Mustang Energy Corp. Expands Land Portfolio Across the Athabasca Basin, Saskatchewan

VANCOUVER, British Columbia, Oct. 10, 2024 (GLOBE NEWSWIRE) -- Mustang Energy Corp. (CSE: MEC)(the “Company” or “Mustang”) is pleased to announce the acquisition of 45,585 hectares of prospective land across the Southern and Western Athabasca Basin in Saskatchewan. This expansion was achieved through a combination of low-cost staking and a strategic purchase agreements, as previously announced in the Company’s news release dated September 9, 2024 and September 26, 2024.

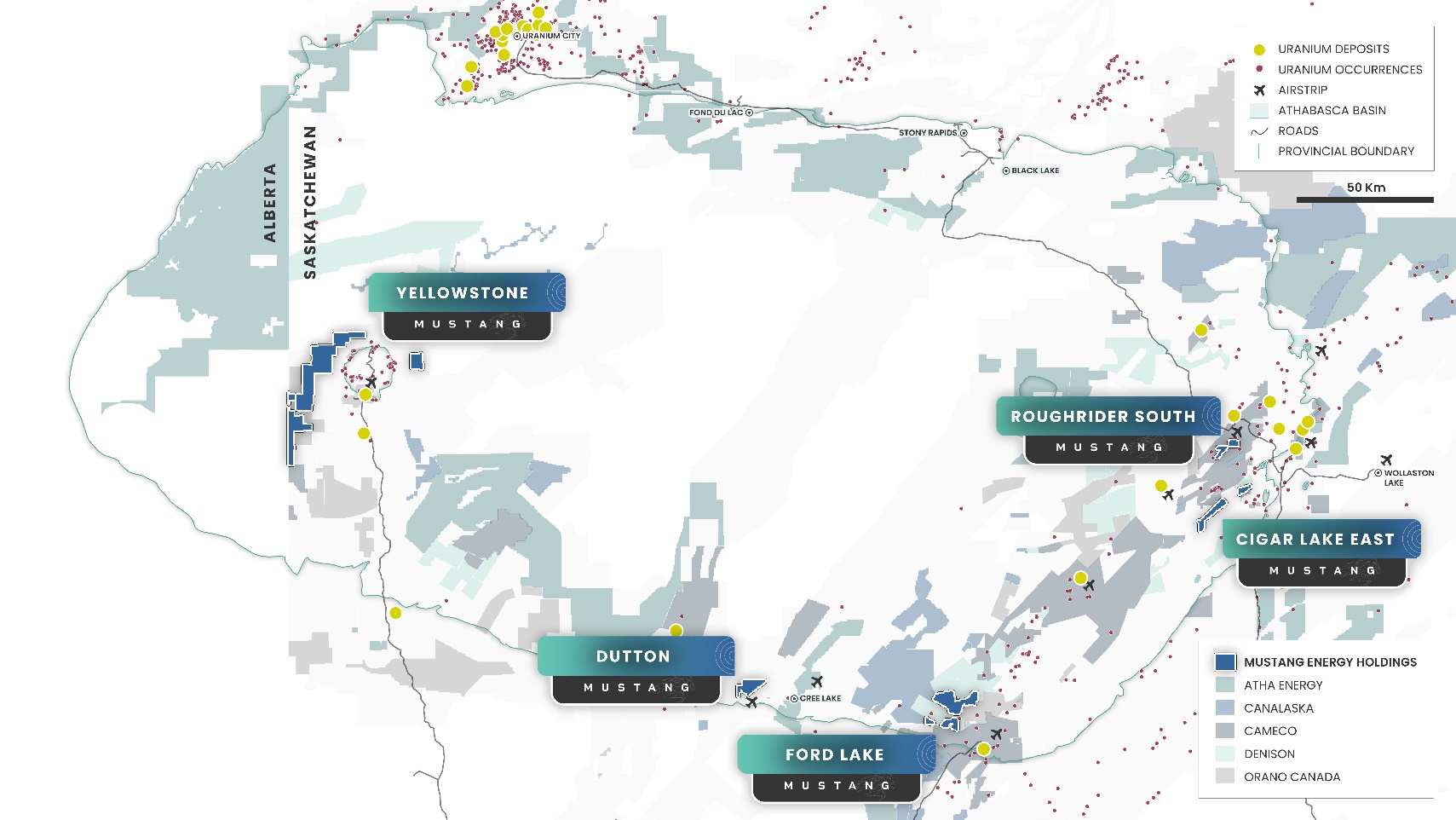

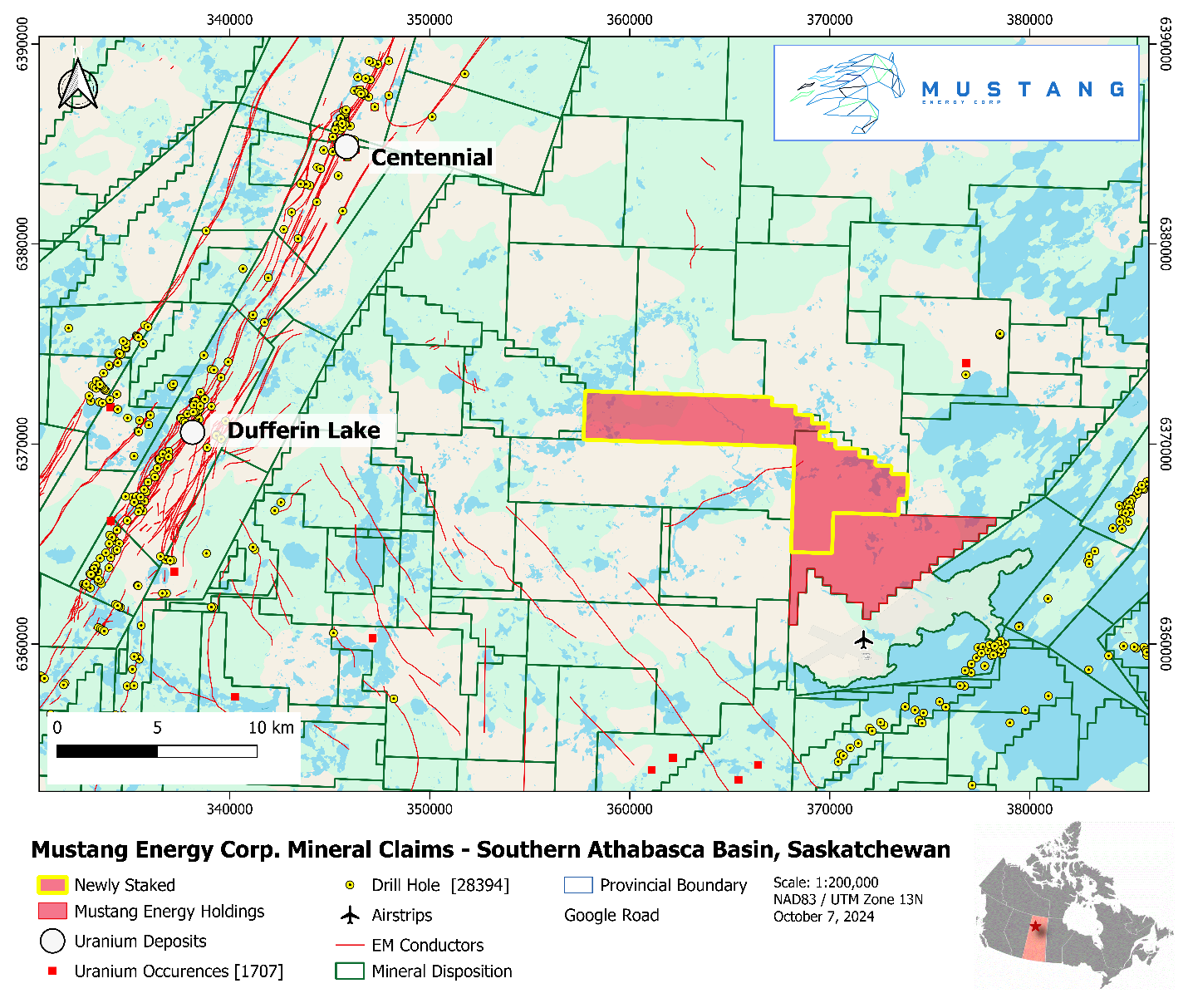

The newly acquired properties include the Yellowstone Project (21,820 hectares – see Figure 2), the Dutton Project (9,666 hectares – see Figure 3), and three additional claims (14,098 hectares) which are currently unnamed. With these acquisitions, Mustang’s total land holdings in the Athabasca Basin have increased from 10,644 hectares—comprising the Ford Lake, Cigar Lake East, and Roughrider South projects—to an impressive 56,229 hectares (see Figure 1).

“This is another significant land acquisition that marks a major milestone for Mustang Energy Corp as we continue to strengthen our asset base in the world's premier uranium-producing region,” stated Nick Luksha, CEO of Mustang Energy. “We successfully secured these adjoining claims to our existing land package. Since going public in early June, we've expanded our portfolio and intend to further strengthen our team. These claims are located in uranium-rich areas, offering excellent exploration potential, and we believe they will enhance long-term value for our shareholders.”

Acquisition of the Yellowstone Project

Mustang completed the previously announced acquisition of a land package in the Cluff Lake region of the Athabasca Basin from Proton Uranium Ltd. and Electron Uranium Ltd. (together, the “Vendors”), in exchange for the issuance of 12,000,000 common shares (each, a “Share”) in the capital of Mustang to three nominees (the “Nominees”) of the Vendors at a deemed price per Share of $0.255. All Shares issued as consideration to the Nominees are subject to a statutory hold period of four months and one day from the date of issuance. Moreover, the Nominees have entered into a voluntary pooling agreement whereby the Shares cannot be sold, transferred, or otherwise disposed of until February 10, 2026. The claims comprising the Yellowstone Project are currently held in trust for Mustang by the Vendors, pending confirmation of transfer from Mineral Administration Registry Saskatchewan.

For more information regarding the acquisition of the Yellowstone Project, see the Company’s news release dated September 9, 2024 filed under its profile on SEDAR+.

Acquisition of a 90% Interest in the Brown Lake Project

Further to the acquisitions discussed above, Mustang is also pleased to announce that it has completed the acquisition of a 90% interest in the Brown Lake project (the “Project”) pursuant to the terms of a mineral property acquisition agreement (the “Agreement”) with Standard Uranium (Saskatchewan) Ltd. (“Standard Uranium SK”) dated September 25, 2024, as previously announced in Mustang’s news release dated September 27, 2024. Mustang issued 60,000 Shares at a deemed price per Share of $0.33 to Standard Uranium Ltd. (“Standard Uranium”), Standard Uranium SK’s parent company, as consideration for the acquisition. All Shares issued to Standard Uranium are subject to a statutory hold period of four months and one day from the date of issuance. In addition, the Shares are subject to a voluntary escrow arrangement whereby the Shares will be released from escrow in four equal parts with the first part released at the expiration of the statutory hold period, and each successive release occurring every two months thereafter.

Pursuant to the Agreement, Standard Uranium SK will hold a 10% carried interest in the Project, while Mustang will be solely responsible for funding all expenses and obligations associated with maintaining, exploring and developing the Project. Mustang may only surrender its interest in the Project with prior approval of Standard Uranium SK. The mineral license underlying the Project is currently held in trust for Mustang by Standard Uranium SK, subject to confirmation of transfer from Mineral Administration Registry Saskatchewan.

For more information regarding the acquisition of the 90% interest in the Project, see the Company’s news release dated September 26, 2024 filed under its profile on SEDAR+.

Figure 1: Map of Mustang Energy's Claims across the Athabasca Basin, Saskatchewan.

Acquisition Highlights:

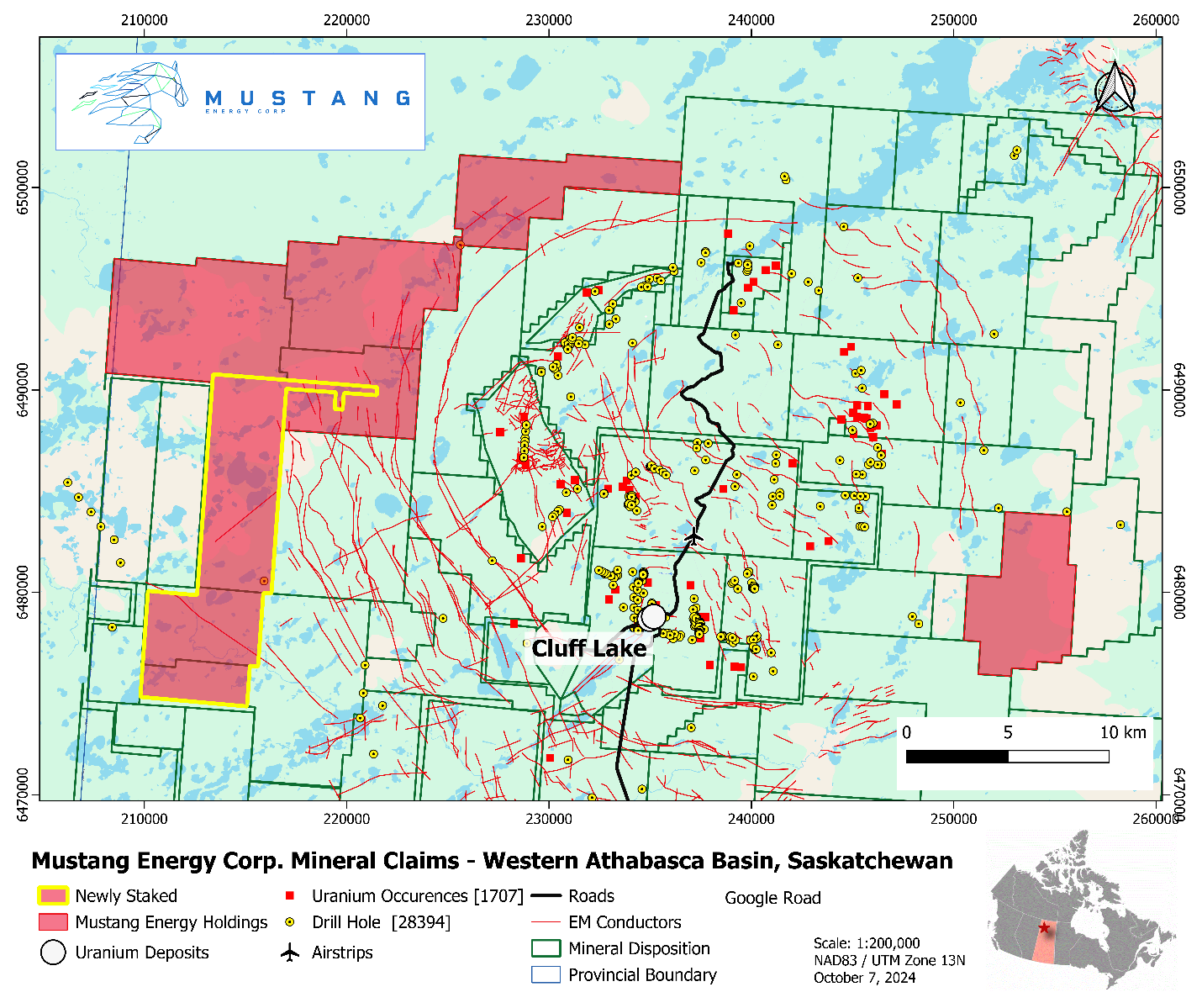

Yellowstone Project

- 100% owned by Mustang Energy, the Yellowstone Project consists of seven adjoining claims totaling 21,820 hectares.

- The property is located approximately 16 kilometers from the Cluff Lake Mine, which has produced over 62 million pounds of uranium¹, and is adjacent to Fission Uranium’s West Cluff Project.

- Surrounds the Carswell Impact Structure, an 18-kilometer-wide feature believed to have been created by a meteorite impact, exposing basement rock with significant high-grade uranium potential.

- The property is transected by known conductors, suggesting potential exploration targets.

- One historic drill hole (SYL-1) encountered strong alteration but missed the intended conductive target.²

Dutton Project

- The Dutton Project spans 9,667 hectares over three adjoining claims in the Southern Athabasca Basin, Saskatchewan.

- Situated near the Cable Bay Shear Zone within the Mudjatik Domain, which is known to host uranium anomalies in the basement rock.

- The project is located approximately 20 kilometers east of the Virgin River Shear Zone, which hosts the Dufferin Lake Zone and Centennial deposit. These deposits have demonstrated high-grade uranium mineralization, including intersections of 1.73% U₃O₈ over 6.5 meters and 8.78% U₃O₈ over 33.9 meters.³,⁴

- The area remains underexplored, offering what Mustang believes to be potential for uranium discoveries.

Figure 2: Mustang Energy's Yellowstone Project in the Western Athabasca Basin, SK.

Figure 3: Mustang Energy's Dutton Property in the Southern Athabasca Basin, Saskatchewan.

Taken together, Mustang believes these acquisitions highlight Mustang’s commitment to expanding its portfolio of high-quality uranium assets within the Athabasca Basin, renowned for its uranium production. As global energy markets transition toward low-carbon solutions, the Company believes that nuclear energy—and the uranium that fuels it— will continue to play an important role in the sustainable energy landscape.

Mustang remains committed to responsible exploration, ensuring that its operations are conducted in an environmentally and socially sustainable manner, while contributing positively to the communities in which it operates.

_____________________________

References:

- Cluff Lake Mine Uranium Production – Orano

- SMAD# 74K05-0140, Drill hole SYL-1, Sylia Lake Project 1998, Cogema Resources Inc.

- SMDI# 2758, Centennial Zone, Virgin River Project, https://mineraldeposits.saskatchewan.ca/Home/Viewdetails/2758

- SMDI# 2056, Dufferin Lake Uranium Zone, https://mineraldeposits.saskatchewan.ca/Home/Viewdetails/2056

Qualifying Statement:

The scientific and technical information in this release has been reviewed by Lynde Guillaume, P.Geo., Technical Advisor for Mustang Energy, and a registered member of the Professional Engineers and Geoscientists of Saskatchewan. Ms. Guillaume is a Qualified Person as defined by National Instrument 43-101 - Standards of Disclosure for Mineral Projects.

About Mustang Energy Corp.:

Mustang is a resource exploration company focused on acquiring and developing high-potential uranium and critical mineral assets. The Company is actively exploring its properties in the Athabasca Basin of Saskatchewan, Canada. Mustang's flagship property, Ford Lake, covers 7,743 hectares in the prolific eastern Athabasca Basin, while its Cigar Lake East and Roughrider South projects span 2,901 hectares in the Wollaston Domain. Mustang has also established its footprint in the Cluff Lake region of the Athabasca Basin with the acquisition of the Yellowstone Project and further expanded its presence in the southeastern margin of the Athabasca Basin through its 90% interest in the Brown Lake project.

For further information, please contact:

Mustang Energy Corp.

Attention: Nicholas Luksha, CEO and Director

Phone: (604) 838-0184

Neither the CSE nor the Market Regulator (as that term is defined in the policies of the CSE) accepts responsibility for the adequacy or accuracy of this release.

This news release includes certain statements and information that may constitute forward-looking information within the meaning of applicable Canadian securities laws. Forward-looking statements relate to future events or future performance and reflect the expectations or beliefs of management of the Company regarding future events. Generally, forward-looking statements and information can be identified by the use of forward-looking terminology such as “intends”, “believes” or “anticipates”, or variations of such words and phrases or statements that certain actions, events or results “may”, “could”, “should”, “would” or “occur”. This information and these statements, referred to herein as “forward‐looking statements”, are not historical facts, are made as of the date of this news release and include without limitation, statements regarding discussions of future plans, estimates and forecasts and statements as to management's expectations and intentions with respect to, among other things: the expected benefits of the various transactions contemplated herein and the future potential of the minerals claims acquired pursuant to the transactions contemplated herein. In making the forward-looking statements in this news release, the Company has applied several material assumptions, including without limitation the assumption that the Company will be able: to receive expected benefits and achieve anticipated integration post-transaction and continue exploring the various projects and surrounding minerals claims acquired pursuant to the transactions contemplated herein. Although management of the Company has attempted to identify important factors that could cause actual results to differ materially from those contained in forward-looking statements or forward-looking information, there may be other factors that cause results not to be as anticipated, estimated or intended. There can be no assurance that such statements will prove to be accurate, as actual results and future events could differ materially from those anticipated in such statements. Accordingly, readers should not place undue reliance on forward-looking statements and forward-looking information. Readers are cautioned that reliance on such information may not be appropriate for other purposes. The Company does not undertake to update any forward-looking statement, forward-looking information or financial out-look that are incorporated by reference herein, except in accordance with applicable securities laws.

Photos accompanying this announcement are available at

https://www.globenewswire.com/NewsRoom/AttachmentNg/cdf3a206-6b98-4f9b-b2a6-80090079abe5

https://www.globenewswire.com/NewsRoom/AttachmentNg/37851c32-0693-41cd-bfd6-be4d5e760007

https://www.globenewswire.com/NewsRoom/AttachmentNg/ef3b2024-db8c-4284-8204-94079d90fb91