Marathon Gold Reports Latest Drill Results from Marathon Deposit at Valentine Gold Project, NL

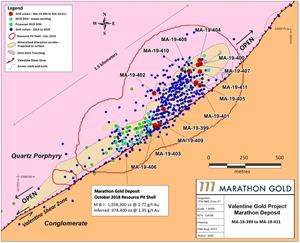

TORONTO, Sept. 03, 2019 (GLOBE NEWSWIRE) -- Marathon Gold Corporation (“Marathon” or the “Company”) (TSX: MOZ) is pleased to announce positive results from the start of the infill drilling campaign at the Marathon Deposit, part of the Valentine Gold Project in central Newfoundland. This latest drilling is part of a series of planned infill and exploration drill holes designed to expand the estimate of Mineral Resources at the Marathon Deposit over the more than 1,500-meter strike length of the deposit’s “Main Zone” corridor. Of note, these drill results continue to successfully demonstrate the continuity of gold mineralization both along and across strike of the Main Zone as well as from surface to the base of the currently planned open pit, where mineralization remains open to depth. Highlights of the latest drilling include:

- Main Zone: MA-19-405 intersected 3.87 g/t Au over 11.0 meters including 13.63 g/t Au over 2.0 meters and 3.78 g/t Au over 8.0 meters including 12.57 g/t Au over 2.0 meters.

- Main Zone: MA-19-401 intersected 3.36 g/t Au over 13.0 meters including 12.81 g/t Au over 2.0 meters and 3.11 g/t Au over 3.0 meters.

- Main Zone: MA-19-408 intersected 1.44 g/t Au over 62.0 meters including 7.70 g/t Au over 2.0 meters and 4.86 g/t Au over 2.0 meters, and 4.67 g/t Au over 3.0 meters.

- Main Zone: MA-19-399 intersected 1.34 g/t Au over 39.0 meters including 8.87 g/t Au over 2.0 meters, and 3.40 g/t Au over 3.0 meters.

- Main Zone NE: MA-19-400 intersected 12.32 g/t Au over 3.0 meters and 4.60 g/t Au over 4.0 meters, MA-19-404 intersected 10.22 g/t Au over 3.0 meters and 4.68 g/t Au over 4.0 meters, MA-19-407 intersected 3.36 g/t Au over 3.0 meters, and MA-19-411 intersected 2.60 g/t Au over 3.0 meters; and,

- Hanging & Footwall DDH’s, drilled along the outer flanks of the Main Zone corridor, intersected significant gold mineralization including in MA-19-406 7.40 g/t Au over 3.0 meters, 8.74 g/t Au over 3.0 meters, and 2.24 g/t Au over 7.0 meters and 4.88 g/t Au over 3.0 meters in MA-19-410.

The latest drilling has been oriented downward through the en-echelon stacked, shallowly SW dipping, gold-bearing Quartz-Tourmaline-Pyrite-Gold (“QTP-Au”) veins which form the dominant vein orientation within the sub-vertical Main Zone corridor of the Marathon Deposit (Table 1; Figure 1). It represents both infill drilling in areas currently classified as Inferred Mineral Resources in the October 2018 Mineral Resource Estimate and new exploration in areas of previously little drilling along the northeast end of the Main Zone corridor.

In addition to the results published today, assays are pending for new drilling which has intersected significant QTP-Au veining in both the NE end of the current open pit design as well as SW along strike on the Main Zone corridor.

Three drill rigs are currently operating at the Marathon Deposit, where a more than 20,000-meter infill and step out drilling program will be completed in September. Thereafter, two drill rigs will move on to complete a planned 7,000-meter exploration drilling campaign at the Sprite Zone.

All drilling completed to the end of September will be utilized in the upcoming Mineral Resource update for the Valentine Gold Project, expected to be completed in the fourth quarter of this year.

In addition to the exploration drilling, a 2,250-meter HQ core size geotechnical drilling program has recently been completed, the results of which will be for open pit design at the Leprechaun and Marathon Deposits in the upcoming Valentine Pre-Feasibility study scheduled for the second quarter of 2020.

TABLE 1: Significant assay intervals, Marathon Deposit, Valentine Gold Camp

| DDH | Zone* | Section | From | To | Core Length (m) | True Thickness (m) | Gold g/t |

| MA-19-399 | MZ | 17090 | 152 | 155 | 3 | 2.6 | 3.40 |

| 163 | 202 | 39 | 33.2 | 1.34 | |||

| including | 182 | 184 | 2 | 1.7 | 8.87 | ||

| 224 | 227 | 3 | 2.6 | 1.85 | |||

| MA-19-400 | MZ | 17430 | 184 | 187 | 3 | 2.7 | 12.32 |

| 196 | 200 | 4 | 3.6 | 4.60 | |||

| 236 | 239 | 3 | 2.7 | 2.12 | |||

| 249 | 252 | 3 | 2.7 | 2.07 | |||

| 277 | 280 | 3 | 2.7 | 3.54 | |||

| MA-19-401 | FW - MZ | 17380 | 80 | 83 | 3 | 2.4 | 3.91 |

| 271 | 274 | 3 | 2.4 | 3.11 | |||

| 306 | 319 | 13 | 10.4 | 3.36 | |||

| including | 317 | 319 | 2 | 1.6 | 12.81 | ||

| 336 | 339 | 3 | 2.4 | 2.83 | |||

| 352 | 357 | 5 | 4.0 | 2.28 | |||

| MA-19-404 | MZ | 17430 | 69 | 72 | 3 | 2.7 | 10.22 |

| 275 | 278 | 3 | 2.7 | 2.52 | |||

| 292 | 295 | 3 | 2.7 | 4.68 | |||

| MA-19-405 | MZ | 17360 | 61 | 64 | 3 | 2.7 | 2.67 |

| 114 | 117 | 3 | 2.7 | 2.03 | |||

| 279 | 290 | 11 | 9.9 | 3.87 | |||

| including | 285 | 287 | 2 | 1.8 | 13.63 | ||

| 336 | 339 | 3 | 2.7 | 12.66 | |||

| 372 | 380 | 8 | 7.2 | 3.78 | |||

| including | 373 | 375 | 2 | 1.8 | 12.57 | ||

| MA-19-406 | FW | 17000 | 119 | 122 | 3 | 2.6 | 7.40 |

| 253 | 256 | 3 | 2.6 | 1.41 | |||

| 269 | 272 | 3 | 2.6 | 8.74 | |||

| 297 | 300 | 3 | 2.6 | 1.68 | |||

| 348 | 355 | 7 | 6.0 | 2.24 | |||

| MA-19-407 | MZ | 17410 | 80 | 83 | 3 | 2.6 | 1.10 |

| 85 | 88 | 3 | 2.6 | 2.92 | |||

| 198 | 202 | 4 | 3.4 | 1.06 | |||

| 219 | 222 | 3 | 2.6 | 3.36 | |||

| MA-19-408 | MZ | 17340 | 94 | 97 | 3 | 2.9 | 1.84 |

| 107 | 110 | 3 | 2.9 | 1.89 | |||

| 122 | 125 | 3 | 2.9 | 4.67 | |||

| 140 | 143 | 3 | 2.9 | 1.18 | |||

| 152 | 155 | 3 | 2.9 | 3.22 | |||

| 168 | 230 | 62 | 58.9 | 1.44 | |||

| including | 174 | 176 | 2 | 1.9 | 7.70 | ||

| including | 192 | 194 | 2 | 1.9 | 4.86 | ||

| MA-19-410 | HW | 17300 | 38 | 41 | 3 | 2.9 | 4.88 |

| MA-19-411 | MZ | 17410 | 230 | 233 | 3 | 2.6 | 2.29 |

| 238 | 241 | 3 | 2.6 | 2.60 | |||

| *MZ = Main Zone, HW = Hanging Wall, FW = Foot Wall *No significant intervals in MA-19-402, 403, and 409 drilled outside of the Main Zone | |||||||

Acknowledgments

Marathon acknowledges the financial support of the Junior Exploration Assistance Program, Department of Natural Resources, Government of Newfoundland and Labrador.

Qualified Person

Disclosure of a scientific or technical nature in this press release was prepared under the supervision of Sherry Dunsworth, MSc., P.Geo (NL), the Senior VP of Exploration and a qualified person under National Instrument (“NI”) 43-101.

Quality Assurance-Quality Control (“QA/QC”)

QA/QC protocols followed at the Valentine Gold Project include the insertion of blanks and standards at regular intervals in each sample batch. Drill core is cut in half with one half retained at site, the other half tagged and sent to Eastern Analytical Limited in Springdale, Newfoundland. All reported core samples are analyzed for Au by fire assay (30g) with AA finish. All samples above 0.10 g/t Au in economically interesting intervals are further assayed using metallic screen to mitigate the presence of coarse gold. Significant mineralized intervals are reported in Table 1 as core lengths and estimated true thickness (80% - 95% of core length).

About Marathon

Marathon is a Toronto based gold company rapidly advancing its 100%-owned Valentine Gold Project located in central Newfoundland, one of the top mining jurisdictions in the world. The Valentine Gold Project comprises a series of mineralised deposits along a 20-kilometer system of gold bearing Quartz-Tourmaline-Pyrite veins. The project is accessible by year-round road and is in close proximity to the provincial electrical grid. To date, four gold deposits at Valentine have been delineated, including the large Leprechaun and Marathon deposits. An October 2018 Preliminary Economic Assessment showed the project to be amenable to open pit mining and conventional milling over a twelve-year mine life. Total Mineral Resources currently comprise Measured Mineral Resources of 16.6 million tonnes at a grade of 2.18 g/t containing 1,166,500 oz. of gold, Indicated Mineral Resources of 28.5 million tonnes at a grade of 1.66 g/t containing 1,524,900 oz. of gold and Inferred Mineral Resources of 26.9 million tonnes at a grade of 1.77 g/t containing 1,531,600 oz. of gold. For more information, readers are referred to the technical report prepared in accordance with the requirements of NI 43-101 dated October 30, 2018 for further details and assumptions relating to the project.

Acknowledgments

Marathon acknowledges the financial support of the Junior Exploration Assistance Program, Department of Natural Resources, Government of Newfoundland and Labrador.

For more information, please contact:

Matthew Manson, PhD Christopher Haldane

President and Chief Executive Officer Manager Investor Relations

Tel: 416-987-0711 Tel: 416-987-0714

Email: mmanson@marathon-gold.com Email: chaldane@marathon-gold.com

To find out more information on Marathon Gold Corporation and the Valentine Gold Project, please visit www.marathon-gold.com.

Cautionary Statement Regarding Forward-Looking Information

Certain information contained in this news release constitutes forward-looking information within the meaning of Canadian securities laws ("forward-looking statements"). All statements in this news release, other than statements of historical fact, which address events, results, outcomes or developments that Marathon expects to occur are forward-looking statements. Forward-looking statements include statements that are predictive in nature, depend upon or refer to future events or conditions, or include words such as "expects", "anticipates", "plans", "believes", "estimates", "considers", "intends", "targets", or negative versions thereof and other similar expressions, or future or conditional verbs such as "may", "will", "should", "would" and "could". More particularly and without restriction, this press release contains forward-looking statements and information about future exploration plans, objectives and expectations of Marathon, future mineral resource and mineral reserve estimates and updates and the expected impact of exploration drilling on mineral resource estimates, future pre-feasibility and feasibility studies and environmental impact statements and the timetable for completion and content thereof and statements as to management's expectations with respect to, among other things, the matters and activities contemplated in this news release.

Forward-looking statements involve known and unknown risks, uncertainties and assumptions and accordingly, actual results and future events could differ materially from those expressed or implied in such statements. You are hence cautioned not to place undue reliance on forward-looking statements. In respect of the forward-looking statements and information concerning the interpretation of exploration results and the impact on the project’s mineral resource estimate, Marathon has provided such statements and information in reliance on certain assumptions it believes are reasonable at this time, including assumptions as to the continuity of mineralization between drill holes. A mineral resource that is classified as "inferred" or "indicated" has a great amount of uncertainty as to its existence and economic and legal feasibility. It cannot be assumed that any or part of an "indicated mineral resource" or "inferred mineral resource" will ever be upgraded to a higher category of mineral resource. Investors are cautioned not to assume that all or any part of mineral deposits in these categories will ever be converted into proven and probable mineral reserves.

By its nature, this information is subject to inherent risks and uncertainties that may be general or specific and which give rise to the possibility that expectations, forecasts, predictions, projections or conclusions will not prove to be accurate, that assumptions may not be correct and that objectives, strategic goals and priorities will not be achieved. Factors that could cause future results or events to differ materially from current expectations expressed or implied by the forward-looking statements include the ability of the current exploration program to identify and expand mineral resources, operational risks in exploration and development for gold, delays or changes in plans with respect to exploration or development projects or capital expenditures, uncertainty as to calculation of mineral resources, changes in commodity and power prices, changes in interest and currency exchange rates, inaccurate geological and metallurgical assumptions (including with respect to the size, grade and recoverability of mineral resources), changes in development or mining plans due to changes in logistical, technical or other factors, cost escalation, changes in general economic conditions or conditions in the financial markets. delays and other risks described in Marathon’s documents filed with Canadian securities regulatory authorities. You can find further information with respect to these and other risks in Marathon’s Annual Information Form for the year ended December 31, 2018 and other filings made with Canadian securities regulatory authorities and available at www.sedar.com. Other than as specifically required by law, Marathon undertakes no obligation to update any forward-looking statement to reflect events or circumstances after the date on which such statement is made, or to reflect the occurrence of unanticipated events, whether as a result of new information, future events or results otherwise.

A photo accompanying this announcement is available at https://www.globenewswire.com/NewsRoom/AttachmentNg/8869a98f-58a3-445a-bec1-b5956fb61a04