March 2022 Quarter Report

PERTH, Western Australia, April 26, 2022 (GLOBE NEWSWIRE) -- Perseus Mining Limited (“Perseus” or the “Company”) (TSX & ASX: PRU) reports on its activities for the three months’ period ended March 31, 2022 (the “Quarter”).

| PERFORMANCE INDICATOR | UNIT | SEPTEMBER 2021 QUARTER | DECEMBER 2021 QUARTER | DECEMBER 2021 HALF YEAR | MARCH 2022 QUARTER | 2022 TO DATE FINANCIAL YEAR |

| Gold recovered | Ounces | 112,786 | 128,378 | 241,164 | 130,523 | 371,687 |

| Gold poured | Ounces | 110,535 | 126,948 | 237,483 | 132,644 | 370,127 |

| Production Cost | US$/ounce | 857 | 823 | 839 | 789 | 822 |

| All-In Site Cost (AISC) | US$/ounce | 966 | 934 | 949 | 908 | 934 |

| Gold sales | Ounces | 107,650 | 130,486 | 238,135 | 131,044 | 369,178 |

| Average sales price | US$/ounce | 1,655 | 1,669 | 1,663 | 1,701 | 1,676 |

| Notional Cashflow | US$ million | 78 | 94 | 172 | 104 | 275 |

- Key Operating highlights include:

- Gold production increased 2% quarter-on-quarter to 130,523 ounces, a new production record.

- Quarterly gold sales increased by 557 ounces for a new quarterly sales record of 131,044 ounces at a weighted average sales price of US$1,701 per ounce.

- Weighted average all-in site costs (AISCs) decreased by 3% or US$26 per ounce quarter-on-quarter to US$908 per ounce for the quarter.

- Average quarterly cash margin of US$793 per ounce of gold was US$58 per ounce more than prior quarter.

- Notional cashflow from operations increased by 10% quarter-on-quarter to US$104 million, resulting in total year to date notional cashflow of US$275 million.

- Operating performance consistently in line with ESG KPIs.

- Perseus’s strong operating performance is forecast to continue with no change to the June 2022 Half Year production guidance of 230,000 to 265,000 ounces at an AISC of US$915 to US$1,085 per ounce.

- Business growth activities delivered excellent results, with a material increase in Perseus’s Ore Reserves inventory and an extension the economic mine lives of our operations likely to result from:

- The proposed acquisition of Orca Gold Inc. through a Plan of Arrangement, which when complete, will result in the ownership of the undeveloped long-life Block 14 Gold Project in Sudan, and an indirect 31.4% interest in the Koné Gold Project, owned by TSX-V listed Montage Gold Corp, in northern Côte d’Ivoire, that is based on a large, potentially long-life undeveloped gold reserve.

- The updated Life of Mine Plan for the Sissingué processing operation has extended the life of that operation to FY2026.

- Exploration programmes at the Nkosuo prospect near Edikan and the CMA Underground prospect at Yaouré have both returned excellent drill results, confirming the potential for strong organic growth of each mine.

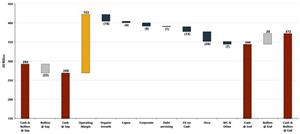

- Perseus’s financial position continues to strengthen with available cash and bullion of US$278 million, debt of US$50 million, and net cash of US$228 million at March 31, 2022, US$66 million more than last quarter.

- Interim dividend of 0.81 Australian cents per share was paid to shareholders following the end of the quarter.

OPERATIONS

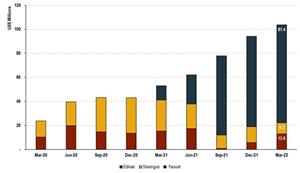

QUARTERLY PRODUCTION, COSTS AND NOTIONAL CASHFLOW

Perseus’s three operating gold mines, Yaouré and Sissingué in Côte d’Ivoire, and Edikan in Ghana have combined to produce a total of 130,523 ounces of gold in the March 2022 quarter, 2% more than in the prior quarter. The weighted average production cost incurred during the quarter was US$789 per ounce, while the weighted average AISC was US$908 per ounce of gold. Both production costs and AISCs were 4% and 3% lower respectively the previous quarter. No change has been made to either production or cost guidance for the June 2022 Half Year of 230,000 to 265,000 ounces of gold produced at an AISC of US$915 to 1,085 per ounce.

On a year-to-date basis, gold production at our three mines totals 371,687 ounces of gold, produced at a weighted average AISC of US$934 per ounce. No change has been made to either production or cost guidance for the 2022 Financial Year of 471,164- 506,164 ounces of gold produced at an AISC of US$932 to 1,020 per ounce.

Table 1: Cost and Production Summary by Mine

| MINE | TOTAL GOLD PRODUCED (OUNCES) | ALL-IN SITE COST (US$/OUNCE) | ||||

| SEPTEMBER 2021 QUARTER | DECEMBER 2021 QUARTER | MARCH 2022 QUARTER | SEPTEMBER 2021 QUARTER | DECEMBER 2021 QUARTER | MARCH 2022 QUARTER | |

| Yaouré | 64,558 | 75,189 | 76,921 | 671 | 700 | 662 |

| Edikan | 32,161 | 35,124 | 38,590 | 1,574 | 1,450 | 1,336 |

| Sissingué | 16,067 | 18,065 | 15,012 | 931 | 905 | 1,067 |

| Perseus Group | 112,786 | 128,378 | 130,523 | 966 | 934 | 908 |

Combined gold sales from all three operations totalled 131,044 ounces, 0.4% more than last quarter. The weighted average gold price realised was US$1,701 per ounce, 2% better than the price received in the December 2021 quarter. Perseus’s average cash margin for the March 2022 quarter was US$793 per ounce, US$59 per ounce or 8% more than that achieved during the December 2021 quarter. Notional operating cashflow from operations was US$104 million, US$10 million or 10% more than that generated in the prior period derived largely from improved production and cost performance at the Yaouré and Edikan mines.

Table 2: Realised Gold Price and Notional Cash Flow by Mine

| MINE | REALISED GOLD PRICE (US$ PER OUNCE) | NOTIONAL CASH FLOW FROM OPERATIONS (US$ MILLION) | ||||

| SEPTEMBER 2021 QUARTER | DECEMBER 2021 QUARTER | MARCH 2022 QUARTER | SEPTEMBER 2021 QUARTER | DECEMBER 2021 QUARTER | MARCH 2022 QUARTER | |

| Yaouré | 1,690 | 1,699 | 1,720 | 66 | 75 | 81 |

| Edikan | 1,602 | 1,613 | 1,673 | 1 | 6 | 13 |

| Sissingué | 1,624 | 1,638 | 1,683 | 11 | 13 | 9 |

| Perseus Group | 1,655 | 1,669 | 1,701 | 78 | 94 | 104 |

YAOURÉ GOLD MINE, CÔTE D’IVOIRE

During the quarter, Yaouré, increased its gold production by a further 2% compared to the prior quarter to 76,921 ounces of gold at a production cost of US$549 per ounce and an AISC of US$662 per ounce. The weighted average sales price of the 74,947 ounces of gold sold during the quarter was US$1,720 per ounce, giving rise to a cash margin of US$1,058 per ounce. Notional operating cashflow generated by Yaouré was US$81 million during the quarter, US$6 million more than in the December 2021 quarter.

The improving operating performance at Yaouré was a result of improving mill throughput rates (507 tph compared to 487 tph) and run time of 94% compared to 88% during the prior quarter. Gold recovery rates (93.5% compared to 93.6%) and head grade of processed ore (2.50 g/t to 2.64 g/t) were reasonably steady and in line with expectations.

In terms of the 5% reduction in quarter-on-quarter AISCs, the increase in gold production and a decrease in G&A costs were the main contributors to the 7% reduction in production costs. A slight decrease in royalties due to the timing of sales was offset by a US$5 per ounce increase in sustaining capital costs related to costs associated with the tailings’ storage facility and other site building works. Overall, AISCs were US$38 per ounce lower than the prior quarter.

Refer to Table 3 below for details of key operating and financial parameters.

Table 3: Yaouré Quarterly Performance

| PARAMETER | UNIT | SEPTEMBER 2021 QUARTER | DECEMBER 2021 QUARTER | DECEMBER 2021 HALF YEAR | MARCH 2022 QUARTER | 2022 TO DATE FINANCIAL YEAR |

| Gold Production & Sales | ||||||

| Total material mined | Tonnes | 6,340,478 | 9,870,283 | 16,210,761 | 9,295,689 | 25,506,450 |

| Total ore mined | Tonnes | 1,070,285 | 1,378,535 | 2,448,820 | 1,463,248 | 3,912,068 |

| Average ore grade | g/t gold | 2.07 | 1.98 | 2.02 | 1.93 | 1.99 |

| Strip ratio | t:t | 4.9 | 6.2 | 5.6 | 5.4 | 5.5 |

| Ore milled | Tonnes | 913,530 | 946,052 | 1,859,582 | 1,025,345 | 2,884,927 |

| Milled head grade | g/t gold | 2.37 | 2.64 | 2.51 | 2.50 | 2.50 |

| Gold recovery | % | 92.7 | 93.6 | 93.2 | 93.5 | 93.3 |

| Gold produced | ounces | 64,558 | 75,189 | 139,747 | 76,921 | 216,668 |

| Gold sales1 | ounces | 60,055 | 79,669 | 139,724 | 74,947 | 214,671 |

| Average sales price | US$/ounce | 1,690 | 1,699 | 1,695 | 1,720 | 1,704 |

| Unit Production Costs | ||||||

| Mining cost | US$/t mined | 2.95 | 2.56 | 2.71 | 2.66 | 2.69 |

| Processing cost | US$/t milled | 13.74 | 13.52 | 13.63 | 12.38 | 13.19 |

| G & A cost | US$M/month | 1.89 | 2.08 | 1.99 | 0.54 | 1.87 |

| All-In Site Cost | ||||||

| Production cost | US$/ounce | 572 | 589 | 581 | 549 | 570 |

| Royalties | US$/ounce | 85 | 90 | 87 | 86 | 87 |

| Sub-total | US$/ounce | 657 | 679 | 669 | 635 | 657 |

| Sustaining capital | US$/ounce | 14 | 21 | 18 | 26 | 21 |

| Total All-In Site Cost2 | US$/ounce | 671 | 700 | 687 | 662 | 678 |

| Notional Cashflow from Operations | ||||||

| Cash Margin | US$/ounce | 1,019 | 999 | 1,008 | 1,058 | 1,026 |

| Notional Cash Flow | US$M | 65.8 | 75.1 | 140.9 | 81.4 | 222.3 |

Notes:

1. Gold sales are recognised in Perseus’s accounts when gold is delivered to the customer from Perseus’s metal account

2. Included in the AISC for the quarter is US$5.23 million of costs relating to excess waste stripping. When reporting cost of sales, in line with accepted practice under IFRS, this cost will be capitalised and the costs amortised over the remainder of the relevant pit life.

MINERAL RESOURCE TO MILL RECONCILIATION

The reconciliation of processed ore tonnes, grade and contained gold relative to the Yaouré Mineral Resource block model are shown in Table 4. During the last quarter, 29% more ore tonnes at 11% lower grade for 15% more ounces have been produced compared to the Mineral Resource model. Over the last six months and project to-date, Yaouré has produced more metal than predicted by the Mineral Resource model. The performance of the Yaouré Mineral Resource model to date is considered satisfactory, however work will continue to optimise the grade and reduce dilution.

Table 4: Yaouré Block Model to Mill Reconciliation

| PARAMETER | BLOCK MODEL TO MILL CORRELATION FACTOR | ||

| 3 MONTHS | 6 MONTHS | PROJECT TO DATE | |

| Tonnes of Ore | 129% | 128% | 116% |

| Head Grade | 89% | 91% | 96% |

| Contained Gold | 115% | 117% | 112% |

SISSINGUÉ GOLD MINE, CÔTE D’IVOIRE

During the quarter, 15,012 ounces of gold were produced at Sissingué at a production cost of US$958 per ounce and an AISC of US$1,067 per ounce. The weighted average sales price of the 16,264 ounces of gold sold during the quarter was US$1,683 per ounce, giving rise to a cash margin of US$616 per ounce. Notional cashflow generated from the Sissingué operation totalled US$9.3 million for the quarter, US$ 3.9 million less than in the prior quarter. Refer to Table 5 below for details of operating and financial parameters.

The quarter-on-quarter decrease in gold production of 3,053 ounces was driven by the decrease in head grade during the quarter from 1.67g/t to 1.36g/t. The impact of this expected fall in head grade was offset to a degree by improved run time (97%), and higher mill throughput rates (189tph) while recoveries remained stable at 89.8%.

The 18% or US$152 per ounce increase in quarter-on-quarter AISCs, was primarily a function of the 17% increase in production costs solely attributed to the 17% decrease in the ounces of gold produced during the quarter as explained above. A slight increase in royalties due to the higher gold sales price was largely offset by a decrease in sustaining capital costs.

Table 5: Sissingué Quarterly Performance

| PARAMETER | UNIT | SEPTEMBER 2021 QUARTER | DECEMBER 2021 QUARTER | DECEMBER 2021 HALF YEAR | MARCH 2022 QUARTER | 2022 TO DATE FINANCIAL YEAR |

| Gold Production & Sales | ||||||

| Total material mined | Tonnes | 395,727 | 706,459 | 1,102,186 | 1,242,344 | 2,344,530 |

| Total ore mined | Tonnes | 162,912 | 186,063 | 348,975 | 228,130 | 577,105 |

| Average ore grade | g/t gold | 1.52 | 0.87 | 1.17 | 0.72 | 0.99 |

| Strip ratio | t:t | 1.4 | 2.8 | 2.2 | 4.5 | 3.1 |

| Ore milled | Tonnes | 299,757 | 375,615 | 675,372 | 395,131 | 1,070,503 |

| Milled head grade | g/t gold | 1.91 | 1.67 | 1.78 | 1.32 | 1.61 |

| Gold recovery | % | 87.1 | 89.8 | 88.5 | 89.8 | 88.9 |

| Gold produced | ounces | 16,067 | 18,065 | 34,132 | 15,012 | 49,144 |

| Gold sales1 | ounces | 18,250 | 16,621 | 34,870 | 16,264 | 51,134 |

| Average sales price | US$/ounce | 1,624 | 1,638 | 1,630 | 1,683 | 1,647 |

| Unit Production Costs | ||||||

| Mining cost | US$/t mined | 9.62 | 6.80 | 7.81 | 4.52 | 6.06 |

| Processing cost | US$/t milled | 19.4 | 16.90 | 18.01 | 14.09 | 16.56 |

| G & A cost | US$M/month | 1.24 | 1.20 | 1.22 | 1.07 | 1.17 |

| All-In Site Cost1 | ||||||

| Production cost | US$/ounce | 830 | 817 | 823 | 958 | 864 |

| Royalties | US$/ounce | 94 | 85 | 89 | 97 | 92 |

| Sub-total | US$/ounce | 924 | 902 | 912 | 1,055 | 956 |

| Sustaining capital | US$/ounce | 7 | 3 | 5 | 13 | 7 |

| Total All-In Site Cost | US$/ounce | 931 | 905 | 917 | 1,067 | 963 |

| Notional Cashflow from Operations1 | ||||||

| Cash Margin | US$/ounce | 693 | 732 | 713 | 616 | 684 |

| Notional Cash Flow | US$M | 11.1 | 13.2 | 24.3 | 9.3 | 33.6 |

Notes:

1. Gold sales are recognised in Perseus’s accounts when gold is delivered to the customer from Perseus’s metal account.

2. Included in the AISC for the quarter is US$0.91 million of costs relating to excess waste stripping. When reporting cost of sales, in line with accepted practice under IFRS, this cost will be capitalised and the costs amortised over the remainder of the relevant pit life.

MINERAL RESOURCE TO MILL RECONCILIATION

The reconciliation of processed ore tonnes, grade and contained ounces relative to the Sissingué Mineral Resource block model is in Table 6 below. During the last three months, grade control has predicted materially increased tonnes (143%) increased grade (104%) and ounces (149%) when compared to the Mineral Resource Estimate (MRE). Over the last six- and 12-month periods of operation, Sissingué has also produced more metal than predicted by the Mineral Resource model. For the project to date, tonnes are 13% higher than predicted by the block model, grade has been 1% lower than estimated but contained gold higher by 11% overall. Perseus regards the overall outperformance as being within normal industry standards.

Table 6: Sissingué Block Model to Mill Reconciliation

| PARAMETER | BLOCK MODEL TO MILL CORRELATION FACTOR | ||

| 3 MONTHS | 6 MONTHS | 1 YEAR | |

| Tonnes of Ore | 143% | 136% | 110% |

| Head Grade | 104% | 108% | 99% |

| Contained Gold | 149% | 146% | 109% |

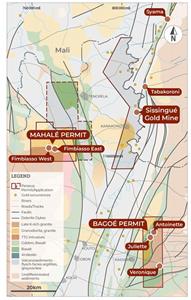

UPDATED LIFE OF MINE PLAN FOR THE SISSINGUÉ OPERATION

An updated Life of Mine Plan for the Sissingué operation that involved the mining and processing of ore from each of the Sissingué, Fimbiasso and the yet to be granted, Bagoé exploitation permit areas, was finalised during the quarter (refer to news release ‘Perseus Mining updates Life of Mine Plan for Sissingué Gold Mine & Satellite Deposits’ dated March 28, 2022), with the following key results:

- The mine life for the Sissingué operation was extended to March 2026 with potential for further extension by processing low grade ore stockpiles.

- Average annual gold production is forecast at 72,000 ounces at an average AISC of US$1,261 per ounce.

- Updated Mineral Resources were estimated at 7.2 million tonnes grading 1.7 g/t gold containing 394,000 ounces of gold at 31 December 2021.

- Proved and Probable Ore Reserves1 totalled 5.0 million tonnes of ore grading 1.8g/t gold and containing 282,000 ounces of gold with ore drawn from pits at Sissingué, Fimbiasso and Bagoé deposits.

Work is ongoing to obtain an Exploitation Permit covering the Bagoé exploration permit area. After the end of the quarter, community consultation processes were initiated as part of the environmental permitting process, a prerequisite to the granting of the Exploitation Permit.

EDIKAN GOLD MINE, GHANA

In the March 2022 quarter, Perseus produced 38,590 ounces of gold at Edikan (10% more than in the December quarter) at a production cost of US$1,202 per ounce and an AISC of US$1,336 per ounce, 9% and 8% respectively lower than in the prior quarter. Gold sales of 39,833 ounces were 16% more than in the prior quarter, at a weighted average realised gold price of US$1,673 per ounce, US$60 per ounce more than in the prior quarter. This generated a cash margin of US$337 per ounce, a 107% improvement on the prior quarter. Notional cashflow of US$13.0 million, was US$6.3 million better than in the prior period. Table 7 below summarises the key operating and financial parameters.

While the overall performance of Edikan was better in the March 2022 quarter than in the December 2021 quarter, further improvement is expected as mining moves to below previously cutback areas in the AG Pit. Results achieved in March and to date in the June 2022 quarter validate this expectation.

In the March 2022 quarter, the primary driver of production improvement was an increase in milled head grade. This averaged 0.87g/t compared to 0.73 g/t in the prior quarter. Other critical operating parameters such as run time, throughput rate and recovery were all relatively unchanged compared to the prior quarter. While the head grade did improve relative to the prior quarter, it fell short of Perseus’s expectation largely due to lower than planned material movements by our mining contractor which necessitated continued feed from low grade stockpile to supplement mill feed from the AG Pit. This situation is steadily improving although our contractor continues to struggle with equipment availability due to supply chain challenges resulting in shortages of spare parts from OEM suppliers.

The 8% or US$114 per ounce decrease in quarter-on-quarter AISCs achieved by Edikan, was a function of the 9% decrease in production costs reflecting the 10% increase in the ounces of gold produced during the quarter as explained above. A slight increase in royalties due to the higher gold sales price slightly offset the decrease in production cost while sustaining capital costs were unchanged on a per ounce basis.

Table 7: Edikan Quarterly Performance

| PARAMETER | UNIT | SEPTEMBER 2021 QUARTER | DECEMBER 2021 QUARTER | DECEMBER 2021 HALF YEAR | MARCH 2022 QUARTER | 2022 TO DATE FINANCIAL YEAR |

| Gold Production & Sales | ||||||

| Total material mined | Tonnes | 7,823,678 | 7,589,717 | 15,413,395 | 6,829,223 | 22,242,617 |

| Total ore mined | Tonnes | 788,612 | 836,266 | 1,624,878 | 1,242,630 | 2,867,507 |

| Average ore grade | g/t gold | 0.92 | 0.90 | 0.91 | 1.03 | 0.96 |

| Strip ratio | t:t | 8.9 | 8.1 | 8.5 | 4.50 | 6.76 |

| Ore milled | Tonnes | 1,731,146 | 1,756,072 | 3,487,218 | 1,633,717 | 5,120,936 |

| Milled head grade | g/t gold | 0.72 | 0.73 | 0.73 | 0.86 | 0.77 |

| Gold recovery | % | 80.2 | 85.6 | 83.0 | 85.8 | 84.0 |

| Gold produced | ounces | 32,161 | 35,124 | 67,285 | 38,590 | 105,875 |

| Gold sales1 | ounces | 29,345 | 34,196 | 63,541 | 39,833 | 103,373 |

| Average sales price | US$/ounce | 1,602 | 1,613 | 1,608 | 1,673 | 1,633 |

| Unit Production Costs | ||||||

| Mining cost | US$/t mined | 3.36 | 3.45 | 3.41 | 3.82 | 3.53 |

| Processing cost | US$/t milled | 8.56 | 8.23 | 8.39 | 9.97 | 8.90 |

| G & A cost | US$M/month | 1.78 | 2.04 | 1.89 | 1.33 | 1.70 |

| All-In Site Cost2 | ||||||

| Production cost | US$/ounce | 1,445 | 1,327 | 1,383 | 1,202 | 1,317 |

| Royalties | US$/ounce | 98 | 105 | 102 | 116 | 107 |

| Sub-total | US$/ounce | 1,543 | 1,432 | 1,485 | 1,318 | 1,424 |

| Sustaining capital | US$/ounce | 32 | 18 | 24 | 18 | 22 |

| Total All-In Site Cost2 | US$/ounce | 1,574 | 1,450 | 1,509 | 1,336 | 1,446 |

| Notional Cashflow from Operations1 | ||||||

| Cash Margin | US$/ounce | 28 | 163 | 98 | 337 | 187 |

| Notional Cash Flow | US$M | 0.9 | 5.7 | 6.6 | 13.0 | 19.8 |

Notes:

1. Gold sales are recognised in Perseus’s accounts when gold is delivered to the customer from Perseus’s metal account.

2. Included in the AISC for the quarter is US$5.38 million of costs relating to excess waste stripping. When reporting cost of sales, in line with accepted practice under IFRS, this cost will be capitalised and the costs amortised over the remainder of the relevant pit life.

MAJOR PLANNED PLANT PREVENTATIVE MAINTENANCE SHUTDOWN

During the June 2022 quarter, a major preventative maintenance shutdown is planned at Edikan to refurbish key items of plant infrastructure. The process plant will be shut down for 18 days starting in late May 2022 while the works are undertaken. Major items of planned work include:

- Refurbishment of the crusher low profile feeder and installation of a dust suppression system;

- Liner replacement and repairs of the mill shell using polyurethane for the internals of the mill shell;

- Replacement of the mill girth gear and pinion;

- Reaming/redrilling stretched bolt holes in the mill head;

- Replacement of mill gearbox and mill drivetrain alignment; and

- Cyanide storage system inspection and preventative repairs.

The loss of gold production and costs associated with the planned shutdown have been accounted for in preparing market guidance on gold production and costs at Edikan for the June 2022 Half Year.

MINERAL RESOURCE TO MILL RECONCILIATION

The reconciliation of processed ore tonnes, grade and contained ounces relative to the Edikan Mineral Resource block model are shown in Table 8 below.

Table 8: Edikan Block Model to Mill Reconciliation

| PARAMETER | BLOCK MODEL TO MILL CORRELATION FACTOR | ||

| 3 MONTHS | 6 MONTHS | 1 YEAR | |

| Tonnes of Ore | 90% | 84% | 85% |

| Head Grade | 86% | 86% | 85% |

| Contained Gold | 78% | 72% | 72% |

Block model to mill reconciliation improved during the quarter relative to the prior period as mining has largely moved below the existing cutback void in the AG Pit – the main source of ore during the quarter. During the quarter, a small increase in mining dilution was also experienced, however the practices that caused this to occur were addressed. Continuing work on the integration of geological structural mapping to control ore block design and improvements in mining has also added to the improved reconciliation performance during the quarter.

Based on reconciliation results achieved in March and April to date, combined with grade control drilling between the 980 to 950 m RL (the area to be mined during the June 2022 quarter) it is expected the reconciliation will revert to a correlation of between 95% to 105% that was achieved in prior cutbacks of the AG pit.

GROUP GOLD PRODUCTION AND COST MARKET GUIDANCE

As noted above, market production and cost guidance for the six months and twelve months to June 30, 2022, remains unchanged from that previously advised to the market, refer to Table 9 below for details.

Table 9: Production and Cost Guidance

| PARAMETER | UNITS | DECEMBER 2021 HALF YEAR (ACTUAL) | JUNE 2022 HALF YEAR (FORECAST) | 2022 FINANCIAL YEAR (FORECAST) |

| Yaouré Gold Mine | ||||

| Production | Ounces | 139,747 | 130,000 - 140,000 | 269,747 - 279,747 |

| All-in Site Cost | USD per ounce | 687 | 765 to 815 | 725 to 750 |

| Sissingué Gold Mine | ||||

| Production | Ounces | 34,133 | 25,000 to 35,000 | 59,133 – 69,133 |

| All-in Site Cost | USD per ounce | 917 | 810 to 1,280 | 872 to 1,100 |

| Edikan Gold Mine | ||||

| Production | Ounces | 67,284 | 75,000 to 90,000 | 142,284 – 157,284 |

| All-in Site Cost | USD per ounce | 1,509 | 1,210 to 1,430 | 1,350 to 1,465 |

| PERSEUS GROUP | ||||

| Production | Ounces | 241,164 | 230,000 to 265,000 | 471,164 – 506,164 |

| All-in Site Cost | USD per ounce | 949 | 915 to 1,085 | 932 to 1,020 |

SUSTAINABILITY

COVID-19 UPDATE

The fourth wave of COVID-19 generally subsided across West Africa during the quarter, with lower cases recorded across our operations. In response to lower case numbers and increasing vaccination rates, government COVID-19 testing controls and mask mandates in both Côte d’Ivoire and Ghana have relaxed. With higher rates of vaccination across our business, Perseus has revised its critical controls in line with government mandates. Perseus continues to monitor case numbers and changes in the threat from COVID-19, with focus on keeping its people safe and well, maintaining safe and stable operations, and supporting host governments and local communities. Although 194 cases of COVID-19 have been recorded across the Company’s operations since the beginning of the pandemic, no cases have led to serious illness and our controls have been effective in limiting the spread in our workforce.

During the quarter, 17 new cases of COVID-19 were recorded, mainly at the Edikan and Yaouré operations and almost all in the month of January following leave taken by employees over the Christmas period. Vaccination campaigns progressed across our operations, and with increased vaccine availability across the region around 60 per cent of Perseus’s employees and contractors are now fully vaccinated. Efforts continue to improve vaccination rates as they become available under government programs.

SUSTAINABILITY GOVERNANCE

During the quarter, Perseus continued to strengthen its sustainability governance by:

- Completing the first phase of a global project to transform Perseus’s health and safety approach and performance across the operations in line with international best practice, focusing on leadership, culture, capability and risk management. Workshops and training were conducted across all operations in February and March. The work will continue to be delivered throughout the remainder of FY22 and FY23.

- Commencing implementation of our supplier due diligence program, including conducting preliminary human rights engagements with selected suppliers in Côte d’Ivoire.

- Completing the first draft of our social performance framework, to be reviewed during the remainder of FY22, with implementation to commence in FY23.

- Commencing gap analysis of our Yaouré and Sissingué Tailings Storage Facilities against the Global Industry Standard on Tailings Management, with results to be reported in our FY22 Sustainability Report.

- Commencing development of a Group-wide standard for Tailings Management, to be implemented in FY23.

- Completing an independent review of closure plans and cost estimates, including updates to rehabilitation provisions in our financial statements and life of mine plans.

- Completing the renewal of the Fimbiasso Environmental and Social Impact Statement (ESIA) with the Côte d’Ivoire government and commenced the land and crop compensation process. Completed planning for the Bagoé ESIA public consultation sessions, scheduled for April 2022.

- Initiating update of security measures at Sissingué due to the increased terrorism risks in countries to the north of Côte d’Ivoire associated with activity of Jihadist groups in the Sahel region.

SUSTAINABILITY PERFORMANCE

This quarter, Perseus continued its strong sustainability performance relative to objectives and targets, as shown below in Table 10 and summarised as follows:

- Safety: Perseus’s record of zero fatalities across the operations was maintained, and safety performance improved from the previous quarter across the Group, with Total Recordable Injury Frequency Rates (TRIFR) reducing from 1.49 at the end of the December quarter to 1.45 at the end of March 2022, however still higher than the FY22 target of 1.3. Lost Time Injury Frequency (LTIFR) across the Group reduced from 0.46 to 0.36, Sissingué celebrated 1,000 days without a recordable incident, and additional focus on safety performance at Yaouré led to significant improvement in TRIFR over the quarter (from 3.49 at the end of the December 2021 quarter to 2.78 in the March 2022 quarter).

- Social:

- Total economic contribution to Perseus’s host countries of Ghana and Côte d’Ivoire for the financial year to date of around US$369 million (around 60% of revenue), included approximately US$281 million paid to local suppliers representing 86% of procurement, US$28 million paid as salaries and wages to local employees, US$60 million in payments to government as taxes, royalties and other payments, and around US$0.8 million in social investment.

- Local and national employment has been maintained at above 95% for the quarter (currently at 96%), and across the Perseus group, our gender diversity was stable with the proportion of female employees ~13%, reflecting the industry in which we are involved but more particularly, the cultural orientation of our host countries.

- Zero significant community events occurred.

- Environment:

- Scope 1 and 2 greenhouse gas emissions remained steady, and emissions intensity per ounce of gold produced reduced slightly due to higher production. Water intensity decreased slightly due to increased rain across the region.

- Following interest from additional vendors and completion of the new Yaouré LOM plan, Perseus is in the process of updating the evaluation of the potential use of solar power at the operation. Should the outcome of the review be positive, then further detailed studies will be carried out ahead of potential implementation.

- Zero environmental events or significant tailings dam integrity issues occurred during the period.

In achieving the above, the following sustainability challenges were encountered by Perseus during the quarter:

- The decree for the Yaouré Community Development Fund has been signed by the Ivorian Government, however there have been further government administrative delays to the establishment of the Fund and associated delays to commencement of community projects. Perseus is working with Government to establish the fund as soon as possible, and community funding is being accumulated in an account each month since commercial production was achieved at Yaouré.

- Illegal mining activities on Perseus’s mining and exploration licence areas continues to present challenges for the Company in both Ghana and Côte d’Ivoire. The Company continues to work closely with relevant government authorities to manage these activities that have proven to negatively impact both the environmental and social fabric of local communities.

- Ongoing tensions with the community around Yaouré regarding employment and business opportunities and land compensation.

- Security risks at Sissingué and satellite development areas (Fimbiasso and Bagoé) continue to be closely monitored due to ongoing political and social unrest which has given rise to terrorist activities in Mali which lies immediately to the north of the Sissingué mine.

Table 10: Sustainability Quarterly Performance

| PERFORMANCE DRIVER | SUB-AREA | METRIC | UNIT | FY2021 | SEPT 2021 QUARTER | DEC 2021 QUARTER | MAR 2022 QUARTER |

| Governance | Compliance | Material legal non-compliance | Number | 0 | 0 | 0 | 0 |

| Social | Worker Health, Safety and Wellbeing | Workplace fatalities | Number | 0 | 0 | 0 | 0 |

| Total Recordable Injury Frequency (TRIF) | Total Recordable Injuries per million hours worked, rolling 12 months | Edikan - 1.49 Sissingué - 1.47 Yaouré - 1.59 Exploration - 1.92 Group - 1.76 | Edikan - 1.89 Sissingué - 0.50 Yaouré - 3.24 Exploration - 2.80 Group - 1.85 | Edikan - 1.36 Sissingué - 0.00 Yaouré - 3.49 Exploration - 2.01 Group - 1.49 | Edikan - 1.38 Sissingué - 0.00 Yaouré - 2.78 Exploration - 0.82 Group - 1.45 | ||

| Lost Time Injury Frequency (LTIFR) | Lost Time Injuries (LTIFR) per million hours worked, rolling 12 months | Edikan - 0.37 Sissingué - 0.00 Yaouré - 1.59 Exploration - 0.00 Group - 0.45 | Edikan - 0.38 Sissingué - 0.00 Yaouré - 0.991 Exploration - 1.40 Group - 0.46 | Edikan - 0.39 Sissingué - 0.00 Yaouré - 0.76 Exploration - 1.00 Group - 0.46 | Edikan - 0.39 Sissingué - 0.00 Yaouré - 0.35 Exploration - 0.82 Group - 0.36 | ||

| COVID-19 Cases | Number | 24 | 66 | 60 | 17 | ||

| Community | Number of significant2 community events | Number | 21 | 0 | 0 | 0 | |

| Community investment | US$ | US$2,100,888 | US$310,899 1 | US$279,743 | US$187,511 | ||

| Economic Benefit | Proportion local and national employment | % of total employees | 95% | 95% | 96% | 96% | |

| Proportion local and national procurement | % of total procurement | 81% | 74% | 81%1 | 86% | ||

| Gender Diversity | Board gender diversity | % | 33% | 33% | 33% | 33% | |

| Executive gender diversity | % | 40% | 40% | 40% | 40% | ||

| Proportion of women employees | % | 14.7%3 | 13.8%3 | 12.0%3 | 13.1%3 | ||

| Responsible Operations | Environment | Number of significant2 environmental events | Number | 0 | 0 | 0 | 0 |

| Tailings | Number of significant2 tailings dam integrity failures | Number | 0 | 0 | 0 | 0 | |

| Water stewardship | Water used per ounce of gold produced | M3/oz | 13.8 | 6.91 | 8.05 | 7.85 | |

| Greenhouse Gas Emissions | Scope 1 and 2 Greenhouse Gas Emissions per ounce of gold produced | Tonnes of CO2-e/oz | 0.63 | 0.57 | 0.57 | 0.53 |

Notes:

- Corrected/re-stated figure from the September and December 2021 Quarter report

- A significant event is one with an actual severity rating of four and above, based on Perseus's internal severity rating scale (tired from one to five by increasing severity) as defined in our Risk Management Framework

- Permanent employees only.

BUSINESS GROWTH

OFFER TO ACQUIRE ORCA GOLD INC

During the quarter, Perseus announced that it had entered into an Arrangement Agreement with Orca Gold Inc. (TSXV: ORG) to acquire all the outstanding common shares of Orca not already owned by Perseus, by way of a statutory plan of arrangement under the Canada Business Corporations Act. Key features of the transaction included:

- The holders of all the outstanding Orca shares were offered 0.56 Perseus shares for every Orca share held.

- Based on Perseus’s closing price of A$1.74 per share immediately prior to announcement, Perseus’s offer implied consideration of approximately C$0.896 per Orca share representing a premium of 62.9% to the last closing price of Orca shares.

- Total consideration to be paid by Perseus for 100% of Orca is C$215 million which includes C$17 million in cash previously paid to acquire an initial 15% equity interest in the company and C$198 million in Perseus shares to acquire the outstanding 85% equity interest.

- Orca shareholders will own approximately 9.1% of the enlarged issued share capital of Perseus post the acquisition of Orca.

- For Perseus’s shareholders, the Orca acquisition is expected to be net asset value per share accretive and result in ownership of:

- a robust, fully licenced gold development project (Block 14) located in the supportive mining jurisdiction of Sudan, that is capable of being developed into a large-scale, long-life gold mining operation, and

- a 31.4% interest in Montage Gold Corp (TSXV: MAU), the owner of the Koné gold deposit, a second potentially large-scale, long-life gold mining operation that is located approximately 150 kilometres south of Sissingué in northern Côte d’Ivoire.

A general meeting of Orca’s shareholders is scheduled to be held on May 16, 2022 to consider the Arrangement. Assuming the requisite approvals are obtained at the meeting, completion is expected to occur on May 19, 2022 when Perseus shares will be issued to Orca shareholders.

In anticipation of a favourable vote at the Shareholders’ Meeting, the management of both Perseus and Orca have been working closely together during the quarter to plan the integration of the two companies to enable activities directed at advancing the development of Orca’s Block 14 Gold Project to commence in the September 2022 quarter.

CÔTE D’IVOIRE EXPLORATION

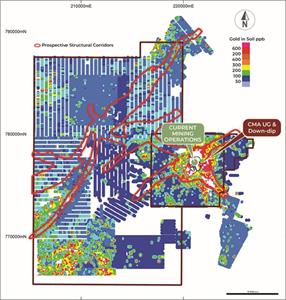

YAOURÉ EXPLORATION & EXPLOITATION PERMITS

Exploration activities on the Yaouré exploitation permit during the quarter continued to focus on drilling at the CMA Underground prospect, located within two kilometres of the Yaouré mill. Other programs included auger drilling on the Yaouré West permit (Appendix 1 – Figure 1.1).

Work at the CMA Underground prospect involved infill drilling to firm up previously defined underground resources extending below the currently planned CMA pit. Perseus defined an Inferred Mineral Resource of 1.8 million tonnes grading 6.1 g/t gold, extending to a maximum 275 metres down dip beneath the open pit resource (refer Resources and Reserves News Release dated August 24, 2021), with potential to extend mineralisation further down dip beyond this. Perseus has also completed a Scoping Study that identified the potential to mine the CMA structure using underground mining methods (refer to News Release ‘Perseus Mining Completes Scoping Study for Potential Underground Mine at Yaouré’ dated November 5, 2018).

Drilling during the quarter comprised 29,805 metres in 136 Reverse Circulation (RC) pre-collared diamond (DD) holes, continuing the infill of the existing 50 x 50 metre coverage to a nominal 25 x 25 metre pattern to allow conversion of the Inferred resource to Indicated. Results to date from the infill drilling program continue to provide strong encouragement, with intercepts generally consistent with those previously encountered in both thickness and grade.

The remaining results from the step-out drilling conducted in the December 2021 quarter to investigate the next 300 metre down-dip from the current CMA Underground resource were received. The step-out program was guided by the 2020 3D seismic survey that clearly identified the CMA structure extending to depth beyond the current drill coverage. Drilling was undertaken on an initial 100 x 200 metre pattern to better define the position of the CMA structure and the intensity of mineralisation.

The results from both the CMA Underground infill and extension drilling continue to demonstrate the potential for Perseus to materially grow its gold inventory at Yaouré organically, for further detail refer to news release ‘Perseus Discovers More High-grade Gold at Yaouré Mine’ dated April 13, 2022.

On the Yaouré West exploration permit auger geochemical drilling commenced on a property-wide 800 x 800 metre grid, with 650 metres drilled in 70 holes. The augering program is designed to map geology and define potential targets through the delineation of alteration patterns using a combination of multi-element XRF and mineral spectro-radiometry (ASD) analyses.

BAGOÉ EXPLORATION PERMIT

Limited drilling was conducted on the Bagoé permit during the March Quarter, with 1,035 metres drilled in 24 RC holes along the Bagoé Shear Zone southwest of Juliette (Appendix 1 – Figure 1.2). Assays received from this program were generally disappointing, with mostly narrow, low-grade intercepts being recorded.

GHANA EXPLORATION

AGYAKUSU OPTION

Exploration drilling continued throughout the March quarter at the Nkosuo prospect on the Agyakusu permit north of the Company’s Edikan Gold Mine (Appendix 1 – Figure 1.3). A total of 13,233 metres was drilled during the quarter in 42 RC holes, seven DD holes and 40 RC pre-collared diamond holes (RD) bringing the total drilled at Nkosuo since drilling commenced on 1 July 2021 to 37,010 metres in 220 holes, including five geotechnical holes.

As fully reported in the news release ‘Perseus Completes Resource Drilling Programme at Nkosuo’ dated 20 April 2022, the drilling continued to produce highly encouraging results, confirming strong potential for shallow gold resources capable of being mined using open pit methods, just seven kilometres from the Edikan mill.

Results from the now completed drilling will inform a Mineral Resource estimate to be completed in the June 2022 quarter. Metallurgical test work, hydrological studies and geotechnical drilling are also underway to allow the evaluation of the Ore Reserve potential in the September 2022 quarter, along with preliminary studies to meet the requirements of the ESIA process.

In anticipation that the Mineral Resource will be economically mineable, Perseus exercised its option to acquire the Agyakusu permit, and the transfer of the Exploration Licence to Perseus has received Ministerial approval after the end of the quarter.

AGYAKUSU-DML OPTION

A planned AC drilling program to test gold-in-soil anomalism along the main structural/intrusive corridor extending SW from the Nkosuo prospect on the adjoining Agyakusu permit has been deferred in favour of an initial lower impact auger program (Appendix 1 - Figure 1.3). Preparations for this program are underway, with augering to commence during the June quarter.

DOMENASE OPTION

Planned first-pass soil sampling covering the main structural/intrusive corridors on this property was further delayed pending renewal of the permit and finalisation of a new option agreement.

EXPLORATION EXPENDITURE

Expenditure on exploration activities throughout West Africa up to March 31, 2022 is outlined in Table 11 below.

Table 11: Group Exploration Expenditure March Quarter

| REGION | UNITS | SEPTEMBER 2021 QUARTER | DECEMBER 2021 QUARTER | DECEMBER 2021 HALF YEAR | MARCH 2022 QUARTER | 2022 TO DATE FINANCIAL YEAR |

| Ghana | US$ million | 2.14 | 4.13 | 6.27 | 4.13 | 10.40 |

| Côte d’Ivoire | ||||||

| Sissingué | US$ million | 1.10 | 0.53 | 1.63 | 0.77 | 2.40 |

| Yaouré | US$ million | 4.16 | 6.09 | 10.25 | 9.19 | 19.44 |

| Regional | US$ million | 0.25 | 0.01 | 0.26 | 0.01 | 0.27 |

| Sub-total | US$ million | 5.52 | 6.62 | 12.14 | 9.97 | 22.10 |

| Total West Africa | US$ million | 7.66 | 10.75 | 18.42 | 14.09 | 32.50 |

GROUP FINANCIAL POSITION

CASHFLOW AND BALANCE SHEET (UNAUDITED)

Perseus achieved yet another strong quarter of cash generation, with a US$66.1 million increase in its overall net cash position (or cash plus bullion less interest-bearing debt) relative to the prior quarter. The Yaouré Gold Mine continued its strong cash generation performance, Sissingué produced slightly less cash than in the previous quarter, mostly due to a reduced head grade of ore treated, whilst performance at Edikan continues to improve.

Based on the spot gold price of US$1,924.10 per ounce and an A$:US$ exchange rate of 0.749141 at March 31, 2022, the total value of cash and bullion on hand at the end of the quarter was A$371.4 million, (US$278.2 million) including cash of A$343.7 million (US$257.5 million) and 10,783 ounces of bullion on hand, valued at A$27.7 million (US$20.7 million). No debt repayments were made during the quarter, leaving the principal amount owing on the Corporate Facility at US$50.0 million.

The graph below (Figure 1) shows the notional operating cash flows from the three mines, the largest single driver of cash movement, and compares this to historical data derived over the past 2 years. Note that “Notional Operating Cash Flow” is obtained by multiplying average sales price less AISC (the “notional margin”) by the ounces of gold recovered.

Figure 1: Notional Operating Cashflow

https://www.globenewswire.com/NewsRoom/AttachmentNg/dcb59c83-2506-4286-8952-373a0b69d2ca

The overall movement in cash and bullion during the quarter is shown below in Figure 2. Aside from the operating margin, other relevant movements are, Australian and West African corporate costs (A$8.8 million), business growth (A$17.9 million), debt service and other finance costs (A$1.3 million), other capex (A$4.3 million, and payments related to the Orca transaction (A$26.2 million).

Figure 2: Quarterly Cash and Bullion Movements

https://www.globenewswire.com/NewsRoom/AttachmentNg/019ae838-a170-43be-871a-5c8ab8ab9121

GOLD PRICE HEDGING

At the end of the quarter, Perseus held gold forward sales contracts for 294,329 ounces of gold at a weighted average sales price of US$1,825 per ounce. These price hedges are designated for delivery progressively over the period up to 30 September 2023. Perseus also held spot deferred sales contracts for a further 90,800 ounces of gold at a weighted average sales price of US$1,742 per ounce. Combining both sets of sales contracts, Perseus’s total hedged position at the end of the quarter was 385,129 ounces at a weighted average sales price of US$1,805 per ounce.

Perseus’s hedge position has increased by 83,835 ounces since the end of the December 2021 quarter, specifically intended to provide price protection during a relatively high-cost year when waste stripping of the Fimbiasso pit occurs. As a result of our policy of replacing lower priced hedges with higher priced hedge contracts when possible, the weighted average sales price of the hedge book increased by US$112 per ounce or 6.6% during the quarter.

Hedging contracts currently provide downside price protection to approximately 23% of Perseus’s currently forecast gold production for the next three years, leaving 77% of forecast production potentially exposed to movements (both up and down) in the gold price.

JUNE 2022 QUARTER ANNOUNCEMENTS

- 13 April – Yaouré Exploration Update

- 21 April – Orca Transaction Update

- 20 April – Edikan Exploration Update

- 26 April – March 2022 Quarter Report

- May 2022 – Completion of Orca Plan of Arrangement

- May 2022 – Nkosuo Mineral Resource Estimate

- June 2022 – CMA UG Mineral Resource Estimate

- June 2022 – Update on planned Edikan Preventative Maintenance Plant Shutdown

This market announcement was authorised for release by the board of Perseus Mining Limited.

COMPETENT PERSON STATEMENT

All production targets referred to in this report are underpinned by estimated Ore Reserves which have been prepared by competent persons in accordance with the requirements of the JORC Code.

Edikan. The information in this report that relates to AF Gap Mineral Resources and Ore Reserve estimate was first reported by the Company in a market announcement “Perseus Mining Updates Mineral Resources and Ore Reserves” released on 26 August 2020. The information in this report that relates to the Mineral Resource and Ore Reserve estimates for the Fetish deposit and the Heap Leach was first reported by the Company in a market announcement “Perseus Mining Updates Edikan Gold Mine’s Mineral Resources and Ore Reserves” released on 20 February 2020. The Mineral Reserve and Ore Reserve estimates for the abovementioned deposits were updated for depletion as at 30 June 2021 in a market announcement. “Perseus Mining Updates Mineral Resources and Ore Reserves” released on 24 August 2021. The information in this report that relates to Esuajah North Mineral Resources estimate was first reported by the Company in a market announcement “Perseus Mining Updates Mineral Resources and Ore Reserves” released on 29 August 2018. The information in this report that relates to the Mineral Resource and Ore Reserve estimates for Esuajah South Underground deposit was first reported by the Company in a market announcement “Perseus Mining Updates Mineral Resources and Ore Reserves” released on 24 August 2021. The Company confirms that it is not aware of any new information or data that materially affect the information in those market releases and that all material assumptions underpinning those estimates and the production targets, or the forecast financial information derived therefrom, continue to apply and have not materially changed. The Company further confirms that material assumptions underpinning the estimates of Ore Reserves described in “Technical Report — Central Ashanti Gold Project, Ghana” dated 30 May 2011 continue to apply.

Sissingué, Fimbiasso, Bagoé. The information in this report that relates to Mineral Resource and Ore Reserve estimates for the Fimbiasso deposits was first reported by the Company in a market announcement “Perseus Mining Updates Mineral Resources and Ore Reserves” released on 26 August 2020. The information in this report that relates to Mineral Resource and Ore Reserve estimates for the Sissingué and Bagoé deposits was first reported by the Company in a market announcement “Perseus Mining Updates Mineral Resources and Ore Reserves” released on 24 August 2021. The Company confirms that it is not aware of any new information or data that materially affect the information in these market releases and that all material assumptions underpinning those estimates and the production targets, or the forecast financial information derived therefrom, continue to apply and have not materially changed. The Company further confirms that material assumptions underpinning the estimates of Ore Reserves described in “Technical Report — Sissingué Gold Project, Côte d’Ivoire” dated 29 May 2015 continue to apply.

Yaouré. The information in this report that relates to Open Pit and Heap Leach Mineral Resources and Ore Reserves at Yaouré was first reported by the Company in a market announcement “Perseus Mining Updates Mineral Resources and Ore Reserves” released on 28 August 2019 and updated for mining depletion as at 30 June 2021 in a market announcement released on 24 August 2021. The information in this report that relates to Underground Mineral Resources at Yaouré was first reported by the Company in a market announcement “Perseus Mining Completes Scoping Study for Potential Underground Mine at Yaouré” released on 5 November 2018 and adjusted to exclude material lying within the US$1,800/oz pit shell that constrains the Open Pit Mineral Resources in a market announcement “Perseus Mining Updates Mineral Resources and Ore Reserves” released on 28 August 2019. The information in this report that relates to the Yaouré near mine satellite deposit Mineral Resource and Ore Reserve estimates was first reported by the Company in a market announcement “Perseus Mining Updates Mineral Resources and Ore Reserves” released on 24 August 2021. The Company confirms that all material assumptions underpinning those estimates and the production targets, or the forecast financial information derived therefrom, in that market release continue to apply and have not materially changed. The Company further confirms that material assumptions underpinning the estimates of Ore Reserves described in “Technical Report — Yaouré Gold Project, Côte d’Ivoire” dated 18 December 2017 continue to apply.

The information in this report relating to exploration results was first reported by the Company in compliance with the JORC Code 2012 and NI43-101 in market updates “Perseus Discovers More High-grade Gold at Yaouré Mine ” released on 13 April 2022 and “Perseus Completes Resource Drilling Programme at Nkosuo” released on 20 April 2022. The Company confirms that it is not aware of any new information or data that materially affect the information in these market releases.

CAUTION REGARDING FORWARD LOOKING INFORMATION:

This report contains forward-looking information which is based on the assumptions, estimates, analysis and opinions of management made in light of its experience and its perception of trends, current conditions and expected developments, as well as other factors that management of the Company believes to be relevant and reasonable in the circumstances at the date that such statements are made, but which may prove to be incorrect. Assumptions have been made by the Company regarding, among other things: the price of gold, continuing commercial production at the Yaouré Gold Mine, the Edikan Gold Mine and the Sissingué Gold Mine without any major disruption due to the COVID-19 pandemic or otherwise, , the receipt of required governmental approvals, the accuracy of capital and operating cost estimates, the ability of the Company to operate in a safe, efficient and effective manner and the ability of the Company to obtain financing as and when required and on reasonable terms. Readers are cautioned that the foregoing list is not exhaustive of all factors and assumptions which may have been used by the Company. Although management believes that the assumptions made by the Company and the expectations represented by such information are reasonable, there can be no assurance that the forward-looking information will prove to be accurate. Forward-looking information involves known and unknown risks, uncertainties, and other factors which may cause the actual results, performance or achievements of the Company to be materially different from any anticipated future results, performance or achievements expressed or implied by such forward-looking information. Such factors include, among others, the actual market price of gold, the actual results of current exploration, the actual results of future exploration, changes in project parameters as plans continue to be evaluated, as well as those factors disclosed in the Company's publicly filed documents. The Company believes that the assumptions and expectations reflected in the forward-looking information are reasonable. Assumptions have been made regarding, among other things, the Company’s ability to carry on its exploration and development activities, the timely receipt of required approvals, the price of gold, the ability of the Company to operate in a safe, efficient and effective manner and the ability of the Company to obtain financing as and when required and on reasonable terms. Readers should not place undue reliance on forward-looking information. Perseus does not undertake to update any forward-looking information, except in accordance with applicable securities laws.

| ASX/TSX CODE: PRU CAPITAL STRUCTURE: Ordinary shares: 1,233,068,447 Performance rights: 19,230,361 REGISTERED OFFICE: Level 2 437 Roberts Road Subiaco WA 6008 Telephone: +61 8 6144 1700 Email: IR@perseusmining.com WWW.PERSEUSMINING.COM | DIRECTORS: Mr Sean Harvey Non-Executive Chairman Mr Jeff Quartermaine Managing Director & CEO Ms Elissa Brown Non-Executive Director Mr Dan Lougher Non-Executive Director Mr John McGloin Non-Executive Director Mr David Ransom Non-Executive Director Amber Banfield Non-Executive Director | CONTACTS: Jeff Quartermaine Managing Director & CEO jeff.quartermaine@perseusmining.com Claire Hall Corporate Communications +61 414 558 202 claire.hall@perseusmining.com Nathan Ryan Media Relations +61 4 20 582 887 nathan.ryan@nwrcommunications.com.au |

APPENDIX 1 – MAPS AND DIAGRAMS

Figure 1.1: Yaouré Gold Project – Tenements and Prospects

https://www.globenewswire.com/NewsRoom/AttachmentNg/2763955d-5eb0-41a8-9eee-bbb8d0125ee7

Figure 1.2: Sissingué Gold Mine and Bagoé Project – Tenements and Prospects

https://www.globenewswire.com/NewsRoom/AttachmentNg/43708abd-2ee5-4e99-9847-14cbe29aedb2

Figure 1.3: Edikan Gold Mine – Regional Geology, Tenements and Prospects

https://www.globenewswire.com/NewsRoom/AttachmentNg/8040be95-69a5-48da-b4ce-d2dca9ae5eb3

______________________

1. Assumes a gold price of US$1,500 per ounce for Ore Reserve.