Kharmagtai Resource Grows to 1.1 Billion Tonnes, Containing 3Mt Cu and 8Moz Au

TORONTO, Dec. 08, 2021 (GLOBE NEWSWIRE) -- Xanadu Mines Ltd (ASX: XAM, TSX: XAM) (Xanadu, XAM or the Company) is pleased to report an updated Mineral Resource Estimate (Resource, Mineral Resource or MRE) for its flagship copper-gold project at Kharmagtai, in the South Gobi region of Mongolia (Table 1).

The Company has successfully delivered its stated aspirational target to grow the Kharmagtai Resource to >1.0Bt including a higher-grade component of >100Mt. This updated Resource positions Kharmagtai as one of the largest undeveloped copper assets held by a listed junior globally.

Highlights

- Significant increase in Kharmagtai Resource to 1.1Bt containing 3Mt Cu and 8Moz Au representing a >50% increase in contained copper (Cu) and >80% increase in contained gold metal (Au).

Table 1: Comparison 2021 vs 2018 Resource1

| Resource | Cutoff (% CuEq) | Classification | Tonnes (Mt) | Grades | Contained Metal | |||||||

| CuEq (%) | Cu (%) | Au (g/t) | CuEq (Mlbs) | CuEq (kt) | Cu (kt) | Au (koz) | ||||||

| 2021 | 0.2 (OC) 0.3 (UG) | Indicated | 487 | 0.4 | 0.3 | 0.2 | 4,375 | 1,980 | 1,330 | 3,900 | ||

| Inferred | 664 | 0.3 | 0.2 | 0.2 | 5,140 | 2,330 | 1,680 | 4,100 | ||||

| 2018 | 0.3 (OC) 0.5 (UG) | Indicated | 129 | 0.5 | 0.4 | 0.4 | 1,570 | 710 | 480 | 1,500 | ||

| Inferred | 469 | 0.4 | 0.3 | 0.2 | 4,350 | 1,970 | 1,500 | 2,930 | ||||

- Updated Mineral Resource is classified as Indicated and Inferred, and notionally constrained with open pit mineralisation commencing from surface, and underground starting below 720m RL; depth constraint is specific for each deposit.

- Material upgrade of higher-grade core to 100Mt @ 0.8% copper equivalent (CuEq) at a 0.55% CuEq cut off.

- Since 2018 Resource update2, the Company has completed 120 diamond drill holes for 69,479 metres and has grown the resource at a rate of approximately 100Mlbs CuEq per month.

- Scoping study underway to model the project, leveraging key advantages of Kharmagtai such as:

- Cohesive higher-grade zones to drive early payback of initial capital and strong project economics

- Lower relative capital intensity driven by low-altitude, flat topography, easy access and good nearby infrastructure including water, power, road and rail transport

- Potential very competitive timeframe to first production due to low population density, strong community relations and favourable environmental, social and governance (ESG).

- Located close to markets, with probable high quality copper concentrate product with strong gold credits and no deleterious elements (including arsenic) based on test-work to date.

- Strong exploration upside remains, with mineralisation open to the north and at depth, and updated Resource covering only 30% of the 8km long Kharmagtai Intrusive Complex.

The Mineral Resource Estimate was prepared by independent consultants Spiers Geological Consultants (SGC) and is reported in accordance with the 2012 Edition of the Australasian Code for Reporting of Exploration Results, Mineral Resources and Ore Reserves (JORC Code 2012) and National Instrument 43-101 Standards of Disclosure for Mineral Projects (NI 43-101).

Xanadu’s Chief Executive Officer, Dr Andrew Stewart, said “This is a major milestone for Xanadu and positions Kharmagtai as one of the largest undeveloped copper and gold resources on ASX, and one of the biggest globally. Importantly, we have now successfully delivered our medium-term aspirational targets for Kharmagtai with total Resource growth to >1.0Bt, including the higher-grade component of >100Mt.

The higher-grade zones (>0.8% CuEq) have grown from approximately 58Mt in the previous estimate to just on 100Mt with this update. This could be a real game-changer for project economics, with better defined and larger high-grade zones, setting the project apart from similarly sized orebodies, with the higher-grade component potentially unlocking project scenarios that could pave the way to put Kharmagtai into production. A significant increase in gold to copper ratios, has resulted in a greater than 80% increase in contained gold, which means higher by-product credits that will be reflected in lower all-in sustaining costs. The high-grade core and high gold to copper ratios of the Kharmagtai system are likely to be very important to future project economics, as they provide a degree of optionality for mine development that is not often seen in mining projects of this nature.

Many of the largest copper projects worldwide, peers to Kharmagtai, have logistical and social challenges, leading to significant delays and increased capital costs. Some projects have been stuck in red tape for so long that their impact on future copper supply is now in doubt. By comparison, Kharmagtai has advantages in both areas. Logistically the South Gobi is flat terrain with ready access to industrial water, nearby power, rail and road infrastructure, and proximity to the largest consumers of copper in Asia. Socially Xanadu has a strong social license to operate and Kharmagtai is in a very low population area. Further, the Mongolian regulators support mining development; it’s important to remember that the Oyu Tolgoi pit was able to move from discovery to production in approx. 5 years, an incredible outcome given the time it takes large mining projects to get off the ground elsewhere.

Importantly, however, the discovery journey is not over. The updated Resource covers only approx. 30% of the 8km strike length of the Kharmagtai Mineralised Complex. The known deposit is open to the north and at depth, and recent drilling has already intercepted high-grade bornite outside the Resource. Step-out drilling continues down-plunge.

Given the scale of the system, gold credits, infrastructure, logistics and social advantages, Kharmagtai clearly has the potential to become a leading global supplier of copper and a part of the solution to the looming global copper shortage, as the world electrifies and moves towards a carbon neutral future.”

INTERIM MINERAL RESOURCE ESTIMATE OVERVIEW

Xanadu engaged independent consultants, Spiers Geological Consultants (SGC), to prepare an updated Resource for Kharmagtai. The Resource has been reported in accordance with the JORC Code 2012 and NI 43-101, is effective as of 8 December 2021, and is shown in full in Tables 2 and 3.

This Resource is the first update to the Resource announced on 31 October 20183 with 120 diamond drill holes and 69,479 metres of drilling completed since 2018. The open pit resources are reported above nominated meters Relative Level (mRL), which is unique to each deposit area. Levels are based on preliminary optimisation analysis and a 0.2% CuEq cut-off grade. The underground Resource is reported below the nominated mRL’s levels based on preliminary optimisation analysis and a 0.3% CuEq cut-off grade.

SGC considers that data collection techniques are consistent with industry best practice and are suitable for use in the preparation of a Resource to be reported in accordance with JORC Code 2012 and NI 43-101. Available quality assurance and quality control (QA/QC) data supports the use of the input data provided by Xanadu.

The Resource is considered to have reasonable prospects for eventual economic extraction (RPEEE) on the following basis:

- the deposit is located in a favourable mining jurisdiction, with no known impediments to land access or tenure status; and

- the volume, orientation and grade of the Resource is amenable to mining extraction via traditional open-pit and underground methods;

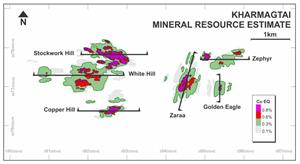

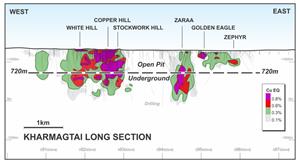

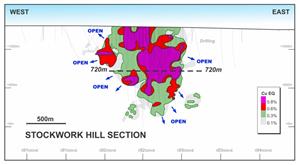

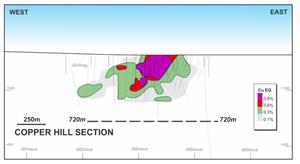

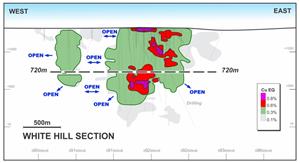

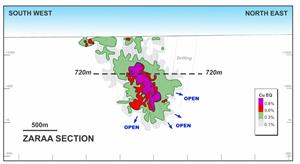

The Resource models are well understood and there is substantial upside potential to be realised by better understanding the economics of the deposit. As demonstrated in the images below, significant volumes of mineralisation have been modelled that fall outside of the constraining pit wireframe. These parts of the model will be targeted for further investigation through economic studies to assess if more of this material can be brought into the Mineral Resource.

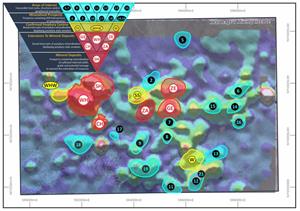

Figure 1: Plan view of the Kharmagtai district, displaying the Mineral Resource Estimate is available at https://www.globenewswire.com/NewsRoom/AttachmentNg/7fb34ef0-7c7f-4a06-b6d6-6f50101d8c27

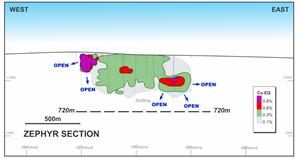

Figure 2: Long-section of the Kharmagtai district, displaying the Mineral Resource Estimate extents in relation to drilling, showing notional 720mRL split between potential open pit and underground is available at https://www.globenewswire.com/NewsRoom/AttachmentNg/97c3ed85-3d47-4bf0-b116-d04a43f25168

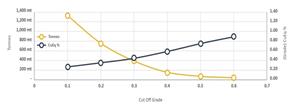

Figure 3: Kharmagtai CuEq grade-tonnage curve for pit-constrained mineralisation on a CuEq cut-off grade basis is available at https://www.globenewswire.com/NewsRoom/AttachmentNg/78464405-5ce8-4d21-811d-e498155c91d2

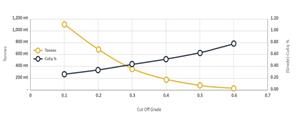

Figure 4: Kharmagtai CuEq grade-tonnage curve for underground-constrained mineralisation on a CuEq cut-off grade basis is available at https://www.globenewswire.com/NewsRoom/AttachmentNg/98d5c594-0f2e-45de-aa03-0a1a88bff5c0

Figure 5: Long section of the Stockwork Hill Deposit, displaying the Mineral Resource Estimate extents in relation to drilling is available at https://www.globenewswire.com/NewsRoom/AttachmentNg/a0de94b1-39b5-441d-a192-3afba19e21bb

Figure 6: Long section of the Copper Hill Deposit, displaying the Mineral Resource Estimate extents in relation to drilling is available at https://www.globenewswire.com/NewsRoom/AttachmentNg/b591cdab-074e-4af0-bfa6-5ea8c07a35ab

Figure 7: Long section of the White Hill Deposit, displaying the Mineral Resource Estimate extents in relation to drilling is available at https://www.globenewswire.com/NewsRoom/AttachmentNg/d7179e83-897d-4a9c-bbe4-88a68535b8b5

Figure 8: Long section of the Zaraa Deposit, displaying the Mineral Resource Estimate extents in relation to drilling is available at https://www.globenewswire.com/NewsRoom/AttachmentNg/9b502777-d891-4141-b030-6430cc1da827

Table 2: Kharmagtai updated Mineral Resource Estimate (JORC 2012 & 43:101). Total Open Pit Mineral Resource Estimates - Reported at a 0.2% CuEq cut-off grade and inside reporting solid 0.1%CuEq above nominated mRL by deposit area - Resources as at 8 December 2021.

| Deposit | Classification | Tonnes (Mt) | Grades | Contained Metal | ||||||

| CuEq (%) | Cu (%) | Au (g/t) | CuEq (Mlbs) | CuEq (kt) | Cu (kt) | Au (koz) | ||||

| SH | Indicated | 158 | 0.4 | 0.3 | 0.3 | 1,534 | 700 | 460 | 1,500 | |

| WH | 188 | 0.3 | 0.2 | 0.2 | 1,424 | 650 | 460 | 1,100 | ||

| CH | 17 | 0.5 | 0.4 | 0.4 | 200 | 90 | 60 | 200 | ||

| ZA | 9 | 0.3 | 0.1 | 0.2 | 51 | 20 | 10 | 100 | ||

| GE | 3 | 0.3 | 0.1 | 0.4 | 25 | 10 | - | - | ||

| ZE | 9 | 0.3 | 0.1 | 0.2 | 51 | 20 | 10 | 100 | ||

| Total Indicated | 384 | 0.4 | 0.3 | 0.2 | 3,285 | 1,490 | 1,000 | 3,000 | ||

| SH | Inferred | 52 | 0.3 | 0.2 | 0.2 | 343 | 160 | 100 | 300 | |

| WH | 211 | 0.3 | 0.2 | 0.1 | 1,418 | 640 | 490 | 1,000 | ||

| CH | 3 | 0.3 | 0.2 | 0.1 | 20 | 10 | 10 | - | ||

| ZA | 13 | 0.2 | 0.1 | 0.2 | 73 | 30 | 20 | 100 | ||

| GE | 51 | 0.3 | 0.1 | 0.3 | 325 | 150 | 70 | 500 | ||

| ZE | 44 | 0.3 | 0.1 | 0.3 | 270 | 120 | 70 | 400 | ||

| Total Inferred | 374 | 0.3 | 0.2 | 0.2 | 2,449 | 1,110 | 760 | 2,300 | ||

Notes:

- CuEq accounts for Au value and CuEq kt must not be totalled to Au ounces

- Figures may not sum due to rounding

- Significant figures do not imply an added level of precision

- Resource constrained by 0.1%CuEqRec reporting solid in-line with geological analysis by XAM

- Resource constrained by open cut above nominated mRL level by deposit as follows SH>=720mRL, WH>=915mRL, CH>=1100mRL, ZA>=920mRL, ZE>=945mRL and GE>=845mRL

- CuEq equation (CuEq=Cu+Au*0.60049*0.86667) where Au at USD$1400/oz and Cu at USD$3.4/lb was employed according to the Clients' (XAM) direction.

- Au recovery is relative with Cu rec=90% and Au rec=78% (rel Au rec=78/90=86.667% with number according to the Clients' (XM) direction

Table 3: Kharmagtai updated Mineral Resource Estimate (JORC 2012 & 43:101). Total underground Mineral Resource Estimates - Reported at a 0.3% CuEq cut-off grade and inside reporting solid 0.1%CuEq area - Resources as at 8 December 2021.

| Deposit | Classification | Tonnes (Mt) | Grades | Contained Metal | |||||

| CuEq (%) | Cu (%) | Au (g/t) | CuEq (Mlbs) | CuEq (kt) | Cu (kt) | Au (koz) | |||

| SH | Indicated | 25 | 0.6 | 0.4 | 0.5 | 323 | 150 | 90 | 400 |

| WH | 21 | 0.4 | 0.4 | 0.2 | 199 | 90 | 70 | 100 | |

| CH | 3 | 0.4 | 0.3 | 0.2 | 24 | 10 | 10 | - | |

| ZA | 27 | 0.5 | 0.3 | 0.3 | 272 | 120 | 80 | 200 | |

| GE | - | - | - | - | - | - | - | - | |

| ZE | 27 | 0.5 | 0.3 | 0.3 | 272 | 120 | 80 | 200 | |

| Total Indicated | 103 | 0.5 | 0.3 | 0.3 | 1,090 | 490 | 330 | 900 | |

| SH | Inferred | 21 | 0.4 | 0.3 | 0.3 | 197 | 90 | 60 | 200 |

| WH | 138 | 0.4 | 0.3 | 0.1 | 1,266 | 570 | 470 | 600 | |

| CH | 2 | 0.3 | 0.3 | 0.2 | 12 | 10 | - | - | |

| ZA | 129 | 0.4 | 0.3 | 0.2 | 1,214 | 550 | 390 | 1,000 | |

| GE | - | 0.3 | 0.1 | 0.3 | - | - | - | - | |

| ZE | - | 0.4 | 0.1 | 0.6 | 3 | - | - | - | |

| Total Inferred | 290 | 0.4 | 0.3 | 0.2 | 2,692 | 1,220 | 920 | 1,800 | |

Notes:

- CuEq accounts for Au value and CuEq kt must not be totalled to Au ounces

- Figures may not sum due to rounding

- Significant figures do not imply an added level of precision

- Resource constrained by 0.1%CuEqRec reporting solid in line with geological analysis by XAM

- Resource constrained by underground below nominated mRL level by deposit as follows SH<720mRL, WH<915mRL, CH<1100mRL, ZA<920mRL, ZE<945mRL and GE<845mRL

- CuEq equation (CuEq=Cu+Au*0.60049*0.86667) where Au at USD$1400/oz and Cu at USD$3.4/lb was employed according to the Clients' (XAM) direction.

- Au recovery is relative with Cu rec=90% and Au rec=78% (rel Au rec=78/90=86.667% with number according to the Clients' (XM) direction

Figure 9: Long Section through the Zephyr Deposit showing resource grown potential is available at https://www.globenewswire.com/NewsRoom/AttachmentNg/dd94afdb-e1d5-4074-937c-e32e03f4cfc9

RESOURCE GROWTH POTENTIAL

All six deposits within the updated Mineral Resource Estimate for Kharmagtai are open and require additional drilling to determine the boundaries of each deposit.

At Stockwork Hill the deposit comprises numerous areas on the edges of the resource where high-grade blocks are not closed off by drilling (Figure 5). These areas represent significant expansion opportunities.

White Hill represents the deposit with the most significant expansion potential. The resource is completely open to the south and the west and at depth (Figure 7) and the drilling to date in the lower portions of the deposit is broad enough to allow numerous blocks of unknown high-grade material to exist. Further drilling will significantly expand the White Hill Deposit.

At Zaraa, the deposit is open at depth and along strike to the north and south (Figure 8). Additional drilling is likely to add significant tonnes to the Zaraa Resource.

The Zephyr deposit is open to the west and the east and at depth. The highest-grade blocks within the resource sit at either end of the deposit with no drilling along strike (Figure 9).

GEOLOGY AND GEOLOGICAL INTERPRETATION

A step change has occurred in the understanding of the geological controls on mineralisation at Kharmagtai since the 2018 MRE. Each deposit in the 2021 MRE has been based on a detailed 3D geological model to constrain populations of grade with hard or soft boundaries determined using statistical analysis. This approach allows for a much more realistic and accurate estimate.

The model is based on a complete re-logging of the 214km of diamond drilling completed at Kharmagtai. This relogging has standardised the geology across the deposits and many phases of drilling/previous loggers, allowing a high-quality 3D model to be generated. Detailed lithogeochemical analyses and modelling were used to refine the intrusive phase categories and separate out mineralised versus unmineralised phases, allowing for more accurate resource domains to be generated. This model not only forms a robust framework for the Mineral Resource update but allows predictions as to extensions to the deposits to be identified and drilled.

3D geological wireframes were developed for all geological units within the deposits, including country rock, all porphyry phases, andesite dykes and breccia bodies. These wireframes were constrained to within a detailed 3D structural model of each deposit. This structural model was built to define the boundaries between the main populations of grade. Individual lithology and mineralisation style wireframes were generated for each fault block, and then each solid geology fault block combined into a complete deposit model. The base of oxidation surface was generated using a combination of geological logging and geochemical data. Wireframes were generated for various cut-off grade shells using statistical changes in the grade data. Separate wireframes were generated for tourmaline breccia mineralisation, both moderately mineralised and high-grade tourmaline breccia bodies. In some areas of the deposit wireframes for high-density veining were used to constrain very high-grade blocks of mineralisation, such as the High-Grade Bornite Zone.

The additional drilling since the last Mineral Resource and other exploration and evaluation programs such as - relogging of historical core, detailed short wave infrared data collection, geophysical review and geochemistry studies have delivered superior understanding of the deposit geometry. This has led to greater confidence in the geological and grade continuity and has infilled several areas of the deposits. The programs have collectively allowed us to deliver a more robust and larger Mineral Resource.

The Mineral Resources have been estimated using all available analytical data. This has included diamond core drilling (NQ, PQ and HQ), reverse circulation percussion drilling and in some areas channel samples taken at surface. Additional data on drilling and sampling procedures is provided in Table 1, Appendix 3.

Significant drilling has taken place since the last Resource in 2018 which has driven the increase in Resources. Table 4 shows the drilling meter difference between the 2018 and 2021 Resource.

Table 4: Drill Hole Summary

| Timing | Reverse Circulation (RC) Holes | RC Metres | Diamond Core Holes | Diamond Core Meters | RC & Diamond Holes | RC and Diamond Core Metres | Poly- crystalline Diamond (PCD) Holes | PCD Metres | Trenches | Trench Metres |

| Drilling < 2018 | 216 | 35,725 | 364 | 144,936 | 21 | 5,022 | 664 | 26,137 | 123 | 45,393 |

| Drilling > 2018 | 12 | 3,049 | 120 | 69,479 | 3 | 1,640 | 0 | 0 | 0 | 0 |

| Total | 228 | 38,774 | 484 | 214,415 | 24 | 6,663 | 664 | 23,137 | 123 | 45,393 |

ESTIMATE METHODOLOGY

The Kharmagtai resource models have been estimated by Ordinary Kriging (OK) using third party software and are post processed in SGC’s preferred software. An internal process review was conducted by SGC and no third party modelling was undertaken at this time.

Data searches were aligned consistent with the strike, dip and plunge (where appropriate) of the mineralisation consistent with the domain and geometry modelling as a result of the detailed geological investigation put forth by Xanadu (the Client).

According to the Client’s interpretation, the mineralisation host exhibit geometries which are consistent with those geometries defined by the spatial analysis of grade (in this instance Copper, Gold, Molybdenum and Sulphur).

A nominal composite length of 4 metre down hole was used for inputs which was settled upon during consultation with the Client and the Client’s preferred Geological Consultant team.

Where appropriate data was transformed and geometry modelling and variograms of the variables were calculated and modelled.

Several iterations of the modelling process were undertaken to assess the sensitivity of estimates to estimation parameters. Post processing, model validation and reporting were undertaken in SGC’s preferred third party software in-line with the Client’s end use.

Ordinary kriging of the variables was performed in the UTM_47N grid. Block dimensions were selected in line with data density and modelling methodology as well as taking into account potential mining methodologies. Search and data criteria were assessed and implemented, in-line with modelling strategy. Models were constructed and iteration undertaken to assess modelling sensitivities to data and search criteria.

The block estimates were validated against the informing data to ensure that they were consistent with the original informing data in a three-dimensional sense and within the search neighbourhood via data analysis.

The block estimates were exported to SGC’s preferred third party software and where appropriate, a topographic surface was applied as were other surfaces and solids which may have acted upon the estimates. Each model area was then compiled into a global model where all fields underwent secondary validation and data/s were assigned (where deemed appropriate by SGC in consultation with the Client’s geological team) as well as coding for primary domain and the calculation of CuEq% and CuEq% were completed.

Final densities were assigned where necessary and model validation completed ahead of final report preparation.

Individual blocks in the resource models (within the Global Kharmagtai Resource Model) have been allocated a resource classification of Indicated and Inferred confidence category based on the consideration of the number and location of data used to estimate the grade of each block in-line with the modelling approach established during the week-long collaboration between XAM staff, SGC and a third-party representative on behalf of XAM. In addition, further consideration incorporated into the resource classification discussion included (but not limited to) the following aspects, quality control and assurances (both internal to XAM and the associated laboratories employed as well as third party laboratory analysis) relating to sampling, sample handling, sample preparation and analysis, database administration and validation. The resource classification also takes into account structural complexity and the associated geological models and constraining solids, as well as population distributions and geometry.

EXPLORATION UPSIDE

Only a small portion of the potentially mineralised Kharmagtai Intrusive Complex has been drill tested. Most of the drilling since 2018 MRE has focused on expanding existing deposits and high-grade targets within and around known mineralisation. There are more than 20 exploration targets identified across the lease, which have been ranked and will be tested by drilling in the coming 12 months (Figure 10). These targets have been identified from surface geochemistry, geophysics, and the presence of the key features of porphyry deposits (veining, alteration and mineralisation).

Figure 10: Kharmagtai copper-gold district showing currently defined mineral deposits and exploration targets is available at https://www.globenewswire.com/NewsRoom/AttachmentNg/2691b234-dc3a-492a-a287-abf6c10d9bda

NEXT STEPS

Xanadu has commenced a Scoping Study to evaluate development options for the Kharmagtai District and compare to previous studies. This will include evaluation of mining, metallurgy and processing, engineering and infrastructure, marketing, logistics and the regulatory environment. Study will aim to leverage the known advantages of Kharmagtai, including:

- Targeting higher-grade core with high gold-copper ratio to drive short payback of capital

- Bulk mining of large resource, delivering a long mine life following capital payback

- Strong recoveries with metallurgy amenable to conventional crushing, milling and flotation

- Conventional tailings and mine waste management leveraging flat and stable topography

- Leverage nearby infrastructure including regional power and industrial water sources

- Simplified logistics with local rail and road access and proximity to smelters

- Saleable Cu concentrates with strong gold credits no known deleterious elements

A positive outcome of this Scoping Study in 2022 would lead to a gating decision and potential commencement of a Pre-Feasibility Study (PFS).

Recognising Kharmagtai still has significant exploration upside, Xanadu plans to continue exploration in parallel with the Scoping Study, including discovery drilling across several identified targets.

APPENDIX 1: COMPETENT PERSON’S STATEMENT

Mr Robert Spiers is a full time Principal Geologist employed by Spiers Geological Consultants (SGC), 2-6 Byrne Street, Mount Martha, Victoria, Australia. Mr Spiers is contracted on a consulting basis by Xanadu Mines.

Mr Spiers graduated with a Bachelor of Science (BSc) Honours and a double Major of Geology and Geophysics from Latrobe University, Melbourne, Victoria, Australia and has been a member of the Australian Institute of Geoscientists for 26 years; working as a Geologist for in-excess of 30 years since graduating.

Mr Spiers has sufficient experience that is relevant to the style of mineralisation and type of deposit under consideration and to the activity being undertaking to qualify as a Competent Person as defined in the JORC Code, 2012. Mr Spiers consents to the inclusion in the report to which this statement is to be attached of the matters based on his information in the form and context in which it appears.

The information in the report to which this statement is to be attached that relates to Mineral Resources is based on information compiled by Mr Robert Spiers, a Competent Person who is a Member of the Australian Institute of Geoscientists or a ‘Recognised Professional Organisation’ (RPO) included in a list posted on the ASX website from time to time.

Mr Spiers consents to the disclosure of this information on the page/s in the form and context in which it appears.

To the best of Mr Spiers’, knowledge, information and belief, neither SGC, himself and / or other related parties have any conflict of interest with by Xanadu Mines in accordance with the transparency principle set out by the JORC Code 2012 and supported by ASX rulings.

In relation to the above statement, Mr Spiers holds 750,000 ordinary shares in the ASX listed XAM entity purchased on market in accordance with XAM’s Securities Trading Policy (ASX Guidance Note 27 Trading Policies). The aforementioned shareholding does not constitute a material holding in Xanadu.

Mr Spiers has read the definition of “competent person” set out in the JORC Code 2012 and guidelines for the reporting of Mineral Resource Estimates and certify that by reason of his education, affiliation with a professional association (MAIG) and past relevant work experience, that he fulfils the requirements of a “Competent Person” for the purposes of JORC Code 2012.

As of the date of this Announcement, to the best of Mr Spiers’ knowledge, information and belief, the Public Release / Technical Report to which this statement is to be attached (in relation to the Reporting of the Kharmagtai Mineral Resource Estimation December 2021) contains all the scientific and technical information that is required to be disclosed in relation to the Mineral Resources to make the Public Release / Technical Report not misleading with respect to the sections for which Mr Spiers is responsible.

Dated the 8th day of December 2021

/s/ Robert Spiers

Robert Spiers, BSc Hons, MAIG

Our Customer

This Report has been produced by or on behalf of Spiers Geological Consultants (SGC) for the sole use by Xanadu Mines Ltd (XAM or the Customer). The Customer’s use and disclosure of this report is subject to the terms and conditions under which SGC prepared the report. All items in the Report must if used in a third-party report be taken in context and consent from SGC must be sought on each occasion.

Notice to Third Parties

- SGC prepared this Report for the Customer only. If you are not the Customer:

- SGC have prepared this Report having regard to the particular needs and interests of the Customer, and in accordance with the Customer’s instructions. It did not draft this Report having regard to any other person’s particular needs or interests. Your needs and interests may be distinctly different to the Customer’s needs and interests, and the Report may not be sufficient, fit or appropriate for your purposes.

- SGC does not make and expressly disclaims from making any representation or warranty to you – express or implied regarding this Report or the conclusions or opinions set out in this Report (including without limitation any representation or warranty regarding the standard of care used in preparing this Report, or that any forward-looking statements, forecasts, opinions or projections contained in the report will be achieved, will prove to be correct or are based on reasonable assumptions).

- SGC expressly disclaim any liability to you and any duty of care to you.

- SGC does not authorise you to rely on this Report. If you choose to use or rely on all or part of this Report, then any loss or damage you may suffer in so doing is at your sole and exclusive risk.

Inputs, subsequent changes, and no duty to update

SGC have created this Report using data and information provided by or on behalf of the Customer (and Customer’s agents and contractors). Unless specifically stated otherwise, SGC has not independently verified that data and information unless expressly noted. SGC accepts no liability for the accuracy or completeness of that data and information, even if that data and information has been incorporated into or relied upon in creating this report (or parts of it).

The conclusions and opinions contained in this Report apply as at the date of the Report. Events (including changes to any of the data and information that SGC used in preparing the Report) may have occurred since that date which may impact on those conclusions and opinions and make them unreliable. SGC is under no duty to update the Report upon the occurrence of any such event, though it reserves the right to do so.

Mining Unknown Factors

The ability of any person to achieve forward-looking production and economic targets is dependent on numerous factors that are beyond SGC’s control and that SGC cannot anticipate. These factors include, but are not limited to, site-specific mining and geological conditions, management and personnel capabilities, availability of funding to properly operate and capitalize the operation, variations in cost elements and market conditions, developing and operating the mine in an efficient manner, unforeseen changes in legislation and new industry developments. Any of these factors may substantially alter the performance of any mining operation.

APPENDIX 2: ADDITIONAL STATEMENTS AND DISCLAIMERS

Mineral Resources and Ore Reserves Reporting Requirements

The 2012 Edition of the Australasian Code for Reporting of Exploration Results, Mineral Resources and Ore Reserves (the JORC Code 2012) sets out minimum standards, recommendations and guidelines for Public Reporting in Australasia of Exploration Results, Mineral Resources and Ore Reserves. The Information contained in this Announcement has been presented in accordance with the JORC Code 2012.

The information in this Announcement relates to the exploration results previously reported in ASX Announcements which are available on the Xanadu website at:

https://www.xanadumines.com/site/investor-centre/asx-announcements

The Company is not aware of any new, material information or data that is not included in those market announcements.

Copper Equivalent Calculations

The copper equivalent (CuEq or eCu) calculation represents the total metal value for each metal, multiplied by the conversion factor, summed and expressed in equivalent copper percentage with a metallurgical recovery factor applied.

Copper equivalent (CuEq or eCu) grade values were calculated using the following formula:

eCu or CuEq = Cu + Au * 0.60049 * 0.86667,

Gold Equivalent (eAu) grade values were calculated using the following formula:

eAu = Au + Cu / 0.60049 * 0.86667.

Where:

Cu - copper grade (%)

Au - gold grade (g/t)

0.60049 - conversion factor (gold to copper)

0.86667 - relative recovery of gold to copper (86.67%)

The copper equivalent formula was based on the following parameters (prices are in USD):

- Copper price - 3.4 $/lb

- Gold price - 1400 $/oz

- Copper recovery - 90%

- Gold recovery - 78%

Relative recovery of gold to copper = 78% / 90% = 86.67%.

Forward-Looking Statements

Certain statements contained in this Announcement, including information as to the future financial or operating performance of Xanadu and its projects may also include statements which are ‘forward‐looking statements’ that may include, amongst other things, statements regarding targets, estimates and assumptions in respect of mineral reserves and mineral resources and anticipated grades and recovery rates, production and prices, recovery costs and results, capital expenditures and are or may be based on assumptions and estimates related to future technical, economic, market, political, social and other conditions. These ‘forward-looking statements’ are necessarily based upon a number of estimates and assumptions that, while considered reasonable by Xanadu, are inherently subject to significant technical, business, economic, competitive, political and social uncertainties and contingencies and involve known and unknown risks and uncertainties that could cause actual events or results to differ materially from estimated or anticipated events or results reflected in such forward‐looking statements.

Xanadu disclaims any intent or obligation to update publicly or release any revisions to any forward‐looking statements, whether as a result of new information, future events, circumstances or results or otherwise after the date of this Announcement or to reflect the occurrence of unanticipated events, other than required by the Corporations Act 2001 (Cth) and the Listing Rules of the Australian Securities Exchange (ASX) and Toronto Stock Exchange (TSX). The words ‘believe’, ‘expect’, ‘anticipate’, ‘indicate’, ‘contemplate’, ‘target’, ‘plan’, ‘intends’, ‘continue’, ‘budget’, ‘estimate’, ‘may’, ‘will’, ‘schedule’ and similar expressions identify forward‐looking statements.

All ‘forward‐looking statements’ made in this Announcement are qualified by the foregoing cautionary statements. Investors are cautioned that ‘forward‐looking statements’ are not guarantee of future performance and accordingly investors are cautioned not to put undue reliance on ‘forward‐looking statements’ due to the inherent uncertainty therein.

For further information please visit the Xanadu Mines’ Website at www.xanadumines.com.

APPENDIX 3: KHARMAGTAI TABLE 1 (JORC 2012)

Set out below is Section 1 and Section 2 of Table 1 under the JORC Code, 2012 Edition for the Kharmagtai project. Data provided by Xanadu. This Table 1 updates the JORC Table 1 disclosure dated 1st December 2021.

JORC TABLE 1 - SECTION 1 - SAMPLING TECHNIQUES AND DATA

(Criteria in this section apply to all succeeding sections).

| Criteria | Commentary |

| Sampling techniques |

|

| Drilling techniques |

|

| Drill sample recovery |

|

| Logging |

|

| Sub-sampling techniques and sample preparation |

|

| Quality of assay data and laboratory tests |

|

| Verification of sampling and assaying |

|

| Location of data points |

|

| Data spacing and distribution |

|

| Orientation of data in relation to geological structure |

|

| Sample security |

|

| Audits or reviews |

|

JORC TABLE 1 - SECTION 2 - REPORTING OF EXPLORATION RESULTS

(Criteria in this section apply to all succeeding sections).

| Criteria | Commentary |

| Mineral tenement and land tenure status |

|

| Exploration done by other parties |

|

| Geology |

|

| Drill hole Information |

|

| Data Aggregation methods |

Copper equivalent (CuEq or eCu) grade values were calculated using the following formula: eCu or CuEq = Cu + Au * 0.60049 * 0.86667, Gold Equivalent (eAu) grade values were calculated using the following formula: eAu = Au + Cu / 0.60049 * 0.86667. Where: Cu - copper grade (%) Au - gold grade (g/t) 0.60049 - conversion factor (gold to copper) 0.86667 - relative recovery of gold to copper (86.67%) The copper equivalent formula was based on the following parameters (prices are in USD):

|

| Relationship between mineralisation on widths and intercept lengths |

|

| Diagrams |

|

| Balanced reporting |

|

| Other substantive exploration data |

|

| Further Work |

|

JORC TABLE 1 - SECTION 3 - ESTIMATION AND REPORTING OF MINERAL RESOURCES

| Criteria | Commentary |

| Database integrity |

|

| Site visits |

|

| Geological interpretation |

|

| Dimensions |

|

| Estimation and modelling techniques |

|

| Moisture |

|

| Cut-off parameters |

|

| Mining factors or assumptions |

|

| Metallurgical factors or assumptions |

|

| Environmental factors or assumptions |

|

| Bulk density |

|

| Classification |

|

| Audits or reviews |

|

| Discussion of relative accuracy/confidence |

|

JORC TABLE 1 - SECTION 4 - ESTIMATION AND REPORTING OF ORE RESERVES

Ore Reserves are not reported so Section 4 is not applicable to this Announcement.

__________________________________

1 ASX/TSX Announcement 18 December 2018 – Technical Report Released to Support Kharmagtai Mineral Resource Estimate

2 ASX/TSX Announcement 31 October 2018 - Major increase in Kharmagtai Open Cut Resource to 1.9Mt Cu & 4.3Moz Au

3 ASX/TSX Announcement 31 October 2018 - Major increase in Kharmagtai Open Cut Resource to 1.9Mt Cu & 4.3Moz Au