Noram Announces New Resource Estimate for Zeus Lithium Deposit

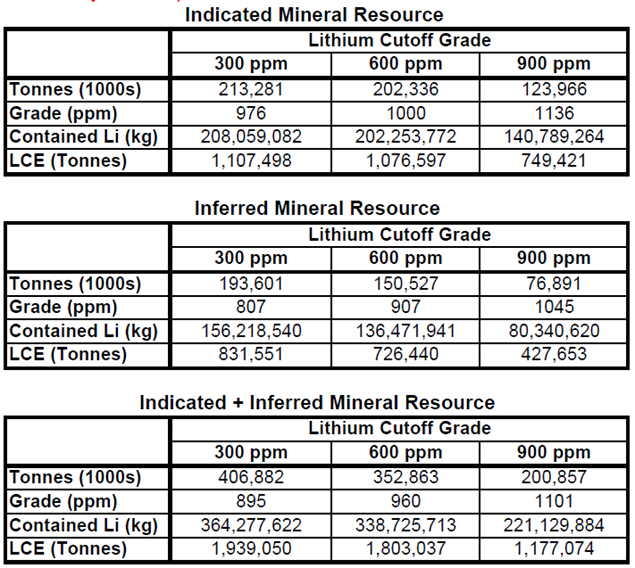

VANCOUVER, BC / ACCESSWIRE / February 5, 2020 / Noram Ventures Inc. ("Noram") (TSXV:NRM)(Frankfurt:N7R)(OTCPINK:NRVTF) is pleased to announce a new resource estimate, following the Phase IV drill program on the Zeus lithium claystone property. At a 900 ppm lithium cut-off, the Zeus deposit has 124 million tonnes at 1136 ppm lithium as indicated resources, and 77 million tonnes lithium at 1045 ppm lithium as inferred resources, for a total of 201 million tonnes at 1101 ppm lithium (1.18 million tonnes lithium carbonate equivalent - "LCE"). This represents an increase in tonnage of 38 percent from the previous resource estimate at a 900 ppm lithium cut-off.

A breakdown of grade and tonnage by resource category and by cut-off values is given in Table 1, and drill results are given in Table 2. The resource has increased substantially from the previous resource at all cut-off values. The Phase IV drill program was designed to test the Esmeralda Formation claystone beneath earlier drill holes that previously extended only to ~30 meters depth. This drill program was highly successful in expanding the resources and providing data to guide further drilling in 2020.

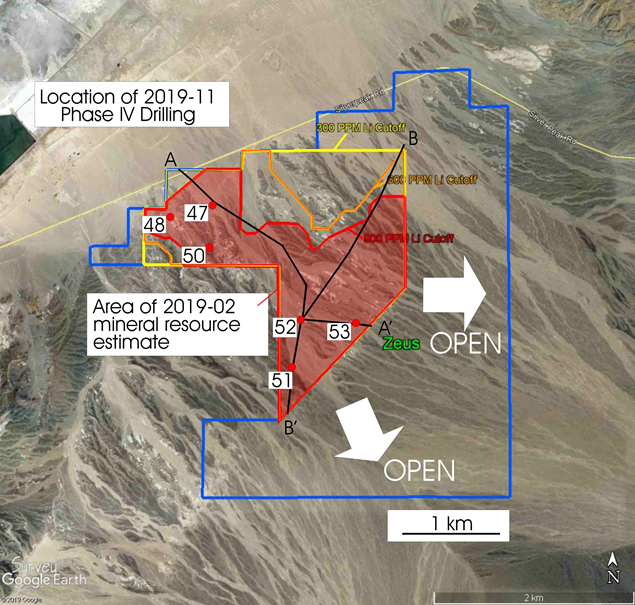

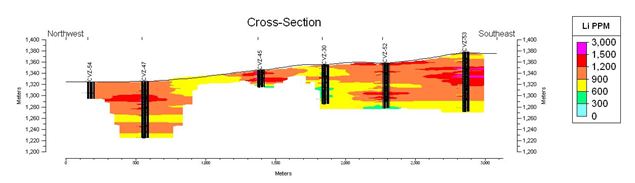

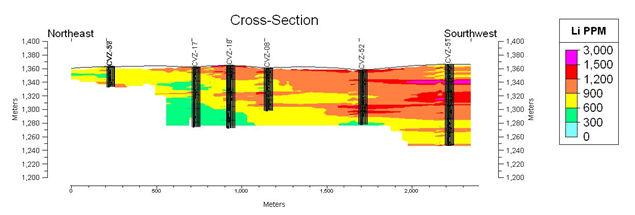

The Zeus lithium deposit is shown in plan view with a Google Maps image as the base in Figure 1. Proximity to Albemarle's Silver Peak lithium brine operation, which is currently North America's only lithium producer, is seen in this image. Representative cross sections with lithium grade through the recent drill holes and through the deposit are given in Figures 2 and 3. The deposit is thicker and has higher grades to the south and east, and is open in this direction. There is a probable fault on the southeast side that currently bounds these resources; however there is evidence from earlier drilling that the lithium rich claystones continue on the other side of this fault. To the south, similar faults that cut the Esmeralda Formation lithium claystones have displacements of meters only.

C. Tucker Barrie, President and CEO of Noram Ventures Inc., notes that "this new resource of 1.18 million tonnes LCE is notable for several reasons."

1) "The current price for lithium carbonate (99.5% pure) is $US 8.75/kg, and most long term lithium price estimates are significantly higher, given the rapid expansion of the electric vehicle industry. This is a very large and potentially very valuable ($US 10.3 billion in-situ) resource.

2) Our neighbor Cypress Development Corp. has a similar lithium claystone deposit. In their 2018 Preliminary Economic Assessment report, Cypress outlined a potentially viable and very profitable operation, with all-in operating costs at less than $US 4/kg LCE. We believe our deposit is equally viable, and we aim to improve on these economics.

3) Lithium Americas Corp. and Ioneer Ltd. have advanced projects, and both demonstrated the viability of lithium extraction from claystone deposits, so the technology is proven.

4) Presently, the United States government is proactive in promoting and developing critical metals within the USA, including lithium. This means that there is strong support for developing projects like Zeus which is on Bureau of Land Management ground in Nevada, one of the most favorable jurisdictions for mining globally."

"We are quite pleased with the success of this drill program and we look forward to de-risking the project with initial engineering studies on lithium upgrading and extraction in 2020."

Table 1. Zeus lithium deposit resource estimate, 2020-02

Figure 1. Zeus lithium deposit, Clayton Valley, Nevada , with 300 ppm (yellow), 600 ppm (orange) and 900 ppm (red) cut-off boundaries in plan view. Albemarle's Silver Peak lithium brine ponds are seen to the northwest. The Phase 4 drill hole collars are located in red. Drill collars for earlier programs are omitted for clarity. Cross-sections A-A' from northwest to southeast, and B-B' from northeast to southwest are given in figures 2 and 3, respectively. The lithium claystone deposit is present at the surface or under a thin alluvium veneer, and has a strip ratio of 0.1:1. The deposit is open to the south and east on the property where there is >2 km2 of area for future drill testing.

Figure 2. Cross section from northwest to southeast showing lithium grade. The section has a 4x vertical exaggeration for clarity. The higher grade intervals of over 1200 ppm lithium in red and pink are relatively pure claystone, and the lower grade material in green is commonly claystone with silt or sand. Infill drilling and step-out drilling to the southeast are required to completely delineate the deposit.

Figure 3. Cross section from northeast to southwest showing lithium grade. The section has a 4x vertical exaggeration. Note that the deposit thickens and has higher grades to the southwest. Further drilling is required in this direction.

Table 2* | ||||||

Phase IV Drilling Results | ||||||

Deepened Portions of Holes (New Drilling) | ||||||

Minimum | Maximum | Weighted | ||||

From | To | Interval | Li | Li | Average Li | |

Core Hole | (m) | (m) | (m) | (ppm) | (ppm) | (ppm) |

CVZ-47-RD | 29.6 | 101.2 | 71.6 | 570 | 1750 | 1004 |

CVZ-48-RD | 29.6 | 49.4 | 19.8 | 192 | 1260 | 528 |

CVZ-50-RD | 29.6 | 64.6 | 35.0 | 215 | 1080 | 513 |

CVZ-51-RD | 22.9 | 119.5 | 96.6 | 550 | 2730 | 1074 |

CVZ-52-RD | 29.0 | 79.9 | 50.9 | 490 | 1720 | 968 |

CVZ-53-RD | 29.6 | 107.3 | 77.7 | 438 | 2040 | 1070 |

Entire Holes | ||||||

Minimum | Maximum | Weighted | ||||

From | To | Interval | Li | Li | Average Li | |

Core Hole | (m) | (m) | (m) | (ppm) | (ppm) | (ppm) |

CVZ-47 | 4.6 | 101.2 | 96.6 | 570 | 1750 | 1020 |

CVZ-48 | 0.0 | 49.4 | 49.4 | 192 | 1510 | 791 |

CVZ-50 | 3.0 | 64.6 | 61.6 | 215 | 1270 | 713 |

CVZ-51 | 0.6 | 119.5 | 118.9 | 550 | 2730 | 1039 |

CVZ-52 | 0.0 | 79.9 | 79.9 | 490 | 1720 | 996 |

CVZ-53 | 2.9 | 107.3 | 104.4 | 438 | 2260 | 1072 |

The technical information contained in this news release has been reviewed and approved by Bradley C. Peek, MSc and Certified Professional Geologist who is a Qualified Person with respect to Noram's Clayton Valley Lithium Project as defined under National Instrument 43-101.

About Noram Ventures Inc.

Noram Ventures Inc. (TSX - Venture: NRM / Frankfurt: N7R / OTCPINK: NRVTF) is a Canadian based junior exploration company, with a goal of developing lithium deposits and becoming a low - cost supplier. The Company's primary business focus since formation has been the exploration of mineral projects. Noram's long term strategy is to build a multi-national lithium minerals company to produce and sell lithium into the markets of Europe, North America and Asia.

Please visit our web site for further information: www.noramventures.com

ON BEHALF OF THE BOARD OF DIRECTORS

/s/ "C. Tucker Barrie, Ph.D., P. Geo."

President and CEO

Office: (604) 553-2279

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release. This news release may contain forward-looking information which is not comprised of historical facts. Forward-looking information involves risks, uncertainties and other factors that could cause actual events, results, performance, prospects and opportunities to differ materially from those expressed or implied by such forward-looking information. Forward-looking information in this news release includes statements regarding, among other things, the completion transactions completed in the Agreement. Factors that could cause actual results to differ materially from such forward-looking information include, but are not limited to, regulatory approval processes. Although Noram believes that the assumptions used in preparing the forward-looking information in this news release are reasonable, including that all necessary regulatory approvals will be obtained in a timely manner, undue reliance should not be placed on such information, which only applies as of the date of this news release, and no assurance can be given that such events will occur in the disclosed time frames or at all. Noram disclaims any intention or obligation to update or revise any forward-looking information, whether as a result of new information, future events or otherwise, other than as required by applicable securities laws.

SOURCE: Noram Ventures Inc.

View source version on accesswire.com:

https://www.accesswire.com/575110/Noram-Announces-New-Resource-Estimate-for-Zeus-Lithium-Deposit