June 2022 Quarter Report

PERTH, Western Australia, July 26, 2022 (GLOBE NEWSWIRE) -- Perseus Mining Limited (“Perseus” or the “Company”) (TSX & ASX: PRU) reports on its activities for the three months’ period ended June 30, 2022 (the “Quarter”).

| PERFORMANCE INDICATOR | UNIT | DECEMBER 2021 HALF YEAR | MARCH 2022 QUARTER | JUNE 2022 QUARTER | JUNE 2022 HALF YEAR | 2022 FINANCIAL YEAR |

| Gold recovered | Ounces | 241,164 | 130,523 | 122,327 | 252,850 | 494,014 |

| Gold poured | Ounces | 237,483 | 132,644 | 120,409 | 253,053 | 490,536 |

| Production Cost | US$/ounce | 839 | 789 | 881 | 834 | 836 |

| All-In Site Cost (AISC) | US$/ounce | 949 | 908 | 1,004 | 955 | 952 |

| Gold sales | Ounces | 238,135 | 131,044 | 111,897 | 242,941 | 481,075 |

| Average sales price | US$/ounce | 1,663 | 1,701 | 1,705 | 1,703 | 1,683 |

| Notional Cashflow | US$ million | 172 | 104 | 85 | 189 | 361 |

- Key Operating highlights include:

- Weighted average AISCs of US$952 per ounce for the financial year to 30 June 2022 (FY2022), in the bottom quartile of the market guidance range. AISC for the June 2022 half year and quarter of US$955 and US$1,004 per ounce respectively, both within market expectations.

- Annual gold production of 494,014 ounces was in upper half of market guidance range, notwithstanding a 19-day preventative maintenance shut at Edikan in the June 2022 quarter. Half Year production of 252,850 ounces included 122,327 ounces of gold produced during the June quarter.

- Average cash margin of US$731 per ounce of gold for FY2022, and US$748 and US$701 per ounce respectively for the half and quarterly year periods.

- Annual gold sales of 481,075 ounces at a weighted average sales price of US$1,683 per ounce including 111,897 ounces of gold sold during the quarter at US$1,705 per ounce.

- Notional cashflow from operations of US$361 million during FY2022 included June 2022 Half year and quarterly notional cashflows of US$189 million, and US$85 million respectively.

- The death of a Yaouré contractor’s employee following an accident on site late in the June quarter, overshadowed Perseus’s otherwise strong ESG performance and improvements made during the quarter.

- Perseus’s strong operating performance is forecast to continue with market guidance for the December 2022 Half Year of 240,000 to 265,000 ounces produced at an AISC of US$1,000 to US$1,100 per ounce.

- Business growth activities delivered excellent results, with a material increase in Perseus’s Ore Reserves inventory and mine lives at Edikan and potentially, Yaouré.

- Indicated Mineral Resources at Nkosuo near Edikan containing 422,000 ounces and Inferred Mineral Resources containing a further 27,000 ounces giving rise to Probable Ore Reserves totalling 10 million tonnes of ore grading 1.04g/t gold and containing 332,000 ounces of gold.

- The Prefeasibility Study for the CMA Underground Project progressed. Drilling was completed, resource modelling well advanced and preliminary mining, geotechnical and metallurgical study work completed. An updated Mineral Resource and Maiden Ore Reserve will be released during the September 2022 quarter.

- Perseus’s financial position continues to strengthen with available cash and bullion of US$328 million, debt of US$50 million, and net cash of US$278 million at 30 June 2022, US$50 million more than last quarter.

OPERATIONS

QUARTERLY PRODUCTION, COSTS AND NOTIONAL CASHFLOW

Perseus’s three operating gold mines, Yaouré and Sissingué in Côte d’Ivoire, and Edikan in Ghana have combined to produce a total of 122,327 ounces of gold in the June 2022 quarter, bringing total annual gold production to 494,014 ounces for the first time.

The weighted average production cost of the Perseus group during the quarter was US$881 per ounce, while the weighted average AISC was US$1,004 per ounce of gold produced. On an annual basis, Perseus’s AISC of US$952 per ounce placed the Company near the middle of the global gold cost curve, as reported in JP Morgan’s June 2022 Gold Sector Review.

Table 1: Cost and Production Summary by Mine

| MINE | TOTAL GOLD PRODUCED (OUNCES) | ALL-IN SITE COST (US$/OUNCE) | ||||

| DECEMBER 2021 QUARTER | MARCH 2022 QUARTER | JUNE 2022 QUARTER | DECEMBER 2021 QUARTER | MARCH 2022 QUARTER | JUNE 2022 QUARTER | |

| Yaouré | 75,189 | 76,921 | 81,150 | 700 | 662 | 641 |

| Edikan | 35,124 | 38,590 | 28,668 | 1,450 | 1,336 | 1,859 |

| Sissingué | 18,065 | 15,012 | 12,509 | 905 | 1,067 | 1,398 |

| Perseus Group | 128,378 | 130,523 | 122,327 | 934 | 908 | 1,004 |

Combined gold sales from all three operations totalled 111,897 ounces this quarter at a weighted average gold price realised of US$1,705 per ounce. For the full financial year, sales amounted to 481,075 ounces, at a weighted average realised gold price of US$1,683 per ounce. Perseus’s average cash margin for the June 2022 quarter was US$701 per ounce, or US$731 per ounce for the full financial year.

Notional operating cashflow from operations for the quarter was US$85 million, bringing the total amount of notional cashflow generated by Perseus during the financial year to 30 June 2022 to US$361 million, the majority of which was generated by our Yaouré Gold Mine.

Table 2: Realised Gold Price and Notional Cash Flow by Mine

| MINE | REALISED GOLD PRICE (US$ PER OUNCE) | NOTIONAL CASH FLOW FROM OPERATIONS (US$ MILLION) | ||||

| DECEMBER 2021 QUARTER | MARCH 2022 QUARTER | JUNE 2022 QUARTER | DECEMBER 2021 QUARTER | MARCH 2022 QUARTER | JUNE 2022 QUARTER | |

| Yaouré | 1,699 | 1,720 | 1,673 | 75 | 81 | 84 |

| Edikan | 1,613 | 1,673 | 1,802 | 6 | 13 | -2 |

| Sissingué | 1,638 | 1,683 | 1,673 | 13 | 9 | 3 |

| Perseus Group | 1,669 | 1,701 | 1,705 | 94 | 104 | 85 |

Both of Perseus’s gold production and AISCs for the June 2022 half and full financial year as reported above, were strong relative to market guidance (refer to Table 3), confirming that Perseus’s plan to transform into a reliable, diversified mid-tier gold producer is on track.

Table 3: Cost and Production Relative to Market Guidance

| PERFORMANCE INDICATOR | HALF YEAR TO 30 JUNE 2022 | FULL 2022 FINANCIAL YEAR | |||

| GUIDANCE | ACTUAL | GUIDANCE | ACTUAL | ||

| Gold Production (ounces) | 230,00 to 265,000 | 252,820 | 471,164 to 506,164 | 494,014 | |

| AISC (US$ per ounce) | 915 to 1,085 | 955 | 932 to 1,020 | 952 | |

YAOURÉ GOLD MINE, CÔTE D’IVOIRE

Yaouré has once again outperformed expectations this quarter, producing above the guided gold production range and below the bottom end of the market cost guidance range for both the June Half Year and the full financial year to 30 June 2022. In the process, Yaouré has produced approximately 66% of the Perseus Group’s quarterly gold production at an AISC that positions the mine towards the bottom end of the global gold cost curve referred to above. Taking the reasonably strong market for gold that has prevailed this financial year into account, in the 12 months to 30 June 2022, Yaouré has generated US$306 million of notional cashflow, US$41 million more than the development cost of the mine.

During the quarter, Yaouré increased its gold production by a further 6% compared to the prior quarter to 81,150 ounces of gold at a production cost of US$543 per ounce and an AISC of US$641 per ounce. The weighted average sales price of the 70,761 ounces of gold sold during the quarter was US$1,673 per ounce, giving rise to a cash margin of US$1,032 per ounce. Notional operating cashflow generated by Yaouré was US$84 million during the quarter, US$2.3 million more than in the March 2022 quarter.

The improving gold production at Yaouré reflected higher mill throughput rates (512 tph compared to 507 tph). Mill run time of 93% compared to 94% during the prior quarter, gold recovery rates (93.8% compared to 93.5%) and head grade of processed ore (2.60 g/t to 2.50 g/t) were all reasonably steady and in line with expectations.

The 3% reduction in quarter-on-quarter AISCs, largely reflected the increase in gold production. A slight decrease in royalties due to the timing of sales was offset by a US$5 per ounce increase in sustaining capital costs related to costs associated with the tailings’ storage facility and other site building works. On a unit cost basis, mining costs and G&A were reasonably steady although processing costs per tonne increased as a result of slightly more maintenance activities at the front end of the circuit. Refer to Table 4 below for details of key operating and financial parameters.

Table 4: Yaouré Quarterly Performance

| PARAMETER | UNIT | DECEMBER 2021 HALF YEAR | MARCH 2022 QUARTER | JUNE 2022 QUARTER | JUNE 2022 HALF YEAR | 2022 FINANCIAL YEAR |

| Gold Production & Sales | ||||||

| Total material mined | Tonnes | 16,210,761 | 9,295,689 | 8,881,028 | 18,176,717 | 34,387,478 |

| Total ore mined | Tonnes | 2,448,820 | 1,463,248 | 1,899,069 | 3,362,317 | 5,811,137 |

| Average ore grade | g/t gold | 2.02 | 1.93 | 1.88 | 1.90 | 1.95 |

| Strip ratio | t:t | 5.6 | 5.4 | 3.7 | 4.4 | 4.9 |

| Ore milled | Tonnes | 1,859,582 | 1,025,345 | 1,036,331 | 2,061,676 | 3,921,258 |

| Milled head grade | g/t gold | 2.51 | 2.5 | 2.6 | 2.55 | 2.53 |

| Gold recovery | % | 93.2 | 93.5 | 93.8 | 93.6 | 93.4 |

| Gold produced | ounces | 139,747 | 76,921 | 81,150 | 158,071 | 297,818 |

| Gold sales1 | ounces | 139,724 | 74,947 | 70,761 | 145,708 | 285,432 |

| Average sales price | US$/ounce | 1,695 | 1,720 | 1,673 | 1,697 | 1,696 |

| Unit Production Costs | ||||||

| Mining cost | US$/t mined | 2.71 | 2.66 | 2.74 | 2.70 | 2.70 |

| Processing cost | US$/t milled | 13.63 | 12.38 | 13.96 | 13.17 | 13.39 |

| G & A cost | US$M/month | 1.99 | 1.62 | 1.76 | 1.69 | 1.84 |

| All-In Site Cost | ||||||

| Production cost | US$/ounce | 581 | 549 | 543 | 546 | 562 |

| Royalties | US$/ounce | 87 | 86 | 67 | 76 | 81 |

| Sub-total | US$/ounce | 669 | 635 | 610 | 622 | 644 |

| Sustaining capital | US$/ounce | 18 | 26 | 31 | 29 | 24 |

| Total All-In Site Cost2 | US$/ounce | 687 | 662 | 641 | 651 | 668 |

| Notional Cashflow from Operations | ||||||

| Cash Margin | US$/ounce | 1,008 | 1,058 | 1,032 | 1,046 | 1,028 |

| Notional Cash Flow | US$M | 140.9 | 81.4 | 83.7 | 165.3 | 306.2 |

Notes:

1. Gold sales are recognised in Perseus’s accounts when gold is delivered to the customer from Perseus’s metal account

2. Included in the AISC for the quarter is US$2.98 million of costs relating to excess waste stripping. When reporting cost of sales, in line with accepted practice under IFRS, this cost will be capitalised and the costs amortised over the remainder of the relevant pit life.

MINERAL RESOURCE TO MILL RECONCILIATION

The reconciliation of processed ore tonnes, grade and contained gold relative to the Yaouré Mineral Resource block model are shown in Table 5. During the last quarter, 35% more ore tonnes at 12% lower grade for 19% more ounces have been produced compared to the Mineral Resource model. Over the last six months and project to-date, Yaouré continues to produce more metal than predicted by the Mineral Resource model. The performance of the Yaouré Mineral Resource model to date is considered satisfactory, however work will continue to optimise the grade and reduce dilution.

Table 5: Yaouré Block Model to Mill Reconciliation

| PARAMETER | BLOCK MODEL TO MILL CORRELATION FACTOR | ||

| 3 MONTHS | 6 MONTHS | 1 YEAR | |

| Tonnes of Ore | 1.35 | 1.32 | 1.24 |

| Head Grade | 0.88 | 0.89 | 0.91 |

| Contained Gold | 1.19 | 1.17 | 1.13 |

FATAL ACCIDENT AT YAOURÉ

On Friday 24 June 2022, an employee of our mining contractor at Yaouré, EPSA Group, was fatally injured following an accident while working in EPSA’s heavy vehicle workshop. Perseus undertook an investigation into the incident and has consulted with the relevant Ivorian regulatory authorities.

Following the accident, a thorough review of all health and safety critical risks and controls has been initiated for all activities undertaken by Perseus’s employees and contractors across our three operating sites. This review will be followed by an improvement program where needed. This work will be conducted throughout FY2023, first prioritising the most significant risks at each site. The cultural Safety Transformation Program that has been underway since February 2022 has also been re-focused to ensure that all employees and contractors understand their personal and a collective role in creating a safe workplace, including coaching managers and supervisors on how they can lead the way.

Both Perseus and EPSA are providing support to help the victim’s family following this tragic accident, as well as offering support to our entire team at Yaouré and our other operations as they come to terms with the tragic loss of a colleague.

SISSINGUÉ GOLD MINE, CÔTE D’IVOIRE

Since pouring first gold in January 2018, Sissingué has continued to comfortably perform in line with market production and cost guidance, generating solid cashflow for Perseus and consistently achieving the targets that were originally set for the mine.

During the quarter, 12,509 ounces of gold were produced at Sissingué at a production cost of US$1,227 per ounce and an AISC of US$1,398 per ounce, an increase relative to prior periods. The weighted average sales price of the 13,445 ounces of gold sold during the quarter was reasonably steady at US$1,673 per ounce, giving rise to a reduced cash margin of US$275 per ounce. Notional cashflow generated by the Sissingué operation totalled US$3.4 million, US$5.9 million less than in the prior quarter. Refer to Table 6 below for details of operating and financial parameters.

The 2,503-ounce decrease in quarterly gold production largely resulted from an 11% decrease in the quantity of ore processed. This was caused by a change in the composition of mill feed as more sedimentary ore was processed compared to prior periods, and a reduction in mill run time due to maintenance activities early in the quarter. The head grade of processed ore also decreased from 1.32g/t to 1.24g/t, due to the composition of the mill feed but gold recovery rates remained stable at 89.6%.

The 31% or US$331 per ounce increase in quarter-on-quarter AISCs, was primarily a function of the 28% increase in production costs, attributable to the 17% decrease in the number of ounces of gold produced during the quarter, as explained above, and an increase in consumable and maintenance costs. Royalties per ounce also increased due to the timing of gold sales (i.e. royalties from the prior quarter were paid this quarter), while sustaining capital costs also increased reflecting an increase in expenditure on expanding the capacity of the TSF and upgrading security infrastructure at the mine.

Table 6: Sissingué Quarterly Performance

| PARAMETER | UNIT | DECEMBER 2021 HALF YEAR | MARCH 2022 QUARTER | JUNE 2022 QUARTER | JUNE 2022 HALF YEAR | 2022 FINANCIAL YEAR |

| Gold Production & Sales | ||||||

| Total material mined | Tonnes | 1,102,186 | 1,242,344 | 1,205,035 | 2,447,379 | 3,549,565 |

| Total ore mined | Tonnes | 348,975 | 228,130 | 325,609 | 553,739 | 902,714 |

| Average ore grade | g/t gold | 1.17 | 0.72 | 1.03 | 0.9 | 1.0 |

| Strip ratio | t:t | 2.2 | 4.5 | 2.7 | 3.4 | 2.9 |

| Ore milled | Tonnes | 675,372 | 395,131 | 350,919 | 746,050 | 1,421,422 |

| Milled head grade | g/t gold | 1.78 | 1.32 | 1.24 | 1.28 | 1.52 |

| Gold recovery | % | 88.5 | 89.8 | 89.6 | 89.7 | 89.0 |

| Gold produced | ounces | 34,132 | 15,012 | 12,509 | 27,521 | 61,653 |

| Gold sales1 | ounces | 34,870 | 16,264 | 13,445 | 29,709 | 64,579 |

| Average sales price | US$/ounce | 1,630 | 1,683 | 1,673 | 1,680 | 1,653 |

| Unit Production Costs | ||||||

| Mining cost | US$/t mined | 7.81 | 4.52 | 4.65 | 4.58 | 5.58 |

| Processing cost | US$/t milled | 18.01 | 14.09 | 18.10 | 15.97 | 16.94 |

| G & A cost | US$M/month | 1.22 | 1.07 | 1.13 | 1.10 | 1.16 |

| All-In Site Cost1 | ||||||

| Production cost | US$/ounce | 823 | 958 | 1,227 | 1,080 | 938 |

| Royalties | US$/ounce | 89 | 97 | 124 | 110 | 98 |

| Sub-total | US$/ounce | 912 | 1,055 | 1,351 | 1,190 | 1,036 |

| Sustaining capital | US$/ounce | 5 | 13 | 47 | 28 | 15 |

| Total All-In Site Cost | US$/ounce | 917 | 1,067 | 1,398 | 1,218 | 1,051 |

| Notional Cashflow from Operations1 | ||||||

| Cash Margin | US$/ounce | 713 | 616 | 275 | 460 | 601 |

| Notional Cash Flow | US$M | 24.3 | 9.3 | 3.4 | 12.6 | 37.0 |

Notes:

- Gold sales are recognised in Perseus’s accounts when gold is delivered to the customer from Perseus’s metal account.

- Included in the AISC for the quarter is US$0.45 million of costs relating to excess waste stripping. When reporting cost of sales, in line with accepted practice under IFRS, this cost will be capitalised and the costs amortised over the remainder of the relevant pit life.

MINERAL RESOURCE TO MILL RECONCILIATION

The reconciliation of processed ore tonnes, grade and contained ounces relative to the Sissingué Mineral Resource block model is in Table 7 below. During the last three months, grade control has predicted materially increased tonnes (25%) increased grade (4%) and ounces (29%) when compared to the Mineral Resource Estimate. Over the last six- and 12-month periods of operation, Sissingué has also produced more metal than predicted by the Mineral Resource model. Perseus regards the overall outperformance as an acceptable variance, and a significant amount of work has been invested to more closely align the Resource Model with the over-delivery of ore experienced in the grade control.

Table 7: Sissingué Block Model to Mill Reconciliation

| PARAMETER | BLOCK MODEL TO MILL CORRELATION FACTOR | ||

| 3 MONTHS | 6 MONTHS | 1 YEAR | |

| Tonnes of Ore | 1.25 | 1.32 | 1.18 |

| Head Grade | 1.04 | 1.06 | 1.01 |

| Contained Gold | 1.29 | 1.39 | 1.19 |

UPDATE ON THE LIFE OF MINE PLAN EXTENSION FOR THE SISSINGUÉ OPERATION

Work is ongoing to obtain an Exploitation Permit (EP) covering the Bagoé exploration permit area. Community consultation processes required as part of the environmental permitting process were completed, and the ESIA (Environment and Social Impact Assessment), a prerequisite to the granting of the EP was completed, lodged with authorities and validated by the government’s inter-departmental review. Evaluation of the EP application is currently in process.

A further review of compensation entitlements for farmers who will be impacted by the development of the Fimbiasso pit, has been undertaken and payments are pending.

EDIKAN GOLD MINE, GHANA

In summary, and in contrast to Perseus’s other two gold mines, Edikan’s operating performance during the June 2022 quarter was disappointing, falling short of Perseus’s required standards. This was partially due to the availability of Edikan’s processing facility being reduced by 21% during the quarter while the 19-day preventative maintenance shut-down, foreshadowed in the March 2022 Quarter Report, was undertaken. It also resulted from a combination of inadequate management of previous maintenance activities on the CIL tanks that impacted gold recovery rates, and poor block model to mill reconciliation recorded while mining in the AG Pit cutback area was completed.

On a positive note, the maintenance shutdown was successfully completed and since Edikan’s processing operations recommenced in mid-June 2022, almost all processing KPIs have been achieved or exceeded, helping to partially reduce the deficit caused by the shutdown of operations, but more importantly, providing confidence that with appropriate management, forecasts for the FY2023 years are achievable.

During the quarter, a total of 28,668 ounces of gold were produced at Edikan (26% less than in the March quarter) at a production cost of US$1,685 per ounce and an AISC of US$1,859 per ounce, 39% higher than in the prior quarter. Gold sales of 27,691 ounces were 30% less than in the prior quarter, at a weighted average realised gold price of US$1,802 per ounce, US$129 per ounce more than in the prior quarter. This generated a cash margin of -US$56 per ounce, approximately $400 per ounce less than the prior quarter. Negative notional cashflow of US$1.7 million resulted which was US$14.6 million worse than in the prior period. Table 8 summarises the key operating and financial parameters.

While an allowance was built into the Edikan market production and cost guidance for the June half year and the full financial year to allow for events such as those referred to above, this allowance was insufficient and both production and AISCs for both periods fell short of guidance. For the June half year, Edikan produced 67,258 ounces of gold at an AISC of US$ 1,559 per ounce compared to market guidance of 75,000 to 90,000 ounces at US$1,210 to US$1,430 per ounce, while for the full financial year, 134,543 ounces of gold were produced at an AISC of US$1,534 per ounce compared to market guidance of 142,284 to 157,284 ounces at US$1,350 to US$1,465 per ounce.

Table 8: Edikan Quarterly Performance

| PARAMETER | UNIT | DECEMBER 2021 HALF YEAR | MARCH 2022 QUARTER | JUNE 2022 QUARTER | JUNE 2022 HALF YEAR | 2022 FINANCIAL YEAR |

| Gold Production & Sales | ||||||

| Total material mined | Tonnes | 15,413,395 | 6,829,223 | 6,577,009 | 13,406,232 | 28,819,627 |

| Total ore mined | Tonnes | 1,624,878 | 1,242,630 | 1,289,580 | 2,532,210 | 4,157,088 |

| Average ore grade | g/t gold | 0.91 | 1.03 | 1.08 | 1.06 | 1.00 |

| Strip ratio | t:t | 8.5 | 4.50 | 4.10 | 4.29 | 5.93 |

| Ore milled | Tonnes | 3,487,218 | 1,633,717 | 1,250,300 | 2,884,017 | 6,371,235 |

| Milled head grade | g/t gold | 0.73 | 0.86 | 0.86 | 0.86 | 0.78 |

| Gold recovery | % | 83.0 | 85.8 | 83.1 | 84.6 | 83.8 |

| Gold produced | ounces | 67,285 | 38,590 | 28,668 | 67,258 | 134,543 |

| Gold sales1 | ounces | 63,541 | 39,833 | 27,691 | 67,524 | 131,064 |

| Average sales price | US$/ounce | 1,608 | 1,673 | 1,802 | 1,726 | 1,669 |

| Unit Production Costs | ||||||

| Mining cost | US$/t mined | 3.41 | 3.82 | 4.17 | 3.99 | 3.68 |

| Processing cost | US$/t milled | 8.39 | 9.97 | 12.95 | 11.26 | 9.69 |

| G & A cost | US$M/month | 1.89 | 1.33 | 1.56 | 1.45 | 1.67 |

| All-In Site Cost2 | ||||||

| Production cost | US$/ounce | 1,383 | 1,202 | 1,685 | 1,408 | 1,396 |

| Royalties | US$/ounce | 102 | 116 | 117 | 116 | 109 |

| Sub-total | US$/ounce | 1,485 | 1,318 | 1,802 | 1,524 | 1,505 |

| Sustaining capital | US$/ounce | 24 | 18 | 57 | 34 | 29 |

| Total All-In Site Cost2 | US$/ounce | 1,509 | 1,336 | 1,859 | 1,559 | 1,534 |

| Notional Cashflow from Operations1 | ||||||

| Cash Margin | US$/ounce | 98 | 337 | -56 | 168 | 135 |

| Notional Cash Flow | US$M | 6.6 | 13.0 | -1.6 | 11.3 | 18.2 |

Notes:

1. Gold sales are recognised in Perseus’s accounts when gold is delivered to the customer from Perseus’s metal account.

2. Included in the AISC for the quarter is US$5.15 million of costs relating to excess waste stripping. When reporting cost of sales, in line with accepted practice under IFRS, this cost will be capitalised and the costs amortised over the remainder of the relevant pit life.

MINERAL RESOURCE TO MILL RECONCILIATION

The reconciliation of processed ore tonnes, grade and contained ounces relative to the Edikan Mineral Resource block model are shown in Table 9 below.

Table 9: Edikan Block Model to Mill Reconciliation

| PARAMETER | BLOCK MODEL TO MILL CORRELATION FACTOR | ||

| 3 MONTHS | 6 MONTHS | 1 YEAR | |

| Tonnes of Ore | 1.07 | 0.99 | 0.91 |

| Head Grade | 0.74 | 0.81 | 0.82 |

| Contained Gold | 0.79 | 0.80 | 0.75 |

Block model to mill reconciliation improved during the last part of the quarter relative to the prior periods in FY22. Mining has moved below the existing Stage 2 cutback void in the AG Pit which is the principal source of ore. During the quarter, ongoing work to reduce mining dilution continued to deliver solid results. Geological mapping has been successfully integrated into the daily ore prediction modelling and reflects the improving performance at Edikan.

Based on reconciliation results achieved in Q4 and the completion of the drilling for the next 30m of mining in the AG pit, the reconciliation has reverted to expected performance for the AG pit.

GROUP GOLD PRODUCTION AND COST MARKET GUIDANCE

Production and cost guidance for the Perseus Group and each of its individual mines for the six months and calendar year ending 31 December 2022, is as set out below in Table 10 below.

Table 10: Production and Cost Guidance

| PARAMETER | UNITS | JUNE 2022 HALF YEAR (ACTUAL) | DECEMBER 2022 HALF YEAR (FORECAST) | 2022 CALENDAR YEAR (FORECAST) |

| Yaouré Gold Mine | ||||

| Production | Ounces | 158,071 | 130,000 to 140,000 | 288,071 to 298,071 |

| All-in Site Cost | USD per ounce | 651 | 810 to 875 | 725 to 750 |

| Sissingué Gold Mine | ||||

| Production | Ounces | 27,521 | 20,000 to 25,000 | 47,521 to 52, 521 |

| All-in Site Cost | USD per ounce | 1,218 | 1,600 to 1,950 | 1,400 to 1,525 |

| Edikan Gold Mine | ||||

| Production | Ounces | 67,258 | 90,000 to 100,000 | 157,258 to 167,258 |

| All-in Site Cost | USD per ounce | 1,559 | 1,190 to 1,320 | 1,340 to 1,420 |

| PERSEUS GROUP | ||||

| Production | Ounces | 252,850 | 240,000 to 265,000 | 492,850 to 517,850 |

| All-in Site Cost | USD per ounce | 954 | 1,000 to 1,100 | 980 to 1,025 |

SUSTAINABILITY

SUSTAINABILITY GOVERNANCE

During the quarter, Perseus continued to strengthen its sustainability governance as follows:

- Following an accident at Yaouré on 24 June 2022, that resulted in the death of an employee of one of Perseus’s contractors, Perseus has:

- Re-focussed Phase 2 of our global project to transform Perseus’s health and safety culture across the operations on ensuring that all employees and contractors understand their personal and collective role in creating a safe workplace, including coaching managers and supervisors on how they can lead the way. Phase 1 of the program was completed in May 2022 and Phase 2 of the program will commence at the sites in early August 2022.

- Initiated a deep review and improvement program of health and safety critical risks and controls across all activities of Perseus and our contractors across our three operating sites. This work will be conducted over FY2023, first prioritising the most significant risks at each site.

- To further advance our Task Force on Climate Related Financial Disclosures Report (with the updated report to be released in our FY2023 sustainability reporting), Perseus:

- Completed a study of the greenhouse gas emissions profile of our portfolio and identified potential pathways of further study for future emissions reduction.

- Conducted a physical impact of climate change study across our portfolio.

- Completed gap analysis of our Yaouré and Sissingué Tailings Storage Facilities against the Global Industry Standard on Tailings Management, with results to be reported in our FY2022 Sustainability Report.

- Created our social performance policy and standard and conducted external expert review of our social performance framework, with implementation to commence in FY23. We also commenced update of our Sissingué Community Development Plan.

- Completed the renewal of the Fimbiasso Environmental and Social Impact Statement (ESIA) with the Côte d’Ivoire government and commenced the land and crop compensation process. We also completed the Bagoé ESIA public consultation sessions and achieved validation of the ESIA.

- Reviewed our Human Rights Policy in line with best practice (to be published in FY23) and conducted a human rights risk assessment across our operations.

- Developed a draft Supplier Code of Conduct, summarising Perseus’s supplier standards in relation to anti-corruption and bribery, legal compliance, business continuity, human and labour rights, health and safety, community engagement, security, biodiversity and air emissions. The Supplier Code of Conduct will be implemented throughout FY23.

- Commenced external assurance on our FY22 sustainability data. The scope included limited assurance over the same data as FY21 (safety data and our alignment with the World Gold Council Responsible Gold Mining Principles). The scope was also expanded for FY22 to include limited assurance over our World Gold Council Conflict Free Gold Statement and value of community investment. Pre-assurance has been initiated over our Scope 1, 2 and 3 greenhouse gas emissions, energy data and water balance, with limited assurance to be conducted over this data in FY23.

- Completed updates to our closure cost models and rehabilitation provisions for the end of FY22.

- Participated in round table industry and government initiatives to reduce the risk of artisanal and illegal mining in and around our operations.

SUSTAINABILITY PERFORMANCE

This quarter, Perseus continued its strong sustainability performance relative to objectives and targets, as shown below in Table 11 and summarised as follows:

- Safety: Despite the tragic incident at Yaouré, safety performance across the rest of the portfolio was strong, with Total Recordable Injury Frequency Rates (TRIFR) reducing from 1.45 at the end of the March quarter to 1.21 at the end of June 2022, lower than the FY22 target of 1.3. Lost Time Injury Frequency (LTIFR) across the Group reduced from 0.36 to 0.17. Sissingué achieved another safety milestone, celebrating 6 million hours without a Lost Time Incident. Additional focus on safety performance at Edikan led to significant improvement over the financial year (from TRIFR of 1.49 and LTIFR of 0.37 in FY21 to a TRIFR of 0.98 and LTIFR of 0.20 for FY22). TRIFR and LTIFR also improved across the Group year on year, from 1.76 and 0.45 respectively in FY21 to 1.21 and 0.17 in FY22.

- Social:

- Total economic contribution to Perseus’s host countries of Ghana and Côte d’Ivoire for the financial year of around US$495 million (around 61% of revenue), including approximately US$394 million paid to local suppliers representing 81% of procurement, US$33 million paid as salaries and wages to local employees, US$67 million in payments to government as taxes, royalties and other payments, and around US$3.6 million in social investment (includes accrual for Yaouré).

- Local and national employment has been maintained at 95% for the quarter, and across the Perseus Group, our gender diversity was stable with the proportion of female employees ~13%, reflecting the industry in which we are involved but more particularly, the cultural orientation of our host countries.

- Zero significant community events occurred.

- Environment:

- Emissions intensity per ounce of gold produced and water intensity remained steady for the quarter and by comparison to FY21. Total Scope 1 and 2 greenhouse gas emissions increased by 33% from FY21, reflecting the increase in Group gold production.

- Following interest from additional vendors and completion of the new Yaouré LOM plan, Perseus updated the evaluation of the potential use of solar power at the operation. Further detailed studies will be carried out once options to extend the life of Yaouré have been confirmed.

- Zero significant environmental or tailings dam integrity issues occurred during the period.

In achieving the above, the following sustainability challenges were encountered by Perseus during the quarter:

- Death of an employee of Yaouré’s mining contractor, EPSA Group, following an accident on 24 June 2022 while working in EPSA’s heavy vehicle workshop as reported above.

- Government administrative delays continue to prevent the establishment of the Yaouré Community Development Fund and commencement of related community projects. Perseus continues to work with Government to establish the fund as soon as possible, escalating the issue on several occasions. Community funding has been accrued each month since commencing commercial production, with approximately US$2.9M accrued to-date.

- Illegal mining activities on Perseus’s mining and exploration licence areas continues to present challenges for the Company in both Ghana and Côte d’Ivoire. The Company continues to work closely with relevant government authorities to manage these activities that have proven to negatively impact both the environmental and social fabric of local communities.

- Ongoing tensions with the communities around Yaouré and Sissingué regarding employment, business opportunities, and crop and land compensation.

- Security risks at Sissingué and satellite development areas (Fimbiasso and Bagoé) continue to be closely monitored due to ongoing political and social unrest which has given rise to terrorist activities in Mali which lies immediately to the north of the Sissingué mine. Increased security threats of banditry were also closely monitored around Yaouré.

- Perseus received a US$5,000 regulatory fine at Edikan in Ghana associated with a Lost Time Injury that occurred in February 2022.

Table 11: Sustainability Performance

| PERFORMANCE DRIVER | SUB-AREA | METRIC | UNIT | SEP 2021 QUARTER | DEC 2021 QUARTER | MAR 2022 QUARTER | JUN 2022 QUARTER | FY2022 | |||||

| Governance | Compliance | Material legal non-compliance | Number | 0 | 0 | 0 | 111 | 1 | |||||

| Social | Worker Health, Safety and Wellbeing | Workplace fatalities | Number | 0 | 0 | 0 | 1 | 1 | |||||

| Total Recordable Injury Frequency (TRIF) | Total Recordable Injuries per million hours worked, rolling 12 months | Edikan - 1.89 Sissingué - 0.50 Yaouré - 3.24 Exploration - 2.80 Group - 1.85 | Edikan - 1.36 Sissingué - 0.00 Yaouré - 3.49 Exploration - 2.01 Group - 1.49 | Edikan - 1.38 Sissingué - 0.00 Yaouré - 2.78 Exploration - 0.82 Group - 1.45 | Edikan – 0.98 Sissingué - 0.00 Yaouré - 2.59 Exploration - 0.66 Group – 1.21 | Edikan – 0.98 Sissingué - 0.00 Yaouré - 2.59 Exploration - 0.66 Group – 1.21 | |||||||

| Lost Time Injury Frequency (LTIFR) | Lost Time Injuries (LTIFR) per million hours worked, rolling 12 months | Edikan - 0.38 Sissingué - 0.00 Yaouré - 0.991 Exploration - 1.40 Group - 0.46 | Edikan - 0.39 Sissingué - 0.00 Yaouré - 0.76 Exploration - 1.00 Group - 0.46 | Edikan - 0.39 Sissingué - 0.00 Yaouré - 0.35 Exploration - 0.82 Group - 0.36 | Edikan - 0.20 Sissingué - 0.00 Yaouré - 0.00 Exploration - 0.66 Group - 0.17 | Edikan - 0.20 Sissingué - 0.00 Yaouré - 0.00 Exploration - 0.66 Group - 0.17 | |||||||

| COVID-19 Cases | Number | 66 | 60 | 17 | 0 | 143 | |||||||

| Community | Number of significant2 community events | Number | 0 | 0 | 0 | 0 | 0 | ||||||

| Community investment | US$ | US$818,459 1,4 | US$956,4784 | US$985,0914 | US$877,5464 | US$3,637,5744 | |||||||

| Economic Benefit | Proportion local and national employment | % of total employees | 95 | % | 96 | % | 96 | % | 95 | % | 96 | % | |

| Proportion local and national procurement | % of total procurement | 74 | % | 81%1 | 86 | % | 84 | % | 81 | % | |||

| Gender Diversity | Board gender diversity | % | 33 | % | 33 | % | 33 | % | 33 | % | 33 | % | |

| Executive gender diversity | % | 40 | % | 40 | % | 40 | % | 40 | % | 40 | % | ||

| Proportion of women employees | % | 13.8%3 | 12.0%3 | 13.1%3 | 14.0%3 | 13.0%3 | |||||||

| Responsible Operations | Environment | Number of significant2 environmental events | Number | 0 | 0 | 0 | 0 | 0 | |||||

| Tailings | Number of significant2 tailings dam integrity failures | Number | 0 | 0 | 0 | 0 | 0 | ||||||

| Water stewardship | Water used per ounce of gold produced | M3/oz | 6.91 | 8.05 | 7.85 | 7.87 | 7.87 | ||||||

| Greenhouse Gas Emissions | Scope 1 and 2 Greenhouse Gas Emissions per ounce of gold produced | Tonnes of CO2-e/oz | 0.57 | 0.57 | 0.53 | 0.55 | 0.55 | ||||||

Notes:

- Corrected/re-stated figure from the September and December 2021 Quarter report

- A significant event is one with an actual severity rating of four and above, based on Perseus's internal severity rating scale (tired from one to five by increasing severity) as defined in our Risk Management Framework

- Permanent employees only.

- Includes accruals for the CDLM at Yaouré.

BUSINESS GROWTH

PROJECT DEVELOPMENT

During the quarter, the proposed Plan of Arrangement between Perseus and Orca Gold Inc. under which Perseus would acquire all the outstanding common shares of Orca not already owned by Perseus, was approved by Orca’s shareholders in a general meeting and subsequently approved by the Canadian court.

Following completion of the acquisition, Perseus became the owner of a:

- 70% interest in the Block 14 Gold Project in Sudan; and a

- 31.4% interest in Montage Gold Corp., the holder of tenements hosting the Kone Project in Cote d’Ivoire.

BLOCK 14 GOLD PROJECT

During the quarter, Perseus engaged in activities directed at advancing the Project towards a possible development decision in relation to the Block 14 Gold Project located in the north of Sudan, approximately 75 kilometres south of the border with Egypt. These pre-development activities have included:

- Integration of members of Orca’s team who wished to remain involved in the project, into Perseus’s team and recruiting additional team members as required;

- Expanding critical relationships within Sudan including with the key government ministries and Sudanese businesses leaders who may be able to supply goods and services to the project when it enters the development and or operating phases;

- Calling for tenders from qualified drilling companies to undertake approximately 100,000 metres drilling program at Block 14 aimed at infill drilling the Gulat Sufur South (GSS) deposit as well as sterilising adjacent land currently targeted to site key pieces of mine infrastructure including the tailings dam and waste dumps;

- Preparing for the mobilisation of the preferred drilling contractor, specifically clearing the way for the importation of drilling rigs and associated equipment and consumables needed to support and manage the program and upgrading site accommodation and support infrastructure;

- Prepare for large scale pump testing of the Area 5 aquifer to test recharge rates.

Work on the planned drilling program is expected to commence late in the September 2022 quarter along with confirmatory work on the Area 5 aquifer and preliminary activities for the Front-End Engineering Design (FEED) Study.

MONTAGE GOLD CORP.

During the quarter, Montage announced that they had entered a transaction with Barrick Gold Corporation and Endeavour Mining plc, to acquire 100% of their Mankono-Sissédougou Joint Venture Project which consists of three properties contiguous to Montage’s Koné Gold Project in Côte d’Ivoire. Two of the joint venture’s properties are currently the subject of Exploration Licence applications being considered by the Ivorian government. Completion of the transaction is subject to these licences being granted. On completion, Montage will acquire 100% of the issued and outstanding shares of Mankono Exploration Limited which holds the Mankono licences, for total consideration of C$30 million including C$14.5 million in cash, 22.1 million common shares of Montage, and a 2% NSR royalty allocated 70% to Barrick and 30% to Endeavour.

To fund the acquisition and ongoing working capital, Montage entered an underwriting agreement with Stifel GMP on behalf of a syndicate of underwriters, pursuant to which the Underwriters have agreed to purchase, on a bought deal private placement basis, approximately 28.6 million Subscription Receipts priced at C$0.70 per Subscription Receipt, which will convert into common Montage shares for gross proceeds of approximately C$20.0 million.

Perseus elected not to participate in the financing and as a result, if the transaction is completed, Perseus’s interest in Montage will decrease from its current level of 31.4% to 21.1% of issued capital.

CÔTE D’IVOIRE EXPLORATION

YAOURÉ EXPLORATION & EXPLOITATION PERMITS

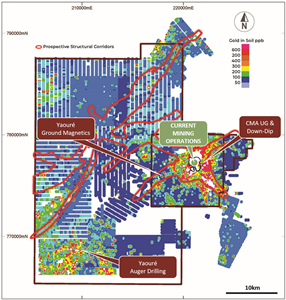

Exploration activities on the Yaouré exploitation permit during the quarter continued to focus on drilling at the CMA Underground prospect, located within two kilometres of the Yaouré mill. Other programs included auger drilling on the Yaouré and Yaouré West permits and ground magnetics on the Yaouré permit (Appendix 1 – Figure 1.1).

At the CMA Underground prospect, infill drilling to firm up previously defined underground resources extending below the currently planned CMA pit, was completed. Perseus has previously defined an Inferred Mineral Resource of 1.8 million tonnes grading 6.1 g/t gold, extending to a maximum 275 metres down dip beneath the open pit resource (refer Resources and Reserves News Release dated 24 August 2021), with potential to extend mineralisation further down dip beyond this. Perseus has also completed a Scoping Study that identified the potential to mine the CMA structure using underground mining methods (refer to News Release ‘Perseus Mining Completes Scoping Study for Potential Underground Mine at Yaouré’ dated 5 November 2018).

Drilling during the quarter comprised 8,817 metres in 37 Reverse Circulation (RC) pre-collared diamond (DD) holes, continuing the infill of the existing 50 x 50 metre coverage to a nominal 25 x 25 metre pattern to allow conversion of the Inferred resource to Indicated. Results to date from the infill drilling program continue to provide strong encouragement, with intercepts generally consistent with those previously encountered in both thickness and grade.

Further drilling was completed to investigate the next 300 metres down-dip from the current CMA Underground resource, with 4,284 metres drilled in 10 RC pre-collared diamond holes. The step-out program was guided by the 2020 3D seismic survey that clearly identified the CMA structure extending to depth beyond the current drill coverage. Drilling on the step out program was undertaken on an initial 100 x 200 metre pattern to better define the position of the CMA structure and the intensity of mineralisation.

The results from both the CMA Underground infill and extension drilling continue to demonstrate the potential for Perseus to materially grow its gold inventory at Yaouré by organic means. Results from both the Underground infill program and the step out program will be used to support an updated Mineral Resource estimate and a maiden Ore Reserve estimate, which are expected to be completed in the September 2022 quarter. The results from the additional drilling referred to above will also be reported at the same time.

On the Yaouré West exploration permit, auger geochemical drilling continued on a property-wide 800 x 800 metre grid, with 267 metres drilled in 33 holes. The augering program is designed to map geology and define potential targets through the delineation of alteration patterns using a combination of multi-element XRF and mineral spectro-radiometry (ASD) analyses. This program will be combined with a ground magnetics survey designed to better define suspected Govisou-like granites to the immediate west of the Yaouré deposit.

BAGOÉ EXPLORATION PERMIT

A 3,197-metre auger program was conducted over the Ludivine zone that lies along the sheared western margin of the Bagoé Granite. Final assay results from this work are pending.

GHANA EXPLORATION

AGYAKUSU EXPLORATION LICENCE

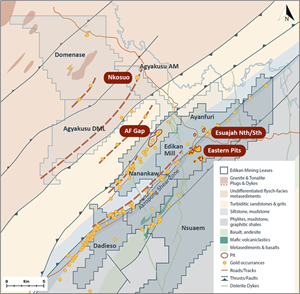

Exploration drilling was completed at the Nkosuo prospect on the Agyakusu Exploration Licence area to the north of Perseus’s Edikan Gold Mine (Appendix 1 – Figure 1.2). One remaining diamond hole was completed during the quarter (115 metres) bringing the reconciled total for the drilling which commenced on 1 July 2021 to 36,982 metres in 222 holes, including five geotechnical holes.

Results from the completed drilling informed the Mineral Resource and Ore Reserve estimate that was contained in the News Release dated 19 July 2022, “Perseus Increases Edikan’s Inventories of Mineral Resources and Ore Reserves”. Indicated Mineral Resources at Nkosuo containing 422,000 ounces and Inferred Mineral Resources containing a further 27,000 ounces have been identified along with a Probable Ore Reserve totalling 10 million tonnes of ore grading 1.04g/t gold and containing 332,000 ounces of gold. Metallurgical test work, hydrological studies and geotechnical drilling and analysis were all completed as part of the feasibility. The final Nkosuo Feasibility Study will be submitted to the Ghanaian Minerals Commission (Mincom) to convert the current Exploration Licence to a Mining Lease.

Perseus had previously exercised its option to purchase the Agyakusu Exploration Licence and following Ministerial approval, the Licence was transferred to Perseus during the quarter.

Baseline environmental studies have been completed and community engagement will commence shortly as part of the Ghanaian Environmental Protection Agency (EPA) approvals process.

The Nkosuo granite is open to the south-west. Drilling is planned for the September 2022 quarter to determine if economic mineralisation continues.

AGYAKUSU-DML OPTION

A planned AC drilling program to test gold-in-soil anomalism along the main structural/intrusive corridor extending SW from the Nkosuo prospect into the adjoining Agyakusu DML permit has been deferred in favour of an initial lower impact auger program (Appendix 1 - Figure 1.3).

Good progress was made on the augering program towards the end of the June 2022 quarter, with results expected in the September quarter.

DOMENASE OPTION

The Domenase Exploration Licence that is held by a Ghanaian company, Union Minerals Prospecting, was renewed by the Mincom during the quarter. After the end of the quarter, the option agreement between Union Minerals and Perseus, that sets out the terms under which Perseus may acquire the licence, was also approved by Mincom. Work programs including augering and RC drilling are expected to commence during the next quarter.

SUDAN EXPLORATION

Planning commenced for an approximately 85,000 metre program of infill and step-out resource drilling at the Galat Sufur South (“GSS”) deposit on the Block 14 project. An additional 18,750 metres of air core (“AC”) drilling is also planned to sterilise areas for planned mine infrastructure, along with geotechnical holes and water bores.

A contract for the drilling is expected to be awarded in July 2022. Preparation for the commencement of drilling will commence shortly, with mobilisation of drills to site expected before the end of the September quarter.

EXPLORATION EXPENDITURE

Expenditure on exploration activities in West Africa by members of the Perseus group up to 30 June 2022 is summarised in Table 12 below.

Table 12: Group Exploration Expenditure March Quarter

| REGION | UNITS | DECEMBER 2021 HALF YEAR | MARCH 2022 QUARTER | JUNE 2022 QUARTER | JUNE 2022 HALF-YEAR | FINANCIAL YEAR 2022 |

| Ghana | US$ million | 6.27 | 4.13 | 1.97 | 6.1 | 12.38 |

| Côte d’Ivoire | ||||||

| Sissingué | US$ million | 1.63 | 0.77 | 0.54 | 1.31 | 2.94 |

| Yaouré | US$ million | 10.25 | 9.19 | 4.34 | 13.53 | 23.78 |

| Regional | US$ million | 0.26 | 0.01 | 0.00 | 0.01 | 0.27 |

| Sub-total | US$ million | 12.14 | 9.97 | 4.88 | 14.85 | 26.99 |

| Total | US$ million | 18.42 | 14.10 | 6.85 | 20.95 | 39.37 |

GROUP FINANCIAL POSITION

CASHFLOW AND BALANCE SHEET (UNAUDITED)

Perseus achieved yet another strong quarter of cash generation, with a US$49.8 million increase in its overall net cash position (or cash plus bullion less interest-bearing debt) relative to the prior quarter. The Yaouré Gold Mine continued to be the primary driver of the Group’s strong cash generation performance.

Based on the spot gold price of US$1,817.00 per ounce and an A$:US$ exchange rate of 0.689273 at 30 June 2022, the total value of cash and bullion on hand at the end of the quarter was A$475.8 million, (US$328.0 million) including cash of A$426.8 million (US$294.2 million) and 18,589 ounces of bullion on hand, valued at A$49.0 million (US$33.8 million). No debt repayments were made during the quarter, leaving the principal amount owing on the Corporate Facility at US$50.0 million.

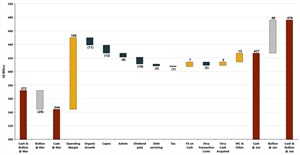

The graph below (Figure 1) shows the notional operating cash flows from the three mines, the largest single driver of cash movement, and compares this to historical data derived over the past 2 years.

Figure 1: Notional Operating Cashflow

https://www.globenewswire.com/NewsRoom/AttachmentNg/3508c91c-ad8d-463a-ac24-d6311b9e5132

Note:

“Notional Operating Cash Flow” is obtained by multiplying average sales price less AISC (the “notional margin”) by the ounces of gold recovered.

The overall movement in cash and bullion during the quarter is shown below in Figure 2. Aside from the operating margin (A$106m), other relevant movements related to organic growth expenditure (A$11.2 million), capital expenditure (A$11.7 million), administrative costs (A$6.2 million), corporate dividend payment (A$10m), debt service and other finance costs (A$3.0 million), Orca transaction costs offset by cash acquired. The cash flows as reported in Australian dollars were also positively impacted by the strengthening of both the US Dollar and Euro.

Figure 2: Quarterly Cash and Bullion Movements

https://www.globenewswire.com/NewsRoom/AttachmentNg/ed9b8ded-e572-4fce-b145-04cb2e95adc7

Note:

“Operating Margin” is obtained by taking from the gold sales revenue the actual cash costs incurred for the quarter (excluding Sustaining Capital).

GOLD PRICE HEDGING

At the end of the quarter, Perseus held gold forward sales contracts for 290,000 ounces of gold at a weighted average sales price of US$1,897 per ounce. These price hedges are designated for delivery progressively over the period up to 29 December 2023. Perseus also held spot deferred sales contracts for a further 71,300 ounces of gold at a weighted average sales price of US$1,740 per ounce. Combining both sets of sales contracts, Perseus’s total hedged position at the end of the quarter was 361,300 ounces at a weighted average sales price of US$1,866 per ounce.

Perseus’s hedge position has decreased by 23,829 ounces since the end of the March 2022 quarter. As a result of our policy of replacing lower priced hedges with higher priced hedge contracts when possible, the weighted average sales price of the hedge book increased by US$60 per ounce or 3.4% during the quarter.

Hedging contracts currently provide downside price protection to approximately 24% of Perseus’s currently forecast gold production for the next three years, leaving 76% of forecast production potentially exposed to movements (both up and down) in the gold price.

SEPTEMBER 2022 QUARTER ANNOUNCEMENTS

- 19 July – Increase of Edikan’s Resource and Reserves Inventory

- 26 July – June 2022 Quarter Report

- August – Group Resource and Reserve Statement

- 31 August – Annual Financial Statement

- September - Updated Mineral Resource estimate and a maiden Ore Reserve estimate for CMA Underground

This market announcement was authorised for release by the board of Perseus Mining Limited.

COMPETENT PERSON STATEMENT

All production targets referred to in this report are underpinned by estimated Ore Reserves which have been prepared by competent persons in accordance with the requirements of the JORC Code.

Edikan. The information in this report that relates to AF Gap Mineral Resources and Ore Reserve estimate was first reported by the Company in a market announcement “Perseus Mining Updates Mineral Resources and Ore Reserves” released on 26 August 2020. The information in this report that relates to the Mineral Resource and Ore Reserve estimates for the Fetish deposit and the Heap Leach was first reported by the Company in a market announcement “Perseus Mining Updates Edikan Gold Mine’s Mineral Resources and Ore Reserves” released on 20 February 2020. The Mineral Reserve and Ore Reserve estimates for the abovementioned deposits were updated for depletion as at 30 June 2021 in a market announcement. “Perseus Mining Updates Mineral Resources and Ore Reserves” released on 24 August 2021. The information in this report that relates to Esuajah North Mineral Resources estimate was first reported by the Company in a market announcement “Perseus Mining Updates Mineral Resources and Ore Reserves” released on 29 August 2018. The information in this report that relates to the Mineral Resource and Ore Reserve estimates for Esuajah South Underground deposit was first reported by the Company in a market announcement “Perseus Mining Updates Mineral Resources and Ore Reserves” released on 24 August 2021. The information in this report that relates to the Nkosuo Mineral Resources and Ore Reserve estimates was first reported by the Company in a market announcement “Perseus Increases Edikan’s Inventories of Mineral Resources and Ore Reserves” released on 19 July 2022. The Company confirms that it is not aware of any new information or data that materially affect the information in those market releases and that all material assumptions underpinning those estimates and the production targets, or the forecast financial information derived therefrom, continue to apply and have not materially changed. The Company further confirms that material assumptions underpinning the estimates of Ore Reserves described in “Technical Report — Edikan Gold Mine, Ghana” dated 7 April 2022 continue to apply.

Sissingué, Fimbiasso, Bagoé. The information in this report that relates to Mineral Resource and Ore Reserve estimates for the Fimbiasso deposits was first reported by the Company in a market announcement “Perseus Mining Updates Mineral Resources and Ore Reserves” released on 26 August 2020. The information in this report that relates to Mineral Resource and Ore Reserve estimates for the Sissingué and Bagoé deposits was first reported by the Company in a market announcement “Perseus Mining Updates Mineral Resources and Ore Reserves” released on 24 August 2021. The Company confirms that it is not aware of any new information or data that materially affect the information in these market releases and that all material assumptions underpinning those estimates and the production targets, or the forecast financial information derived therefrom, continue to apply and have not materially changed. The Company further confirms that material assumptions underpinning the estimates of Ore Reserves described in “Technical Report — Sissingué Gold Project, Côte d’Ivoire” dated 29 May 2015 continue to apply.

Yaouré. The information in this report that relates to Open Pit and Heap Leach Mineral Resources and Ore Reserves at Yaouré was first reported by the Company in a market announcement “Perseus Mining Updates Mineral Resources and Ore Reserves” released on 28 August 2019 and updated for mining depletion as at 30 June 2021 in a market announcement released on 24 August 2021. The information in this report that relates to Underground Mineral Resources at Yaouré was first reported by the Company in a market announcement “Perseus Mining Completes Scoping Study for Potential Underground Mine at Yaouré” released on 5 November 2018 and adjusted to exclude material lying within the US$1,800/oz pit shell that constrains the Open Pit Mineral Resources in a market announcement “Perseus Mining Updates Mineral Resources and Ore Reserves” released on 28 August 2019. The information in this report that relates to the Yaouré near mine satellite deposit Mineral Resource and Ore Reserve estimates was first reported by the Company in a market announcement “Perseus Mining Updates Mineral Resources and Ore Reserves” released on 24 August 2021. The Company confirms that all material assumptions underpinning those estimates and the production targets, or the forecast financial information derived therefrom, in that market release continue to apply and have not materially changed. The Company further confirms that material assumptions underpinning the estimates of Ore Reserves described in “Technical Report — Yaouré Gold Project, Côte d’Ivoire” dated 18 December 2017 continue to apply.

The information in this report relating to Yaouré exploration results was first reported by the Company in compliance with the JORC Code 2012 and NI43-101 in market update “Perseus Discovers More High-grade Gold at Yaouré Mine” released on 13 April 2022. The Company confirms that it is not aware of any new information or data that materially affect the information in these market releases.

CAUTION REGARDING FORWARD LOOKING INFORMATION:

This report contains forward-looking information which is based on the assumptions, estimates, analysis and opinions of management made in light of its experience and its perception of trends, current conditions and expected developments, as well as other factors that management of the Company believes to be relevant and reasonable in the circumstances at the date that such statements are made, but which may prove to be incorrect. Assumptions have been made by the Company regarding, among other things: the price of gold, continuing commercial production at the Yaouré Gold Mine, the Edikan Gold Mine and the Sissingué Gold Mine without any major disruption due to the COVID-19 pandemic or otherwise, , the receipt of required governmental approvals, the accuracy of capital and operating cost estimates, the ability of the Company to operate in a safe, efficient and effective manner and the ability of the Company to obtain financing as and when required and on reasonable terms. Readers are cautioned that the foregoing list is not exhaustive of all factors and assumptions which may have been used by the Company. Although management believes that the assumptions made by the Company and the expectations represented by such information are reasonable, there can be no assurance that the forward-looking information will prove to be accurate. Forward-looking information involves known and unknown risks, uncertainties, and other factors which may cause the actual results, performance or achievements of the Company to be materially different from any anticipated future results, performance or achievements expressed or implied by such forward-looking information. Such factors include, among others, the actual market price of gold, the actual results of current exploration, the actual results of future exploration, changes in project parameters as plans continue to be evaluated, as well as those factors disclosed in the Company's publicly filed documents. The Company believes that the assumptions and expectations reflected in the forward-looking information are reasonable. Assumptions have been made regarding, among other things, the Company’s ability to carry on its exploration and development activities, the timely receipt of required approvals, the price of gold, the ability of the Company to operate in a safe, efficient and effective manner and the ability of the Company to obtain financing as and when required and on reasonable terms. Readers should not place undue reliance on forward-looking information. Perseus does not undertake to update any forward-looking information, except in accordance with applicable securities laws.

| ASX/TSX CODE: PRU CAPITAL STRUCTURE: Ordinary shares: 1,364,655,141 Performance rights: 13,080,399 REGISTERED OFFICE: Level 2 437 Roberts Road Subiaco WA 6008 Telephone: +61 8 6144 1700 Email: IR@perseusmining.com WWW.PERSEUSMINING.COM | DIRECTORS: Mr Sean Harvey Non-Executive Chairman Mr Jeff Quartermaine Managing Director & CEO Ms Elissa Cornelius Non-Executive Director Mr Dan Lougher Non-Executive Director Mr John McGloin Non-Executive Director Mr David Ransom Non-Executive Director Ms Amber Banfield Non-Executive Director | CONTACTS: Jeff Quartermaine Managing Director & CEO jeff.quartermaine@perseusmining.com Claire Hall Corporate Communications +61 414 558 202 claire.hall@perseusmining.com Nathan Ryan Media Relations +61 4 20 582 887 nathan.ryan@nwrcommunications.com.au |

APPENDIX 1 – MAPS AND DIAGRAMS

Figure 1.1: Yaouré Gold Project – Tenements and Prospects

https://www.globenewswire.com/NewsRoom/AttachmentNg/c7d42e9b-fa59-49b2-8577-ff999a124eb7

Figure 1.2: Edikan Gold Mine – Regional Geology, Tenements and Prospects

https://www.globenewswire.com/NewsRoom/AttachmentNg/cc1d99cc-7acf-47f8-91f1-0dcdc92cbe71