Nevada Copper Announces Positive PEA Results for Pumpkin Hollow Open Pit Copper Project

VANCOUVER, British Columbia, Sept. 10, 2018 (GLOBE NEWSWIRE) -- Nevada Copper Corp. (TSX: NCU) (“Nevada Copper” or the “Company”) is pleased to announce the results of a Preliminary Economic Assessment (“PEA”) for the development of its open pit project (the “Open Pit Project”) at its 100% owned Pumpkin Hollow property (“Pumpkin Hollow”). The PEA contemplates the option of developing the Open Pit Project independently from the Company’s underground mine at Pumpkin Hollow (the “Underground Project”) which is fully funded as to expected construction capital expenditures and under construction (see News Release dated August 28, 2018) and presents an alternative to the previously disclosed option for the integrated development of the Pumpkin Hollow mine.

The PEA for the Open Pit Project describes the opportunity to develop the Open Pit Project for a substantially lower upfront capital cost compared to previous technical studies by implementing the same “margin-over-tons” philosophy that has been used to optimize the Underground Project.

The PEA study focuses on a fresh mining perspective for the deposit, while utilizing strengths of the previous feasibility study data (as set out in the Existing Technical Report)1 on aspects of metallurgical test work and environmental design, with a focus on project value / economic returns, rather than chasing scale. The go-forward Open Pit Project work plan following the PEA will include analysis of the successful 2018 drilling program to produce an updated Mineral Resource, and the completion of a Pre-Feasibility Study for the Open Pit Project which will further test the staged production plan set out in the PEA using the (to be) enhanced Mineral Resource.

Highlights include:

- Reduced upfront cost, simplified build and phased expansion:

- Initial capital cost estimate: US$592M with a mine design and plant processing rate of 37Kstpd, which reduces implementation risk versus previously studied 70Kstpd integrated project2

- Very low capital intensity of US$7,588/st Cu-eq3 for 37Kstpd production and low operating costs

- Focus on high grade Northern Pit, with South Pit as the supplementary feed

- Strong standalone project economics:

- Pre-tax NPV7.5 of US$1,174M and IRR of 21%4

- Post-tax NPV7.5 of US$927M and IRR of 19%

- Average life of mine EBITDA: $272M per annum (steady state operations average)

- Payable Copper: life of mine average 177M lbs per annum (steady state operations average)

- First five-year copper grades averaging 0.57%Cu (0.61% Cu-eq.)

- C1 Cash Costs: US$1.67/lb net of by-product credits

- 20 year mine life

- Project returns highly resilient across copper price cycle

- Phased expansion delivers opportunity to fund required project capex internally:

- Potential to fund ongoing development work and construction through future cash flows from the Underground Mine, reducing need to access equity capital markets

- Open Pit comprises two optional phases, in-line with Nevada Copper’s strategy of incremental production expansions that can be achieved with low capital intensity and short lead times

- Phase 2 expansion capital costs of US$447M to increase to a 70Kstpd rate in year 8 of the life of mine

- Significant optimization opportunities identified to be studied:

- Current PEA results are yet to include the findings from the successful 2018 drilling campaign, which has identified additional shallow mineralization in areas currently classified as waste, to improve grade and reduce early stripping

- Maintains optionality for future exploration results that may enlarge the open pit potential

- Open Pit Project can deliver excellent returns as either a 37Kstpd or 70Kstpd operation

- Improvements to logistics and freight through targeting increased domestic sales

______________________________

1 Source: NI 43-101 Technical Report “NI43-101 Technical Report: Pumpkin Hollow Development Options - Pre-feasibility Study 5,000tons/day Underground Project; Feasibility Study for a 70,000 tons/day Open Pit/Underground Project”, with an effective date of September 15, 2017 and an amended report date of January 3, 2018 (the “Existing Technical Report”)

2 Source: Existing Technical Report

3 Cu-eq. calculated using prices / recoveries: Cu 3.20/lb & 89.3%; Au $1,325/Oz & 67.3%; and Ag $20.01/Oz & 56.3%. Applies to all Cu-eq references throughout this press release.

4 Utilizes analyst consensus long-term copper price of $3.20/lb

Matt Gili, President and Chief Executive Officer of Nevada Copper, commented:

“We are highly encouraged with the results of the PEA for our open pit project at Pumpkin Hollow. The report clearly illustrates the potential to put this large, open pit project into production with lower capital costs and in a shorter period of time than originally envisaged. The phased development approach also aligns with our strategy of pursuing optionality through low-capital intensity and staged production growth to generate shareholder returns. We have used this same margin-over-tonnes philosophy with the Pumpkin Hollow underground mine, which will be in production in 2019, and we are looking forward to the next steps in advancing the open pit project.”

Golder Associates Ltd. (“Golder”) and Sedgman Canada Limited (“Sedgman”) prepared the PEA report, supported by the Nevada Copper project team. The PEA study focuses on the Pumpkin Hollow open pit North and South deposits and does not include the underground development.

Geology and Mineralization

The Pumpkin Hollow property is located within the Walker Lane mineral belt of western Nevada. Within the Pumpkin Hollow property the Western deposits, comprising the North and South deposits, represent the proposed Open Pit Project. The North deposit is a Cu-rich, magnetite-poor skarn breccia body hosted by hornfels of the Gardnerville Formation. The South deposit is a magnetite-chalcopyrite body closely associated with an intrusive contact of granodiorite into limestones of the Mason Valley Formation.

Mineral Resources Included in the Open Pit Project Mine Plan

The total resources included in the PEA mine plan (the “Mine Plan”) are shown in the table below. The mineral resource used in the PEA has been updated to include the approximately 45,000 ft (13,700m) of drilling undertaken in 2015 at the Pumpkin Hollow site. Golder has included this additional drilling data for the PEA mineral resource. The Company is currently carrying out a targeted drill program on the northern extension zone and connector zone between the North and South deposits. Results from this drilling is not included in the PEA but the Company will include this data in future studies. Information regarding the additional drilling data and resource modelling methodology is detailed in the PEA.

Mineral Resources Included in the Mine Plan5

| Category | Cut-off %Cu | Tons (M) | % Cu | % Cu Eq. | Oz/st Au | Oz/st Ag |

| Measured | 0.17 | 133 | 0.51 | 0.55 | 0.002 | 0.063 |

| Indicated | 0.17 | 264 | 0.46 | 0.50 | 0.001 | 0.058 |

| Measured & Indicated | 0.17 | 397 | 0.48 | 0.51 | 0.001 | 0.060 |

| Inferred | 0.17 | 8 | 0.56 | 0.57 | 0.000 | 0.034 |

Proposed Open Pit Project Mining Plan

The Open Pit Project has been designed to be a conventional truck-and-shovel operation with a combination of hydraulic and electric cable shovels and haul trucks. The Open Pit Project mineralized material is found in the North and South deposits. The Mine Plan has been phased and developed to minimize pre-production stripping to deliver material as soon as possible and provide an attractive life of mine grade profile of 0.48%Cu (0.51% Cu-eq) and the first five years with a grade average of 0.57%Cu (0.61% Cu-eq). To minimize pre-stripping, mining initially takes place in select areas of the shallower South Pit while access is being opened to the higher-grade North Pit which is the focus of the main part of the mine life, before the South pit material comes on-line towards the tail. The Mine Plan produces at 37Kstpd rate for production years 1 to 7, before expanding to 70Kstpd rate from year 8 to 20. Material is delivered by haul truck to a primary crusher, with discharge from the crusher conveyed to a coarse stockpile adjacent to the mill.

Mining is planned to be conducted using 50 ft benches with variable inter-ramp pit slope angles (46o to 55o) depending on geotechnical domain. The PEA utilized the Geovia Whittle™ pit optimization process to define ultimate pit limits and target the most economic ore early in the mine life. Over the mine life, a total of 1,655Mst will be moved which includes 405Mst of ore as mill feed.

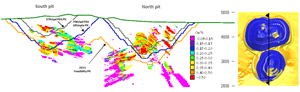

The mining fleet includes 240t class trucks, loaded by a 45 yd3 diesel-hydraulic and electric shovels and 22 yd3 wheel loader. Drill and blast will be undertaken with track mounted drill rigs drilling 10 ¾ inch holes. Explosives are planned as down hole service by explosives supplier. Haul roads are designed to be 120 ft wide to allow for two-way traffic at a maximum gradient of 10%. Strip ratios vary over life of mine with an average of 2.91 excluding pre-strip (3.1 including pre-strip). Figure 1 illustrates a long-section of the Open Pit Project showing the 37Kstpd pit and the ultimate 70Kstpd pit as set out in the PEA, while also indicating the ultimate pit of the 2015 Feasibility Study for a 70Kstpd Open Pit/Underground Project as set out in the Existing Technical Report.

______________________________

5 1) CIM definitions were followed in the development of Mineral Resources

2) Mineral Resources were estimated at a cutoff grade of 0.17% Cu

3) Resources were stated at a Cu price of $3.00/lb

4) Included Au and Ag were valued at prices of $1,343/Troy Oz and $19.86/ Troy Oz respectively

5) The Mineral Resources include the following modifying factors 2% dilution, 98% mining recovery.

6) Includes North and South deposits.

7) Excludes materials that are oxidized, transition or volcanics.

8) Columns may not total due to rounding.

9) Cu Eq. calculated using prices / recoveries: Cu 3.20/lb & 89.3%; Au $1,325/Oz & 67.3%; and Ag $20.01/Oz & 56.3%.

A photo accompanying this announcement is available at http://www.globenewswire.com/NewsRoom/AttachmentNg/a6823067-26a1-4863-8b6f-c29ac6e28379

Proposed Open Pit Project Processing Plant

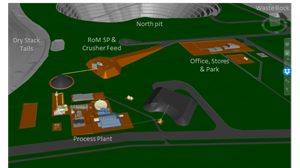

The treatment technology proposed for the project is the conventional flotation concentration. The processing plant will consist of crushing and grinding circuits, followed by a flotation process to recover and upgrade copper and silver from the feed material at a daily production rate of 37Kstpd for the first 7 years of production before expanding to 70Kstpd for the remaining 13 years of production.

Crushed material with the approximate particle grind size P80 of 6 inch, will be fed to the grinding circuit via SAG Mill feed conveyor. Oversized material from the SAG Mill trommel screen will be conveyed to the pebble crusher. The pebble crusher will discharge to the SAG Mill. The product from the SAG Mill will be fed into the grinding cyclone feed pump-box, from where it will be pumped to the primary cyclopack. The cyclone underflow product will report via chute to the ball mill for further grinding. The cyclone overflow product with the approximate particle grind size P80 of 150 microns, is the final ground product and will report to the rougher flotation conditioning tank.

The flotation circuit will consist of one rougher and two stages of cleaner flotation, with the single tower/Verti-mill being used for the fine grinding of the rougher concentrate. The copper concentrate will be thickened using a hi-rate thickener and the underflow pumped to the agitated stock tank prior to filtration, and the thickener overflow will be collected in the process water tank. The tailings will be disposed of by dry stacking of filtered tailings. The tailings will be thickened prior to the tailings filtration plant.

The PEA metallurgical test work is based on the Integrated Feasibility Study NI 43-101 Technical Report on the Pumpkin Hollow Copper Open Pit and Underground Ore Project, prepared for Nevada Copper Corporation by Tetra Tech Inc. in July 2015, as reported in the Existing Technical Report.

A photo accompanying this announcement is available at http://www.globenewswire.com/NewsRoom/AttachmentNg/7ae8d66c-8899-4362-89b1-603335d83935

Open Pit Project Infrastructure

The Pumpkin Hollow site is currently accessible via an existing network of roads, designed for accommodating heavy equipment and other vehicles. Power for the Open Pit Project will be drawn from the existing network of transmission lines located adjacent to the site.

The site infrastructure for the Open Pit Project will include fencing, temporary facilities, network of onsite roads, water associated infrastructure including tanks and pumps, treatment plant, 120kV line with tie into nearby HV infrastructure, various site buildings including truck shop, warehouse, a mine dry facility, and operations offices, as well as items such as truck scale, fuel and distribution facility and wash bay.

The Open Pit Project is estimated to provide direct employment of 300 to 600 hourly and staff personnel across the different phases of the life of mine, which would be expected to be drawn from the surrounding communities to provide support to the project. During the construction phase, the peak work force is expected to be approximately 600 to 800. The Open Pit Project construction will provide additional employment opportunities to the surrounding communities.

Open Pit Project Economic Analysis and Sensitivity Analysis

The operating assumptions for the financial model for the Open Pit Project are as follows:

| Production | Units | LOM Total |

| Life of mine | years | 20 |

| Annual tons processed (LOM average) | Mtons | 20 |

| Total tons processed | Ktons | 405 |

| Total tons concentrate produced (dry mass) | Ktons | 6,825 |

| Copper recovered to concentrate | Ktons | 1,740 |

| Net revenue from sales (before royalty) | US$ millions | 10,123 |

| Net revenue from sales (after royalty) | US$ millions | 9,523 |

| LOM Opex | ||

| Mining* | US$ millions | 2,233 |

| Processing & tailings management | US$ millions | 2,050 |

| General and administrative+ | US$ millions | 124 |

| Life of Mine operating costs | US$ millions | 4,408 |

| Mining* | US$/t rock | 1.35 |

| Processing & tailings management | US$/t RoM ore | 5.06 |

| General and administrative+ | US$/t RoM ore | 0.31 |

| Total Life of mine operating cost | US$/t RoM ore | 10.87 |

| LOM Avg Unit Costs | ||

| Mining* | US$/ lb payable | 0.68 |

| Processing & tailings management | US$/ lb payable | 0.60 |

| General and administrative+ | US$/ lb payable | 0.04 |

| RGGS Royalty | US$/ lb payable | 0.18 |

| TC/RCs, Shipping | US$/ lb payable | 0.37 |

| By-product Credits | US$/ lb payable | -0.21 |

| C1 Cash Costs | US$/ lb payable | 1.67 |

| AISC (All-in Sustaining Costs) | US$/lb payable | 1.99 |

| LT Copper price | US$/lb | 3.2 |

| Economic Indicators | ||

| Pre-tax operating cash flow | US$ millions | 5,115 |

| Pre-tax NPV at 5% | US$ millions | 1,717 |

| Pre-tax NPV 7.5% | US$ millions | 1,174 |

| Pre-tax IRR | % | 21 |

| Post-tax NPV at 5% | US$ millions | 1,385 |

| Post-tax NPV at 7.5% | US$ millions | 927 |

| Post-tax IRR | % | 19 |

* Includes mining equipment lease costs. Excludes capitalized waste stripping

+ Includes environment, water and Nevada Rule 9 allowance for power infrastructure

The initial and sustaining capital costs are presented as follows:

| Capital costs | US$ millions |

| Initial capital costs (pre-production)^ | 592 |

| Expansion capital costs | 447 |

| Sustaining capital costs | 445 |

| Total LOM Capital Costs | 1,485 |

^ Includes pre-production leasing cost

Breakdown of the capital cost is shown below:

| Item | Initial Capital | Expansion | Sustaining | LoM Capital |

| US$M | US$M | US$M | US$M | |

| Mining (including capitalized waste) | 115 | 123 | 284 | 522 |

| Process Plant and Tailings | 361 | 295 | 85 | 742 |

| Infrastructure | 91 | 11 | 28 | 130 |

| Reclamation and permits | - | - | 47 | 47 |

| Contingency | 26 | 17 | - | 43 |

| Total | 592 | 447 | 445 | 1,485 |

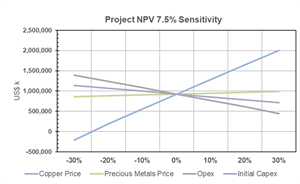

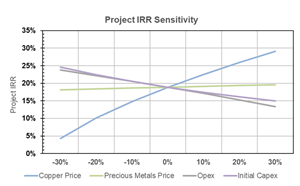

A sensitivity analysis was performed, to test the impact of changes to copper price included in the economic model, with the following results:

A photo accompanying this announcement is available at http://www.globenewswire.com/NewsRoom/AttachmentNg/58d2b127-78ec-40eb-bed8-0dc76babe10e

A photo accompanying this announcement is available at http://www.globenewswire.com/NewsRoom/AttachmentNg/f7f2d8b4-23d0-4fe8-82ac-ca3200850456

Qualified Persons and Technical Report

The written technical disclosure and data in this news release was approved by Gregory French, P.G., Vice-President Exploration & Project Development of Nevada Copper, Robert McKnight, P.Eng., Executive Vice-President and CFO of Nevada Copper, both of whom are non-independent Qualified Persons within the meaning of NI 43-101., together with the following independent qualified persons:

- Ted Minnes P.E., Golder, consultant, responsible for mine planning, mine design and cost estimation.

- Ronald Turner, PG, Golder, consultant, responsible for geology and mineral resource estimation.

- Aleksandar Petrovic, P.Eng. Sedgman, responsible for mineral processing, infrastructure design and cost estimation.

A technical report in respect of the PEA will be filed by Nevada Copper on SEDAR within 45 days of this press release in accordance with the requirements of National Instrument 43-101.

Notes on Preliminary Economic Assessments

The Existing Technical Report contemplates two potential options for developing the Pumpkin Hollow mine. Case A (the 2017 Underground PFS) contemplates an underground mine as a stand-alone case and that is not impacted by the results of the PEA, and construction has commenced on the Underground Project on this basis. Case B (the 2015 Integrated Open Pit and Underground FS) is described as an integrated open pit and underground mine case. Despite the fact that construction has commenced on the Underground Project, the Open Pit Project can be developed and designed (including with regard to surface facilities and services) as an integrated operation for some years to come before Case A and Case B might be considered to become mutually exclusive to one another. The PEA was undertaken to contemplate an alternative approach to developing the Open Pit Project by emphasizing a smaller scale and lower cost operation. Nevertheless, the results of the 2015 Integrated Open Pit and Underground FS remain valid and represent a viable option for the Company at this time. The PEA considers an alternative development option for the Open Pit Project at a conceptual level and does not change the key assumptions and conclusions set out in the 2015 Integrated Open Pit and Underground FS.

Please note that the PEA is preliminary in nature, that it includes inferred mineral resources that are considered too speculative geologically to have the economic considerations applied to them that would enable them to be categorized as mineral reserves, and there is no certainty that the PEA will be realized. Mineral resources that are not mineral reserves do not have demonstrated economic viability.

About Nevada Copper

Nevada Copper’s (TSX: NCU) Pumpkin Hollow project is the only major, shovel-ready and fully-permitted copper project in North America. Located in Nevada, USA, Pumpkin Hollow has substantial reserves and resources including copper, gold and silver. Its two fully-permitted projects include: the high-grade Pumpkin Hollow underground project which is in construction with a view to near-term commencement of copper production; and the Pumpkin Hollow open pit project, a large-scale copper deposit with substantial mineral reserves, and which is currently undergoing an optimization program to target a reduced-capex, staged-development approach.

Additional Information

For further information please visit the Nevada Copper corporate website (www.nevadacopper.com).

NEVADA COPPER CORP.

Matthew Gili, President and CEO

For further information call:

Rich Matthews,

VP Marketing and Investor Relations

Phone: 604-355-7179

Toll free: 1-877-648-8266

Email: rmatthews@nevadacopper.com

We seek safe harbour.