Kerr Mines Corporate Update

TORONTO, Oct. 03, 2019 (GLOBE NEWSWIRE) -- Kerr Mines Inc. (TSX: KER, OTC: KERMF) (“Kerr” or the “Company”) is pleased to provide a corporate update of recent activities and project developments at its 100% owned Copperstone gold project located in Arizona, USA.

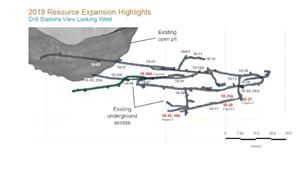

2019 Resource Expansion and Drilling Update

Positive results from the Company’s recently completed phase one drilling program totaling 5,000 meters have been incorporated into our planning for the second phase of resource expansion drilling of up to 10,000 meters. The second phase of resource expansion drilling is targeted to commence in early 2020.

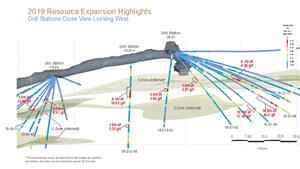

This second phase of drilling will continue to focus on resource expansion by way of underground core drilling in the D and C zones and surface reverse circulation drilling in the B, A and Footwall zones. Recent step-out drilling results as previously reported, including from Drill Hole 18-21-06 (16.8 meters of 40.0 g/t gold, including 3 meters of 98.26 g/t gold), returned significant values and will be followed up. The next phase of drilling will focus on stepping out along strike and dip beyond the previously defined mineralized domains. Recent drilling results have demonstrated further continuity and higher grades as shown in Figure 2.

We will be shifting from reverse circulation drilling to underground core drilling which will allow for greater accuracy when stepping out from previously defined mineralized domains while providing granularity of gold ore contacts inclusive of structural information. Underground core drilling will also be beneficial for mine planning and resource extraction purposes.

The results from the next phase of resource expansion drilling will be combined with those from the recently completed first phase to update the current resource estimate. Based on the drill results to date, the updated resource estimate is expected to reflect an increase in overall tonnage and grade. For purposes of updating the resource estimate, the Company will also update the previously used cut-off grade and cap on high-grade values.

The Copperstone zone is the underground extension of the same orebody that was historically mined as an open pit. The pit historically mined nearly 150 vertical meters of the Copperstone zone and produced in excess of 500,000 gold ounces from 5.6 million tons of ore at an average grade of 3 g/t gold. The Copperstone orebody currently has a horizontal strike length of over 1,500 meters and extends 110 meters beneath the historical open pit.

Select highlights from Phase One drilling are included below (Also see Figures 1 & 2):

- Drill hole 18-21-06, an exploration step-out hole returned an interval of 16.8 meters at 40.0 g/t gold, including 3 meters of 98.26 g/t gold (See Figure 2), further indicating the zone is significantly of higher grade and thickness than initially anticipated with a total effective mining width of 17.9 meters;

- Drill hole 18-08A-02 returned an interval of 12.2 meters at 11.7 g/t Au, including 3 meters of 38.3 g/t gold, indicating the zone is higher grade and thicker than initially anticipated with an effective mining width of 17.7 meters;

- Drill hole 18-21-04, an exploration step-out hole returned an interval of 10.7 meters at 17.49 g/t gold, including 6.1 meters of 29.45 g/t gold with a total effective mining width of 12 meters;

- Drill hole 18-21A-05, an exploration step-out hole, returned an interval of 6.1 meters at 15.02 g/t gold, including 3 meters of 22.4 g/t gold further indicating the zone is significantly of higher grade and thickness than initially anticipated with a total effective mining width of 13.1 meters;

- Drill hole 18-04-01, a conversion hole, returned an interval of 6.1 meters at 15.91 g/t gold, including 4.6 meters of 21.02 g/t gold with a total effective mining width of 3.2 meters;

- Drill Hole 18-18-02, a conversion hole, returned a high-grade gold mineralized interval of 3 meters at 27.45 g/t gold, including 1.5 meters of 52.30 g/t gold (See Figure 2), in an area where additional down-dip step-out drilling is planned for the next phase of drilling while further indicating the zone is significantly of higher grade and thickness than initially anticipated;

- Drilling was accomplished entirely from existing underground access and affects an area of 500 meters of strike length and 200 meters of elevation, representing approximately 30 per cent of the current resource strike length;

Figure 1 is available at https://www.globenewswire.com/NewsRoom/AttachmentNg/b430adcc-ae40-4aec-bab4-0bedd0de9bc1

Figure 2 is available at https://www.globenewswire.com/NewsRoom/AttachmentNg/3c6bbd26-3f65-4c11-80c7-b1dec2770d3a

Permitting Update

On February 5, 2019 the Company announced the Arizona Department of Environmental Quality (“ADEQ”) has issued approval for the modification of the existing Air Permit (“Air Permit”) governing air quality. On September 19, 2019 the Company announced the ADEQ has issued approval for the modification of the existing Aquifer Protection Permit (“Water Permit”). The Water Permit is effective for the life of mine and the Air Permit is valid for five years.

The final step in the permitting process was contingent on receipt of both the modified air and water permit and requires modification to the Federal Bureau of Land Management (“BLM”) Mine Plan of Operations (“MPO”). The MPO modifications have been accepted by the BLM and the formal notification process has commenced with approval expected in Q4-2019.

Once the MPO modification is approved the positive project implications are as follows:

- Increase of gold ore production from the current allowable limit of 450 tons per day to 600 tons per day;

- Use of cyanide for recovery of gold from ore using captive steel tanks located in the ore processing facility;

- Storage of stabilized tailings produced from the ore processing facility; and,

- Construction and use of a water evaporation and infiltration basin to be used to recirculate back into the underground mine.

All remaining permits required for mine operations and gold production are in hand and do not require further modification.

Seeking modifications of existing State and Federal permits was part of the strategic value-enhancing process undertaken by management to restart of the Copperstone Gold Mine under improved operating conditions and is expected to further improve project economics.

Project Optimization and Financing

In accordance with Copperstone PFS1 and until recently, the Copperstone Mine was slated to recover gold and produce a gold dore utilizing a Whole Ore Leach (“WOL”) mineral processing plant. As a result Management’s on-going efforts to improve project economics and extend the current mine life, it has been successful over the course of the last six months by way of internal trade off studies and advancing detailed engineering in reducing the estimated initial project capital from what has been reflected in the Copperstone PFS. These reductions are expected to improve project economics as a result of moving forward with a mineral processing strategy that moves to refurbishment and modification of the existing grinding and flotation plant.

Evaluating a change to Flotation from WOL was primarily driven by the Company’s optimization efforts focused on lowering the initial capital requirements while also shortening the timeline to commercial production. While a modest reduction of gold recovery results, the reduction in project capital and reduced project timeline are expected to allow improved project economics while retaining the ability to produce a gold dore. Further detailed engineering will allow for the addition of the WOL plant to the existing Mill at a future date.

The optimization work was performed primarily with Resource Development, Inc. and FLSmidth, and is based on historic and recent metallurgical test work, packaged pricing and a thorough assessment of refurbishment costs. Further metallurgical testing will be completed in order to complete the optimization of the existing plant flowsheet and bring both cost and gold production performance to final detailed engineering level prior to the commencement of any refurbishment and modification activities.

The merits of WOL, especially in terms of +95% gold recoveries and strong positive cash flows, are not being abandoned but are now thought of as a probable and positive future enhancement on a phased basis. The opportunity is to implement WOL when the mine is in a position to fund the incremental capital with little or no equity or debt burdens and, through investments in expanding our resources/reserves, to possibly coincide it with an increase in gold ore processing above the currently planned 600 tons per day.

_______________

1 National Instrument 43-101 Technical Report: Preliminary Feasibility Study for the Copperstone Project, La Paz County, Arizona, USA” dated May 18, 2018. prepared by Hard Rock Consulting, LLC and endorsed by Zachary J. Black, SME-RM; J.J. Brown, P.G., SME-RM, Jeff Choquette, P.E., MMSA-QP; Deepak Malhotra, PhD, SME-RM each of whom are independent “Qualified Persons” as defined in NI 43-101 (the “Copperstone PFS”)

In addition, further project optimization is being undertaken on the mine operations aspect of the project. In an effort to further reduce execution risk, the Company has been actively engaged with mine operations contractors in planning several options to use contractor services in the pre-production and start-up phases of mine production and development.

In view of these positive developments resulting from the optimization efforts, the previously targeted commencement date for production has been delayed to Q4-2020 subject to finalizing a project funding package inclusive of mobile and fixed equipment purchases.

On November 6, 2018 the Company announced that it had received approval for and signed a term sheet for a finance facility with Sprott Resource Lending (Collector) LP for up to US$25 Million of senior secured project financing to fund the development and production of gold at the Copperstone Mine (the “Sprott Project Financing Package”). The first phase of the financing was completed in November 2018 with the Company receiving US$2 million under a senior redeemable convertible promissory note.

The Company continues in discussions with Sprott regarding the balance of the Sprott Project Financing Package while the company completes its optimization efforts and in view of the expected lower project capital requirements. At the same time, the Company is considering alternative forms of project financing that could further enhance project economics by reducing the effective cost of capital.

Giulio T. Bonifacio, Chief Executive Officer stated: “Our entire team has been extremely pleased with the positive developments from drilling, permitting and project optimization. While our anticipated target for commencement of production has been modestly delayed, we believe the overall project enhancements will prove beneficial for all stakeholders.”

About Kerr Mines Inc.

Kerr Mines is an Emerging American Gold Producer currently advancing the 100% owned, fully permitted past-producing Copperstone Mine project to production. Copperstone is a high-grade gold project located along a detachment fault mineral belt located in mining-friendly Arizona.

For further information please visit the Kerr Mines website (www.kerrmines.com).

The technical information in this news release has been reviewed and approved by Michael R. Smith, SME Registered Member (Geology), who is a “Qualified Person” as defined by NI 43-101.

Quality Assurance and Quality Control Statement

Procedures have been implemented to assure Quality Assurance Quality Control (QAQC) of drill hole assaying being done at ALS Global, which is ISO Accredited. All intervals of drill holes are being assayed and samples are securely stored for shipment to ALS, with chain of custody documentation through delivery. Mineralized commercial reference standards and coarse blank standards are inserted every 30th sample in sequence and results are graphed to assure acceptable results, resulting in high confidence of the drill hole assay results. When laboratory assays are received, the QAQC results are immediately evaluated and graphed to analyze dependability of the drill hole assays. As the Copperstone Project advances, additional QAQC measures will be implemented including selected duplicate check assaying on pulps and coarse rejects at a second accredited assay laboratory. All results will be analyzed for consistency.

For further information contact:

Giulio Bonifacio

Chief Executive Officer

gtbonifacio@kerrmines.com

604-318-6760

Cautionary Note Regarding Forward Looking Statements

This news release contains forward-looking statements, including current expectations on future exploration plans, the timing of the commencement of production and the rate of production, if commenced, receipt of permit approvals, potential changes to the mineral processing method set out in the Copperstone PFS and anticipated changes to project capital costs and overall project economics. These forward-looking statements entail various risks and uncertainties that could cause actual results to differ materially from those reflected in these forward-looking statements. Such statements are based on current expectations, are subject to a number of uncertainties and risks, and actual results may differ materially from those contained in such statements. These uncertainties and risks include, but are not limited to, the strength of the Canadian economy; the price of gold; operational, funding, and liquidity risks; reliance on third parties, the degree to which mineral resource and reserve estimates are reflective of actual mineral resources and reserves; and the degree to which factors which would make a mineral deposit commercially viable are present; the risks and hazards associated with underground operations. Risks and uncertainties about Kerr Mines’ business are more fully discussed in the Company's disclosure materials, including its annual information form and MD&A, filed with the securities regulatory authorities in Canada and available at www.sedar.com and readers are urged to read these materials. Kerr Mines assumes no obligation to update any forward-looking statement or to update the reasons why actual results could differ from such statements unless required by law.

While management believes that the results of its project optimization efforts and proposed changes to the project design are likely to improve the overall economics of the Copperstone Project previously disclosed in the Copperstone PFS, there can be no certainty that the actual effects will be as stated. The Company has not completed a new economic study in accordance with applicable law to evaluate the effect of the proposed changes and, as such, readers should not place undue reliance on these statements as the actual results may be significantly less favourable than expected.

Neither TSX nor its Regulation Services Provider (as that term is defined in the policies of the TSX) accepts responsibility for the adequacy or accuracy of this release and no stock exchange, securities commission or other regulatory authority has approved or disapproved the information contained herein.