New Age Metals/Azincourt Energy Acquire Option to 100% of the Mining Rights for Lithium, And Rare Earths for Lithium Two Project From Mustang Minerals

(TheNewswire)

-

1.NAM exercised its option agreement with Mustang Minerals to explore on the Cat 4 claim, which will be added to the Lithium Two Project and contains the western extension of the Eagle Pegmatite. An agreement to clarify terms and conditions has been signed.

-

2.New Age Metals and its Option/Joint-Venture Partner Azincourt Energy Corp. (AAZ) plan to explore the westward extension of the Eagle Pegmatite which is the main Lithium bearing pegmatite on the Lithium Two Project.

-

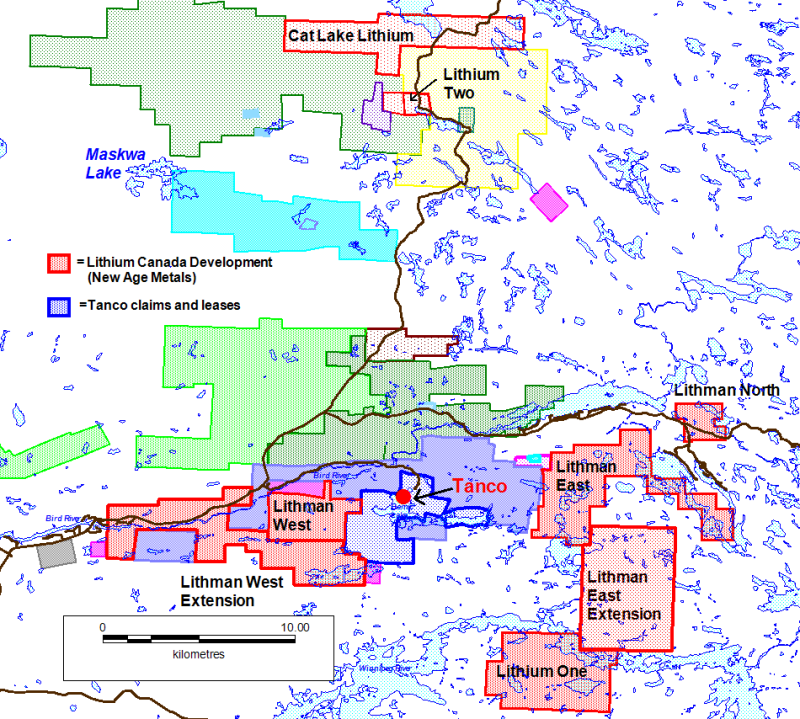

3.New Age Metal/Azincourt Option/Joint-Venture has added strategic mineral rights to the company’s portfolio and maybe the possible extension of the Eagle Pegmatite. The NAM/AAZ Option/Joint-Venture is now largest claim holder in the Winnipeg River Pegmatite Field, the Option/JV are now in possession of an approximate total of 14,100 hectares (34,800 acres). The companies eight Manitoba projects have excellent infrastructure are located in a mining friendly jurisdiction. The Option/ Joint-Venture now has eight projects in this large undeveloped Lithium, Tantalum, Cesium, and Rare Metals bearing pegmatite field.

-

4.Preliminary field work and additional ground proofing is completed on the Lithium Two Project and the exploration crew is exploring the eastern claim blocks. The objective of this work is to finalize a drill plan and initiate a drill program, which is slated for the late summer 2018. Management of both companies plan to update their shareholders and interested parties with a complete exploration plans for all eight projects and continue to do monthly updates on a regular basis. The minimum exploration budget for 2018 is $600,000.

-

5.The Lithium Two Project is a part of the Cat Lake portion of the Cat Lake – Winnipeg River Pegmatite Field. The Winnipeg River Pegmatite Field hosts the World-Class Tanco Pegmatite which has been mined since 1969. The Lithium Two Project contains several lithium bearing pegmatites with a historic non 43-101 compliant 1947 drilled resource on the Eagle Pegmatite (see figure 2) of 545,000 tonnes of 1.4% Li2O to a depth of only 60 meters. Historical reports have suggested that the Eagle Pegmatite is open to depth and along strike.

-

6.Lithium has an ever increasing demand for batteries in electric cars cellphones, laptops, solar storage, wireless charging and renewable energy products.

-

7.NAM’s Platinum Group Metals (PGM) Division, more specifically our River Valley PGM project in Sudbury, Ontario, is the largest undeveloped primary platinum group metal project in North America, and management is advancing the project towards its first economic study, more specifically, a Preliminary Economic Assessment (PEA). See news releases dated May 8, 2018 and May 23, 2018.

July 11, 2018 / TheNewswire / Rockport, Canada – New Age Metals Inc. (TSX.V: NAM; OTCQB: NMTLF; FSE: P7J.F) is pleased to announce that its wholly owned subsidiary, Lithium Canada Developments (LCD), has acquired the right to explore for and develop a 100% of the Lithium and Rare Metals on the Cat 4 claim block, which will be added to the Lithium Two Project.

Westward Extension of the Eagle Pegmatite

The company has an agreement with Mustang Minerals to acquire the rights to explore the ground west of the Lithium Two and to option what is thought to be the westward extension of the Eagle Pegmatite. This agreement comes at no additional cost to the company and is a part of the 2016 original agreement to option the claims. (See news release Aug 16th, 2016)

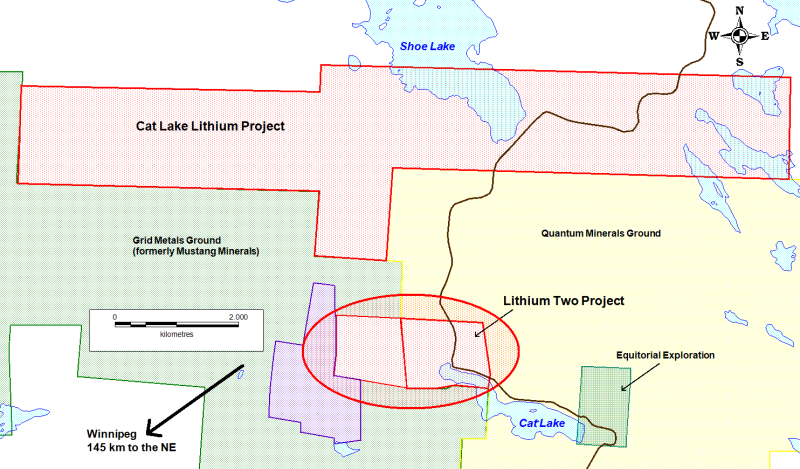

Figure 1: Project Location Map

The Lithium Two Project is located approximately 145 kilometres (90 miles) NE of Winnipeg (see Figure 1), Manitoba, Canada and 24 kilometers directly north of the Tanco Pegmatite (see Figure 4). The world-class Tanco Pegmatite has been mined for Tantalum, Cesium and Spodumene (one of the primary Lithium ore minerals) in varying capacities, since 1969 at the Tanco Mine. The Lithium Two Project is one of eight Lithium Projects that the Joint Venture has in the Winnipeg River Pegmatite Field (see Figure 4).

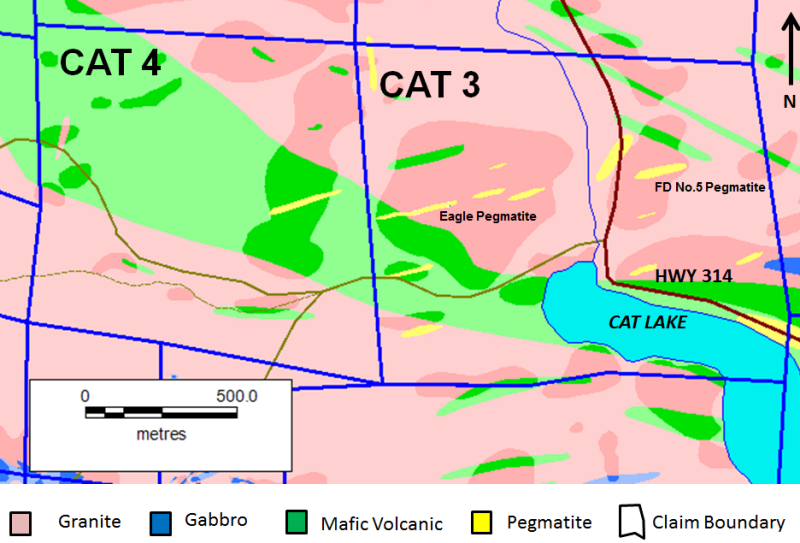

Figure 2: Lithium Two Project, With The CAT 4 Claim Included.

Lithium Two Project

The Lithium Two Project is a part of the Cat Lake portion of the Cat Lake – Winnipeg River Pegmatite Field. The Winnipeg River Pegmatite Field hosts the World-Class Tanco Pegmatite which has been mined since 1969. The Lithium Two Project contains several lithium bearing pegmatites with a historic non 43-101 compliant 1947 drilled resource on the Eagle Pegmatite (see figure 3) of 545,000 tonnes of 1.4% Li2O to a depth of only 60 meters. Historical reports have suggested that the Eagle Pegmatite is open to depth and along strike. The Phase One surface field work is in progress. The first new strategic drilling on this project since the 1950’s is slated for late summer 2018. Numerous pegmatites were and are currently being sampled on the Lithium Two Project as well as chip sampling along the Eagle and FD5 Pegmatites. Fractionation samples were also collected to aid in the understanding of the degree of how evolved the pegmatites may be. The more evolved a pegmatite is, the more chance of the mineral potential being high. Field samples have been sent off for assay.

Figure 3: Map of the Eagle Pegmatite area (modified from Mustang Minerals)

The field work will aid in establishing drill targets. Drilling is planned for late summer of 2018. The minimum exploration budget for all the Lithium projects in the Joint Venture in SE Manitoba for 2018 is $600,000.

Field crews have mobilized to the east of the Pegmatite Field to carry out some field sampling of surface exposed pegmatites on the Joint Venture claims.

OPT-IN LIST

If you have not done so already, we encourage you to sign up on our website (www.newagemetals.com) to receive our updated news or click here.

ABOUT NAM’S PGM DIVISION

NAM’s flagship project is its 100% owned River Valley PGM Project (NAM Website – River Valley Project) in the Sudbury Mining District of Northern Ontario (100 km east of Sudbury, Ontario). Presently the River Valley Project is North America’s largest undeveloped primary PGM deposit with Measured + Indicated resources of 160 million tones @ 0.44 g/t Palladium, 0.17 g/t Platinum, 0.03 g/t Gold, with a total metal grade of 0.64 g/t at a cut-off grade of 0.4 g/t equating to 3,297,173 ounces PGM plus Gold and 4,626,250 PdEq Ounces (Table 1). This equates to 4,626,250 PdEq ounces M+I and 2,713,933 PdEq ounces in inferred (see May 8th, 2018 press release). Having completed a 2018 NI-43-101 resource update the company is finalizing its 2018 exploration programs which will include geophysics, and extensive drill, advanced metallurgical and minerology studies and selective drill programs, which are all moving our flagship project towards the completion of a Preliminary Economic Assessment (PEA). Our objective is to develop a series of open pits (bulk mining) over the 16 kilometers of mineralization, concentrate on site, and ship the concentrates to the long-established Sudbury Metallurgical Complex. On May 23rd, 2018, NAM’s board approved a Preliminary Economic Assessment (PEA) on River Valley Platinum Group Metals Project’s. Management is currently finalizing its selection of a 3rd party engineering company to complete this PEA. This will be the first economic study on the project. On June 13th, 2018 NAM received a completed IP Geophysics Report from Abitibi Geophysics and is currently working with Alan King, NAM’s Sudbury Geological consultant to review all geophysics. On April 4th, 2018, NAM signed an agreement with one of Alaska’s top geological consulting companies. The companies stated objective is to acquire additional PGM and Rare Metal projects in Alaska. On April 18th, 2018, NAM announced the right to purchase 100% of the Genesis PGM Project, NAM’s first Alaskan PGM acquisition related to the April 4th agreement. The Genesis PGM Project is a road accessible, under explored, highly prospective, multi-prospect drill ready Pd-Pt-Ni-Cu property. A comprehensive report on previous exploration and future phases of work is slated for completion by mid-July on Genesis. Management will then actively seek an option/joint-venture partner for this round accessible PGM and Multiple Element Project.

The results of the new resource estimation for NAM’s flagship River Valley PGM Project are tabulated in Table 1 below (0.4 PdEq cut-off).

------------------------------------------------------------------------ | Class |Tonnes |Pd |Pt |Rh |Au |Cu |Ni |Co |PdEq | | |‘,000 |(g/t)|(g/t)|(g/t)|(g/t)|(%) |(%) |(%) |(g/t)| |----------------------------------------------------------------------| |Total Measured|62,877.5 |0.49 |0.19 |0.02 |0.03 |0.05|0.01|0.002|0.99 | |----------------------------------------------------------------------| |Total |97,855.2 |0.40 |0.16 |0.02 |0.03 |0.05|0.01|0.002|0.83 | |Indicated | | | | | | | | | | |----------------------------------------------------------------------| |Total |160,732.7|0.44 |0.17 |0.02 |0.03 |0.05|0.01|0.002|0.90 | |Meas | | | | | | | | | | |+Ind | | | | | | | | | | |----------------------------------------------------------------------| |Inferred |127,662.0|0.27 |0.12 |0.01 |0.02 |0.05|0.02|0.002|0.66 | ------------------------------------------------------------------------ ------------------------------------------------------------- |Class |PGM + Au (oz)|PdEq (oz)|PtEq (oz)|AuEq (oz)| |-----------------------------------------------------------| |Total Measured |1,440,248 |1,999,575|1,999,575|1,136,930| |-----------------------------------------------------------| |Total Indicated|1,856,925 |2,626,675|2,626,675|1,463,793| |-----------------------------------------------------------| |Total Meas +Ind|3,297,173 |4,626,250|4,626,250|2,600,724| |-----------------------------------------------------------| |Inferred |1,578,367 |2,713,933|2,713,933|1,323,809| -------------------------------------------------------------Notes:

-

A.CIM definition standards were followed for the resource estimation.

-

B.The 2018 resource models used Ordinary Krig grade estimation within a three-dimensional block model with mineralized zones defined by wireframed solids.

-

C.A base cut-off grade of 0.4 % g/t PdEq was used for reporting resources.

-

D.Palladium Equivalent (PdEq) calculated using (US$): $1,000/oz Pd, $1,000/oz Pt, $1,350/oz Au, $1750/oz Rh, $3.20/lb Cu, $5.50/lb Ni, $36/lb Co.

-

E.Numbers may not add exactly due to rounding.

-

F.Mineral Resources that are not mineral reserves do not have economic viability

-

G.The quantity and grade of reported inferred resources in this estimation are uncertain in nature and there has been insufficient exploration to define these inferred resources as an indicated or measured mineral resource and it is uncertain if further exploration will result in upgrading them to an indicated or measured mineral resource category.

ABOUT NAM’S LITHIUM DIVISION

The summer exploration plan has begun for the company’s Lithium Division. NAM has 100% ownership of eight pegmatite hosted Lithium Projects in the Winnipeg River Pegmatite Field, located in SE Manitoba, with focus on Lithium bearing pegmatites. Three of the projects are drill ready. This Pegmatite Field hosts the world class Tanco Pegmatite that has been mined for Tantalum, Cesium and Spodumene (one of the primary Lithium ore minerals) in varying capacities, since 1969. NAM’s Lithium Projects are strategically situated in this prolific Pegmatite Field. Presently, NAM is the largest mineral claim holder for Lithium and Rare Metal projects in the Winnipeg River Pegmatite Field.

Lithium Canada Development is a 100% owned subsidiary of New Age Metals (NAM) who presently has an agreement with Azincourt Energy Corporation (AAZ) whereby AAZ will now expand on its first year of this project a minimum of $600,000 in 2018. In its initial earn in AAZ may earn up to 50%, of the eight Lithium projects that are 100% owned by NAM. AAZ’s 50% exploration expenditure earn in is $2.950 million and should they continue with their option they must issue up to 1.75 million shares of AAZ to NAM. NAM has a 2% royalty on each of eight Lithium Projects in this large underdeveloped pegmatite field. As of June 14th, 2018 the option/joint-venture has begun their field exploration program where a minimum of $600,000 will be spent in 2018. For additional information on the NAM/AAZ option/joint-venture and recent acquisitions (see the news releases dated Jan 15, 2018, May 2, 2018, May 10, 2018, June 6, 2018) or go to the investors presentation on newagemetals.com.

QUALIFIED PERSON

The contents contained herein that relate to Exploration Results or Mineral Resources is based on information compiled, reviewed or prepared by Carey Galeschuk, a consulting geoscientist for New Age Metals. Mr. Galeschuk is the Qualified Person as defined by National Instrument 43-101 and has reviewed and approved the technical content of this news release.

On behalf of the Board of Directors

“Harry Barr”

Harry G. Barr

Chairman and CEO

ADDITIONAL INFORMATION

Should you have additional inquiries, please contact Paul Poggione, Corporate Development, Tel: 1-613-659-2773, email: PaulP@NewAgeMetals.com.

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release. Cautionary Note Regarding Forward Looking Statements: This release contains forward-looking statements that involve risks and uncertainties. These statements may differ materially from actual future events or results and are based on current expectations or beliefs. For this purpose, statements of historical fact may be deemed to be forward-looking statements. In addition, forward-looking statements include statements in which the Company uses words such as “continue”, “efforts”, “expect”, “believe”, “anticipate”, “confident”, “intend”, “strategy”, “plan”, “will”, “estimate”, “project”, “goal”, “target”, “prospects”, “optimistic” or similar expressions. These statements by their nature involve risks and uncertainties, and actual results may differ materially depending on a variety of important factors, including, among others, the Company’s ability and continuation of efforts to timely and completely make available adequate current public information, additional or different regulatory and legal requirements and restrictions that may be imposed, and other factors as may be discussed in the documents filed by the Company on SEDAR (www.sedar.com), including the most recent reports that identify important risk factors that could cause actual results to differ from those contained in the forward-looking statements. The Company does not undertake any obligation to review or confirm analysts’ expectations or estimates or to release publicly any revisions to any forward-looking statements to reflect events or circumstances after the date hereof or to reflect the occurrence of unanticipated events. Investors should not place undue reliance on forward-looking statements.

Copyright (c) 2018 TheNewswire - All rights reserved.