Loncor Gold Announces Adumbi PEA With 303,000 oz/year Over a 10.3 Year LOM

- Pre-tax NPV (5% discount) of US$895 million and post-tax NPV of US$624 million for HEP Hybrid case at a US$1,600 gold price

- Using a US$1,760 gold price, post-tax NPV (5% discount) of US$879 million for HEP Hybrid case

- Average annual production of 303,000 ounces of gold over a 10.3 year life of mine within proposed pit shell

- Average total cash costs of US$852 per ounce over life of mine and AISC of US$950 per ounce for HEP Hybrid case

TORONTO, Dec. 15, 2021 (GLOBE NEWSWIRE) -- Loncor Gold Inc. ("Loncor" or the "Company") (TSX: "LN"; OTCQX: "LONCF”; FSE: "LO51") is pleased to announce the results of the Preliminary Economic Assessment (“PEA”) for its Adumbi gold deposit within its 84.68%-owned Imbo Project in the Democratic Republic of the Congo (the “DRC”).

Project economics and financial analysis was undertaken on two power options at Adumbi: a Hydroelectric Power (“HEP”) Hybrid case and a Diesel Only case. The table below summarises the PEA results for the HEP Hybrid and Diesel Only cases:

| HEP HYBRID CASE | DIESEL ONLY CASE | ||||

| DESCRIPTION | Units | PRE-TAX | AFTER TAX | PRE-TAX | AFTER TAX |

| Life of Mine (“LOM”) Tonnage Ore Processed | t (000) | 49,771 | 49,771 | 49,771 | 49,771 |

| LOM Feed Grade Processed | g/t | 2.172 | 2.172 | 2.172 | 2.172 |

| Production Period | yrs | 10.3 | 10.3 | 10.3 | 10.3 |

| LOM Gold Recovery | % | 89.8% | 89.8% | 89.8% | 89.8% |

| LOM Gold Production | oz (000) | 3,121 | 3,121 | 3,121 | 3,121 |

| LOM Payable Gold After Refining Losses | oz (000) | 3,119 | 3,119 | 3,119 | 3,119 |

| Gold Price | US$/oz | 1,600 | 1,600 | 1,600 | 1,600 |

| Revenue | US$ million | 4,990 | 4,990 | 4,990 | 4,990 |

| Total Cash Costs | US$/oz | 852 | 852 | 908 | 908 |

| AISC | US$/oz | 950 | 950 | 1,040 | 1,040 |

| Preproduction Capital Costs | US$ million | 530 | 530 | 392 | 392 |

| Sustaining Capital Costs | US$ million | 305 | 305 | 411 | 411 |

| Net Present Value (“NPV”) (5% discount rate) | US$ million | 895 | 624 | 843 | 600 |

| IRR | % | 25.2% | 20.7% | 30.3% | 25.2% |

| Discount Rate | % | 5% | 5% | 5% | 5% |

| Payback Period-from start of production | Years | 4.16 | 4.98 | 3.16 | 4.06 |

| Project Net Cash | US$ million | 1,495.2 | 1,087.0 | 1,352.8 | 992.5 |

Note: Total cash costs per payable ounce, AISC (All-in Sustaining-Costs) per payable ounce and project net cash are non-GAAP financial measures. Please see “Cautionary Note Concerning Non-GAAP Measures”. Total cash costs includes all on-site mining costs, processing costs, mine level G&A, refining and royalties. AISC includes all mining costs, processing costs, mine level G&A, royalties, refining, sustaining capital and closure costs. Project net cash is cash revenues less selling costs, less all mining costs, processing costs, mine level G&A, and royalties.

All financial figures in this press release are in United States dollars, unless otherwise noted.

The Adumbi PEA study was prepared for Loncor by a number of independent mining and engineering consultants led by New SENET (SENET), Johannesburg (Processing and Infrastructure) and Minecon Resources and Services Limited (Minecon), Accra (Mineral Resources, Mining and Environmental and Social) and Maelgwyn South Africa (MMSA), Johannesburg (Metallurgical test work), Knight Piésold and Senergy, Johannesburg (Power) and Epoch, Johannesburg (Tailings and Water Storage). SENET undertook the financial and economic evaluation.

Cautionary Statement:

The Adumbi PEA is preliminary in nature and includes Inferred Mineral Resources in the open pit outlines that are considered too speculative geologically to have the economic considerations applied to them that would enable them to be categorized as Mineral Reserves. There is no certainty that all the conclusions reached in the Adumbi PEA will be realized. Mineral Resources that are not Mineral Reserves do not have demonstrated economic viability.

Commenting on today’s Adumbi PEA study, Loncor’s President Peter Cowley said: “The results from the Adumbi PEA demonstrates a robust project with an average of +300,000 ounces of gold per annum over 10 years with low total cash costs and AISC costs of US$852 and US$950 per ounce respectively over the LOM for the HEP Hybrid power case.”

“There also remains significant upside potential at Adumbi and environs to increase mineral resources, gold production, reduce operating costs and further improve the economics of the project. Excellent exploration potential exists to further increase mineral resources at Adumbi, within the Imbo permit and other permits held by Loncor in the Ngayu greenstone belt. At Adumbi, the mineralized BIF host sequence increases in thickness below the open pit shell and wide spaced drilling has already intersected grades and thicknesses amenable to underground mining. Further drilling is required to initially outline a significant underground mineral resource which can then be combined with the open pit mineral resource so that studies can be undertaken for a combined open pit and underground mining scenario at Adumbi. Besides increasing the resource base, a combined open pit/underground project could increase grade throughput and reduce strip ratios with the higher grade, deeper mineral resources being mined by underground which could increase annual gold production and reduce operating costs.”

“Additional deposits and prospects occur close by to Adumbi and have the potential to add mineral resources and feed for the Adumbi mine operation. Along trend from Adumbi, the Manzako and Kitenge deposits have Inferred Mineral Resources of 313,000 ounces (1.68 million tonnes grading 5.80 g/t Au) and remain open along strike and at depth. Further along strike within the Imbo permit area, four priority prospects have been identified with similar host lithologies to Adumbi and will require drilling. Additional feed for the Adumbi processing plant could also come from Loncor’s 100%-owned high grade Makapela deposit where Indicated Mineral Resources of 2.20 million tonnes grading 8.66 g/t Au (614,200 ounces of gold) and Inferred Mineral Resources of 3.22 million tonnes grading 5.30 g/t Au (549,600 ounces of gold) have been outlined to date with the high grade material being able to be transported to Adumbi.”

“Other opportunities are being pursued to improve Adumbi’s economics. The Company is already in discussion with potential power suppliers with experience in the DRC to project finance and build a hydroelectric facility at Adumbi and then have an offtake agreement with Loncor to supply power for the operation. Any hydroelectric power scheme could also have the potential to obtain carbon credits.”

Imbo Project Containing the Adumbi Deposit

The Imbo Project which contains the Adumbi deposit is situated at the eastern end of the Ngayu Archean greenstone gold belt in the Ituri Province of northeastern DRC and is approximately 220 kilometres from Africa’s largest gold mine of Kibali, operated by Barrick Gold which in 2020 produced 808,134 ounces of gold.

This PEA was undertaken on the Adumbi deposit, which is the main gold deposit on the Company’s 122 square kilometre Imbo Project. Loncor has a 84.68% interest in the Imbo Project through its subsidiary Adumbi Mining S.A., with the minority shareholders holding 15.32% (including a 10% free carried interest held by the government of the DRC). The Imbo exploitation permit is valid until February 2039.

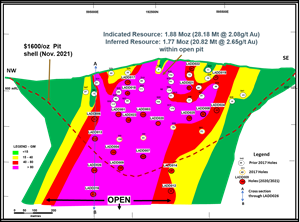

Drilling commenced on the Adumbi deposit in 2010 and to date 21,512 metres (74 core holes) have been drilled (see Figure 1 below). Gold mineralization at Adumbi is hosted in banded ironstone formation (BIF) and is similar to the gold mineralization host lithologies of the major Kibali and Geita mines in the DRC and Tanzania respectively. The main mineralized host lithologies at Adumbi are BIF within which is a more altered, higher sulfide RP (“replacement rock”) lithology. As at Kibali and Geita, significant underground mineral resource potential exists below the Adumbi pit shell where the gold mineralization is open at depth and where wide spaced drilling has already intersected significant widths and grades with the BIF sequence thickening at depth.

Figure 1: Adumbi Deposit Longitudinal Section Looking Northeast with Drill Hole Grade (g/t) x True Thickness (Metre) Product Contours

https://www.globenewswire.com/NewsRoom/AttachmentNg/74d970f8-01f4-41e1-bbfc-e3fec4637d25

Mineral Resources

The mineral resource assessment at Adumbi was undertaken by the Company’s independent geological consultants Minecon Resources and Services Limited (“Minecon”).

Table I below summarises the Adumbi indicated and inferred mineral resources based on in-situ block cut-off grade at a 0.52 g/t Au for Oxide, 0.57 g/t Au for Transition and 0.63 g/t Au for Fresh material and constrained within a US$1,600 per ounce optimized pit shell. 84.68% of the Adumbi mineral resources are attributable to Loncor via its 84.68% interest in the Imbo Project.

Table I: Adumbi Deposit Indicated and Inferred Mineral Resources

(effective date: November 17, 2021)

| Mineral Resource Category | Tonnage (Tonnes) | Grade (g/t Au) | Contained Gold (Ounces) |

| Indicated | 28,185,000 | 2.08 | 1,883,000 |

| Inferred | 20,828,000 | 2.65 | 1,777,000 |

Note: Numbers may not add up due to rounding.

Tables II below summarise the indicated and inferred category mineral resources in terms of material type.

Table II: Adumbi Mineral Resources by Material Type

(effective date: November 17, 2021)

| INDICATED MINERAL RESOURCE | INFERRED MINERAL RESOURCE | |||||

| Material Type | Tonnage | Grade | Contained Gold | Tonnage | Grade | Contained Gold |

| (Tonnes) | (g/t Au) | (Ounces) | (Tonnes) | (g/t Au) | (Ounces) | |

| Oxide | 3,169,000 | 2.05 | 208,000 | 458,000 | 3.39 | 49,000 |

| Transitional | 3,401,000 | 2.51 | 274,000 | 280,000 | 2.74 | 24,000 |

| Fresh (Sulphide) | 21,614,000 | 2.02 | 1,400,000 | 20,089,000 | 2.64 | 1,703,000 |

| TOTAL | 28,185,000 | 2.08 | 1,883,000 | 20,828,000 | 2.65 | 1,777,000 |

Note: Numbers may not add up due to rounding.

Geological Modelling and Grade Estimation

The Adumbi 3-dimensional (“3-D”) model was constructed by Minecon in collaboration with on-site geologists using cross sectional and horizontal flysch plans of the geology and mineralization and was used to assist in the constraining of the 3-D geological model. The mineralization model was constrained within a wireframe at 0.5 g/t Au cut-off grade. Grade interpolation was undertaken using:

- 2 metre sample composites capped at 18 g/t Au to improve the reliability of the block grade estimates.

- Ordinary Kriging to interpolate grades into the block model.

- Relative densities of 2.45 for oxide, 2.82 for transitional and 3.05 for fresh rock were applied to the block model for tonnage estimation.

Pit Optimisation Parameters

To constrain the depth extent of the geological model and any mineral resources, an open pit for the Adumbi deposit was constructed based on the following pit optimisation parameters:

- A gold price of US$1,600 per ounce.

- Block size: 16 metres x 16 metres x 8 metres.

- A thirty-two metres minimum mining width and a maximum of four metres of internal waste was applied.

- Mining dilution of 100% of the tonnes at 95% of the grade.

- Ultimate slope angle of minus 45 degrees.

- Average mining cost of US$3.29/tonne mined.

- Metallurgical recoveries of 91% for oxide, 88% for transitional and 90% for fresh.

- Average general and administration cost of US$4.20/tonne.

- Mineral resources were estimated at a block cut-off grade of 0.52 g/t Au for oxide, 0.57 g/t Au for transition materials and 0.63 g/t Au for fresh material constrained by a US$1,600 per ounce optimized pit shell.

- Transport of gold and refining costs equivalent to 4.5% of the gold price.

- No additional studies on depletion by artisanal activity was undertaken since the RPA study of 2014 and the same total amount of material was used by Minecon.

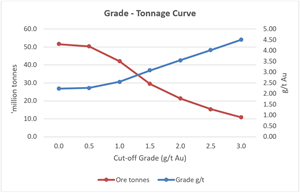

Tonnage/Grade Curve

Grade/tonnage curves for the Adumbi mineral resources at various gold cut-offs are summarised in Table III and the graph below:

Table III:

| Block Cut-off | Tonnage | Grade | Contained Au |

| g/t Au | million tonnes | g/t Au | million ounces |

| 0.0 | 51.60 | 2.23 | 3.70 |

| 0.5 | 50.10 | 2.29 | 3.68 |

| 1.0 | 41.15 | 2.61 | 3.45 |

| 1.5 | 29.07 | 3.17 | 2.97 |

| 2.0 | 21.76 | 3.66 | 2.56 |

| 2.5 | 16.06 | 4.17 | 2.15 |

| 3.0 | 12.12 | 4.63 | 1.80 |

A graph accompanying this announcement is available at https://www.globenewswire.com/NewsRoom/AttachmentNg/e102869e-00d7-4db7-baa9-25bbfb0c1149

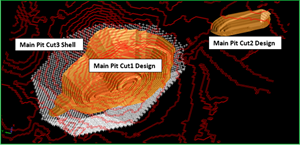

Mining

The Adumbi deposit is planned to be mined by conventional, contract, open pit mining using truck and shovel mining fleet with drill and blasting for all material types. Mining costs were broken down into reference and incremental mining costs and were estimated from first principles using knowledge of recent mining contracts operating in similar gold mining operations in Africa. For the PEA, both Inferred and Indicated Mineral Resources were included in the material to be mined. Mining is planned to be carried out by a contractor on a cost per tonne basis utilising a mining fleet consisting of 140 tonne rigid haul trucks with 8 cubic meter excavators.

Figure II: Adumbi Open Pit Design

https://www.globenewswire.com/NewsRoom/AttachmentNg/a1b785a5-3c30-46ec-acd5-f154a07228a1

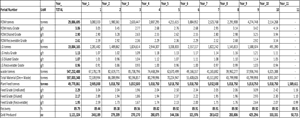

Table IV below summarises the mining, processing and gold production schedules over Adumbi’s LOM.

Table IV: Mining, Processing and Gold Production Schedules over Adumbi’s LOM

https://www.globenewswire.com/NewsRoom/AttachmentNg/9c394b09-1b2c-4dfe-ab55-e45e3f1d5865

Processing

Metallurgical Testwork

Preliminary Economic Assessment level metallurgical testwork (comminution and gold recovery) was performed by Maelgwyn Mineral Services Laboratory on the Adumbi ore to evaluate the process route required to treat the ore and to obtain gold recoveries that can be achieved.

Table V below shows a summary of the PEA Adumbi metallurgical testwork results.

Table V: Adumbi Metallurgical Testwork Results

| Parameters | Units | Oxides | Transition | Fresh | |||

| Bond Rod Work Index | kWh/t | 12.7 | 13.6 | 14.6 | |||

| Bond Ball Work Index | kWh/t | 11.8 | 13.7 | 14.2 | |||

| Abrasion Index | 0.19 | 0.25 | 0.34 | ||||

| Diagnostic Leach CIL Recovery | % | 90.76% | 87.53% | 89.9% | |||

Average diagnostic leach recovery for the fresh sulfide material was the weighted mean of RP and BIF lithologies relative to their volume occurrence (20% RP: 80% BIF) in the fresh material. Diagnostic leach recoveries of 80.10% for RP and 92.37% for BIF were realized for the fresh sulfide.

Comminution results indicated that both oxides and transition are medium-hard while fresh material indicated that it is slightly hard. These results were taken into account in the design of the comminution flowsheet.

In order to optimize gold recovery further testwork was conducted on fresh and transitional material whereby gravity was followed by flotation on gravity tails. The results showed that most of the gold can be floated into float concentrates as summarized in Table VI below.

Table VI: Flotation Results

| Sample ID | Rougher Concentrate | |||||

| Gold | Sulphur | |||||

| Grade ( g/t) | Rec.(%) | Grade (%) | Rec. (%) | |||

| Fresh - RP | 9.57 | 95.06% | 25.07 | 93.03% | ||

| Fresh - BIF | 8.30 | 87.16% | 17.90 | 85.13% | ||

| Transition | 11.82 | 81.31% | 15.80 | 95.52% | ||

The concentrate samples generated were not sufficient to enable further processing routes such as:

- Fine milling followed by leaching with oxygen addition

- Fine milling followed by partial oxidation using high shear reactors and leaching

- Albion process

- Pressure oxidation

- Bio leaching

- Roasting

These recovery processes will be investigated during the next phase of the project to optimize the gold recovery in the transitional and fresh ore types.

Process Plant

Based on the above metallurgical testwork results, the Adumbi process plant design was configured utilising well-known proven and established gravity and carbon-in-leach (CIL) technologies to recover gold from blends of oxide, transition and fresh ores that will be processed at a rate of 5.0 million tonnes per annum.

The process plant consists of the following sections:

- Crushing

- Milling

- Gravity and concentrate leach

- Trash removal and pre-leach thickener

- CIL

- Cyanide detoxification

- Arsenic precipitation

- Tails storage and return water

- Acid wash

- Elution

- Electrowinning

- Gold room

- Carbon regeneration

- Reagents

- Air services

- Water services

Table VII below summarises the key process design criteria for the process plant.

Table VII: Summary of key process design criteria

| ITEM | UNIT | OXIDE | TRANSITION | FRESH |

| Plant Throughput | Mt/a | 5.0 | 5.0 | 5.0 |

| Gold Head Grade | g Au/t | 2.25 | 3.2 | 4.00 |

| Design Gold Recovery | % | 91.82 | 90.38 | 80.1 to 89.83 |

| Crushing Plant Utilisation | % | 65.0 | 65.0 | 65.0 |

| Plant Availability | % | 91.32 | 91.32 | 91.32 |

| Comminution Circuit | 1° Crush & SAB | 1° Crush & SABC | 1° Crush & SABC | |

| Crush Size, P80 | mm | 180 | 180 | 180 |

| Grind Size, P80 | µm | 75 | 75 | 75 |

| Leach/CIL Residence Time | hrs | 24 | 24 | 24 |

| Leach Slurry Density | % w/w | 40 | 40 | 50 |

| Number of Pre-leach Tanks | # | 1 | 1 | 1 |

| Number of CIL Tanks/Stages | # | 11 | 11 | 11 |

| Cyanide Consumption | kg/t | 0.99 | 1.32 | 1.31 |

| Lime Consumption | kg/t | 3.64 | 5.40 | 3.61 |

| Elution Circuit Type | Pressure Zadra | Pressure Zadra | Pressure Zadra | |

| Elution Circuit Size | t | 12 | 12 | 12 |

Figure III below shows the proposed process plant flowsheet.

Figure III: Proposed Process Plant Flowsheet

https://www.globenewswire.com/NewsRoom/AttachmentNg/0e9ac826-81d8-4585-83af-a9683c39744f

Project Infrastructure

A team of engineers from SENET and Knight Piesold carried out a site investigation and, in conjunction with the Loncor team, assessed the optimal positions for key infrastructure components of the mine site. Preliminary designs and layouts were done and positioned utilising the detailed LIDAR survey which was previously commissioned by Loncor.

Figure IV below highlights the positions of key infrastructure for Adumbi.

Figure IV: Adumbi Key Infrastructure and Site layout

https://www.globenewswire.com/NewsRoom/AttachmentNg/71ffa8ab-b84a-443d-a3fd-182ec3339985

Power

A desktop study was undertaken by DRA Energy, South Africa assessing potential hydroelectric, diesel and photovoltaic power sources for Adumbi. Knight Piésold Ltd. from South Africa also undertook a desktop study on a number of potential hydroelectric sites in and around the Adumbi area and was part of the team of engineers from South Africa who visited potential sites on the ground. The total installed power required for Adumbi is estimated at 32 Megawatts (MW)

Table VIII below indicates the different priority power generation options that were investigated.

Table VIII: Priority Power Options for Adumbi

| Option | Power Option | Capex- Power Plant | Power Cost | Approximate Distance from plant site (km) |

| USD | USD/kWh | |||

| 1 | Diesel Only 32 MW | 15,708,000 | 0.2768 | 0 |

| 2 | Hybrid, 32 MW Diesel, 20MW PV, 2.5MW/3.7MWh BESS | 36,845,015 | 0.2459 | 0 |

| 3 | Imbo Upper Site 3, 3.7MW HEP, 32 MW Diesel, 20 MW PV, 12.4 MW/18.4MWh BESS | 73,593,075 | 0.2133 | 5 |

| 4 | Ngayu Confluence, 16.3 MW HEP, 32 MW Diesel, 20 MW PV, 12.4MW/18.4MWh BESS | 138,593,075 | 0.1201 | 23 |

For the Adumbi PEA study, two financial model cases were examined: the diesel only case of generating power for essential processing plant equipment and infrastructure; and the HEP Hybrid case option (Option 4) which is a hybrid system consisting of HEP supplemented by diesel and solar photovoltaic (PV) power generation with battery energy storage. Although capital costs are higher for the HEP Hybrid case, operating costs, especially processing power costs are significantly reduced and subsequent project economics are enhanced compared to the diesel only powered generation case.

For the HEP Hybrid case, it was assumed the capital cost for the HEP option would be funded by Loncor. However, the Company is already in discussion with potential power suppliers with experience in the DRC to project finance and build a hydroelectric facility at Adumbi and then have an offtake agreement with Loncor to supply power for the operation. Any hydroelectric power scheme could also have the potential to obtain carbon credits.

Tailings Management Facility (TMF)

EPOCH undertook a site selection exercise to design a tailings management system to cater for 50 million tonnes over the life of mine.

The following were considered for the design of the TMF:

- A new (tailings storage facility) TSF

- A new return water dam (RWD) associated with the TSF

- The storm water management and associated infrastructure for the TSF comprising slurry deposition pipeline, drainage, perimeter access road, and boundary fencing.

- The following legislation, regulations and design standards were considered during the PEA design of the TMF:

- International Cyanide Code Standard of Practice

- Global Industry Standard for Tailings Management (GISTM)

The site selection process was based on a multi criteria analyses and qualitative risk analysis, which aimed to determine the most favourable location for the TSF footprint.

Water

Raw water for the project will be abstracted from the rivers in the area, which have significant flow throughout the year.

Accessibility and Transport

A number of potential access routes have been assessed from the major port of Mombasa in Kenya via Uganda to the Imbo Project in the Ituri province of northeastern DRC. In comparison to the tarred roads in Kenya and Uganda, the roads in northeastern DRC are lateritic in nature and can become difficult during the rainy season.

Of the three transport DRC border options from Mombasa to Adumbi, the preferred route via Kenya and Uganda is Aru – Durba (location of the Kibali gold mine) - Mungbere - Isiro - Wamba -Adumbi based on the following considerations:

- It is the shortest itinerary in terms of distance and time.

- The traffic is less dense, which determines a lower rate of deterioration of the roads.

- The security along the roads is good, Kibali mine having used this route up to Durba for several years without any incidents.

- The 1,512 km long road from Mombasa to Araba is a good, tarred road and is maintained by the Kenyan and Ugandan government authorities.

- From Arua to Durba (Kibali mine), a distance of 189 km, the road is well maintained with the support of Barrick/AngloGold Ashanti.

- The section of the route from Durba to Wamba (451 km) is now being maintained by the provincial authorities of Haut-Uele

- Only the remaining stretch of road from Wamba to Adumbi (64 km) will need to be rehabilitated and maintained by Loncor.

- Estimates for initial rehabilitation/refurbishment of the route and ongoing maintenance where required has been included in initial pre-production capital costs and in annual maintenance costs.

The new airstrip at Adumbi is expected to be commissioned in January 2022 and can accommodate propeller aircraft with up to 8.1 tonne payloads.

Environmental and Social Considerations

Minecon is implementing pre-feasibility level Environmental and Social Impact Assessment (ESIA), in compliance with the DRC mining code, as part of the ESIA/ESMP, including but not limited to ecological, hydrological, geochemical monitoring and socio-economic assessment. The study will include village-level socio-economic survey, which will generate data on demography, lifestyles and household livelihoods. This will provide the needed guidance for the formulation of a Resettlement Policy Framework, that will form the basis for taking the resettlement planning process to the level of a Resettlement Action Plan. The social assessment, including public consultation, will also serve to help generate a Community Development Plan and a Stakeholder Engagement Plan which will be detailed and refined during the study. An amount has been included in pre-production capital costs for environmental and social considerations under Owner’s Costs.

Initial Pre-Production and Sustaining Capital Cost Estimate Summaries

The following Tables IX to XII summarise the initial Adumbi pre-production and sustaining capital costs for the two power case options: Diesel Only and HEP Hybrid.

Table IX: Adumbi Pre-Production Capital Cost Estimate for Diesel Only Power Case

| Description | Capital Cost | Contingency | Total Capital Cost |

| US$(000) | US$(000) | US$(000) | |

| Mining | 49,988 | 9,998 | 59,986 |

| Process Plant | 143,655 | 27,714 | 171,369 |

| Power Plant | 12,004 | 2,401 | 14,405 |

| Initial TSF | 54,900 | 10,980 | 65,880 |

| Infrastructure | 22,675 | 4,785 | 27,461 |

| Access Transport Road | 6,500 | 1,300 | 7,800 |

| Owner's Costs | 39,323 | 5,787 | 45,110 |

| Total Initial Capex | 329,045 | 62,965 | 392,010 |

Table X: Adumbi Sustaining Capital Estimate for Diesel Only Power Case

| Description | Total Capital Cost | |

| US$(000) | ||

| Mining Capitalized Waste | 328,215 | |

| Power Plant | 14,122 | |

| TSF | 66,329 | |

| Rehabilitation & Closure Costs | 30,678 | |

| Equipment Salvage Value | -28,789 | |

| Total Sustaining Capital | 410,556 | |

Table XI: Adumbi Pre-Production Capital Cost Estimate for HEP Hybrid Power Case

| Description | Capital Cost | Contingency | Total Capital Cost |

| US$(000) | US$(000) | US$(000) | |

| Mining | 49,988 | 9,998 | 59,986 |

| Process Plant | 143,655 | 27,714 | 171,369 |

| HEP Hybrid Power Plant | 138,593 | 13,859 | 152,452 |

| Initial TSF | 54,900 | 10,980 | 65,880 |

| Infrastructure | 22,675 | 4,785 | 27,461 |

| Access Transport Road | 6,500 | 1,300 | 7,800 |

| Owner's Costs | 39,323 | 5,787 | 45,110 |

| Total Initial Capex | 455,634 | 74,423 | 530,058 |

Table XII: Adumbi Sustaining Capital Estimate for HEP Hybrid Power Case

| Description | Total Capital Cost | |

| US$(000) | ||

| Mining Capitalized Waste | 328,215 | |

| Power Plant | 0 | |

| TSF | 66,329 | |

| Rehab & Closure Costs | 30,678 | |

| Equipment Salvage Value (Process Plant &HEP) | -120,260 | |

| Total Sustaining Capital | 304,962 | |

Adumbi Operating Costs Summaries

The following Tables XIII to XIV summarise LOM operating costs for the Diesel Only and HEP Hybrid cases:

Table XIII: Adumbi LOM Operating Costs for the Diesel Only Case

| Description | LOM | |

| US$/t processed | US$/oz | |

| Mining | 31.33 | 499.56 |

| Processing | 17.95 | 286.21 |

| TSF | 0.55 | 8.75 |

| G & A | 3.40 | 54.19 |

| Refining & Transport | 0.22 | 3.50 |

| Royalties | 3.51 | 55.96 |

| Total Cash Costs | 57.0 | 908 |

A diesel price of US$0.90/litre was used based on supplier quotes.

Table XIV: Adumbi LOM Operating Costs for the HEP Hybrid Case

| Description | LOM | |

| US$/t processed | US$/oz | |

| Mining | 31.33 | 499.56 |

| Processing | 14.44 | 230.22 |

| TSF | 0.55 | 8.75 |

| G & A | 3.40 | 54.19 |

| Refining & Transport | 0.22 | 3.50 |

| Royalties | 3.51 | 55.96 |

| Total Cash Costs | 53.4 | 852 |

Project Economics and Financial Analysis

SENET has produced a cash flow valuation model for the Adumbi deposit for the HEP Hybrid and Diesel Only cases taking into account annual processed tonnages, grades and recoveries, metal prices, site operating and total cash costs including royalties and refining charges and initial pre-production and sustaining capital expenditure estimates. The financial assessment of Adumbi has been carried out on a “100% equity” basis for both pre-tax and after-tax considerations. The financial analysis assumed a base gold price of US$1,600 per ounce of gold.

Table XV below summarises the pre-tax and after-tax financial analysis for the HEP Hybrid and Diesel Only cases:

Table XV: Comparison of HEP Hybrid vs Diesel power generation Financial Models

| HEP HYBRID CASE | DIESEL ONLY CASE | ||||

| DESCRIPTION | Units | PRE-TAX | AFTER TAX | PRE-TAX | AFTER TAX |

| LOM Tonnage Ore Processed | t (000) | 49,771 | 49,771 | 49,771 | 49,771 |

| LOM Feed Grade Processed | g/t | 2.172 | 2.172 | 2.172 | 2.172 |

| Production Period | yrs | 10.3 | 10.3 | 10.3 | 10.3 |

| LOM Gold Recovery | % | 89.8% | 89.8% | 89.8% | 89.8% |

| LOM Gold Production | oz (000) | 3,121 | 3,121 | 3,121 | 3,121 |

| LOM Payable Gold After Refining Losses | oz (000) | 3,119 | 3,119 | 3,119 | 3,119 |

| Gold Price | US$/oz | 1,600 | 1,600 | 1,600 | 1,600 |

| Revenue | US$ million | 4,990 | 4,990 | 4,990 | 4,990 |

| Site Operating Costs | US$/oz | 793 | 793 | 849 | 849 |

| Total Cash Costs | US$/oz | 852 | 852 | 908 | 908 |

| AISC | US$/oz | 950 | 950 | 1,040 | 1,040 |

| Preproduction Capital Costs | US$ million | 530 | 530 | 392 | 392 |

| Sustaining Capital Costs | US$ million | 305 | 305 | 411 | 411 |

| NPV (5% discount rate) | US$ million | 895 | 624 | 843 | 600 |

| IRR | % | 25.2% | 20.7% | 30.3% | 25.2% |

| Discount Rate | % | 5% | 5% | 5% | 5% |

| Payback Period-from start of production | Years | 4.16 | 4.98 | 3.16 | 4.06 |

| Project Net Cash | US$ million | 1,495.2 | 1,087.0 | 1,352.8 | 992.5 |

Note: Total cash costs per payable ounce, AISC (All-in Sustaining-Costs) per payable ounce and project net cash are non-GAAP financial measures. Please see “Cautionary Note Concerning Non-GAAP Measures”. Total cash costs includes all on-site mining costs, processing costs, mine level G&A, refining and royalties. AISC includes all mining costs, processing costs, mine level G&A, royalties, refining, sustaining capital and closure costs. Project net cash is cash revenues less selling costs, less all mining costs, processing costs, mine level G&A, and royalties.

Sensitivity Financial Analysis

Calculated sensitivities to the Adumbi base case gold price of US$1,600/ounce show significant upside leverage to the gold price and the robust nature of the projected economics to the capital and operating assumptions.

Project sensitivities for the NPV, IRR, cash cost, AISC and payback period have been undertaken for varying gold price percentages from the US$1,600/ounce base case and are summarised in Table XVI and XVII below for the HEP Hybrid and Diesel Only cases:

Table XVI: Gold Price Sensitivities for the HEP Hybrid Case

| Average Gold Price (US$/oz) | ||||||

| Change in Gold Price | % | -15% | -10% | 0% | 10% | 15% |

| Average Gold Price | US$/oz | 1,360 | 1,440 | 1,600 | 1,760 | 1,840 |

| NPV @ 5% -Pre-Tax | US$M | 373 | 547 | 895 | 1,243 | 1,417 |

| NPV @ 5% -Post-Tax | US$M | 238 | 368 | 624 | 879 | 1,006 |

| IRR- Pre-Tax | % | 14.1% | 18.0% | 25.2% | 31.9% | 35.1% |

| IRR- Post -Tax | % | 11.4% | 14.7% | 20.7% | 26.4% | 29.1% |

| Total Cash Costs | US$/oz | 844 | 847 | 852 | 858 | 861 |

| AISC | US$/oz | 941 | 944 | 950 | 955 | 958 |

| Payback Period– Pre-Tax | Years | 7.88 | 6.26 | 4.16 | 3.00 | 2.64 |

| Payback Period- Post-Tax | Years | 8.28 | 7.10 | 4.98 | 3.76 | 3.30 |

Table XVII: Gold Price Sensitivities for the Diesel Only Case

| Average Gold Price (US$/oz) | ||||||

| Change in Gold Price | % | -15% | -10% | 0% | 10% | 15% |

| Average Gold Price | US$/oz | 1,360 | 1,440 | 1,600 | 1,760 | 1,840 |

| NPV @ 5% -Pre-Tax | US$M | 321 | 495 | 843 | 1,191 | 1,365 |

| NPV @ 5% -Post-Tax | US$M | 211 | 345 | 600 | 855 | 983 |

| IRR- Pre-Tax | % | 15.6% | 20.8% | 30.3% | 39.0% | 43.1% |

| IRR- Post-Tax | % | 12.7% | 17.2% | 25.2% | 32.6% | 36.1% |

| Total Cash Costs | US$/oz | 900 | 903 | 908 | 914 | 917 |

| AISC | US$/oz | 1,031 | 1,034 | 1,040 | 1,045 | 1,048 |

| Payback Period - Pre-Tax | Years | 7.53 | 5.46 | 3.16 | 2.18 | 1.93 |

| Payback Period – Post-Tax | Years | 8.02 | 6.28 | 4.06 | 2.77 | 2.39 |

Project Opportunities

Loncor has identified and will be pursuing a number of opportunities for enhancing and increasing the economics and financial returns relating to the Adumbi project. These include the following:

- Increasing Mineral Resources

There is excellent exploration potential to increase mineral resources at Adumbi, within the Imbo Project and other permit areas held by Loncor in the Ngayu greenstone belt. At Adumbi, the mineralized BIF host sequence increases in thickness below the open pit shell and wide spaced drilling has already intersected grades and thicknesses amenable to underground mining. Further drilling is required to initially outline a significant underground mineral resource which can then be combined with the open pit mineral resource so that studies can be undertaken for a combined open pit and underground mining scenario at Adumbi. Besides increasing the resource base, a combined open pit/underground project could increase grade throughput and reduce strip ratios with the higher grade, deeper mineral resources being mined by underground which could increase annual gold production and reduce operating costs.

Additional deposits and prospects occur close by to Adumbi and have the potential to add mineral resources and feed to the Adumbi mine operation. Along trend from Adumbi, the Manzako and Kitenge deposits have Inferred Mineral Resources of 313,000 ounces of gold (1.68 million tonnes grading 5.80 g/t Au) and remain open along strike and at depth. Further along strike within the Imbo Project, four priority prospects have been identified with similar host lithologies to Adumbi and will require drilling.

Additional feed for the Adumbi processing plant could also come from Loncor’s 100%-owned high grade Makapela deposit where Indicated Mineral Resources of 2.20 million tonnes grading 8.66 g/t Au (614,200 ounces of gold) and Inferred Mineral Resources of 3.22 million tonnes grading 5.30 g/t Au (549,600 ounces of gold) have been outlined to date with the high grade material being able to be transported to Adumbi.

- Additional geotechnical investigations including drilling has the potential to optimize and steepen pit slopes especially for the competent fresh BIF host rock and thus reducing the strip ratio and thereby lowering mining costs.

- Further metallurgical testwork to confirm recoveries, reagent consumptions and optimize flowsheet design should be undertaken as the project advances into pre-feasibility and full feasibility stages.

- As mentioned previously, hydroelectric sites have already been identified close to Adumbi and further studies are required to optimize the power set for the operation.

Qualified Persons

Mr. Philemon Bundo, Senior Vice President of Process at New SENET (Pty) Ltd, and Mr. Daniel Bansah, Chairman and Managing Director of Minecon, are the "qualified persons" (as such term is defined in National Instrument 43-101) who are responsible for the technical information disclosed in this press release. Mr. Bansah and Mr. Bundo have reviewed and approved the contents of this press release.

A technical report relating to the Adumbi PEA reported in this press release will be prepared in accordance with National Instrument 43- 101 and will be filed on SEDAR and EDGAR within the period required by National Instrument 43-101.

Technical Reports

Additional information with respect to the Company’s Imbo Project (which includes the Adumbi deposit) is contained in the technical report of Minecon Resources and Services Limited dated April 27, 2021 and entitled "Updated Resource Statement and Independent National Instrument 43-101 Technical Report, Imbo Project, Ituri Province, Democratic Republic of the Congo". A copy of the said report can be obtained from SEDAR at www.sedar.com and EDGAR at www.sec.gov.

Information with respect to the Company’s Makapela Project, and certain other properties of the Company in the Ngayu gold belt, is contained in the technical report of Venmyn Rand (Pty) Ltd dated May 29, 2012 and entitled "Updated National Instrument 43-101 Independent Technical Report on the Ngayu Gold Project, Orientale Province, Democratic Republic of the Congo". A copy of the said report can be obtained from SEDAR at www.sedar.com and EDGAR at www.sec.gov.

About Loncor Gold Inc.

Loncor is a Canadian gold exploration company focussed on the Ngayu Greenstone Gold Belt in the northeast of the Democratic Republic of the Congo (the "DRC"). The Loncor team has over two decades of experience of operating in the DRC. Loncor’s growing resource base in the Ngayu Belt currently comprises the Imbo and Makapela Projects. At the Imbo Project, the Adumbi deposit holds an indicated mineral resource of 1.88 million ounces of gold (28.185 million tonnes grading 2.08 g/t gold), and the Adumbi deposit and two neighbouring deposits hold an inferred mineral resource of 2.090 million ounces of gold (22.508 million tonnes grading 2.89 g/t Au), with 84.68% of these resources being attributable to Loncor. Loncor has been carrying out a drilling program at the Adumbi deposit with the objective of outlining additional mineral resources. The Makapela Project (which is 100%-owned by Loncor and is located approximately 50 kilometres from the Imbo Project) has an indicated mineral resource of 614,200 ounces of gold (2.20 million tonnes grading 8.66 g/t Au) and an inferred mineral resource of 549,600 ounces of gold (3.22 million tonnes grading 5.30 g/t Au).

Additional information with respect to Loncor and its projects can be found on Loncor's website at www.loncor.com

Cautionary Note to U.S. Investors

National Instrument 43-101 - Standards of Disclosure for Mineral Projects ("NI 43-101") is a rule of the Canadian Securities Administrators which establishes standards for all public disclosure an issuer makes of scientific and technical information concerning mineral projects. Unless otherwise indicated, all resource estimates contained in this press release have been prepared in accordance with NI 43-101 and the Canadian Institute of Mining, Metallurgy and Petroleum Classification System. These standards differ from the requirements of the U.S. Securities and Exchange Commission, and resource information contained in this press release may not be comparable to similar information disclosed by U.S. companies.

Cautionary Note Concerning Forward-Looking Information

This press release contains forward-looking information. All statements, other than statements of historical fact, that address activities, events or developments that the Company believes, expects or anticipates will or may occur in the future (including, without limitation, statements regarding estimates and/or assumptions in respect of production, revenue, cash flow and costs, estimated project economics, Adumbi project opportunities, mineral resource estimates, potential underground mineral resources, potential mineralization, potential gold discoveries, drill targets, potential mineral resource increases, exploration results, and future exploration and development plans) are forward-looking information. This forward-looking information reflects the current expectations or beliefs of the Company based on information currently available to the Company. Forward-looking information is subject to a number of risks and uncertainties that may cause the actual results of the Company to differ materially from those discussed in the forward-looking information, and even if such actual results are realized or substantially realized, there can be no assurance that they will have the expected consequences to, or effects on the Company. Factors that could cause actual results or events to differ materially from current expectations include, among other things, uncertainty of estimates of capital and operating costs, production estimates and estimated economic return, the possibility that actual circumstances will differ from the estimates and assumptions used in the Adumbi PEA, the possibility that future exploration (including drilling) or development results will not be consistent with the Company's expectations, the possibility that drilling or development programs will be delayed, activities of the Company may be adversely impacted by the continued spread of the widespread outbreak of respiratory illness caused by a novel strain of the coronavirus (“COVID-19”), including the ability of the Company to secure additional financing, risks related to the exploration stage of the Company's properties, uncertainties relating to the availability and costs of financing needed in the future, failure to establish estimated mineral resources (the Company’s mineral resource figures are estimates and no assurances can be given that the indicated levels of gold will be produced), changes in world gold markets or equity markets, political developments in the DRC, gold recoveries being less than those indicated by the metallurgical testwork carried out to date (there can be no assurance that gold recoveries in small scale laboratory tests will be duplicated in large tests under on-site conditions or during production), fluctuations in currency exchange rates, inflation, changes to regulations affecting the Company's activities, delays in obtaining or failure to obtain required project approvals, the uncertainties involved in interpreting drilling results and other geological data and the other risks disclosed under the heading "Risk Factors" and elsewhere in the Company's annual report on Form 20-F dated March 31, 2021 filed on SEDAR at www.sedar.com and EDGAR at www.sec.gov. Forward-looking information speaks only as of the date on which it is provided and, except as may be required by applicable securities laws, the Company disclaims any intent or obligation to update any forward-looking information, whether as a result of new information, future events or results or otherwise. Although the Company believes that the assumptions inherent in the forward-looking information are reasonable, forward-looking information is not a guarantee of future performance and accordingly undue reliance should not be put on such information due to the inherent uncertainty therein.

Cautionary Note Concerning Mineral Resource Estimates

The mineral resource figures referred to in this press release are estimates and no assurances can be given that the indicated levels of gold will be produced. Such estimates are expressions of judgment based on knowledge, mining experience, analysis of drilling results and industry practices. Valid estimates made at a given time may significantly change when new information becomes available. While the Company believes that the mineral resource estimates included in this press release are well established, by their nature mineral resource estimates are imprecise and depend, to a certain extent, upon statistical inferences which may ultimately prove unreliable. If such estimates are inaccurate or are reduced in the future, this could have a material adverse impact on the Company.

Mineral resources are not mineral reserves and do not have demonstrated economic viability. There is no certainty that mineral resources can be upgraded to mineral reserves through continued exploration.

Due to the uncertainty that may be attached to inferred mineral resources, it cannot be assumed that all or any part of an inferred mineral resource will be upgraded to an indicated or measured mineral resource as a result of continued exploration. Confidence in the estimate is insufficient to allow meaningful application of the technical and economic parameters to enable an evaluation of economic viability worthy of public disclosure (except in certain limited circumstances). Inferred mineral resources are excluded from estimates forming the basis of a feasibility study.

Cautionary Note Concerning Non-GAAP Measures

This press release includes certain terms or performance measures commonly used in the mining industry that are not defined under International Financial Reporting Standards (“IFRS”), including cash costs and AISC per payable ounce of gold sold. Non-GAAP measures do not have any standardized meaning prescribed under IFRS and, therefore, they may not be comparable to similar measures employed by other companies. The Company believes that, in addition to conventional measures prepared in accordance with IFRS, certain investors use this information to evaluate performance. The data presented is intended to provide additional information and should not be considered in isolation or as a substitute for measures of performance prepared in accordance with IFRS.

For further information, please visit our website at www.loncor.com or contact:

John Barker, CEO, +44 7547 159 521

Peter Cowley, President, +44 7904 540 856

Arnold Kondrat, Executive Chairman, +1 416 366 7300