Nighthawk Gold's Maiden PEA: C$1.2 Billion NPV5% and 35% IRR after-taxes at US$1,600/oz Gold

Nighthawk Gold Corp. (“Nighthawk”, “NHK”, or the “Company”) (TSX: NHK; OTCQX: MIMZF) is pleased to report its maiden PEA1 for the Colomac Gold Project, located 200 kilometres (“km”) north of Yellowknife, NWT, Canada. Please refer to Tables 1 and 2 for a summary of the Project PEA economics and Conceptual LOM plan, respectively.

This press release features multimedia. View the full release here: https://www.businesswire.com/news/home/20230425006224/en/

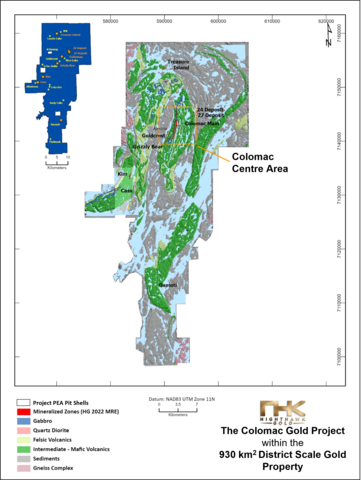

Figure 1 – The Colomac Gold Project within the District Scale Property - Map (Graphic: Business Wire)

Table 1: Project PEA1 Economics*

Potential Economics |

Gold Price (US$/oz) |

|||

US$1,300 Downside |

US$1,600 Base Case |

US$1,672 Long-term Consensus3 |

US$2,000 Upside Case |

|

Pre-tax IRR (%) |

22.5% |

42.4% |

47.1% |

68.1% |

After-tax IRR (%) |

18.4% |

34.6% |

38.5% |

56.2% |

Pre-tax NPV5% (C$M) |

$824 |

$1,800 |

$2,034 |

$3,101 |

After-tax NPV5% (C$M) |

$532 |

$1,170 |

$1,322 |

$2,016 |

After-tax LOM free cash flow (“FCF”)4, Net of Initial Capex (“C$M”) |

$958 |

$1,802 |

$2,005 |

$2,927 |

FX rate assumption (US$/C$) |

0.74 |

0.74 |

0.74 |

0.74 |

Pre-taxNPV5%/Initial Capex ratio |

1.3x |

2.8x |

3.1x |

4.7x |

After-taxNPV5%/Initial Capex ratio |

0.8x |

1.8x |

2.0x |

3.1x |

Pre-tax Payback period (years) |

4.1 |

2.1 |

1.9 |

1.5 |

After-tax Payback period (years) |

4.9 |

2.1 |

1.9 |

1.5 |

*Numbers may not add up due to rounding |

||||

Table 2: Conceptual LOM Plan, Capex, Cost, and ESG Summary*

Metrics |

LOM Total |

Average or Per Unit |

Conceptual Production |

||

Conceptual mine life (“LOM”) |

11.2 years |

- |

Waste material - Open Pit (“OP”)(M tonnes (“t”)) |

554.1 Mt |

49.5 Mt/year |

Mineralized material OP + Underground (“UG”)(Mt) |

67.2 Mt |

6.0 Mt/year |

OP strip ratio (Waste : Mineralized Material) |

9.0 |

|

Mill head grade - grams per tonne gold (“g/t Au”) |

1.57 g/t Au |

- |

Mill recovery rate (%) |

96.3% |

- |

Potential LOM payable gold production (Koz) |

3,256 Koz |

290Koz/year |

OP production UG Production |

2,503Koz 753Koz |

223Koz/year 67Koz/year |

Peak potential payable gold production – Year 2 |

340Koz |

- |

Potential payable gold production – Years 1-4 |

1,254Koz |

313Koz/year |

|

|

|

Capex and Operating Costs (“Opex”) |

||

Initial Capex (including contingency) |

C$654M |

- |

Sustaining Capex |

C$665M |

C$59M/year |

Total Cash Costs |

C$2,960M |

US$673/oz |

AISC2 |

C$3,643M |

US$828/oz |

AIC2 |

C$4,297M |

US$977/oz |

|

|

|

ESG |

||

Sustainable energy dependency (wind + solar) |

60% |

|

Carbon intensity |

0.48t CO2e/oz |

|

Mill and site |

0.18t CO2e/oz |

|

Mining fleet |

0.30t CO2e/oz |

|

*Numbers may not add up due to rounding |

||

The PEA1 is preliminary in nature and includes inferred mineral resources that are considered too speculative geologically to have the economic considerations applied to them that would enable them to be categorized as mineral reserves, and there is no certainty that the PEA will be realized. Mineral resources that are not mineral reserves do not have demonstrated economic viability.

Nighthawk President and CEO Keyvan Salehi, P.Eng. commented: “The results of our PEA demonstrate that the Colomac Gold Project has the potential to be a phenomenal asset, and the PEA is a monumental milestone for our Company. The PEA gives us a snapshot of the free-cash-flow-generating potential of the Project. We believe that the Colomac Gold Project is a top-tier North American mining project that could deliver significant value to our shareholders and has the potential to meaningfully contribute to the NWT economy. Only a handful of gold projects in the world (that are owned by junior gold companies) have similar favourable economics with the potential to deliver approximately 300,000 oz of annual gold production over a 10 year mine life and achieve an NPV5% to Initial Capex ratio close to 2.0. As such, we believe our Project belongs to this rare class of global gold assets and that there is runway for the Project to continue to grow as we start exploring for other meaningful deposits across our massive greenstone Property.”

“All our deposits remain wide open along strike and at depth with the potential for further expansion of the existing mineral resources. Furthermore, we’ve only scratched the surface on the immense exploration upside of our 930 km2 District Scale Property; our Property has more than 27 historical gold occurrences that warrant follow-up exploration. We strongly believe that this Project PEA is the cornerstone of what could be a major gold camp.”

“We have an exciting rest of the year ahead of us. In the near term, we are expecting assay results from the highly prospective Leta Arm Zone. We are also planning to further drill the Cass, 24/27, and Damoti deposits, which we believe have the potential to expand mineralization beyond what has been outlined in the PEA. We look forward to updating the markets with our progress.”

Conceptual Mine Development and Mine Plan

Conceptual Mine Development

The Project envisions the extraction of mineralized material predominantly by OP mining, with a small portion of the overall mineralized material to be extracted via UG. Mineralized material will be mined from the following deposits:

- Colomac Centre Area: Colomac Main (OP & UG), 24/27 (OP), Grizzly Bear (OP), and Goldcrest (OP) deposits

- Satellite Deposits: Cass (OP & UG), Kim (OP), Damoti (OP & UG) and Treasure Island (UG)

See Figure 1 for the District Scale Property Regional Map displaying the location of the Project Deposits.

The main components of the PEA development plan include: a phased approach to pit development (minimal pre-stripping) of the OP deposits, the construction of haul roads to access the Satellite Deposits, and the development of ramp systems from surface to access the UG mineralized material. Construction is managed by EPCM then transitioned to owner-operator upon commencement of initial gold production. Conceptual mine development is expected to be completed over 24 months, with some mineralized material stockpiled ahead of the completion of the processing plant.

Conceptual Mine Plan

The PEA conceptual mine plan envisions a “hub-and-spoke” model. The main infrastructure and processing facilities are located within the Colomac Centre Area and mineralized material from the Satellite Deposits are trucked to the Colomac Centre Area via haul roads. The conceptual mine plan envisions a phased approach to mining the deposits and scheduling prioritizes the extraction of higher-grade (above 1.5 g/t Au gold grade) OP mineralization to maximize after-tax NPV5% and IRR.

The conceptual OP mining of the near-surface mineralized material envisions a conventional drill/blast/load/haul method within the 5-metre-high benches of the pit. The Colomac Main deposit contains the largest amount of OP mineralization and comprises 6 pit pushbacks (over a strike length of roughly 6 km) that are phased throughout the LOM. All Satellite Deposits are mined as one phase from top to bottom.

Conceptual UG mining utilizes mechanized cut-and-fill methods. UG mineralization will be accessed via portal and ramp system from surface. The average size of planned UG stopes is 20 metres (“m”) (height) x 20 m (depth) x 3 m (width).

The Conceptual mine plan covers a period of 11.2 years, followed by reclamation. Overall LOM average annual throughput is expected to reach a maximum capacity of 6.1 Mt per annum (“Mtpa”). The conceptual mine plan estimates an average overall OP strip ratio of 9.0, however the strip ratio varies depending on the deposit. The OP mill feed grades average 1.32 g/t Au over the LOM, and UG mill feed grades average 4.12 g/t Au over the LOM.

Assuming a 96.3% mill recovery (See “Processing” section for further details), the Project LOM potential payable gold production is 3.256 Moz for an average potential production profile of 290,000oz per year; for the first four years, average annual potential payable gold production 313,000oz per year.

See Figures 2-5 for the conceptual pit shells and surrounding infrastructure for the Colomac Centre (Colomac Main, Grizzly Bear, and Goldcrest), Kim and Cass, Damoti, and 24/27 Deposits, respectively. See Figure 6 for the Project PEA LOM potential production, capex and cost profile.

Project Powered by Sustainable Energy

The Project PEA contemplates the construction of wind turbines and solar panels to provide up to 60% of the year-round power requirements for the processing plant and camp operation. Wind and solar energy have been primary sources of power generation for a couple of NWT diamond mines for more than a decade. The remaining 40% power requirement would come from diesel generation. Initial and sustaining capex of the sustainable power supply amounts to C$103 million and C$10 million, respectively.

Processing

The Project PEA contemplates the processing of mineralized material through a conventional milling, gravity, and leach recovery circuit. The milling circuit consists of a primary crusher, secondary crusher, followed by a semi-autogenous grinding (“SAG”) mill, gravity circuit and ball mill before entering the leaching circuit (See Figure 7 for the Planned Mill Circuit Flow Sheet). The average estimated gold recovery is 96.3%, which is supported by the metallurgical testing5 completed by the Company. The mill processing circuit has an operating capacity of up to 17,000t per day (“tpd”), or 6.1Mtpa.

Tailings Storage Facility (“TSF”), Water Management and Permitting

TSF

The PEA contemplates the phased construction of conventional tailings storage facilities. There is ample TSF capacity to handle the LOM waste material generated by the Project PEA. The TSF locations are proximal to the deposits. Please see Figures 2-5 for more information on the TSF locations.

Water Management

The conceptual OP mine plan requires the diversion of shallow bodies of water that are adjacent to some of the deposits. The largest body of water that requires diversion is Baton Lake, located on the eastside of the Colomac Main Deposit.

Permitting and Closure

Permitting requires a minimum of 2 years of environmental baseline studies to be completed as part of the Environmental Assessment (“EA”). The EA is reviewed and approved by the NWT Mackenzie Valley Environmental Review Board (which includes all relevant Federal agencies as parties to the process). Upon EA approval, the Mackenzie Valley Land and Water Board will then process applications for a Water License and Land Use Permit through a public process. Closure and reclamation costs at the end of the mine life are estimated to be C$50 million.

Other Site Infrastructure

In addition to the mill, TMF, and sustainable power components, other site infrastructure includes a truck shop and other maintenance buildings, haul roads, 300-person camp, wastewater treatment plant, airstrip upgrade to accommodate cargo planes and ditching and sedimentation ponds for water management.

Capex and Opex

Please refer to Tables 3 and 4 for the Project PEA capex and opex, respectively.

Table 3 – Summary of the Project PEA Capex*

Capex item |

Initial (C$M) |

Sustaining (C$M) |

Total (C$M) |

Mining6 |

$161 |

$547 |

$708 |

Processing (including the mill) |

$160 |

- |

$160 |

TSF |

$34 |

$23 |

$57 |

Sustainable power supply (wind and solar) |

$103 |

$10 |

$113 |

Other Site Infrastructure (including access roads and expanded airstrip) |

$42 |

$53 |

$95 |

Total Directs: |

$499 |

$633 |

$1,133 |

Total Indirects7 |

$59 |

- |

$59 |

Closure (net of salvage) |

- |

$18 |

$18 |

Contingency (17%8) |

$96 |

$32 |

$127 |

Kim & Cass NSR Buyback |

- |

$3 |

$3 |

Total Capex |

$654 |

$686 |

$1,340 |

*Numbers may not add up due to rounding |

|||

Table 4 – Summary of the Project Opex*

Cost Item |

LOM (C$ millions) |

Per Mineralized Tonne (C$/t) |

Per Production Ounce (US$/oz) |

Total Mining (OP+UG) |

$2,183 |

$3.5/t mined |

$496 |

OP mining |

$1,504 |

$2.5/t mined |

$342 |

UG mining |

$680 |

$115.0/t mined |

$154 |

Processing |

$600 |

$8.9/t milled |

$136 |

G&A |

$168 |

$2.5/t milled |

$38 |

Total operating cost |

$2,952 |

$43.9/t |

$671 |

Refining, transport, royalties |

$8 |

- |

$2 |

Total Cash Costs |

$2,960 |

$44.0/t |

$673 |

Total AISC |

$3,643 |

- |

$828 |

Total AIC |

$4,297 |

- |

$977 |

*Numbers may not add up due to rounding |

|||

Taxes, Royalties, and Other Production Taxes

Corporate Taxable Income for entities located in the Northwest Territories are subject to a combined (federal and territorial) income tax rate of 26.5%. Furthermore, the Northwest Territories Mining Regulations require the payment of royalty taxes based on a “sliding scale” between 5-14% based on the output of the mine – mine output of C$10,000 triggers 5% in royalty taxes and C$45 million (and above) qualifies for the maximum 14% royalty tax rate.

There is a minor 2.5% net smelter royalty (“NSR”) on the Kim and Cass Properties. The NSR agreement gives NHK the right to buy back 100% of the NSR for C$2.5 million, which the Company intends to execute before the commencement of potential commercial production.

Nighthawk intends to engage with the local First Nation communities as part of an impact benefits agreement (“IBA”) or cooperation agreement.

Economics

Using a Base Case of US$1,600/oz Au, the Project generates C$1.2 billion of after-tax NPV5% and 35% after-tax IRR. At an Upside Case of US$2,000/oz Au, Project PEA generates C$2.0 billion after-tax NPV5% and 56% after-tax IRR. Below are select sensitivity tables:

Tables 5 (after-tax NPV5%) and 6 (after-tax IRR): Gold Price vs. US$/C$ Exchange Rate

Table 5 |

Table 6 |

|||||||||||

After-Tax NPV5% (C$M) Sensitivity To Gold Price and FX Rate |

After-Tax IRR% Sensitivity To Gold Price and FX Rate |

|||||||||||

|

|

|

|

|

|

|

|

|

|

|||

FX Rate (US$/C$) |

|

Gold Price (US$/oz) |

FX Rate (US$/C$) |

|

Gold Price (US$/oz) |

|||||||

|

$1,300 |

$1,600 |

$1,672 |

$2,000 |

|

$1,300 |

$1,600 |

$1,672 |

$2,000 |

|||

0.80 |

$321 |

$915 |

$1,057 |

$1,700 |

0.80 |

13.0% |

28.2% |

31.7% |

48.3% |

|||

0.77 |

$422 |

$1,038 |

$1,184 |

$1,852 |

0.77 |

15.6% |

31.3% |

35.0% |

52.1% |

|||

0.74 |

$532 |

$1,170 |

$1,322 |

$2,016 |

0.74 |

18.4% |

34.6% |

38.5% |

56.2% |

|||

0.72 |

$609 |

$1,264 |

$1,421 |

$2,133 |

0.72 |

20.4% |

37.0% |

41.0% |

59.2% |

|||

0.70 |

$691 |

$1,363 |

$1,525 |

$2,257 |

0.70 |

22.5% |

39.5% |

43.7% |

62.3% |

|||

Tables 7 (after-tax NPV5%) and 8 (after-tax IRR): Capex vs. Opex

Table 7 |

Table 8 |

|||||||||||||

After-Tax NPV5% (C$M) Sensitivity To Capex and Opex Change |

After-Tax IRR% Sensitivity To Capex and Opex Change |

|||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

Total Capex Change |

|

Total Capex Change |

|||||||||||

Opex Change |

|

(20.0%) |

(10.0%) |

Base Case |

10.0% |

20.0% |

Opex Change |

|

(20.0%) |

(10.0%) |

Base Case |

10.0% |

20.0% |

|

(20.0%) |

$1,621 |

$1,540 |

$1,457 |

$1,374 |

$1,292 |

(20.0%) |

56.6% |

48.5% |

41.8% |

36.5% |

32.2% |

|||

(10.0%) |

$1,479 |

$1,396 |

$1,313 |

$1,231 |

$1,148 |

(10.0%) |

52.3% |

44.4% |

38.2% |

33.3% |

29.2% |

|||

Base Case |

$1,335 |

$1,252 |

$1,170 |

$1,087 |

$1,004 |

Base Case |

47.7% |

40.3% |

34.6% |

30.0% |

26.2% |

|||

10.0% |

$1,191 |

$1,109 |

$1,026 |

$943 |

$860 |

10.0% |

43.0% |

36.2% |

31.0% |

26.7% |

23.2% |

|||

20.0% |

$1,048 |

$965 |

$882 |

$799 |

$716 |

20.0% |

38.3% |

32.2% |

27.3% |

23.4% |

20.1% |

|||

Tables 9 (after-tax NPV5%) and 10 (after-tax IRR): Mill Head Grade vs. Mill Recoveries

Table 9 |

Table 10 |

|||||||||||||

After-Tax NPV5% (C$M) Sensitivity To Head Grade and Recovery Change |

After-Tax IRR% Sensitivity To Head Grade and Recovery Change |

|||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

Head Grade Change |

|

Head Grade Change |

|||||||||||

Mill Recovery |

|

(10.0%) |

(5.0%) |

Base Case |

5.0% |

10.0% |

Mill Recovery |

|

(10.0%) |

(5.0%) |

Base Case |

5.0% |

10.0% |

|

98.0% |

$883 |

$1,056 |

$1,228 |

$1,400 |

$1,573 |

98.0% |

27.3% |

31.6% |

36.0% |

40.4% |

44.9% |

|||

Base Case |

$821 |

$995 |

$1,170 |

$1,343 |

$1,516 |

Base Case |

25.8% |

30.2% |

34.6% |

39.0% |

43.5% |

|||

95.0% |

$788 |

$956 |

$1,123 |

$1,289 |

$1,456 |

95.0% |

24.9% |

29.1% |

33.3% |

37.5% |

41.8% |

|||

92.5% |

$709 |

$872 |

$1,035 |

$1,197 |

$1,360 |

92.5% |

22.9% |

27.0% |

31.1% |

35.2% |

39.3% |

|||

The PEA is preliminary in nature and includes inferred mineral resources that are considered too speculative geologically to have the economic considerations applied to them that would enable them to be categorized as mineral reserves, and there is no certainty that the PEA will be realized. Mineral resources that are not mineral reserves do not have demonstrated economic viability.

Recommendations

The Company is evaluating a series of recommendations to further advance and de-risk the Project:

- Continue to optimize the mining sequence, pit slopes and equipment sizing

- Complete prefeasibility study (“PFS”) variability testwork to refine gold recovery model and process equipment sizing

- Complete additional logistics studies to refine storage of fuel, consumables as well as camp operation

- Complete site field activities (geotechnical hydrogeology, to support PFS level engineering)

- Infill drilling the inferred mineral resources with the goal of upgrading to at least the indicated category

- Targeted geotechnical drilling for each deposit's planned open pit walls, and within underground ramp/stope host rock

- Lidar surveys of topography along all planned roads to satellite deposits

- Conduct cost/benefit analysis of an airstrip extension

2023 Mineral Resource Estimate (“2023 MRE”)9

The 2023 MRE provides the basis for the PEA conceptual mine plan, please refer to Table 11 for the summary.

Table 11 – 2023 MRE9 Summary

|

Indicated Mineral Resource |

Inferred Mineral Resource |

||||

Potential mining method |

Tonnes (000s) |

Grade (g/t Au) |

Contained gold ounces |

Tonnes (000s) |

Grade (g/t Au) |

Contained gold ounces |

Open Pit (OP) |

59,945 |

1.45 |

2,804,000 |

11,070 |

2.33 |

830,000 |

Underground (UG) |

10,486 |

1.73 |

583,000 |

13,364 |

2.03 |

872,000 |

Global (OP+UG) |

70,432 |

1.50 |

3,387,000 |

24,434 |

2.17 |

1,702,000 |

There is no certainty that the 2023 MRE will be converted to Proven and Probable Mineral Reserve categories or will be realized in the future. Mineral Resource estimates that are not Mineral Reserves do not have demonstrated economic viability. The 2023 MRE may be materially affected by environmental, permitting, legal, title, taxation, socio-political, marketing, or other relevant risks, uncertainties and other factors, as more particularly described in the Cautionary Statements at the end of this news release.

Technical Report and Qualified Persons

A Technical Report prepared in accordance with NI 43-101 (as defined below) in support of the PEA1 (“PEA Technical Report”) will be filed on SEDAR (www.sedar.com) within 45 days. Readers are encouraged to read the 2023 MRE9 and PEA Technical Reports in its entirety, including all qualifications, assumptions and exclusions that relate to the 2023 MRE and PEA. The PEA Technical Report is intended to be read as a whole, and sections should not be read or relied upon out of context.

Scientific and technical information related to the PEA1 and 2023 MRE10 contained in this news release has been reviewed and verified by:

- Tommaso Roberto Raponi, P. Eng, Ausenco Engineering Canada Inc., Metallurgy and Infrastructure

- Jonathan Cooper, P. Eng, Ausenco Engineering Canada Inc., Water Resources

- James Millard, P.Geo, Ausenco Engineering Canada Inc., Environmental studies and Permitting

- Aleksander Spasojevic, P. Eng, Ausenco Engineering Canada Inc. Project Infrastructure – Tailings Management Facility Design

- Marc Schulte, P. Eng, Moose Mountain Technical Services, Conceptual Mine Planning

- Marina Iund, P. Geo, InnovExplo, 2023 MRE

These persons have the ability and authority to verify the authenticity and validity of this data and are independent from the Company.

John McBride, MSc., P.Geo., VP Exploration of Nighthawk, is a “Qualified Person” as defined by NI 43-101 for this Project, has reviewed and approved of the scientific and technical disclosure contained in this news release.

About Nighthawk Gold Corp.

Nighthawk is a Canadian-based gold exploration company with 100% ownership of more than 930 km2 District Scale Property within 200 km north of Yellowknife, Northwest Territories, Canada. The Colomac Gold Project PEA1 demonstrates a potential large-scale gold operation of 290,000oz/year per year over 11.2-year conceptual mine life that generates a C$1.2 billion after-tax NPV5% and 35% after-tax IRR based on a US$1,600/oz gold. Nighthawk’s experienced management team, with a track record of successfully advancing projects and operating mines, is working towards rapidly advancing its assets towards a development decision.

Keyvan Salehi President & CEO

|

Salvatore Curcio CFO |

Allan Candelario VP, Investor Relations & Corporate Development |

Forward-Looking Information

This news release contains "forward-looking information" within the meaning of applicable Canadian securities legislation. Forward-looking information includes, but is not limited to, information with respect to the Company’s Mineral Resource Estimates, PEA and the potential extractability of the OP and UG mineralization, the potential expansion of Mineral Resource Estimates, the potential for the economics of the Project to improve, the potential for the Project to grow, the potential for higher-grade assay results, the potential of the Project to be a ‘top-tier’ gold project in a safe mining jurisdiction, the potential of the Project to be developed, the large-scale and robust nature of the Project PEA, the advancement of the PEA towards a higher-level economic study, the continued exploration and drilling initiatives and having the necessary funding required to complete these initiatives, the prospectivity of exploration targets, the potential economic viability of the assets, and the advancement of projects towards a development decision. Generally, forward-looking information can be identified by the use of forward-looking terminology such as “add” or “additional”, “advancing”, “anticipates” or “does not anticipate”, “appears”, “believes”, “can be”, “conceptual”, “confidence”, “continue”, “convert” or “conversion”, “deliver”, “demonstrating”, “estimates”, “encouraging”, “expand” or “expanding” or “expansion”, “expect” or “expectations”, “forecasts”, “forward”, “goal”, “improves”, “increase”, “intends”, “justification”, “plans”, “potential” or “potentially”, “promise”, “prospective”, “prioritize”, “reflects”, “scheduled”, “suggesting”, “support”, “updating”, “upside”, “will be” or “will consider”, “work towards”, or variations of such words and phrases or state that certain actions, events or results “may”, “could”, “would”, “might”, or “will be taken”, “occur”, or “be achieved”.

Forward-looking information is based on the opinions and estimates of management at the date the information is made, and is based on a number of assumptions and is subject to known and unknown risks, uncertainties and other factors that may cause the actual results, level of activity, performance or achievements of Nighthawk to be materially different from those expressed or implied by such forward-looking information, including risks associated with required regulatory approvals, the exploration, development and mining such as economic factors as they effect exploration, future commodity prices, changes in foreign exchange and interest rates, actual results of current exploration activities, government regulation, political or economic developments, the ongoing wars and their effect on supply chains, environmental risks, COVID-19 and other pandemic risks, permitting timelines, capex, operating or technical difficulties in connection with development activities, employee relations, the speculative nature of gold exploration and development, including the risks of diminishing quantities of grades of reserves, contests over title to properties, and changes in project parameters as plans continue to be refined as well as those risk factors discussed in Nighthawk's annual information form for the year ended December 31, 2022, available on www.sedar.com. Although Nighthawk has attempted to identify important factors that could cause actual results to differ materially from those contained in forward-looking information, there may be other factors that cause results not to be as anticipated, estimated or intended. There can be no assurance that such information will prove to be accurate, as actual results and future events could differ materially from those anticipated in such information. Accordingly, readers should not place undue reliance on forward-looking information. Nighthawk does not undertake to update any forward-looking information, except in accordance with applicable securities laws.

Cautionary Statement regarding Mineral Resource Estimates

Until mineral deposits are actually mined and processed, Mineral Resources must be considered as estimates only. Mineral Resource estimates that are not Mineral Reserves and have not demonstrated economic viability. The estimation of Mineral Resources is inherently uncertain, involves subjective judgement about many relevant factors and may be materially affected by, among other things, environmental, permitting, legal, title, taxation, socio-political, marketing, or other relevant risks, uncertainties, contingencies and other factors described in the Company’s public disclosure available on SEDAR at www.sedar.com. The quantity and grade of reported “Inferred” Mineral Resource estimates are uncertain in nature and there has been insufficient exploration to define “Inferred” Mineral Resource estimates as an “Indicated” or “Measured” Mineral Resource and it is uncertain if further exploration will result in upgrading “Inferred” Mineral Resource estimates to an “Indicated” or “Measured” Mineral Resource category. The accuracy of any Mineral Resource estimates is a function of the quantity and quality of available data, and of the assumptions made and judgments used in engineering and geological interpretation, which may prove to be unreliable and depend, to a certain extent, upon the analysis of drilling results and statistical inferences that may ultimately prove to be inaccurate. Mineral Resource estimates may have to be re-estimated based on, among other things: (i) fluctuations in mineral prices; (ii) results of drilling, and development; (iii) results of future test mining and other testing; (iv) metallurgical testing and other studies; (v) results of geological and structural modeling including block model design; (vi) proposed mining operations, including dilution; (vii) the evaluation of future mine plans subsequent to the date of any estimates; and (viii) the possible failure to receive required permits, licenses and other approvals. It cannot be assumed that all or any part of a “Inferred” or “Indicated” Mineral Resource estimate will ever be upgraded to a higher category. The Mineral Resource estimates disclosed in this news release were reported using Canadian Institute of Mining, Metallurgy and Petroleum Definition Standards for Mineral Resources and Mineral Reserves (the “CIM Standards”) in accordance with National Instrument 43-101 Standards of Disclosure for Mineral Projects of the Canadian Securities Administrators (“NI 43-101”).

Cautionary Statement regarding the PEA

The reader is advised that the PEA summarized in this press release is only a conceptual study of the potential viability of the Project's mineral resource estimates, and the economic and technical viability of the Project and its estimated mineral resources has not been demonstrated. The PEA is preliminary in nature and provides only an initial, high-level review of the Project's potential and design options; there is no certainty that the PEA will be realized. The PEA conceptual LOM plan and economic model include numerous assumptions and mineral resource estimates including Inferred mineral resource estimates. Inferred mineral resource estimates are considered to be too speculative geologically to have any economic considerations applied to such estimates. There is no guarantee that Inferred mineral resource estimates will be converted to Indicated or Measured mineral resources, or that Indicated or Measured resources can be converted to mineral reserves. Mineral resources that are not mineral reserves do not have demonstrated economic viability, and as such there is no guarantee the Project economics described herein will be achieved. Mineral resource estimates may be materially affected by environmental, permitting, legal, title, taxation, socio-political, marketing, or other relevant risks, uncertainties and other factors, as more particularly described in the Cautionary Statements at the end of this news release.

Cautionary Statement to U.S. Readers

This news release uses the terms “Mineral Resource”, “Indicated Mineral Resource” and “Inferred Mineral Resource” as defined in the CIM Standards in accordance with NI 43-101. While these terms are recognized and required by the Canadian Securities Administrators in accordance with Canadian securities laws, they may not be recognized by the United States Securities and Exchange Commission.

The Mineral Resource estimates and related information in this news release may not be comparable to similar information made public by U.S. companies subject to the reporting and disclosure requirements under the United States federal securities laws and the rules and regulations thereunder.

__________________________________

1 Please review the “Cautionary Statement regarding the PEA” at the end of the news release

2 AISC and All-In Costs (“AIC”) are not standardized financial measures under the financial reporting framework utilized by the Company. AlSC includes cash costs plus sustaining capex, closure cost and salvage value. AIC includes AISC plus initial capex. The Company does not currently have operations, and therefore does not have historical equivalent measures to compare to and cannot perform a Reconciliation of this Non-GAAP Financial Performance Measure.

3 Long-term analyst consensus data as of April 3, 2023. Source: Bloomberg

4 Undiscounted

5 Please refer to the Nighthawk April 19, 2017 news release, which is available in the Company’s profile in www.sedar.com.

6 Includes mine development, operating fleet lease downpayment, and maintenance shop. The mining equipment lease assumes a 15% downpayment and 7% lease interest rates.

7 Includes EPCM, first fills/spares, general owner’s costs.

8 Blended rate: 10% contingency applied to civil works and 20% applied to the remaining capex (except NSR buy back)

9 For more information on the 2023 MRE, please refer to the NI 43-101 technical report titled “NI 43-101 Technical Report and Update of the Mineral Resource Estimate for the Indin Lake Gold Property, Northwest Territories, Canada” dated March 15, 2023 (“Technical Report”) which is available on SEDAR (www.sedar.com) or the Company’s website (www.nighthawkgold.com)

View source version on businesswire.com: https://www.businesswire.com/news/home/20230425006224/en/