Loncor Increases Open Pit Mineral Resources by 44% to 3.15 Million Ounces of Gold at Its Adumbi Deposit

TORONTO, April 27, 2021 (GLOBE NEWSWIRE) -- Loncor Resources Inc. ("Loncor" or the "Company") (TSX: "LN"; OTCQX: "LONCF”; FSE: "LO51") is pleased to announce a 44% increase in mineral resources at its Adumbi deposit in the Imbo Project (Loncor 84.68%) in the D.R. Congo.

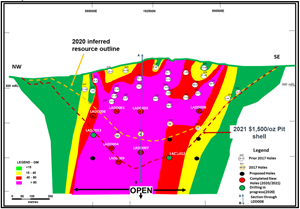

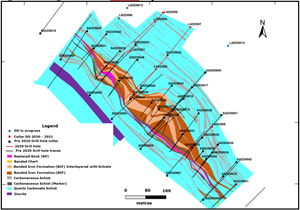

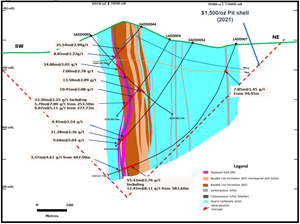

Compared to the inferred mineral resource of 2.19 million ounces of gold (28.97 million tonnes grading 2.35 g/t Au) outlined in April 2020 (see Company press release dated April 17, 2020), further drilling has now increased the Adumbi inferred mineral resource by 44% to 3.15 million ounces of gold (41.316 million tonnes grading 2.37 g/t Au), constrained within a US$1,500 open pit shell (see Figures 1 and 2 below). 84.68% of this inferred mineral resource is attributable to Loncor via its 84.68% interest in the Imbo Project.

Table I below summarises the Adumbi inferred mineral resource based on in-situ block cut-off at a 0.68 g/t Au for Oxide and Transition materials and 0.72 g/t Au for Fresh material, and constrained within a US$1,500 per ounce optimized pit shell.

Table I: Adumbi Deposit Inferred Mineral Resource by Material Type

(effective date: April 27, 2021)

| Material Type | Tonnage (Tonnes) | Grade (g/t Au) | Contained Gold (Ounces) |

| Oxide | 4,623,000 | 2.24 | 333,000 |

| Transition | 3,674,000 | 2.53 | 299,000 |

| Fresh | 33,019,000 | 2.38 | 2,521,000 |

| TOTAL | 41,316,000 | 2.37 | 3,153,000 |

Note: Numbers may not add up due to rounding.

Commenting on today’s inferred mineral resource increase at Adumbi, Loncor’s President Peter Cowley said: “This major increase in mineral resources within a US$1,500 pit shell to 3.15 million ounces of gold is an important milestone in demonstrating the potential economic viability of the Adumbi deposit. Sensitivities show this mineral resource within the pit shell is robust and not markedly sensitive to changes in the gold price. Gold mineralization is open at depth below the pit shell where drilling is continuing with the objective of outlining underground resources (see Figure 2 below). Drilling at Adumbi also demonstrates that grade is increasing at depth, which bodes well for a significant underground resource to be outlined. Going forward, once drilling has been completed in Q2 2021, we will embark on a Preliminary Economic Assessment (PEA) to determine the potential economic viability of Adumbi.”

This mineral resource assessment was undertaken by the Company’s independent geological consultants Minecon Resources and Services Limited (“Minecon”). The updated estimate for Adumbi was based on the additional drilling and a review of the Adumbi deposit including remodelling, grade and considering the CIM requirement for mineral resources to have “reasonable prospects for economic extraction”.

Drilling Results included in Mineral Resource Update

An additional six core holes totaling 2,557.25 metres were drilled with the initial focus in areas within the pit shell where insufficient drilling had been undertaken to outline mineral resources. Later drilling has and is being undertaken at depth below the open pit shell to outline potential underground mineral resources.

The following Table II summarises drill results incorporated into the April 27, 2021 mineral resource:

Table II: Core Hole Results from 2020-21 Drilling Program

| Borehole | From (m) | To (m) | Intercept Width (m) | Grade (g/t) Au |

| LADD001 | 202.58 | 223.35 | 20.77 | 1.72 |

| LADD001 | 231.27 | 237.17 | 5.90 | 1.89 |

| LADD001 | 251.27 | 258.60 | 7.33 | 5.80 |

| LADD001 | 295.25 | 298.70 | 3.45 | 2.10 |

| LADD001 | 301.62 | 321.95 | 20.33 | 2.47 |

| LADD001 | Incl.317.11 | 321.95 | 4.84 | 5.40 |

| LADD003 | 224.55 | 235.00 | 10.45 | 3.88 |

| LADD003 | 253.50 | 286.80 | 33.30 | 3.25 |

| LADD003 | Incl. 253.50 | 259.20 | 5.70 | 7.00 |

| LADD003 | Incl. 277.73 | 286.80 | 9.07 | 5.11 |

| LADD004 | 429.00 | 457.00 | 28.00 | 3.26 |

| LADD004 | Incl. 432.00 | 436.90 | 4.90 | 6.96 |

| LADD004 | Incl. 450.62 | 454.15 | 3.53 | 8.30 |

| LADD004 | 473.80 | 478.40 | 4.60 | 2.07 |

| LADD004 | 505.85 | 526.15 | 20.30 | 2.83 |

| LADD004 | Incl. 506.85 | 513.40 | 6.55 | 4.64 |

| LADD004 | Incl. 523.85 | 526.15 | 2.30 | 7.25 |

| LADD006 | 299.37 | 302.25 | 2.88 | 2.64 |

| LADD006 | 308.00 | 309.00 | 1.00 | 21.20 |

| LADD006 | 322.10 | 337.30 | 15.20 | 1.67 |

| LADD006 | 353.35 | 357.85 | 4.50 | 3.25 |

| LADD007 | 99.95 | 107.80 | 7.85 | 1.45 |

| LADD007 | 540.62 | 596.05 | 55.43 | 2.76 |

| LADD007 | Incl. 583.60 | 596.05 | 12.45 | 8.11 |

| LADD007 | 607.90 | 611.27 | 3.37 | 4.61 |

| LADD008 | 235.05 | 278.15 | 43.1 | 1.68 |

| LADD008 | 291.8 | 298.9 | 7.1 | 1.34 |

| LADD008 | 305.15 | 305.93 | 0.78 | 21.8 |

| LADD008 | 323.8 | 338.78 | 14.98 | 3.62 |

| LADD008 | Incl. 335.75 | 338.78 | 3.09 | 13.28 |

| Notes: | 1. It is estimated that the true widths of the mineralised sections for core holes LADD001, LADD003, LADD004, LADD006, LADD007 and LADD008 are, respectively, 82%, 80%, 81%, 95%, 89% and 62% of the intercepted widths in the above table. |

| 2. Deep core hole LADD009 results, which included 32.15 metres grading 6.17 g/t Au and 15.36 metres grading 3.73 g/t Au, are not included in current mineral resource update due to timing. | |

| 3. Core holes LADD002 and LADD005 were discontinued before intersecting mineralized zone. |

Core Logging & Geological Controls

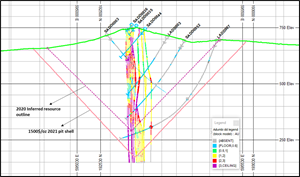

Gold mineralization at Adumbi is found within a BIF (Banded Iron Formation) unit with a strike length of 850 metres and up to 130 metres in thickness (see Figures 3 and 4 below: Geologic Plan and Geologic Cross Section of the Adumbi Deposit). Four main zones of gold mineralization are present within the BIF and are located in:

- the upper part of the Upper BIF Sequence,

- the lower part of the Upper BIF Sequence separated by the Carbonaceous Marker, which is essentially unmineralized, and

- within the Lower BIF Sequence.

There is a higher-grade zone of gold mineralization termed the Replaced Rock Zone (“RP Zone”) associated with alteration and structural deformation that has destroyed the primary host BIF fabric. The RP Zone occurs in the lower part of the Upper BIF and in the Lower BIF, and transgresses the Carbonaceous Marker, located between the Upper and Lower BIF zones, both along strike and down dip.

Geological Modelling and Grade Estimation

The Adumbi 3-dimensional model was constructed by Minecon in collaboration with on site geologists using cross sectional and horizontal flysch plans of the geology and mineralization and was used to assist in the constraining of the 3-D geological model. The mineralization model was constrained within a wireframe at 0.5 g/t Au cut-off grade (see Figure 5 below). Grade interpolation was undertaken using:

- 2 metre sample composites capped at 18 g/t Au to improve the reliability of the block grade estimates.

- Ordinary Kriging to interpolate grades into the block model.

- Relative densities of 2.45 for oxide, 2.82 for transitional and 3.05 for fresh rock were applied to the block model for tonnage estimation.

Pit Optimisation Parameters

To constrain the depth extent of the geological model and any mineral resources, an open pit for the Adumbi deposit was constructed based on the following pit optimisation parameters:

- A gold price of US$1,500 per ounce.

- Block size: 8 metres x 8 metres x 8 metres.

- A two-metre minimum mining width and a maximum of four metres of internal waste was applied.

- Mining dilution of 100% of the tonnes at 95% of the grade.

- Ultimate slope angle of minus 45 degrees.

- Metallurgical recoveries of 95% for oxide and transitional material and 90% for fresh rock (no additional metallurgical studies have been undertaken since the April 2020 resource).

- Average mining cost of US$3.29/tonne mined.

- Average processing cost of US$22.02/tonne processed.

- Average general and administration cost of US$4.20/tonne.

- Mineral resources were estimated at a block cut-off grade of 0.68 g/t Au for oxide and transition materials and 0.72 g/t Au for fresh material constrained by a Whittle pit.

- Transport of gold and refining costs equivalent to 4.5% of the gold price.

- No additional studies on depletion by artisanal activity was undertaken since the RPA study of 2014 and the same total amount of material was used by Minecon.

Gold Price Sensitivities

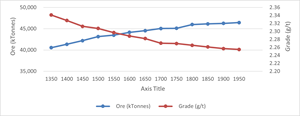

Sensitivities were undertaken around the base case US$1,500/ounce gold price, and tonnage and grade are summarised in the graph below:

Tonnage/Grade Variation Graph Related to Gold Price Sensitivities

https://www.globenewswire.com/NewsRoom/AttachmentNg/5ef09afc-1619-4092-b7c7-23509699fa91

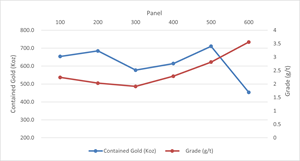

Adumbi Deposit Variation of Grade and Contained Gold with Depth

Panel evaluation of the mineral resource at 100 metre intervals without any pit constraint has demonstrated an increase in gold grade with depth from 300 metres and demonstrates the depth potential of the Adumbi deposit. Table III and the graph below details the increased grade with depth of the Adumbi resources.

Table III: Adumbi Mineral Resource, Panel Evaluation at 100 metre Intervals

| DEPTH FROM (m) | DEPTH TO (m) | PANEL (m) | TONNAGE (tonnes) | GRADE (g/t) | CONTAINED Gold (Moz) |

| 0 | 100 | 100 | 9,052,000 | 2.25 | 0.65 |

| 100 | 200 | 200 | 10,482,000 | 2.03 | 0.6 |

| 200 | 300 | 300 | 9,388,000 | 1.91 | 0.58 |

| 300 | 400 | 400 | 8,331,000 | 2.29 | 0.61 |

| 400 | 500 | 500 | 7,853,000 | 2.82 | 0.71 |

| 500 | 600 | 600 | 3,959,000 | 3.56 | 0.45 |

Note: Low tonnage for 600 Panel (500-600m) due to insufficient drill density, which is being addressed with ongoing drill program.

The graph accompanying Table III is available at https://www.globenewswire.com/NewsRoom/AttachmentNg/d55f18f1-b6fa-422c-9b74-3024707b7a93

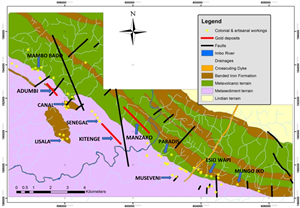

The Adumbi deposit is found within Loncor’s Imbo Project, which contains two other deposits, Kitenge and Manzako. As a result of the increased mineral resource at Adumbi, the total inferred mineral resource of the Imbo Project is now 3.466 million ounces of gold (42.996 million tonnes grading 2.51 g/t Au) and is summarised in Table IV below. 84.68% of this inferred mineral resource is attributable to Loncor via its 84.68% interest in the Imbo Project.

Table IV: Inferred Mineral Resource for the Imbo Project (effective date: April 27, 2021)

| Deposit | Tonnage (Tonnes) | Grade (g/t Au) | Contained Gold (Ounces) |

| Adumbi | 41,316,000 | 2.37 | 3,153,000 |

| Kitenge | 910,000 | 6.60 | 191,000 |

| Manzako | 770,000 | 5.00 | 122,000 |

| TOTAL | 42,996,000 | 2.51 | 3,466,000 |

Note: Numbers may not add up due to rounding.

Combined with the Company’s Makapela Project, which is situated approximately 50 kilometres northwest of the Imbo Project, total mineral resources at Loncor’s properties in the Ngayu belt now stand at 4.016 million ounces of inferred mineral resources (46.216 million tonnes grading 2.70 g/t Au) and 0.614 million ounces of indicated mineral resources (2.205 million tonnes grading 8.66 g/t Au ).

Quality Control and Quality Assurance

Drill cores for assaying were taken at a maximum of one-metre intervals and were cut with a diamond saw, with one-half of the core placed in sealed bags by Company geologists and sent to the Company’s on-site sample preparation facility. The core samples were then crushed down to 80% passing minus 2 mm and split with one half of the sample up to 1.5 kg pulverized down to 90% passing 75 microns. Approximately 150 grams of the pulverized sample was then sent to the SGS Laboratory in Mwanza, Tanzania (independent of the Company). Gold analyses were carried out on 50g aliquots by fire assay. In addition, check assays were also carried out by the screen fire assay method to verify high-grade sample assays obtained initially by fire assay. As part of the Company’s QA/QC procedures, internationally recognized standards, blanks and duplicates were inserted into the sample batches prior to submitting to SGS Laboratory.

Qualified Person

Mr. Daniel Bansah, Chairman and Managing Director of Minecon, is the "qualified person" (as such term is defined in National Instrument 43-101) who is responsible for the mineral resource estimates and other technical information disclosed in this press release. Mr. Bansah has reviewed and approved the contents of this press release.

A National Instrument 43-101 technical report of Minecon relating to the mineral resource estimates on the Adumbi deposit reported in this press release will be filed on SEDAR and EDGAR within the period required by National Instrument 43-101.

Figure 1: Imbo Project Simplified Geology

https://www.globenewswire.com/NewsRoom/AttachmentNg/0069c87d-cb6a-4a15-af9b-c1c48ff21694

Figure 2: Adumbi Longitudinal Section Looking Northeast with Drill Hole (Grade x Metre)

https://www.globenewswire.com/NewsRoom/AttachmentNg/355df1bc-024b-4b04-ac67-41c0b561eccd

Figure 3: Geologic Plan of the Adumbi Deposit

https://www.globenewswire.com/NewsRoom/AttachmentNg/8fe30afe-6dc3-4f22-a15d-1e5bf76b1cf6

Figure 4: Geological Cross Section

https://www.globenewswire.com/NewsRoom/AttachmentNg/10613d92-222c-4adb-b403-0958b769bd3d

Figure 5: Grade Block Model Cross Section

https://www.globenewswire.com/NewsRoom/AttachmentNg/68cc7ac7-eab8-4c70-8eef-508f28735a50

Technical Reports

Additional information with respect to the Company’s Imbo Project (which includes the Adumbi deposit) is contained in the technical report of Minecon Resources and Services Limited dated April 17, 2020 and entitled "Independent National Instrument 43-101 Technical Report on the Imbo Project, Ituri Province, Democratic Republic of the Congo". A copy of the said report can be obtained from SEDAR at www.sedar.com and EDGAR at www.sec.gov.

Additional information with respect to the Company’s Makapela Project, and certain other properties of the Company in the Ngayu gold belt, is contained in the technical report of Venmyn Rand (Pty) Ltd dated May 29, 2012 and entitled "Updated National Instrument 43-101 Independent Technical Report on the Ngayu Gold Project, Orientale Province, Democratic Republic of the Congo". A copy of the said report can be obtained from SEDAR at www.sedar.com and EDGAR at www.sec.gov.

About Loncor Resources Inc.

Loncor is a Canadian gold exploration company focussed on the Ngayu Greenstone Gold Belt in the northeast of the Democratic Republic of the Congo (the “DRC”). The Loncor team has over two decades of experience of operating in the DRC. Loncor’s growing resource base in the Ngayu Belt currently comprises the Imbo and Makapela Projects. At the Imbo Project, the Adumbi deposit and two neighbouring deposits hold an inferred mineral resource of 3.466 million ounces of gold (42.996 million tonnes grading 2.51 g/t Au), with 84.68% of this resource being attributable to Loncor. Loncor is currently carrying out a drilling program at the Adumbi deposit with the objective of outlining additional mineral resources. The Makapela Project (which is 100%-owned by Loncor and is located approximately 50 kilometres from the Imbo Project) has an indicated mineral resource of 614,200 ounces of gold (2.20 million tonnes grading 8.66 g/t Au) and an inferred mineral resource of 549,600 ounces of gold (3.22 million tonnes grading 5.30 g/t Au).

Loncor also has several joint ventures with Barrick (TSX: “ABX”; NYSE: “GOLD”) in the Ngayu Belt. The joint venture areas are located approximately 220 kilometres southwest of the large Kibali gold mine, which is operated by Barrick. As per the joint venture agreements entered between Loncor and Barrick, Barrick manages and funds exploration on approximately 2,000 km2 of Loncor ground in the Ngayu Belt until the completion of a pre-feasibility study on any gold discovery meeting the investment criteria of Barrick. Subject to the DRC’s free carried interest requirements, Barrick would earn 65% of any discovery with Loncor holding the balance of 35%. Loncor will be required, from that point forward, to fund its pro-rata share in respect of the discovery in order to maintain its 35% interest or be diluted. Loncor’s Imbo and Makapela Projects do not form part of the joint ventures with Barrick.

Additional information with respect to Loncor and its projects can be found on Loncor's website at www.loncor.com.

Cautionary Note to U.S. Investors

The United States Securities and Exchange Commission (the "SEC") permits U.S. mining companies, in their filings with the SEC, to disclose only those mineral deposits that a company can economically and legally extract or produce. Certain terms are used by the Company, such as "Indicated" and "Inferred" "Resources", that the SEC guidelines strictly prohibit U.S. registered companies from including in their filings with the SEC. U.S. Investors are urged to consider closely the disclosure in the Company's Form 20-F annual report, File No. 001- 35124, which may be secured from the Company, or from the SEC's website at http://www.sec.gov/edgar.shtml.

Cautionary Note Concerning Forward-Looking Information

This press release contains forward-looking information. All statements, other than statements of historical fact, that address activities, events or developments that the Company believes, expects or anticipates will or may occur in the future (including, without limitation, statements regarding mineral resource estimates, potential mineral resource increases, embarking on a Preliminary Economic Assessment to determine the potential economic viability of the Adumbi deposit, drill results at the Adumbi deposit, potential mineralization, exploration under the joint venture agreements with Barrick, potential gold discoveries, drill targets, exploration results, and future exploration and development) are forward-looking information. This forward-looking information reflects the current expectations or beliefs of the Company based on information currently available to the Company. Forward-looking information is subject to a number of risks and uncertainties that may cause the actual results of the Company to differ materially from those discussed in the forward-looking information, and even if such actual results are realized or substantially realized, there can be no assurance that they will have the expected consequences to, or effects on the Company. Factors that could cause actual results or events to differ materially from current expectations include, among other things, the possibility that future exploration (including drilling) or development results will not be consistent with the Company's expectations, the possibility that drilling programs will be delayed, activities of the Company may be adversely impacted by the continued spread of the widespread outbreak of respiratory illness caused by a novel strain of the coronavirus (“COVID-19”), including the ability of the Company to secure additional financing, risks related to the exploration stage of the Company's properties, uncertainties relating to the availability and costs of financing needed in the future, failure to establish estimated mineral resources (the Company’s mineral resource figures are estimates and no assurances can be given that the indicated levels of gold will be produced), changes in world gold markets or equity markets, political developments in the DRC, gold recoveries being less than those indicated by the metallurgical testwork carried out to date (there can be no assurance that gold recoveries in small scale laboratory tests will be duplicated in large tests under on-site conditions or during production), fluctuations in currency exchange rates, inflation, changes to regulations affecting the Company's activities, delays in obtaining or failure to obtain required project approvals, the uncertainties involved in interpreting drilling results and other geological data and the other risks disclosed under the heading "Risk Factors" and elsewhere in the Company's annual report on Form 20-F dated March 31, 2021 filed on SEDAR at www.sedar.com and EDGAR at www.sec.gov. Forward-looking information speaks only as of the date on which it is provided and, except as may be required by applicable securities laws, the Company disclaims any intent or obligation to update any forward-looking information, whether as a result of new information, future events or results or otherwise. Although the Company believes that the assumptions inherent in the forward-looking information are reasonable, forward-looking information is not a guarantee of future performance and accordingly undue reliance should not be put on such information due to the inherent uncertainty therein.

Cautionary Note Concerning Mineral Resource Estimates

The mineral resource figures referred to in this press release are estimates and no assurances can be given that the indicated levels of gold will be produced. Such estimates are expressions of judgment based on knowledge, mining experience, analysis of drilling results and industry practices. Valid estimates made at a given time may significantly change when new information becomes available. While the Company believes that the mineral resource estimates included in this press release are well established, by their nature mineral resource estimates are imprecise and depend, to a certain extent, upon statistical inferences which may ultimately prove unreliable. If such estimates are inaccurate or are reduced in the future, this could have a material adverse impact on the Company.

Mineral resources are not mineral reserves and do not have demonstrated economic viability. There is no certainty that mineral resources can be upgraded to mineral reserves through continued exploration.

Due to the uncertainty that may be attached to inferred mineral resources, it cannot be assumed that all or any part of an inferred mineral resource will be upgraded to an indicated or measured mineral resource as a result of continued exploration. Confidence in the estimate is insufficient to allow meaningful application of the technical and economic parameters to enable an evaluation of economic viability worthy of public disclosure (except in certain limited circumstances). Inferred mineral resources are excluded from estimates forming the basis of a feasibility study.

For further information, please visit our website at www.loncor.com or contact:

Arnold Kondrat , CEO, Toronto, Ontario Tel: (416) 366-7300

Peter Cowley, President, United Kingdom +44 7904540876

John Barker, VP of Business Development, United Kingdom +44 7547 159 521