Mandalay Resources Corporation Reports High-Grade Gold Discovered at the Brown's Prospect - 2 km From the Shepherd Discovery and Youle Mine

TORONTO, Oct. 26, 2021 (GLOBE NEWSWIRE) -- Mandalay Resources Corporation ("Mandalay" or the "Company") (TSX: MND, OTCQB: MNDJF) is pleased to provide an update on the deep drilling campaign completed at the Brown’s Prospect at its Costerfield Operation (Victoria, Australia).

Drilling Highlights:

- 17-hole diamond drill program confirms the presence of a promising gold system at the Brown’s Prospect, 2 km east of the current mining operation at Youle.

- Drilling has identified two main mineralized trends exhibiting high-grade gold intercepts, including:

- 19.5 g/t gold over a true width of 1.01 m in BWN009, including;

- 38.4 g/t gold over a true width of 0.51 m and;

- 19.9 g/t gold over a true width of 1.70 m in BWN023, including;

- 158.4 g/t gold over a true width of 0.09 m and;

- 110.8 g/t gold over a true width of 0.16 m

- 19.5 g/t gold over a true width of 1.01 m in BWN009, including;

Note: Further intercept details can be found in Table 1 in the Appendix to this document.

Dominic Duffy, President and CEO of Mandalay, commented: “We are pleased to report encouraging results from our ongoing drill testing campaign at the Brown’s Prospect situated 2 km to the east of the Shepherd discovery and Youle mine. The most recent results confirm significant gold grades within fault hosted breccias along two mineralized trends, building on previous high-grade results seen and reported in 2020.”

Mr. Duffy continued, “Mineralization across the two trends has been tracked over a 200 m strike and 300 m vertical extent. The Felix trend is associated with the historic shallow Felix Brown mine and associated alluvial workings that played an important role in gold production during the 1890’s. However, the newly discovered Western Trend is not associated to the old workings and was unknown to previous explorers; it is therefore still open up dip to surface.”

Mr. Duffy concluded, “A strong increase in data resolution through this prospect has allowed us to improve our understanding of the structural complexity associated with the mineralized trends. We observe that the structural controls on the Brown’s mineral system could be likened to those that allowed the formation of the nearby million ounces Bendigo and Castlemaine gold deposits. This inference, along with the knowledge that the geological setting of the Central Costerfield line sits below the recent drilling success, provides further confidence that there is a more extensive, high-grade mineralization at depth.”

A video has been prepared by Mr. Chris Davis, Vice President of Operational Geology and Exploration, to further explain the information in this release. The video can be found on Mandalay’s website or by clicking here.”

Drilling Results and Interpretation

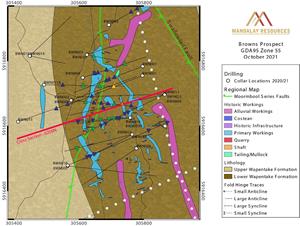

Early success was achieved on the initial five-hole drill testing program at Brown’s with BWN001 intercepting 14.5 g/t gold over true width of 1.27 m underneath the historic (approx. 1883-1894) Felix Brown Mine and paving the way for a more detailed testing campaign. Since the release of the initial two holes (June 22, 2020), a further 20 holes have been drilled to identify the nature and extent of gold mineralization at Brown’s Prospect (Figure 1). To date, this drilling has identified multiple high-grade intercepts in a sequence of tightly folded sandstone-dominated turbidites crosscut by three main “panel boundary” thrust faults. Gold mineralization is concentrated in the middle thrust panel within narrow, brecciated and sheared fault zones along two main mineralized trends (Figure 2).

Figure 1: Surface map of the Brown’s prospect, showing collar locations and drillhole traces. Coordinates are in GDA95 Zone 55:

https://www.globenewswire.com/NewsRoom/AttachmentNg/838e96da-52d0-4097-b2a2-b9d8e2aa5e6d

Felix Trend

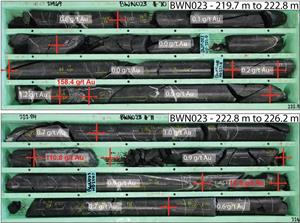

The Felix Trend is a moderately west dipping trend parallel to the axial plane of the main Brown’s anticline, expressing at surface with the historically mined Felix Lode. Mineralized structures associated with this trend are typically steeply dipping quartz-stibnite bearing fault hosted breccias, with associated stockwork veining and wide pyrite halos. These structures have developed preferentially in hinge zones of the main Brown’s anticline, parallel to the axial planar cleavage. Visible gold is present in several intercepts along this trend. Mineralization along the Felix Trend has been identified over a vertical extent of 200 m and a strike extent of ~100 m; however, gold anomalism along this trend has been observed down to the Swallowtail Fault at a depth of approximately 300 m. An increase in gold grade observed between 1000 RL and 1100 RL may be caused by the interaction of the fault-hosted breccias with syn-to-post mineralization, northeast dipping faults. The anticipated potential for upgrade in this zone was demonstrated with an intercept of the highest grade yet seen at Brown's, comprising an interval with two steep east dipping gold bearing breccias and quartz-stibnite veining grading at 19.9 g/t gold with trace amounts of antimony over a true thickness of 1.70 m in BWN023 (Figures 3 and 4).

Figure 2: Brown’s Prospect cross section along 6200N (mine grid) showing main structures, mineralised trends and intercepts between 6300N and 6100N:

https://www.globenewswire.com/NewsRoom/AttachmentNg/2f57be2f-2638-4d11-9afc-df0d1509c8de

Figure 3: Drill core photos of BWN023 high-grade gold intercepts and gold grades for each sample:

https://www.globenewswire.com/NewsRoom/AttachmentNg/f8f09d07-4a1d-4c30-a48e-79ec62d71d02

Figure 4: Microphotographs of gold grains in the high-grade gold bearing quartz breccia grading at 110.7 g/t gold (0.16 m true width) in BWN023 at 223.77 m depth:

https://www.globenewswire.com/NewsRoom/AttachmentNg/d806ea58-36b4-4907-bd1d-d93e394038b5

Western Trend

The Western Trend is a broadly subvertical corridor containing several high-grade intercepts that occur in structures that have developed across a secondary antiformal structure on the western limb of the Brown’s anticline. Like the Felix Trend, intercepts are characterized by quartz-stibnite fault-hosted breccias and veins with large pyrite alteration halos and in some cases visible gold. While mineralization along this trend has been identified over a vertical extent of approximately 100 m, the strike extent remains open and poorly constrained at this date. The Western Trend contains high-grade gold intercepts comparable to the Felix Trend, including a quartz-stibnite breccia with intense pyrite alteration grading 19.5 g/t gold and 2.4% antimony over a true thickness of 1.01 m in BWN009 (Figure 5).

Figure 5: Drill core photos of BWN009 high-grade gold intercept and gold grades for each sample:

https://www.globenewswire.com/NewsRoom/AttachmentNg/3ce48dce-4c28-4969-bb92-b0b35e6e41b5

Panel Boundary Faults

The panel boundary faults that control the mineralized structures at Brown’s Prospect are interpreted to predate mineralization and accommodate movement caused by shortening of the turbidite sequence. Minor fault reactivation during and after mineralization has been observed along these structures and drilling has identified areas of gold anomalism along them. The highest grade to date on a panel boundary fault was observed on the Metalmark Fault in BWN008 up-dip of the western trend, culminating in an intercept of 9.1 g/t gold over a 0.63 m true width. Mineralization has also been observed in the panel bounding Swallowtail Fault, the highest grade seen being 1.3 g/t gold over a true width of 0.67 m in BWN004. Excitingly, visible gold was also observed in the Swallowtail Fault in BWN002, confirming that the panel thrust faults bounding the mineralized middle thrust panel represent important pathways for the mineralized fluids. The Luna Fault, the deeper of the three panel boundary faults, exhibits intense sericitic alteration characteristic of a distal discharge of gold bearing hydrothermal fluids vectoring towards a gold rich fluid source at depth.

Future Directions

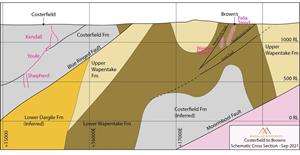

The Brown’s Prospect drilling program has demonstrated the presence of a promising mineral system extending at depth at the Brown’s prospect. Increasing levels of fold shortening compared to the central (Costerfield) line of lode has resulted in the formation of a strong fluid trapping environment and consequently, the distribution of the fault-hosted mineralized breccias is strongly controlled by fold geometry and bedding. Current interpretation suggests that this structural architecture may share similarities with the Bendigo and Castlemaine goldfields, which are found in a similar structural environment and exhibit similar controls on mineralization. Extension of the mineralized trends to the south, beyond the currently tested zone is expected based on the continuation of the north-south trending Brown’s anticline, as well as the presence of historically worked gold reef systems along-strike at the Robinson Prospect (press released June 22, 2020). A soil sampling and geochemistry program is currently underway to cover the entire eastern corridor and identify extension of the mineralised system to the south. In addition, surface drilling along the eastern corridor will continue in 2022, targeting depth and strike extensions, including the Robinson prospect.

Encouragingly, mineralized breccias in the middle thrust panel at the Brown’s Prospect may only represent the most surficial expression of a much more extensive mineral system at depth; district-scale structural and litho-stratigraphic modelling suggests that the geological and structural setting of the central corridor may be present at about 600 m depth under the tightly folded sequence of the Wapentake Formation turbidites. The depth continuation of the Brown’s mineral system may therefore be hosted in the same favourable lithostratigraphic environment that hosts classic Costerfield-style mineralization like that of the Youle and Cuffley deposits. Gold anomalism in two subvertical quartz breccias under the Luna fault intercepted in BWN010 provides additional evidence that such a domain may exist beneath the Brown’s prospect.

Figure 6: Conceptual cross section across Costerfield and Brown’s looking north:

https://www.globenewswire.com/NewsRoom/AttachmentNg/072223be-a9a1-44a4-b06e-3aa9acb044c2

Drilling and Assaying

All diamond drill core was logged and sampled by Costerfield geologists. All samples were sent to On Site Laboratory Services (OSLS) in Bendigo, Victoria, Australia, for sample preparation and analysis by fire assay for gold, and Atomic Absorption Spectroscopy (AAS) for antimony. Samples featuring coarse grained visible gold were assayed using a variant of fire assay known as screen fire assay. This method is routinely used to mitigate potential problems associated with heterogeneity in the distribution of coarse gold within drill samples. The procedure collects all coarse heterogenous coarse gold by screening at 75µm after crushing and pulverisation, and subsequently fire assays the resultant mass to extinction. A mass weighted average of gold grade of the sample is subsequently calculated from the +75µm and -75µm fractions of the sample. Site geological and metallurgical personnel have implemented a QA/QC procedure that includes systematic submission of standard reference materials and blanks within batches of drill and face samples submitted for assay. Costerfield specific reference materials produced from Costerfield ore have been prepared and certified by Geostats Pty Ltd., a specialist laboratory quality control consultancy. See Technical Report entitled “Costerfield Operation, Victoria, Australia NI 43-101 Report” dated March 30, 2020, available on SEDAR (www.sedar.com) for a complete description of drilling, sampling, and assaying procedures.

Qualified Person:

Chris Davis, Vice President of Operational Geology and Exploration at Mandalay Resources, is a Chartered Professional of the Australasian Institute of Mining and Metallurgy (MAusIMM CP(Geo)), and a Qualified Person as defined by NI 43-101. He has reviewed and approved the technical and scientific information provided in this release.

For Further Information

Dominic Duffy

President and Chief Executive Officer

Edison Nguyen

Manager, Analytics and Investor Relations

Contact:

647.260.1566

About Mandalay Resources Corporation

Mandalay Resources is a Canadian-based natural resource company with producing assets in Australia and Sweden, and care and maintenance and development projects in Chile. The Company is focused on growing production at its gold and antimony operation in Australia, and gold production from its operation in Sweden to continue being a significant cash flow generating company.

Forward-Looking Statements:

This news release contains "forward-looking statements" within the meaning of applicable securities laws, including statements regarding the exploration and development potential of the Brown’s Prospect (Costerfield). Readers are cautioned not to place undue reliance on forward-looking statements. Actual results and developments may differ materially from those contemplated by these statements depending on, among other things, changes in commodity prices and general market and economic conditions. The factors identified above are not intended to represent a complete list of the factors that could affect Mandalay. A description of additional risks that could result in actual results and developments differing from those contemplated by forward-looking statements in this news release can be found under the heading “Risk Factors” in Mandalay’s annual information form dated March 31, 2021, a copy of which is available under Mandalay’s profile at www.sedar.com. In addition, there can be no assurance that any inferred resources that are discovered as a result of additional drilling will ever be upgraded to proven or probable reserves. Although Mandalay has attempted to identify important factors that could cause actual actions, events or results to differ materially from those described in forward-looking statements, there may be other factors that cause actions, events or results not to be as anticipated, estimated or intended. There can be no assurance that forward-looking statements will prove to be accurate, as actual results and future events could differ materially from those anticipated in such statements. Accordingly, readers should not place undue reliance on forward-looking statements.

Appendix

Table 1. Significant intercepts of the Brown's Testing Drilling Program

| DRILL HOLE ID | FROM (M) | TO (M) | DRILL WIDTH (M) | TRUE WIDTH (M) | AU GRADE (G/T) | SB GRADE (%) | AUEQ (G/T) OVER MIN. 1.8M MINING WIDTH | SAMPLED STRUCTURE |

| BWN004 | 101.87 | 103.22 | 1.35 | 0.67 | 1.3 | 0.2 | 0.7 | Swallowtail Fault |

| INCLUDING | 101.87 | 102.16 | 0.29 | 0.14 | 4.9 | 0.7 | 0.5 | |

| BWN004 | 107.03 | 109.23 | 2.20 | 0.95 | 1.3 | 0.5 | 1.3 | Unnamed |

| INCLUDING | 107.54 | 107.72 | 0.18 | 0.09 | 9.7 | 2.7 | 0.8 | |

| BWN006 | 31.37 | 31.75 | 0.38 | 0.21 | 1.5 | 0.3 | 0.2 | Unnamed |

| BWN006 | 36.38 | 36.8 | 0.42 | 0.28 | 2.5 | 0.0 | 0.4 | Unnamed |

| BWN006 | 86.19 | 86.36 | 0.17 | 0.16 | 2.0 | 0.1 | 0.2 | Metalmark Fault |

| BWN006 | 147.1 | 147.97 | 0.87 | 0.39 | 16.9 | 0.0 | 3.7 | Felix Trend |

| INCLUDING | 147.7 | 147.8 | 0.10 | 0.05 | 125.0 | 0.0 | 3.5 | |

| BWN007 | 164.03 | 164.16 | 0.13 | 0.10 | 3.2 | 1.0 | 0.3 | Felix Trend |

| BWN007 | 174.73 | 175.1 | 0.37 | 0.23 | 0.9 | LLD | 0.1 | Felix Trend |

| INCLUDING | 174.85 | 174.92 | 0.07 | 0.04 | 2.1 | LLD | 0.0 | |

| BWN007 | 176.26 | 179.88 | 3.62 | 0.94 | 0.5 | 0.1 | 0.3 | Felix Trend |

| INCLUDING | 176.9 | 177.43 | 0.53 | 0.14 | 2.1 | 0.1 | 0.2 | |

| BWN008 | 122.87 | 123.54 | 0.67 | 0.63 | 9.1 | 2.3 | 5.0 | Metalmark Fault |

| INCLUDING | 123.14 | 123.54 | 0.40 | 0.37 | 15.1 | 3.5 | 4.7 | |

| BWN008 | 143.33 | 143.77 | 0.44 | 0.41 | 3.4 | 0.6 | 1.1 | Unnamed |

| INCLUDING | 143.33 | 143.42 | 0.09 | 0.08 | 15.9 | 2.6 | 1.0 | |

| BWN008 | 168.62 | 171.47 | 2.85 | 1.63 | 0.5 | 0.4 | 1.3 | Unnamed |

| INCLUDING | 168.62 | 168.75 | 0.13 | 0.07 | 2.3 | 0.2 | 0.1 | |

| BWN008 | 204.15 | 206.57 | 2.42 | 1.68 | 0.8 | 0.1 | 1.0 | Felix Trend |

| INCLUDING | 205.87 | 206.18 | 0.31 | 0.22 | 4.2 | 0.2 | 0.6 | |

| BWN008 | 212.64 | 214.38 | 1.74 | 1.64 | 3.8 | 0.3 | 4.0 | Felix Trend |

| INCLUDING | 212.52 | 213.79 | 1.27 | 0.25 | 18.4 | 0.0 | 2.6 | |

| BWN008 | 271.02 | 271.3 | 0.28 | 0.25 | 3.6 | LLD | 0.5 | Unnamed |

| BWN009 | 261.18 | 261.29 | 0.11 | 0.08 | 8.1 | 0.0 | 0.4 | Felix Trend |

| BWN009 | 271.15 | 271.24 | 0.09 | 0.08 | 1.2 | 0.2 | 0.1 | Felix Trend |

| BWN009 | 283.04 | 283.52 | 0.48 | 0.51 | 1.2 | 0.2 | 0.5 | Western Trend |

| BWN009 | 289.82 | 292.29 | 2.47 | 1.89 | 0.8 | 0.2 | 1.2 | Western Trend |

| INCLUDING | 289.82 | 289.94 | 0.12 | 0.09 | 3.9 | 2.1 | 0.4 | |

| BWN009 | 313.51 | 314.78 | 1.27 | 1.14 | 3.3 | 0.8 | 3.2 | Western Trend |

| INCLUDING | 313.75 | 313.87 | 0.12 | 0.11 | 17.3 | 0.5 | 1.1 | |

| BWN009 | 347.36 | 348.5 | 1.14 | 1.01 | 19.5 | 2.4 | 14.1 | Western Trend |

| INCLUDING | 347.36 | 347.94 | 0.58 | 0.51 | 38.4 | 4.6 | 13.9 | |

| BWN010 | 76.22 | 77.34 | 1.12 | 0.99 | 0.4 | LLD | 0.2 | Western Trend |

| INCLUDING | 76.9 | 77.12 | 0.22 | 0.19 | 1.8 | LLD | 0.2 | |

| BWN010 | 100.38 | 100.51 | 0.13 | 0.08 | 7.8 | LLD | 0.3 | Western Trend |

| BWN010 | 374.34 | 374.52 | 0.18 | 0.18 | 0.2 | LLD | 0.0 | Swallowtail Fault |

| BWN010 | 426.95 | 427.91 | 0.96 | 0.80 | 0.7 | LLD | 0.3 | Unnamed |

| INCLUDING | 427.02 | 427.1 | 0.08 | 0.07 | 3.3 | LLD | 0.1 | |

| BWN011A | 146.96 | 148.9 | 1.94 | 1.59 | 0.4 | LLD | 0.3 | Unnamed |

| INCLUDING | 146.96 | 147.13 | 0.17 | 0.14 | 1.5 | LLD | 0.1 | |

| BWN011A | 255.4 | 255.53 | 0.13 | 0.10 | 29.4 | 0.1 | 1.7 | Western Trend |

| BWN011A | 348.13 | 350.65 | 2.52 | 1.78 | 0.4 | 0.5 | 1.6 | Felix Trend |

| INCLUDING | 348.13 | 348.73 | 0.60 | 0.47 | 1.3 | 0.6 | 0.7 | |

| BWN012 | 22.5 | 23.36 | 0.86 | 0.55 | 10.1 | LLD | 3.1 | Unnamed |

| INCLUDING | 22.84 | 23.36 | 0.52 | 0.33 | 14.8 | LLD | 2.7 | |

| BWN013 | 346.07 | 346.18 | 0.11 | 0.04 | 2.3 | LLD | 0.1 | Felix Trend |

| BWN015 | 426.95 | 427.91 | 0.96 | 0.83 | 0.7 | LLD | Unnamed | |

| INCLUDING | 427.02 | 427.1 | 0.08 | 0.07 | 3.3 | LLD | 0.1 | |

| BWN019 | 88.26 | 88.96 | 0.70 | 0.24 | 3.2 | LLD | 0.4 | Felix Trend |

| BWN019 | 95.26 | 95.47 | 0.21 | 0.07 | 12.1 | LLD | 0.5 | Felix Trend |

| BWN019 | 125.98 | 126.54 | 0.56 | 0.46 | 20.9 | LLD | 5.3 | Felix Trend |

| BWN020A | 105.63 | 105.91 | 0.28 | 0.07 | 3.3 | 0.6 | 0.2 | Unnamed |

| BWN020A | 107.88 | 110.23 | 2.35 | 1.93 | 1.0 | 0.5 | 2.2 | Unnamed |

| INCLUDING | 108.39 | 108.53 | 0.14 | 0.11 | 6.7 | 4.0 | 1.0 | |

| BWN020A | 134.85 | 137.6 | 2.75 | 1.74 | 1.2 | 0.3 | 1.8 | Unnamed |

| INCLUDING | 135.35 | 135.8 | 0.45 | 0.32 | 4.3 | LLD | 0.8 | |

| BWN020A | 187.36 | 190.42 | 3.06 | 0.79 | 2.0 | 0.3 | 1.2 | Western Trend |

| INCLUDING | 189.29 | 189.53 | 0.24 | 0.06 | 23.4 | 2.8 | 1.0 | |

| BWN020A | 256.54 | 261.63 | 5.09 | 1.74 | 0.5 | 0.0 | 0.5 | Western Trend |

| INCLUDING | 260.11 | 260.3 | 0.19 | 0.06 | 3.6 | LLD | 0.1 | |

| BWN021 | 243.94 | 248.09 | 4.15 | 1.74 | 1.3 | 0.3 | 1.9 | Western Trend |

| BWN022 | 294.05 | 297.09 | 3.04 | 1.74 | 1.1 | 0.1 | 1.2 | Western Trend |

| BWN023 | 221.09 | 222.95 | 1.86 | 1.70 | 19.9 | 0.0 | 18.9 | Felix Trend |

| INCLUDING | 221.09 | 221.19 | 0.10 | 0.09 | 158.4 | LLD | 7.9 | |

| INCLUDING | 222.77 | 222.95 | 0.18 | 0.16 | 110.8 | 0.0 | 9.9 | |

| BWN023 | 224 | 224.19 | 0.19 | 0.05 | 16.5 | LLD | 0.5 | Felix Trend |

Notes

1. The AuEq (gold equivalent) grade is calculated using the following formula:

| AuEq g per t = Au g per t + Sb% x | Sb price per 10kg x Sb processing recovery |

| Au price per g x Au processing recovery |

Prices and recoveries used: Au $/oz = 1,760; Sb $/t = 12,800; Au Recovery = 93% and; Sb Recovery = 95%

2. LLD signifies an undetectable amount of antimony. Detection limit for the analysis used is 0.01%

3. Composites that are not interpreted to be connected to a named vein or trend and are below 1 g/t Au are not considered significant and are not recorded here.