LeadFX announces hydrometallurgical plant definitive feasibility study meets success criteria

(All dollar amounts are in United States dollars unless otherwise indicated)

PERTH, Australia, Feb. 28, 2018 /CNW/ - LeadFX Inc. (the "Company" or "LeadFX") (TSX: LFX) is pleased to announce the results of the definitive feasibility study ("DFS") conducted by SNC-Lavalin Australia Pty Ltd ("SNC-Lavalin").

The DFS has demonstrated the technical and economic feasibility of constructing and operating a Hydrometallurgical Facility at the Company's 100% owned Paroo Station Lead Mine ("Paroo Station" or the "Mine") in Wiluna, Western Australia.

|

Highlights:

|

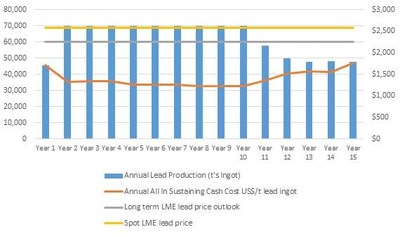

The two success criteria outlined in the Umbrella Agreement with InCoR Technologies Limited and InCoR Energy Materials Limited (together "InCoR") dated June 20, 2017 (a copy of which is available under the Company's SEDAR profile at www.sedar.com) have been met. Gross operating cashflow over the Mine life minus Hydrometallurgical Facility capital expenditure has exceeded the target of US$450 million by approximately US$200 million and the Mine life has exceeded the ten year minimum by five years.

As previously disclosed, InCoR holds (i) an exclusive license from BASF SE related to patented hydrometallurgical technology for 'recovering lead from a mixed oxide material' (the "Oxide Technology"), and (ii) an exclusive license from the University of British Columbia related to patented hydrometallurgical technology for 'recovering lead from a lead material including lead sulphide' (the "Sulphide Technology" and together with the Oxide Technology, the "Technology"), both of which utilize methane sulfonic acid as a leaching agent.

Dr. David Dreisinger, (B.A.Sc., Ph.D., P. Eng. FCIM, FCAE) LeadFX director and President of InCoR Technologies Limited, oversaw SNC-Lavalin's preparation of the DFS and the metallurgical test work and pilot plant operation that applied the Oxide Technology.

Dr. Dreisinger stated "the SNC-Lavalin DFS has confirmed that the Paroo Station lead carbonate concentrates may be acid leached and the lead electro-won to lead cathode. From this point further melting processes would produce lead ingots. This is a world first application of this technology and sets the stage for further advances in hydrometallurgical recovery of lead. We look forward to advancing Paroo Station to commercial production".

Highlights of the DFS, being a fully integrated mining and processing study of the existing plant with the addition of the new Hydrometallurgical Facility, include:

|

Hydrometallurgical Facility Cost Estimate (+/- 15% accuracy) |

|

|

Operating cost (ex contingency) |

$258 / t Pb $0.117 / lb Pb |

|

Capital cost |

|

|

Direct and Indirect Costs |

$93.7 million |

|

Power Station |

$21.8 million |

|

Engineering, Procurement and Construction Management (EPCM) fees and Contingency |

$35.5 million |

|

Total Capital Cost |

$151.1 million |

|

Integrated DFS metrics |

|

|

Life of Mine |

15 years |

|

Life of Mine C1 Cash Cost 3 |

$1,254 / t Pb $0.57 / lb Pb |

|

Life of Mine All In Sustaining Cash Cost 4 |

$1,367 / t Pb $0.62 / lb Pb |

|

Average annual lead ingot production |

61,606 tonnes |

|

Average annual ore processed |

1,963,785 tonnes |

|

Life of mine strip ratio |

2.99 |

|

Life of mine ore grade processed |

3.94%Pb |

|

Construction period |

18 months |

|

Financial metrics (ungeared post tax) 5 |

LME lead price = |

LME lead price = |

|

Net present value pre finance post tax 8% discount rate |

$191 million |

$303 million |

|

IRR |

23.5%pa |

31.3%pa |

|

Hydrometallurgical Facility capital cost and owners costs to first production |

$177 million |

$177 million |

|

Average annual revenue |

$139 million |

$159 million |

|

Average annual after-tax project cashflow |

$42 million |

$56 million |

|

Payback period (years of operations) |

4 years |

3 years |

Commenting on the DFS LeadFX CEO Andrew Worland stated "the completion of the DFS provides the opportunity to re-launch LeadFX in 2018 and showcase Paroo Station as a long life sustainable lead metal producer amidst continued strong base metals pricing.

In production, Paroo Station would be a top ten global lead producer and the largest listed pure lead producer in the world6. Lead will continue to be strongly sought after as a reliable, cost effective and efficient store of energy in the combustion engine and electric motor vehicle sectors as well as in the large scale industrial and renewable energy projects.

We look forward now to commencing the construction phase of the Hydrometallurgical Plant."

Exercise of Warrants and Technology Transfer

InCoR has delivered to the Company a duly completed Exercise Form to exercise 23,000,000 Warrants upon achieving the DFS Success Criteria pursuant to the Umbrella Agreement.

The Company has received a signed counterpart of the Technology Transfer Agreement under which InCoR will exclusively license (and subsequently assign on certain conditions being met) its Technology rights and its rights to improvements to the Technology (if any) to the Company.

LeadFX has instructed Computershare to allot 23,000,000 Common Shares to InCoR. Upon allotment the Company would have the following capital structure (excluding 106,666 out of the money options):

|

Non-Diluted Equity |

Fully-Diluted Equity | |||||

|

Common Shares |

Interest in |

Balance of |

Warrants |

Fully- |

Interest in | |

|

Sentient |

35,225,682 |

52.8% |

- |

1,153,554 |

36,379,236 |

48.6% |

|

InCoR |

25,827,466 |

38.7% |

5,750,000 |

1,220,747 |

32,798,213 |

43.8% |

|

Other |

5,700,056 |

8.5% |

- |

- |

5,700,056 |

7.6% |

|

Total |

66,753,204 |

100.0% |

5,750,000 |

2,374,301 |

74,877,505 |

100.0% |

Project Financing

LeadFX has initiated the exchange of information with project finance institutions seeking debt finance terms to be progressed during Q2 2018 and targeting a financial close for the Hydrometallurgical Facility of Q3, 2018.

A period of DFS optimization and Early Works will now commence, subject to funding, prior to a final investment decision. The program will focus on planning and strategic activities including equipment and civil works, power station tenders and the progression of engineering to allow detailed design to commence and the establishment of construction systems and practices.

The project implementation schedule forecasts ground disturbing activities to commence in Q3 2018.

LeadFX believes further value enhancing opportunities exist for the project including mine life extensions from Measured and Indicated Mineral Resources of satellite deposits, successful Inferred Mineral Resource conversion, near mine exploration and potential tailings reprocessing.

Qualified Persons

The scientific and technical information in this press release has been reviewed and approved by Mr. Kahan Cervoj (MAUSIMM, MAIG), Mr. Lawrie Gillett FAUSIMM, Mr. Adrian Jones MAusIMM and Mr. Alan Taylor FAUSIMM(CP). Each of the foregoing individuals is independent of the Company and is a Qualified Person within the meaning of NI43-101.

The complete NI 43-101 Technical Report ("Report") for the DFS is being prepared and will be posted on www.sedar.com no later than 45 days from the date of this hereof and made available on the Company's website www.leadfxinc.com.

DEFINITIVE FEASIBILITY STUDY

HYDROMETALLURGICAL FACILITY FOR THE PAROO STATION LEAD MINE, WILUNA WA

Introduction

SNC-Lavalin's DFS scope was the performance of all necessary engineering design and estimation to produce a Class 3 estimate for the Hydrometallurgical Facility in accordance with American Association of Cost Engineers ("AACE") International Standard. The scope includes:

- Confirming the technical suitability of the metallurgical processes selected to the extent possible

- Estimating capital and operating costs of the Hydrometallurgical Facility

- Providing an integrated DFS report incorporating data generated by LeadFX and InCoR.

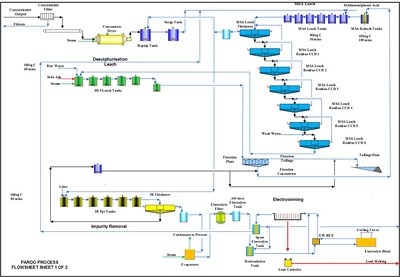

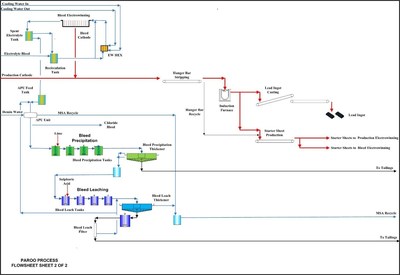

The Technology would utilize Methane Sulfonic Acid ("MSA") to leach lead from concentrates. Lead rich leach solution would be treated through an electro-winning circuit to produce lead cathode which would subsequently be melted in a furnace with the molten lead cast into ingots of London Metal Exchange ("LME") specification.

The Hydrometallurgical Facility design is based on a three phase test work program and vendor testwork commissioned by InCoR. Data from those programs was interpreted by SNC-Lavalin and applied to the design of the Hydrometallurgical Facility.

LeadFX provided all Paroo Station operating history to SNC-Lavalin and commissioned AMC Consultants to provide a new Ore Reserve (as defined by the JORC Code) Report that incorporated new mine optimizations, pit designs and mine scheduling for inclusion in the DFS financial modelling.

LeadFX is responsible for the preparation of the financial models incorporated in the DFS.

The overall construction and commissioning schedule for the Hydrometallurgical Facility from first site access is estimated at 18 months. The Company expects to have necessary approvals in place to commence ground disturbing activities on site within the next six months.

Hydrometallurgical Facility

i) Testwork, Process Description and General Arrangement

SNC-Lavalin developed the process flowsheet, process design criteria and Metsim Model through a succession of testwork programs commissioned by InCoR and performed predominately by ALS Metallurgy in Perth. The testwork stages were:

- Proof of concept test work based on historical concentrates from Paroo Station;

- Bulk variability testwork program on metallurgical drill core composite samples from various parts of the Paroo Station deposits; and

- A 3kg/h continuous leach and electro-winning pilot plant utilizing concentrates produced from pilot flotation testwork on selected ore from Mine stockpiles to verify operational leach conditions, liquid-solids separation performance and electrowinning performance.

The pilot plant recovered lead from Paroo Station ore to cathode (Figure 1).

The recovery of lead from concentrate to final ingot has been estimated for the various composites using test results and the Metsim Model and ranges from 96.4% to 99.4%.

Three Metsim Models comprising base, and minimum and maximum anglesite cases have been developed by SNC-Lavalin. The models have been used to generate heat and mass balances required to size equipment.

Process Design Criteria has been developed by SNC-Lavalin from a combination of testwork results and SNC-Lavalin experience with similar processing plants. Testwork data from the completed programs has been used in the models and other engineering data to verify the equipment selected.

The Hydrometallurgical Facility would involve the following main stages:

- Feed Preparation, MSA Leaching and solid liquid separation;

- Desulphurization of MSA Leach Residue and Flotation;

- MSA re-leach;

- Impurity removal and electrolyte preparation;

- Lead electrowinning and cathode handling;

- Bleed treatment;

- Lead melting, casting and load-out;

- Utilities and reagents; and

- Power station, heat recovery and steam generation.

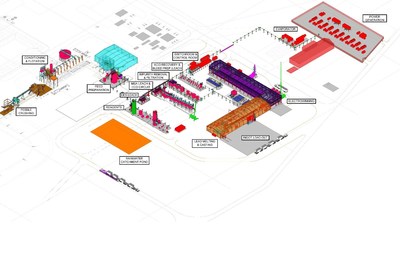

The general arrangement of the Hydrometallurgical Facility is presented in 3D model format in Figure 2. The process flowsheet is shown in Figure 3.

ii) Capital Cost Estimate

The DFS capital cost estimate meets AACE Class 3 criteria and achieves +/-15% accuracy. SNC-Lavalin has estimated the total capital cost of the Hydrometallurgical Facility at $151.1 million as summarized below:

|

Capital Cost Estimate |

$'M |

|

Site development |

2.9 |

|

Direct costs |

79.0 |

|

Mobile equipment |

0.8 |

|

Indirect costs |

11.0 |

|

Sub-total |

93.7 |

|

Power Station 7 |

21.8 |

|

EPCM fees and Contingency |

35.5 |

|

Total |

151.1 |

Approximately 94% of the direct cost component of the capital cost estimate is supported by vendor quotes with the balance derived from SNC-Lavalin's pricing database. Contingency has been determined after applying a @Risk Monte Carlo simulation at an industry standard 'P80 outcome'.

i) Operating Cost Estimate

The operating cost estimate for the Hydrometallurgical Facility, averaged over the life of the Mine, is shown below:

|

Operating Cost Estimate |

$'M |

$/t ore |

$/t lead ingot |

$/lb lead ingot |

|

Labour |

3.40 |

1.73 |

55.2 |

0.025 |

|

Maintenance |

1.20 |

0.61 |

19.4 |

0.009 |

|

Consumables |

5.61 |

2.86 |

91.1 |

0.041 |

|

Power |

5.06 |

2.58 |

82.2 |

0.037 |

|

General & administration |

0.63 |

0.32 |

10.2 |

0.005 |

|

Total |

15.91 |

8.10 |

258.1 |

0.117 |

Mineral Resources

The Paroo Station Mineral Resources estimate applied in the DFS has been prepared by Optiro Pty Ltd and is as per the Technical Report dated March 10, 2015 prepared by SRK Consulting (Australasia) Pty Ltd, net of mining depletion (totaling 5kt of contained lead) in January and February 2015 and reported in the Company's Annual Information Form dated February 23, 2017.

A summary of total Mineral Resources8 (inclusive of Ore Reserves) is shown in the following tables:

|

Measured |

Indicated |

Total | |||||||

|

Deposit |

Tonnes |

Grade |

Contained |

Tonnes |

Grade |

Contained |

Tonnes |

Grade |

Contained |

|

Magellan |

3.5 |

4.8 |

170 |

13.1 |

4.6 |

600 |

16.6 |

4.6 |

770 |

|

Cano |

1.2 |

4.0 |

50 |

1.2 |

2.9 |

35 |

2.4 |

3.5 |

85 |

|

Pinzon |

0.1 |

6.4 |

5 |

8.4 |

4.4 |

370 |

8.5 |

4.4 |

375 |

|

Pizarro |

- |

- |

- |

3.1 |

3.6 |

115 |

3.1 |

3.6 |

115 |

|

Stockpiles |

1.5 |

3.0 |

45 |

- |

- |

- |

1.5 |

3.0 |

45 |

|

Total |

6.3 |

4.3 |

270 |

25.8 |

4.3 |

1,120 |

32.0 |

4.3 |

1,390 |

|

Inferred | |||

|

Deposit |

Tonnes |

Grade |

Contained |

|

Magellan |

2.5 |

4.5 |

115 |

|

Cano |

0.4 |

3.0 |

10 |

|

Pinzon |

1.7 |

3.8 |

65 |

|

Pizarro |

1.1 |

3.6 |

40 |

|

Drake |

2.7 |

4.1 |

110 |

|

Stockpiles |

- |

- |

- |

|

Total |

8.4 |

4.0 |

340 |

Mining

AMC Consultants Pty Ltd ("AMC") have prepared a mining Technical Study and Ore Reserve Statement (JORC 2012 compliant) to contribute to the DFS. The studies included only Measured and Indicated Mineral Resources from the Magellan, Cano and Pinzon deposits.

As in previous operating periods of the Mine, ore would be extracted via drilling and blasting from a series of open pits and excavators used to dig and load ore and waste into 85t haul trucks. Ore would be mined concurrently from a number of faces to provide a homogenous blend to the concentrator and ore stockpiled and further blended on the run of mine pad.

To develop a new mine plan and schedule for the Mine, the Company supplied AMC with mining costs, processing costs, transport and logistics costs, metallurgical recovery rates, royalties and taxes, commodity price forecasts and foreign exchange assumptions to which AMC added dilution and ore loss factors, assessed geotechnical and hydrological parameters, amongst other factors to undertake pit optimizations using Whittle software. Pit designs were generated from the optimizations and a life of mine mining schedule developed.

Proven and Probable 9Ore Reserves are estimated at February 27, 2018:

|

Proven |

Probable |

Total | |||||||

|

Deposit |

Tonnes |

Grade |

Contained |

Tonnes |

Grade |

Contained |

Tonnes |

Grade |

Contained |

|

Magellan |

3.9 |

4.3 |

169 |

13.1 |

4.1 |

538 |

17.0 |

4.2 |

707 |

|

Cano |

1.4 |

3.5 |

47 |

1.0 |

2.6 |

27 |

2.4 |

3.1 |

74 |

|

Pinzon |

0.1 |

5.8 |

5 |

8.8 |

3.9 |

343 |

8.9 |

3.9 |

348 |

|

Stockpiles10 |

2.9 |

2.4 |

70 |

- |

- |

- |

2.9 |

2.4 |

70 |

|

Total |

8.3 |

3.5 |

291 |

22.9 |

4.0 |

908 |

31.2 |

3.8 |

1,199 |

The following tables summarizes the life of Mine mining schedule applied to the DFS and the associated mining costs:

|

Deposit |

Waste |

Ore mined |

Strip ratio |

Pb Grade |

Contained |

|

Magellan |

54,024,336 |

16,986,904 |

3.18 |

4.16 |

706,535 |

|

Cano |

4,115,548 |

2,393,771 |

1.72 |

3.10 |

74,293 |

|

Pinzon |

26,335,366 |

8,841,224 |

2.98 |

3.94 |

347,910 |

|

Total Mined |

84,475,251 |

28,221,899 |

2.99 |

4.00 |

1,128,684 |

|

Stockpiles |

- |

1,234,870 |

- |

2.50 |

30,879 |

|

Total |

84,475,251 |

29,456,769 |

3.94 |

1,159,563 |

Existing Processing Plant

Modifications and improvements to the Existing Processing Plant have been proposed in the DFS following and are estimated by LeadFX at $7.3 million. The modifications would be designed to maximize flotation recovery and minimize solid / liquid separation issues in the Hydrometallurgical Facility. A revised reagent regime was developed that increased overall recovery. The modifications include:

- Inclusion of pebble crushing in the grinding circuit to increase milling capacity;

- New conditioning tanks, new column flotation cell and associated pumps and blowers; and

- Replacement of the existing flotation thickener with a larger unit to accommodate increased concentrate production.

All in Sustaining Costs11

The DFS is a fully integrated mining and processing study of the existing plant with the addition of the new Hydrometallurgical Facility. The DFS estimates all in sustaining costs as follows:

|

All In Sustaining Cash Costs |

$'M |

$/t ore |

$/t lead ingot |

$/lb lead ingot |

|

Utilities (ex-Hydromet Facility) |

3.76 |

1.92 |

61.1 |

0.028 |

|

Mining |

20.75 |

10.57 |

336.8 |

0.153 |

|

Flotation |

21.41 |

10.90 |

347.5 |

0.158 |

|

Hydrometallurgical Facility |

15.91 |

8.10 |

258.3 |

0.117 |

|

Supply & Logistics 12 |

5.50 |

2.80 |

89.2 |

0.040 |

|

Sustainability |

2.95 |

1.50 |

47.9 |

0.022 |

|

Operational Support |

6.97 |

3.55 |

113.2 |

0.051 |

|

C1 Cash Costs |

77.25 |

39.34 |

1,254 |

0.569 |

|

Corporate |

1.25 |

0.63 |

20.2 |

0.009 |

|

Ongoing Capex |

1.69 |

0.86 |

27.4 |

0.012 |

|

Royalties |

4.05 |

2.06 |

65.8 |

0.030 |

|

All In Sustaining Cash Costs |

84.24 |

42.90 |

1,367 |

0.620 |

Tailings Management

Tailings from the Hydrometallurgical Facility would be discharged to an existing tailings storage system with increased capacity to accept tailings from the expanded mine life.

Environmental Approvals

As announced on February 12, 2018 the seven-day public comment period on the level of assessment for the proposed Hydrometallurgical Facility closed. The EPA is expected to set the level of assessment, which guides the Hydrometallurgical Facility approval timeline, during March 2018.

In January 2018 the Hydrometallurgical Facility environmental referral document (Referral) was filed with the EPA and made available to the public on February 5, 2018.

The Referral describes the key environmental factors relevant to the construction and operation of the proposed Hydrometallurgical Facility including the expansion to the mining footprint.

In preparing the Referral, management undertook comprehensive stakeholder engagement - meeting directly with all 20 local government representatives impacted by activities already approved under existing environmental conditions for operations at Paroo Station, various state regulators including the EPA, Department of Water and Environmental Regulation, Department of Mines Industry Regulation and Safety and community groups.

The EPA assessment process is the Western Australian State governments primary approval for the Hydrometallurgical Facility. In parallel, secondary licensing approvals with various key decision-making authorities of the State government are also being progressed.

Non-IFRS Measures

Certain financial metrics used in this press release are non-IFRS measures. Specifically, 'C1 cost" and "all-in sustaining costs" are non-IFRS measures intended to provide additional information only and does not have any standardized meaning under IFRS and may not be comparable to similar measures presented by other mining companies. It should not be considered in isolation or as a substitute for measures of performance prepared in accordance with IFRS. The measure is not necessarily indicative of cash flow from operations under IFRS or operating costs presented under IFRS.

Annual Production Schedule

|

Description |

Units |

Year 1 |

Year 2 |

Year 3 |

Year 4 |

Year 5 |

Year 6 |

Year 7 |

Year 8 |

Year 9 |

Year 10 |

Year 11 |

Year 12 |

Year 13 |

Year 14 |

Year 15 |

Total |

|

Ore Feed |

|||||||||||||||||

|

Plant ore feed-rate |

t'000 |

1,457 |

2,000 |

2,000 |

2,000 |

2,000 |

2,000 |

2,000 |

2,000 |

2,000 |

2,000 |

2,000 |

2,000 |

2,000 |

2,000 |

2,000 |

29,457 |

|

Ore head grade |

%Pb |

3.90% |

4.35% |

4.32% |

4.29% |

4.33% |

4.33% |

4.36% |

4.34% |

4.35% |

4.37% |

3.66% |

3.20% |

3.07% |

3.10% |

3.07% |

3.94% |

|

Contained lead in ore |

t Pb |

56,878 |

86,903 |

86,360 |

85,819 |

86,614 |

86,640 |

87,170 |

86,831 |

87,094 |

87,333 |

73,126 |

63,923 |

61,335 |

62,053 |

61,484 |

1,159,563 |

|

Floatation |

|||||||||||||||||

|

Floatation recovery |

% |

81.3% |

82.1% |

82.6% |

83.1% |

82.33% |

82.3% |

81.8% |

82.1% |

81.9% |

81.6% |

80.3% |

79.4% |

79.4% |

79.3% |

78.9% |

81.4% |

|

Lead in concentrate |

t Pb |

46,243 |

71,307 |

71,307 |

71,307 |

71,307 |

71,307 |

71,307 |

71,307 |

71,307 |

71,307 |

58,718 |

50,744 |

48,692 |

49,200 |

48,510 |

943,866 |

|

Concentrate grade |

% |

70.0% |

70.0% |

70.0% |

70.0% |

70.0% |

70.0% |

70.0% |

70.0% |

70.0% |

70.0% |

70.0% |

70.0% |

70.0% |

70.0% |

70.0% |

70.0% |

|

Concentrate production |

t con |

66,062 |

101,867 |

101,867 |

101,867 |

101,867 |

101,867 |

101,867 |

101,867 |

101,867 |

101,867 |

83,882 |

72,492 |

69,559 |

70,286 |

69,300 |

1,348,380 |

|

Refinery |

|||||||||||||||||

|

Lead in concentrate |

t Pb |

46,243 |

71,307 |

71,307 |

71,307 |

71,307 |

71,307 |

71,307 |

71,307 |

71,307 |

71,307 |

58,718 |

50,744 |

48,692 |

49,200 |

48,510 |

943,866 |

|

Refinery recovery |

% |

97.9% |

97.9% |

97.9% |

97.9% |

97.9% |

97.9% |

97.9% |

97.9% |

97.9% |

97.9% |

97.9% |

97.9% |

97.9% |

97.9% |

97.9% |

97.9% |

|

Lead ingot |

t Pb |

45,275 |

69,813 |

69,813 |

69,813 |

69,813 |

69,813 |

69,813 |

69,813 |

69,813 |

69,813 |

57,488 |

49,681 |

47,672 |

48,169 |

47,494 |

924,093 |

|

Sales Price |

|||||||||||||||||

|

LME Lead Price (real) |

$/t |

2,250 |

2,250 |

2,250 |

2,250 |

2,250 |

2,250 |

2,250 |

2,250 |

2,250 |

2,250 |

2,250 |

2,250 |

2,250 |

2,250 |

2,250 |

2,250 |

Annual Unit Operating Costs (real $/t lead ingot)

|

Description |

Year 1 |

Year 2 |

Year 3 |

Year 4 |

Year 5 |

Year 6 |

Year 7 |

Year 8 |

Year 9 |

Year 10 |

Year 11 |

Year 12 |

Year 13 |

Year 14 |

Year 15 |

Total | |

|

Utilities (ex-Hydromet) |

73 |

54 |

54 |

54 |

54 |

54 |

54 |

54 |

54 |

54 |

66 |

76 |

80 |

79 |

80 |

61 | |

|

Mining |

493 |

397 |

401 |

401 |

329 |

329 |

330 |

295 |

296 |

295 |

277 |

318 |

332 |

336 |

225 |

337 | |

|

Floatation |

429 |

309 |

309 |

309 |

309 |

309 |

309 |

309 |

309 |

309 |

375 |

434 |

453 |

447 |

454 |

347 | |

|

Hydromet Facility |

295 |

246 |

246 |

246 |

246 |

246 |

246 |

246 |

246 |

246 |

265 |

283 |

288 |

287 |

288 |

258 | |

|

Supply & Logistics13 |

97 |

87 |

87 |

87 |

87 |

87 |

87 |

87 |

87 |

87 |

91 |

94 |

95 |

95 |

95 |

89 | |

|

Sustainability |

65 |

42 |

42 |

42 |

42 |

42 |

42 |

42 |

42 |

42 |

51 |

59 |

62 |

61 |

62 |

48 | |

|

Operational Support |

154 |

100 |

100 |

100 |

100 |

100 |

100 |

100 |

100 |

100 |

121 |

140 |

147 |

145 |

147 |

113 | |

|

C1 Cash Costs |

1,607 |

1,235 |

1,239 |

1,239 |

1,168 |

1,167 |

1,168 |

1,133 |

1,135 |

1,133 |

1,246 |

1,405 |

1,457 |

1,449 |

1,351 |

1,254 | |

|

Corporate |

28 |

18 |

18 |

18 |

18 |

18 |

18 |

18 |

18 |

18 |

22 |

25 |

26 |

26 |

26 |

20 | |

|

Ongoing Capex |

17 |

11 |

11 |

11 |

11 |

11 |

11 |

11 |

11 |

11 |

13 |

15 |

16 |

16 |

313 |

27 | |

|

Royalties |

66 |

66 |

66 |

66 |

66 |

66 |

66 |

66 |

66 |

66 |

66 |

66 |

66 |

66 |

66 |

66 | |

|

All-In Sustaining Costs |

1,718 |

1,329 |

1,333 |

1,333 |

1,263 |

1,261 |

1,262 |

1,227 |

1,229 |

1,228 |

1,347 |

1,511 |

1,565 |

1,557 |

1,756 |

1,367 | |

Annual Cashflows (real $ @ $2,250/t LME lead price)

|

Description |

Year 1 |

Year 2 |

Year 3 |

Year 4 |

Year 5 |

Year 6 |

Year 7 |

Year 8 |

Year 9 |

Year 10 |

Year 11 |

Year 12 |

Year 13 |

Year 14 |

Year 15 |

Total | |

|

Ingot Sales @ LME Price |

102 |

157 |

157 |

157 |

157 |

157 |

157 |

157 |

157 |

157 |

129 |

112 |

107 |

108 |

107 |

2,079 | |

|

Operating Costs |

|||||||||||||||||

|

Utilities (ex- Hydromet) |

(3) |

(4) |

(4) |

(4) |

(4) |

(4) |

(4) |

(4) |

(4) |

(4) |

(4) |

(4) |

(4) |

(4) |

(4) |

(56) | |

|

Mining |

(22) |

(28) |

(28) |

(28) |

(23) |

(23) |

(23) |

(21) |

(21) |

(21) |

(16) |

(16) |

(16) |

(16) |

(11) |

(311) | |

|

Floatation |

(19) |

(22) |

(22) |

(22) |

(22) |

(22) |

(22) |

(22) |

(22) |

(22) |

(22) |

(22) |

(22) |

(22) |

(22) |

(321) | |

|

Hydromet Facility |

(13) |

(17) |

(17) |

(17) |

(17) |

(17) |

(17) |

(17) |

(17) |

(17) |

(15) |

(14) |

(14) |

(14) |

(14) |

(239) | |

|

Supply & Logistics14 |

(4) |

(6) |

(6) |

(6) |

(6) |

(6) |

(6) |

(6) |

(6) |

(6) |

(5) |

(5) |

(5) |

(5) |

(5) |

(82) | |

|

Sustainability |

(3) |

(3) |

(3) |

(3) |

(3) |

(3) |

(3) |

(3) |

(3) |

(3) |

(3) |

(3) |

(3) |

(3) |

(3) |

(44) | |

|

Operational Support |

(7) |

(7) |

(7) |

(7) |

(7) |

(7) |

(7) |

(7) |

(7) |

(7) |

(7) |

(7) |

(7) |

(7) |

(7) |

(105) | |

|

Corporate |

(1) |

(1) |

(1) |

(1) |

(1) |

(1) |

(1) |

(1) |

(1) |

(1) |

(1) |

(1) |

(1) |

(1) |

(1) |

(19) | |

|

Ongoing Capex |

(1) |

(1) |

(1) |

(1) |

(1) |

(1) |

(1) |

(1) |

(1) |

(1) |

(1) |

(1) |

(1) |

(1) |

(15) |

(25) | |

|

Royalties |

(3) |

(5) |

(5) |

(5) |

(5) |

(5) |

(5) |

(5) |

(5) |

(5) |

(4) |

(3) |

(3) |

(3) |

(3) |

(61) | |

|

All-In Sustaining Costs |

(78) |

(93) |

(93) |

(93) |

(88) |

(88) |

(88) |

(86) |

(86) |

(86) |

(77) |

(75) |

(75) |

(75) |

(83) |

(1,264) | |

|

EBITDA |

24 |

64 |

64 |

64 |

69 |

69 |

69 |

71 |

71 |

71 |

52 |

37 |

33 |

33 |

23 |

816 | |

|

Corporate Income Tax |

- |

- |

(8) |

(16) |

(16) |

(17) |

(17) |

(17) |

(18) |

(18) |

(18) |

(12) |

(7) |

(6) |

(10) |

(179) | |

|

Net Operating Cashflow |

24 |

64 |

56 |

48 |

53 |

52 |

52 |

54 |

53 |

54 |

34 |

25 |

25 |

27 |

14 |

637 | |

Forward looking statements

This news release may contain "forward-looking statements" within the meaning of applicable Canadian securities laws. Examples of forward-looking information in this news release include but are not limited to statements and information concerning the following: preliminary cost reporting; production, cost and capital expenditures guidance; timing of and ability to secure project financing favorable to the Company (if at all); implementation schedule and forecasts; design and construction of the proposed Hydrometallurgical Facility; capital and operating expenditures; mineral resource estimates; mine plan and schedule; all in sustaining cost estimates; metallurgical recovery rates; commodity price forecasts; modification and improvement plans for mining and processing lead ore at Paroo Station; tailings management at Paroo Station; cash flow estimates; the productive mine life of Paroo Station; and environmental approvals regarding the proposed Hydrometallurgical Facility.

Forward-looking statements are often, but not always, identified by the use of words such as ''seek'', ''anticipate'', ''contemplate'', ''target'', ''believe'', ''plan'', ''estimate'', ''expect'', and ''intend'' and statements that an event or result ''may'', ''will'', ''can'', ''should'', ''could'' or ''might'' occur or be achieved and other similar expressions. Forward-looking information by its nature requires assumptions and involves known and unknown risks, uncertainties and other factors which may cause the actual results, performance or achievements to be materially different from any future results, performance or achievements expressed or implied by the forward-looking information, and readers are cautioned not to place undue reliance on such information. These statements are based on expectations, estimates and projections as at the date of this news release and are subject to a number of risks and uncertainties. Should one or more of these risks or uncertainties materialize, or should assumptions underlying the forward-looking information prove incorrect, actual results, performance or achievement may vary materially from those expressed or implied by the forward-looking information contained in this news release. These risk factors should be carefully considered and readers are cautioned not to place undue reliance on forward-looking information, which is current only as of the date of this news release. All subsequent forward-looking information attributable to LeadFX herein is expressly qualified in its entirety by the cautionary statements contained in or referred to herein. LeadFX does not undertake any obligation to release publicly any revisions to this forward-looking information to reflect events or circumstances that occur after the date of this news release or to reflect the occurrence of unanticipated events, except as may be required under applicable securities laws.

Notes to the Mineral Resources Estimate

- All Mineral Resources have been reported in accordance with the 2012 JORC Code reporting guidelines and are inclusive of Ore/Mineral Reserves.

- All Mineral Resources have been reported using a cut-off grade of 2.1% lead and depleted for mining to December 31, 2015. There has been no mining or processing of material during the 2016 or 2017 calendar years.

- The stockpiled Mineral Resource is based on mine production data.

- The Mineral Resource figures are based on the Mineral Resource Report which has been prepared by Mr. Kahan Cervoj (MAusIMM, MAIG), who is an employee of Optiro Pty Ltd, and is a "Competent Person" as defined by the 2012 JORC Code. He is a "Qualified Person" for purposes of NI 43-101 and he supervised the preparation of and verified the above Mineral Resource figures prepared by the Company's consultants, including the underlying sampling, analytical and production data. Data was verified by site visits and reviews of the Company's and consultants' data.

- Mr. Cervoj was the Competent Person for the Magellan Hill 2014 Mineral Resource that is the basis for the December 2015 Mineral Resource estimate.

- Mineral Resources which are not Mineral Reserves do not have demonstrated economic viability. The estimate of Mineral Resources may be materially affected by environmental, permitting, legal, marketing, or other relevant issues.

- Table entries are rounded to reflect the precision of the estimate and differences may occur due to this rounding.

Notes to the Ore Reserves Estimate

- Mineral Reserves are a subset of Measured and Indicated Mineral Resources. The Mineral Reserve Estimate was developed to JORC (2012) standards which are accepted CIM under the use of a Foreign Code. The 2012 JORC Code uses the terms "Ore Reserve" and "Proved" which are equivalents to the terms "Mineral Reserve" and "Proven" respectively, as defined in NI 43-101.

- The Mineral Reserve Estimate was developed by Mr Adrian Jones, a full time employee of AMC Consultants Pty Ltd (AMC). Mr Jones is the Competent Person for the 2015 Paroo Station Ore Reserve estimate under the 2012 JORC Code. Mr Jones supervised preparation of the estimate with assistance from specialists in each area of the estimate. Mr Jones is a Member of The Australasian Institute of Mining and Metallurgy. He has sufficient experience relevant to the style of mineralisation, type of deposit under consideration, and in open pit mining activities, to qualify as a Competent Person as defined in the JORC Code. Mr Jones consents to the inclusion of this information in the form and context in which it appears.

- Mr Laurie Gillett FAuslMM of AMC is a Qualified Person for the purposes of NI 43-101 and he also supervised and verified the above Mineral Reserve figures prepared by Mr Jones, including the underlying sampling, analytical test and production data.

- Mr Jones participated in a site visit in the second week of March 10, 2015.

- The pit limits for the open pit were selected through optimisation using the Gemcom Whittle Four-X implementation of the Lerchs-Grossman algorithm. The optimisation considered Measured and Indicated Mineral Resources only. Pit designs followed the optimisation shell outline that developed the largest undiscounted cashflow for the evaluation parameters.

- The process recovery of lead is linked to lead head grade. The following recovery formula was used in the analysis: Flotation Pb Recovery = 73.5% + (1.55 x % Ore Grade), Hydrometallurgical Plant Recovery 98.17%[15]. The average overall recovery is 80%.

- Dilution of the resource model and an allowance for ore loss are included in the Ore Reserve estimate, and were introduced through applying a selective mining unit of 6.25 x 6.25 x 2.5m. Within the Ore Reserve pit design, the application of dilution resulted in inclusion of 5.59% dilution and results in an ore loss of 6.43%. Metal pricing of US$2,250/t Pb plus US$85/t Pb premium was used in the mine planning.

- The Proved Ore Reserve estimate is based on Mineral Resources classified as Measured, after consideration of all mining, metallurgical, social, environmental, statutory and financial aspects of the project. The Probable Ore Reserve estimate is based on Mineral Resources classified as Indicated, after consideration of all mining, metallurgical, social, environmental, statutory and financial aspects of the project.

- Table entries are rounded to reflect the precision of the estimate and differences may occur due to this rounding.

_______________________________

1 Compared to the Company's last Technical Report dated March 10, 2015

2 Wood MacKenzie – Lead long-term outlook Q4 update, December 2017

3 C1 Cash Costs means total Mine site operating costs plus transport costs from site to customers at China port net of LME grade specification premia.

4 All In Sustaining Cash Cost means C1 cash costs plus royalties, corporate overhead and sustaining capital expenditure.

5 AUD:USD – 0.75 constant across life of Mine in all scenarios

6 Wood Mackenzie – Lead Long-term outlook Q4 2017 update, December 2017

7 Management is exploring the opportunity to pursue "Build Own Operate' financing for the Power Station.

8 Refer Notes at the conclusion of this News Release

9 Refer Notes at the conclusion of this News Release

10 Stockpiles included in Ore Reserves includes Mineral Resources below the cut-of grade for the Mineral Resource estimate

11 See "Non-IFRS" measures elsewhere in this press release

12 net of premia pricing for LME spec material

13 net of premia pricing for LME spec material

14 net of premia pricing for LME spec material

15 The Hydrometallurgical Plant recovery used in the optimisation was 98.17%. The DSF reported recovery is 97.91%. This is considered an immaterial change as it has a life of mine impact of minus 2,500kt Pb metal which equates to less than minus 0.3% of the recovered Pb metal over that time, well within the limits of accuracy of the Ore Reserve calculation.

SOURCE LeadFX Inc.

View original content with multimedia: http://www.newswire.ca/en/releases/archive/February2018/28/c5726.html