill drilling certainly appears to be achieving our primary objectives of adding new ounces of gold to the global resource, moving inferred material into measured and indicated resource category, and decreasing open-pit strip ratios as we move towards a Pre-Feasibility Study.”

TABLE 1: Significant assay intervals, Marathon Deposit, Valentine Lake Gold Camp.

| DDH | Section | From | To | Core Length (m) | True Thickness (m) | Gold g/t | Gold g/t (cut)* |

| MA-18-304 | 17260 | 24 | 27 | 3.0 | 2.9 | 2.75 | |

| 54 | 57 | 3.0 | 2.9 | 4.36 | |||

| 111 | 116 | 5.0 | 4.8 | 9.53 | |||

| including | 111 | 113 | 2.0 | 1.9 | 23.30 | ||

| 347 | 350 | 3.0 | 2.9 | 2.16 | |||

| 410 | 418 | 8.0 | 7.6 | 2.23 | |||

| including | 415 | 418 | 3.0 | 2.9 | 5.20 | ||

| including | 429 | 432 | 3.0 | 2.9 | 3.62 | ||

| 462 | 472 | 10.0 | 9.5 | 5.65 | |||

| including | 462 | 466 | 4.0 | 3.8 | 12.71 | ||

| 514 | 517 | 3.0 | 2.9 | 3.11 | |||

| MA-18-305 | 17340 | 87 | 90 | 3.0 | 2.9 | 4.34 | |

| 111 | 114 | 3.0 | 2.9 | 14.97 | |||

| 226 | 230 | 4.0 | 3.8 | 2.16 | |||

| 267 | 372 | 105.0 | 99.8 | 1.41 | |||

| including | 267 | 268 | 1.0 | 1.0 | 5.21 | ||

| including | 302 | 303 | 1.0 | 1.0 | 6.52 | ||

| including | 319 | 325 | 6.0 | 5.7 | 4.59 | ||

| including | 328 | 330 | 2.0 | 1.9 | 3.51 | ||

| including | 352 | 354 | 2.0 | 1.9 | 4.90 | ||

| including | 368 | 372 | 4.0 | 3.8 | 7.65 | ||

| MA-18-306 | 17320 | 129 | 132 | 3.0 | 2.9 | 5.24 | |

| 316 | 323 | 7.0 | 6.7 | 5.67 | |||

| including | 316 | 319 | 3.0 | 2.9 | 12.26 | ||

| 355 | 358 | 3.0 | 2.9 | 3.19 | |||

| 541 | 553 | 12.0 | 11.4 | 3.82 | |||

| including | 543 | 547 | 4.0 | 3.8 | 9.90 | ||

| MA-18-307 | 17280 | 55 | 58 | 3.0 | 2.7 | 1.22 | |

| 113 | 117 | 4.0 | 3.6 | 0.94 | |||

| 361 | 368 | 7.0 | 6.3 | 5.14 | |||

| including | 366 | 368 | 2.0 | 1.8 | 15.44 | ||

| 407 | 410 | 3.0 | 2.7 | 2.25 | |||

| 440 | 444 | 4.0 | 3.6 | 2.15 | |||

| MA-18-308 | 17240 | 64 | 68 | 4.0 | 3.8 | 0.97 | |

| 87 | 111 | 24.0 | 22.8 | 1.32 | |||

| including | 92 | 95 | 3.0 | 2.9 | 4.11 | ||

| 147 | 189 | 42.0 | 39.9 | 2.67 | |||

| including | 147 | 149 | 2.0 | 1.9 | 7.22 | ||

| including | 157 | 159 | 2.0 | 1.9 | 7.23 | ||

| including | 171 | 175 | 4.0 | 2.9 | 12.84 | ||

| including | 179 | 180 | 1.0 | 1.0 | 4.58 | ||

| including | 188 | 189 | 1.0 | 1.0 | 7.62 | ||

| 197 | 200 | 3.0 | 2.9 | 2.44 | |||

| 376 | 379 | 3.0 | 2.9 | 1.83 | |||

| 400 | 407 | 7.0 | 6.7 | 2.93 | |||

| including | 403 | 404 | 1.0 | 1.0 | 11.32 | ||

| 427 | 432 | 5.0 | 4.8 | 11.93 | 9.85 | ||

| including | 430 | 432 | 2.0 | 1.9 | 28.34 | 23.12 |

*Cut to 45 g/t Au.

Figure 1: Schematic cross section 17340 showing MA-18-305, Marathon Deposit

http://www.globenewswire.com/NewsRoom/AttachmentNg/19b53ba4-99ac-468b-9502-7f9232fd8004

Figure 2: Location of drill hole collars MA-18-304 to MA-18-308, Marathon Deposit

http://www.globenewswire.com/NewsRoom/AttachmentNg/f5916256-30a4-43ae-8c38-dd3657f74905

Acknowledgments

Marathon acknowledges the financial support of the Junior Exploration Assistance Program, Department of Natural Resources, Government of Newfoundland and Labrador.

Quality Assurance-Quality Control (“QA/QC”)

Sherry Dunsworth, M.Sc., P. Geo., Senior VP of Exploration, Marathon’s Qualified Person, has reviewed the contents for accuracy and has approved this press release on behalf of Marathon. Thorough QA/QC protocols are followed including the insertion of blanks and standards at regular intervals in each sample batch. Drill core is cut in half with one half retained at site, the other half tagged and sent to Eastern Analytical Limited in Springdale, Newfoundland. All reported core samples are analyzed for Au by fire assay (30g) with AA finish. All samples above 0.10 g/t Au in economically interesting intervals are further assayed using metallic screen to mitigate the presence of coarse gold. Significant mineralized intervals are reported in Table 1 as core lengths and estimated true thickness (90-95% of core length).

About Marathon

Marathon Gold Corp. is a high-quality growth-oriented gold development company with a long-term strategy of moving the 100% owned Valentine Lake Gold Camp through to production in central Newfoundland. Marathon recently completed a positive PEA that shows an average annual production of 188,500 ounces per year over the first 10 years, payback of 2.8 years, NPV (5%) of $367 million (USD) and an IRR of 25.3%, all after-tax. The Valentine Lake Gold Camp currently hosts four near-surface, mainly pit-shell constrained, deposits with measured and indicated resources totaling 2,137,100 oz. of gold at 1.99 g/t and inferred resources totaling 1,104,800 oz. of gold at 1.99 g/t. Most of the resources occur at the Marathon and Leprechaun Deposits. All the deposits are open to expansion. Marathon’s 240 sq. km sized Valentine Lake property has multiple exploration targets to be explored in 2018.

To find out more information on the Valentine Lake Gold Camp please visit www.marathon-gold.com

For more information, please contact:

| Christopher Haldane | Phillip Walford |

| Investor Relations Manager | President and Chief Executive Officer |

| Tel: 1-416-987-0714 | Tel: 1-416-987-0711 |

| e-mail: chaldane@marathon-gold.com | e-mail: pwalford@marathon-gold.com |

CAUTIONARY STATEMENT REGARDING FORWARD-LOOKING INFORMATION

Except for statements of historical fact relating to Marathon Gold Corporation, certain information contained herein constitutes "forward-looking statements". Forward-looking statements include statements that are predictive in nature, depend upon or refer to future events or conditions, or include words such as "expects", "anticipates", "plans", "believes", "considers", "intends", "targets", or negative versions thereof and other similar expressions, or future or conditional verbs such as "may", "will", "should", "would" and "could". We provide forward-looking statements for the purpose of conveying information about our current expectations and plans relating to the future and readers are cautioned that such statements may not be appropriate for other purposes. By its nature, this information is subject to inherent risks and uncertainties that may be general or specific and which give rise to the possibility that expectations, forecasts, predictions, projections or conclusions will not prove to be accurate, that assumptions may not be correct, and that objectives, strategic goals and priorities will not be achieved. These risks and uncertainties include but are not limited to those identified and reported in Marathon Gold Corporation's public filings, which may be accessed at www.sedar.com. Other than as specifically required by law, we undertake no obligation to update any forward-looking statement to reflect events or circumstances after the date on which such statement is made, or to reflect the occurrence of unanticipated events, whether as a result of new information, future events, results or otherwise.