Moneta Delivers Positive PEA for Tower Gold

261,014 oz Au Average Annual Production for First 11 Years

After-Tax $1,066 Million NPV(5%) and 31.7% IRR at US$1,600/oz Au with 24 Year Mine Life

$159 Million Average Annual After-Tax Free Cash Flow for First 11 Years of Full Production

Toronto, Ontario--(Newsfile Corp. - September 7, 2022) - Moneta Gold Inc. (TSX: ME) (OTCQX: MEAUF) (XETRA: MOP) ("Moneta" or the "Company") is pleased to announce positive results from a Preliminary Economic Assessment ("PEA") for the Company's 100% owned Tower Gold project in Timmins, Ontario. The PEA, prepared by Ausenco Engineering Canada Inc. ("Ausenco") in accordance with National Instrument 43-101 ("NI 43-101"), demonstrates the potential to develop a low-cost 19,200 tonnes per day ("tpd") combined open pit and underground mining operation with strong economics and the opportunity for significant benefit to the Indigenous Nations, local stakeholders, and the Company.

HIGHLIGHTS OF THE PEA

(All figures are stated in Canadian dollars unless otherwise stated)

- Low capital intensity project, with initial capital ("CAPEX") of $517 million for a 7.0 million tonne per annum ("tpa") processing plant including mine preproduction, infrastructure (roads, power line and substation, tailings storage facility, ancillary buildings, and site water management structures) and $886 million sustaining capital

- After-tax pay-back of 2.6 years and profitability index (NPV/initial capital) of 2.1

- Robust economics with $1,459 million pre-tax Net Present Value at a 5% discount rate ("NPV5%"), $1,066 million after-tax, and 38.9% pre-tax Internal Rate of Return ("IRR"), 31.7% after-tax; at US$1,600/oz gold and exchange rate of US$0.78/C$

- Highly leveraged to the gold price with after-tax NPV5% of $1,339 million, 37.8% IRR, and 2.2-year payback at spot US$1,700 per ounce gold

- $1,932 million cumulative after-tax cash flow

- Mine life of 24 years, with average annual gold production of 261,014 oz in years 1 to 11 (192,666 oz for LOM) for 4,581,000 ounces total gold production LOM

- Peak annual gold production of 368,622 ounces

- Average mill head gold grade of 1.28 grams per tonne ("g/t") gold ("Au") in years 1 to 11 (0.94 g/t Au for LOM)

- Average mill recovery of 91.3% LOM

- Cash cost of US$910 per ounce and all-in sustaining cost ("AISC") of US$1,073 per ounce gold

- Opportunities to increase production and expand and improve economics of resources

Gary O'Connor, Moneta's President and Chief Executive Officer commented, "We're very pleased with the results of this PEA, which has outlined a strong base-case for a significant and highly profitable new gold mine in Ontario. Our robust base case at US$1,600 per ounce gold price for the project supports a 24-year mine life with average annual production of 261,014 ounces of gold for the first 11 years with an after-tax NPV of $1,066 million and IRR of 31.7%, with very attractive cash costs and AISC, low CAPEX and low capital intensity. This PEA confirms the potential for a robust gold project with compelling project economics and represents an important interim update on the progress of our work program at Tower Gold. In 2022, we will continue to focus on in-fill and definition drilling to better define resources and improve the economics of the resource through increasing grades and lowering strip ratios, while also identifying new targets."

TOWER GOLD PEA OVERVIEW

The PEA was prepared in accordance with National Instrument 43-101 ("NI 43-101") by Ausenco. The Company will file the PEA on SEDAR at www.sedar.com in accordance with NI 43-101, and on its website within 45 days.

Table 1: Summary of Project Economics

| General | Unit | LOM Total / Avg. | |

| Gold price assumption | per ounce | US$1,600 | |

| Exchange rate | ($US: $CAD) | 0.78 | |

| Mine life | years | 24 | |

| Total waste | million tonnes | 495 | |

| Total overburden | million tonnes | 237 | |

| Total mill feed | million tonnes | 166 | |

| Strip ratio (total) | waste: mined resource | 4.63 | |

| Strip ratio (without overburden) | waste: mined resource | 3.13 | |

| Economics (pre-tax) | |||

| Net present value (NPV 5%) | millions | $1,459 | |

| Internal rate of return (IRR) | % | 38.9% | |

| Payback | years | 2.2 | |

| LOM avg. annual cash flow | millions | $132 | |

| LOM cumulative cash flow | millions | $2,579 | |

| Economics (after-tax) | |||

| Net present value (NPV 5%) | millions | $1,066 | |

| Internal rate of return (IRR) | % | 31.7% | |

| Payback | years | 2.6 | |

| LOM avg. annual cash flow | millions | $105 | |

| LOM cumulative cash flow | millions | $1,932 | |

| Profitability index (NPV/initial capital) | ratio | 2.1 | |

| Peak investment | millions | $517 | |

| Production | |||

| Mill head grade | g/t Au | 0.94 | |

| Mill head grade (years 1 - 11) | g/t Au | 1.28 | |

| Mill recovery rate (average LOM) | % | 91.3% | |

| Average annual mining rate | tpd | 19,178 | |

| Average annual gold production | ounces | 192,666 | |

| Average annual gold production (years 1 - 11) | ounces | 261,014 | |

| Peak gold production (year 6) | ounces | 368,622 | |

| Total LOM recovered gold | thousand ounces | 4,581 | |

| Operating Costs | |||

| Mining + Reclaim cost | $/t mined | $3.7 | |

| Mining + Reclaim cost | $/t milled | $20.8 | |

| Processing cost | $/t milled | $10.1 | |

| G&A cost | $/t milled | $0.9 | |

| Total operating costs | $/t milled | $31.8 | |

| Refining & transport cost | $/oz | $4.7 | |

| Royalty NSR (Garrison deposits) | % | 1.5% | |

| Cash costs* | US$/oz | $910 | |

| AISC** | US$/oz | $1,073 | |

| Capital Costs | |||

| Initial capital | millions | $517 | |

| Sustaining capital | millions | $886 | |

| Closure costs | millions | $78 | |

| Salvage value | millions | $10 |

Notes

* Cash costs consist of mining costs, processing costs, general & administrative expenses and refining charges and royalties.

** AISC includes cash costs plus sustaining capital, closure cost and salvage value.

The PEA is preliminary in nature, includes inferred mineral resources that are considered too speculative geologically to have the economic considerations applied to them that would enable them to be categorized as mineral reserves, and there is no certainty that the PEA will be realized. Mineral resources that are not mineral reserves do not have demonstrated economic viability.

SENSITIVITIES

A sensitivity analysis was conducted on the base case pre-tax and after-Tax NPV and IRR of the Project, using the following variables: metal price, initial capex, total operating costs, and foreign exchange. Table 2 summarizes the after-tax sensitivity analysis results at various gold price assumptions.

Table 2: After-Tax Sensitivity Summary

| Gold Price | $1,350 | $1,500 | $1,600 | $1,700 | $1,950 |

| (US$/oz) | (Base Case) | ||||

| After-tax NPV(5%), millions | $385 | $794 | $1,066 | $1,339 | $2,019 |

| IRR | 15.8% | 25.6% | 31.7% | 37.8% | 52.0% |

| Profitability index | 0.7x | 1.5x | 2.1x | 2.6x | 3.9x |

| Payback (years) | 5.4 | 4.1 | 2.6 | 2.2 | 1.6 |

As shown in Table 3 and Table 4, the sensitivity analysis revealed that the project is most sensitive to changes in gold prices, and foreign exchange and less sensitive to initial capex and operating costs.

Table 3: After-Tax NPV5% Sensitivity

| Gold Price | After-Tax NPV(5%) | Initial CAPEX | Total OPEX | FX | |||

| (US$/oz) | (Base Case) | (-10%) | (+10%) | (-10%) | (+10%) | (-10%) | (+10%) |

| $1,350 | $385 | $425 | $344 | $623 | $145 | $794 | $48 |

| $1,500 | $794 | $833 | $754 | $1,032 | $555 | $1,248 | $422 |

| $1,600 | $1,066 | $1,106 | $1,026 | $1,304 | $828 | $1,550 | $670 |

| $1,700 | $1,339 | $1,378 | $1,299 | $1,577 | $1,101 | $1,853 | $917 |

| $1,950 | $2,019 | $2,059 | $1,980 | $2,257 | $1,781 | $2,609 | $1,537 |

| $2,100 | $2,427 | $2,467 | $2,388 | $2,665 | $2,189 | $3,062 | $1,908 |

Table 4: After-Tax IRR Summary

| Gold Price | After-Tax IRR | Initial CAPEX | Total OPEX | FX | |||

| (US$/oz) | (Base Case) | (-10%) | (+10%) | (-10%) | (+10%) | (-10%) | (+10%) |

| $1,350 | 15.8% | 18.2% | 13.9% | 21.1% | 9.6% | 25.6% | 6.5% |

| $1,500 | 25.6% | 28.9% | 22.9% | 30.3% | 20.5% | 35.8% | 16.8% |

| $1,600 | 31.7% | 35.8% | 28.5% | 36.3% | 27.0% | 42.3% | 22.7% |

| $1,700 | 37.8% | 42.3% | 34.0% | 42.1% | 33.2% | 48.6% | 28.4% |

| $1,950 | 52.0% | 58.0% | 47.1% | 56.0% | 47.9% | 63.9% | 42.0% |

| $2,100 | 60.3% | 67.1% | 54.7% | 64.1% | 56.3% | 72.9% | 49.7% |

MINING

The Tower Gold project will consist of the extraction of two separate areas: Golden Highway and Garrison. Golden Highway consists of the mineral deposits Westaway, Southwest, 55, and Windjammer, while Garrison encompasses Garrcon, 903, and Jonpol. The overall strategy is to mine the deposits in two phases using a combination of open pit and underground mining to achieve a total annual production rate of 7.0 million tonnes.

The mineral resources used in the mine plan are contained in the seven mineral deposits over a length of 12 kilometres and span from surface down to a vertical depth of approximately 1,100 metres ("m"). The Westaway and South West deposits are characterized by multiple mineral corridors striking NW and dip sub-vertically and steeply to the west. The deposits have potential for open pit and underground mining.

The Tower Gold project will be extracted with a combination of open pit mining for mineralization closer to surface, and underground mining for mineralization at depth. The combined output of both mines will be 166.4 million tonnes ("Mt") at an average grade of 0.94 g/t Au. The open pit mine will be responsible for 158.2 Mt at a grade of 0.81 g/t Au over an open pit life of 24 years, while the underground mine will contribute 8.2 Mt at a grade of 3.42 g/t Au over an underground mine life of 12 years. Table 5, below, illustrates the mineral deposits each mine will extract.

The underground mine will be accessed through a single portal from surface leading to Westaway and South West via the main ramp of size 5.5 m width ("W") x 5.8 m height ("H") and at a slope gradient of 1:7. The mining method selected is longitudinal sublevel long-hole open stoping with minimum dimensions of 20 m L x 3 m W x 25 m H. Mineralized material will be extracted by ramp using a fleet of 50 tonne haul trucks at an average peak mine production rate of 900,000 tpa. Paste-fill will be used to backfill mined stopes.

Table 5: Mining Areas and Deposits

| Mine | Area | Deposit |

| Underground | Golden Highway | Westaway |

| South West | ||

| Open Pit | Golden Highway | 55 |

| Westaway | ||

| South West | ||

| Windjammer | ||

| Garrison | Garrcon | |

| 903 | ||

| Jonpol |

The Tower Gold project will employ a conventional truck shovel open pit mining method comprising separate waste and ore equipment fleets to improve on ore selectivity and reduce waste removal costs. The ore fleet consists of 12 m³ excavators and 90 tonne trucks while the waste fleet consists of 29 m³ excavators and 220 tonne trucks. Surface mining will extract material from two areas of the property: Garrison and Golden Highway with Golden Highway providing the bulk of the PEA mine plan.

PROCESSING

The process flowsheet was designed based on metallurgical test-work carried out for both the Garrison and Golden Highway deposits. Based on a mine to mill analysis, the processing plant capacity was selected as 7.0 million tpa, or 19,200 tpd.

The process design for the Project consists of:

- Two-stage crushing, consisting of a primary jaw crusher and a secondary cone crusher with screen classification and material handling equipment.

- Grinding of crushed material to 80% (P80) passing size of 75 μm (micron) with a 9.1 m diameter by 5.2 m length SAG (semi-autogenous grind) mill and an 8.2 m diameter by 12.8 m length ball mill in closed circuit with hydrocyclones. The SAG mill and ball mill are equipped with 8.0 MW (megawatt) and twin 9.0 MW motors, respectively.

- A gravity concentration circuit included in the grinding area. Gravity concentrate will feed intensive cyanidation and will be recovered by electrowinning independently of the primary leach circuit.

- Leaching and adsorption circuit including two leach tanks and six carbon-in-leach (CIL) tanks, for a total leach and adsorption circuit retention time of 24 hours which will feed loaded carbon to twin 9 t carbon elution systems.

- Cyanide destruction using an SO2/air system on the final tailings slurry.

- Final tails from the cyanide destruction circuit will be thickened prior to deposition in either a management facility or in exhausted open pits. A portion of the tailings will be filtered to produce paste backfill suitable for use in the underground mine workings.

TAILINGS MANAGEMENT

The tailings management design was completed by Ausenco based on conventional thickened tailings storage. There are two storage facilities for the project:

- A wet tailings storage facility which will be utilized in the first 6 years of the project (before the open pits become available for in-pit tailings disposal) and from year 17 to the end of project after all available open pits have been filled. The design incorporates five phases to build the embankments over the life of the facility. Ultimate storage capacity of this facility is 90.1 Mt.

- In-pit deposition in the exhausted open pits, from years 7 through 17 of the project. Total storage capacity of these pits is 73.9 Mt.

The Company will provide additional details related to Tailings Management and Closure in the PEA report filed on SEDAR within 45 days.

Table 6: Mining & Processing Inputs

| Mining & Processing Inputs | ||

| Mine life - Total | years | 24 |

| Mining Rate | ||

| Open pit* | tpd | 18,228 |

| Underground** | tpd | 2,466 |

| Open pit | ||

| Total mill feed | million tonnes | 158.2 |

| Gold grade (diluted) (years 1 - 11) | g/t | 1.03 |

| Gold grade (diluted) (LOM) | g/t | 0.81 |

| Total waste | million tonnes | 495.3 |

| Total overburden | Million tonnes | 237.2 |

| Total material mined | million tonnes | 890.7 |

| Strip ratio (total) | waste: mined resource | 4.63 |

| Strip ratio (without overburden) | waste: mined resource | 3.13 |

| Underground | ||

| Total mill feed | million tonnes | 8.2 |

| Gold grade (diluted) | g/t | 3.42 |

| Processing | ||

| Feed rate | tpd | 19,178 |

| Total tonnes processed | million tonnes | 166.4 |

| Mill head gold grade | g/t | 0.94 |

| LOM gold recovery | % | 91.3% |

Notes

* Mineralized material average LOM mining rate

** Mineralized material average peak mining rate

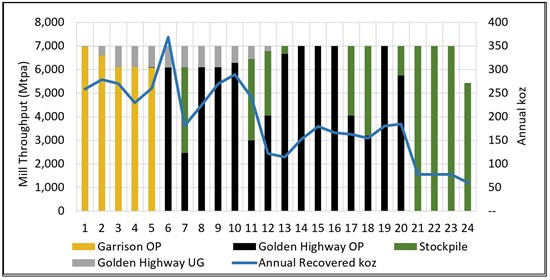

Figure 1: Gold Production Profile

To view an enhanced version of Figure 1, please visit:

https://images.newsfilecorp.com/files/4852/136275_figure1.jpg

OPERATING COSTS

Operating costs have been compiled based on the following sources and assumptions:

- Mining unit costs have been estimated by Mining Plus based on 2022 quotes and database costs.

- Processing units costs have been estimated by Ausenco from first principles, using 2022 prices for major reagents and media. Grinding media and power consumptions were estimated based on estimated conservative hardness characteristics.

- G&A (General and Administration) costs are based on benchmark salary tables for staff positions and other costs from Ausenco databases.

Table 7: Total Life of Mine Operating Costs

| Operating Costs (life of mine average) | ||

| Mining costs (Golden Highway open pit) | $/t mined | $3.11 |

| Mining costs (Garrison open pit) | $/t mined | $2.56 |

| Mining costs (underground) | $/t mined | $87.43 |

| Mining costs (open pit) | $/t milled | $20.77 |

| Processing costs | $/t milled | $10.07 |

| G&A costs | $/t milled | $0.94 |

| Total site operating costs | $/t milled | $31.78 |

| Cash Costs | ||

| Cash costs (LOM)* | US$/oz | $910 |

| AISC (LOM)** | US$/oz | $1,073 |

Notes

* Cash costs consist of mining costs, processing costs, mine-level general & administrative expenses and refining charges and royalties.

** AISC includes cash costs plus sustaining capital, closure cost and salvage value.

INITIAL AND SUSTAINING CAPITAL COSTS

The total initial (pre-production) capital cost for the Tower Gold project is estimated to be $517.0 million including allowances for contingency of $80.9 million. Sustaining costs are estimated to be $886.4 million over life of mine.

The initial and sustaining capital costs were compiled using the following sources:

- Mining capital costs were developed by Mining Plus, based on the mine plan

- Processing, infrastructure, project delivery and project in-directs were developed by Ausenco, and are inclusive of 7.0 Mtpa conventional leach/CIL processing plant, power substation, tailings facility initial construction, paste plant, and other required infrastructure

- Sustaining capital costs consist of mining costs, tailings storage facility expansions, and water management structures

Table 8: Total Capital Costs

| Description | Initial Capital Cost | Sustaining Capital Cost | Total Capital Cost |

| (millions) | (millions) | (millions) | |

| Mining Golden Highway | $0 | $647.7 | $647.7 |

| Mining Garrison | $63.7 | $174.7 | $238.4 |

| Process Plant | $203.0 | $0.0 | $203.0 |

| Infrastructure On-site | $96.2 | $60.9 | $157.2 |

| Off-site infrastructure | $0.5 | $0.0 | $0.5 |

| Total Directs | $363.4 | $883.3 | $1,246.8 |

| Project in-directs | $21.8 | $0.0 | $21.8 |

| Project delivery | $36.3 | $0.0 | $36.3 |

| Owner's costs | $14.5 | $0.0 | $14.5 |

| Total In-directs | $72.7 | $0.0 | $72.6 |

| Contingency | $80.9 | $3.0 | $83.9 |

| Total | $517.0 | $886.4 | $1,403.4 |

Figure 2: LOM Post-Tax-Free Cash Flow

To view an enhanced version of Figure 2, please visit:

https://images.newsfilecorp.com/files/4852/136275_figure2.jpg

OPPORTUNITIES

The PEA outlined several initiatives that may enhance the Project including:

- Expansion of resources through exploration drilling of additional targets within the remaining 8 km of untested strike length along the Destor-Porcupine Fault Zone corridor

- Expansion of resources from new exploration targets outside of Tower Gold project area

- Expansion of underground resources through additional exploration drilling, notably at Westaway and Garrcon. Currently 12 years of underground mining are proposed

- Increase in production rates from underground to increase mill feed grades

- Review the potential for larger scale bulk tonnage underground mining

- Review the potential to expand of the processing plant to increase through-put

- Infill drilling of open pits to convert waste to resources, notably at 903, Westaway, South West and Windjammer

- Additional cyanidation test-work is recommended for the deposits with the objective of further optimizing process grind size and ideal leaching conditions to minimize capital and operating costs

- Test-work relating to gravity concentration is recommended to more accurately determine the presence of free gold across the deposits and estimate gravity concentration recovery as a function of the mine plan

- Hardness characteristics of the Tower Gold material were conservatively assumed for the purposes of this PEA. Comminution test-work should be performed to verify the assumptions made regarding the rock breakage parameters, which may demonstrate cost reduction opportunities

- Optimization of plant and overall site layouts to further reduce site operational footprint.

NEXT STEPS

The results of the PEA indicate that the proposed Project has the potential to be technically and economically viable using the base case assumptions presented in the tables above. The study also shows several opportunities for project enhancement. The Qualified Persons ("QPs") consider the PEA results sufficiently reliable and recommend that the Tower Gold project be advanced to the next stage of development through the initiation of a pre-feasibility study ("PFS"). An Environmental Impact Study should be conducted for the Project, while continuing to explore the geological potential of the property. Following the release of this PEA, Moneta will complete the necessary bridging work to commence a pre-feasibility study.

TOWER GOLD PROJECT MINERAL RESOURCE ESTIMATE UPDATE

An updated mineral resource estimate ("MRE") was independently prepared by APEX Geoscience Ltd. in accordance with National Instrument 43-101 ("NI 43-101"), with an effective date of September 07, 2022, and using a drillhole database current as of March 15, 2022. The consolidated mineral resource now totals 4.46Moz indicated gold and 8.29Moz inferred gold. The updated MRE is used to support the updated PEA detailed above.

The MRE is an update to, and supersedes, the technical report ("Technical Report") filed by Moneta on June 24, 2022, where the resource estimation domains and open pit block model size were modified. The mineral resource block model utilized a block size of 2.5 m (X) x 2.5 m (Y) x 2.5 m (Z) to honour the mineralization wireframes. The percentage of the volume of each block below the bare earth surface, below the modelled waste overburden surface and within each mineralization domain was calculated using the 3D (Three dimensional) geological models and a 3D surface model. For the open pit Garrcon, Jonpol, and 903 resources, the block model was block-averaged up to a 5 m (X) x 5 m (Y) x 5 m (Z) SMU block size for pit optimization with the outer blocks on the boundaries of the domains diluted. For the open pit South West, Windjammer South, Windjammer Central, Westaway, Discovery, and Iron Formation resources, the block model was block-averaged up to a 2.5 m (X) x 5 m (Y) x 5 m (Z) SMU block size for pit optimization with the outer blocks on the boundaries of the domains diluted. Resource within the iron formation units throughout the Golden Highway area and an additional resource area, South West North, are now reported.

Table 9: September 2022 NI 43-101 Mineral Resource Estimate by Deposit - Tower Gold Project

| September 2022 Resource | Category | Indicated | Inferred | ||||

| Category | Tonnes (t) | Grade (g/t Au) | Ounces (oz) | Tonnes (t) | Grade (g/t Au) | Ounces (oz) | |

| Total | Open Pit | 149,773,000 | 0.90 | 4,338,000 | 223,910,000 | 0.92 | 6,652,000 |

| Underground | 801,000 | 4.75 | 122,000 | 11,719,000 | 4.35 | 1,640,000 | |

| Total Open Pit + Underground | 150,574,000 | 0.92 | 4,460,000 | 235,629,000 | 1.09 | 8,292,000 | |

| Breakdown by Deposit | |||||||

| South West | Open Pit | 16,687,000 | 0.90 | 482,000 | 49,415,000 | 0.97 | 1,546,000 |

| Underground | 211,000 | 4.53 | 31,000 | 6,725,000 | 4.26 | 920,000 | |

| Windjammer South | Open Pit | 42,049,000 | 0.78 | 1,058,000 | 34,461,000 | 0.97 | 1,074,000 |

| Underground | - | - | - | 704,000 | 4.16 | 94,000 | |

| Westaway | Open Pit | 750,000 | 2.20 | 53,000 | 22,106,000 | 1.95 | 1,383,000 |

| Underground | - | - | - | 2,349,000 | 4.23 | 320,000 | |

| Windjammer Central | Open Pit | 28,498,000 | 0.63 | 581,000 | 77,834,000 | 0.64 | 1,595,000 |

| Underground | - | - | - | - | - | - | |

| 55 Zone | Open Pit | 4,780,000 | 1.30 | 199,000 | 4,266,000 | 1.01 | 139,000 |

| Underground | - | - | - | 150,000 | 3.95 | 19,000 | |

| Discovery | Open Pit | 3,244,000 | 1.20 | 125,000 | 5,767,000 | 0.85 | 158,000 |

| Underground | - | - | - | 326,000 | 3.97 | 42,000 | |

| Garrcon | Open Pit | 26,787,000 | 1.01 | 872,000 | 971,000 | 0.83 | 26,000 |

| Underground | 590,000 | 4.82 | 91,000 | 1,466,000 | 5.22 | 246,000 | |

| 903 | Open Pit | 18,090,000 | 1.01 | 585,000 | 24,127,000 | 0.75 | 581,000 |

| Underground | - | - | - | - | - | - | |

| Jonpol | Open Pit | 8,898,000 | 1.34 | 383,000 | 4,962,000 | 0.94 | 151,000 |

| Underground | - | - | - | - | - | - | |

Mineral resources which are not mineral reserves do not have demonstrated economic viability. The estimate of mineral resources may be materially affected by environmental, permitting, legal, title, market or other relevant factors.

Notes:

- Mineral Resource Estimates are reported at two different cut-off grades; 0.3 g/t Au for the surface mining scenario and 2.6 g/t Au for the underground mining scenario.

- The cut-off grade was determined at a gold price of US$1,750 per ounce and an exchange rate of USD$/CDN$ of 0.78.

- The resource estimate is supported by statistical analysis with different high-grade capping applied to each of the deposits ranging from 0.6 g/t Au to 79.0 g/t Au applied on assays composited into one (1) metre composites

- The mineral resources presented here were estimated with a block size of 2.5mx2.5mx2.5m utilizing percent blocks and constrained within geological wireframes with a minimum width of 1.50m. Gold was estimated by Ordinary Kriging using locally varying anisotropy variogram models. The maximum range of the variogram models generally are between 65mx25mx2.5m and 80m x 45m x5m. The search ellipse was constrained to selecting composites flagged within each domain.

- The mineral resources presented here were estimated by personnel from APEX Geoscience Ltd. using the Canadian Institute of Mining, Metallurgy and Petroleum (CIM) Standards on Mineral Resources and Reserves definitions and guidelines.

- The quantity and grade of reported Inferred Resources are uncertain in nature and there has not been sufficient work to define these Inferred Resources as Indicated or Measured Resources. It is reasonably expected that the majority of the Inferred Mineral Resources could be upgraded to Indicated Mineral Resources with continued exploration.

- The historical underground voids from mining in any of the deposit areas have been removed.

- Tonnage estimates are based on bulk densities individually measured and calculated for each of the deposit areas. Resources are presented as undiluted and in situ.

- This mineral resource estimate is dated September 7, 2022. The effective date for the drill-hole database used to produce this updated mineral resource estimate is March 15, 2022. Tonnages and ounces in the tables are rounded to the nearest thousand and hundred, respectively. Numbers may not total due to rounding.

- A new updated NI 43-101 technical report will be produced with updated resources as part of the updated PEA.

- Discovery includes the Windjammer North resource. Windjammer South includes the Golden Highway Iron Formation resource. South West North resource is included in South West.

- Mr. Michael Dufresne, M.Sc., P.Geo. of APEX Geoscience Ltd., who is deemed a qualified persons as defined by NI 43-101 is responsible for the completion of the updated mineral resource estimation.

QUALIFIED PERSONS

The PEA study was prepared for Moneta by the following Qualified Persons (QP's) under National Instrument 43-101 from Ausenco Engineering Canada Inc. ("Ausenco"), Mining Plus Canada Consulting Ltd. ("Mining Plus"), and APEX Geoscience Ltd. ("APEX"):

- Tommaso Roberto Raponi, P.Eng., Process and Infrastructure (Ausenco)

- Ali Hooshiar, P. Eng., Tailings Management (Ausenco)

- Davood Hasanloo, P.Eng., Site Water Management (Ausenco)

- Scott Weston, P.Geo., Environment (Ausenco)

- Michael B. Dufresne, M.Sc., P.Geol., P.Geo (APEX)

- James Lill, P.Eng., Underground Mining (Mining Plus)

- Neda Farmer P.Eng., Surface Mining (Mining Plus)

The scientific and technical information contained in this news release, has been reviewed and approved by Jason Dankowski, P.Geo, of Moneta who is a "qualified person" within the meaning of NI 43-101.

Non-IFRS Financial Measures

Moneta has included certain non-IFRS financial measures in this news release, such as Initial Capital Cost, Sustaining Capital, Cash Operating Costs, Total Cash Cost, All-In Sustaining Cost, All-in Cost, Profitability Index and Peak Investment, which are not measures recognized under IFRS and do not have a standardized meaning prescribed by IFRS. As a result, these measures may not be comparable to similar measures reported by other corporations. Each of these measures used are intended to provide additional information to the user and should not be considered in isolation or as a substitute for measures prepared in accordance with IFRS.

Non-IFRS financial measures used in this news release and common to the gold mining industry are defined below.

Total Cash Costs and Total Cash Costs per Ounce

Total Cash Costs are reflective of the cost of production. Total Cash Costs reported in the PEA include mining costs, processing & water treatment costs, general and administrative costs of the mine, off-site costs, refining costs, transportation costs and royalties. Total Cash Costs per Ounce is calculated as Total Cash Costs divided by payable gold ounces.

All-in Sustaining Costs ("AISC") and AISC per Ounce

AISC is reflective of all the expenditures that are required to produce an ounce of gold from operations. AISC reported in the PEA includes total cash costs, sustaining capital and closure costs, but excludes corporate general and administrative costs and salvage. AISC per Ounce is calculated as AISC divided by payable gold ounces.

WEBCAST DETAILS

Management will host a webcast and conference call to discuss the results of the PEA on September 08, 2022 at 11:00 am ET. Please refer to the details below to join the conference call or the webcast.

CONFERENCE CALL NUMBER

Toll Free Dial-In Number: 1-416-764-8646

Toll Free North America: 1-888-396-8049

WEBCAST LINK

https://app.webinar.net/NjVvZM2o7n4

Please send your questions to management at larmstrong@monetagold.com or at 647-456-9223.

A replay of the conference call will be available at 1:30 pm on the Company's website and by calling (877) 674-7070 or (416) 764-8692. Please enter passcode 330954#

About Moneta Gold

Moneta is a Canadian-based gold exploration company focused on advancing its 100% wholly owned Tower Gold project, located in the Timmins region of Northeastern Ontario, Canada's most prolific gold producing camp. A September 2022, Preliminary Economic Assessment study outlined a combined open pit and underground mining and a 7.0 million tonne per annum conventional leach/CIL operation over a 24-year mine life, with 4.6 Moz of recovered gold, generating an after-tax NPV5% of $1,066MM, IRR of 31.7%, and a 2.6-year payback at a gold price US$1,600/oz. Tower Gold hosts an estimated gold mineral resource of 4.5 Moz indicated and 8.3 Moz inferred. Moneta is committed to creating shareholder value through the strategic allocation of capital and a focus on the current resource upgrade drilling program, while conducting all business activities in an environmentally and socially responsible manner.

FOR FURTHER INFORMATION, PLEASE CONTACT:

Gary V. O'Connor, CEO

416-357-3319

Linda Armstrong, Investor Relations

647-456-9223

The Company's public documents may be accessed at www.sedar.com. For further information on the Company, please visit our website at www.monetagold.com or email us at info@monetagold.com.

This news release includes certain forward-looking information and forward-looking statements, collectively "forward-looking statements" within the meaning of applicable securities legislation. Forward-looking statements are frequently identified by such words as "may", "will", "plan", "expect", "anticipate", "estimate", "intend" and similar words referring to future events and results. Forward-looking statements include but are not limited to information with respect to the closing of the Offering, the use of proceeds, the timing of the renunciation and tax treatment of the Flow Through Shares as well as future performance of the business, its operations and financial performance and condition such as the Corporation's drilling program . Forward-looking statements are subject to inherent risks and uncertainties including without limitation the impact of COVID-19 related disruptions in relation to the Corporation's business operations including upon its employees, suppliers, facilities and other stakeholders; uncertainties and risk that have arisen and may arise in relation to travel, and other financial market and social impacts from COVID-19 and responses to COVID 19 and the ability of the Corporation to finance and carry out its anticipated goals and objectives. International conflicts and other geopolitical risks, including war, military action, terrorism, trade and financial sanctions, which have historically led to, and may in the future lead to, uncertainty or volatility in global commodity and financial markets and supply chains; the impact of Russia's invasion of Ukraine and the widespread international condemnation has had a significant destabilizing effect on world commodity prices, supply chains, inflation risk, and global economies more broadly, may adversely affect the Corporation's business, financial condition, and results of operations.

Forward-looking statements are based on the current opinions and expectations of management. All forward-looking information is inherently uncertain and subject to a variety of assumptions, risks and uncertainties, including the speculative nature of mineral exploration and development, fluctuating commodity prices, competitive risks and the availability of financing, as described in more detail in our recent securities filings available at www.sedar.com. Actual events or results may differ materially from those projected in the forward-looking statements and we caution against placing undue reliance thereon. We assume no obligation to revise or update these forward-looking statements.

To view the source version of this press release, please visit https://www.newsfilecorp.com/release/136275