Midas Gold Completes Positive Feasibility Study for the Stibnite Gold Project, Idaho

Over US$1 Billion Investment Set to Restore Brownfields Site, Implement State-of-the-Art Modern Mining Methods, Employ Hundreds of People and Recover nearly 120 Million Pounds of Antimony, a Critical Mineral

Expected Annual Average Gold Production of 466 thousand ounces at All-in Sustaining Costs of US$427/oz during the First 4 Years of Operation

At US$1,850/oz gold, Robust Project Economics Yield NPV (5%) of US$1.9 Billion and

Average Annual Free Cash Flow of US$594 million in the First 4 Years of Operation

VANCOUVER, BC, Dec. 22, 2020 /CNW/ - Midas Gold Corp. (TSX: MAX) (OTCQX: MDRPF) ("Midas Gold" or the "Company") announced today the results of an independent Feasibility Study (the "FS" or "Feasibility Study") and technical report (the "Report") completed on its Stibnite Gold Project ("Project") in Idaho. The Project, as envisioned in the FS, would become one of the largest and highest-grade open pit gold mines in the United States and the country's only primary producer of antimony, a critical and strategic mineral(1). The FS builds upon Midas Gold's Plan of Restoration and Operations ("PRO"), identifying a suite of operational improvements and environmental refinements to achieve the Company's key objective for the financially viable restoration and brownfields development of the Stibnite mining district.

"The Feasibility Study represents a major milestone for Midas Gold as we continue to advance the Stibnite Gold Project," said Laurel Sayer, President and CEO of Midas Gold Corp. "The positive results demonstrate that our vision to combine economic development with environmental restoration of a brownfield site is technically, financially and environmentally feasible. Each step of the way, our approach to responsible, restorative, modern mining in Idaho has been reconfirmed. We are now one step closer to seeing the river and water quality improved, 550 direct jobs for Idahoans and production of the critical mineral, antimony."

"The results of the Feasibility Study highlight the attractive economics of the Stibnite Gold Project," said Marcelo Kim, Chairman of Midas Gold Corp. "The Project's exceptional grade and low strip ratio place this project in the lowest quartile of the industry cost curve and coupled with its large mineral reserve and manageable capital expenditure profile, make the Stibnite Gold Project one of the gold industry's most attractive development projects. The Project's economics are resilient at lower metal prices and also exhibit significant leverage to rising prices. Despite the recent strength in its share price, Midas Gold represents one of the most undervalued gold investment opportunities in North America. At current market prices, Midas trades at a fully diluted market capitalization of $551 million, or 29% of the Project's NPV 5% of $1.9 billion at spot gold prices. We remain steadfast in our commitment to continue de-risking and advancing the Stibnite Project for the benefit of all stakeholders."

The Stibnite Gold Project economics, as contemplated in the FS, are summarized in Table 1.

Table 1: Stibnite Gold Project – Feasibility Study Highlights(3)(6)

Component | Early Production Years 1-4 | Life-of-Mine Years 1-15 |

Recovered Gold (3) Total | 1,862 koz | 4,284 koz |

Recovered Antimony(1) Total | 76 millon lbs | 118 million lbs |

Recovered Gold (3) Annual Average | 466 koz/yr | 301 koz/yr |

Cash Costs(3) (Net of by-product credits) | $317/oz | $528/oz |

All-in Sustaining Costs(3) (Net of by-product credits) | $427/oz | $625/oz |

Initial Capital – including contingency | $1,292 million | |

Case B at US$1,600/oz gold (Base Case) (2) | ||

After-Tax Net Present Value 5% | $1,347 million | |

Annual Average EBITDA | $576 million | $298 million |

Annual Average After Tax Free Cash Flow | $509 million | $248 million |

Internal Rate of Return (After-tax) | 22.3% | |

Payback Period in Years (After-tax) | 2.9 years | |

Case C at US$1,850/oz gold (2) | ||

After-Tax Net Present Value 5% | $1,900 million | |

Annual Average EBITDA | $689 million | $368 million |

Annual Average After Tax Free Cash Flow | $594 million | $302 million |

Internal Rate of Return (After-tax) | 27.7% | |

Payback Period in Years (After-tax) | 2.5 years | |

(1) | Antimony is a chemical element included on the U.S. Interior Department's list of Critical Minerals. | |

(2) | Base case prices US$1,600/oz gold, $20/oz silver and $3.50/lb antimony, Case C price based on metal selling prices of US$1,850/oz gold, $24/oz silver and $3.50/lb antimony, Post-Tax NPV at 5% discount rate. | |

(3) | In this release, "M" = million, "k" = thousand, all amounts in US$, gold and silver reported in troy ounces ("oz"). | |

(4) | See non-International Financial Reporting Standards ("IFRS") measures below. | |

(5) | All numbers have been rounded in above table and may not sum correctly. | |

(6) | The FS assumes 100% equity financing of the Project. | |

For readers to fully understand the information in this News Release, they should read the Report (to be available on www.SEDAR.com, www.sec.gov or at www.midasgoldcorp.com within 45 days of December 22, 2020) in its entirety, including all qualifications, assumptions and exclusions that relate to the information set out in this news release that qualifies the technical information contained in the Report. The Report is intended to be read as a whole, and sections should not be read or relied upon out of context. The technical information in this news release is subject to the assumptions and qualifications contained in the Report.

The FS affirms that the Project can address legacy impacts left behind by previous mining operators including the recovery, reprocessing and safe storage of historical tailings, restoration of fish passage, stream restoration, and reforestation. The FS verifies a positive local economic benefit to Idaho communities bringing more than $1 billion in initial capital investment, approximately 550 direct jobs during operations, and hundreds of indirect and induced jobs, while generating significant taxes and other benefits to the local, state and national economies. Key studies and operational refinements incorporated into the FS include:

- Updated geological models and mineral resource estimates based on new drilling;

- Optimization of pit geometries and mine sequencing to reduce project footprint, minimize water management requirements, eliminate the Fiddle development rock storage facility, and reduce the size of the Hangar Flats pit while allowing for its complete backfilling;

- A strategy for stockpiling low-grade ore supporting an extended operating life and lower strip ratio;

- Process flowsheet optimizations to enhance metallurgical recoveries and improve environmental outcomes;

- Addition of an onsite lime plant to reduce ore processing operating costs and mine access road traffic impacts;

- Development of comprehensive water management and water treatment plans including placement of covers on development rock storage facility; and,

- Incorporation of an access road through site for public use.

Several of these refinements were incorporated in the Draft Environmental Impact Statement ("DEIS") released by the US Forest Service in August 2020.

Conference Call and Webcast

Midas Gold will be hosting a conference call and webcast to discuss the FS December 22, 2020 at 4:30 PM (EST).

Project Background and Design Principles

Since inception, Midas Gold's vision for the Stibnite Mining District (the "District") has been to use modern mining to redevelop an abandoned, brownfield mine site, provide long-term employment and business opportunities for a rural area in Idaho, funded by an economically viable project. Restoration goals were established early on to address environmental impacts from over 100 years of historical mining activities and return the site to a fully functioning, self-sustaining ecosystem with improved water quality and habitat capable of supporting enhanced populations of fish, wildlife and flora. In addition to gold, the District also contains significant Mineral Reserves of antimony, which is on the U.S. Department of Interior's final list of 35 critical minerals.

Midas Gold submitted its PRO to regulators in September 2016. The plan laid out in the PRO was founded on Midas Gold's core values of safety, environment, community involvement, transparency, accountability, integrity and performance. Since filing the PRO, Midas Gold has continued to advance the Project along two parallel paths: additional design and engineering studies in support of the FS; and further environmental modeling and analysis in support of Project permitting. The Project envisioned in the FS achieves Midas Gold's vision of unifying environmental protection and restoration with modern mining operations in an economically attractive project.

Feasibility Study Summary

The FS was compiled by M3 Engineering & Technology Corp. ("M3") which was engaged by Midas Gold, through its subsidiary Midas Gold Idaho, Inc. ("MGII"), to evaluate the development of the Stibnite Gold Project based on information available up to the date of the FS. The FS was prepared under the direction of Independent Qualified Persons ("QPs") and in compliance with National Instrument 43-101 the Canadian Securities Administrators ("NI 43-101") standards for reporting mineral properties. Additional details of responsibilities are provided at the end of this news release and in the Report to be filed on SEDAR within 45 days of December 22, 2020. The FS supersedes and replaces the technical report entitled "Amended Preliminary Feasibility Study Technical Report for the Stibnite Gold Project, Idaho" prepared by M3 and dated March 28, 2019 and that report should no longer be relied upon. Mineral Resource Statements in the FS supersede and replace the Mineral Resources disclosed publicly on February 15, 2018, which should no longer be relied upon.

Project Introduction and Concept

The Stibnite Mining District is located in central Idaho, USA approximately 100 miles (mi) northeast of Boise, Idaho, 38 mi east of McCall, Idaho, and approximately 10 mi east of Yellow Pine, Idaho. The Project detailed in the FS consists of mining the Yellow Pine, Hangar Flats and West End deposits using conventional open pit methods, conventional processing methods to extract gold, silver and antimony, and on-site production of gold (Au) and silver (Ag) doré and an antimony (Sb) concentrate. The Project also incorporates extensive reclamation and restoration of historical impacts to the site including: the recovery and reprocessing of Historical Tailings, restoration of fish passage during and after operations, relocation of historical mining wastes to engineered storage facilities, stream restoration, and reforestation. Midas Gold's plans for restoration and decommissioning the site include progressive and concurrent remediation, reclamation and restoration, beginning at the start of construction and continuing through operations and Project closure.

Geology, Exploration and Drilling

Mineralization and alteration in the District are associated with multiple hydrothermal alteration events occurring through the Paleocene and early Eocene epochs. Main-stage gold mineralization and associated potassic alteration typically occurs in structurally prepared zones in association with very fine grained disseminated arsenical pyrite and, to a lesser extent, arsenopyrite, with gold almost exclusively in solid solution in these minerals. Antimony mineralization occurs primarily associated with the mineral stibnite. Additional gold mineralization in the Stibnite roof pendant is associated with epithermal quartz-adularia-carbonate veins.

The District has been the subject of exploration and production activities for nearly 100 years, yet much of the area remains poorly explored due to its remote location, low level of outcrop and extensive glacial cover in valley bottoms. Midas Gold has completed extensive exploration work over the last decade that has included: geophysics; rock, soil and stream sampling and analysis; geologic mapping; mineralogical and metallurgical studies; and drilling. This newer data has been integrated with datasets from previous operators and provides a comprehensive toolkit for future exploration. These efforts have led to the identification of over 75 prospects with varying levels of target support.

Exploration targets include conceptual geophysical targets, geochemical targets from soil, rock and trench samples, and results from widely spaced drill holes; as a result, the potential size and tenor of the targets are conceptual in nature. There has been insufficient exploration to define mineral resources on these prospects and this data may not be indicative of the occurrence of a mineral deposit. Such results do not provide assurance that further work will establish sufficient grade, continuity, metallurgical characteristics and economic potential to be classed as a category of mineral resource. Mineral resources are not mineral reserves and do not have demonstrated economic viability.

The focus of Midas Gold drilling, and the related permitting process, has been on the three main deposits. The District has been drilled by numerous operators, totaling 793,769 ft in 2,723 drill holes, of which Midas Gold drilled 637 holes totaling over 344,465 ft since 2009. Pre-Midas Gold drilling was undertaken by a wide variety of methods and operators while Midas Gold employed a variety of drilling methods including core, reverse circulation, auger, and sonic throughout the District, but with the primary method being core. Midas Gold undertook an extensive vetting process, supported by its own drilling, to determine which Pre-Midas Gold data was suitable for use in the FS.

Mineral Processing and Flowsheet Development

Gold in all three deposits is hosted in pyrite and arsenopyrite minerals and is predominantly refractory to direct cyanidation; however, discrete free gold is present in oxidized portions of the West End Deposit. Antimony in the Yellow Pine and Hangar Flats Deposits occurs almost entirely as stibnite and is typically coarse-grained when occurring at head grades above 0.1% antimony. Stibnite becomes sufficiently liberated for recovery via selective antimony flotation.

Flotation and pressure oxidation ("POX") pilot plant testing demonstrated successful sulfide concentrate production and gold liberation. The POX pilot study was completed using in-situ acid neutralization (ISAN), which involves adding ground limestone to the POX feed to control free acid and sulfate concentrations to limit the formation of jarosites and basic iron sulfates. The ISAN process was shown to produce environmentally stable arsenic compounds while inhibiting encapsulation of gold particles prior to gold extraction.

Mineral Resources

The Mineral Resource estimates for the Project were estimated in conformity with generally accepted Canadian Institute of Mining and Metallurgy ("CIM") "Estimation of Mineral Resources and Mineral Reserves Best Practices Guidelines" as adopted by CIM Council November 29, 2019 and are reported in accordance with NI43–101 requirements. The Mineral Resource estimates for each of the Hangar Flats, West End and Yellow Pine deposits, and the Historical Tailings, were prepared using commercial mine-modeling and geostatistical software, take into account relevant modifying factors, and have been verified by an Independent QP. The consolidated Mineral Resource statement for the Project in metric tonnes (t) is shown in Table 2 based on a gold selling price of US$1,250/troy ounce.

Table 2: Stibnite Gold Project Consolidated Mineral Resource Statement

Classification | Tonnage | Gold | Contained | Silver | Contained | Antimony | Contained |

Measured ("M") | |||||||

Yellow Pine | 4,902 | 2.42 | 382 | 3.75 | 590 | 0.24 | 25,831 |

Indicated ("I") | |||||||

Yellow Pine | 45,350 | 1.72 | 2,509 | 2.07 | 3,020 | 0.09 | 85,774 |

Hangar Flats | 25,861 | 1.44 | 1,194 | 3.24 | 2,697 | 0.15 | 84,463 |

West End | 53,469 | 1.08 | 1,849 | 1.31 | 2,259 | 0.00 | 0 |

Historical Tailings | 2,687 | 1.16 | 100 | 2.86 | 247 | 0.17 | 9,817 |

Total M & I | 132,269 | 1.42 | 6,034 | 2.07 | 8,814 | 0.07 | 205,885 |

Inferred | |||||||

Yellow Pine | 3,214 | 0.96 | 99 | 0.60 | 62 | 0.00 | 50 |

Hangar Flats | 12,224 | 1.12 | 440 | 2.64 | 1,037 | 0.11 | 28,560 |

West End | 20,540 | 1.06 | 700 | 1.11 | 733 | 0.00 | 0 |

Historical Tailings | 191 | 1.13 | 7 | 2.64 | 16 | 0.16 | 662 |

Total Inferred | 36,168 | 1.07 | 1,246 | 1.59 | 1,849 | 0.04 | 29,272 |

Notes: | ||||||||

(1) | All Mineral Resources have been estimated in accordance with CIM definitions, as required under NI43-101. | |||||||

(2) | Mineral Resources are reported in relation to a conceptual pit shell to demonstrate potential for economic viability, as required under NI43-101; mineralization lying outside of these pit shells is not reported as a Mineral Resource. Mineral resources are not mineral reserves and do not have demonstrated economic viability. These mineral resource estimates include inferred mineral resources that are considered too speculative geologically to have economic considerations applied to them that would enable them to be categorized as mineral reserves. It is reasonably expected that the majority of inferred mineral resources could be upgraded to Indicated. All figures are rounded to reflect the relative accuracy of the estimate and therefore numbers may not appear to add precisely. | |||||||

(3) | Open pit sulfide mineral resources are reported at an effective cut-off grade of 0.45 g/t Au and open pit oxide Mineral Resources are reported at an effective cut-off grade of 0.40 g/t Au. | |||||||

(4) | The Yellow Pine and Hangar Flats deposits contain zones with substantially elevated antimony-silver mineralization, defined as containing greater than 0.1% antimony. These higher-grade antimony zones comprise 18,477 kt grading 0.48% antimony of measured and indicated gold mineral resource estimates and 1,387 kt grading 0.93% antimony of inferred gold mineral resource estimates. Antimony mineralization is not classified separately from gold and is reported only if it lies within gold Mineral Resource estimates, and only if blocks meet gold cut-off grade criteria. | |||||||

It is the opinion of the Independent QP responsible for the Mineral Resource estimates that the data used for estimating the Mineral Resources and Mineral Reserves for the Hangar Flats, West End, Yellow Pine and Historical Tailings deposits herein is adequate for this purpose and may be relied upon to report the Mineral Resources and Mineral Reserves contained in this Report.

Mineral Reserves

The Mineral Reserve Estimates for the Project were estimated in conformity with generally accepted CIM "Estimation of Mineral Resources and Mineral Reserves Best Practices Guidelines" and are reported in accordance with NI43–101. The general mine planning sequence to produce the Project Mineral Reserves estimate and associated mill feed schedule consisted of an ultimate pit limit analysis, pit shell selection, ultimate pit designs, internal pit phase design, mining sequence schedule, and mill feed optimization. The pit limit analysis was performed on gold recovery only, to ensure the ultimate pit geometries would not be dependent on silver or antimony value. Mining costs used for the pit limit analysis are based on a first principles cost buildup for equipment requirements, labor estimates, and consumables price quotes. Selection of the optimal pit shells for each deposit was based on discounted cash flow analysis. For Yellow Pine and West End, the incremental change in discounted pit value ("NPV") and strip ratio between potentially optimal pit shells is gradual, and pit shells representing gold selling prices of $1,250/oz and $1,300/oz respectively were selected. For Hangar Flats, the pit limit analysis suggested selecting the $1,150/oz pit shell but, due to additional technical and environmental considerations, the $750/oz pit shell was ultimately selected for mineral reserve estimation.

The ultimate pit designs were based on the selected pit shells, design parameters for 150-ton haul trucks, geotechnical design criteria, and additional mine sequencing and haulage considerations. Cut-off determination utilized a Net Smelter Return ("NSR") methodology to account for varying ore types and separate process streams with unique process costs. The cut-off strategy applies elevated cut-off values to ensure the highest-grade ore available in the mine plan is processed preferentially and lower grade ore is stored in ore stockpiles for processing later in the Project life.

Cut-off grades for Mineral Reserves were developed assuming long term metal prices of $1,600/oz gold, $20.00/oz silver, and $3.50/lb antimony for material lying within the pit designs based on the pit shells selected above ($1,250, $750 and $1,300/oz Au for Yellow Pine, Hangar Flats and West End, respectively). This results in a Life-of-Mine ("LOM") average gold cut-off grade for the Mineral Reserves of 0.48 g/t for open-pit mining. The Mineral Reserves are summarized in Table 3.

Table 3: Stibnite Gold Project Consolidated Mineral Reserve Summary

Deposit | Tonnage (000s) | Gold Grade (g/t) | Contained Gold (000s oz) | Silver Grade (g/t) | Contained Silver (000s oz) | Antimony Grade (%) | Contained Antimony (000s lbs) |

Yellow Pine | |||||||

Low Sb Sulfide – Proven & Probable | 37,615 | 1.69 | 2,047 | 1.56 | 1,881 | 0.009 | 7,859 |

High Sb Sulfide – Proven & Probable | 10,232 | 2.04 | 671 | 4.69 | 1,543 | 0.460 | 103,758 |

Yellow Pine Proven & Probable Mineral Reserves | 47,847 | 1.77 | 2,718 | 2.23 | 3,423 | 0.106 | 111,617 |

Hangar Flats | |||||||

Low Sb Sulfide – Probable | 5,167 | 1.34 | 223 | 1.65 | 273 | 0.018 | 2,104 |

High Sb Sulfide – Probable | 3,095 | 1.92 | 191 | 4.85 | 483 | 0.369 | 25,148 |

Hangar Flats Probable Mineral Reserves | 8,262 | 1.56 | 414 | 2.85 | 756 | 0.150 | 27,252 |

West End | |||||||

Oxide – Probable | 4,749 | 0.54 | 83 | 0.87 | 133 | - | - |

Low Sb Sulfide – Probable | 15,242 | 1.33 | 649 | 1.30 | 635 | - | - |

Transitional – Probable | 25,839 | 1.03 | 855 | 1.49 | 1,236 | - | - |

West End Probable Mineral Reserves | 45,830 | 1.08 | 1,587 | 1.36 | 2,004 | - | - |

Historical Tailings (1) | |||||||

Low Sb Sulfide – Probable | 1,839 | 1.16 | 68 | 2.86 | 169 | 0.166 | 6,692 |

High Sb Sulfide – Probable | 855 | 1.16 | 32 | 2.86 | 79 | 0.166 | 3,125 |

Historical Tailings Probable Mineral Reserves | 2,687 | 1.16 | 100 | 2.86 | 247 | 0.166 | 9,817 |

Project Proven & Probable Mineral Reserves | |||||||

Oxide – Probable | 4,749 | 0.54 | 83 | 0.87 | 133 | - | - |

Low Sb Sulfide – Proven & Probable | 59,856 | 1.55 | 2,988 | 1.54 | 2,958 | 0.013 | 16,656 |

High Sb Sulfide – Proven & Probable | 14,181 | 1.96 | 894 | 4.61 | 2,104 | 0.422 | 132,031 |

Transitional – Probable | 25,839 | 1.03 | 855 | 1.49 | 1,236 | - | - |

Total Proven & Probable Mineral Reserves (2)(3) | 104,625 | 1.43 | 4,819 | 1.91 | 6,431 | 0.064 | 148,686 |

Notes: | |||||||

(1) Historical Tailings ore type classification is proportional to the pit-sourced mill feed during Historical Tailings processing. | |||||||

(2) Metal prices used for Mineral Reserves: $1,600/oz Au, $20.00/oz Ag, $3.50/lb Sb. | |||||||

(3) Antimony recovery is expected from High Sb Sulfide ore only, which contains 132,031 klbs of Sb. |

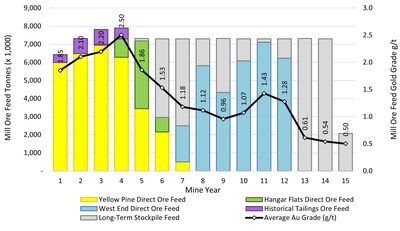

Production Schedule

The mine plan developed for the Project incorporates the mining of the three in situ deposits: Yellow Pine, Hangar Flats, and West End and their related development rock; and the re-mining of Historical Tailings along with its cap of spent heap leach ore. The general sequence of open pit mining would be Yellow Pine deposit first, Hangar Flats deposit second, and West End deposit last, as shown on Figure 1. This sequence generally progresses from mining highest value ore to lowest value ore and accommodates the sequential backfilling the Yellow Pine and Hangar Flats open pits with material mined from West End open pit. Lower grade ore extracted during mining of the three pits is stockpiled and then processed during the operating life of the mill. The spent ore that overlies the Historical Tailings would be used as tailings storage facility ("TSF") construction material. Most development rock would be sent to one of five destinations: the TSF embankment, the TSF buttress, the Yellow Pine pit as backfill, the Hangar Flats pit as backfill, or the Midnight area within the West End pit as backfill. The Historical Tailings would be hydraulically transferred to the process plant during the first four years of operation, concurrent with mining ore from the Yellow Pine open pit.

Long-term lower-grade ore stockpiles have been incorporated into the FS mine plan located for the most part within the footprint of the TSF buttress, thereby minimizing their incremental disturbance. The primary benefits to adding ore stockpile capacity is increased potential to optimize process ore feed value throughout the mine life, improved utilization of the mineral resource, reduced peak water treatment needs, reduced development rock tonnage and associated mining impacted water management. A summary of the mining statistics by ore type is provided in Table 4.

Table 4: Life-of-Mine Mining Statistics

General Life-of-Mine Production | Unit | Value |

Open Pit Development Rock Mined | Mt | 254 |

Open Pit Ore Mined | Mt | 102 |

Open Pit Strip Ratio | waste:ore | 2.5:1 |

Historical Tailings Mined | Mt | 2.7 |

Mining Cost | $/t | 2.47 |

Daily Mill Throughput | kt/day | 20.0 |

Mine Life | years | 12.0 |

Mill Life | years | 14.3 |

Ore Processing

The Project's ore process plant has been designed to process sulfide, transition and oxide material from the Yellow Pine, Hangar Flats, and West End deposits, as well as Historical Tailings. The processing facility is designed to treat an average of 20,000 t/d. The Historical Tailings would be reprocessed early in the mine life to recover precious metals and antimony, and to provide space for the TSF embankment and buttress.

The process operations include the following components: crushing, grinding, pyrite and stibnite flotation, lime and oxygen plants, pressure oxidation, oxidized concentrate neutralization, carbon in leach, carbon handling, gold refinement, tailings detoxification, and process control systems. The two finished products from the Stibnite Gold Project ore processing facility will be gold/silver bars, known as doré; and filtered antimony–silver concentrate.

Infrastructure

Support infrastructure for the Project includes onsite and offsite facilities, access road improvements and upgrades to electrical infrastructure. Onsite facilities at Stibnite would include a comprehensive water management system including mine-impacted water treatment, stormwater management, water supply, and sediment control; electrical substation; onsite roads, parking and laydown areas; firefighting support facilities, security and fencing; sanitary and solid waste handling facilities; offices, truck and maintenance shop; warehouses; communication facilities; borrow sources; and solar and diesel or propane power supply systems. A new worker housing facility would be constructed approximately two miles south of the ore processing plant area to provide accommodations for the operations workforce. Incremental accommodations for the construction workforce would be addressed with leased accommodations and use of the existing on-site worker housing facility.

Access to the Site via the Burntlog Route was selected over several other possible alternatives because it provides safer year-round access for mining operations, reduces the proximity of roads to major fish-bearing streams, and respects the advice and privacy of community members along other possible routes close to the Project location. The route originates from the intersection of Highway 55 and Warm Lake Road and would be approximately 71 miles long. The route consists of 34 miles of existing highway (Warm Lake Road), 23 miles of upgraded road, and 14 miles of new road. The 37 miles of new and upgraded road would have a design speed of 20 mph, max 10% grade, a 21–foot width and intermediate-sized tractor trailer loading criteria. Midas Gold would provide buses and vans as the primary means of employee and contractor transportation to the site, reducing the risks and effects of Project-related traffic. A through-site public access route would replace the current access through the site during mine operations.

Offsite administrative offices, transportation hub, warehousing and assay laboratory needed for the Project, referred to as Stibnite Gold Logistics Facility, would be located on private land in Valley County, with easy access to State Highway 55.

Grid power was selected as the best electrical power supply for the Project based on its low operating cost, low electricity prices, and Idaho Power Company's existing clean energy portfolio. The upgrades required to provide the 50- to 60-megawatt capacity to the Site include an increased 230/138 kV transformer capacity; approximately 41.3 miles of 69 kV lines upgraded to 138 kV; approximately 21.0 miles of 12.5 kV line upgraded to 138 kV line; and approximately 9.2 miles of new 138 kV line; and upgraded substations.

Tailings and Water Management

The Tailings Storage Facility ("TSF") would consist of a rockfill embankment raised using the downstream method, a buttress built mostly of development rock sourced from the open pits, a fully lined impoundment utilizing a composite liner system, and related water management features. The facility is designed to contain approximately 109 million tonnes of tailings solids. The addition of the buttress downstream of the embankment substantially increases the geotechnical safety factor to approximately double that required by Idaho regulations.

The Project water management system would protect or improve water quality in Project-area streams by diverting clean water around mine facilities and collecting, reusing, evaporating, or treating and discharging mining impacted water. Major clean water diversions include the EFSFSR tunnel and fishway at Yellow Pine pit, Meadow Creek at Hangar Flats pit, and Meadow Creek at the TSF and buttress.

Meteoric and tailings consolidation water would be reclaimed from the TSF and would supply the majority of the water needed for ore processing. Additional water needs would be supplied from: pit dewatering, reuse of stored contact water, groundwater wells, and a surface intake near the upstream portal of the EFSFSR diversion tunnel. Seasonal excess contact water and dewatering water would be treated to meet water quality standards before discharge to surface water.

Capital Costs

Initial, sustaining and closure capital costs ("CAPEX") were estimated based on Q3, 2020, un-escalated US dollars and are summarized in Table 5 below. Vendor quotes were obtained for all major equipment. Some of the costs were developed from first principles, while some were estimated based on factored references and experience with similar projects. Reclamation financial assurance costs are not included in the capital costs.

Table 5: Capital Cost Summary

Area | Detail | Initial CAPEX ($000s) | Sustaining CAPEX ($000s) | Closure CAPEX ($000s) (2) | Total CAPEX ($000s) |

Direct Costs | Mine Costs (1) | 84,019 | 118,968 | - | 202,987 |

Processing Plant | 460,466 | 49,041 | - | 509,507 | |

On-Site Infrastructure | 185,590 | 81,621 | 5,792 | 273,003 | |

Off-Site Infrastructure | 123,616 | - | - | 123,616 | |

Indirect Costs | 243,632 | - | - | 243,632 | |

Owner's Costs | 21,480 | - | - | 21,480 | |

Offsite Environmental Mitigation Costs | 14,397 | - | - | 14,397 | |

Onsite Mitigation, Monitoring and Closure Costs(2) | 3,474 | 23,484 | 99,296 | 126,254 | |

Total CAPEX without Contingency | 1,136,674 | 273,114 | 105,087 | 1,514,876 | |

Contingency | 155,173 | 21,697 | 1,349 | 178,219 | |

Total CAPEX with Contingency | 1,291,847 | 294,812 | 106,437 | 1,693,095 | |

Note: | |

(1) | Initial mining CAPEX includes environmental remediation costs. |

(2) | Closure and mitigation assume self-performed costs, which will differ for those assumed for financial assurance calculations required by regulators. Costs include stream and wetland restoration and reclamation costs. |

Operating Costs

Operating cost estimates ("OPEX") were developed based on Q3 2020, un-escalated US dollars and are summarized in Table 6 below. The All-In Sustaining Costs ("AISC") are also provided, as well as the All-In Costs ("AIC"), which include non-sustaining capital and closure and reclamation costs.

Table 6: Operating Cost, AISC and AIC Summary

Total Production Cost Item | Years 1-4 | LOM | ||

($/t milled) | ($/oz Au) | ($/t milled) | ($/oz Au) | |

Mining | 9.71 | 155 | 8.22 | 202 |

Processing | 13.18 | 210 | 12.81 | 315 |

Water Treatment Plant | 0.02 | 0 | 0.03 | 1 |

G&A | 3.55 | 57 | 3.43 | 84 |

Cash Costs Before By-Product Credits | 26.47 | 422 | 24.49 | 603 |

By-Product Credits | (6.60) | (105) | (3.05) | (75) |

Cash Costs After of By-Product Credits | 19.87 | 317 | 21.45 | 528 |

Royalties | 1.70 | 27 | 1.10 | 27 |

Refining and Transportation | 0.49 | 8 | 0.26 | 6 |

Total Cash Costs | 22.06 | 352 | 22.81 | 561 |

Sustaining CAPEX | 4.64 | 74 | 2.82 | 69 |

Salvage | - | - | (0.26) | (6) |

Property Taxes | 0.05 | 1 | 0.04 | 1 |

All-In Sustaining Costs | 26.75 | 427 | 25.41 | 625 |

Reclamation and Closure(1) | - | - | 1.02 | 25 |

Initial (non-sustaining) CAPEX(2) | - | - | 12.35 | 304 |

All-In Costs | - | - | 38.78 | 954 |

Notes: | ||||

(1) | Defined as non-sustaining reclamation and closure costs in the post-operations period. | |||

(2) | Initial Capital includes capitalized preproduction. | |||

Metal Production

Recovered metal production by deposit and product type is summarized in Table 7.

Table 7: Recovered Metal Production

Product by Deposit | Gold (koz) | Silver (koz) | Antimony (klbs) |

Doré Bullion | |||

Yellow Pine | 2,475 | 639 | - |

Hangar Flats | 371 | 102 | - |

West End | 1,359 | 746 | - |

Historical Tailings | 68 | 2 | - |

Doré Bullion Recovered Metal Totals | 4,251 | 1,459 | - |

Antimony Concentrate | |||

Yellow Pine | 7 | 909 | 94,258 |

Hangar Flats | 3 | 313 | 21,150 |

Historical Tailings | 1 | 31 | 2,454 |

Antimony Concentrate Recovered Metal Totals | 11 | 1,253 | 117,863 |

Total Recovered Metals | 4,284 | 2,741 | 117,863 |

Economic Analysis

The economic analysis completed for this FS assumed that gold and silver production in the form of doré with appropriate deductions for payabilities, refining and transport charges. The gold prices selected for the five economic cases in this Report vary from $1,350/oz to $2,350/oz. The Base Case $1,600/oz gold price was derived from the weighted average of the 3-year trailing gold price (60%) and the 2-year gold futures price (40%); this calculation was completed in July 2020. Silver prices were set at a gold:silver ratio ($/oz:$/oz) of 80:1 for the base case then the silver price was varied by $4.00/oz Ag (versus $250/oz Au) for the other cases, which is approximately 60:1; the lower ratio for the delta was used to reflect the historically greater level of volatility of the silver market. Antimony prices were assumed to be constant at $3.50/lb for all cases based on a market study undertaken by an independent expert in antimony markets. The Project is subject to a 1.7% NSR Royalty on gold only; there is no royalty on silver or antimony.

There is no guarantee that any of the metal prices used in the five cases are representative of future metals prices. The financial assumptions used in the economic analyses for all cases are provided in Table 8. The results of the pre- and after-tax economic analyses for all five metal price scenarios are provided in Table 9.

Table 8: Financial Assumptions used in the Economic Analyses

Item | Unit | Value |

Net Present Value Discount Rate | % | 5 |

Federal Income Tax Rate | % | 21 |

Idaho Income Tax Rate | % | 6.9 |

Idaho Mine License Tax | % | 1.0 |

Valley County Rural Property Tax Rate ($/$1,000 market value) | % | 0.063 |

Percentage Depletion Rate for Gold and Silver | % | 15 |

Percentage Depletion Rate for Antimony | % | 22 |

Depreciation Term | Years | 7 |

Equity Finance Assumption | % | 100 |

Table 9: Pre- and After-Tax Economic Results by Case

Parameter | Unit | Pre-Tax Results | After-Tax Results |

Case A ($1,350/oz Au, $16/oz Ag, $3.50/lb Sb) | |||

NPV0% | M$ | 1,681 | 1,470 |

NPV5% | M$ | 920 | 791 |

Annual Average EBITDA | M$ | 228 | - |

Annual Average After Tax Free Cash Flow | M$ | - | 194 |

IRR | % | 17.3 | 16.2 |

Payback Period | Production Years | 3.4 | 3.4 |

Case B ($1,600/oz Au, $20/oz Ag, $3.50/lb Sb) – Base Case | |||

NPV0% | M$ | 2,728 | 2,281 |

NPV5% | M$ | 1,633 | 1,347 |

Annual Average EBITDA | M$ | 298 | - |

Annual Average After Tax Free Cash Flow | M$ | - | 248 |

IRR | % | 24.4 | 22.3 |

Payback Period | Production Years | 2.9 | 2.9 |

Case C ($1,850/oz Au, $24/oz Ag, $3.50/lb Sb) | |||

NPV0% | M$ | 3,773 | 3,087 |

NPV5% | M$ | 2,346 | 1,900 |

Annual Average EBITDA | M$ | 368 | - |

Annual Average After Tax Free Cash Flow | M$ | - | 302 |

IRR | % | 30.4 | 27.7 |

Payback Period | Production Years | 2.5 | 2.5 |

Case D ($2,100/oz Au, $28/oz Ag, $3.50/lb Sb) | |||

NPV0% | M$ | 4,819 | 3,888 |

NPV5% | M$ | 3,059 | 2,448 |

Annual Average EBITDA | M$ | 435 | - |

Annual Average After Tax Free Cash Flow | M$ | - | 355 |

IRR | % | 35.9 | 32.4 |

Payback Period | Production Years | 2.2 | 2.2 |

Case E ($2,350/oz Au, $32/oz Ag, $3.50/lb Sb) | |||

NPV0% | M$ | 5,865 | 4,689 |

NPV5% | M$ | 3,771 | 2,995 |

Annual Average EBITDA | M$ | 507 | - |

Annual Average After Tax Free Cash Flow | M$ | - | 409 |

IRR | % | 41.0 | 36.9 |

Payback Period | Production Years | 1.9 | 1.9 |

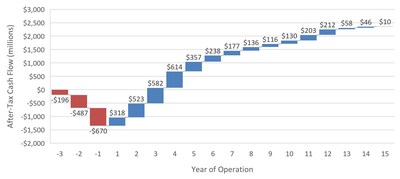

The contribution to the Project economics, by metal, is approximately 96% from gold, 4% from antimony, and less than 1% from silver. The undiscounted after-tax cash flow for Case B is presented on Figure 2. Summary information on mine production and process plant metallurgical recovery is appended at the end of this document.

Environmental Studies

An extensive dataset demonstrating historical and existing conditions exists for the Project site, including data collected by contractors for the US Forest Service ("USFS") and US Environmental Protection Agency ("EPA"), the US Geological Survey ("USGS"), prior mine operators, and Midas Gold and its contractors.

Assessments by several Midas Gold and Federal agency contractors determined that there were no imminent threats to human health or the environment, but that there were a number of pre-existing significant and moderate recognized environmental conditions and overall water quality in all drainages was impaired due to naturally occurring mineralization and impacts associated with historical mining.

Permitting and Mitigation

Approval of the Project requires completion of the Environmental Impact Statement ("EIS") in compliance with the National Environmental Policy Act ("NEPA"), which requires federal agencies to study and consider the probable environmental impacts of a proposed federal action before making a decision on that action. For the Project to proceed, there are multiple federal actions required as described in the Draft EIS ("DEIS") for the Project which is available at https://www.fs.usda.gov/project/?project=50516. In addition to federal permits, the Project requires multiple state and local permits, which also are described in the DEIS. The DEIS was issued by the USFS for public review in August 2020, and the public comment period concluded in October 2020. State and local permitting processes are integrated through the Idaho Joint Review Process ("IJRP") in progress concurrent with preparation of the EIS, and include water discharge ("IPDES"), air quality, cyanidation, groundwater, water rights, dam safety, mine and reclamation, building permits, sewer and water systems, among others. Once the USFS completes revisions to the DEIS, a Final EIS will be issued which will support the Records of Decision to be issued by the federal authorities.

Refinements to the Project reflected in the FS present opportunities to reduce the Project footprint and improve environmental outcomes. These refinements are responsive to comments received from stakeholders before the DEIS was published, comments received during the comment period and Midas Gold's own review of the environmental analysis. As such, the FS contemplates a Project that includes: contact water treatment; low-permeability cover on the TSF buttress; mine plan adjustments to reduce Project footprint; elimination of certain facilities; backfilling pits; and piping summer low flows to reduce stream temperatures.

While Project facilities and infrastructure would be located in areas of previous disturbance wherever practicable, in some cases disturbance of wetlands and streams would be unavoidable, therefore requiring compensatory mitigation under Section 404 of the Clean Water Act. Midas Gold is pursuing a comprehensive approach to wetland and stream compensatory mitigation that entails on-site enhancement and restoration of both streams and wetlands, banking, and off-site projects such as stream habitat enhancement and culvert replacement.

Community and Economic Impacts

The Project would create approximately 550 direct jobs in Idaho during the almost 15 years of operations and would result in at least a similar number of indirect and induced jobs while generating significant taxes and other benefits to the local, state and national economies.

Midas Gold has strived to develop a Project that respects and responds to the needs of all Project stakeholders. including local communities, tribal governments, and regional interests. In addition to board adoption of a formal Environmental Social and Governance commitment, Midas Gold has proactively implemented an iterative process of community engagement involving communicating with and listening to stakeholders through all aspects and phases of Project planning and design. These activities include interaction with potentially affected communities regarding potential Project economic impacts and opportunities, working with local communities to identify community needs and to plan for potential expansion of public services and infrastructure, engaging with tribal governments, and sponsoring and participating in community programs and educational events. Midas Gold's commitments also include agreeing to community agreements to ensure communication, coordination and transparency throughout the life of the project and that financial benefits to local communities continue beyond the Project lifespan.

Closure and Restoration

Midas Gold has made considerable effort to design the Project with restoration in mind through the incorporation of specific mitigation and restoration components. The objective of this restoration work is to establish a sustainable fishery with enhanced habitat to support natural populations of salmon, steelhead, and bull trout; improve water quality; establish vegetation; and enhance wildlife habitat, all contributing to a self–sustaining and productive ecosystem.

Significant components of reclamation and restoration occur concurrently with operations, including: removing and reprocessing and/or reusing historical tailings, development rock and spent ore; enhancing existing streams; improving water quality; backfilling and reclaiming the Hangar Flats and Yellow Pine pits; stream restoration; and establishing permanent fish passage to the headwaters of the EFSFSR. The remaining closure activities occur in the first 10 years after operations cease: further improvements to water quality; restoring additional streams, wetlands, and riparian habitat throughout the site; decommissioning onsite infrastructure and facilities; replacing growth media; re-contouring artificial landforms to blend into the landscape; and replanting Project and historical disturbance areas. Closure maintenance, water treatment, and long-term monitoring are anticipated to continue longer to protect water quality gains and ensure that closure features are performing as intended. Figure 3 depicts the proposed restoration of the EFSFSR through the backfilled Yellow Pine Pit.

Project Risks and Opportunities

A number of risks and opportunities have been identified with respect to the Project; aside from industry-wide risks and opportunities (such as changes in capital and operating costs related to inputs like steel and fuel, metal prices, permitting timelines, etc.), high impact Project specific risks and opportunities are summarized below.

Risks, which additional information could eliminate or mitigate:

- Delay in permitting or necessary Project changes resulting from permitting;

- Legal challenges to ROD, other federal, state or local permit decisions;

- Environmental complications associated with legacy mining impacts;

- Water management and chemistry that could affect diversion and closure designs and/or the duration of long-term water treatment;

- Increases to estimated capital and operating costs; and

- Construction schedule.

Opportunities that could improve the economics, and/or permitting schedule of the Project, including a number with potential to increase the NPV by more than $100 million follow:

- In-pit conversion of approximately 9.8 Mt of Inferred Mineral Resources grading 1.02 g/t Au occurring within the Mineral Reserve Pits containing approximately 321 koz of gold, to Mineral Reserves, increasing Mineral Reserves and reducing the strip ratio;

- Out-of-pit conversion of approximately 26.2 Mt of Inferred Mineral Resources grading 1.09 g/t Au occurring outside the current Mineral Reserve Pits containing approximately 917 koz of gold, to Mineral Reserves;

- Out-of-pit conversion of approximately 27.1 Mt of Measured and Indicated Mineral Resources grading 1.26 g/t occurring outside the current Mineral Reserve Pits containing approximately 1,098 koz of gold, to Mineral Reserves;

- In-pit conversion of unclassified material currently treated as development rock to Mineral Reserves, increasing Mineral Reserves and reducing strip ratios;

- Definition of additional Mineral Reserves within the West End deposit through infill and resource definition drilling;

- Potential for the definition of higher grade, higher margin underground Mineral Reserves at Scout, Garnet or Hangar Flats; and,

- Discovery of other new deposits with attractive operating margins.

Mineral resources exclusive of mineral reserves are reported based on a fixed gold cut-off grade of 0.45 g/t for sulfide and 0.40 g/t for oxide, and in relation to conceptual Mineral Resource pit shells and Mineral Reserve pits to demonstrate potential economic viability as required under NI43-101. Indicated mineral resources exclusive of mineral reserves are reported to demonstrate potential for future expansion should economic conditions warrant. Inferred mineral resources exclusive of mineral reserves are reported to demonstrate potential to increase in-pit production should inferred mineral resources be successfully converted to mineral reserves; mineralization lying outside of Mineral Resource pit shells is not reported as a mineral resource. Mineral resources are not mineral reserves and do not have demonstrated economic viability. These mineral resource estimates include inferred mineral resources that are considered too speculative geologically to have economic considerations applied to them that would enable them to be categorized as mineral reserves. It is reasonably expected that the majority of inferred mineral resources could be upgraded to indicated.

Opportunities with a medium impact ($10 to $100 million increase in Project NPV) include improved metallurgical recoveries, secondary processing of antimony concentrates, steeper pit slopes, and government funding of off-site infrastructure. A number of lesser impact opportunities also exist.

Qualified Persons

The FS was compiled by M3 under the direction of Independent QPs and in compliance with NI 43-101 standards for reporting mineral properties, Companion Policy 43-101CP, and Form 43-101F1. Independent QPs for the study include: Richard Zimmerman, SME-RM (onsite and offsite infrastructure, cost estimating and financial modeling) and Art Ibrado, P.E. (mineral processing) with M3; Garth Kirkham, P.Geo. (mineral resources) with Kirkham Geosystems Ltd.; Christopher Martin, C.Eng. (metallurgy) with Blue Coast Metallurgy Ltd.; Grenvil Dunn, C.Eng. (hydrometallurgy) with Hydromet WA (Pty) Ltd.; Chris Roos, P.E. (mineral reserves) and Scott Rosenthal P.E. (mine planning) with Value Consulting, Inc.; and Peter Kowalewski, P.E. (tailings storage facility and closure) with Tierra Group International, Ltd.

The technical information in this news release has been prepared in accordance with Canadian regulatory requirements set out in National Instrument 43-101 and reviewed and approved by Austin Zinsser, SME-RM, Sr. Resource Geologist for Midas Gold Idaho, Inc., and a Qualified Person. Mr. Zinsser is not responsible for statements attributed to officers and directors of Midas Gold Corp, or other non-technical information in this news release.

About Midas Gold and the Stibnite Gold Project

Midas Gold Corp., through its wholly owned subsidiaries, is focused on the exploration and, if warranted, site restoration and development of gold-antimony-silver deposits in the Stibnite-Yellow Pine district of central Idaho that are encompassed by the Stibnite Gold Project.

Facebook: www.facebook.com/midasgoldidaho

Twitter: @MidasIdaho

Website: www.midasgoldcorp.com

Forward-Looking Information:

Forward-Looking Information Statements contained in this news release that are not historical facts are "forward-looking information" or "forward-looking statements" (collectively, "Forward-Looking Information") within the meaning of applicable Canadian securities legislation and the United States Private Securities Litigation Reform Act of 1995. Forward Looking Information includes, but is not limited to, disclosure regarding possible events, conditions or financial performance that is based on assumptions about future economic conditions and courses of action; the timing and impact of future activities on the Project, including but not limited to the ability to address legacy features left by previous operators; the anticipated economic, environmental and other benefits of the Project; the viability of the Project; development and operating costs in the event that a production decision is made; success of exploration, development and environmental protection, closure and remediation activities; permitting time lines and requirements; requirements for additional capital; requirements for additional water rights and the potential effect of proposed notices of environmental conditions relating to mineral claims; risks and opportunities associated with the Project; planned exploration and development of properties and the results thereof; planned expenditures, production schedules and budgets and the execution thereof. In certain cases, Forward-Looking Information can be identified by the use of words and phrases such as "reduce", "feasible", "vision", "goals", "improved", "plans", "future", "prospects", dependent", "estimates", "long-term", "sequence", "minimizing", "needs", "likely", "readily", "assumed", "imminent", "proposed", "drives", "opportunities", "improve", "contemplates", "pursuing", "strived", "adoption", "planning", "estimation", "potentially", "potential", "anticipated", "schedule", "additional", "discovery", "plans", "expects" or "does not expect", "is expected", "budget", "scheduled", "estimates", "forecasts", "intends", "anticipates", "potential" or "does not anticipate", "believes", "contemplates", "recommends" or variations of such words and phrases or statements that certain actions, events or results "may", "could", "would", "might" or "will be taken", "occur" or "be achieved". Statements concerning mineral resource and mineral reserve estimates may also be deemed to constitute Forward-Looking Information to the extent that they involve estimates of the mineralization that may be encountered if the Stibnite Gold Project is developed. In preparing the Forward-Looking Information in this news release, the Company has applied several material assumptions, including, but not limited to, that any additional financing needed will be available on reasonable terms; the exchange rates for the U.S. and Canadian currencies will be consistent with the Company's expectations; that the current exploration, development, environmental and other objectives concerning the Stibnite Gold Project can be achieved and that its other corporate activities will proceed as expected; that the current price and demand for gold and antimony will be sustained or will improve; that general business and economic conditions will not change in a materially adverse manner and that all necessary governmental approvals for the planned exploration, development and environmental protection activities on the Stibnite Gold Project will be obtained in a timely manner and on acceptable terms; the continuity of the price of gold and other metals, economic and political conditions and operations; that the circumstances surrounding the COVID-19 pandemic, although evolving, will stabilize or at least no worsen; and the assumptions set out in the FS. Forward-Looking Information involves known and unknown risks, uncertainties and other factors which may cause the actual results, performance or achievements of the Company to be materially different from any future results, performance or achievements expressed or implied by the Forward-Looking Information. Such risks and other factors include, among others, the industry-wide risks and project-specific risks identified in the FS and summarized above; risks related to the availability of financing on commercially reasonable terms and the expected use of proceeds; operations and contractual obligations; changes in exploration programs based upon results of exploration; changes in estimated mineral reserves or mineral resources; future prices of metals; availability of third party contractors; availability of equipment; failure of equipment to operate as anticipated; accidents, effects of weather and other natural phenomena and other risks associated with the mineral exploration industry; environmental risks, including environmental matters under US federal and Idaho rules and regulations; impact of environmental remediation requirements and the terms of existing and potential consent decrees on the Company's planned exploration and development activities on the Stibnite Gold Project; certainty of mineral title; community relations; delays in obtaining governmental approvals or financing; fluctuations in mineral prices; the Company's dependence on one mineral project; the nature of mineral exploration and mining and the uncertain commercial viability of certain mineral deposits; the Company's lack of operating revenues; governmental regulations and the ability to obtain necessary licenses and permits; risks related to mineral properties being subject to prior unregistered agreements, transfers or claims and other defects in title; currency fluctuations; changes in environmental laws and regulations and changes in the application of standards pursuant to existing laws and regulations which may increase costs of doing business and restrict operations; risks related to dependence on key personnel; COVID-19 risks to employee health and safety and a slowdown or temporary suspension of operations in geographic locations impacted by an outbreak; and estimates used in financial statements proving to be incorrect; as well as those factors discussed in the Company's public disclosure record. Although the Company has attempted to identify important factors that could affect the Company and may cause actual actions, events or results to differ materially from those described in Forward-Looking Information, there may be other factors that cause actions, events or results not to be as anticipated, estimated or intended. There can be no assurance that Forward-Looking Information will prove to be accurate, as actual results and future events could differ materially from those anticipated in such statements. Accordingly, readers should not place undue reliance on Forward-Looking Information. Except as required by law, the Company does not assume any obligation to release publicly any revisions to Forward-Looking Information contained in this news release to reflect events or circumstances after the date hereof or to reflect the occurrence of unanticipated events.

Note to US Investors

This news release has been prepared in accordance with the requirements of the securities laws in effect in Canada, which differ from the requirements of United States securities laws. The terms "mineral resource", "indicated mineral resource" and "inferred mineral resource" are defined in and required to be disclosed by NI 43-101; however, these terms are not defined terms under SEC Industry Guide 7 and are normally not permitted to be used in reports and registration statements filed with the SEC. In addition, the terms "mineral reserve" and "probable mineral reserve" are also defined in accordance with NI43-101 and not Guide 7. Investors are cautioned not to assume that all or any part of an "indicated mineral resource" or "inferred mineral resource" will ever be upgraded to a higher category or converted into mineral reserves in accordance with Guide 7. "Inferred mineral resources" have a great amount of uncertainty as to their existence, and great uncertainty as to their economic and legal feasibility. Under Canadian rules, estimates of inferred mineral resources may not form the basis of feasibility or pre-feasibility studies, except in rare cases. Investors are cautioned not to assume that all or any part of an inferred mineral resource exists or is economically or legally mineable. Disclosure of "contained ounces" in a mineral resource is permitted disclosure under Canadian regulations; however, the SEC normally only permits issuers to report mineralization that does not constitute "reserves" by SEC Industry Guide 7 standards as in place tonnage and grade without reference to unit measures. Accordingly, information contained in this News Release contain descriptions of the Company's mineral deposits that may not be comparable to similar information made public by U.S. companies subject to the reporting and disclosure requirements under the United States federal securities laws and the rules and regulations thereunder.

Non-IFRS Reporting Measures

"Cash Costs", "All-in Sustaining Costs" and "All-in costs" are not Performance Measures reported in accordance with International Financial Reporting Standards ("IFRS"). These performance measures are included because these statistics are key performance measures that management uses to monitor performance. Management uses these statistics to assess how the Project ranks against its peer projects and to assess the overall effectiveness and efficiency of the contemplated mining operations. These performance measures do not have a meaning within IFRS and, therefore, amounts presented may not be comparable to similar data presented by other mining companies. These performance measures should not be considered in isolation as a substitute for measures of performance in accordance with IFRS.

Table 10: Mine Production Schedule and Process Plant Metallurgical Summary

Parameter | Units | Total / | Year of Operation | |||||||||||||||

-1 | 1 | 2 | 3 | 4 | 5 | 6 | 7 | 8 | 9 | 10 | 11 | 12 | 13 | 14 | 15 | |||

Mining | ||||||||||||||||||

Yellow Pine Ore Mined | kt | 47,847 | 737 | 7,188 | 8,102 | 11,883 | 11,299 | 4,804 | 3,100 | 734 | - | - | - | - | - | - | - | - |

Hangar Flats Ore Mined | kt | 8,262 | - | - | - | 57 | 1,849 | 5,219 | 1,138 | - | - | - | - | - | - | - | - | - |

West End Ore Mined | kt | 46,224 | 36 | - | - | 31 | - | 79 | 1,713 | 7,027 | 8,137 | 5,599 | 8,035 | 9,509 | 6,058 | - | - | - |

Historical Tailings Ore Mined | kt | 2,687 | - | 432 | 831 | 831 | 592 | - | - | - | - | - | - | - | - | - | - | - |

Total Ore Mined | kt | 105,020 | 773 | 7,621 | 8,933 | 12,801 | 13,740 | 10,101 | 5,951 | 7,761 | 8,137 | 5,599 | 8,035 | 9,509 | 6,058 | - | - | - |

Average Gold Grade | g/t | 1.43 | 1.08 | 1.62 | 1.85 | 1.74 | 1.84 | 1.45 | 1.48 | 0.90 | 1.03 | 1.03 | 1.01 | 1.25 | 1.38 | - | - | - |

Average Silver Grade | g/t | 1.91 | 1.22 | 1.80 | 3.12 | 2.63 | 2.09 | 2.23 | 1.85 | 0.93 | 0.90 | 1.55 | 1.68 | 1.71 | 1.46 | - | - | - |

Average Antimony Grade in High Antimony Ore | % | 0.168 | 0.131 | 0.529 | 0.489 | 0.380 | 0.382 | 0.375 | 0.694 | 0.529 | - | - | - | - | - | - | - | - |

Waste Rock Mined | kt | 258,586 | 23,841 | 21,958 | 22,521 | 20,031 | 17,079 | 21,032 | 22,069 | 22,625 | 23,326 | 27,345 | 22,942 | 10,721 | 3,098 | - | - | - |

Average Strip Ratio (Waste tonnes / Ore tonnes) | t / t | 2.5 | 30.8 | 2.9 | 2.5 | 1.6 | 1.2 | 2.1 | 3.7 | 2.9 | 2.9 | 4.9 | 2.9 | 1.1 | 0.5 | - | - | - |

Processing | ||||||||||||||||||

Total Plant Feed | kt | 104,625 | 6,429 | 7,321 | 7,816 | 7,895 | 7,323 | 7,303 | 7,303 | 7,303 | 7,323 | 7,303 | 7,303 | 7,303 | 7,323 | 7,303 | 2,076 | |

Gold Grade | g/t | 1.43 | 1.85 | 2.10 | 2.20 | 2.50 | 1.86 | 1.53 | 1.18 | 1.12 | 0.96 | 1.07 | 1.43 | 1.28 | 0.61 | 0.54 | 0.50 | |

Silver Grade | g/t | 1.91 | 2.06 | 3.54 | 3.27 | 2.51 | 2.81 | 2.18 | 1.24 | 0.98 | 1.49 | 1.70 | 1.78 | 1.42 | 1.08 | 0.87 | 0.82 | |

Antimony Grade in High Antimony Ore | % | 0.506 | 0.638 | 0.587 | 0.491 | 0.696 | 0.402 | 0.491 | 0.968 | - | 0.202 | - | - | - | - | - | - | |

Gold Recovery in Doré (overall) | % | 88.9 | 90.4 | 89.8 | 90.0 | 90.5 | 90.8 | 91.1 | 88.4 | 86.4 | 86.7 | 85.4 | 85.3 | 88.5 | 85.8 | 86.7 | 86.6 | |

Yellow Pine Gold Recovery in Doré | % | 91.1 | 91.2 | 90.8 | 90.8 | 91.2 | 91.2 | 91.0 | 91.3 | 91.4 | 91.1 | 91.4 | 91.4 | 91.4 | 91.4 | 91.4 | - | |

Hangar Flats Gold Recovery in Doré | % | 89.5 | - | - | 89.9 | 89.4 | 89.4 | 89.6 | 89.9 | 89.9 | 89.6 | 89.9 | 89.9 | 89.9 | 89.9 | 89.9 | - | |

West End Gold Recovery in Doré | % | 85.6 | - | - | - | - | - | 81.0 | 84.2 | 85.7 | 85.0 | 84.8 | 85.2 | 88.3 | 85.8 | 82.8 | 86.6 | |

Historical Tailings Gold Recovery in Doré | % | 67.7 | 67.7 | 67.7 | 67.7 | 67.7 | - | - | - | - | - | - | - | - | - | - | - | |

Silver Recovery in Doré (overall) | % | 23.2 | 19.9 | 14.0 | 14.0 | 17.9 | 14.6 | 17.4 | 30.5 | 38.4 | 34.2 | 36.2 | 30.0 | 26.6 | 41.7 | 34.6 | 72.1 | |

Antimony Recovery in High Antimony Ore | % | 77.6 | 76.5 | 80.4 | 76.6 | 65.7 | 79.6 | 86.5 | 51.1 | - | 79.0 | - | - | - | - | - | - | |

Payables | ||||||||||||||||||

Payable Gold in Doré | koz | 4,251 | 343 | 440 | 491 | 571 | 393 | 324 | 244 | 225 | 194 | 214 | 285 | 264 | 123 | 110 | 29 | |

Payable Silver in Doré | koz | 1,459 | 83 | 114 | 113 | 112 | 95 | 87 | 87 | 86 | 118 | 142 | 123 | 87 | 104 | 70 | 39 | |

Payable Antimony in Antimony Concentrate | klb | 80,147 | 5,744 | 20,108 | 17,350 | 8,177 | 12,875 | 13,228 | 656 | - | 2,009 | - | - | - | - | - | - | |

Payable Gold in Antimony Concentrate | koz | 0.09 | - | - | - | - | - | 0.08 | - | - | 0.01 | - | - | - | - | - | - | |

Payable Silver in Antimony Concentrate | koz | 454 | - | 126.2 | 127.3 | 58.0 | 115.5 | 14.3 | - | - | 12.4 | - | - | - | - | - | - | |

SOURCE Midas Gold Corp.

![]() View original content to download multimedia: http://www.newswire.ca/en/releases/archive/December2020/22/c3339.html

View original content to download multimedia: http://www.newswire.ca/en/releases/archive/December2020/22/c3339.html