Kerr Mines 2020 Drilling & Project Update

TORONTO, Aug. 27, 2020 (GLOBE NEWSWIRE) -- Kerr Mines Inc. (TSX: KER, OTC: KERMF), (“Kerr” or the “Company”) provides an update of recent project developments at its 100% owned Copperstone gold project located in Arizona, USA.

2020 Resource Expansion and Drilling Update

Positive results from the Company’s 2019 successful drilling program totaling 5,000 meters have been incorporated into our planning for the second phase of resource expansion drilling of up to 10,000 meters. The second phase of resource expansion drilling has commenced with a drill contractor selected and a drill rig mobilized to the Copperstone project.

The purpose of the first phase of the 2020 drilling program is step-out reverse circulation (“RC”) exploration holes for the purpose of increasing resource ounces in the Copperstone and Footwall zones. The step-out holes will target the limit of known mineralization trends for future conversion of resources that will be used for mine planning purposes.

The 2020 underground core drilling will commence at the culmination of the surface RC drilling program and includes both step-out and definition drilling in the Copperstone and Footwall zones for purposes of resource addition and conversion in areas proximal to the initial stopes to be mined.

Overall, drilling will continue to focus on resource expansion by way of underground core drilling in the D and C zones and surface RC drilling in the Copperstone B and A and Footwall zones. As previously reported in 2019 step-out underground drilling results from Drill Hole 18-21-06 returned 16.8 meters of 40.0 grams per tonne (“g/t”) gold, including 3 meters of 98.26 g/t gold within the same interval (See Figure 1). Building on the previous results, this next phase of drilling will focus on stepping out along strike and dip beyond the previously defined mineralized domains.

Of the prospective targets for the current program, the areas beneath the Copperstone D and C zones have a number of down-dip targets which can be reached from underground. The Copperstone B and A zones and the Footwall zone drilling includes targets along the strike of these zones and will be drilled from surface. In these areas, drilling for the purposes of expanding the significant potential of resources in a down-dip direction will be allocated to future drilling from underground due to the depth of the targets.

Drilling results from the 2020 resource expansion program, using surface RC and underground core drilling, will be combined with those from the 2019 drilling results to update the current resource estimate. Based on the 2019 drill program, the updated resource estimate is expected to reflect an increase in overall tonnage and ounces. For purposes of updating the resource estimate, the Company will also update the previously used cut-off grade and structural mapping.

The Copperstone zone is the underground extension of the same orebody that was historically mined as an open pit. The pit historically mined nearly 150 vertical meters of the Copperstone zone and produced in excess of 500,000 gold ounces from 5.0 million tonnes of ore at an average grade of 3 g/t gold. The Copperstone orebody currently has a horizontal strike length of over 1,500 meters and extends 110 meters beneath the historical open pit.

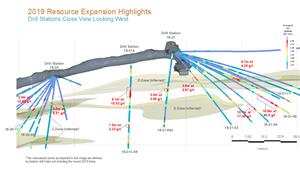

Highlights from the 2019 program are below and a view of several underground drilling stations used during the 2019 program is shown in Figure 1:

- Drill hole 18-21-06, an exploration step-out hole, returned an interval of 16.8 meters at 40.0 g/t gold, including 3 meters of 98.26 g/t gold, further indicating the zone is significantly of higher grade and thickness than initially anticipated with a total effective mining width of 17.9 meters;

- Drill hole 18-08A-02 returned an interval of 12.2 meters at 11.7 g/t Au, including 3 meters of 38.3 g/t gold, indicating the zone is higher grade and thicker than initially anticipated with an effective mining width of 17.7 meters;

- Drill hole 18-21-04, an exploration step-out hole, returned an interval of 10.7 meters at 17.49 g/t gold, including 6.1 meters of 29.45 g/t gold with a total effective mining width of 12 meters;

- Drill hole 18-21A-05, an exploration step-out hole, returned an interval of 6.1 meters at 15.02 g/t gold, including 3 meters of 22.4 g/t gold further indicating the zone is significantly of higher grade and thickness than initially anticipated with a total effective mining width of 13.1 meters;

- Drill hole 18-04-01, a conversion hole, returned an interval of 6.1 meters at 15.91 g/t gold, including 4.6 meters of 21.02 g/t gold with a total effective mining width of 3.2 meters;

- Drill Hole 18-18-02, a conversion hole, returned a high-grade gold mineralized interval of 3 meters at 27.45 g/t gold, including 1.5 meters of 52.30 g/t gold, in an area where additional down-dip step-out drilling is planned for the next phase of drilling while further indicating the zone is significantly of higher grade and thickness than initially anticipated;

- Drilling was accomplished entirely from existing underground access and affects an area of 500 meters of strike length and 200 meters of elevation, representing approximately 30 per cent of the current resource strike length,

Complete drilling results as previously disclosed are included in press releases dated April 4, 2019, May 1, 2019, June 5, 2019, and July 9, 2019.

Figure 1. Long View Highlights of 2019 drilling program

https://www.globenewswire.com/NewsRoom/AttachmentNg/338bf135-b334-4cc5-87fb-312000dd9e0b

The Copperstone zone is the underground extension of the same orebody that was historically mined as an open pit. The pit mined nearly 150 vertical meters of the Copperstone zone and produced in excess of 500,000 gold ounces historically. The Copperstone orebody currently has a horizontal strike length of over 1,500 meters and extends 110 meters beneath the historical open pit. Within this area and the Footwall Zone, there are Measured and Indicated resources of 276,100 gold ounces and Inferred resources of 145,700 gold ounces.1

Permitting

On January 22, 2020 the U.S. Bureau of Land Management (“BLM”) issued a decision of record (“DOR”) based on a finding of no significant impact (“FONSI”) formally approving Kerr Mines Inc.'s mining plan of operation (“MPO”) at its 100-per-cent-owned Copperstone mine gold project located in Arizona.

Receipt of the DOR based on FONSI and approved MPO were part of a strategic value-enhancing process undertaken by the company to restart the Copperstone gold mine and resulted in the following positive project implications:

- Increase of gold ore production from the current allowable limit of 450 tons per day to 600 tons per day;

- Use of cyanide for recovery of gold from ore using captive steel tanks located in the gold ore processing facility;

- Storage of stabilized tailings produced from the ore processing facility;

- Construction and use of a water evaporation and infiltration basin to be used to manage surplus water generated from underground operations;

- Improved operating conditions, which will further improve project economics.

This final approval and receipt of the DOR marked the conclusion of the permit modification effort that commenced in 2018. On Feb. 5, 2019, the company announced the Arizona Department of Environmental Quality (ADEQ) issued approval for the modification of the existing air permit governing air quality. On Sept. 19, 2019, the company announced the ADEQ issued approval for the modification of the existing aquifer protection permit. The water permit is effective for the life of mine and the air permit is valid for five years.

Project Optimization and Financing

In accordance with Copperstone Preliminary Feasibility Study1 and Management’s on-going efforts to improve project economics and extend the current mine life, the Company anticipates a reduction in the estimated initial project capital from what has been reflected in the Copperstone PFS. These reductions are facilitated by way of internal trade off studies and advancement of the detailed engineering of the mine and mineral processing. These reductions are expected to improve project economics as a result of moving forward with a mineral processing strategy that moves to refurbishment and modification of the existing mineral processing and gold recovery circuit.

The mineral processing optimization work is being performed primarily with Resource Development, Inc. and FLSmidth, and is based on historic and recent metallurgical test work, packaged pricing and a thorough assessment of refurbishment costs. Further metallurgical testing will be completed in order to complete the optimization of the existing plant flowsheet and bring both cost and gold production performance to final detailed engineering level prior to the commencement of any refurbishment and modification activities.

In addition, further project optimization is being undertaken on the mine operations aspect of the project. In an effort to further reduce execution risk, the Company has been actively engaged with mine operations contractors in planning several options to use contractor services in the pre-production and start-up phases of mine production and development.

The Company is continuing its discussions with Sprott regarding the balance of the Sprott Project Financing Package which is subject to achieving defined project milestones. In view of the much improved capital markets the Company is also considering alternative forms of project financing that could further enhance project economics by reducing the effective cost of capital while negating further dilution.

1 National Instrument 43-101 Technical Report: “Preliminary Feasibility Study for the Copperstone Project, La Paz County, Arizona, USA” dated May 18, 2018. prepared by Hard Rock Consulting, LLC and endorsed by Zachary J. Black, SME-RM; J.J. Brown, P.G., SME-RM, Jeff Choquette, P.E., MMSA-QP; Deepak Malhotra, PhD, SME-RM, each of whom are independent “Qualified Persons” as defined in NI 43-101 (the “Copperstone PFS”)

The technical information in this news release has been prepared in accordance with the Canadian regulatory requirements set out in NI 43-101 and reviewed and approved by Sean Muller, PGeo, SME Registered Member (Geology), who is a “Qualified Person” as defined by NI 43-101 for this project.

Quality Assurance and Quality Control Statement

Procedures have been implemented to assure Quality Assurance Quality Control (QAQC) of drill hole assaying being done at an ISO Accredited assay laboratory. All intervals of drill holes are being assayed and samples are securely stored for shipment, with chain of custody documentation through delivery. Mineralized commercial reference standards and coarse blank standards are inserted every 30th sample in sequence and results are graphed to assure acceptable results, resulting in high confidence of the drill hole assay results. When laboratory assays are received, the QAQC results are immediately evaluated and graphed to analyze dependability of the drill hole assays. As the Copperstone Project advances, additional QAQC measures will be implemented including selected duplicate check assaying on pulps and coarse rejects at a second accredited assay laboratory. All results will be analyzed for consistency.

About Kerr Mines Inc.

Kerr Mines is an Emerging American Gold Producer currently advancing the 100% owned, fully permitted past-producing Copperstone Mine project to production. Copperstone is a high-grade gold project located along a detachment fault mineral belt in mining-friendly Arizona. This gold project in Arizona demonstrates tremendous exploration potential targeting multi-million-ounce prospects within a 50 Square kilometers (12,259 acre) land package.

For further information please visit the Kerr Mines website (www.kerrmines.com)

For further information contact:

Giulio Bonifacio

Chief Executive Officer

gtbonifacio@kerrmines.com

Cautionary Note Regarding Forward Looking Statements

This news release contains forward-looking statements, including current expectations on future exploration plans and the expected use of proceeds of the Offering. These forward-looking statements entail various risks and uncertainties that could cause actual results to differ materially from those reflected in these forward-looking statements. Such statements are based on current expectations, are subject to a number of uncertainties and risks, and actual results may differ materially from those contained in such statements. These uncertainties and risks include, but are not limited to: the strength of the Canadian economy; the price of gold; operational, funding, and liquidity risks; reliance on third parties, the degree to which mineral resource and reserve estimates are reflective of actual mineral resources and reserves; the degree to which factors which would make a mineral deposit commercially viable are present; and the risks and hazards associated with underground operations. Risks and uncertainties about Kerr Mines’ business are more fully discussed in the Company’s disclosure materials, including its annual information form and MD&A, filed with the securities regulatory authorities in Canada and available at www.sedar.com and readers are urged to read these materials. Kerr Mines assumes no obligation to update any forward-looking statement or to update the reasons why actual results could differ from such statements unless required by law.