New Pacific Intersects 591 Metres Grading 1.03 Grams Per Tonne Gold at the Carangas Project, Bolivia

VANCOUVER, BC, Nov. 14, 2022 /CNW/ - New Pacific Metals Corp. ("New Pacific" or the "Company") (TSX: NUAG) (NYSE American: NEWP), together with its local Bolivian partner, report additional assay results from the 2022 drill program at its Carangas Silver-Gold Project, Oruro Department, Bolivia (the "Carangas Project" or the "Project"). Six new deep drill holes were completed to define the extent of the gold mineralization beneath a shallow silver mineralization zone, which, to date, measures approximately 1,000 metres ("m") long, 800 m wide, and up to 200 m thick. Detailed results and drill hole specifications are provided in Tables 1 and 2.

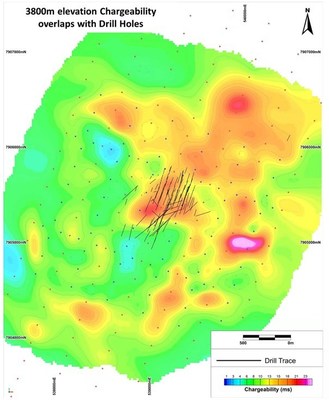

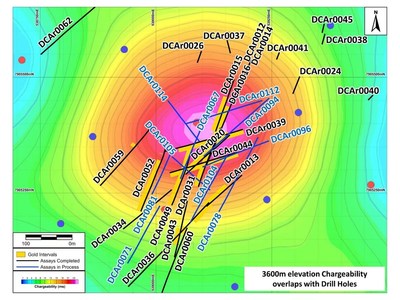

The Company also completed a 3D Bipole-Dipole IP-MT geophysical survey, which showed a clear correlation between high gold tenors and high chargeability anomalies. This IP signature will help refine gold targets and guide future exploration drilling at Carangas.

Hole DCAr0049: 591.85 m interval (from 176.25 m to 768.1 m) grading 1.03 grams per tonne ("g/t") gold ("Au"), 6 g/t silver ("Ag"), 0.11 percent ("%") lead ("Pb"), and 0.18% zinc ("Zn"), including higher grade intervals of 14.64 m (from 412.1 m to 426.74 m) grading 2.16 g/t Au, 9 g/t Ag, 29.07 m (from 446.63 m to 475.7 m) grading 2.76 g/t Au, 18 g/t Ag, and 29.31 m (from 501.9 m to 531.21 m) grading 4.15 g/t Au, 9 g/t Ag.

Hole DCAr0052: 513.35 m interval (from 157.65 m to 671.0 m) grading 0.23 g/t Au, 8 g/t Ag, 0.26% Pb and 0.61% Zn, including 18.82 m (from 625.8 m to 644.62 m) grading 2.07 g/t Au, 9 g/t Ag, 0.1% Zn and 0.15% copper ("Cu").

Hole DCAr0060: 84.17 m interval (from 714.43 m to 798.6 m) grading 0.7 g/t Au, 5 g/t Ag and 0.2 % Cu, including 8.65 m (from 729.52 m to 738.17 m) grading 3.98 g/t Au, 20 g/t Ag and 0.78% Cu.

Hole DCAr0049 was drilled in the Central Valley area. As expected, shallow broad silver-lead-zinc mineralization hosted in strongly altered volcanoclastic sediments was intersected from surface down to a depth of around 170 m, as represented by an upper interval of 61.18 m (from 5.44 m to 66.62 m) grading 21 g/t Ag, 0.44% Pb and 1.02% Zn, and a lower interval of 82.4 m (from 79.4 m to 161.8 m) grading 35 g/t Ag, 0.1 g/t Au, 0.27% Pb and 0.93% Zn. Beneath the silver zone, the hole intersected a gold interval of 591.85 m (from 176.25 m to 768.1 m) grading 1.03 g/t Au, 6 g/t Ag, 0.11% Pb, 0.18% Zn and 0.07% Cu, including several higher grade sub-intervals such as 14.64 m (from 412.1 m to 426.74 m) grading 2.16 g/t Au, 9 g/t Ag, 29.07m (from 446.63 m to 475.7 m) grading 2.76 g/t Au, 18 g/t Ag, and 29.31 m (from 501.9 m to 531.21 m) grading 4.15 g/t Au, 9 g/t Ag. Deeper in the hole, weaker argillic alteration and chalcopyrite mineralization continues to persist, as represented by 6.25 m (from 924.55 m to 930.8 m) grading 0.18 g/t Au, 6 g/t Ag and 0.46% Cu, and 38.98 m (from 1055.24 m to 1094.22 m) grading 0.04 g/t Au, 4 g/t Ag and 0.25% Cu, indicating a trend of increasing copper mineralization with depth.

Hole DCAr0043 was drilled on the southern limit of the Central Valley, about 120 m south of hole DCAr0049, and intersected multiple intervals of silver-lead-zinc mineralization from 24.92 m to 369.43 m. Gold mineralization intensifies with depth and multiple gold-dominant intervals were intersected, as represented by 120.55 m (from 410.75 m to 531.3 m) grading 0.15 g/t Au, 5 g/t Ag, 0.45% Pb and 0.99% Zn, 66.0 m (from 668.0 m to 734.0 m) grading 1.22 g/t Au, 5 g/t Ag, 0.03% Pb, 0.12% Zn and 0.17% Cu, including a higher grade sub-interval of 10.02 m (from 678.28 m to 688.3 m) grading 3.76 g/t Au, 3 g/t Ag, 0.06% Pb, 0.16% Zn and 0.1% Cu, 13.41 m (from 801.72 m to 815.13 m) grading 0.43 g/t Au, 10 g/t Ag and 0.86% Cu, and 8.36 m (from 955.91m to 964.27 m) grading 0.14 g/t Au, 5 g/t Ag and 0.16% Cu. The mineralization style is generally similar to hole DCAr0049, but DCAr0043 has weaker argillic alteration. Furthermore, it appears that mineralization hits in hole DCAr0043 are splays and down plunges of hole DCAr0049.

Hole DCAr0052 was drilled at South Dome near the southern limit of the Central Valley. It intersected silver-lead-zinc mineralization close to the surface, represented by an interval of 151.31 m (from 4.95 m to 156.26 m) grading 18 g/t Ag, 0.57% Pb and 1.19% Zn, followed by a broad gold mineralization interval of 513.35 m (from 157.65 m to 671.0 m) grading 0.23 g/t Au, 8 g/t Ag, 0.26% Pb and 0.61% Zn, including a higher grade sub-interval of 18.82 m (from 625.8 m to 644.62 m) grading 2.07 g/t Au, 9 g/t Ag, 0.1% Zn and 0.15% Cu, and a short interval of 3.75 m (from 715.1 m to 718.85 m) grading 0.32 g/t Au, 28 g/t Ag, 01% Pb and 0.42% Cu.

Hole DCAr0059 was drilled at South Dome near the western limit of the Central Valley. It intersected silver-lead-zinc mineralization close to the surface, represented by 167.2 m (from 12.5 m to 179.7 m) grading 20 g/t Ag, 0.2% Pb and 0.46% Zn, and 150.6 m (from 198.5 m to 349.1 m) grading 10 g/t Ag, 0.37% Pb and 0.65% Zn. Beneath the silver-lead-zinc horizon, multiple weak-moderate gold mineralization intervals were intersected, including 18.74 m (from 419 m to 437.74 m) grading 0.16 g/t Au, 6 g/t Ag, 0.62% Pb and 0.97% Zn, 20.46 m (from 625.43 m to 645.89 m) grading 0.8 g/t Au, 12 g/t Ag, 0.18% Pb, 0.4% Zn and 0.06% Cu. These gold intervals appear to be the west splays from the broad mineralization zones intersected in the Central Valley.

Hole DCAr0060 was drilled about 190 m to the south of hole DCAr0049 near the southern limit of the Central Valley. It intersected multiple narrow silver-lead-zinc mineralization intervals in the upper (~700 m) portion of the hole, followed by a gold mineralization interval of 84.17 m (from 714.43 m to 798.6 m) grading 0.7 g/t Au, 5 g/t Ag and 0.2% Cu, including a higher grade sub-interval of 8.65 m (from 729.52 m to 738.17 m) grading 3.98 g/t Au, 20 g/t Ag and 0.78% Cu, which appears to be the southern extension of the gold zone intersected in hole DCAr0043.

Hole DCAr0062 was drilled near the western limit of West Dome, about 470 m to the west of hole DCAr0049. This hole intersected multiple moderate silver-lead-zinc mineralization intervals, but did not return any gold interval. Rocks are dominated by volcanoclastic sediments, which are pervasively sericitic altered but missing strong argillic alteration, cut by dykes of rhyolite and andesitic basalt. It appears to be the peripheral alteration halo of the strongly argillic altered and mineralized zone in the Central Valley area.

With five rigs running at Carangas, a total of 39,862 meters in 86 drill holes has been completed to date in 2022. Assay results of 39 holes have been received and released. With the success of resource definition drilling, the Company plans to engage independent consultants to carry out an inaugural mineral resource estimate once the drilling is completed by the end of 2022.

In September 2022, a 3D Bipole-Dipole IP-MT survey was completed in the current (West Dome-Central Valley-East Dome) drilling area by Southern Rock Geophysics S.A., based in Santiago, Chile. This program tests how the geophysical signatures of known mineralization responds to the survey, which successfully identified multiple chargeability anomalies (Figure 1). Results from the IP survey revealed that holes drilled to date overlap with one of many IP chargeability anomalies. Furthermore, there are several anomalies north of the current drilling area, warranting follow up drill testing.

The IP survey also showed that higher chargeability at 3600 m elevation, approximately 350 m below the surface, appears to perfectly coincide with the higher grade gold intercepts at that depth (Figure 2). Previous gold intercepts seem to have hit the east half of the chargeability anomaly at 3600 m elevation. More drill holes are planned to test the west half of this target.

Recent geophysical results also indicate that gold mineralization is potentially related to some kind of "plume" system, which differs from our previous view that the gold may be related to regional north-west structures.

Table 1 Summary of Drill Intercepts | ||||||||||

Hole_ID | Depth_from | Depth_to | Interval_m | Ag_g/t | Au_g/t | Pb_% | Zn_% | Cu_% | AgEq_g/t | |

DCAr0043 | 24.92 | 112.22 | 87.30 | 17 | 0.30 | 0.71 | 50 | |||

132.70 | 140.57 | 7.87 | 19 | 0.22 | 0.56 | 0.01 | 45 | |||

151.14 | 165.70 | 14.56 | 25 | 0.02 | 0.36 | 0.69 | 0.01 | 60 | ||

172.42 | 224.00 | 51.58 | 12 | 0.04 | 0.27 | 0.56 | 0.01 | 42 | ||

233.64 | 369.43 | 135.79 | 6 | 0.06 | 0.52 | 0.96 | 0.01 | 58 | ||

410.76 | 531.30 | 120.54 | 5 | 0.15 | 0.45 | 0.99 | 0.02 | 64 | ||

563.60 | 621.72 | 58.12 | 4 | 0.02 | 0.32 | 0.98 | 0.02 | 49 | ||

668.00 | 734.00 | 66.00 | 5 | 1.22 | 0.03 | 0.12 | 0.17 | 114 | ||

incl. | 678.28 | 688.30 | 10.02 | 3 | 3.76 | 0.06 | 0.16 | 0.10 | 288 | |

801.72 | 815.13 | 13.41 | 10 | 0.43 | 0.00 | 0.02 | 0.86 | 131 | ||

955.91 | 964.27 | 8.36 | 5 | 0.14 | 0.00 | 0.01 | 0.16 | 32 | ||

DCAr0049 | 5.44 | 66.62 | 61.18 | 21 | 0.44 | 1.02 | 0.01 | 69 | ||

79.40 | 161.80 | 82.40 | 35 | 0.10 | 0.27 | 0.93 | 0.04 | 84 | ||

176.25 | 768.10 | 591.85 | 6 | 1.03 | 0.11 | 0.18 | 0.07 | 96 | ||

incl. | 412.10 | 426.74 | 14.64 | 9 | 2.16 | 0.06 | 0.05 | 0.05 | 171 | |

incl. | 446.63 | 475.70 | 29.07 | 18 | 2.76 | 0.10 | 0.05 | 0.16 | 236 | |

incl. | 501.90 | 531.21 | 29.31 | 9 | 4.15 | 0.07 | 0.03 | 0.05 | 312 | |

924.55 | 930.80 | 6.25 | 6 | 0.18 | 0.01 | 0.04 | 0.46 | 68 | ||

1055.24 | 1094.22 | 38.98 | 4 | 0.04 | 0.25 | 33 | ||||

DCAr0052 | 4.95 | 156.26 | 151.31 | 18 | 0.01 | 0.57 | 1.19 | 0.01 | 76 | |

157.65 | 671.00 | 513.35 | 8 | 0.23 | 0.26 | 0.61 | 0.03 | 55 | ||

incl. | 625.80 | 644.62 | 18.82 | 9 | 2.07 | 0.02 | 0.10 | 0.15 | 176 | |

715.10 | 718.85 | 3.75 | 28 | 0.32 | 0.10 | 0.03 | 0.42 | 97 | ||

814.41 | 849.00 | 34.59 | 3 | 0.01 | 0.15 | 0.53 | 0.04 | 30 | ||

892.72 | 953.50 | 60.78 | 3 | 0.32 | 0.59 | 0.02 | 35 | |||

DCAr0059 | 12.50 | 179.70 | 167.20 | 20 | 0.01 | 0.20 | 0.46 | 0.01 | 42 | |

incl. | 113.40 | 122.90 | 9.50 | 83 | 0.02 | 0.43 | 0.88 | 0.03 | 127 | |

198.50 | 349.10 | 150.60 | 10 | 0.07 | 0.37 | 0.65 | 0.01 | 47 | ||

371.32 | 383.97 | 12.65 | 2 | 0.10 | 0.30 | 0.44 | 33 | |||

419.00 | 437.74 | 18.74 | 6 | 0.16 | 0.62 | 0.97 | 0.01 | 41 | ||

625.43 | 645.89 | 20.46 | 12 | 0.80 | 0.18 | 0.40 | 0.06 | 88 | ||

677.16 | 691.60 | 14.44 | 2 | 0.05 | 0.13 | 0.38 | 0.01 | 22 | ||

737.56 | 745.00 | 7.44 | 4 | 0.12 | 0.31 | 0.68 | 0.01 | 44 | ||

785.66 | 798.50 | 12.84 | 4 | 0.04 | 0.16 | 1.08 | 0.02 | 48 | ||

838.82 | 845.22 | 6.40 | 3 | 0.19 | 0.65 | 30 | ||||

1081.70 | 1089.65 | 7.95 | 7 | 0.15 | 0.02 | 1.14 | 0.07 | 57 | ||

DCAR0060 | 54.26 | 66.68 | 12.42 | 13 | 0.12 | 0.46 | 0.00 | 33 | ||

83.91 | 94.20 | 10.29 | 24 | 0.01 | 0.09 | 0.24 | 0.01 | 36 | ||

161.44 | 165.84 | 4.40 | 114 | 0.01 | 0.40 | 0.77 | 0.04 | 156 | ||

216.64 | 256.15 | 39.51 | 7 | 0.06 | 0.25 | 0.53 | 0.01 | 37 | ||

299.92 | 313.80 | 13.88 | 8 | 0.02 | 0.48 | 0.85 | 0.01 | 53 | ||

445.56 | 455.16 | 9.60 | 4 | 0.04 | 0.31 | 0.48 | 0.01 | 34 | ||

466.40 | 647.84 | 181.44 | 3 | 0.03 | 0.17 | 0.81 | 0.01 | 38 | ||

714.43 | 798.60 | 84.17 | 5 | 0.70 | 0.01 | 0.04 | 0.20 | 77 | ||

incl. | 729.52 | 738.17 | 8.65 | 20 | 3.98 | 0.02 | 0.01 | 0.78 | 385 | |

829.70 | 844.20 | 14.50 | 3 | 0.05 | 0.02 | 0.34 | 0.06 | 24 | ||

DCAr0062 | 55.39 | 78.85 | 23.46 | 17 | 0.19 | 0.29 | 32 | |||

101.70 | 106.36 | 4.66 | 10 | 0.01 | 0.37 | 0.77 | 0.02 | 50 | ||

217.48 | 227.77 | 10.29 | 46 | 0.10 | 0.22 | 0.01 | 57 | |||

255.51 | 262.34 | 6.83 | 19 | 0.01 | 0.50 | 0.45 | 0.10 | 59 | ||

404.25 | 429.58 | 25.33 | 10 | 0.01 | 0.14 | 0.28 | 23 | |||

Notes: | |

1. | Drill location, altitude, azimuth, and dip of drill holes are provided in Table 2 |

2. | Drill intercept is core length, and grade is length weighted. True width of mineralization is unknown due to early stage of exploration without adequate drill data. |

3. | Calculation of silver equivalent ("AgEq") is based on the long-term median of the August 2021 Street Consensus Commodity Price Forecasts, which are US$22.50/oz for Ag, US$0.95/lb for Pb, US$1.10/lb for Zn, US$3.40/lb for Cu, and US$1,600/oz for Au. The formula used for the AgEq calculation is as follows: AgEq = Ag g/t + Pb g/t * 0.0029 + Zn g/t * 0.00335 + Cu g/t * 0.01036 + Au g/t * 71.1111. This calculation assumes 100% recovery. Due to the early stage of the Project, the Company has not yet completed metallurgical test work on the mineralization encountered to date. |

4. | A cut-off of 20 g/t AgEq is applied to calculate the length-weighted intercept. At times, samples lower than 20 g/t AgEq may be included in the calculation of consolidation of mineralized intercepts. |

Table 2 Summary of Drill Holes of Discovery Drill Program of Carangas Project | |||||||

Hole_id | Easting | Northing | Altitude | Depth_m | Azimuth (°) | Dip (°) | Target |

DCAr0043 | 539000.36 | 7905001.41 | 3904.79 | 968.00 | 20 | -66 | CV |

DCAr0049 | 538989.57 | 7905122.62 | 3905.42 | 1360.00 | 20 | -68 | CV |

DCAr0052 | 538930.52 | 7905105.75 | 3905.07 | 1373.50 | 20 | -68 | SD |

DCAr0059 | 538794.74 | 7905170.10 | 3915.94 | 1250.00 | 40 | -66 | SD |

DCAr0060 | 538971.76 | 7904930.05 | 3905.30 | 1097.00 | 20 | -70 | CV |

DCAr0062 | 538637.77 | 7905437.90 | 3943.17 | 800.00 | 40 | -68 | WD |

Note: | 1. Drill collar coordinate system is WGS1984 UTM Zone 19S | ||||||

2. Coordinate of drill collar is picked with Real Time Kinematics (RTK) GPS | |||||||

3. CV - Central Valley; WD - West Dome; SD – South Dome | |||||||

The Company maintains tight sample security and QA/QC for all aspects of its exploration program at the Carangas Project. Drill core is logged, photographed and split on-site by the company and stored under secure conditions until being shipped in security-sealed bags by New Pacific staff in Company vehicles, directly from the project to ALS Global in Oruro, Bolivia for preparation, and ALS Global in Lima, Peru for geochemical analysis. ALS Global is an ISO 17025 accredited laboratory independent from New Pacific. All samples are first analyzed by a multi-element ICP package (ALS code ME-MS41) with ore grade specified limits for silver, lead, and zinc, further analyzed using ALS code OG46. Further silver samples over specified limits are analyzed by gravimetric analysis (ALS code of GRA21). Gold is assayed first by ICP and then by fire assay with AAS finish (ALS code of Au-AA25). Certified reference materials, various types of blank samples and duplicate samples are inserted into normal drill core sample sequences prior to delivery to the laboratory for preparation and analysis. The overall ratio of quality control samples in sample sequences is around twenty percent.

The scientific and technical information contained in this news release has been reviewed and approved by Alex Zhang, P. Geo., Vice President of Exploration, who is a Qualified Person for the purposes of National Instrument 43-101 — Standards of Disclosure for Mineral Projects ("NI 43-101"). The Qualified Person has verified the information disclosed herein, including the sampling, preparation, security and analytical procedures underlying such information, and is not aware of any significant risks and uncertainties that could be expected to affect the reliability or confidence in the information discussed herein.

New Pacific is a Canadian exploration and development company with precious metal projects in Bolivia. The Company's flagship Project, the Silver Sand Silver Deposit, is expecting a new Mineral Resource Estimate Update and a PEA by the end of 2022. The recently discovered Carangas Silver-Gold Project is undergoing a 40,000 m drill program. The third project, the Silverstrike Silver-Gold Project, commenced a 6,000 m discovery drill program in June 2022 and discovered a near surface broad gold zone in its first hole drilled.

For further information, please contact:

New Pacific Metals Corp.

Phone: (604) 633-1368 Ext. 222

U.S. & Canada toll-free: 1-877-631-0593

E-mail: invest@newpacificmetals.com

For additional information and to receive company news by e-mail, please register using New Pacific's website at www.newpacificmetals.com.

Certain of the statements and information in this news release constitute "forward-looking statements" within the meaning of the United States Private Securities Litigation Reform Act of 1995 and "forward-looking information" within the meaning of applicable Canadian provincial securities laws. Any statements or information that express or involve discussions with respect to predictions, expectations, beliefs, plans, projections, objectives, assumptions, or future events or performance (often, but not always, using words or phrases such as "expects", "is expected", "anticipates", "believes", "plans", "projects", "estimates", "assumes", "intends", "strategies", "targets", "goals", "forecasts", "objectives", "budgets", "schedules", "potential" or variations thereof or stating that certain actions, events or results "may", "could", "would", "might" or "will" be taken, occur or be achieved, or the negative of any of these terms and similar expressions) are not statements of historical fact and may be forward-looking statements or information. Such statements include, but are not limited to: statements regarding anticipated exploration, drilling, development, construction, and other activities or achievements of the Company; timing of receipt of permits and regulatory approvals; timing and content of the PEA, and estimates of the Company's revenues and capital expenditures; and other future plans, objectives or expectations of the Company.

Forward-looking statements or information are subject to a variety of known and unknown risks, uncertainties and other factors that could cause actual events or results to differ from those reflected in the forward-looking statements or information, including, without limitation, risks relating to: global economic and social impact of COVID-19; fluctuating equity prices, bond prices, commodity prices; calculation of resources, reserves and mineralization, general economic conditions, foreign exchange risks, interest rate risk, foreign investment risk; loss of key personnel; conflicts of interest; dependence on management, uncertainties relating to the availability and costs of financing needed in the future, environmental risks, operations and political conditions, the regulatory environment in Bolivia and Canada; risks associated with community relations and corporate social responsibility, and other factors described under the heading "Risk Factors" in the Company's Annual Information Form for the year ended June 30, 2022 and its other public filings.

This list is not exhaustive of the factors that may affect any of the Company's forward-looking statements or information.

The forward-looking statements are necessarily based on a number of estimates, assumptions, beliefs, expectations and opinions of management as of the date of this news release that, while considered reasonable by management, are inherently subject to significant business, economic and competitive uncertainties and contingencies. These estimates, assumptions, beliefs, expectations and options include, but are not limited to, those related to the Company's ability to carry on current and future operations, including: the duration and effects of COVID-19 on our operations and workforce; development and exploration activities; the timing, extent, duration and economic viability of such operations; the accuracy and reliability of estimates, projections, forecasts, studies and assessments; the Company's ability to meet or achieve estimates, projections and forecasts; the stabilization of the political climate in Bolivia; the Company's ability to obtain and maintain social license at its mineral properties; the availability and cost of inputs; the price and market for outputs; foreign exchange rates; taxation levels; the timely receipt of necessary approvals or permits, including the ratification and approval of the Mining Production Contract with COMIBOL by the Plurinational Legislative Assembly of Bolivia; the ability of the Company's Bolivian partner to convert the exploration licenses at the Carangas Project to AMC; the ability to meet current and future obligations; the ability to obtain timely financing on reasonable terms when required; the current and future social, economic and political conditions; and other assumptions and factors generally associated with the mining industry.

Although the forward-looking statements contained in this news release are based upon what management believes are reasonable assumptions, there can be no assurance that actual results will be consistent with these forward-looking statements. All forward-looking statements in this news release are qualified by these cautionary statements. Accordingly, readers should not place undue reliance on such statements. Other than specifically required by applicable laws, the Company is under no obligation and expressly disclaims any such obligation to update or alter the forward-looking statements whether as a result of new information, future events or otherwise except as may be required by law. These forward-looking statements are made as of the date of this news release.

This news release has been prepared in accordance with the requirements of the securities laws in effect in Canada which differ from the requirements of United States securities laws. The technical and scientific information contained herein has been prepared in accordance with NI 43-101, which differs from the standards adopted by the U.S. Securities and Exchange Commission (the "SEC"). Accordingly, the technical and scientific information contained herein, including any estimates of mineral reserves and mineral resources, may not be comparable to similar information disclosed by U.S. companies subject to the disclosure requirements of the SEC.

Additional information relating to the Company, including the Company's Annual Information Form, can be obtained under the Company's profile on SEDAR at www.sedar.com, on EDGAR at www.sec.gov, and on the Company's website at www.newpacificmetals.com.

![]() View original content to download multimedia:https://www.prnewswire.com/news-releases/new-pacific-intersects-591-metres-grading-1-03-grams-per-tonne-gold-at-the-carangas-project-bolivia-301676235.html

View original content to download multimedia:https://www.prnewswire.com/news-releases/new-pacific-intersects-591-metres-grading-1-03-grams-per-tonne-gold-at-the-carangas-project-bolivia-301676235.html

SOURCE New Pacific Metals Corp.

![]() View original content to download multimedia: http://www.newswire.ca/en/releases/archive/November2022/14/c0806.html

View original content to download multimedia: http://www.newswire.ca/en/releases/archive/November2022/14/c0806.html