Orla Mining Reports Third Quarter 2021 Results and Provides Camino Rojo Construction Update

Camino Rojo construction 96% complete

VANCOUVER, BC, Nov. 15, 2021 /CNW/ - Orla Mining Ltd. (TSX: OLA) (NYSE: ORLA) ("Orla" or the "Company") today announces the results for the third quarter ended September 30, 2021.

(All amounts are in U.S. dollars unless otherwise stated)

THIRD QUARTER 2021 HIGHLIGHTS:

- Camino Rojo Oxide Project construction is progressing on schedule and was 89% complete at September 30, 2021, and 96% complete at October 31, 2021.

- Construction remains on budget. Camino Rojo capital expenditures totalled $24.3 million in the third quarter and totalled $106.3 million at September 30, 2021, out of a total project capital expenditure estimate of $134.1 million. As of October 31, 2021, capital expenditures totalled $110.9 million. Capital expenditures to date have been in line with estimates as a result of the Company's early procurement efforts.

- Construction remains on schedule. The main activities completed during the quarter included ramp up of mining activities, mechanical completion of the crushing system, conveying system, reclaim tunnel, overland conveyor, and grasshopper conveyors, commencement of wet commissioning with introduction of ore into the crushing circuit, and completion of the camp facilities.

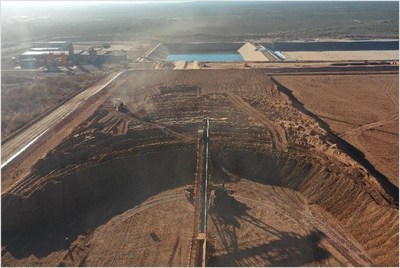

- Overliner ore material was placed on the heap leach pad and ore stacking began in early October in preparation for cyanide leaching which is expected to begin in mid-November.

- As of October 31, 2021, there were 529 workers at the Camino Rojo Project as part of construction activities. The number of construction workers on site has been steadily decreasing in the second half of 2021 as many areas complete construction activities. Once Camino Rojo reaches commercial production, Orla expects to have approximately 300 workers at Camino Rojo, with most being Mexican nationals.

- During the third quarter, Orla finalized the negotiation of the Collective Bargaining Agreement ("CBA") with the Miners' Union (Sindicato Minero). In October, Orla's employees at Camino Rojo ratified the CBA with 99% employee approval. The ratification of the CBA solidifies Orla's relationships with the Company's employees and the elected union while standardizing a set of fair and competitive benefits for all employees.

- During the third quarter, the Cerro Quema Pre-Feasibility Study ("PFS") Technical Report was completed.

- Exploration and evaluation expenditures totalled $3.6 million for the quarter and included activities across the Company's portfolio in Mexico and Panama with a focus on Camino Rojo target generation and project study advancement.

- Net loss of $9.6 million or $0.04 per share for the quarter.

- Cash balance of $50.7 million at September 30, 2021 and $41.6 million at October 31, 2021.

- During the quarter, the Company closed a $35 million non-brokered prospectus financing.

- To date, Camino Rojo's safety and environmental performance has been excellent and there have been no delays in construction due to COVID-19. As of October 31, 2021, 69% of all employees and contractors at Camino Rojo are fully vaccinated against COVID-19 and 94% are partially vaccinated.

"We are now counting down the weeks until first gold pour at Camino Rojo," said Jason Simpson, President and Chief Executive Officer of Orla. "Execution and delivery underpin our Company's strategy for value creation, and our transition into a gold producer will be another value-adding milestone."

CAMINO ROJO OXIDE CONSTRUCTION UPDATE

Mining operations commenced during the third quarter, including drilling, blasting, and hauling of ore and waste. Construction of the primary and secondary crushers is complete and the overland conveyors and heap leach stacking system were installed and are being commissioned. Electrical and instrumentation commissioning of the overland and heap leach stacking systems will continue in the fourth quarter. Leach pad and process pond construction continued during the quarter and the pregnant solution pond is now complete. Installation of the heap leach pad liners, piping, and placement of the overliner material on Cell 1 was completed during the quarter and Cell 2 is expected to be completed during the fourth quarter of 2021. The Merrill-Crowe plant and refinery was 98% complete at September 30 and is currently being commissioned. Leaching activities are expected to begin in mid-November 2021 with first gold production expected by late 2021.

Mining and Processing Totals - Year to Date | 31-Oct-21 | |

Ore Mined | tonnes | 1,123,779 |

Waste Mined | tonnes | 1,100,721 |

Total Mined | tonnes | 2,224,500 |

Ore Mined Au Grade | g/t | 0.75 |

ROM Ore Stockpile | tonnes | 221,741 |

Total Crushed Ore Stockpile | tonnes | 526,450 |

Total Crushed Ore Stockpile Au Grade | g/t | 0.87 |

Ore Stacked | tonnes | 375,588 |

Stacked Ore Au Grade | g/t | 0.74 |

Construction of the power line to the Camino Rojo Project commenced in January and connection to the substation was completed on October 26, 2021. Installation of the office buildings was completed, and the construction and operation teams have moved in. Construction of the permanent camp dormitory buildings, kitchen and dining hall and laundry facilities was also completed. Construction of the road to El Berrendo was completed and opened during the quarter.

Several images highlighting construction progress at the Camino Rojo Project are shown below and additional photographs are available at Camino Rojo Progress Photos.

CAMINO ROJO SULPHIDE PROJECT

The Company continues to evaluate multiple development scenarios on the Camino Rojo Sulphide Project. The development scenarios being considered to potentially form the basis of a Preliminary Economic Assessment ("PEA") currently include: (1) an underground mining option, (2) an open pit mining option with processing at a to-be-constructed sulphide facility at Camino Rojo, and (3) an open pit mining option with processing at Newmont Corporation's Peñasquito plant. Based on the additional drilling and testwork to date, all development options remain possible.

Drill results on a 6,079-metre, 14-hole program on the sulphide deposit were released during the third quarter. The drilling was intended to test the continuity of higher-grade mineralization within the sulphide mineral resource at a different orientation than most historical drilling. The positive drill results in the sulphide deposit confirmed the presence of intercepts with higher-than-average widths and grades. The recent data is helping refine the geological model and guide mining scenario evaluation as part of a PEA. The positive drill results also demonstrate the need for further drilling at the more optimal drill orientation to capture a greater understanding of the higher grades zones within the large, mineralized envelope. To further the evaluation of the Camino Rojo Sulphide Project, Orla is considering additional drilling in 2022 to provide confirmation of grade and geometry of the higher-grade zones. The phase two drill program would be scheduled to commence upon ramp-up of the Camino Rojo Oxide operations. Full drill results are available on Orla's website: Sulphide Drill Results.

The phase one drill program also provided material for metallurgical testwork and the Company is assessing multiple processing options. Geometallurgical modelling is in progress to define the distribution and types of mineralization within the sulphide deposit. The new geological model and metallurgical results will be considered in the development of a PEA.

"We are encouraged by the positive results at the Camino Rojo Sulphides," said Jason Simpson, President and Chief Executive Officer of Orla. "Our increasing knowledge of the sulphide mineral resource will guide us towards the development pathway that we believe will generate the most value for shareholders."

CERRO QUEMA OXIDE PROJECT UPDATE

The Company announced the results of the PFS for the Cerro Quema Oxide Project in Panama in July 2021. The 2021 PFS highlights a low cost, high return heap leach project with a six-year mine life. The estimated Cerro Quema Oxide Project after-tax net present value ("NPV") at a 5% discount rate is $176 million with an after-tax internal rate of return ("IRR") of 38% at a gold price of $1,600 per ounce and a silver price of $20 per ounce.

An independent technical report for the Pre-Feasibility Study on the Cerro Quema Oxide Project, prepared in accordance with the requirements of National Instrument ("NI") 43-101, was filed under Orla's profiles on SEDAR, EDGAR, and also on the Company's website on September 7, 2021.

Pre-Feasibility Study Highlights:

Units | Values | |

Throughput Rate per Day | tonnes | 10,000 |

Total Ore to Leach Pad | M tonnes | 21.7 |

Gold Grade (Average) | g/t | 0.80 |

Silver Grade (Average) | g/t | 2.2 |

Contained Gold | ounces | 562,000 |

Contained Silver | ounces | 1,526,000 |

Average Gold Recovery | % | 87% |

Average Silver Recovery | % | 26% |

Recovered Gold | ounces | 489,000 |

Recovered Silver | ounces | 399,000 |

Mine Life | years | 6.0 |

Average Annual Gold Production | ounces | 81,000 |

Strip Ratio | waste : ore | 0.66 |

Initial Capex | US$ million | $164 |

Avg. Life of Mine Operating costs | $/t ore processed | $10.34 |

Total Cash Cost (net of by-product credits)1 | $/oz Au | $511 |

All-In Sustaining Cost ("AISC")1 | $/oz Au | $626 |

Pre-Tax NPV (5% discount rate) | US$ million | $233 |

Pre-Tax IRR | % | 48% |

After-Tax NPV (5% discount rate) | US$ million | $176 |

After-Tax IRR | % | 38% |

Payback | years | 1.7 |

1 | Total cash cost and AISC are non-GAAP measures and are net of silver credits and includes royalties payable. See the "Non-GAAP Measures" section of this news release for additional information. |

* | All dollar amounts in US dollars |

Please see the Company's July 28, 2021 press release for more detail: "Orla Mining Delivers Robust Pre-Feasibility Study at the Cerro Quema Oxide Gold Project with 38% Rate of Return".

The permitting process in Panama has been ongoing and as of May 2021, the extension of the exploitation contracts was signed by both the Ministry of Commerce and Industry and by Orla. The documents are now with the Comptroller General for final review and approval.

In February 2021, the Ministry of Environment conducted its final site inspection of the project. As a result of the positive site inspection review, the Category 3 Environmental and Social Impact Assessment is in the final stage of approval.

UPCOMING MILESTONES

- Maintain robust health and safety protocols, including COVID-19 prevention measures, to support the health of employees and local communities.

- Release Caballito (Panama) initial copper-gold resource estimate.

- Complete construction and ramp up activities at the Camino Rojo Oxide Gold Project towards a targeted first pour in the fourth quarter of 2021.

- Further the PEA study on the Camino Rojo Sulphide Project.

- Continue to advance the Cerro Quema Oxide Project engineering once the environmental permit and concession renewals are received which would provide the basis for a construction decision.

- Continue exploration programs with activities focused on supporting study work and new target identification for drilling programs in 2022.

COVID-19 RISK MANAGEMENT

The Company maintains robust organization-wide COVID-19 protocols to support the health of employees and local communities. Orla is closely monitoring the potential impacts from the pandemic on areas including on-site construction, equipment delivery and logistics, construction costs and schedule, as well as community and government relations.

CONSOLIDATED FINANCIAL STATEMENTS

Orla's unaudited interim consolidated financial statements and management's discussion and analysis for the three and nine months ended September 30, 2021, are available on the Company's website at www.orlamining.com, and under the Company's profiles on SEDAR and EDGAR.

Qualified Persons Statement

The scientific and technical information related to Camino Rojo and Cerro Quema in this news release was reviewed and approved by Mr. J. Andrew Cormier, P. Eng., Chief Operating Officer of the Company, and Mr. Sylvain Guerard, P. Geo., Senior Vice President, Exploration of the Company, who are the Qualified Persons as defined under NI 43-101 standards.

THIRD QUARTER 2021 CONFERENCE CALL

Orla will host a conference call on November 15, 2021, at 10:00 AM, Eastern Time, to provide a corporate update:

Dial-In Numbers: | |

Conference ID: | 7591045 |

Toll Free: | (833) 499-1157 |

International: | (236) 712-2875 |

Webcast: | https://event.on24.com/wcc/r/3409186/080E351BF7079A7B45EB3BA688FCC837 |

About Orla Mining Ltd.

Orla is developing the Camino Rojo Oxide Gold Project, an advanced gold and silver open-pit and heap leach project, located in Zacatecas State, Central Mexico. The project is 100% owned by Orla and covers over 160,000 hectares. The technical report for the 2021 Feasibility Study on the Camino Rojo Oxide Gold Project entitled "Unconstrained Feasibility Study NI 43-101 Technical Report on the Camino Rojo Gold Project – Municipality of Mazapil, Zacatecas, Mexico" dated January 11, 2021, is available on SEDAR and EDGAR under the Company's profile at www.sedar.com and www.sec.gov, respectively. The technical report is also available on Orla's website at www.orlamining.com. Orla also owns 100% of the Cerro Quema Project located in Panama which includes a near-term gold production scenario and various exploration targets. The Cerro Quema Project is a proposed open pit mine and gold heap leach operation. The technical report for the 2021 Pre-Feasibility Study on the Cerro Quema Oxide Gold Project entitled "Project Pre-Feasibility NI 43-101 Technical Report on the Cerro Quema Gold Oxide Project, Province of Los Santos, Panama" dated July 27, 2021, is available on SEDAR and EDGAR under the Company's profile at www.sedar.com and www.sec.gov, respectively. The technical report is also available on Orla's website at www.orlamining.com.

Non-GAAP Measures

We have included certain performance measures ("non-GAAP measures") in this press release which are not specified, defined, or determined under generally accepted accounting principles (in our case, International Financial Reporting Standards, or "IFRS"). These are common performance measures in the gold mining industry, but because they do not have any mandated standardized definitions, they may not be comparable to similar measures presented by other issuers. Accordingly, we use such measures to provide additional information and you should not consider them in isolation or as a substitute for measures of performance prepared in accordance with generally accepted accounting principles ("GAAP").

ALL-IN SUSTAINING COSTS ("AISC")

We have provided an AISC performance measure that reflects all the expenditures that are required to produce an ounce of gold from operations. While there is no standardized meaning of the measure across the industry, our definition conforms to the all-in sustaining cost definition as set out by the World Gold Council in its guidance dated June 27, 2013.

We believe that the inclusion of projected AISC has evolved into a common market practice in the mining industry for a feasibility-level study, and that some investors have come to expect this type of disclosure from issuers at the development stage. We acknowledge that this is a performance measure that relates to production, and our mines are not yet in production, but we disclose this measure as an estimate or projection in a similar manner as the general feasibility study results relating to production figures. We have provided AISC to identify it as non-GAAP and to disclose that it lacks a standardized meaning. Upon commencing production and reporting actual AISC, we will provide a reconciliation to IFRS figures then presented.

CASH COSTS PER OUNCE

We calculate cash costs per ounce by dividing the sum of operating costs, royalty costs, production taxes, refining and shipping costs, net of by-product silver credits, by payable gold ounces. While there is no standardized meaning of the measure across the industry, we believe that this measure is useful to external users in assessing operating performance.

Forward-looking Statements

This news release contains certain "forward-looking information" and "forward-looking statements" within the meaning of Canadian securities legislation and within the meaning of Section 27A of the United States Securities Act of 1933, as amended, Section 21E of the United States Exchange Act of 1934, as amended, the United States Private Securities Litigation Reform Act of 1995, or in releases made by the United States Securities and Exchange Commission, all as may be amended from time to time, including, without limitation, statements regarding the results of the Company's expected milestones, the Cerro Quema pre-feasibility study and future development and permitting activities, statements with respect to the Company's construction, operation, and exploration of projects, as well as its objectives and strategies, including the timing and results of the PEA on the Camino Rojo Sulphide Project and the resource estimate at Caballito (Panama), the results of the drill program and future exploration work at the Camino Rojo Sulphide Project, the generation of value for shareholders and the timing and construction plans at the Company's Camino Rojo Oxide Project, including estimated total capital expenditures, the timing of the first gold pour and ramp up activities. Forward-looking statements are statements that are not historical facts which address events, results, outcomes or developments that the Company expects to occur. Forward-looking statements are based on the beliefs, estimates and opinions of the Company's management on the date the statements are made and they involve a number of risks and uncertainties. Certain material assumptions regarding such forward-looking statements were made, including without limitation, assumptions regarding the price of gold and silver; the accuracy of mineral resource and mineral reserve estimations; that there will be no material adverse change affecting the Company or its properties; that all required approvals will be obtained, including concession renewals and permitting; that political and legal developments will be consistent with current expectations; that currency and exchange rates will be consistent with current levels; that there will be no significant disruptions affecting the Company or its properties; the Company's ability to operate in a safe, efficient and effective manner; construction and operation of projects; the costs of operating and exploration expenditures; and the impact of the COVD-19 pandemic on the Company's operations. Consequently, there can be no assurances that such statements will prove to be accurate and actual results and future events could differ materially from those anticipated in such statements. Forward-looking statements involve significant known and unknown risks and uncertainties, which could cause actual results to differ materially from those anticipated. These risks include, but are not limited to: risks related to uncertainties inherent in the preparation of feasibility and pre-feasibility studies, including but not limited to, assumptions underlying the production estimates not being realized, changes to the cost assumptions, variations in quantity of mineralized material, grade or recovery rates, changes to geotechnical or hydrogeological considerations, failure of plant, equipment or processes, changes to availability of power or the power rates, ability to maintain social license, changes to interest or tax rates, changes in project parameters, delays and costs inherent to consulting and accommodating rights of local communities, environmental risks, title risks, including concession renewal, commodity price and exchange rate fluctuations, risks relating to COVID-19, delays in or failure to receive access agreements or amended permits, risks inherent in the estimation of mineral reserves and mineral resources; and risks associated with executing the Company's objectives and strategies, including costs and expenses, as well as those risk factors discussed in the Company's most recently filed management's discussion and analysis, as well as its annual information form dated March 29, 2021, available on www.sedar.com and www.sec.gov. Except as required by the securities disclosure laws and regulations applicable to the Company, the Company undertakes no obligation to update these forward-looking statements if management's beliefs, estimates or opinions, or other factors, should change.

Cautionary Note to U.S. Readers

We prepare our financial statements in United States dollars and in accordance with IFRS as issued by the International Accounting Standards Board, which differs from US generally accepted accounting principles ("US GAAP") in certain material respects, and thus are not directly comparable to financial statements prepared in accordance with US GAAP.

The disclosure contained or referenced herein uses mineral reserve and mineral resource classification terms that comply with reporting standards in Canada, and mineral reserve and mineral resource estimates are made in accordance with Canadian NI 43-101 and the Canadian Institute of Mining, Metallurgy and Petroleum — CIM Definition Standards on Mineral Resources and Mineral Reserves, adopted by the CIM Council, as amended (the "CIM Definition Standards"). Canadian NI 43-101 establishes standards for all public disclosure an issuer makes of scientific and technical information concerning mineral projects. These standards differ significantly from the mineral reserve disclosure requirements of the United States Securities Exchange Commission (the "SEC") set forth in Industry Guide 7. Consequently, information regarding mineralization contained or referenced herein is not comparable to similar information that would generally be disclosed by U.S. companies under Industry Guide 7 in accordance with the rules of the SEC which applied to U.S. filings prior to the current SEC Modernization Rules (as defined herein). Further, the SEC has adopted amendments to its disclosure rules to modernize the mineral property disclosure requirements for issuers whose securities are registered with the SEC under the Securities Exchange Act of 1934 ("Exchange Act"). These amendments became effective February 25, 2019 (the "SEC Modernization Rules") and, commencing for registrants with their first fiscal year beginning on or after January 1, 2021, the SEC Modernization Rules replace the historical property disclosure requirements included in SEC Industry Guide 7. As a foreign private issuer that files its annual report on Form 40-F with the SEC pursuant to the multi-jurisdictional disclosure system, the Company is not required to provide disclosure on its mineral properties under the SEC Modernization Rules and will continue to provide disclosure under NI 43-101 and the CIM Definition Standards. The SEC Modernization Rules include the adoption of terms describing mineral reserves and mineral resources that are "substantially similar" to the corresponding terms under the CIM Definition, but there are differences in the definitions under the SEC Modernization Rules and the CIM Definition Standards. Accordingly, there is no assurance any mineral reserves or mineral resources that the Company may report as "proven mineral reserves", "probable mineral reserves", "measured mineral resources", "indicated mineral resources" and "inferred mineral resources" under NI 43-101 would be the same had the Company prepared the mineral reserve or mineral resource estimates under the standards adopted under the SEC Modernization Rules. U.S. investors are also cautioned that while the SEC recognizes "measured mineral resources", "indicated mineral resources" and "inferred mineral resources" under the Modernization Rules, investors should not assume that any part or all of the mineralization in these categories will ever be converted into a higher category of mineral resources or into mineral reserves. Mineralization described using these terms has a greater amount of uncertainty as to its existence and feasibility than mineralization that has been characterized as reserves. Accordingly, investors are cautioned not to assume that any measured mineral resources, indicated mineral resources, or inferred mineral resources that the Company reports are or will be economically or legally mineable. Further, "inferred mineral resources" have a greater amount of uncertainty as to their existence and as to whether they can be mined legally or economically. Therefore, U.S. investors are also cautioned not to assume that all or any part of the "inferred mineral resources" exist. Under Canadian securities laws, estimates of "inferred mineral resources" may not form the basis of feasibility or pre-feasibility studies, except in rare cases. For the above reasons, information contained or referenced herein regarding descriptions of our mineral reserve and mineral resource estimates is not comparable to similar information made public by U.S. companies subject to reporting and disclosure requirements of the SEC under either Industry Guide 7 or SEC Modernization Rules.

SOURCE Orla Mining Ltd.

![]() View original content to download multimedia: http://www.newswire.ca/en/releases/archive/November2021/15/c6007.html

View original content to download multimedia: http://www.newswire.ca/en/releases/archive/November2021/15/c6007.html