MAS Gold Completes Drilling on their 100% Owned North Lake Deposit

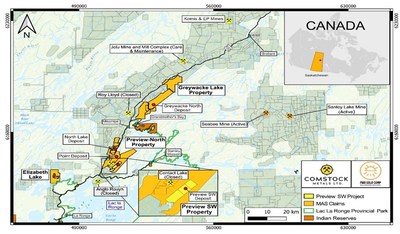

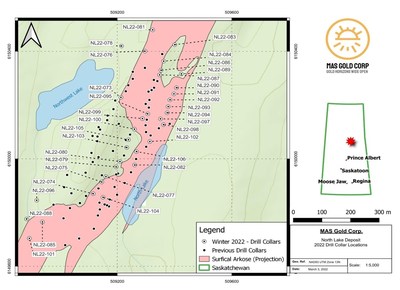

SASKATOON, SK, March 8, 2022 /CNW/ - MAS Gold Corp. ("MAS Gold") (TSX.V: MAS) has completed drilling at the North Lake Deposit on its 100% owned Preview North Property in the La Ronge Gold Belt, Saskatchewan (Figure 1). A total of 4,123.5 metres were completed over 34 diamond drill holes (DDH) (Figure 2). Samples are currently being processed and delivered to SRC Laboratories in Saskatoon Saskatchewan.

The drill program was successful in completing 24 infill drill holes, four twin drill holes and six exploration drill holes (Table 1). A total of 3,759 samples were sent for assay with 3,256 being core samples and 503 additional samples reserved for Quality Assurance and Quality Control (QAQC). A robust QAQC program was implemented at the start of the drill program at the North Lake Deposit which resulted in 13% percent of the samples sent to SRC were dedicated to QAQC. All drill holes were successful in intersecting the felsite unit (also mapped as Arkose) which is known to host previously intersected mineralization hosted in broad zones of sheeted quartz veins. DDH NL22-081 and NL22-083 were successful in extending the felsite by 80 metres to the northeast and DDH NL22-101 was successful in extending felsite by 50 meters to the southwest (Figure 2).

"In addition to implementing an aggressive QAQC program the MAS geological team was able to successfully extend the felsite host by 80 metres to the northwest and 50 metres to the southwest," reported Jim Engdahl, CEO of MAS Gold Corp. He continued, "We are excited to initiate our next phase of drilling on the Point Deposit and the Preview SW Deposit."

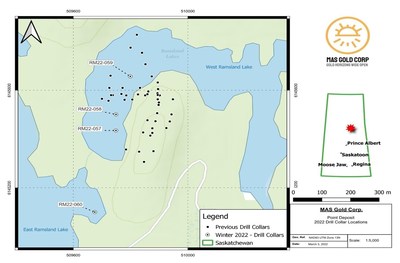

The on-going drilling is expected to continue throughout the month of March as the next phase of the program transitions to the Point Deposit and the Preview SW Deposit. One drill rig is currently operating at the Point Deposit on MAS Gold's Preview-North property and has completed three holes (RM22-057 through RM22-059) for a total of 584 metres with one drill hole in progress (RM22-060) (Figure 3).

Point Deposit (MAS Gold Corp.)

The 800-metre (m) drill program is currently ongoing at the Point Deposit is designed to:

- Test three high-priority targets identified during 2019 drilling program.

- Test high priority anomaly identified in the 2021 summer field program.

- Extend mineralization to the south with strategically planned drill holes.

Preview SW Property (Comstock Metals Ltd.)

The drill program at the Preview SW Property is now anticipated to complete a 1,400 metre program which will include expenditures from Comstock. The program is designed to further define the historical resource at the Preview SW Deposit and extend mineralization at the North Zone.

Table 1: North Lake Collar Summary

North Lake Drilling Summary | |||

Hole ID | Azimuth | Dip | EOH |

NL22-073 | 110 | -60 | 238.5 |

NL22-074 | 110 | -60 | 127 |

NL22-075 | 110 | -60 | 134 |

NL22-076 | 110 | -60 | 173 |

NL22-077 | 110 | -60 | 167 |

NL22-078 | 110 | -55 | 263 |

NL22-079 | 110 | -60 | 140 |

NL22-080 | 110 | -65 | 140 |

NL22-081 | 110 | -45 | 167 |

NL22-082 | 110 | -45 | 80 |

NL22-083 | 110 | -45 | 83 |

NL22-084 | 110 | -45 | 107 |

NL22-085 | 110 | -60 | 180 |

NL22-086 | 110 | -45 | 107 |

NL22-087 | 110 | -45 | 113 |

NL22-088 | 110 | -60 | 233 |

NL22-089 | 110 | -45 | 35 |

NL22-090 | 110 | -45 | 41 |

NL22-091 | 110 | -45 | 44 |

NL22-092 | 110 | -45 | 53 |

NL22-093 | 110 | -45 | 47 |

NL22-094 | 110 | -45 | 94 |

NL22-095 | 110 | -55 | 101 |

NL22-096 | 110 | -60 | 239 |

NL22-097 | 110 | -45 | 56 |

NL22-098 | 110 | -45 | 44 |

NL22-099 | 110 | -65 | 110 |

NL22-100 | 110 | -55 | 110 |

NL22-101 | 110 | -60 | 221 |

NL22-102 | 110 | -45 | 53 |

NL22-103 | 110 | -65 | 137 |

NL22-104 | 110 | -60 | 94 |

NL22-105 | 110 | -45 | 106 |

NL22-106 | 110 | -45 | 86 |

TOTAL HOLES DRILLED | TOTAL METRES DRILLED | ||

34 | 4,123.5 | ||

Sample Quality Assurance / Quality Control

MAS Gold is working with its principal geological exploration consultant, Axiom Exploration of Saskatoon, Saskatchewan, who has designed and executed a vigorous quality control / quality assurance program for its 2022 winter drill program.

Sample intervals were laid out with the objective of capturing homogenous lithology without crossing any significant alterations within the sample guideline of a minimum sample size of 0.50m, and a maximum sample size of 2.0m. All drill core samples were logged, tagged, photographed, cut and stored in a secure facility in the North Lake deposit area.

Samples were marked on core with assigned sample number from a pre-numbered sample tag. These markings and stapled sample tags were placed at the start of the intervals. Drill core was cut using a core saw with a diamond bit blade using fresh flowed water to ensure no possible contamination between samples. Care was taken to ensure that the same half of the core was sampled for the entire sample interval to maintain consistency minimizing and potential biases in the assay results. Core duplicates were generated by quarter sampling core.

MAS Gold utilized SRC laboratories in Saskatoon for core assay analysis. All rock sample preparation conducted by SRC at their preparation facility in Saskatoon, SK. Rock samples were dried, crushed to 70% passing 1.70 mm. 250 gram samples were then riffle split and pulverized to 95% passing 106 microns. The pulveriser was cleaned using a silica sand wash after every samples as to avoid any potential cross sample contamination.

Core analyzed by SRC was handled at their facility in Saskatoon, SK. Core samples were analyzed for gold using FA/AA of 30g as well as multi-element ICP-MS with a multi-acid digestion. Gold assays returning greater than 3 g/t (ppm) where analyzed using gold fire assay with gravimetric finish. Reject pulps were saved and stored for potential, future metallic screening or other analyses.

An independent QAQC program was conducted by inserting pulp sample duplicates, certified reference materials, coarse and pulp blanks. This was used to test for natural variability/sampling bias / testing the lab for homogeneity during sample preparation processes within the lab as well as testing the precision and any possible contamination from the lab. Additionally, SRC labs also included an internal QAQC duplicate on gold analyses.

Qualified Person

The scientific and technical information contained in this news release has been prepared, reviewed and approved by David Tupper, P.Geo. (British Columbia), MAS Gold's VP Exploration and Darren Slugoski, P.Geo. (Saskatchewan and Ontario), of Axiom Exploration Group Ltd., and Kristopher J. Raffle, P.Geo.(British Columbia) Principal and Consultant of APEX Geoscience Ltd. of Edmonton, AB, each a Qualified Person within the context of Canadian Securities Administrators' National Instrument 43-101; Standards of Disclosure for Mineral Projects (NI 43-101).

About MAS Gold:

MAS Gold Corp. is a Canadian mineral exploration company focused on gold exploration projects in the prospective La Ronge Gold Belt of Saskatchewan. MAS Gold operates four prospective La Ronge, Kisseynew and Glennie Domains that make up the La Ronge Gold Belt.

MAS Gold's current projects include the North Lake, Greywacke North, Bakos (Contact Lake) and Point gold deposits and the historically defined Elizabeth Lake copper-gold volcanic-hosted massive sulphide deposit within four properties totalling 34,703.4 hectares (85,753.8 acres).

The North Lake deposit located at the Preview-North Property is estimated to contain an Inferred Mineral Resource of 18,100,000 t grading 0.85 g/t Au, hence 494,000 contained ounces of gold (Godden, S, Thomas, D. Tupper, Technical Report on the Mineral Resource Updates, North Lake and Greywacke North Gold Projects, La Ronge Gold Belt, Saskatchewan, Canada.; effective date December 1, 2021). The Technical Report about the updated Mineral Resource estimate was filed on SEDAR January, 12, 2022.

The Greywacke North deposit, which hosts multiple known stratabound, high-grade gold-bearing zones, has an updated, combined open pit and underground Indicated Mineral Resource of 645,000 t averaging 4.90 g/t Au for 101,000 insitu ounces of gold (600,000 t at 4.89 g/t Au, and 45,000t at 5.03 g/t Au, respectively), plus a combined open pit and underground Inferred Mineral Resource of 410,000 t averaging 4.12 g/t Au for 55,000 insitu ounces of gold (35,000 t at 1.97 g/t Au, and 375,000 t at 4.33 g/t Au, respectively). The Indicated and Inferred Mineral Resources were estimated using open pit and underground cut-off grades of 0.65 g/t Au and 1.75 g/t Au, respectively (Godden, S, Thomas, D. Tupper, D. Technical Report on the Mineral Resource Updates, North Lake and Greywacke North Gold Projects, La Ronge Gold Belt, Saskatchewan, Canada.; Effective Date December 1, 2021). The Technical Report about the updated Mineral Resource estimate was filed on SEDAR January 12, 2022.

MAS Gold Corp.

Jim Engdahl

President & CEO

Caution Regarding Forward-Looking Information and Statements:

Information set forth in this news release contains forward-looking statements that are based on assumptions as of the date of this news release. These statements reflect management's current estimates, beliefs, intentions, and expectations. They are not guarantees of future performance. MAS Gold cautions that all forward-looking statements are inherently uncertain, and that actual performance may be affected by a number of material factors, many of which are beyond their respective control. Such factors include, among other things: risks and uncertainties relating to MAS Gold's limited operating history, the need to comply with environmental and governmental regulations, results of exploration programs on their projects and those risks and uncertainties identified in each of their annual and interim financial statements and management discussion and analysis. Accordingly, actual and future events, conditions and results may differ materially from the estimates, beliefs, intentions and expectations expressed or implied in the forward-looking information. Except as required under applicable securities legislation, MAS Gold undertakes no obligation to publicly update or revise forward-looking information.

Neither TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this news release.

SOURCE MAS Gold Corp

![]() View original content to download multimedia: http://www.newswire.ca/en/releases/archive/March2022/08/c5976.html

View original content to download multimedia: http://www.newswire.ca/en/releases/archive/March2022/08/c5976.html