Monument Commences Phase 2 Drilling Program at the Murchison Gold Project

VANCOUVER, British Columbia, Dec. 15, 2021 (GLOBE NEWSWIRE) -- Monument Mining Limited (TSX-V: MMY and FSE: D7Q1) “Monument” or the “Company” is pleased to announce the commencement of a Phase 2 exploration drilling program at Burnakura, one of the primary Murchison Gold Projects in the Meekatharra area, Western Australia. Together the Phase 2 with the Phase 1 drilling that was completed in August forms part of a two year exploration program to test Murchison potential for gold discovery.

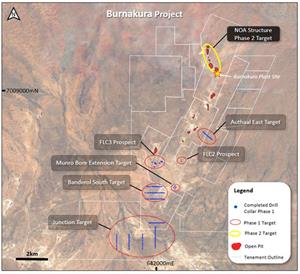

Contrary to the Phase 1 Drilling Program which focused on unexplored areas to the south of Burnakura, the Phase 2 program is targeting down dip and down plunge of known high grade deposits that some of them have been mined historically. The drilling is aimed at testing the potential expansion of the underground resource. Step out spacing from existing drilling is broad to increase the probability of discovering mineralization at NOA Structure area (Figure 1).

Figure 1: Murchison Exploration Locations is available at https://www.globenewswire.com/NewsRoom/AttachmentNg/0bfe4993-e938-49f6-8abb-9fe6220d2afe

The CEO and President Cathy Zhai comments: “Our Murchison team is delighted to start the Phase 2 drilling program after having done considerable work to identify these high quality targets. The objective of this program is to test the target areas to potentially identify new resources at Burnakura to improve the economics of the project. The drill rigs have been secured and drilling has already started.”

To date, all assay results from Phase 1 drill program have been received and will be announced once the interpretation is completed.

PHASE 2 HIGHLIGHTS

- The NOA structure has already proven it contains mineralization that can support an underground operation.

- The NOA 2 deposit historically produced high grade from both open pit and underground operations.

- The Phase 2 program is targeting mineralization in economic grades and thicknesses underneath NOA 1, NOA 2, NOA 4-6 and NOA 7/8.

- The analysis and results of this program will drive subsequent exploration phases.

- This drill program is expected to be completed by February 2022.

PROGRAM SUMMARY

A total 5,546 drill metres are planned under the Phase 2 drilling program, combining reverse circulation (“RC”) and diamond drilling (“DD”) targeting completion by February 2022. All pre-drilling work including preparation of drill pads, refinement of drill hole planning and logistics, heritage and environmental surveys and Permit of Work (“POW”) applications for the areas have been completed. The drilling contract has been awarded to Minch Enterprises Pty Ltd trading as Frontline Drilling Australia (“Frontline"), who will supply a KWL 700 RC drill rig for RC drilling and a KWL 1600 rig for the DD component. The earliest commencement date of work was originally planned to be January next year; however, working in conjunction with Frontline, the Company has been able to fast-track the deployment of the RC drill rig and has secured it for an initial three-month window, which started in the third week of November 2021.

All samples collected from the drilling program will be dispatched to ALS Geochemistry laboratory in Wangara, Western Australia for gold and selected multi-element analysis. Results are expected to be received starting in March 2022.

The second drill program will commence at a series of high potential targets identified on the Burnakura Project as shown in Figure 2. The program will focus on the NOA structure which is related to the regional Burnakura Shear Zone and is identified for 2.5km in a north-northwest direction. Open pit mines along this structure have produced significant ounces of gold from five deposits. Details of the drill program are presented in Table 1.

| Table 1: Drill Program Summary | |||

| Drill Area | Holes | RC Metres | DD Metres |

| NOA 7/8 | 6 | 1,200 | 1,040 |

| NOA 4-6 | 2 | 400 | 215 |

| NOA 2 | 4 | 800 | 450 |

| NOA 1 | 5 | 1,000 | 270 |

| New Alliance | 1 | 165 | - |

| Total | 18 | 3,565 | 1,975 |

Figure 2: High potential target locations at the Burnakura project is available at https://www.globenewswire.com/NewsRoom/AttachmentNg/9b51519e-35b6-43d3-857c-9a2967b3945d

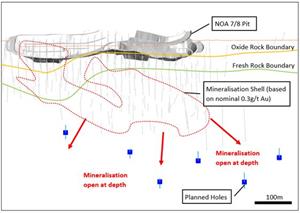

NOA 7/8

The NOA 7/8 deposit is the last exploited open pit along the NOA structure. High grade gold mineralization underneath the current pit extends to 200m vertically below surface. Indications are this is of thickness and grades that could support underground development. The mineralization remains open down dip but appears to be truncated to the north by a northeast trending fault that dips to the west.

It is proposed to drill six RC holes with diamond tails to test the mineralization between 220m to 340m vertically below the surface. A total of 1,200m RC and 1,040m DD holes have been planned (Figure 3).

Figure 3: A long section looking west through NOA 7/8 showing target location of planned drill holes is available at https://www.globenewswire.com/NewsRoom/AttachmentNg/a8455775-bead-46d5-b684-b14cfd6465ce

NOA 4-6

NOA 4-6 deposits consist of modest shallow zones of mineralization along the NOA structure. They were exploited by two shallow open pits. RC drilling has tested mineralization for depth extensions to NOA 4-6 to a depth of approximately 130m.

Two RC holes with diamond tails aim to test the potential for economic mineralization to a depth of 240m vertically below the surface, 100m below the existing drilling. A total of 400m of RC and 220m of DD are planned.

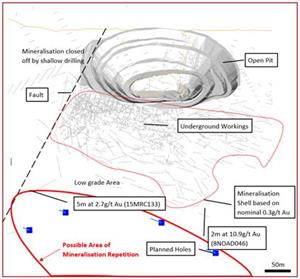

NOA 2

The NOA 2 deposit historically produced high grade gold from both an open pit and underground operation. Its mineralization is truncated to the south by a major EW fault that separates it from the NOA 1 deposit. The mineralization steepens down dip, coincident with a decrease in grade.

A total of four RC holes with diamond tails are proposed to test for the continuation and repetition of mineralization at depth, down to 280m vertically below the surface, including planned 800m RC and 450m DD (Figure 4).

Figure 4: A long section looking west through NOA 2 showing structure and planned drill hole targets is available at https://www.globenewswire.com/NewsRoom/AttachmentNg/3efce8b4-6586-4f8b-bbcb-06c0e870a00a

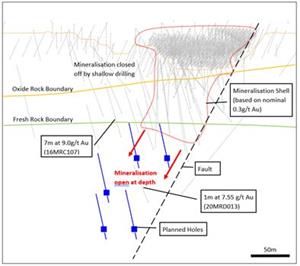

NOA 1

The NOA 1 deposit is the southernmost exploited deposit with several high-grade gold intersections including 7m at 9.0g/t Au from drill hole 16MRC107. In 2020, drill hole 20MRD013, the deepest hole drilled at NOA 1, intersected 1m at 7.55g/t Au. It is truncated to the north by a major EW fault. Shallow drilling to the south of the NOA1 pit failed to intersect economic mineralization.

A total of five deep holes are planned, consisting of RC pre-collars with diamond tails targeting the interpreted mineralized zone with pierce points 150m to 250m vertically below surface. A total of 1,000m RC and 270m diamond core have been included in the program (Figure 5).

Figure 5: A long section through NOA 1 looking west showing structure and planned drill hole targets is available at https://www.globenewswire.com/NewsRoom/AttachmentNg/00365484-74c9-4e81-8de0-57b3d306d262

NEW ALLIANCE

The New Alliance open pit has produced approximately 30koz of gold in the past and its mineralization is consistently low-medium grade but contains a small body (50x30m) of very high-grade mineralization at the northern end of the pit at a depth of approximately 75m. The high-grade body is located at a lithological contact between tuffs and ultramafics within the transition zone. The best intersection within the body is 10m at 18.2g/t Au (drill hole NARC001). Two 40m step-out RC holes have partially closed off the down dip direction of the high-grade body.

One RC hole for 170m is proposed to test the high-grade gold mineralization down plunge beneath the northern end of the pit.

The scientific and technical information in this press release has been assembled by Adrian Woodfield, Chief Geologist of the Company, reviewed and approved by Roger Stangler, MEng, FAusIMM, MAIG, a Qualified Person as defined by NI43-101, retained by Golder Associates Pty Ltd.

About Monument

Monument Mining Limited (TSX-V: MMY, FSE:D7Q1) is an established Canadian gold producer that owns and operates the Selinsing Gold Mine in Malaysia. Its experienced management team is committed to growth and is also advancing the Murchison Gold Projects comprising Burnakura, Gabanintha and Tuckanarra JV (20% interest) in the Murchison area of Western Australia. The Company employs approximately 200 people in both regions and is committed to the highest standards of environmental management, social responsibility, and health and safety for its employees and neighboring communities.

Cathy Zhai, President and CEO

Monument Mining Limited

Suite 1580 -1100 Melville Street

Vancouver, BC V6E 4A6

FOR FURTHER INFORMATION visit the company web site at www.monumentmining.com or contact:

Richard Cushing, MMY Vancouver T: +1-604-638-1661 x102 rcushing@monumentmining.com

"Neither TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release."

Forward-Looking Statement

This news release includes statements containing forward-looking information about Monument, its business and future plans (“forward-looking statements”). Forward-looking statements are statements that involve expectations, plans, objectives or future events that are not historical facts and include the Company’s plans with respect to its mineral projects and the timing and results of proposed programs and events referred to in this news release. Generally, forward-looking information can be identified by the use of forward-looking terminology such as "plans", "expects" or "does not expect", "is expected", "budget", "scheduled", "estimates", "forecasts", "intends", "anticipates" or "does not anticipate", or "believes", or variations of such words and phrases or state that certain actions, events or results "may", "could", "would", "might" or "will be taken", "occur" or "be achieved". The forward-looking statements in this news release are subject to various risks, uncertainties and other factors that could cause actual results or achievements to differ materially from those expressed or implied by the forward-looking statements. These risks and certain other factors include, without limitation: risks related to general business, economic, competitive, geopolitical and social uncertainties; uncertainties regarding the results of current exploration activities; uncertainties in the progress and timing of development activities; foreign operations risks; other risks inherent in the mining industry and other risks described in the management discussion and analysis of the Company and the technical reports on the Company’s projects, all of which are available under the profile of the Company on SEDAR at www.sedar.com. Material factors and assumptions used to develop forward-looking statements in this news release include: expectations regarding the estimated cash cost per ounce of gold production and the estimated cash flows which may be generated from the operations, general economic factors and other factors that may be beyond the control of Monument; assumptions and expectations regarding the results of exploration on the Company’s projects; assumptions regarding the future price of gold of other minerals; the timing and amount of estimated future production; the expected timing and results of development and exploration activities; costs of future activities; capital and operating expenditures; success of exploration activities; mining or processing issues; exchange rates; and all of the factors and assumptions described in the management discussion and analysis of the Company and the technical reports on the Company’s projects, all of which are available under the profile of the Company on SEDAR at www.sedar.com. Although the Company has attempted to identify important factors that could cause actual results to differ materially from those contained in forward-looking statements, there may be other factors that cause results not to be as anticipated, estimated or intended. There can be no assurance that such statements will prove to be accurate, as actual results and future events could differ materially from those anticipated in such statements. Accordingly, readers should not place undue reliance on forward-looking statements. The Company does not undertake to update any forward-looking statements, except in accordance with applicable securities laws.