Marathon's Infill Drilling Continues to Confirm Open-Pit, High-Grade Gold Continuity, Valentine Lake Gold Camp, NL

Drilling Highlights:

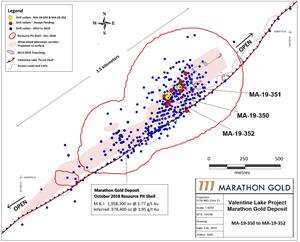

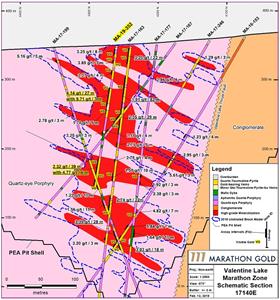

- The Marathon Deposit infill drill holes MA-19-350, MA-19-351 and MA-19-352 intersected wide zones of QTP-Au veining with visible gold over a strike length of 100 meters within the open-pit core region of the main mineralized corridor; further confirming the geological model for lateral continuity of the higher-grade gold mineralization between adjacent drill holes at shallow depths in the Marathon Deposit (Figures 1 and 2):

- MA-19-352 intersected 4.14 g/t Au over 27.0 meters including 9.71 g/t Au over 7.0 meters, and 2.32 g/t Au over 39.0 meters including 4.77 g/t Au over 6.0 meters as well as other high-grade intervals (Table 1 and Figure 2).

- MA-19-351 intersected 2.73 g/t Au over 24.0 meters including 7.57 g/t Au over 3.0 meters and 15.44 g/t Au over 1.0 meter.

- MA-19-350 intersected 2.29 g/t Au over 24.0 meters including 5.37 g/t Au over 3.0 meters, 9.11 g/t Au over 1.0 meter and 8.35 g/t Au over 1.0 meter.

- MA-19-352 intersected 4.14 g/t Au over 27.0 meters including 9.71 g/t Au over 7.0 meters, and 2.32 g/t Au over 39.0 meters including 4.77 g/t Au over 6.0 meters as well as other high-grade intervals (Table 1 and Figure 2).

- The thick, high-grade gold intervals from the infill drill holes MA-19-350 to MA-19-352, which were drilled subvertical, down through en-echelon stacked, shallow southwest dipping QTP veining and located between adjacent strongly mineralized drill holes in the main zone, further confirm the geological model for the Marathon Deposit and the extensive lateral continuity of the QTP veining between adjacent drill holes.

Program Update:

- The winter 2019 infill drilling campaign has focused on infill drilling at the Marathon Deposit which is currently the largest resource in the Valentine Lake Gold Camp. The results of this infill drilling continue to validate the mineralization boundary in the block model as well as the lateral continuity of the high-grade mineralized zones.

- Advanced metallurgical testing of material from both the Marathon and Leprechaun Deposits is continuing with focus on optimizing both mill and heap leach recoveries.

- A Project Description is being prepared for submission to the Federal and Provincial regulators, a key step in the overall regulatory approvals process.

TORONTO, Feb. 14, 2019 (GLOBE NEWSWIRE) -- Marathon Gold Corporation (“Marathon” or the “Company”) (TSX: MOZ) is pleased to announce the excellent results from drill holes MA-19-350, MA-19-351 and MA-19-352, which were strategically located between existing, strongly mineralized drill holes in the open pit portion of the Marathon Deposit (Figure 1). Each of these drill holes succeeded in intersecting strongly mineralized, en-echelon stacked QTP-Au veining with thick intervals of higher-grade gold intercepts. The intent of the infill drilling program is two-fold; first, to further confirm Marathon’s geological model by demonstrating the extensive lateral continuity of the QTP-Au veining into adjacent drill holes both along and across strike; and second, to continue to upgrade Inferred resource material into the Measured and Indicated resource categories.

“The infill holes are adding confidence to our model and providing better definition of the mineralization. As with all infill programs, we expect there will be changes to the resources. So far, we see good correlation of the mineralization as predicted by the geological model including the presence of visible gold,” said Phillip Walford, President and CEO of Marathon Gold. “These new gold intersections are expected to upgrade Inferred material to Measured and Indicated resources while also adding additional Inferred material. Assays are pending on more drill holes located along the strike length of the deposit (Figure 1), all of which have intersected wide intervals of QTP veining with abundant visible gold. All initial fire assay analysis above 0.1 g/t Au are further assayed using the metallic screen method which more accurately reflects free gold content and typically shows a significant increase in grade for material over 1.5 g/t Au at the Marathon Deposit.”

TABLE 1: Significant assay intervals, Marathon Deposit, Valentine Lake Gold Camp.

| DDH | Section | From | To | Core Length (m) | True Thickness (m) | Gold g/t |

| MA-19-350 | 17160 | 40 | 43 | 3 | 2.9 | 1.27 |

| 72 | 96 | 24 | 22.8 | 2.29 | ||

| including | 72 | 73 | 1 | 1 | 9.11 | |

| including | 78 | 79 | 1 | 1 | 8.35 | |

| including | 83 | 86 | 3 | 2.9 | 5.37 | |

| 169 | 172 | 3 | 2.9 | 1.31 | ||

| MA-19-351 | 17240 | 53 | 56 | 3 | 2.9 | 1.43 |

| 79 | 103 | 24 | 22.8 | 2.73 | ||

| including | 79 | 82 | 3 | 2.9 | 4.26 | |

| including | 90 | 93 | 3 | 2.9 | 7.57 | |

| including | 102 | 103 | 1 | 1 | 15.44 | |

| MA-19-352 | 17140 | 6 | 14 | 8 | 7.6 | 3.25 |

| including | 11 | 14 | 3 | 2.9 | 6.29 | |

| 22 | 25 | 3 | 2.9 | 3.89 | ||

| 38 | 42 | 4 | 3.8 | 2.37 | ||

| 62 | 89 | 27 | 25.7 | 4.14 | ||

| including | 62 | 69 | 7 | 6.7 | 9.71 | |

| including | 84 | 86 | 2 | 1.9 | 8.68 | |

| 94 | 99 | 5 | 4.8 | 1.78 | ||

| 127 | 130 | 3 | 2.9 | 3.25 | ||

| 166 | 205 | 39 | 37.1 | 2.32 | ||

| including | 166 | 168 | 2 | 1.9 | 7.78 | |

| including | 178 | 184 | 6 | 5.7 | 4.77 | |

Figure 1: http://www.globenewswire.com/NewsRoom/AttachmentNg/ec7924e6-a173-4178-a0de-fa6d606d2c29

Figure 2: http://www.globenewswire.com/NewsRoom/AttachmentNg/0f8993e8-e1f3-4416-8353-141ef1561541

Acknowledgments

Marathon acknowledges the financial support of the Junior Exploration Assistance Program, Department of Natural Resources, Government of Newfoundland and Labrador.

Quality Assurance-Quality Control (“QA/QC”)

Sherry Dunsworth, M.Sc., P. Geo., Senior VP of Exploration, Marathon’s Qualified Person, has reviewed the contents for accuracy and has approved this press release on behalf of Marathon. Thorough QA/QC protocols are followed including the insertion of blanks and standards at regular intervals in each sample batch. Drill core is cut in half with one half retained at site, the other half tagged and sent to Eastern Analytical Limited in Springdale, Newfoundland. All reported core samples are analyzed for Au by fire assay (30g) with AA finish. All samples above 0.10 g/t Au in economically interesting intervals are further assayed using metallic screen to mitigate the presence of coarse gold. Significant mineralized intervals are reported in Table 1 as core lengths and estimated true thickness (95% of core length).

About Marathon

Marathon is a Toronto based gold exploration company rapidly advancing its 100% owned Valentine Lake Gold Camp located in Newfoundland and Labrador, one of the top mining jurisdictions in the world. The Valentine Lake Gold Camp currently hosts four near-surface, mainly pit-shell constrained, deposits with measured and indicated resources totaling 2,691,400 oz. of gold at 1.85 g/t and inferred resources totaling 1,531,600 oz. of gold at 1.77 g/t. The majority of the resources occur in the Marathon and Leprechaun deposits, which also have resources below the current open pit shell. Both deposits are open to depth and on strike. Gold mineralization has been traced down over 350 meters vertically at Leprechaun and almost a kilometer at Marathon. The four deposits identified to date occur over a 20-kilometer system of gold bearing veins, with much of the 24,000-hectare property having had only minimal exploration activity to date.

The Valentine Lake Gold Camp is accessible by year-round road and is in close proximity to the provincial electrical grid. Marathon maintains a 50-person all-season camp at the property. Recent metallurgical tests have demonstrated 93% to 98% recoveries via conventional milling and 50% to 70% recoveries via low cost heap leaching at both the Leprechaun and Marathon Deposits.

To find out more information on the Valentine Lake Gold Camp please visit www.marathon-gold.com.

For more information, please contact:

| Christopher Haldane Investor Relations Manager Tel: 1-416-987-0714 E-mail: chaldane@marathon-gold.com | Phillip Walford President and Chief Executive Officer Tel: 1-416-987-0711 E-mail: pwalford@marathon-gold.com | ||

CAUTIONARY STATEMENT REGARDING FORWARD-LOOKING INFORMATION

Except for statements of historical fact relating to Marathon Gold Corporation, certain information contained herein constitutes "forward-looking statements". Forward-looking statements include statements that are predictive in nature, depend upon or refer to future events or conditions, or include words such as "expects", "anticipates", "plans", "believes", "considers", "intends", "targets", or negative versions thereof and other similar expressions, or future or conditional verbs such as "may", "will", "should", "would" and "could". We provide forward-looking statements for the purpose of conveying information about our current expectations and plans relating to the future and readers are cautioned that such statements may not be appropriate for other purposes. By its nature, this information is subject to inherent risks and uncertainties that may be general or specific and which give rise to the possibility that expectations, forecasts, predictions, projections or conclusions will not prove to be accurate, that assumptions may not be correct, and that objectives, strategic goals and priorities will not be achieved. These risks and uncertainties include but are not limited to those identified and reported in Marathon Gold Corporation's public filings, which may be accessed at www.sedar.com. Other than as specifically required by law, we undertake no obligation to update any forward-looking statement to reflect events or circumstances after the date on which such statement is made, or to reflect the occurrence of unanticipated events, whether as a result of new information, future events, results or otherwise.