New Age Metals Signs Agreement to Acquire 100% of the Genesis PGM Project in Alaska

(TheNewswire)

-

- New Age Metals (NAM) owns 100% of the River Valley Platinum Group Metals (PGM) Project, which is North America’s largest undeveloped primary PGM Project located 100 kilometers from the Sudbury Metallurgical Complex, Ontario, Canada. Primary PGM deposits are rare outside of South Africa and Russia.

- PGM’s are a Green Metal and their demand is increasing for autocatalysis, a key component for reducing toxic emissions for automotive, gasoline and diesel engines. Fuel cell automobiles use up to one ounce of platinum per vehicle.

- In order to add to its mineral inventory, NAM has signed an agreement to acquire 100% of a road accessible and drill ready PGM project in Alaska.

- Alaska: On April 4th, NAM announced that it had signed a binding Letter of Intent (LOI) with Avalon Development Corp. in Alaska. This agreement will allow NAM to acquire PGM projects in the State in the future. See April 4th, 2018 press release for more details and to opt-in for NAM’s press releases: Click Here.

-

- Lithium Division: As field manager, NAM is currently preparing for the spring/summer exploration program where a minimum of $500,000 is to be expended in 2018 on the company’s five Lithium projects in Manitoba (see news release dated January 15th, and February 22nd, 2018). The 2018 budget will allow for 2 out of the 3 drill ready projects to be drilled.

- These new age metals, Lithium, PGM’s and Rare Metals, have robust macro trends with surging demands and limited supply, and will fuel the demand for energy storage and other core 21st Century Technologies.

- Lithium has an ever increasing demand for batteries in cellphones, laptops, electric cars, solar storage, wireless charging and renewable energy products.

April 18th, 2018 / TheNewswire / Rockport, Canada – New Age Metals Inc. (TSX.V: NAM; OTCQB: NMTLF; FSE: P7J.F) is pleased to announce that it has signed an agreement with Anglo Alaska Gold Corp. (“Anglo Alaska”). The agreement which is subject to regulatory approval allows for New Age Metals and its wholly owned subsidiary Pacific Northwest Capital USA (jointly called “NAM”) to acquire 100% interest of the 10,240 acre road accessible and drill ready Genesis PGM Project, located in the Valdez and Chitina Recording District, of Alaska.

Harry Barr, Chairman/CEO of New Age Metals stated: “We are pleased to have the final agreement completed and partner with Anglo Alaska on the Genesis PGM Project. NAM uses the Prospector Generator Model and after the preliminary field work and additional ground proofing, our objective is to find an option/joint venture partner to further the development of this promising new drill ready project, with excellent base metal credits. NAMs management will continue to actively acquire other PGM and other rare metal projects in the state of Alaska.

Figure 1: Projects Location Map: The road accessible Genesis PGM Project adjacent to Richardson Highway and 138 kv electric lines. The project is 460 road kilometers to Fairbanks, Alaska and 120 road kilometers to the all-weather port city of Valdez

Merits of the Genesis PGM Project

The Genesis PGM Project is an under explored, highly prospective multi-prospect drill ready Pd-Pt-Ni-Cu property that warrants follow-up drilling, additional surface mapping, sampling to expand the known footprint of mineralization and to determine the ultimate size and grade of the layered mineralization outlined to date. The stable land status, ease of access and superb infrastructure make this project prospective for year-around exploration, development and production.

Significant aspects of the Genesis PGM Project include:

-

- Drill ready PGM-Ni-Cu reef style target with 2.4 grams/ton Palladium (Pd), 2.4 grams/ton Platinum (Pt), 0.96% Nickle (Ni), and 0.58% Copper (Cu).

- Reef mineralization is open to the west, east, north, and at depth

- Mineralized reef identified in outcrop for 850 m along strike and a 40 m true thickness

- Separate style of chromite mineralization contains Platinum Group Metals (PGM) up to 2.5 g/t Pd and 2.8 g/t Pt.

- Known PGM mineralization covers a distance of 9 km across the prospect.

- No historic drilling has been done on the project.

- Project is within 3 km of a paved highway and electric transmission line.

- Project is on stable State of Alaska claims.

- Fraser Institute’s 2017 survey of mining companies has Alaska ranked as the 10th best jurisdiction in the world for mining.

Terms of the Final Agreement

In order for NAM to earn 100% of the Genesis PGM Project, NAM has agreed to the following terms:

-

1)Cash Payments to Anglo Alaska

-

- $30,000 on the Closing Date;

- $30,000 on or before the one (1) year anniversary of the Closing Date;

- $30,000 on or before the two (2) year anniversary of the Closing Date; and

- $30,000 on or before the three (3) year anniversary from the Closing Date;

-

2)Stock Payments to Anglo Alaska

-

- 200,000 Consideration Shares on the Closing Date;

- 200,000 Consideration Shares on or before the one (1) year anniversary of the Closing Date;

- 200,000 Consideration Shares on or before the two (2) year anniversary of the Closing Date; and

- 200,000 Consideration Shares on or before the three (3) year anniversary of the Closing Date;

-

3)Royalty to Anglo Alaska

Under the terms of the agreement and in the event the project goes into production, NAM has agreed to pay Anglo Alaska a 3% net smelter royalty return on the project. The agreement also calls for NAM to be able to buy down the 3% royalty as follows:

-

- $500,000 for each one-half percentage point for a total of $1,500,000, leaving Anglo Alaska with a one-point five percent (1.5%) net smelter return production royalty in the event that NAM exercises all of its buydown rights.

-

4)Minimum Assessment Expenditures

The agreement between NAM and Anglo Alaska calls for NAM to pay the minimum State of Alaska mining claim rentals and annual labor on a yearly basis.

All securities issued in connection with the property option will be subject to a four-month-and one-day statutory hold period. The property option remains subject to a number of conditions, including negotiation of definitive agreements, approval of the TSX Venture Exchange, and such other conditions as are customary in transactions of this nature.

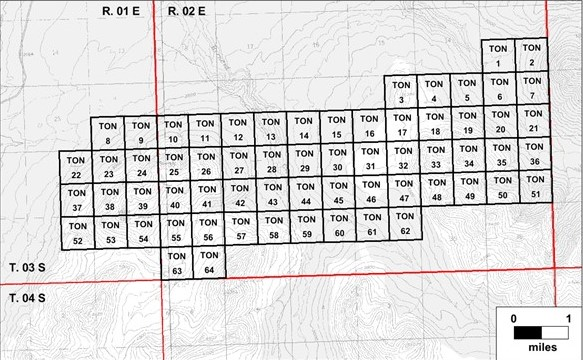

The agreement is for an aggregate of 64 contiguous one hundred and sixty-acre claims (10,240 acres) in the Valdez and Chitina Recording District, Alaska. This can be seen in the map below.

Warrant Extension

The Company also announces that it will make an application to the TSX Venture Exchange to amend the terms of 5,273,560 (post-consolidated) share purchase warrants, (the "Warrants"). Subject to TSX Venture Exchange approval, the original expiry date of May 3, June 29 and October 4, 2018 is proposed to be extended to May 3, June 29 and October 4, 2020. The Company will also apply to amend the exercise price of 4,550,917 Warrants from their current exercise price of $0.60 to an amended exercise price of $0.20 per share during the first year and $0.25 per share during the second year, subject to an acceleration clause, such that the exercise period of the Warrants will be reduced to 30 days if, for any 10 consecutive trading days during the unexpired term of the Warrants, the closing price of the Company’s shares is $0.30 or more. All other terms and conditions will remain the same.

OPT-IN LIST

If you have not done so already, we encourage you to sign up on our website (www.newagemetals.com) to receive our updated news or click here.

ABOUT AVALON DEVELOPMENT CORP, NAM’S GEOLOGICAL CONSULTING COMPANY IN AK

Since its founding in 1985, Avalon Development has evolved along with the mineral industry and its clients. Avalon exploration teams participated in a number of discoveries in the state. Avalon was responsible for Alaska’s newest gold discovery, the +1-million-ounce Peak zone deposit, as well as the 6.5 million ounce intrusive-hosted Dolphin gold deposit, initial targeting of the 20 million-ounce Livengood deposit, and deep high-grade gold resources at the historic Cleary Hill mine. Avalon has also been responsible for platinum group element, copper-nickel and rare metal discoveries on several exploration projects across Alaska. Avalon continues to work with a number of major and junior mining companies involved in precious, base and strategic metal exploration in Alaska. On April 4th, NAM announced that it had signed a binding Letter of Intent (LOI) with Avalon Development Corp. in Alaska. This agreement will allow NAM to utilize Avalon’s extensive geophysical and geochemical database for a period of two years to enable NAM’s management and technical team to acquire additional PGM, and rare metal projects in the State of Alaska in the future. See April 4th, 2018 press release for more details

ABOUT NAM’S PGM DIVISION

NAM’s flagship project is its 100% owned River Valley PGM Project (NAM Website – River Valley Project) in the Sudbury Mining District of Northern Ontario (100 km east of Sudbury, Ontario). Presently the River Valley Project is North America’s largest undeveloped primary PGM deposit with Measured + Indicated resources of 160 million tones @ 0.44 g/t Palladium, 0.17 g/t Platinum, 0.03 g/t Gold, with a total metal grade of 0.64 g/t at a cut-off grade of 0.4 g/t equating to 3,297,173 ounces PGM plus Gold and 4,626,250 PdEq Ounces. This equates to 4,626,250 PdEq ounces M+I and 2,713,933 PdEq ounces in inferred (figure 1). Having completed a 2018 NI-43-101 resource update the company is finalizing its 2018 exploration programs which will include geophysics, and extensive drill programs, which are all working towards the completion of a Preliminary Economic Assessment (PEA). Our objective is to develop a series of open pits (bulk mining) over the 16 kilometers of mineralization, concentrate on site, and ship the concentrates to the long-established Sudbury Metallurgical Complex. Alaska: April 4th, 2018, NAM signed an agreement with one of Alaska’s top geological consulting companies. The companies stated objective is to acquire additional PGM and Rare Metal projects in Alaska.

ABOUT NAM’S LITHIUM DIVISION

The Company has five pegmatite hosted Lithium Projects in the Winnipeg River Pegmatite Field, located in SE Manitoba. Three of the projects are drill ready. This Pegmatite Field hosts the world class Tanco Pegmatite that has been mined for Tantalum, Cesium and Spodumene (one of the primary Lithium ore minerals) in varying capacities, since 1969. NAM’s Lithium Projects are strategically situated in this prolific Pegmatite Field. Presently, NAM is one of the largest mineral claim holders for Lithium in the Winnipeg River Pegmatite Field. On January 15th 2018, NAM announced an agreement with Azincourt Energy Corporation (see Jan 15, 2018 and Feb 22nd, 2018 Press Releases) whereby Azincourt will commit up to $3.85 million dollars in exploration, up to 3 million shares of Azincourt stock to NAM, up to $210,000 in cash, and a 2% net smelter royalty on all 5 projects. Exploration plans for 2018 are currently in progress, whereby a minimum of $500,000 will be expended this year.

QUALIFIED PERSON

The contents contained herein that relate to Exploration Results or Mineral Resources is based on information compiled, reviewed or prepared by Curt Freeman, a consulting geologist for New Age Metals. Mr. Freeman is the Qualified Person as defined by National Instrument 43-101 and is the owner of Avalon Development Corp. and Anglo Alaska Gold Corp, which is the vendor of the Genesis PGM Project. Mr. Freeman has reviewed and approved the technical content of this news release.

On behalf of the Board of Directors

“Harry Barr”

Harry G. Barr

Chairman and CEO

ADDITIONAL INFORMATION

Should you have additional inquiries, please contact Paul Poggione, Corporate Development, Tel: 1-613-659-2773, email: PaulP@NewAgeMetals.com.

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

Cautionary Note Regarding Forward Looking Statements: This release contains forward-looking statements that involve risks and uncertainties. These statements may differ materially from actual future events or results and are based on current expectations or beliefs. For this purpose, statements of historical fact may be deemed to be forward-looking statements. In addition, forward-looking statements include statements in which the Company uses words such as “continue”, “efforts”, “expect”, “believe”, “anticipate”, “confident”, “intend”, “strategy”, “plan”, “will”, “estimate”, “project”, “goal”, “target”, “prospects”, “optimistic” or similar expressions. These statements by their nature involve risks and uncertainties, and actual results may differ materially depending on a variety of important factors, including, among others, the Company’s ability and continuation of efforts to timely and completely make available adequate current public information, additional or different regulatory and legal requirements and restrictions that may be imposed, and other factors as may be discussed in the documents filed by the Company on SEDAR (www.sedar.com), including the most recent reports that identify important risk factors that could cause actual results to differ from those contained in the forward-looking statements. The Company does not undertake any obligation to review or confirm analysts’ expectations or estimates or to release publicly any revisions to any forward-looking statements to reflect events or circumstances after the date hereof or to reflect the occurrence of unanticipated events. Investors should not place undue reliance on forward-looking statements.

Copyright (c) 2018 TheNewswire - All rights reserved.