Osisko Announces Record Preliminary Q3 2022 Deliveries, Revenues and Cash Margin

MONTREAL, Oct. 11, 2022 (GLOBE NEWSWIRE) -- Osisko Gold Royalties Ltd (the “Corporation” or “Osisko”) (OR: TSX & NYSE) is pleased to provide an update on its third quarter 2022 deliveries, revenues, cash margin and recent asset advancements for its royalty and stream segment.

PRELIMINARY Q3 2022 RESULTS

Osisko earned approximately 23,850 attributable gold equivalent ounces1 (“GEOs”) in the third quarter of 2022, record deliveries for the Corporation since inception in 2014. Osisko recorded preliminary revenues from royalties and streams of C$53.7 million during the third quarter and preliminary cost of sales (excluding depletion) of C$4.4 million, resulting in a record quarterly cash margin2 of approximately C$49.3 million (or 92%).

During the third quarter, Osisko purchased for cancellation a total of 1.3 million common shares for C$16.5 million (average acquisition price per share of C$12.77) under its NCIB program.

Sandeep Singh, President and CEO of Osisko, commented: “We are delighted to have experienced another quarter of record deliveries, revenues and cash margin in Q3. These records were achieved despite the Eagle mine still working towards steady-state production, the gold price averaging US$142 per ounce lower quarter over quarter, and a meaningfully higher gold-silver price ratio used to convert silver deliveries into GEOs. The higher gold-silver price ratio, which has since subsided somewhat, decreased GEOs earned by approximately 850 ounces in the third quarter versus expectations. We believe our assets have the ability to end the year on a continued upswing and meet the low end of our guidance, with further increases from core assets expected in 2023.

“Further, we are pleased to welcome Mr. Rob Krcmarov to our Board of Directors. This is in keeping with our board renewal process, with six new additions to the board since the start of 2020. Rob adds unparalleled expertise in geology and mining transactions with relationships and asset knowledge around the globe. He will be an invaluable asset to the Corporation.”

Osisko will provide full production and financial details with the release of its third quarter 2022 results after market close on Wednesday, November 9th, 2022 followed by a conference call on Thursday, November 10th at 10am ET. More details are provided at the end of this release.

BOARD OF DIRECTORS APPOINTMENT

Osisko is pleased to announce the appointment of Mr. Rob Krcmarov to its Board of Directors. Mr. Krcmarov is a renowned international mining executive with over 32 years of experience in the natural resources sector. Mr. Krcmarov recently retired as Executive Vice President of Exploration and Growth for Barrick Gold Corporation (“Barrick”). During his tenure at Barrick, he progressed through several senior positions from 1988 to 2021, and built an exceptional skillset in global exploration spanning across five continents and more than 20 countries.

Mr. Krcmarov holds a Bachelor of Science, University of Adelaide (1986), an Honours Degree, University of Adelaide (1987) and a Master of Economic Geology, University of Tasmania (1995). He was co-recipient of the PDAC’s Thayer Lindsley award for International Mineral Discovery of the year in 2014.

PORTFOLIO UPDATE

Canadian Malartic Update

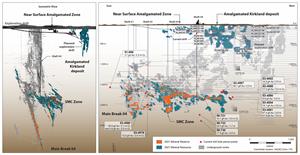

On July 27th, Agnico Eagle Mines Limited (“Agnico Eagle”) reported that underground development and surface construction activities were progressing on schedule, with initial pre-commercial production at Odyssey expected near the end of the first quarter of 2023. On August 11th, Agnico Eagle reported that during the first half of 2022, 685 meters of underground development and 2,622 meters of lateral development had been completed. The ramp has now reached a depth of 380 meters below surface.

The Canadian Malartic Partnership has budgeted $23.8 million for 136,800 meters of exploration and conversion drilling in 2022. Twenty drills are active, with four underground drills completing infill drilling on the Odyssey South deposit, twelve surface drills focused on infilling and expanding the East Gouldie deposit and four drills active in regional exploration. Recent drilling has extended the East Gouldie deposit to the west by approximately 225 meters and to the east at depth by approximately 500 meters to more than 1,700 meters from the current mineral resources outline.

A recent exploration highlight is hole MEX22-231, which returned 1.8 g/t gold over 62.9 meters at 1,580 meters depth in the western extension of the East Gouldie deposit approximately 225 meters west of the current mineral resources outline. This intercept is approximately halfway between the East Gouldie deposit and the Norrie Zone to the west and shows the potential for East Gouldie to connect with other mineral inventories in the Norrie and South Sladen mineralized zones that are not yet classified as mineral resources (Figure 1).

Figure 1: Canadian Malartic Mine – Composite Longitudinal Section

https://www.globenewswire.com/NewsRoom/AttachmentNg/b9824043-57e5-4c69-b47d-2de6c4ae9bd2

During a recent mining conference in Colorado, Yamana Gold Inc.’s Executive Chairman expressed the belief that the Odyssey Mine has the strategic potential to produce 1 million ounces of gold per year with a mine life that is expected to continue into the 2040’s and beyond, establishing it as one of the top precious metals mines globally.

Mantos Blancos Update (100% Silver Stream)

In August, Capstone Copper Corp. (“Capstone”) announced that it had committed to the Copper Mark at its Mantos Blancos mine in Chile. The Copper Mark is an assurance framework to promote responsible production practices and demonstrate the industry’s commitment to the United Nations Sustainable Development Goals.

The Mantos Blancos Concentrator Debottlenecking Project is ramping up to design capacity and expected to achieve targeted throughput rates and recoveries in Q3 2022. A feasibility study analyzing the potential to expand throughput from 7.3M tpa to 10.0M tpa is expected to be completed in Q4 2022.

Victoria Gold Updates (5% NSR Royalty)

On October 4th, Victoria Gold Corp. (“Victoria”) reported lower than expected Q3 production of 50,028 gold ounces as Victoria continues to work towards steady state throughput levels. On September 29th, the 1.5 kilometers overland conveyor that delivers ore from the crushing plant to the heap leach facility experienced a failure which requires replacement of the belt. Victoria anticipates that crushing, conveying and stacking operations will be down between 2 to 3 weeks. If not for the conveyor belt failure, the mine was on track to meet the lower end of its guidance.

On September 7th, Victoria reported drill results expanding the Eagle deposit to the west of the existing pit. Highlights included 72.3 meters of 1.14 g/t gold and 240.3 meters of 0.63 g/t gold. The meaningful intervals of continuous Eagle-style gold mineralization along strike of the Eagle deposit have added over 500 meters of mineralized strike length from the Eagle pit boundary. This year’s drill results are expected to be included in an updated Eagle Gold Mineral Resource in Q1 2023.

On September 15th, Victoria reported a maiden resource on the Raven deposit located 15 kilometers from the Eagle Gold Mine. The Inferred resource includes 20 million tonnes of 1.67 g/t gold for 1.07 million ounces defined within an open pit scenario (Figure 2). Victoria initiated its 2022 Dublin Gulch exploration program in late May and currently has four drills on site with over 20,000 meters of drilling in 76 holes completed. This campaign is heavily focused on Raven where the footprint of mineralized intercepts has been extended approximately 325 meters east of the extents defined by the 2021 drilling.

Figure 2: Idealized Long-Section of Raven Pit and MRE Bounds

https://www.globenewswire.com/NewsRoom/AttachmentNg/4edda7ce-bad1-41a4-85b8-b585c57c3f75

Lamaque (1% NSR Royalty)

On October 3rd, Eldorado Gold Corporation (“Eldorado”) released an exploration update, including results at Lamaque. Resource expansion drilling at Ormaque has totaled over 16 kilometers this year. Drilling has identified both extensions to known mineralized zones and new zones outside the current resources. Notable results include 2.0 meters at 30.6 g/t gold, corresponding to a 50 meter step-out from the current resource, 1.75 meters at 16.8 g/t gold, a 270 meter step out to the west of the current resources and 4.0 meters at 13.2 g/t gold, representing a new mineralized lens approximately 180 meters below the current resource.

The Ormaque exploration drift project was completed on schedule in early July, providing underground platforms for further drilling of the deposit. Resource conversion drilling from the drift commenced in June and is expected to include approximately 28 kilometers of drilling to be completed during the remainder of 2022 and 2023, targeting the upper two-thirds of the Ormaque deposit. Partial results will be incorporated in the company’s 2023 Mineral Reserve and Mineral Resource update.

CSA Transaction Update

On September 6th, Metals Acquisition Corp. (“MAC”) announced that it had received approval from the Australian Foreign Investment Review Board (“FIRB”) of its proposed acquisition of the CSA Copper Mine in New South Wales, Australia. MAC is in the process of completing the necessary regulatory reporting requirements and associated financing arrangements to conclude the acquisition.

Osisko Bermuda Limited (“OBL”), a wholly owned subsidiary of the Corporation, has entered into an agreement with MAC with respect to a silver stream to facilitate MAC’s acquisition of the CSA mine. Closing of the silver stream is subject to, among other things, MAC securing sufficient financing to close the acquisition.

Osisko Development Corp. Updates

Osisko Development Corp. (“ODV”) started an Environmental Assessment Process in the spring of 2019 for the Cariboo Gold Project (“Cariboo”). Cariboo has completed several milestones with regards to permitting and receipt of the EA Certificate is anticipated in the first quarter of 2023. A feasibility study for the project is due for completion by the end of 2022.

Test mining continues at the Trixie mine in Utah, with 703 samples collected this year within the T2 and T4 structures across a combined strike length of 200 meters. Some of the high grade highlights include 2,724 g/t Au and 215 g/t Ag over 1.68 meters including 14,883 g/t Au and 1,153 g/t Ag over 0.30 meter. Exploration in 2022 will target potential on T2, T4 structures and stockwork zones. Phase 2 exploration will continue drilling and drifting east of the Trixie mine along T2 structure over a 1-kilometer strike length and extending down to 300 meters of depth.

ODV is targeting an initial resource on Trixie by the end of 2022. The surface decline is expected to be completed by Q2 2023. All permitting is in place and surface access roads and portal face excavation has been completed. The decline will allow mining of T4 material at higher tonnages and continued development of the lower levels of the Trixie mine.

While ODV expects final permits for full scale operation at San Antonio to be granted in the near-term, small-scale gold production from leaching the surface stockpile continues at the project. On June 30, 2022, ODV announced an initial resource estimate at San Antonio comprising 14.9 million tonnes grading 1.2 g/t gold for 576,000 ounces of gold in the Indicated resource category plus 16.6 million tonnes grading 1.0 g/t gold for 544,000 ounces of gold in the Inferred resource category. San Antonio has the potential to host an open pit heap leach gold project with low strip; ODV drilled 27,000 meters at the project in 2021 and has identified mineralization over a 10 kilometers strike.

Windfall Resource Update (2-3% NSR Royalty)

On August 30th, Osisko Mining Inc. reported an updated mineral resource estimate. Measured and Indicated resources contained 11.1 million tonnes of 11.4 g/t gold for 4.2 million ounces and Inferred resources of 12.3 million tonnes of 8.4 g/t gold for 3.3 million ounces. Measured and Indicated ounces increased by 26% since the previous estimate and the Lynx deposit now contains 65% of the mineral resources. The third bulk sample has been extracted and transported for testing and results are expected in October. A feasibility study on the Windfall project is expected by year end.

AK Deposit (2% NSR Royalty)

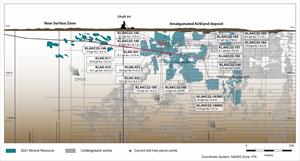

On July 27th, Agnico Eagle reported that an assessment is underway to evaluate the AK deposit as a potential ore source for the Macassa mine. Subject to the study outcome, AK ore could complement the mill feed at Macassa as early as 2024.

The underground ramp at Macassa has been extended by 615 meters year-to-date (of a planned 984 meters exploration drift). Two drills have been active underground with 3,068 meters completed in 24 holes. This drilling was focused on infill drilling of the higher-grade portions of the deposit. Significant intersections returned to date include 14.1 g/t gold over 6.5 meters and 23.9 g/t gold over 2 meters. A surface drill program is also underway at AK, and two drill rigs completed 10,136 meters in the second quarter of 2022. Results to date have confirmed grade thicknesses in the core of the zone. Drill highlights include 9.0 g/t gold over 9.2 meters and 8.7 g/t gold over 7.6 meters. The surface drilling program is expected to total approximately 17,000 meters and was completed in September 2022. Agnico Eagle published sections illustrating the location and potential of the AK Zone (Figure 3 and Figure 4).

Figure 3: Macassa Mine and AK Deposit Composite Longitudinal Section

https://www.globenewswire.com/NewsRoom/AttachmentNg/3134636e-9b8b-4b8e-9af7-ee429bd0c37d

Figure 4: AK Deposit Longitudinal Section

https://www.globenewswire.com/NewsRoom/AttachmentNg/aa2c8262-8d5c-43a9-a29f-1787acbe7e76

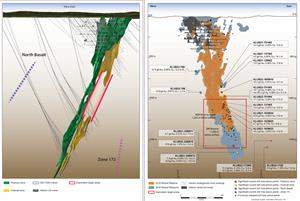

Upper Beaver (2% NSR Royalty)

On August 11th, Agnico Eagle reported that the conversion drilling program at Upper Beaver achieved multiple objectives that will benefit the technical evaluation and mineral reserve and resource update expected in 2023. Among them, the recent drilling filled in gaps in the eastern portion of the Footwall Zone mineralized corridor, located between 800 and 1,000 meters below surface. Highlight intercepts include 16.7 g/t gold over 7 meters and 12.4 g/t gold over 9 meters. An increase in mineral resources is expected from this newly drilled gap area where no information was previously available. In addition, all drill holes targeting the gap areas of the Footwall Zone provided the opportunity to add drilling intercepts in the main Porphyry Zone highlighted by 5.0 g/t gold over 14.1 meters.

With the resource conversion drilling completed, the focus of drilling at Upper Beaver has shifted outside of the mineral resources footprint to identify areas of potential future growth with two areas already delivering promising results. Approximately 500 meters east of the main Upper Beaver deposit, veining and alteration typical of the mineralization observed at Upper Beaver was intersected and assays returned 3.6 g/t gold and 1.1% copper over 1.2 meters. Follow-up drilling returned 11.3 g/t gold and 0.1% copper over 0.7 meter, and further drilling is underway to assess this new discovery.

New mineralization was also intersected 800 meters north-west of the main Upper Beaver deposit, including 11.5 g/t gold over 5.5 meters and 51.5 g/t gold over 5.2 meters. This mineralization is interpreted as the possible faulted and offset extension of the known North Basalt zone. Exploration drilling is ongoing to define the geometry of this new mineralization (Figure 5).

Figure 5: Upper Beaver Composite Longitudinal Section

https://www.globenewswire.com/NewsRoom/AttachmentNg/34148744-0144-4936-b9bf-2a28faa4cc42

Casino (2.75% NSR Royalty)

Western Copper and Gold Corporation (“WRN”) has been active on multiple fronts on the Casino project. A portion of the existing access road is being upgraded with funding of C$130 million from the Federal and Yukon governments. In partnership with Rio Tinto, WRN has completed metallurgical and geotechnical drilling, resource confirmation drilling, soil sampling east and south of the main deposit and 1,600 meters of exploration drilling on new targets. WRN continues to engage with First Nations and community stakeholders to advance Casino towards the submission of an Environmental and Socio-Economic statement in 2023.

Wharekirauponga (WKP) (2% NSR Royalty)

OceanaGold Corporation (“Oceana”) is investing US$10 million in exploration drilling on its highly prospective WKP project and believes the project has the potential to be a Tier 1 asset. WKP currently hosts an Indicated resource of 640koz gold at 13.5 g/t and Inferred resources of 700koz gold at 9.5 g/t. Oceana is aiming to increase the Indicated resource to 1 million ounces of gold to support a prefeasibility study in 2023. Oceana envisions a 6 kilometers decline to the center of the deposit, enabling mineralized material to be transported to their existing Waihi processing plant 10 kilometers away.

Hermosa Budget Expanded (1% NSR Royalty)

In its 2022 Annual Report, South32 Limited (“South32”) highlighted that growth expenditure is expected to increase by US$193 million to US$290 million at the Hermosa project in Arizona. The investment in infrastructure will support critical path dewatering and progress study work for the Taylor Deposit, ahead of a planned final investment decision expected in mid-2023. Following the decision by the United States Government to invoke the Defense Production Act, supporting the production of critical metals including manganese, South32 is looking at options to potentially accelerate the pre-feasibility study for the Clark Deposit.

Patriot Battery Metals (2% NSR Royalty on Lithium)

On August 31st, Patriot Battery Metals (“Patriot”) announced some of the strongest lithium mineralized intervals of its drill campaign to date, at the Corvette property in the James Bay Region of Québec. Results included 1.65% Li2O over 159.7 meters in hole CV22-042, including 4.12% Li2O over 9.0 meters and 3.07% Li2O over 18 meters. As of August 24th, a total of 15,497 meters over 53 holes had been completed from the 2022 drill campaign and 19 holes are pending assays. The deposit remains open to the east, west and to depth.

ADDITIONAL HIGHLIGHTS

1) Calibre Mining reported results from their 50 kilometers drill program at the Pan mine including 3.35 g/t gold over 18 meters at the Black Stallion Target and 0.8 g/t gold over 47 meters at the Pegasus target (4% NSR royalty).

2) Group 6 Metals announced construction is advancing on schedule for first production in Q1 2023 at its Dolphin Tungsten project (1.5% GRR Royalty).

3) O3 Mining Inc. reported results of a PFS on the Marban project highlighting average annual production of 161koz of gold over a ~10 year mine life starting in 2026 (0.435% to 2% NSR royalty).

4) Osisko Metals released results of an updated PEA on Pine Point which outlined average annual production of 329Mlb of zinc and 141Mlb of lead over a 12-year mine life (3% NSR royalty).

5) G Mining Ventures secured financing enabling construction to commence in Q3 2022 at its Tocantinzinho project and announced a formal construction decision (0.75% NSR Royalty).

6) Agnico Eagle announced they will start construction of the Akasaba West open pit mine this year, producing 115,000 ounces of gold and 21,000 tonnes of copper (2% NSR Royalty).

7) Talisker Resources intersected 41.93 g/t gold over 1.25 meters within the Bralorne East Block (1.7% NSR Royalty).

8) Shanta Gold intersected 47 g/t gold over 1.6 meters at Bushiangala and 65.2 g/t gold over 0.7 meter at Isulu (2% NSR Royalty).

9) Westhaven Gold intersected 1.84 g/t gold over 21.9 meters on the FMN Zone at Shovelnose (2% NSR royalty on Shovelnose).

10) Eagle Mountain Mining intersected 1.68% copper, 14.68 g/t silver and 0.37 g/t gold over 24.5 meters at Talon (3% NSR royalty).

11) Argonaut Gold reported 8.33 g/t gold over 11 meters and 7.4 g/t gold over 13 meters at depth on the Magino Project (3% NSR Royalty on eastern claims).

12) Aldebaran Resources announced a drill intersection of 0.33% Cu over 1,059.5 meters on the Altar Project (1% NSR Royalty).

13) NorthWest Copper announced a resource estimation including Indicated resources of 13 million tonnes of 0.55% Cu and Inferred resources of 45 million tonnes of 0.4% Cu at Lorraine, and have initiated a 5,000 meter drill campaign (2% NSR Royalty on certain claims).

14) Cornish Metals intersected 3.7% tin and 9.09% zinc over 2.42 meters at United Downs (0.5% NSR Royalty).

Q3 2022 RESULTS AND CONFERENCE CALL DETAILS

Osisko provides notice of the third quarter 2022 results and conference call details.

| Q3 2022 Results Release: | Wednesday, November 9th, 2022 after market close |

| Conference Call: | Thursday, November 10th, 2022 at 10:00 am ET |

| Dial-in Numbers: | North American Toll-Free: 1 (888) 886 7786 Local and International: 1 (416) 764 8658 Conference ID: 52047754 |

| Replay (available until November 24th at 11:59 pm ET): | North American Toll-Free: 1 (877) 674 7070 Local and International: 1 (416) 764 8692 Playback Passcode: 047754# |

| Replay also available on our website at www.osiskogr.com |

Notes:

The figures presented in this press release, including revenues and costs of sales, have not been audited and are subject to change. As the Corporation has not yet finished its quarter-end procedures, the anticipated financial information presented in this press release is preliminary, subject to quarter-end adjustments, and may change materially.

(1) Gold Equivalent Ounces

GEOs are calculated on a quarterly basis and include royalties, streams and offtakes. Silver earned from royalty and stream agreements are converted to gold equivalent ounces by multiplying the silver ounces earned by the average silver price for the period and dividing by the average gold price for the period. Diamonds, other metals and cash royalties are converted into gold equivalent ounces by dividing the associated revenue earned by the average gold price for the period. Offtake agreements are converted using the financial settlement equivalent divided by the average gold price for the period.

Average Metal Prices and Exchange Rate

| Three months ended September 30, | |||||||

| 2022 | 2021 | ||||||

| Gold(i) | $1,729 | $1,790 | |||||

| Silver(ii) | $19.23 | $24.36 | |||||

| Exchange rate (US$/Can$)(iii) | 1.3056 | 1.2600 | |||||

(i) The London Bullion Market Association’s pm price in U.S. dollars.

(ii) The London Bullion Market Association’s price in U.S. dollars.

(iii) Bank of Canada daily rate.

(2) Non-IFRS Measures

The Corporation has included certain performance measures in this press release that do not have any standardized meaning prescribed by International Financial Reporting Standards (IFRS) including cash margin in dollars and in percentage. The presentation of these non-IFRS measures is intended to provide additional information and should not be considered in isolation or as a substitute for measures of performance prepared in accordance with IFRS. These measures are not necessarily indicative of operating profit or cash flow from operations as determined under IFRS. As Osisko’s operations are primarily focused on precious metals, the Corporation presents cash margins as it believes that certain investors use this information, together with measures determined in accordance with IFRS, to evaluate the Corporation’s performance in comparison to other companies in the precious metals mining industry who present results on a similar basis. However, other companies may calculate these non-IFRS measures differently.

Cash margin (in dollars) represents revenues less cost of sales (excluding depletion). Cash margin (in percentage) represents the cash margin (in dollars) divided by revenues.

| Three months ended September 30, 2022 | ||||||||

| Revenues | $ 53,661 | |||||||

| Less: Cost of sales (excluding depletion) | ($4,407 | ) | ||||||

| Cash margin (in dollars) | $ 49,254 | |||||||

| Cash margin (in percentage of revenues) | 92 | % | ||||||

Qualified Person

The scientific and technical content of this news release has been reviewed and approved by Guy Desharnais, Ph.D., P.Geo., Vice President, Project Evaluation at Osisko Gold Royalties Ltd, who is a “qualified person” as defined by National Instrument 43-101 – Standards of Disclosure for Mineral Projects (“NI 43-101”).

In this press release, Osisko relies on information publicly disclosed by other issuers and third parties pertaining to its assets and, therefore, assumes no liability for such third-party public disclosure.

About Osisko Gold Royalties Ltd

Osisko is an intermediate precious metal royalty company focused on the Americas that commenced activities in June 2014. Osisko holds a North American focused portfolio of over 165 royalties, streams and precious metal offtakes. Osisko’s portfolio is anchored by its cornerstone asset, a 5% net smelter return royalty on the Canadian Malartic mine, which is the largest gold mine in Canada.

Osisko’s head office is located at 1100 Avenue des Canadiens-de-Montréal, Suite 300, Montréal, Québec, H3B 2S2.

| For further information, please contact Osisko Gold Royalties Ltd: | |

Heather Taylor Vice President, Investor Relations Tel: (514) 940-0670 #105 Email: htaylor@osiskogr.com | |

Forward-looking Statements

Certain statements contained in this press release may be deemed “forward‐looking statements” within the meaning of the United States Private Securities Litigation Reform Act of 1995 and “forward-looking information” within the meaning of applicable Canadian securities legislation. These forward‐looking statements, by their nature, require Osisko to make certain assumptions and necessarily involve known and unknown risks and uncertainties that could cause actual results to differ materially from those expressed or implied in these forward‐looking statements. Forward‐looking statements are not guarantees of performance. These forward‐looking statements, may involve, but are not limited to, statements with respect to future events or future performance, the realization of the anticipated benefits deriving from Osisko’s investments, the general performance of the assets of Osisko, and the results of exploration, development and production activities as well as expansions projects relating to the properties in which Osisko holds a royalty, stream or other interest. Words such as “may”, “will”, “would”, “could”, “expect”, “suggest”, “appear”, “believe”, “plan”, “anticipate”, “intend”, “target”, “estimate”, “continue”, or the negative or comparable terminology, as well as terms usually used in the future and the conditional, are intended to identify forward‐looking statements. Information contained in forward‐looking statements is based upon certain material assumptions that were applied in drawing a conclusion or making a forecast or projection, including, without limitation, management’s perceptions of historical trends; current conditions; expected future developments; the ongoing operation of the properties in which Osisko holds a royalty, stream or other interest by the operators of such properties in a manner consistent with past practice; the accuracy of public statements and disclosures made by the operators of such underlying properties; no material adverse change in the market price of the commodities that underlie the asset portfolio; no adverse development in respect of any significant property in which Osisko holds a royalty, stream or other interest; the accuracy of publicly disclosed expectations for the development of underlying properties that are not yet in production; and the absence of any other factors that could cause actions, events or results to differ from those anticipated, estimated or intended. Osisko considers its assumptions to be reasonable based on information currently available, but cautions the reader that their assumptions regarding future events, many of which are beyond the control of Osisko, may ultimately prove to be incorrect since they are subject to risks and uncertainties that affect Osisko and its business. Such risks and uncertainties include, among others, that the financial information presented in this press release is preliminary and could be subject to adjustments, the successful continuation of operations underlying the Corporation’s assets, the performance of the assets of Osisko, the growth and the benefits deriving from its portfolio of investments, risks related to the operators of the properties in which Osisko holds a royalty, stream or other interest, including changes in the ownership and control of such operators; risks related to development, permitting, infrastructure, operating or technical difficulties on any of the properties in which Osisko holds a royalty, stream or other interest, the influence of macroeconomic developments as well as the impact of and the responses of relevant governments to the COVID-19 outbreak and the effectiveness of such responses. In this press release, Osisko relies on information publicly disclosed by other issuers and third parties pertaining to its assets and, therefore, assumes no liability for such third party public disclosure.

For additional information with respect to these and other factors and assumptions underlying the forward‐looking statements made in this press release, see the section entitled “Risk Factors” in the most recent Annual Information Form of Osisko which is filed with the Canadian securities commissions and available electronically under Osisko’s issuer profile on SEDAR at www.sedar.com and with the U.S. Securities and Exchange Commission and available electronically under Osisko’s issuer profile on EDGAR at www.sec.gov. The forward‐ looking statements set forth herein reflect Osisko’s expectations as at the date of this press release and are subject to change after such date. Osisko disclaims any intention or obligation to update or revise any forward‐looking statements, whether as a result of new information, future events or otherwise, other than as required by law.