Noram Lithium Announces a Further Metallurgical Test Work Program for the Zeus Lithium Project

VANCOUVER, BC / ACCESSWIRE / February 14, 2023 / Noram Lithium Corp. ("Noram" or the "Company") (TSXV:NRM)(OTCQB:NRVTF)(Frankfurt:N7R) announces it has initiated a further round of metallurgical testing on mineralized samples from its 100% owned Zeus Lithium Project ("Zeus" or the "Project") in Clayton Valley, Nevada.

Following the completion of the Phase VI drill program in May 2022, samples were collected from the Zeus drill core and shipped to Bureau Veritas Laboratories in Richmond, BC. During the period of July 2022 through September 2022, a number of tests were conducted on Zeus samples including: sulphuric acid leaching, hydrochloric acid leaching, roasting, neutralization, impurity removal and solid-liquid separation tests. Based on the test work completed and experience in other industries, the Company has refined the process design for lithium carbonate recovery that is based on known and commercially proven technology.

The Company has engaged Kemetco Research Inc ("Kemetco"), a private sector integrated science, technology and innovation company based in Richmond, BC to carry out further metallurgical test work to confirm and refine the process design. Kemetco have extensive experience in bench scale and pilot scale laboratory studies in lithium extraction.

"The proposed process for the Zeus Lithium Project is based on known technology and we are expecting the results from this round of test work will confirm our ability to recover high-purity lithium carbonate from Zeus mineralized material," stated Greg McCunn, Noram's CEO. "The team at Kemetco, in conjunction with our metallurgical consultant, have designed a robust test work program to further de-risk the project. The results will be combined with the mine plan optimization currently underway to support the completion of a Prefeasibility Study."

Proposed Process Description

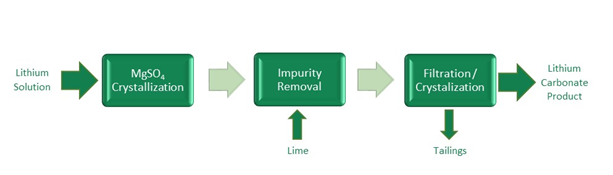

The proposed process consists of three main steps (Figure 1), as follows:

1. Feed Preparation/Beneficiation:

- Mineralized material from the mine is passed through a roll crusher;

- Water is added in an agitated attrition scrubber to produce a slurry, and

- Coarse particles containing calcite are rejected through hyrdocyloning to reduce the acid consumption in the subsequent leaching stage.

2. Leaching, Neutralization and Filtration:

- Lithium bearing clays from feed preparation are leached with sulphuric acid in agitated tanks at 90°C;

- Iron and aluminum impurities are removed from the lithium bearing solution using limestone under controlled conditions, and

- Iron and aluminum precipitates are filtered for dry-stacking in a tailings storage facility, minimizing water losses from the process and environmental impact.

3. Lithium solution is further purified using known technology from lithium hard rock processing facilities to produce battery quality lithium carbonate for packaging and sale.

Test work is currently underway, initially testing the Feed Preparation/Beneficiation and Leaching, Neutralization and Filtration processes in the proposed flowsheet. It is expected that some testing will also be done on lithium solutions to produce battery quality lithium carbonate. Results of the test work will be used to validate the Company's metallurgical models and mass/energy balances for the Project.

Figure 1 Simplified Process Flow Sheet

1. Feed Preparation / Beneficiation

2. Leaching / Neutralization / Filtration

3. Purification

This important phase of metallurgical test work is expected to take 5-6 months to complete. Results from the test work will be made available as the work progresses in the coming months.

About Noram Lithium Corp.

Noram Lithium Corp. (TSXV:NRM)(OTCQB:NRVTF)(Frankfurt:N7R) is focusing on advancing its 100%-owned Zeus Lithium Project located in Clayton Valley, Nevada an emerging lithium hub within the United States. With the upsurge in the electric vehicle and energy storage markets the Company aims to become a key participant in the domestic supply of lithium in the United States. The Company is committed to creating shareholder value through the strategic allocation of capital and is well-funded with approximately CAD$14 million in cash on December 31, 2022 and no debt.

About the Zeus Project (100% Noram)

The Zeus Lithium Project contains a Measured and Indicated Resource estimate of 5.2 Mt Lithium Carbonate Equivalent ("LCE", 1034 Mt at 941 ppm lithium), and an additional Inferred resource estimate of 1.1 Mt LCE (235 Mt at 871 ppm lithium) utilizing a 400 ppm Li cut-off1.

In December 2021, a robust PEA2 indicated the Project could produce an annual average of 31,900 tonnes of Lithium Carbonate for supply to battery manufacturers with an modelled mine life of 40 years (resources support a +100 year mine life). The PEA outlined a US$528 million capital cost to construct the Project with a robust after-tax NPV(8%) of US$1.3 billion and an IRR of 31% using US$9,500/tonne LCE pricing. The PEA indicates an after-tax NPV(8%) of US$2.7 billion and an IRR of 52% at US$14,250/tonne LCE pricing. Note that the current daily prices have increased to over US$70,000/tonne LCE.

Please visit our web site for further information: www.noramlithiumcorp.com.

ON BEHALF OF THE BOARD OF DIRECTORS

Sandy MacDougall

Founder and Executive Chairman

C: 778.999.2159

For additional information please contact:

Greg McCunn

Chief Executive Officer

greg@noramlithiumcorp.com

C: 778.991.3798

Footnote

1 Refer to the News Release dated January 30, 2023 titled ‘Noram Lithium Announces Significant Increase in Mineral Resources at the Zeus Lithium Deposit'.

2 Preliminary Economic Assessment Zeus Project, ABH Engineering (December 2021).

Cautionary Statement Regarding Forward Looking Information

This news release may contain forward-looking information which is not comprised of historical facts. Forward-looking information involves risks, uncertainties and other factors that could cause actual events, results, performance, prospects and opportunities to differ materially from those expressed or implied by such forward-looking information. Forward-looking information in this news release includes statements regarding, among other things, the results from this round of test work will confirm the Company's ability to recover high-purity lithium carbonate from Zeus mineralized material. Factors that could cause actual results to differ materially from such forward-looking information include, but are not limited to, regulatory approval processes. Although Noram believes that the assumptions used in preparing the forward-looking information in this news release are reasonable, including that all necessary regulatory approvals will be obtained in a timely manner, undue reliance should not be placed on such information, which only applies as of the date of this news release, and no assurance can be given that such events will occur in the disclosed time frames or at all. Noram disclaims any intention or obligation to update or revise any forward-looking information, whether as a result of new information, future events or otherwise, other than as required by applicable securities laws.

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

SOURCE: Noram Lithium Corp.

View source version on accesswire.com:

https://www.accesswire.com/739206/Noram-Lithium-Announces-a-Further-Metallurgical-Test-Work-Program-for-the-Zeus-Lithium-Project