Marimaca Announces Significant Increase in Mineral Resources at the Marimaca Copper Project

98% increase in M&I Resource tonnes to 140Mt at 0.48% CuT for 665.5kt of Contained Copper

92% growth in Inferred Resource tonnes to 83Mt at 0.39% CuT for 322.9kt of Contained Copper

Marimaca Confirmed as One of the Largest Copper Discoveries in the Last Decade(2)

VANCOUVER, British Columbia, Oct. 13, 2022 (GLOBE NEWSWIRE) -- Marimaca Copper Corp. (“Marimaca Copper” or the “Company”) (TSX: MARI) is pleased to announce an updated Mineral Resource Estimate (“MRE”) for the Marimaca Oxide Deposit (the “MOD” or the “Project”) located in the Antofagasta region of northern Chile. The 2022 MRE demonstrates significant resource growth over the 2019 MRE and marks an important step-change in the scale of the Project, supporting a potential production rate higher than proposed in the Preliminary Economic Assessment (“PEA”).

The 2022 MRE incorporates 19,580m of ~41,500m of drilling (reverse circulation (“RC”) + diamond) completed in 2022 for a total of over 110,000m of drilling completed since 2016. The balance of the 2022 infill drilling program, totalling approximately 28,000m, will be included in a subsequent MRE planned for early 2023 with the objective of converting the remaining Inferred Resources to the Measured and Indicated Categories to underpin the Definitive Feasibility Study (“DFS”) planned for 2023.

The 2022 MRE was prepared in accordance with the Canadian Institute of Mining, Metallurgy and Petroleum ("CIM") Definition Standards and National Instrument 43-101 - Standards of Disclosure for Mineral Projects ("NI 43-101").

Highlights

- Significant increase in M&I and Inferred tonnage and contained metal over the 2019 MRE1

- 98% growth in Measured and Indicated Resource tonnage to 139.6Mt at 0.48% CuT (0.30% CuS) for ~665,000 tonnes of contained Cu metal

- 92% growth in Inferred Resource tonnage to 82.7Mt at 0.39% CuT (0.16% CuS) for ~323,000 tonnes of contained Cu

- Establishes Marimaca as one of the largest copper discoveries globally in the last decade2 and has positive implications for production scale increases in future development studies

- 50kt and 60kt per annum copper cathode production cases (vs. 36ktpa LOM average in PEA) will be assessed for DFS

- High grade core which comprises the first six years of the 2019 PEA mine life is expected to remain intact and accessible in a scaled-up development scenario

- Approximately 50Mt at 0.7% CuT commencing from surface in green oxide3 for ~350,000 tonnes of contained metal

- Very low strip ratio of 1:1 maintained in constraining pit shell, with all resources captured in a single continuous pit

- Low pre-strip and LOM strip ratio drive significant cost advantages

- Clear opportunities remain for additional resource expansion with further exploration:

- Mineralization at the MOD remains open to the east, south-east, and down-plunge

- Near mine (<5km) satellite targets discovered in 2021 – Mercedes, Cindy, and Robles (see announcement dated January 20, 2022) – provide high probability targets for further mine life extension

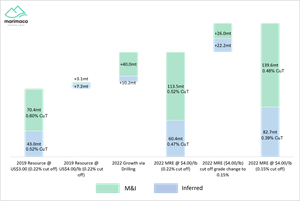

- 2019 MRE showed relatively low sensitivity to changes in underlying copper price assumption indicating high return on investment of 2021 and 2022 drilling campaigns as they pertained to resource growth for the MOD (see Figure 1)

- Significant amount of remaining 2022 drilling to be captured in planned early 2023 MRE

- Targeting majority of tonnes to be captured in M&I categories to support eventual reserves

- Potential for new higher-grade green oxide zone identified in the shallow north and north- eastern areas of MOD to have positive grade implications for final MRE in early 2023

1 2019 MRE at a 0.22% cut-off grade, 2022 MRE at a 0.15% cut-off grade

2 Source: S&P Global Market Intelligence

3 Per the June 2020 PEA mine plan

Hayden Locke, President & CEO of Marimaca Copper, commented:

“Sergio Rivera and his team delivered two very successful drilling programs in 2021 and 2022 through challenging operating conditions discovering new additional mineralisation adjacent and below the current Marimaca pit model. The 2022 MRE is a fantastic achievement and reflects the exceptional exploration and geological work completed by our extremely dedicated team.

“With the discovery of the MOD depth extensions in 2021, we believed there was the potential to make a step change in the scale of the resource. This MRE has clearly achieved that. It establishes the MOD as one of the most significant greenfield copper oxide discoveries in the last 20 years and confirms its potential to host over one million tonnes of contained copper in a single pit.

“Given the M&I resource estimate already points to more than 600,000 tonnes of contained metal, the Project will now clearly support a larger operation in terms of copper cathode production, but also a meaningful mine life extension. We will assess production scenarios between 50,000 and 60,000 tonnes per annum prior to commencing our Definitive Feasibility Study in 2023.

“Importantly, the positive attributes which were key to the MOD’s industry leading return on invested capital (ROIC) metrics – low life of mine strip ratio, shallow high-grade core in the first five years of the mine life, minimal pre-strip and low expected start up capital cost – remain firmly intact, meaning this resource upgrade will be reflected as a material improvement in project value.

“We have completed another 28,000m of drilling for which we are waiting on results. These will be released over the coming months and incorporated into a final MRE in early 2023, which will form the basis of our development plans for the Project.”

Summary of 2022 Mineral Resource Estimate

The 2022 MRE was completed by independent consultants NCL Ingeniería y Construcción SpA (“NCL”) and verified by Luis Oviedo of NCL, a qualified person under NI 43-101 and independent of Marimaca. The 2022 MRE incorporates 110,790m of drilling across 424 drill holes completed between 2016 and 2022 and is reported with an effective date of October 13, 2022. The Whittle Optimisations were run using the operating cost parameters from the Preliminary Economic Assessment for the Project and US$4/lb copper price assumption.

| Mineral Resource Category and Type | Quantity | CuT | CuS | CuT | CuS |

| (kt) | (%) | (%) | (t) | (t) | |

| Total Measured | 47,051 | 0.54 | 0.36 | 253,157 | 167,614 |

| Total Indicated | 92,516 | 0.45 | 0.26 | 412,375 | 244,200 |

| Total Measured and Indicated | 139,567 | 0.48 | 0.30 | 665,531 | 411,814 |

| Total Inferred | 82,678 | 0.39 | 0.16 | 322,910 | 128,416 |

Table 1. 2022 Mineral Resource Estimate

* Pit shell constrained resources with demonstrated reasonable prospects for eventual economic extraction (RPEEE) are generated using series of Lerchs-Grossmann pit shell optimizations completed by NCL

* CuT means total copper and CuS means acid soluble copper. Technical and economic parameters include: copper price US$4.00/lb; mining cost US$1.51/t; HL processing cost US$5.94/t (incl. G&A); ROM processing cost US$1.65/t (incl. G&A); selling cost US$0.16/lb Cu; heap leach recovery 76% of CuT; ROM recovery 40% of CuT; and 45°-52° pit slope angle

* With the economic parameters stated above, the Cut-Off grade of the Mineral Resource Estimate is approximately 0.15% CuT and a strip ratio of 1:1 has been estimated by NCL.

* Mineral resources which are not mineral reserves do not have demonstrated economic viability. Due to the uncertainty which may attach to inferred mineral resources, it cannot be assumed that all or any part of an inferred mineral resource will be upgraded to an indicated or measured mineral resource as a result of continued exploration

| Cut-off grade (% CuT) | Measured | Indicated | Measured + Indicated | Inferred | |||||||||

| Quantity kt | CuT [%] | CuS [%] | Quantity kt | CuT [%] | CuS [%] | Quantity kt | CuT [%] | CuS [%] | Quantity kt | CuT [%] | CuS [%] | ||

| 0.40 | 24,607 | 0.79 | 0.53 | 37,550 | 0.72 | 0.44 | 62,158 | 0.74 | 0.48 | 27,222 | 0.68 | 0.25 | |

| 0.30 | 32,157 | 0.68 | 0.46 | 54,563 | 0.60 | 0.37 | 86,720 | 0.63 | 0.40 | 41,422 | 0.56 | 0.22 | |

| 0.25 | 36,837 | 0.63 | 0.42 | 65,910 | 0.55 | 0.33 | 102,746 | 0.58 | 0.36 | 52,332 | 0.50 | 0.20 | |

| 0.22 | 40,000 | 0.60 | 0.40 | 73,517 | 0.51 | 0.31 | 113,517 | 0.54 | 0.34 | 60,431 | 0.47 | 0.19 | |

| 0.20 | 42,206 | 0.58 | 0.39 | 78,880 | 0.49 | 0.30 | 121,086 | 0.52 | 0.33 | 66,256 | 0.44 | 0.18 | |

| 0.18 | 44,291 | 0.56 | 0.37 | 84,610 | 0.47 | 0.28 | 128,900 | 0.50 | 0.31 | 72,670 | 0.42 | 0.17 | |

| 0.15 | 47,051 | 0.54 | 0.36 | 92,516 | 0.45 | 0.26 | 139,567 | 0.48 | 0.30 | 82,678 | 0.39 | 0.16 | |

| 0.10 | 50,536 | 0.51 | 0.34 | 100,946 | 0.42 | 0.25 | 151,482 | 0.45 | 0.28 | 96,064 | 0.35 | 0.14 | |

| 0.05 | 57,125 | 0.46 | 0.30 | 119,653 | 0.36 | 0.21 | 176,777 | 0.39 | 0.24 | 123,552 | 0.29 | 0.11 | |

| 0.00 | 61,333 | 0.43 | 0.28 | 129,985 | 0.34 | 0.20 | 191,318 | 0.37 | 0.22 | 134,056 | 0.27 | 0.11 | |

Table 2. Mineral Resource Sensitivity

* Pit shell constrained resources with demonstrated reasonable prospects for eventual economic extraction (RPEEE) are generated using series of Lerchs-Grossmann pit shell optimizations completed by NCL

* CuT means total copper and CuS means acid soluble copper. Technical and economic parameters include: copper price US$4.00/lb; mining cost US$1.51/t; HL processing cost US$5.94/t (incl. G&A); ROM processing cost US$1.65/t (incl. G&A); selling cost US$0.16/lb Cu; heap leach recovery 76% of CuT; ROM recovery 40% of CuT; and 45°-52° pit slope angle

* With the economic parameters stated above, the Cut-Off grade of the Mineral Resource Estimate is approximately 0.15% CuT and a strip ratio of 1:1 has been estimated by NCL.

* Mineral resources which are not mineral reserves do not have demonstrated economic viability. Due to the uncertainty which may attach to inferred mineral resources, it cannot be assumed that all or any part of an inferred mineral resource will be upgraded to an indicated or measured mineral resource as a result of continued exploration

Outcome of 2021 and 2022 Expansion & Infill Drill Programs

Figure 1 demonstrates Resource growth in the 2022 MRE attributable to both the increased copper price assumption, and growth driven by the results of the 2021 and 2022 drilling campaigns. Drilling delivered strong extensions both below the previously interpreted limits of the Marimaca oxide mineralization into the newly-discovered zone of mixed mineralization (“MAMIX”), as well as on the east and south-east periphery of the MOD where mineralization was previously interpreted to be thinning. Both areas delivered extensions to higher-grade zones and had a positive influence on the contained metal increases in the 2022 MRE relative to the 2019 MRE.

Figure 1. Resource Growth – Tonnage

https://www.globenewswire.com/NewsRoom/AttachmentNg/51043c14-d8d9-47a5-be47-9e052c09dcab

Metallurgy Commentary

Marimaca has completed 5 phases of extensive metallurgical test work at Marimaca. Results from Phase 5 were announced on June 15, 2022 following a rigorous program including full-scale column testing, mini-column testing, container-leach testing, sulfation tests, acid sensitivity testing, Iso-pH testing, and head characterization for heap leach (“HL”) and run-of-mine (“ROM”) samples. In-line with results from Phases 1-4, Phase 5 recoveries in the column and bottle roll tests generally exceeded the solubility ratio (CuS/CuT) and leaching potential of the samples, indicating a potentially larger proportion of total copper will be recovered in industrial-scale operations. The leaching potential of copper ores is defined as acid soluble copper (CuS) plus cyanide soluble copper (CuCN) divided by total copper (CuT). The acid solubility ratio (CuS/CuT) for copper oxides such as atacamite, brochantite and chrysocolla, which dissolve quickly when exposed to acid, is a good predictor of leachability. However, where the mineralization has several copper bearing minerals with different dissolution characteristics under these leaching conditions (such as Marimaca’s black oxide (wad) component), the copper acid solubility ratio may materially underestimate the acid leaching potential for heap leach operations, especially where soluble copper sulphides such as chalcocite, covellite and bornite are present.

The Marimaca Deposit Commentary

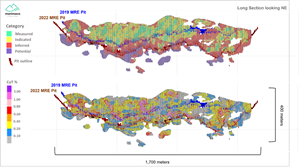

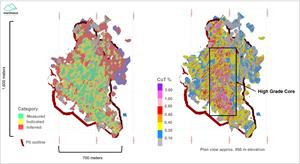

The 2021/22 drilling programs and subsequent 2022 MRE provide further validation of the Marimaca geological model developed by the Company’s exploration team. Figure 2 (long section) demonstrates the continuity of the oxide mineralization across the N-S extent of the deposit. Mineralization is hosted consistently by east-dipping fracture sets with higher grades concentrated along controlling NW-SE structures and splays. Higher grade green oxide mineralization (brochantite, atacamite, chrysocolla) dominates the core of the deposit and is located near-surface. High grade zones of oxides, mixed and enriched mineralization extend at depth into the underlying MAMIX zone which was an important driver of growth in the 2022 MRE. Due to the continuous nature of mineralization, the increased copper price assumption does not materially impact the Project’s strip ratio due to the extensive green and black oxide (wad) mineralized halo which gets captured by the larger resource pit.

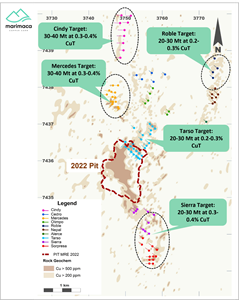

The Company believes that significant oxide resource upside remains at the MOD and in nearby satellite targets. At the MOD, mineralized intercepts located to the east and southeast of the deposit have not been captured in the 2022 MRE due to lack of sufficient drill density. The MOD remains open to the east and southeast and further exploration may be planned in due course. In addition, the satellite oxide discoveries made in 2021 (Mercedes, Cindy, Roble) have not received sufficient drilling to be included in the 2022 MRE. The plan map seen in Figure 4 demonstrates the proximity of the satellite targets to the 2022 MRE resource pit.

Figure 2. Long Section, Looking North-East, 2022 MRE Pit Shell

https://www.globenewswire.com/NewsRoom/AttachmentNg/97facfaf-c411-44aa-849a-4999346486ff

Figure 3. Block Model Plan View – 2022 MRE

https://www.globenewswire.com/NewsRoom/AttachmentNg/08428edb-1051-4fca-a400-23e70e092445

Figure 4. Plan View of Marimaca Satellite Exploration Targets

https://www.globenewswire.com/NewsRoom/AttachmentNg/ddd27096-27c1-4ec3-a64e-4183e3afd6e6

The potential quantity and grade presented in the exploration target ranges are conceptual and have insufficient exploration and drill density to define a Mineral Resource. At this stage, it is uncertain if further exploration will result in the targets being delineated as a Mineral Resource. Estimates of exploration targets are not Mineral Resources and are too speculative to meet the NI 43-101 reporting standards. The detailed methodology for preparing the Exploration Targets and a summary of supporting technical data can be found in the announcement dated January 20, 2022 “Marimaca Announces Exploration Targets for Near-Pit Oxide Satellites and MAMIX Depth Extension”.

2022 MRE Estimation Parameters

Grade estimates were completed using ordinary kriging with nominal block size measuring 5m by 5m by 5m. Resources have been classified by their proximity to sample locations and number of drill holes and samples within different search ellipsoids, and are reported according to Canadian Institute of Mining, Metallurgy and Petroleum (CIM) Definition Standards for Mineral Resources and Mineral Reserves and National Instrument 43-101 - Standards of Disclosure for Mineral Projects.

Operating costs and certain operating parameters, such as metallurgical recoveries, were taken from the 2020 Preliminary Economic Assessment, which was completed by Ausenco according to Canadian Institute of Mining, Metallurgy and Petroleum (CIM) Definition Standards for Mineral Resources and Mineral Reserves and National Instrument 43-101 - Standards of Disclosure for Mineral Projects.

| Mineral Resource Category and Type | Quantity | CuT | CuS | CuT | CuS |

| (kt) | (%) | (%) | (t) | (t) | |

| Measured | |||||

| Brochantite | 22,371 | 0.65 | 0.47 | 144,870 | 104,957 |

| Chrysocolla | 12,252 | 0.46 | 0.36 | 56,558 | 44,057 |

| Wad/Black oxides | 6,578 | 0.31 | 0.17 | 20,366 | 11,445 |

| Mixed | 5,106 | 0.55 | 0.13 | 28,176 | 6,693 |

| Enriched | 743 | 0.43 | 0.06 | 3,186 | 462 |

| Total Measured | 47,051 | 0.54 | 0.36 | 253,157 | 167,614 |

| Indicated | |||||

| Brochantite | 27,865 | 0.60 | 0.44 | 166,469 | 122,706 |

| Chrysocolla | 18,239 | 0.41 | 0.30 | 74,012 | 55,497 |

| Wad/Black oxides | 28,036 | 0.29 | 0.16 | 82,607 | 45,340 |

| Mixed | 14,557 | 0.51 | 0.13 | 73,595 | 18,413 |

| Enriched | 3,819 | 0.41 | 0.06 | 15,692 | 2,244 |

| Total Indicated | 92,516 | 0.45 | 0.26 | 412,375 | 244,200 |

| Measured and Indicated | |||||

| Brochantite | 50,235 | 0.62 | 0.45 | 311,340 | 227,663 |

| Chrysocolla | 30,492 | 0.43 | 0.33 | 130,571 | 99,554 |

| Wad/Black oxides | 34,614 | 0.30 | 0.16 | 102,973 | 56,785 |

| Mixed | 19,664 | 0.52 | 0.13 | 101,771 | 25,106 |

| Enriched | 4,562 | 0.41 | 0.06 | 18,877 | 2,706 |

| Total Measured and Indicated | 139,567 | 0.48 | 0.30 | 665,531 | 411,814 |

| Inferred | |||||

| Brochantite | 10,364 | 0.52 | 0.37 | 54,026 | 38,124 |

| Chrysocolla | 9,028 | 0.35 | 0.25 | 31,400 | 22,496 |

| Wad/Black oxides | 24,907 | 0.28 | 0.14 | 70,325 | 35,229 |

| Mixed | 17,129 | 0.47 | 0.12 | 80,152 | 19,809 |

| Enriched | 21,249 | 0.41 | 0.06 | 87,008 | 12,758 |

| Total Inferred | 82,678 | 0.39 | 0.16 | 322,910 | 128,416 |

Table 3. 2022 MRE by Mineralization Type

* Pit shell constrained resources with demonstrated reasonable prospects for eventual economic extraction (RPEEE) are generated using series of Lerchs-Grossmann pit shell optimizations completed by NCL

* CuT means total copper and CuS means acid soluble copper. Technical and economic parameters include: copper price US$4.00/lb; mining cost US$1.51/t; HL processing cost US$5.94/t (incl. G&A); ROM processing cost US$1.65/t (incl. G&A); selling cost US$0.16/lb Cu; heap leach recovery 76% of CuT; ROM recovery 40% of CuT; and 45°-52° pit slope angle

* With the economic parameters stated above, the Cut-Off grade of the Mineral Resource Estimate is approximately 0.15% CuT and a strip ratio of 1:1 has been estimated by NCL.

* Mineral resources which are not mineral reserves do not have demonstrated economic viability. Due to the uncertainty which may attach to inferred mineral resources, it cannot be assumed that all or any part of an inferred mineral resource will be upgraded to an indicated or measured mineral resource as a result of continued exploration

Qualified Person

The technical information in this news release, including the information related to geology, drilling, mineralization, modeling and estimation has been reviewed and approved by Luis Oviedo, an independent Consulting Geologist with more than 45 years of experience. Mr. Oviedo is a member of the Colegio de Geólogos and the Institute of Mining Engineers of Chile and is an Independent Qualified Person as defined by National Instrument 43-101 – Standards of Disclosure for Mineral Projects.

The QP confirms he has visited the project area, has reviewed relevant project information, is responsible for the information contained in this news release, and consents to its publication.

Contact Information

For further information please visit www.marimaca.com or contact:

Tavistock

+44 (0) 207 920 3150

Emily Moss / Adam Baynes

marimaca@tavistock.co.uk

Forward Looking Statements

This news release includes certain “forward-looking statements” under applicable Canadian securities legislation. There can be no assurance that such statements will prove to be accurate, and actual results and future events could differ materially from those anticipated in such statements. Forward-looking statements reflect the beliefs, opinions and projections on the date the statements are made and are based upon a number of assumptions and estimates that, while considered reasonable by Marimaca Copper, are inherently subject to significant business, economic, competitive, political and social uncertainties and contingencies. Many factors, both known and unknown, could cause actual results, performance or achievements to be materially different from the results, performance or achievements that are or may be expressed or implied by such forward-looking statements and the parties have made assumptions and estimates based on or related to many of these factors. Such factors include, without limitation: risks related to share price and market conditions, the inherent risks involved in the mining, exploration and development of mineral properties, the uncertainties involved in interpreting drilling results and other geological data, fluctuating metal prices, the possibility of project delays or cost overruns or unanticipated excessive operating costs and expenses, uncertainties related to the necessity of financing, the availability of and costs of financing needed in the future as well as those factors disclosed in the annual information form of the Company dated March 28, 2022, the final short form base prospectus and other filings made by the Company with the Canadian securities regulatory authorities (which may be viewed at www.sedar.com). Accordingly, readers should not place undue reliance on forward-looking statements. Marimaca Copper undertakes no obligation to update publicly or otherwise revise any forward-looking statements contained herein whether as a result of new information or future events or otherwise, except as may be required by law.

Neither the Toronto Stock Exchange nor the Investment Industry Regulatory Organization of Canada accepts responsibility for the adequacy or accuracy of this release.