Magna Terra to Acquire Portfolio of Advanced Exploration Assets in Atlantic Canada from Anaconda Mining

Encompasses three projects in the established mining jurisdictions of Newfoundland and Labrador and New Brunswick; district scale exploration potential; past production; three known deposits with numerous high-grade gold showings and prospects

Project Highlights:

- Combined 12,375 hectares of highly prospective mineral lands over three projects in Atlantic Canada;

- Includes total 28 km strike along two, regional scale, gold bearing structures;

- District scale exploration potential with numerous gold showings, prospects and deposits;

- Established mining jurisdictions of Newfoundland and Labrador and New Brunswick;

- Low cost of exploration with all projects road accessible.

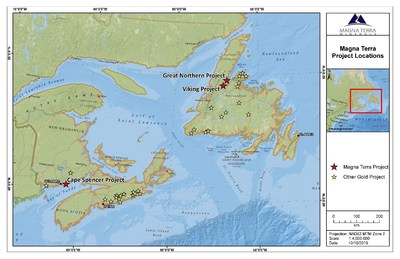

TORONTO, Oct. 15, 2019 /CNW/ - Magna Terra Minerals Inc. (the "Company" or "Magna Terra") (TSX-V: MTT) (SSE: MTTCL) and Anaconda Mining Inc. ("Anaconda") (TSX: ANX) (OTCQX: ANXGF) (together the "Parties") are pleased to announce that they have entered into a definitive Share Purchase Agreement (the "SPA") dated October 14, 2019, whereby Magna Terra proposes to acquire all of the issued and outstanding common shares of Anaconda's wholly-owned subsidiary, 2647102 Ontario Inc. ("ExploreCo")(the "Acquisition"). ExploreCo owns a 100% interest in the Great Northern and Viking Projects in Newfoundland and Labrador and the Cape Spencer Project in New Brunswick.

"We are very pleased to have the opportunity to position ourselves through the acquisition of ExploreCo in the established mining jurisdictions of Newfoundland and Labrador and New Brunswick. The Appalachian geological region has numerous multi-million ounce gold deposits with about 30% of them situated in Atlantic Canada. Recent development and exploration success has brought renewed interest in the region, and the acquisition of this significant project portfolio with multiple drill ready targets will allow us to rapidly generate value. We will also continue to look at all opportunities to advance and extract value from our extensive project portfolio in Santa Cruz, Argentina."

~ Lew Lawrick, President and CEO of Magna Terra

"In 2018, Anaconda created a wholly-owned subsidiary to house these advanced stage, highly-prospective, Atlantic Canadian exploration projects, with the aim of developing strategic alternatives to realize value from them. We have established these gold projects in areas with sizeable land packages that provide the platform to build significant district-scale mineral resources in Atlantic Canada in the long term. We have continued to create value at these projects with low expenditures and are well positioned to realize future value for our shareholders through this transaction with Magna Terra, while remaining focused on our core assets at Goldboro, Nova Scotia and the Tilt Cove and Point Rousse Projects on the Baie Verte Peninsula, Newfoundland."

~ Kevin Bullock, President and CEO of Anaconda

Details of the Acquisition

Under the SPA, Magna Terra will acquire ExploreCo by issuing to Anaconda an aggregate number of common shares of the Company equal to 100% of the outstanding Magna Terra common shares on the closing date of the Acquisition, following the completion of a share consolidation (described below) on an undiluted basis and before the Magna Terra financing (also described below). The Acquisition constitutes a "Reverse Take-Over" and "Non-Arms' Length" transaction within the meaning of the policies of the TSX Venture Exchange (the "Exchange") as (i) Anaconda will become a control person of Magna Terra following the closing of the Acquisition and (ii) Mr. Lew Lawrick and Mr. Michael Byron, respectively President & Chief Executive Officer and Directors of the Company, are also Directors of Anaconda. Further, following the closing of the Acquisition and Financing, the management and board of directors of Magna Terra will remain unchanged.

The Acquisition is therefore subject to Magna Terra obtaining the approval of its disinterested shareholders at a special meeting to be called to that effect on a date to be determined. In connection with the special meeting, a detailed management proxy circular in the form prescribed by the policies of the Exchange and applicable securities regulations will be sent to all the shareholders of Magna Terra.

The closing of the Acquisition is scheduled to take place on or before December 31, 2019 and is subject to numerous conditions customary to this type of transaction, including notably, regulatory approval, and Magna Terra shareholder approval. The closing of the Acquisition is also subject to the following conditions: (i) the execution of an investor rights agreement between Magna Terra and Anaconda (see below for details); (ii) Magna Terra Shareholders' approval at the special meeting of a share consolidation on the basis of one (1) new share of Magna Terra for every seven (7) common shares of Magna Terra presently issued and outstanding; and (iii) Completion by Magna Terra of a financing for minimum gross proceeds of $1.5 million (the "Financing") to be completed on a post-consolidation basis (terms of the Offering to be disclosed at a future date).

No finder's fees will be paid by either Party in connection with the Acquisition. The Acquisition was approved by the independent directors of both Magna Terra and Anaconda.

Following the completion of the Acquisition, but prior to completion of the Financing, it is anticipated that Anaconda will hold approximately 50% of the issued and outstanding shares of Magna Terra, on a post-consolidation basis. In connection with the the Acquisition, the Parties will enter into an investor rights agreement (the "Investor Rights Agreement") pursuant to which Anaconda will have certain rights, including:

- the right to participate in any future equity financings undertaken by Magna Terra in order to allow Anaconda to maintain its then percentage ownership interest in Magna Terra; such participation right will not apply to any issuance of securities (a) pursuant to Magna Terra's existing stock option plan and other incentive plans as may be approved by its shareholders from time to time, or to management, directors and employees of the Corporation for compensatory purposes; or (b) upon the exercise or conversion of any convertible or exchangeable securities outstanding on the date the Investor Rights Agreement was entered into; or (c) in connection with or pursuant to any merger, business combination, exchange offer, take-over bid, arrangement, asset purchase transaction or other acquisition of assets or shares of a third party, provided, however, that Anaconda will be permitted to exercise its participation right in connection with the issuance of any shares or other securities of Magna Terra that may be delivered pursuant to the terms of any option agreement, earn-in agreement or similar agreement that Magna Terra or any of its subsidiaries may be party to that does not exist as of the date the Investor Rights Agreement was entered into;

- the right to appoint two (2) directors on the Board of Directors of Magna Terra as long as Anaconda's ownership interest is above 20%, and one (1) director if Anaconda's ownership interest falls below 20%, it being agreed that such designated directors would be Mr. Lew Lawrick and Mr. Michael Byron for as long as such persons remained Directors of Anaconda.

All the above rights shall automatically terminate and be of no further force or effect at the later of (i) June 30, 2021, and (ii) Anaconda ceasing to beneficially own more than 10% of the issued and outstanding common shares of Magna Terra (on an undiluted basis).

The Investor Rights Agreement also provides that Anaconda will be subject, until June 30, 2021, to a standstill obligation pursuant to which, among other things, it will not without the prior authorization of the board of directors of Magna Terra, purchase, offer or agree to purchase or negotiate to purchase any securities or assets of Magna Terra other than in connection with acquisitions carried out by Anaconda or its affiliates where such securities, when added together with the securities held by Anaconda, its affiliates and any other person acting jointly or in concert would cause Anaconda's ownership percentage to exceed 35%. The Investor Rights Agreement further provides that Anaconda will vote or cause to be voted, all common shares of Magna Terra beneficially held or controlled by Anaconda, at all shareholder meetings of Magna Terra to be held until June 30, 2021, in favour of each matter recommended by the board of director of Magna Terra for approval by its shareholders at each such meeting.

About ExploreCo:

Great Northern and Viking Project Highlights:

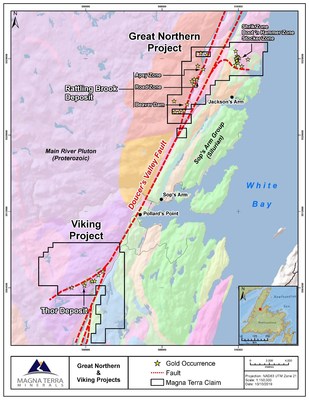

- Includes 9,775 hectares of highly prospective geology coincident with 20 kilometres of strike along a regional scale, gold related structure - the Doucer's Valley Fault;

- Located adjacent to the Doucer's Valley Fault, part of the Long Range Fault system – a fertile gold bearing structure, similar to that associated with Marathon Gold's Valentine Lake project in central Newfoundland, which has been the focus of recent significant resource growth and discovery;

- Host to several known deposits including Rattling Brook (Great Northern) and Thor (Viking) as well as high-grade prospects including Jackson's Arm (Great Northern) that present numerous drill ready targets and potential for near term discovery;

- Mineral Resources - Magna Terra has commissioned a NI 43-101 Technical Report and Mineral Resource Estimate on the Rattling Brook Deposit, disclosure of which when finalized will be made public via press release, on SEDAR, and on the Company's website.

Details of the Great Northern and Viking Projects

The Great Northern and Viking Projects comprise 2 separate claim blocks (9,775 hectares) that are located 3 km north and 15 km south of the community of Jackson's Arm, NL, respectively (Exhibit A and Exhibit C).

The Great Northern Project is comprised of four mineral exploration licences that collectively encompass 167 mineral claims covering approximately 4,175 ha. Two mineral exploration licences are held 100% by ExploreCo. Two other licences, are held 100% by ExploreCo under terms of an option agreement with Metals Creek Resources Corp. ("Metals Creek") by making aggregate payments of $200,000 ($120,000 paid) and issuing a total of 125,000 ANX shares (75,000 issued) to Metals Creek.

One of the 100% owned licences is subject to a 3% net smelter return royalty ("NSR"). ExploreCo has a right to purchase a 1.5% portion of the NSR at a cost of $1.5 million. A portion of one licence is subject to a 0.5% NSR. The Metals Creek NSR includes 2% payable to Metals Creek and is capped at a total payment level of $1,500,000. Once $1,500,000 in NSR payments have been made to Metals Creek, the 2% NSR is reduced to a 1% NSR for the remaining production from the Property.

The Viking Project is comprised of 3 mineral exploration licences totalling 224 claims covering 5,600 hectares. Anaconda has the ability to earn a 100% interest in two of the licences, known as the Viking and Kramer Properties, via two option agreements by making aggregate payments of $432,500 ($117,500 paid), issuing 250,000 common shares of Anaconda shares (issued).

The Viking and Kramer option agreements include NSR obligations of 0.5% and 2%, respectively. The Kramer NSR is capped at $2,500,000, after which, the NSR will be reduced to 1%. A total of $750,000 in qualified exploration expenditures is also required on the Kramer Property during the option period.

Upon earning into the Viking and Kramer option agreements, a separate NSR obligation to a third party will be in effect and includes a 2.5% NSR on the Viking Property, a 1% NSR on the Kramer Property and a 1.5% NSR granted on an area of interest within 3 km of the combined Viking and Kramer Properties.

Geology and Mineralization

The Great Northern and Viking Projects are centered along the Doucer's Valley Fault, a regional splay of the Long Range Fault. The Doucer's Valley Fault is a significant geological control on, and host to, several gold deposits, including the Rattling Brook Deposit and the Thor Deposit.

Gold mineralization at Great Northern and Viking occurs either as disseminated gold, hosted in Precambrian or Ordovician granites or in the unconformably, overlying adjacent volcanic and sedimentary rocks. The sedimentary-hosted gold mineralization is typically higher grade. Rocks underlying each claim block show both styles of mineralization with granite-hosted gold mineralization in the Road and Incinerator Trail Zones and sedimentary-rock-hosted Beaver Dam Zone, or as a combination as in the Apsy Zone. The Thor Deposit is hosted in Precambrian granites and the adjacent Kramer Prospect shows mineralization hosted within the overlying Cambrian quartzites.

Alteration consists of mesothermal style quartz ± iron carbonate ± sulfide veins and stockworks with 2- 5% total sulfides consisting of pyrite, galena, chalcopyrite or sphalerite, and locally show trace amounts of visible gold.

The Great Northern Project is host to several untested gold prospects and showings, including the Shrik, Stocker, Boot N' Hammer, 954 Prospects, and Incinerator Trail Zone. Surface grab samples assaying up to 20.2 grams per tonne ("g/t") gold and 1,232 g/t silver at the Boot N' Hammer Prospect; up to 56.7 g/t gold and 2.75 oz/t silver at the Stocker Prospect; up to 7.2 g/t gold at the Shrik Prospect; and 13.6 g/t gold at the 954 Prospect. The Incinerator Trail Zone has been tested by four reconnaissance-style diamond drill holes in the 1980's and returned assays of 1.78 g/t gold over 4.0 m (hole RB-35) and 2.30 g/t gold over 4.05 m (hole RB-41).

The Shrik, Stocker, Boot N' Hammer prospects are hosted within a 1.7 km long by 40 to 400 m wide continuous alteration zone, that is controlled by a north-south striking fault. The fault extends immediately to the north along strike with similar repeating fault zones to the east outlining a potential strike extent of an additional 4 km. Initially, exploration in this area will be a primary focus for Magna Terra.

The Viking Project is host to variably tested gold prospects and showings including the Viking, Asgard, Thor's Cross, Odin's Triangle and Kramer Prospects. Trenching along the Viking Trend has returned gold grades ranging between 0.10 and 0.40 g/t over continuously sampled intervals of up to 40 m, and high-grade results including a grab sample from a large boulder of altered granite from the northeast end of the Viking Trend which returned 12.0 g/t gold, and a channel sample grading 9.9 g/t gold and 52 g/t silver over 1.4 metres.

Cape Spencer Highlights

- 8 kilometres of highly prospective strike in the hanging wall of a regional scale structure with 10 known gold occurrences including the Emilio Zone (7.86 g/t over 7.4 m; AB-04-06) and drill ready targets;

- Hosted within similar Proterozoic-aged rocks of the Avalon Zone that host multi-million ounce gold deposits such as Haile, Ridgeway, and Hope Brook gold deposit;

- Past production (1985-1989) of 194,224 tonnes producing 4,832 ounces @~50% recovery through heap leach;

- Two gold deposits open along strike - past drilling demonstrates broad zones of mineralization;

- Project has been dormant since 2005, with most of the historic work conducted between 1982-1987.

- Magna Terra has commissioned NI 43-101 Technical Report and Mineral Resource Estimate on the Cape Spencer Deposit, disclosure of which when finalized will be made public via press release, on SEDAR, and on the Company's website.

Details of the Cape Spencer Project

The Cape Spencer Project is an exploration stage project that has a history of past-production and the potential for near-term resource growth and discovery. Cape Spencer is located 15 kilometers southeast of Saint John, New Brunswick (Exhibit A and Exhibit B), comprising 104 mineral exploration claims covering 2,365 ha of land acquired via staking and through the Cape Spencer Option Agreement. Under the terms of the Cape Spencer Option Agreement, ExploreCo can earn a 100% interest in underlying mineral properties by making cash payments of $300,000 ($100,000 paid), further payments of $145,000 in cash or equivalent value shares over a five-year period ($10,000 paid), and undertaking $400,000 in exploration expenditures on Cape Spencer within four years. The option agreement also provides for a 2% NSR on earn-in, with a buy-back of 1% of the NSR for $1,000,000 and a right of first refusal on the remaining 1% of the NSR.

Geology and Mineralization

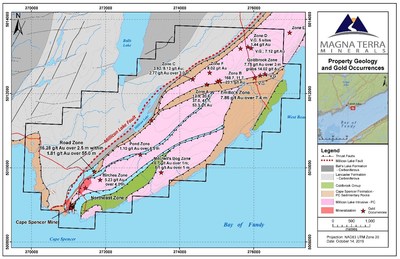

The Cape Spencer Project is centered along the Millican Lake Fault, a regional splay of the Caledonia and Cobequid Fault Zones. The Property is underlain by Precambrian Millican Lake granite, and Coldbrook and Cape Spencer volcanic and sedimentary rocks. The Precambrian stratigraphy is unconformably overlain by and in fault contact with younger Carboniferous sedimentary rocks of the Lancaster Formation.

Gold mineralization at Cape Spencer is hosted within Precambrian Millican Lake granite or bounding Coldbrook and Cape Spencer volcanic and sedimentary rocks, with mineralization and alteration focussed along strongly faulted and sheared contacts between the two lithologies. Alteration consists of pervasive and patchy illite + pyrite + quartz ± iron carbonate ± sulfide veins and stockworks with 2-5% total sulfides consisting of pyrite, galena, chalcopyrite or sphalerite, and locally show trace amounts of visible gold.

There are several gold prospects that warrant additional exploration over an 8-kilometre strike outside of the Pit and Northeast Zones particularly in the eastern half of the property that will initially be a primary focus for Magna Terra.

Highlights from historic exploration work outside of the main deposit areas from 1982 to 2004 include:

Emilio Zone – Prospect at Eastern end of Property

- 7.86 g/t gold over 7.4 m (AB-04-06; near surface);

- 12.00 g/t gold over 1.4 m (chip) and 2.77 g/t gold over 3.0 m (chip); and

- Surface grab samples up to 168.00 g/t gold

Birches Zone – 300-metre-long gold-bearing alteration zone south of the Northeast Zone.

- 17.85 g/t gold over 1.0 metre within a zone grading 5.23 g/t gold over 4.0 metres (MR-150);

- 9.48 g/t gold over 1.0 metre within a zone grading 4.01 g/t gold over 4.0 metres (MR-149);

- 3.60 g/t gold over 5.0 metres (AB-04-08);

- 12.00 g/t gold over 1.4 metres (chip) and 2.77 g/t gold over 3.0 metres (chip); and

- Surface grab samples up to 168.00 g/t gold

Zone A – *Grab samples up to 53.50 g/t gold.

Zone C – *Grab samples up to 8.92 g/t gold and chip sample of 2.77 g/t gold over 3.0 m.

Zone D – *Five occurrences of visible gold with grab samples up to 7.12 g/t gold.

*Grab samples are selected samples and are not necessarily indicative of mineralization that may be hosted on the property |

Qualified Person

This news release has been reviewed and approved by David A. Copeland, P. Geo., Chief Geologist with Anaconda Mining Inc., a "Qualified Person", under National Instrument 43-101 Standard for Disclosure for Mineral Projects. Widths from drill core intervals reported in this press release are presented as core lengths only. True widths are unknown. All quoted drill core sample intervals, grades and production statistics have been compiled from historic assessment reports obtained from either the Government of New Brunswick or Newfoundland and Labrador.

About Magna Terra

Magna Terra Minerals Inc. is a precious metals focused exploration company, headquartered in Toronto, Canada. With the closing of the ExploreCo Acquisition, Magna Terra will have 2 district scale, advanced gold exploration projects in the world class mining jurisdictions of New Brunswick and Newfoundland and Labrador. The Company maintains a significant exploration portfolio in the province of Santa Cruz, Argentina which includes its precious metals discovery on its Luna Roja Project, as well as an extensive portfolio of district scale drill ready projects available for option or joint venture.

About Anaconda

Anaconda is a TSX and OTCQX-listed gold mining, development, and exploration company, focused in Atlantic Canada. The company operates mining and milling operations in the prolific Baie Verte Mining District of Newfoundland which includes the fully-permitted Pine Cove Mill, tailings facility and deep-water port, as well as ~11,000 hectares of highly prospective mineral lands including those adjacent to the past producing, high-grade Nugget Pond Mine. Anaconda is also developing the Goldboro Gold Project in Nova Scotia, a high-grade resource and the subject of an on-going feasibility study.

Completion of the transaction is subject to a number of conditions, including but not limited to, TSX Venture Exchange acceptance disinterested shareholder approval by the shareholders of Magna Terra. The transaction cannot close until the required shareholder approval is obtained. There can be no assurance that the transaction will be completed as proposed or at all. Investors are cautioned that, except as disclosed in the management information circular to be prepared in connection with the transaction, any information released or received with respect to the transaction may not be accurate or complete and should not be relied upon. Trading in the securities of Magna Terra should be considered highly speculative.

The TSX Venture Exchange has in no way passed upon the merits of the proposed transaction and has neither approved nor disapproved the contents of this news release.

Neither TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

Cautionary Statements Regarding Forward-Looking Information

Some statements in this release may contain forward-looking information. All statements, other than of historical fact, that address activities, events or developments that the Company believes, expects or anticipates will or may occur in the future (including, without limitation, statements regarding potential mineralization) are forward-looking statements. Forward-looking statements are generally identifiable by use of the words "may", "will", "should", "continue", "expect", "anticipate", "estimate", "believe", "intend", "plan" or "project" or the negative of these words or other variations on these words or comparable terminology. Forward-looking statements are subject to a number of risks and uncertainties, many of which are beyond the Company's ability to control or predict, that may cause the actual results of the Company to differ materially from those discussed in the forward-looking statements. Factors that could cause actual results or events to differ materially from current expectations include, among other things, without limitation, failure by the parties to complete the Acquisition, failure to establish estimated mineral resources, the possibility that future exploration results will not be consistent with the Company's expectations, changes in world gold markets or markets for other commodities, and other risks disclosed in the Company's public disclosure record on file with the relevant securities regulatory authorities. Any forward-looking statement speaks only as of the date on which it is made and except as may be required by applicable securities laws, the Company disclaims any intent or obligation to update any forward-looking statement.

SOURCE Anaconda Mining Inc.

View original content to download multimedia: http://www.newswire.ca/en/releases/archive/October2019/15/c0703.html